My Parents Bought An Investment Property Under My Name: Should We Sell To Apply For A BTO Or Resale HDB?

December 10, 2023

Hi there! Wanted to get your opinions of the following:

I have a fully paid private condo under my name (paid by parents) for investment purposes. The issue now is that I can’t apply for public housing with my partner.

Here are some options we are exploring:

Option 1: sell the private condo

- this will free up my name and we can apply for public housing after the waiting period

- however, we can only sell next year after the 3 years minimum holding period

- some concerns is that by the time we can apply for BTO, our combined salary will be >14k which makes us ineligible, hence we only can go for resales or EC (I believe the cap is 16k)

Option 2: Cash-out refinancing

- take 75% of value of the condo and use it to finance a private property under my partner’s name (to avoid additional 2nd property tax etc)

- also, can I clarify that my partner can still take a bank loan for the housing on top of this cash-out refinancing?

Some considerations on our end is that we want a sizeable property so we can start a family in and look to secure housing within 5 years. The private condo is freehold so abit hesitant to sell.

If we go for the resale HDB, we would prefer the owner-occupier scheme so the house will be legally under one name which frees the other name up for a second property in the future.

Based on the two options, which will be more feasible from your POV?

Hello,

Thanks for writing in.

To be sure, the 30-month wait that you face after selling the private property makes things a little less straightforward.

And while cash-out refinancing is an option to partially cash out of the existing property without having to sell it, there are certain restrictions to this which we will touch on later in the article.

Let’s start by looking at your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Based on the options you’re considering, we will look at your affordability based on:

- Selling The Gale and buying an HDB

- Sales proceeds from Gale

- Individual affordability – we will assume here that the partner with the lower income buys the HDB as the owner, while the partner with the higher income will be the occupier that goes on to purchase the private property after the MOP is obtained

- Your combined affordability if you were to buy a private property and EC

- Cash-out refinancing

- Your partner’s affordability (with the $300,000 cash downpayment)

Sales proceeds from The Gale

There isn’t any transaction for a 1,012 sqft unit this year but there were two other 2+Study units above 1,000 sqft that were sold at an average price of $1,285,000.

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2023 | 1,044 | $1,236 | $1,290,000 | #01 |

| Apr 2023 | 1,033 | $1,239 | $1,280,000 | #07 |

We will assume $1,2850,000 to be the selling price and since it has been fully paid, the sales proceeds will be received in cash.

Given that The Gale was purchased by your parents, the assumption here is that all the sales proceeds will go to them and that the cash portion you have will be the $300,000 that your parents are willing to put towards the deposit. As the funds are in cash, it will be easy to adjust your affordability by tweaking this.

As any action you take will likely be after the sale of The Gale next year, we will calculate your affordability based on the age of 27 (for the partner buying the HDB – including the 15-month wait out) and 32 (for the partner buying the private property). For calculation purposes, we will do an even split of the cash for the two purchases.

Partner 1 (Buying an HDB)

| Description | Amount |

| Maximum loan based on age of 27 with a fixed monthly income of $4,500 at 3% interest | $284,683 (25 year tenure) |

| CPF | $0 |

| Cash | $150,000 |

| Total loan + CPF + cash | $434,683 |

| BSD based on $434,683 | $7,640 |

| Estimated affordability | $427,043 |

*Assuming an HDB loan is taken

Partner 2 (Buying a private property after HDB’s MOP)

| Description | Amount |

| Maximum loan based on age of 32 with a fixed monthly income of $7,500 at 4.6% interest | $804,651 (30 year tenure) |

| CPF | $0 |

| Cash | $150,000 |

Although Partner 2 can take up a loan of $800,000, the purchase price is limited to $600,000 due to the funds you have for the 25% down payment, which is at $150,000. Taking BSD into consideration, your affordability will be $587,400, which means you will not be able to secure any private property. Since this purchase will be made 5 years later, you would have more time to save up and would also have accumulated some CPF funds.

