Why Singapore Property Is A Hotspot For The Super Rich: The Rise Of The Centi-Millionaires

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

At this stage of cooling measures, there’s growing concern that even Singapore’s stable climate might put off foreign property investment. The Additional Buyers Stamp Duty (ABSD) rate for foreigners now stands at 30 per cent; this is against a backdrop of soaring interest rates, and restrictions against land ownership (e.g., foreigners can’t own freehold landed properties without special permission). A recent report on centi-millionaires by Henley & Partners, however, suggests even these may be irrelevant in deterring the super-rich from Singapore’s shores.

One of the major reasons is due to the migration of the super-rich. Given about 40 per cent of the world’s centi-millionaires are based in the US, it’s reasonable to assume that much of their wealth will be tied to the US dollar. Along with that comes risks such as political issues and the US national debt that’s approaching USD 31 trillion. For those who feel that the USD could never collapse, a recent example of the British Pound makes for grim reading.

As such, these centi-millionaires are seeing the need to move, be it to diversify their risks, for better education options, safer environments, etc.

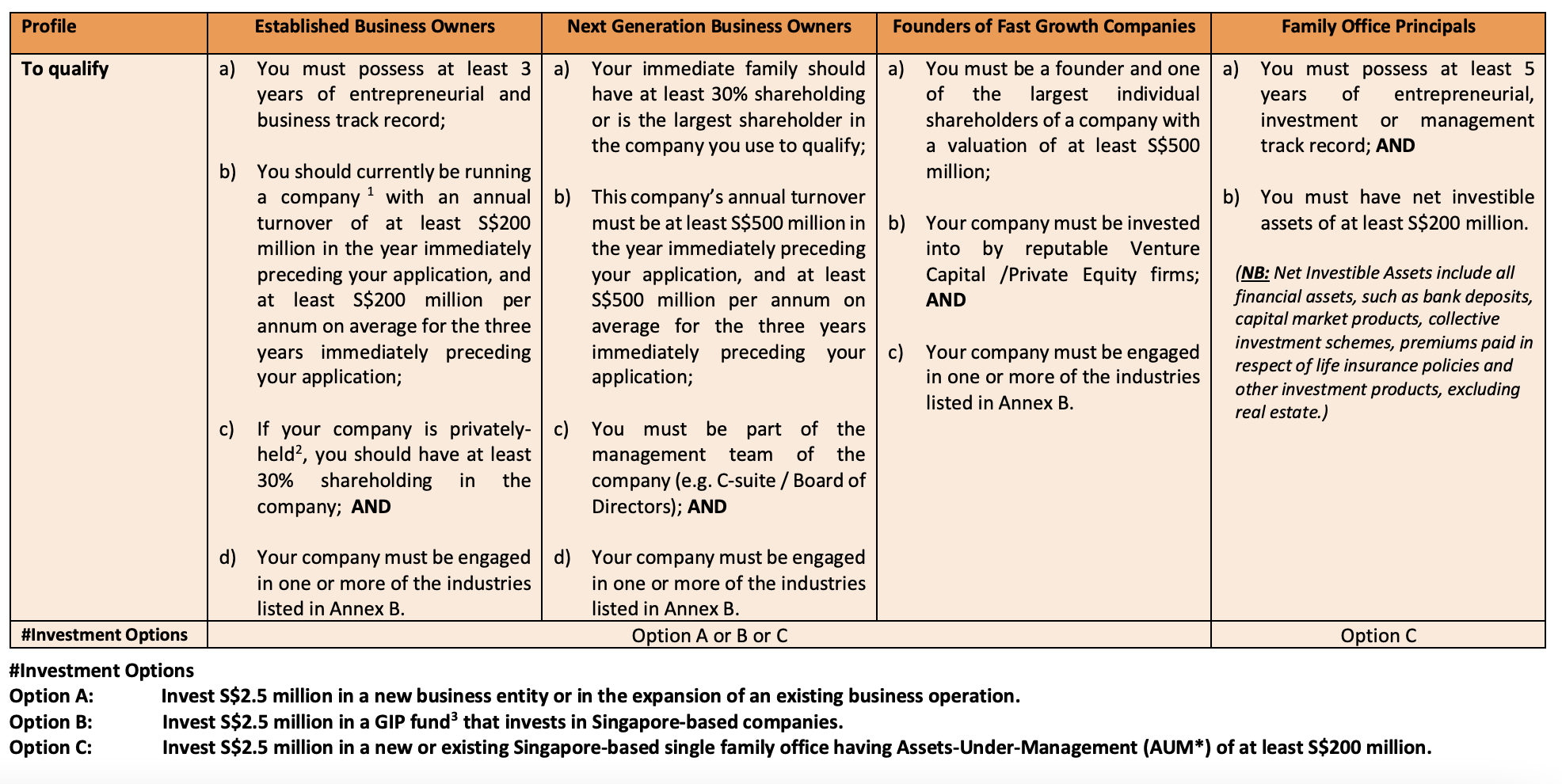

Clearly, Singapore is making moves to attract these super-rich. One of which is the Global Investor Programme (GIP) which accords Singapore Permanent Resident (PR) status to eligible global investors. Here’s the qualification profile below:

