We Are 28 And Have $1.2 Million In Cash: As First-Time Homeowners Should We Buy A Resale HDB First, Condo, Or Landed?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Recognized for his warm and approachable demeanour, Jared prioritises establishing trust and fostering genuine connections with his clients. Drawing from his background in the automotive and airline industries, he brings a passion for creating memorable experiences in every interaction. Jared's authenticity and dedication set him apart, as he believes that real estate is more than just transactions—it's about cultivating meaningful relationships and positively impacting his clients' lives.

Dear Stacked team,

We’re huge fans of your editorial and have been following for years, and are looking to dip our toes in Singapore’s property market – we’re hoping to lean on your well informed advice. My partner and I are in a bit of a predicament; we both earn about S$30k per month, have S$600k in cash each and are first-time home buyers.

We’re both 28, live in our parents’ home and don’t have an immediate need to live in a place of our own (although we don’t mind). Our current thinking is:

1) Purchase a resale HDB under the essential-owner and occupier scheme; in 5 years’ time one person’s name would be freed up to purchase a private property, the downside being unable to rent out the unit from the get-go, and also one partner having to sit out of the market for 5 years, especially since we don’t have a need to stay in the flat but are obliged to

2) Each of us purchase a private condominium, c.$1.5-2mm

3) (a little far-fetched) but potentially combine our resources to purchase a landed property, though this is a lot more far-fetched and riskier, plus we are of the opinion that landed property has much higher vacancy rates so net rental yield is likely lower and we will probably not pursue this.

Thanks very much in advance and look forward to hearing from you! We’re also happy to provide any further information as needed.

Hi there,

Thank you for reaching out, and it’s great to hear that you are fans of what we do.

To introduce myself briefly, I’m Jared, and as a property agent, I like to establish a genuine connection with each client. As important as numbers are, I believe this human element is essential for an effective collaboration and working relationship.

Before I explore the options you’re considering, let’s first assess your financial capacity.

Affordability

Combined affordability (Buying a private property)

| Description | Amount |

| Maximum loan for ages of 28 with a fixed monthly combined income of $30K, at a 4.8% interest | $3,144,862 (30-year tenure) |

| Cash | $1,200,000 |

| Total loan + cash | $4,344,862 |

| BSD based on $4,344,862 | $200,291 |

| Estimated affordability | $4,144,571 |

Individual affordability

For this calculation, I will assume that both your incomes are equal at $15K/month.

Buying an HDB

| Description | Amount |

| Maximum loan for age of 28 with a fixed monthly income of $15K, at a 4.8% interest | $785,344 (25-year tenure) |

| Cash | $600,000 |

| Total loan + cash | $1,385,344 |

| BSD based on $1,385,344 | $40,013 |

| Estimated affordability | $1,345,331 |

Buying a private property

| Description | Amount |

| Maximum loan for age of 28 with a fixed monthly income of $15K, at a 4.8% interest | $1,572,431 (30-year tenure) |

| Cash | $600,000 |

| Total loan + cash | $2,172,431 |

| BSD based on $2,172,431 | $78,221 |

| Estimated affordability | $2,094,210 |

Looking at your financial capacity, all three options that you’re considering are likely to be viable. Let’s now run through them.

Potential pathways

Given that you’ve mentioned both of you aren’t compelled to move out of your parents’ home but are open to the idea, is the property acquisition primarily for your residence or for investment? Establishing a clear objective will assist in determining which pathway aligns better with your goals.

Option 1. Buy an HDB first and buy a second property after the HDB obtains its Minimum Occupation Period (MOP)

This option carries a lower risk due to the affordable price of an HDB. However, as you rightly mentioned, the HDB regulations impose limitations, and there’s also the opportunity cost for 5 years.