Combined affordability (Buying a brand new EC – entails a 30-month wait out)

| Description | Amount |

| Maximum loan based on ages of 29 with a fixed monthly income of $12,000 at 4.6% interest | $704,241 (30 year tenure) |

| CPF | $0 |

| Cash | $300,000 |

| Total loan + CPF + cash | $1,004,241 |

| BSD based on $1,004,241 | $24,769 |

| Estimated affordability | $979,472 |

Combined affordability (Buying a private property)

| Description | Amount |

| Maximum loan based on ages of 26 with a fixed monthly income of $12,000 at 4.6% interest | $1,287,442 (30 year tenure) |

| CPF | $0 |

| Cash | $300,000 |

| Total loan + CPF + cash | $1,587,442 |

| BSD based on $1,587,442 | $48,972 |

| Estimated affordability | $1,538,470 |

Partner 1’s affordability (with the $300,000 cash downpayment)

| Description | Amount |

| Maximum loan based on age of 26 with a fixed monthly income of $4,500 at 4.6% interest | $482,791 (30 year tenure) |

| CPF | $0 |

| Cash | $300,000 |

| Total loan + CPF + cash | $782,791 |

| BSD based on $782,791 | $18,083 |

| Estimated affordability | $764,708 |

Now that we have a better understanding of your financial capacity, let’s take a look at how The Gale has been performing.

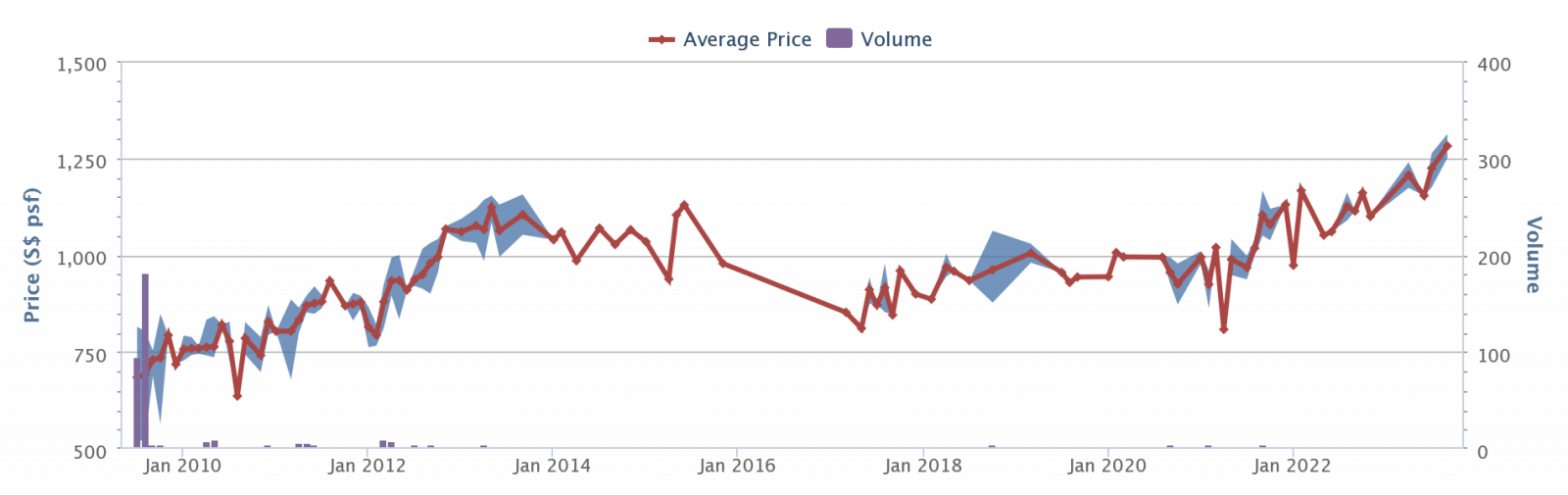

Performance of The Gale

| Year | Avg PSF (Resale) | YoY | Property Price Index of Residential Properties (PPI) | YoY |

| 2013 | $1,104 | – | 153.2 | – |

| 2014 | $1,041 | -5.71% | 147 | -4.05% |

| 2015 | $1,036 | -0.48% | 141.6 | -3.67% |

| 2016 | – | – | 137.2 | -3.11% |

| 2017 | $884 | – | 138.7 | 1.09% |

| 2018 | $953 | 7.81% | 149.6 | 7.86% |

| 2019 | $965 | 1.26% | 153.6 | 2.67% |

| 2020 | $960 | -0.52% | 157 | 2.21% |

| 2021 | $1,007 | 4.90% | 173.6 | 10.57% |

| 2022 | $1,093 | 8.54% | 188.6 | 8.64% |

| Annualised | – | -0.11% | – | 2.34% |

Although the annualised growth rate for The Gale over the last 9 years does not look promising, if we were to look closer at the YoY growth rates, we can see that prices at The Gale are actually moving in the same direction as the overall market.