And according to a Hubbis article about how Singapore is a regional and global centre for UHNW wealth, it’s clear to see just what makes Singapore such an attractive place for the rich right now.

“They might say, yes, if I stay in my home country, I’m going to be paying high tax rates on my worldwide income, worldwide capital gains, I’m going to pay estate tax when I pass away, I’m going to pay gift tax when I make gifts. But in Singapore those are not applicable, and the family office and other structures offer additional incentives as well. Nowadays transparency is the norm, and secrecy is gone. Aside from incentives, Singapore also has many double tax treaties to help families invest in other countries as well. That is another huge advantage that Singapore offers.

We break down Henly & Partners report for you with 4 key points to note.

Table Of Contents

Singapore’s appeal to centi-millionaires:

Some of the key factors to note include:

- Singapore’s own centi-millionaires

- Not all foreigners pay ABSD

- Rise of family offices in the APAC region

- Singapore remains the most stable state in our region

1. Singapore’s own centi-millionaires

Singapore’s ultra-wealthy aren’t just attached to the local property market; it’s how most of them got to where they are. They’ve established the prevalent – and perhaps self-fulfilling – the belief that property ownership is the road to wealth.

As of 2022, the number of centi-millionaires in Singapore is creeping up the scale of the top 15 cities. We currently have around 336 centi-millionaires, and are ninth on the list of 15 cities.

As we saw in March last year, foreigners are quick to snap up luxury homes in Singapore; but it’s still local money that makes up the majority of buyers. And as of 2022, the proportion of foreign buyers has actually fallen, even as demand and private home prices rose.

So far, the signs seem clear that Singapore’s wealthiest sons and daughters still look to properties at home; and as Singaporeans get richer, our luxury developers still have a growing domestic market.

More from Stacked

Which Is A Suitable 2 Bedroom Apartment In Thomson? (Meadows At Peirce, Thomson Grand, Thomson Impressions)

Hi,

2. Not all foreigners pay ABSD

You’ll notice that the US cities make up the bulk of hotspots for centi-millionaires: this includes New York City, San Francisco, Los Angeles, Chicago, and Houston.

Given the increased volatility of US markets, and issues of high taxation, American centi-millionaires are likely to look beyond their own shores. At this point, it’s important to remember something about the ABSD:

American citizens pay the same ABSD rate as Singaporeans. This means, for instance, paying no ABSD on the first property they buy. Other exceptions include nationals and Permanent Residents of Iceland, Liechtenstein, Norway, and Switzerland.

While Americans don’t make up a large demographic of property buyers here, this may change as Singapore becomes more visible via economic ties, and the US pivot toward Asia.

Property AdviceThe Stacked Guide for Foreigners Buying Property in Singapore

by Ryan JIt certainly doesn’t help that Americans can avoid ABSD, and that US citizens are less likely to pick China and India due to rising political tensions.

3. Rise of family offices in the APAC region

A 2021 Citibank report estimated that 10,000 family offices have been established across the world in the past two decades, a 10x increase from the early 2000s.

North America still has the largest share of family offices; but Asia-Pacific recorded the fastest growth of such entities, with a 44 per cent growth over the past two decades.

It’s believed that 229 family offices have been registered in Singapore since 2020.

Along with the rise in family offices come Permanent Residencies, and portfolios that seek exposure to Singapore’s prime real estate sector. It’s been noted, for instance, that newer family offices tend to prefer real estate and fixed income instruments over growth assets.

One private wealth manager we spoke to, on condition of anonymity, said that real estate in Singapore is still the easiest choice, even with the ABSD. She said that:

“If you want to invest in China, you must deal with the government’s strict capital controls, and now there has been a scare with the Evergrande situation. If you want to invest in places like Indonesia and Australia, there are strong controls on resale and gains; and in New Zealand many foreigners are outright banned from buying residential property.”

She also pointed out that Hong Kong, once Singapore’s closest rival in terms of real estate investment, is increasingly falling out of favour as political dissent mounts.

As such, these situations may see family offices directing their client’s wealth toward Singapore real estate, especially in the volatile years ahead.