Conversely, you could use that time to observe the market and accumulate more funds for your next property. Since you have an alternative place to live, there are numerous possibilities to explore once the HDB fulfils its MOP. You could potentially:

- Stay in the HDB and purchase a new launch for investment

- Purchase a new launch and continue staying with your parents while renting out the HDB

- Buy a private resale property and rent out both your properties while staying with your parents

- Purchase a private resale property for your own stay and rent out your HDB

- Rent out both your private resale property and HDB, and rent in a location of your liking

| Year | HDB Resale Price Index | Non-landed Private Property Price Index |

| 2013-Q4 | 145.8 | 147.6 |

| 2014-Q4 | 137 | 142.5 |

| 2015-Q4 | 134.8 | 137.4 |

| 2016-Q4 | 134.6 | 133.8 |

| 2017-Q4 | 132.6 | 135.6 |

| 2018-Q4 | 131.4 | 146.8 |

| 2019-Q4 | 131.5 | 149.6 |

| 2020-Q4 | 138.1 | 153.3 |

| 2021-Q4 | 155.7 | 168.4 |

| 2022-Q4 | 171.9 | 182.1 |

| 2023-Q4 | 180.4 | 194.2 |

| Average | 2.30% | 2.90% |

In addition to facing more stringent regulations, the HDB market is more controlled compared to the private property market, given its primary objective of providing affordable housing for the masses. Consequently, from an investment perspective, holding a private property would be preferable to an HDB.

Despite the typically higher rental yield of HDB units due to their lower entry cost, the inability to rent out the entire unit for the initial 5 years is a limiting factor. However, if considering it for personal residence, opting for an HDB would make financial sense due to the lower incurred costs.

With a budget of $1.3M, you would have the means to acquire the majority of HDB units on the market. Depending on your intended holding period, the factors to consider when selecting a suitable property would vary.

One advantage here is your age. Assuming the occupier’s income remains constant over the next 5 years, their maximum loan amount will remain unchanged as the loan tenure remains at 30 years. With the accumulation of additional funds during the 5-year waiting period, you may have a broader range of options to explore with a bigger budget.

Assuming a 10-year timeframe, let’s analyse the potential costs and gains. For the sake of this calculation, let’s presume you purchase an HDB priced at $1M and rent out two bedrooms at $1,000 each during the 5-year MOP (remember you have to still live within the flat), followed by renting out the entire unit at a 5% rental yield for the subsequent 5 years.

| Description | Amount |

| Purchase price | $1,000,000 |

| BSD | $24,600 |

| Cash | $600,000 |

| Loan required | $424,600 |

| Description | Amount |

| BSD | $24,600 |

| Interest expense (Assuming a 4% interest and 25-year tenure) | $147,335 |

| Property tax | $22,400 |

| Town council service & conservancy fees (Assuming $90/month) | $10,800 |

| Rental income | $370,020 |

| Agency fee (Payable once every 2 years) | $14,580 |

| Total gains | $150,305 |

Let’s presume you purchased the second property 5 years later at $1.5M. I will look at two scenarios here: if you rent out the unit and continue staying with your parents, and if you move into the unit.

Costs incurred if the unit is rented out at 3% rental yield

| Description | Amount |

| BSD | $44,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $180,347 |

| Property tax | $33,000 |

| Maintenance fee (Assuming $300/month) | $18,000 |

| Rental income | $225,000 |

| Agency fee (Payable once every 2 years) | $12,150 |

| Total costs | $63,097 |

Costs incurred if you were to move in

| Description | Amount |

| BSD | $44,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $180,347 |

| Property tax | $9,900 |

| Maintenance fee (Assuming $300/month) | $18,000 |

| Total costs | $252,847 |

I’ll do a simple projection of the potential gains based on the average growth rates over the past decade, which stand at 2.3% for HDBs and 2.9% for non-landed private properties.