Source: Squarefoot Research

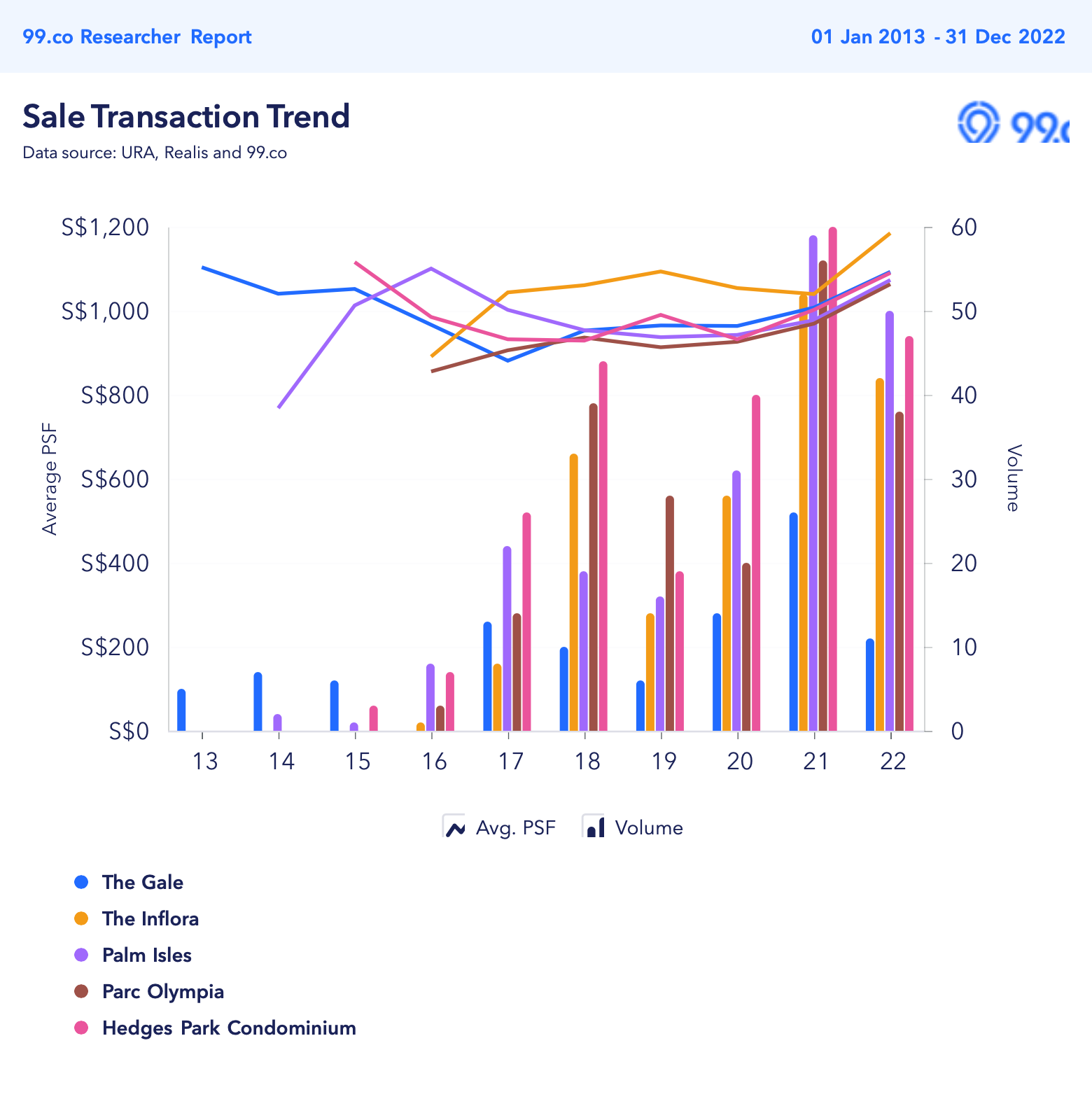

Given that The Gale is located in an area where there is a considerable supply of condominiums, let’s take a look at some of your potential competitors.