4. Singapore remains the most stable state in our region

Love it or hate it, Singapore has proven itself to be one of the most stable countries in South East Asia. From the Asian Financial Crisis, through to the Global Financial Crisis and Covid-19, Singapore has made it through without revolts, protests in the streets, or knee-jerk economic decisions.

One side-benefit to this, mentioned in the report, is the stability of the Singapore dollar – like the Swiss franc, it’s a well-managed currency that represents a safe store of wealth; in some ways an analogy to the Singapore real estate sector.

So long as Singapore continues to demonstrate stability, its real estate segment – particularly the luxury half – is likely to keep drawing foreign investment; ABSD or not.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale projects alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

Landed Home Tours Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

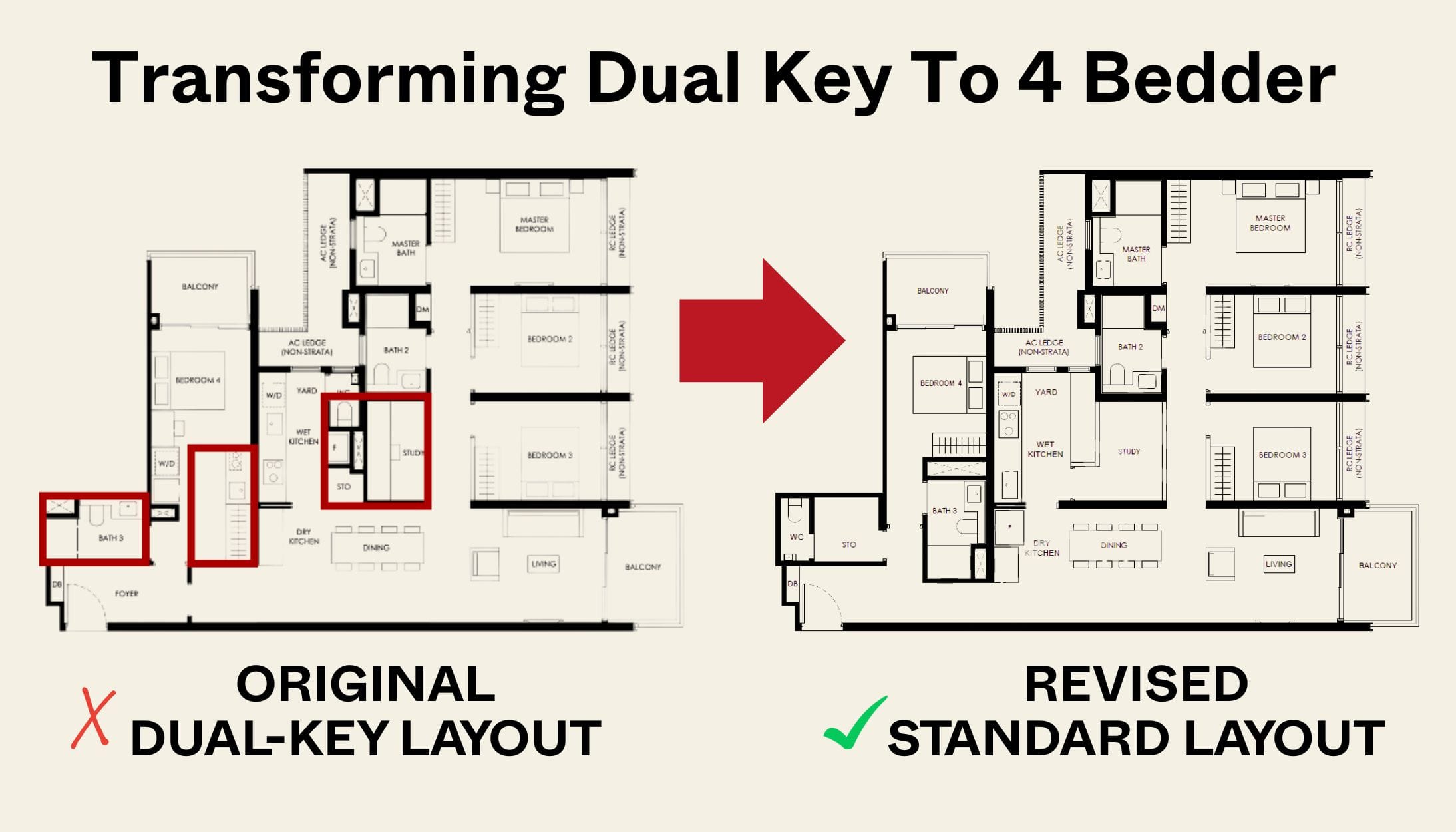

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look