Potential gains for HDB

| Time period | Property price | Gains |

| Starting point | $1,000,000 | $0 |

| Year 1 | $1,023,000 | $23,000 |

| Year 2 | $1,046,529 | $46,529 |

| Year 3 | $1,070,599 | $70,599 |

| Year 4 | $1,095,223 | $95,223 |

| Year 5 | $1,120,413 | $120,413 |

| Year 6 | $1,146,183 | $146,183 |

| Year 7 | $1,172,545 | $172,545 |

| Year 8 | $1,199,513 | $199,513 |

| Year 9 | $1,227,102 | $227,102 |

| Year 10 | $1,255,325 | $255,325 |

Potential gains for condo

| Time period | Property price | Gains |

| Starting point | $1,500,000 | $0 |

| Year 1 | $1,543,500 | $43,500 |

| Year 2 | $1,588,262 | $88,262 |

| Year 3 | $1,634,321 | $134,321 |

| Year 4 | $1,681,716 | $181,716 |

| Year 5 | $1,730,486 | $230,486 |

Total gains for this pathway if you were to rent out both properties: $255,325 + $230,486 + $150,305 – $63,097 = $573,020

Total gains for this pathway if you were to rent out HDB and move into a condo: $255,325 + $230,486 + $150,305 – $252,847 = $383,270

Option 2. Both of you to purchase one private property each

There are various options to explore here, but without understanding your specific buying goals, it’s difficult for me to recommend the most appropriate one. Since you indicated no urgent need to relocate, I’m assuming that starting a family might not be in your immediate plans. If you prioritise investment, owning one property each would undoubtedly optimise your resources.

So since you have alternative housing arrangements, you might contemplate purchasing two new properties for the progressive payments. However, given the influx of completed projects and the uncertain economic situation, these could potentially impact the rental market, possibly leading to a slowdown which can be noticed in the last few quarters.

| Time period | Rental Index of non-landed private properties | Quarterly % change |

| 2022Q1 | 120.3 | 4.1 |

| 2022Q2 | 128.8 | 7.1 |

| 2022Q3 | 139.5 | 8.3 |

| 2022Q4 | 150 | 7.5 |

| 2023Q1 | 159.3 | 6.2 |

| 2023Q2 | 163 | 2.3 |

| 2023Q3 | 163.3 | 0.2 |

| 2023Q4 | 160.4 | -1.8 |

Although you will not be able to rent out the units immediately, the progressive payment plan will keep the monthly mortgage payments affordable during the initial construction phases.

Let’s take a look at the potential costs incurred if you were to each buy a new launch at $1.8M.

| Description | Amount |

| Purchase price | $1,800,000 |

| BSD | $59,600 |

| Cash | $600,000 |

| Loan required | $1,259,600 |

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 0% | $0 | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 9.98% | $179,640 | $259 | $599 | $858 | 6-9 months | $5,391 |

| Completion of brick wall | 5% | $90,000 | $389 | $899 | $1,288 | 3-6 months | $5,394 |

| Completion of ceiling/roofing | 5% | $90,000 | $518 | $1,199 | $1,717 | 3-6 months | $7,194 |

| Completion of electrical wiring/plumbing | 5% | $90,000 | $648 | $1,499 | $2,147 | 3-6 months | $8,994 |

| Completion of roads/car parks/drainage | 5% | $90,000 | $778 | $1,799 | $2,577 | 3-6 months | $10,794 |

| Issuance of TOP | 25% | $450,000 | $1,426 | $3,299 | $4,725 | Usually one year until CSC | $39,588 |

| Certificate of Statutory Completion (CSC) | 15% | $270,000 | $1,815 | $4,199 | $6,014 | Until property is sold (57 months) | $239,343 |

*I am assuming the longest duration for each stage

The intention behind purchasing two new launch properties is to potentially sell them once the SSD is up. However, for a fair comparison, I will assess the potential costs and gains over a 10-year holding period. As before, I will examine two scenarios: renting out both units while continuing to reside with your parents, and moving into one unit while renting out the other.