Leasehold properties in the vicinity

| Project | Tenure | TOP | No. of units | Avg PSF (Resale) |

| The Gale | Freehold | 2014 | 329 | $1,093 |

| The Inflora | 99 years | 2016 | 396 | $1,185 |

| Parc Olympia | 99 years | 2015 | 486 | $1,063 |

| Palm Isles | 99 years | 2015 | 429 | $1,073 |

| Hedges Park Condominium | 99 years | 2015 | 501 | $1,090 |

Looking at the data, despite The Gale being a freehold property, its average price PSF isn’t considerably higher than leasehold projects of similar age, and it’s even lower than The Inflora. Comparing it to the latest leasehold development in the area, The Jovell, its average PSF from launch till date stands at $1,552, significantly surpassing The Gale’s average.

So considering The Gale’s comparable development size and similar shared neighbourhood amenities with these leasehold projects, its freehold status does put it in an advantageous position – at least based on historical data so far. This would likely be different when the effects of depreciation become stronger once the leasehold properties get much older.

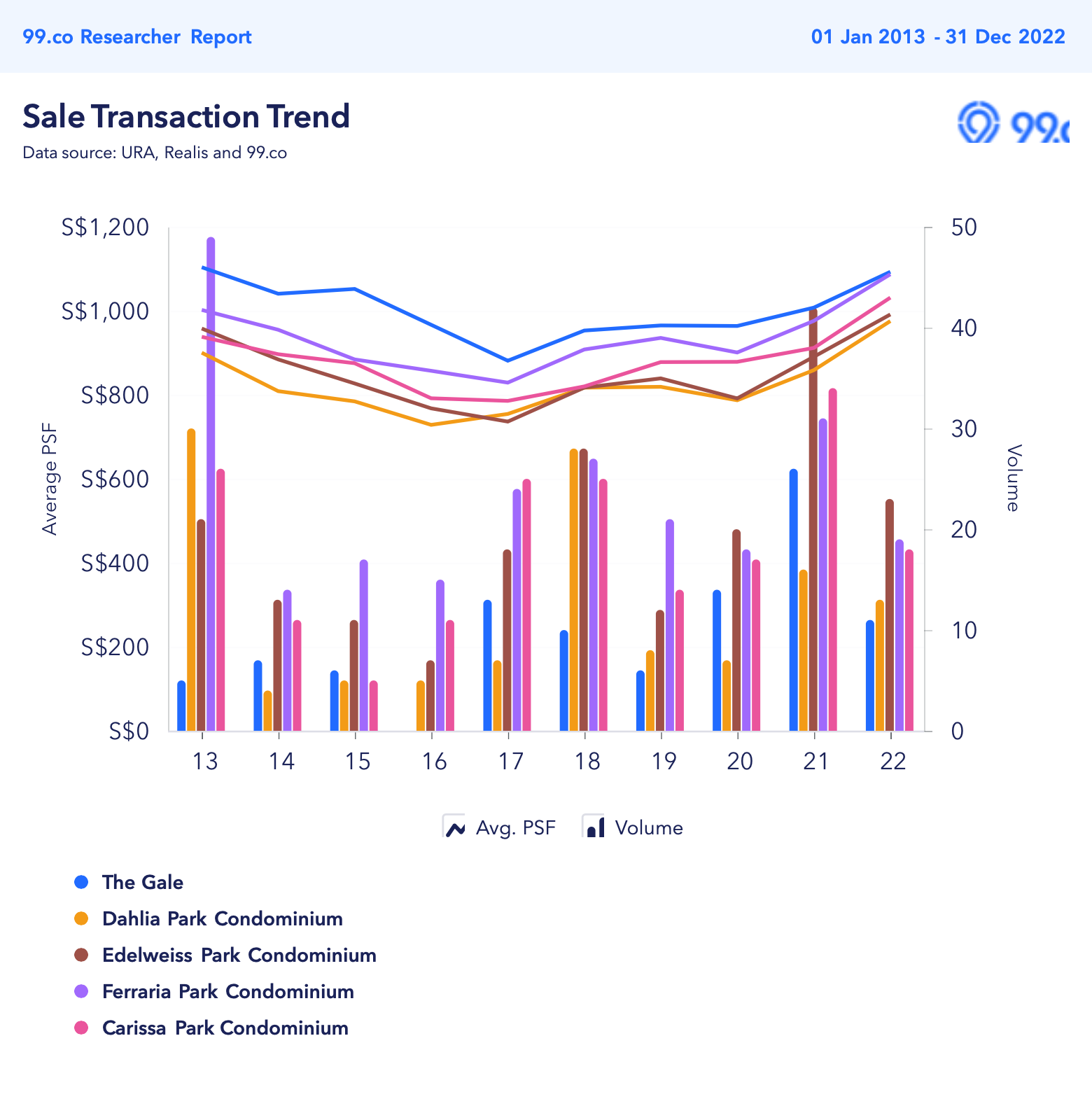

Freehold properties in the vicinity

| Project | Tenure | TOP | No. of units | Avg PSF (Resale) |

| The Gale | Freehold | 2014 | 329 | $1,093 |

| Ferraria Park Condominium | Freehold | 2010 | 475 | $1,087 |

| Edelweiss Park Condominium | Freehold | 2006 | 517 | $991 |

| Dahlia Park Condominium | Freehold | 2004 | 299 | $976 |

| Carissa Park Condominium | Freehold | 2003 | 528 | $1,031 |

Among the freehold projects in the vicinity, The Gale stands as the youngest development. Naturally being the newest, its average price PSF is slightly higher than the older developments but this increment is only marginal. Contrasted with the most recent freehold new launch nearby, Parc Komo, which boasts an average PSF of $1,765 from its launch to date, The Gale’s pricing remains notably lower.

Considering The Gale’s age and pricing metrics in comparison to neighbouring competitors, whether freehold or leasehold, it seems to hold a stable position.

Let’s now run through the options you’re considering.

Potential pathways

First, we’ll take it that moving to The Gale is not a consideration at all as it seems to be the obvious choice, but wasn’t mentioned in your question. As such, we’ll only look at the pathways you mentioned.

Option 1. Sell The Gale and buy an HDB, EC or private property

Let’s first look at the option of buying an HDB under the owner-occupier scheme. Considering Partner 2’s higher salary, listing them as the occupier seems reasonable due to their greater affordability for purchasing the private property down the road. By allocating $150,000 towards the HDB purchase, Partner 1’s affordability is at $427,043. However, depending on the HDB you intend to buy, this may or may not suffice. If you were to put more cash towards the HDB purchase, it would further reduce your affordability for the private property. So unless substantial savings are accumulated during the 5-year MOP, it’s improbable for Partner 2 to buy another property.

While purchasing a BTO is an ideal route if immediate housing isn’t urgent, there’s an inherent opportunity cost. The timeline presents several challenges: a 30-month wait out after selling The Gale, a potential 3-4 years for construction, and a 5-year wait before the occupier can purchase another property. This extended waiting period, stretching over 10 years, might not be the most efficient use of time despite potential gains from selling the BTO.

Do note that the timeline for purchasing a brand new EC is also similar, but that will have to be bought under both names. Buying a SBF (if there is any), will cut down the construction time but still entails a 30-month wait out.

On the other hand, if you opt to purchase a resale HDB, the wait-out period is only 15 months, and you bypass the 3-4 year construction time, significantly altering the overall timeline compared to buying a BTO/ brand new EC.

With your combined income presently below $14,000, you remain eligible for the First Timer CPF Housing Grant, which amounts to $80,000 for a 4-room flat or smaller, or $50,000 for a 5-room or larger flat. Furthermore, if you choose a unit within 4 km of either you or your partner’s parents’ home, you qualify for the Proximity Housing Grant (PHG) of $20,000. Despite potentially lower gains compared to a selling BTO, the CPF Housing Grants are substantial and can be perceived as initial “profits” from the outset, depending on your perspective. These grants will also help to increase your budget for the purchase.

One advantage of this pathway is that your own stay property and investment property are separate. It also provides more flexibility if your investment property is profitable and you wish to cash out, your living situation will not be affected. Even if in 5 years you do not have sufficient funds to purchase the private property, there is still that option open when you have saved up enough.

Assuming you sell The Gale in June 2024, you will only be able to purchase the resale HDB in September 2025. Even though this is 2 years later, there will be no change in terms of your affordability unless you have a pay increment.

We understand that since you mentioned wanting to buy under the owner-occupier scheme, you would likely want to be able to own two properties in the future. But if owning just one property is not an issue, another option you can consider is to buy a private property under both your names. This will eliminate any waiting time. With a budget of $1.5M, the following are some units that are available on the market.