Costs incurred if the unit is rented out at 3% rental yield after TOP

| Description | Amount |

| BSD | $59,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $316,698 |

| Property tax | $54,720 |

| Maintenance fee (Assuming $300/month) | $21,600 |

| Rental income | $324,000 |

| Agency fees (Payable once every 2 years) | $14,580 |

| Total costs | $143,198 |

*Property tax and maintenance fees are only payable after the project obtains its TOP

Costs incurred if you were to move in after TOP

| Description | Amount |

| BSD | $59,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $316,698 |

| Property tax | $17,280 |

| Maintenance fee (Assuming $300/month) | $21,600 |

| Total costs | $376,298 |

*Property tax and maintenance fees are only payable after the project obtains its TOP

If both the properties appreciate at the same rate as the average growth rate of non-landed private properties over the last 10 years at 2.9%:

| Time period | Property price | Gains |

| Starting point | $3,600,000 | $0 |

| Year 1 | $3,704,400 | $104,400 |

| Year 2 | $3,811,828 | $211,828 |

| Year 3 | $3,922,371 | $322,371 |

| Year 4 | $4,036,119 | $436,119 |

| Year 5 | $4,153,167 | $553,167 |

| Year 6 | $4,273,609 | $673,609 |

| Year 7 | $4,397,543 | $797,543 |

| Year 8 | $4,525,072 | $925,072 |

| Year 9 | $4,656,299 | $1,056,299 |

| Year 10 | $4,791,332 | $1,191,332 |

Total gains for this pathway if you were to rent out both properties: $1,191,332 – ($143,198 x 2) = $904,936

Total gains for this pathway if you were to rent out one and move into the other: $1,191,332 – $143,198 – $376,298 = $671,836

For completeness, let’s also consider the costs and gains if you were to buy 2 resale properties instead.

| Description | Amount |

| Purchase price | $1,800,000 |

| BSD | $59,600 |

| Cash | $600,000 |

| Loan required | $1,259,600 |

I will also look at two scenarios (with the same timeline as the new launch): if you rent out both units and continue staying with your parents, and if you rent out both units for the first 4 years and move into one in the fifth year.

Costs incurred if both units are rented out at a 3% rental yield for 10 years

| Description | Amount |

| BSD | $59,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $454,386 |

| Property tax | $91,200 |

| Maintenance fee (Assuming $300/month) | $36,000 |

| Rental income | $540,000 |

| Agency fees (Payable once every 2 years) | $24,300 |

| Total costs | $125,486 |

| Total costs for 2 properties | $250,972 |

Costs incurred if you were to rent for 4 years and move in for 6 years

| Description | Amount |

| BSD | $59,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $454,386 |

| Property tax | $53,760 |

| Maintenance fee (Assuming $300/month) | $36,000 |

| Rental income | $216,000 |

| Agency fees (Payable once every 2 years) | $9,720 |

| Total costs | $397,466 |

Total gains for this pathway if you were to rent out both properties: $1,191,332 – $250,972 = $940,360

Total gains for this pathway if you were to rent out both for 4 years and move into one in the fifth year: $1,191,332 – $125,486 – $397,466 = $668,380

From here you can see that the disparity in potential costs and gains between buying 2 new launches and 2 resale properties is rather negligible. However, this is also very much dependent on the specific properties that you purchase as the rental yield and appreciation rates will differ.

Option 3. Buy a landed property

With a budget of $4M, you may be able to acquire a landed property with a built-up spanning approximately 1,500 to 3,000 sq ft. Depending on size and location, it’s possible to secure one with a freehold tenure. However, landed properties are typically situated in less accessible areas with limited proximity to amenities, owing to the privacy they afford. As you rightly pointed out, this could result in lower rental demand compared to HDB flats or condominiums.

Owning a freehold landed property can be a sound long-term strategy, especially if you envision it as your permanent residence. However, considering your age of 28, it’s unlikely that you’re planning to settle in your forever home at this stage. Investing in a landed property for the short term may not be the most prudent choice, particularly given the higher costs involved, especially if renovations and maintenance are necessary.

I will also look at the potential costs and gains for this option in the same 2 scenarios: if you rent out the house and continue staying with your parents, and if you rent it out for 4 years before moving in on the fifth year.

| Description | Amount |

| Purchase price | $4,000,000 |

| BSD | $179,600 |

| Cash | $1,200,000 |

| Loan required | $2,979,600 |

Costs incurred if the property is rented out at a 2% rental yield for 10 years (landed properties typically have lower rental yields)

| Description | Amount |

| BSD | $179,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $1,074,855 |

| Property tax | $324,000 |

| Maintenance fee (Assuming $5000/year) | $50,000 |

| Rental income | $800,000 |

| Agency fees (Payable once every 2 years) | $54,000 |

| Total costs | $882,455 |

*The maintenance costs for a landed property can be hard to determine as maintenance is done periodically or whenever needed. As such, this is just a rough estimate. Do note that this pathway is also riskier as the home may require repairs to bring it to a rentable state.

Costs incurred if you were to rent for 4 years and move in for 6 years

| Description | Amount |

| BSD | $179,600 |

| Interest expense (Assuming a 4% interest and 30-year tenure) | $1,074,855 |

| Property tax | $239,880 |

| Maintenance fee (Assuming $5000/year) | $50,000 |

| Rental income | $320,000 |

| Agency fees (Payable once every 2 years) | $21,600 |

| Total costs | $1,245,935 |

*The maintenance costs for a landed property can be hard to determine as maintenance is probably done periodically or whenever needed. This is just a rough estimate.

Assuming the property appreciates at the same rate as the average growth rate of landed private properties over the last 10 years at 2.98%:

| Time period | Property price | Gains |

| Starting point | $4,000,000 | $0 |

| Year 1 | $4,119,200 | $119,200 |

| Year 2 | $4,241,952 | $241,952 |

| Year 3 | $4,368,362 | $368,362 |

| Year 4 | $4,498,540 | $498,540 |

| Year 5 | $4,632,596 | $632,596 |

| Year 6 | $4,770,647 | $770,647 |

| Year 7 | $4,912,813 | $912,813 |

| Year 8 | $5,059,214 | $1,059,214 |

| Year 9 | $5,209,979 | $1,209,979 |

| Year 10 | $5,365,236 | $1,365,236 |

Total gains for this pathway if you were to rent out the property: $1,365,236 – $482,455 = $882,781

Total gains for this pathway if you were to rent out the property for 4 years and move in in the fifth year: $1,365,236 – $1,085,935 = $279,301

What should you do?

Let’s do a quick recap of the potential costs and gains for the 3 options.

| Options | Number of property owned | Property value | Costs | Potential gains | % Annualised returns needed to breakeven on costs |

| Buy an HDB first and buy a second property after the HDB obtains its Minimum Occupation Period (MOP) | 2 | $2.5M | If you rent out both properties: $87,208 (Gains) If you rent out the HDB and move into condo: $102,542 | If you rent out both properties: $573,020 If you rent out the HDB and move into condo: $383,270 | If you rent out both properties: -0.35% If you rent out the HDB and move into condo: 0.4% |

| Both of you to purchase one private property each (2 new launches) | 2 | $3.6M | If you rent out both properties: $286,396 If you rent out one and move into the other: $519,496 | If you rent out both properties: $904,936 If you rent out one and move into the other: $671,836 | If you rent out both properties: 0.77% If you rent out one and move into the other: 1.36% |

| Both of you to purchase one private property each (2 resale) | 2 | $3.6M | If you rent out both properties: $250,972 If you rent out both for 4 years and move into one in the fifth year: $522,952 | If you rent out both properties: $940,360 If you rent out both for 4 years and move into one in the fifth year: $668,380 | If you rent out both properties: 0.68% If you rent out both for 4 years and move into one in the fifth year: 1.37% |

| Buy a landed property | 1 | $4M | If you were to rent out the property: $882,455 If you rent out the property for 4 years and move in in the fifth year: $1,245,935 | If you were to rent out the property: $882,781 If you rent out the property for 4 years and move in in the fifth year: $279,301 | If you rent out the property: 1.15% If you rent out the property for 4 years and move in in the fifth year: 2.43% |

Given that potential gains aren’t guaranteed, as they heavily rely on the property you choose, I’ll focus on the potential costs incurred, as they tend to be more predictable.

If investment is indeed your primary goal, I wouldn’t recommend buying a landed property at this juncture due to the significantly higher costs and lower rental demand/yield.

While purchasing an HDB first and then a second property involves the lowest costs, it doesn’t fully maximise your resources since you’re unable to rent out the entire HDB for the first 5 years, which is a considerable amount of time. Additionally, given the slower growth rate and regulated nature of the HDB market, it may not be the optimal choice for investment.

Among the three options, Option 2 of purchasing two private properties appears to be the most favourable from an investment perspective. Considering the relatively minor difference in costs between buying two new launches and two resale properties, the decision on which properties to purchase will depend on your preferences. You could even opt for a combination of both to diversify your risks. Private properties offer fewer limitations on renting out units compared to HDBs, allowing immediate rental from the outset. Moreover, if you opt for a new launch, the progressive payment plan during the construction phases won’t overly strain your finances.

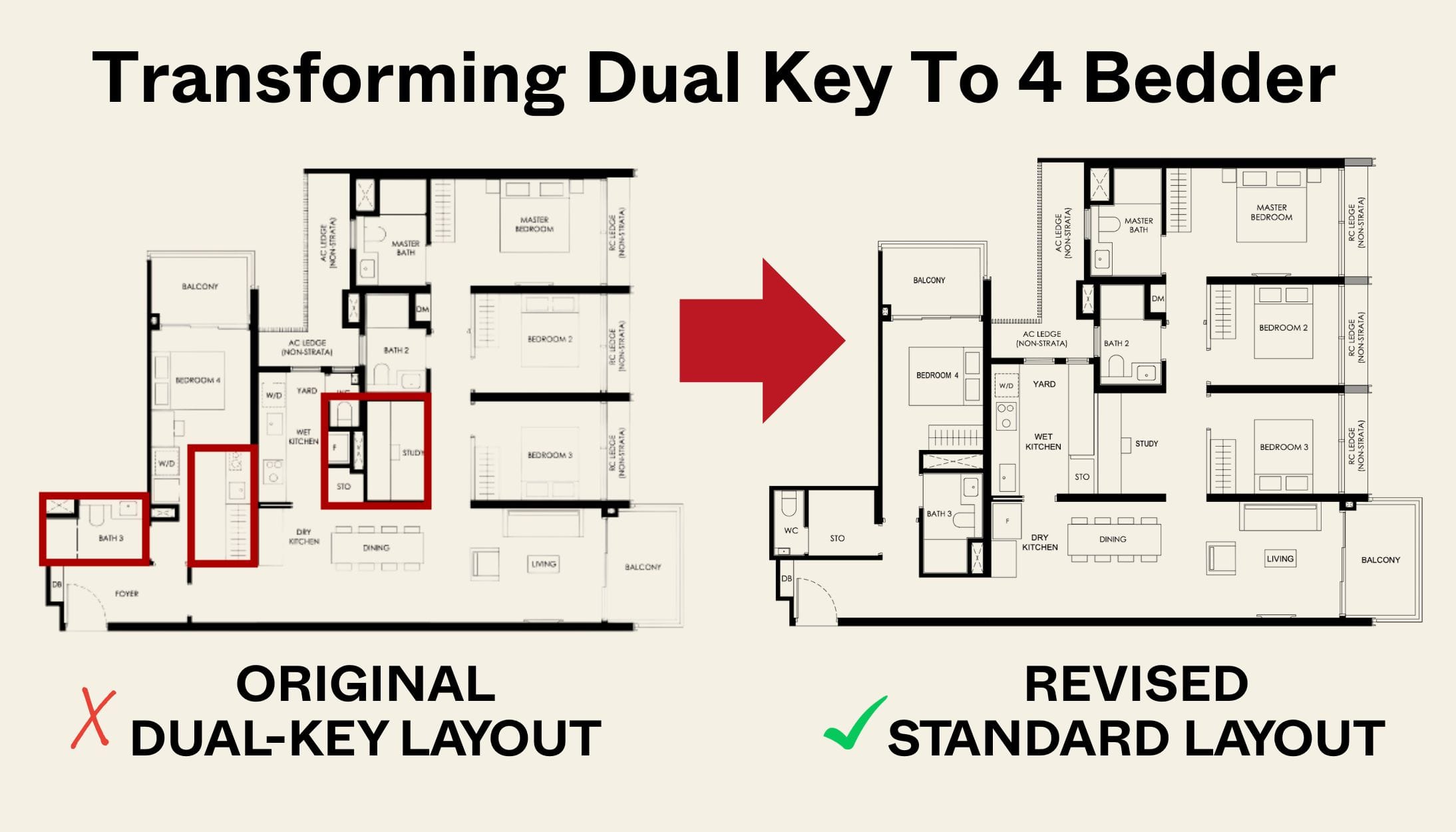

Finally, while it’s not covered in this piece so far, one more option you can consider if you are looking for a condo with ample space is to purchase a 4-bedder condo of your liking.

With a combined affordability of just over $4 million, you shouldn’t have much difficulty finding a spacious unit. To allow for the possibility of owning 2 properties in the long term, one owner can own 99% while the other owns 1% of the property so that the cost to decouple in the future is lower.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Jared Foo

Recognized for his warm and approachable demeanour, Jared prioritises establishing trust and fostering genuine connections with his clients. Drawing from his background in the automotive and airline industries, he brings a passion for creating memorable experiences in every interaction. Jared's authenticity and dedication set him apart, as he believes that real estate is more than just transactions—it's about cultivating meaningful relationships and positively impacting his clients' lives.Read next from Editor's Pick

Property Market Commentary The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Irrelevant post for everyone alive, except that couple.

Hi how do I contact you for this kind of analysis

With your level of monthly income & cash, I’d buy a FH/999-yr Landed property in the suburbs (lower PSF compared to condos everywhere). Age is on your side, meaning you’re able to take on more risk.

Good land ( Freehold / 999-yr, not strata title ) is getting scarcer in Singapore, and will only continue to appreciate over the long run AND outperform condos & apartments, in terms of Net ROI. Even if we enter a property market downturn, Landed Property will generally depreciate at a slower pace than condos, which quite honestly, there is plenty of supply of. Cooling measures will be rolled back if things get bad.

In comparison to your situation, we could only afford to buy a landed property in District 28 at age 34, some 17 years ago in 2007. It was the best decision ever. Mid-2022, we sold the house for slightly more than 3x its purchase price, for a profit of 213%. This enabled us to upgrade to a 2.5 storey semi-detached house within the same estate, again within a reasonable PSF below $1300 (2022 prices).

Our decision to upgrade was 3-fold. Firstly, there was an opportunity to upgrade our quality of life by moving to a quieter part of the estate, where the houses are further apart, the roads are wider & no parking issues, which are common in landed estates.

Secondly, when we retire eventually, we would have a much bigger base to deal with ( 1780 vs 3800 sq ft land ) when it’s time to right size.

Thirdly, to increase our inflation hedging ability leading up to retirement in the next 10 years. Honestly, there is only so much you’d want to invest & risk with Stocks & Bonds.

In this era of high inflation, which i expect to get even worse over the years, a high quality asset with LIMITED SUPPLY will always have a scarcity premium attached to it, and continue to appreciate in value over the years. Freehold / 999-year Landed Property in Singapore is the way to go for outperformance in wealth creation, wealth preservation and wealth transfer to future generations.

From a cost & maintenance perspective, my experience over 37 years growing up in, then owning landed property, is that it is cheaper than paying condo conservancy fees.

In conclusion, I can only say that the longer you put off buying a FH/ 999- yr landed property in Singapore, if you can afford it now,

the more difficult it would be to own one in the future. Most people are already priced out of this segment of the market.