Also given that you plan to start a family, we presume that you will stay in this property for an extended period. With that in mind, we picked out some freehold properties and also newer leasehold developments.

| Project | Tenure | TOP | District | Unit type | Size (sqft) | Asking price |

| Sol Acres | 99 years | 2019 | 23 | 3b | 1,044 | $1,500,000 |

| Treasure Crest | 99 years | 2018 | 19 | 3b | 1,076 | $1,530,000 |

| Edelweiss Park Condo | Freehold | 2006 | 17 | 3b | 1,270 | $1,350,000 |

| Azalea Park Condo | Freehold | 1996 | 17 | 3b | 1,335 | $1,500,000 |

Do note that these developments are purely selected because they fall within your affordability, so they may or may not be suitable for you. We strongly advise speaking to a property agent for further analysis.

Option 2. Cash out refinancing

For the benefit of those who may not know what cash out refinancing is, it’s where homeowners refinance their existing mortgage, obtaining a new loan for an amount greater than what they currently owe.

This allows them to receive the difference between the new loan and their existing mortgage balance in cash. Essentially, it involves leveraging the accumulated equity in a property by borrowing against its increased value to obtain additional funds.

As this method utilises your property as collateral to secure the loan, the interest rates are notably more favourable.

There are however several limitations to doing this:

- It is only possible to do a cash-out refinancing on private properties and not HDBs.

- You’re still subjected to the maximum 75% Loan To Value (LTV) ratio, provided you do not have an existing mortgage loan. If you do have one, the LTV for a second mortgage loan is at 45% and 35% for a third mortgage loan.

- You cannot utilise your CPF funds for the monthly mortgage repayments, which means they have to be paid in cash. Depending on the size of your loan, this could be a substantial amount.

- Most importantly, the funds are not supposed to be used to finance the purchase of another property.

While there aren’t strict guidelines on the usage of the funds, they are typically directed towards purposes such as home enhancements, investments, settling debts, or addressing various financial needs. Strictly speaking, utilising the funds for purchasing another property is not permissible.

Since this practice is technically prohibited, we would not pursue this since it is in breach of the terms of the financing.

However, even without the funds from The Gale, it is still possible for Partner 1 to purchase a private property with the $300,000 cash, although options will be limited since the estimated affordability is around $765,000.

At the current moment, these are some newer developments within your affordability that are on the market:

| Project | Tenure | TOP | District | Unit type | Size (sqft) | Asking price |

| Treasure at Tampines | 99 years | 2023 | 18 | 1b | 463 | $740,000 |

| High Park Residences | 99 years | 2019 | 28 | 1 + Study | 452 | $750,000 |

| Kingsford Waterbay | 99 years | 2018 | 19 | 1b | 484 | $738,000 |

This approach is more straightforward as it entails purchasing only one property without any waiting period.

Nevertheless, opting for this may imply residing in The Gale, which might adequately accommodate a small family. However, considering your preference for a larger property, it might not be the most ideal choice for the long term.

What should you do?

Both pathways are feasible and at the end of the day, you could still potentially own two properties, but which route to take hinges on your preferences and timeline.

Assessing The Gale’s performance suggests that its prices are likely to remain stable. However, pursuing Option 1 necessitates selling The Gale to free up your name, whether for an HDB or private property purchase.

Given that you plan to secure a home in 5 years, buying a BTO or brand new EC is out of the question. Although buying a resale HDB also entails a 15-month wait out period, it is shorter than if you were to buy a BTO/EC. Buying an HDB is a longer process due to the 3-year SSD period, 15-month wait-out, and 5-year MOP before the occupier can go on to buy the second property. Also, substantial savings will be needed to purchase a decent investment property.

One silver lining with this option is that it lets you potentially ride out the high interest rate environment today which will play out nicely for you if the property market remains stable/declines and interest rates remain high.

On the other hand, if owning just one property suffices, you might consider purchasing a private property jointly with your partner. This eliminates the longer wait times and still offers prospects for appreciation in the future if the right development is chosen.

Additionally, considering your desire for a larger home as you plan to start a family, Option 1 enables you to select a residence that suits your living needs.

Regarding Option 2, the funds obtained through cash-out refinancing are not meant to be used to finance a property purchase so we will not advise doing so. Although simpler, this option limits investment property choices due to Partner 2’s affordability. Moreover, retaining The Gale will likely result in it being your primary residence, which might not suit your long-term needs for a growing family.

Considering these factors, despite the required waiting period, Option 1 of acquiring a resale flat under the owner-occupier scheme might be more suitable. Alternatively, if having only one property is acceptable, buying a private property together could be considered as it bypasses waiting times.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments