The Impact Of War On The Singapore Property Market: Here’s What History Teaches Us

March 17, 2022

The year of the Tiger was supposed to be “roar-some”. Yet, there hasn’t been much to cheer about from the start of 2022 so far.

The last thing on our minds was a war breaking out, which was exactly what happened when Ukraine was invaded by Russia on 24th Feb 2022. This rattled investors’ nerves and sapped confidence from the stock markets worldwide in the weeks that followed, as the septic smell of carnage and death filled Ukraine’s brooding skies. It extended the volatility that has roiled the markets, which comes on the heels of a series of interest rate hikes that the US Federal Reserve (Fed) will be implementing from this month onwards.

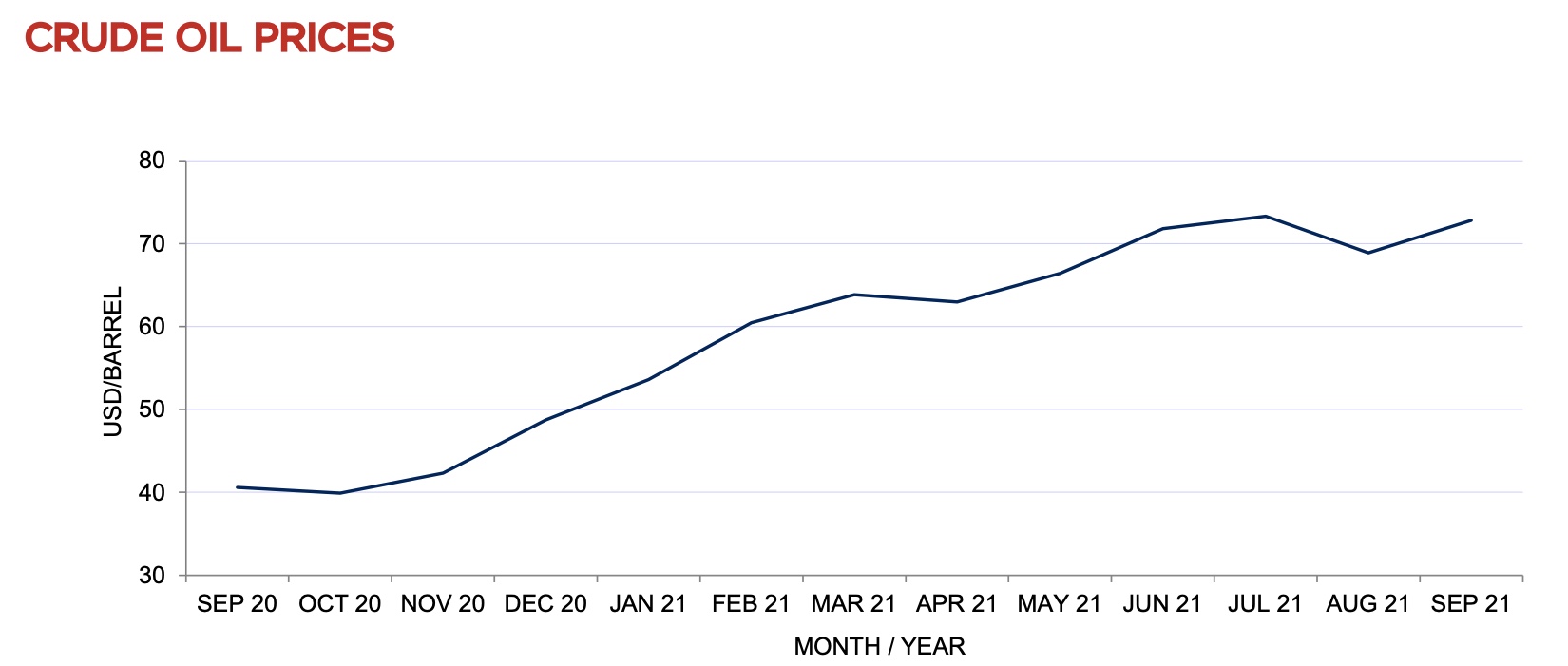

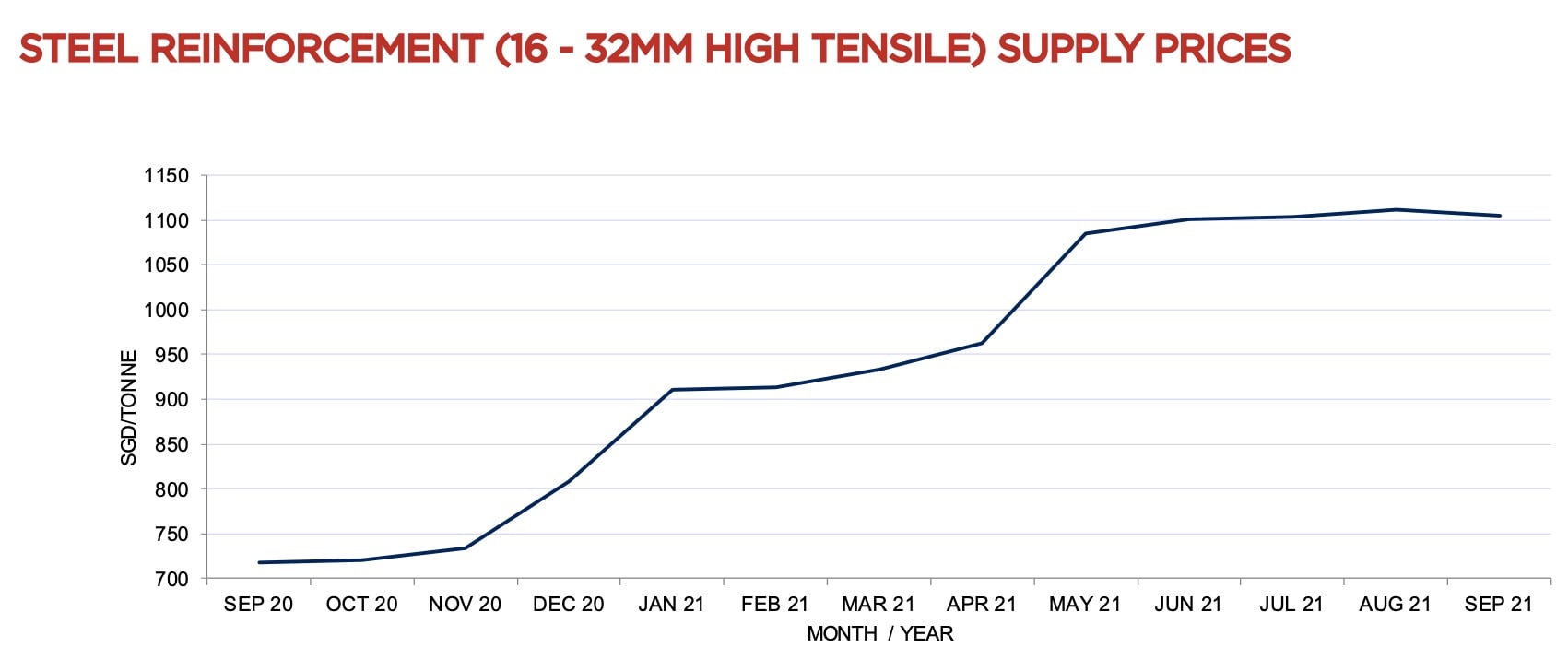

Against this gloomy backdrop, prices of commodities and energy have soared as fears of potential disruption of oil supply swept the globe, which would likely raise construction costs.

As always, anyone that’s looking around in the property market in Singapore would have questions. How would this affect the property market in Singapore? Should you wait and see what happens?

To answer that, let’s look at previous major world events, and see how that has affected the Singapore property market:

Key findings and tips

Our findings/tips are summarised as follows –

- Wars do not adversely affect the local property market. Rather, the main culprits are financial crisis and local fiscal measures;

- While commodities and energy prices are likely to be remain elevated, leading to higher construction cost, the impact on the local private property market is likely to be muted; and

- It’s important to remain prudent regardless of geopolitical events

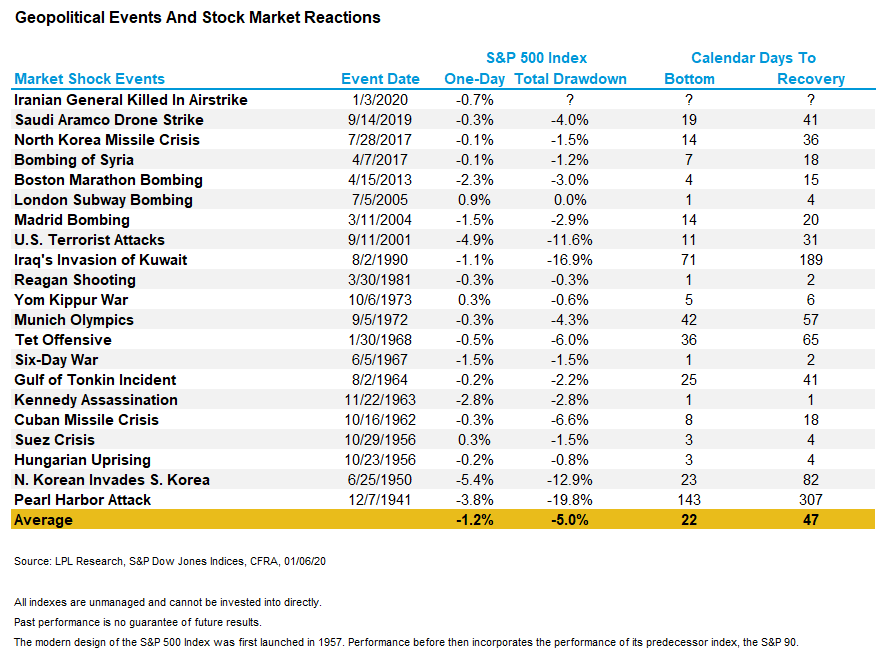

- Wars do not impact local private property market much

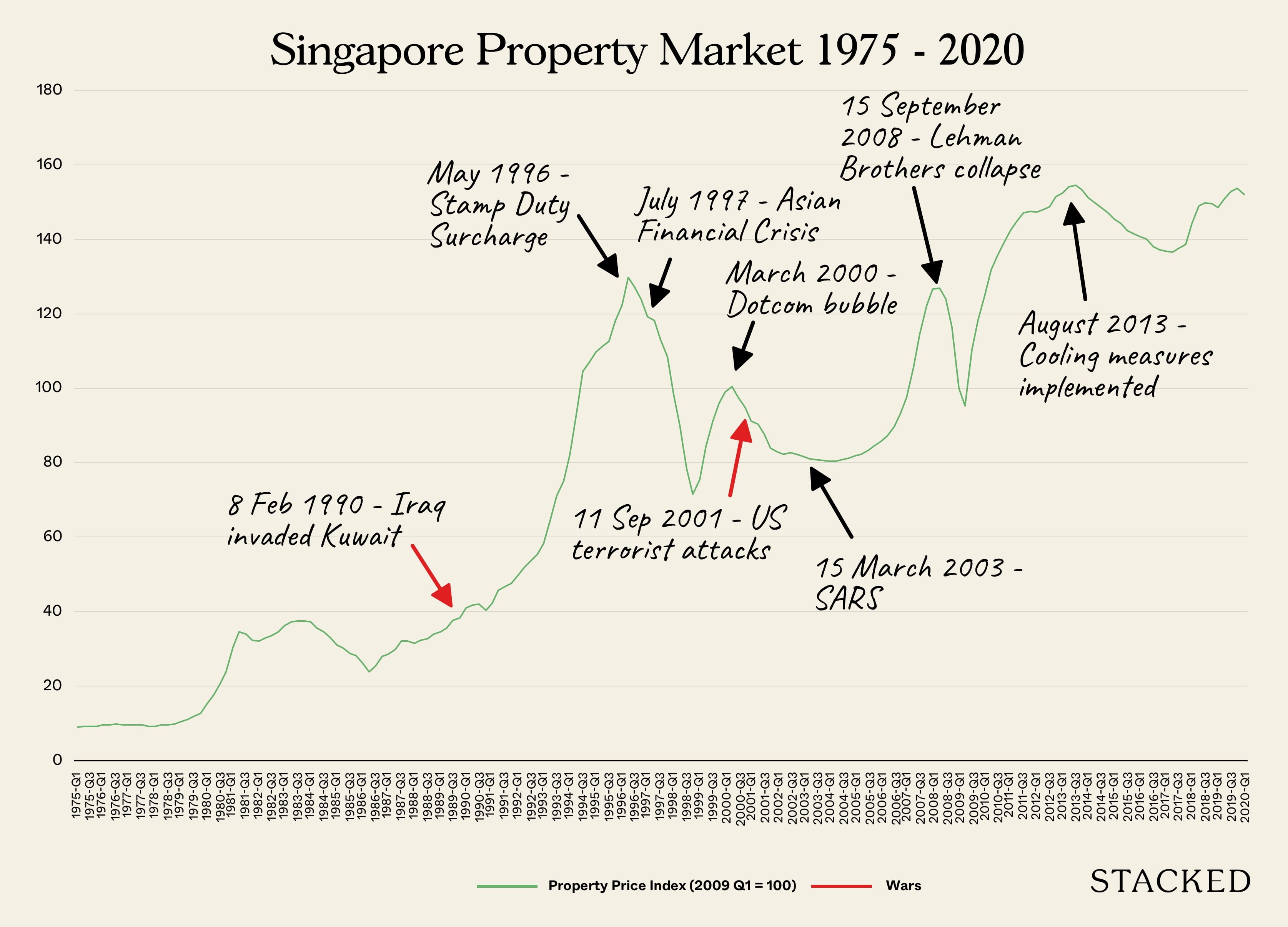

Unlike the stock markets, the local private property market has demonstrated resilience in the wake of military conflicts (pls see Figures 1 and 2 below). In fact, when the S&P 500 Index suffered a double-digit decline during Iraq’s invasion of Kuwait in 1990, it rebounded quickly and even went on to set a new record level. In another similar instance, the S&P 500 Index was in the doldrums for a protracted period following the 9/11 terrorist attack on the US. However, it was also sandwiched between the “Dotcom Bubble Burst” in 2000 and SARS in 2003. Hence, it’s hard to say that it was the sole catalyst for the market dip then.

On closer inspection, we observed that subsequent dips in the local property market were due to non-military conflicts (e.g. global financial crisis, implementation of cooling measures like the total debt servicing ratio (TDSR)). Even so, the dips were transient, suggesting the need for homeowners to have good holding power to weather the troughs. In fact, this was a recurring trend for the preceding dips in the local property market.

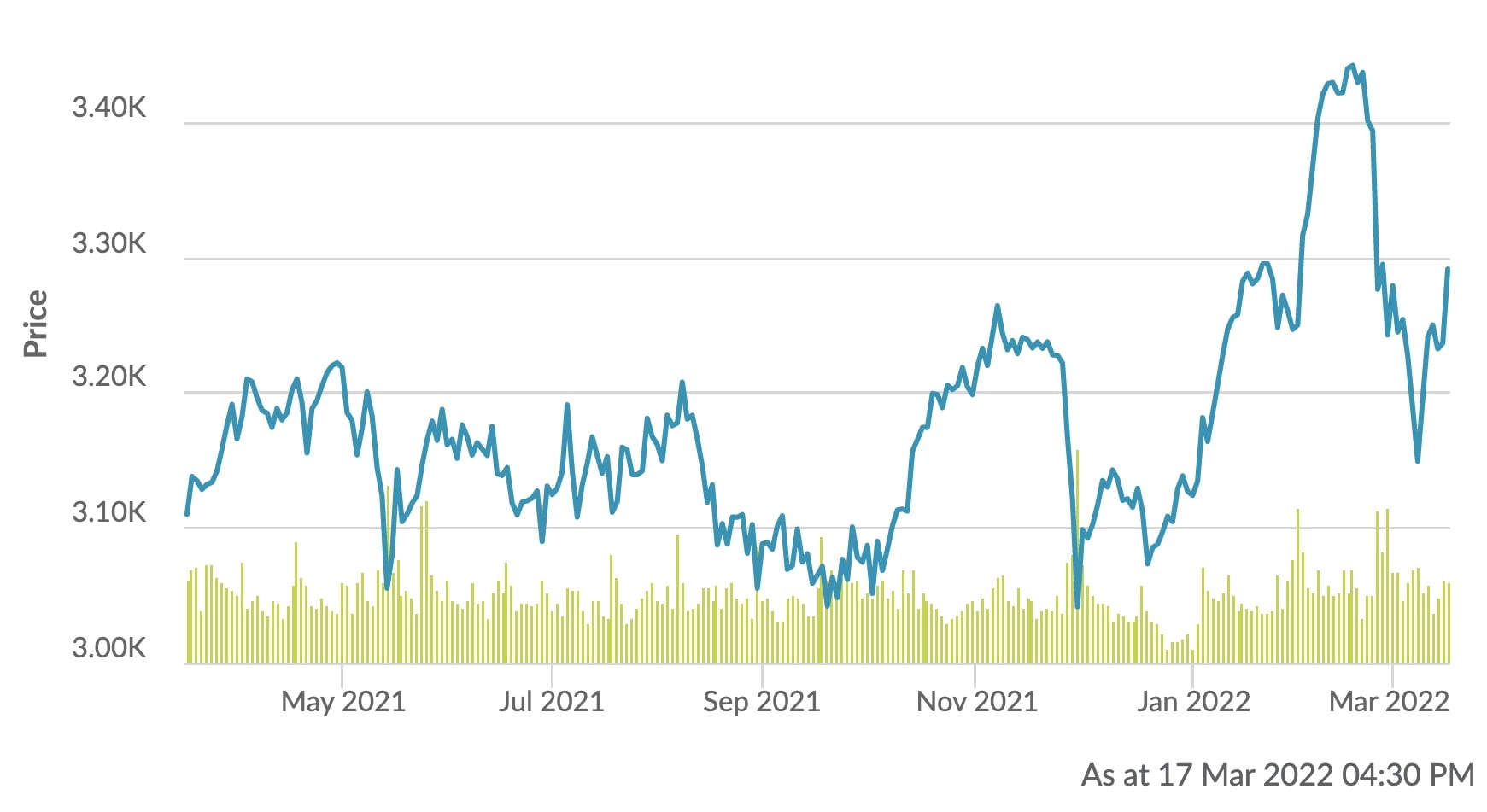

If you wish to have a “crystal ball” on how the local property market will likely fare, do check out our earlier article here, where we showed that the stock markets lead the property market. Back then, we mentioned that property prices will continue to go north at least for the 1Q 2022 based on the STI Index and this was corroborated by the recent bullish government land sales at Dairy Farm Walk and Bukit Batok West. If this continues to hold true, we could see home prices continue rising in Q2 and Q3 2022 based on the latest STI Index in Figure 3. The upcoming new launches at Northumberland Road and Ang Mo Kio Ave 1 in Q2 may see the same trends as well.

2. Higher construction costs likely to persist

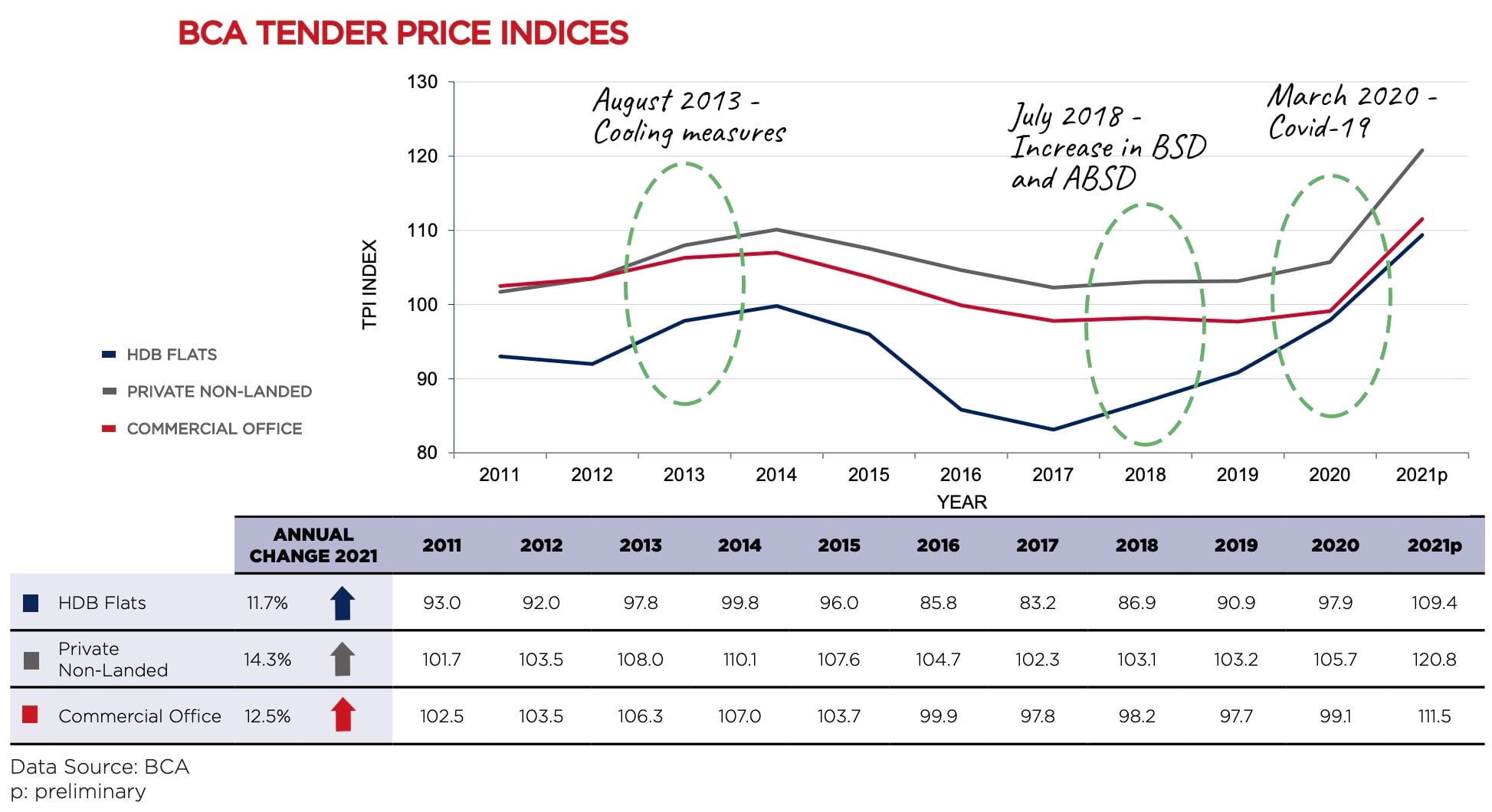

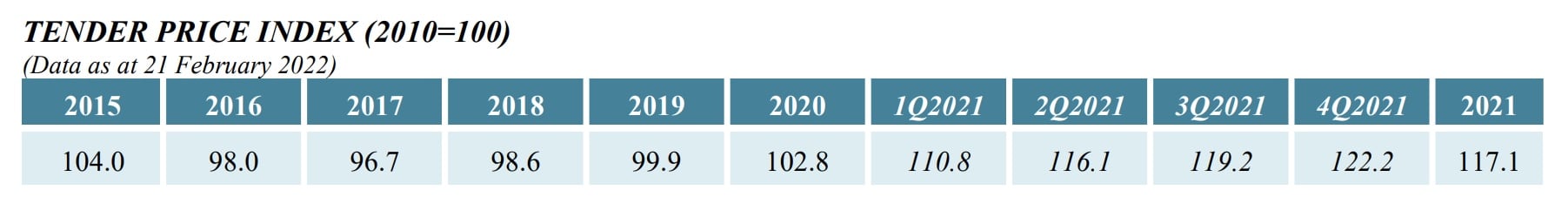

Historical data has shown that the impact of military conflicts on the local private property market is muted. Similarly, we note that the movement in the construction prices, as reflected by the BCA Tender Price Index was driven by non-military conflicts (pls see Figure 4 below). In fact, the Index was already on the uptrend before the conflicts occur (precipitated by the rise in manpower and material cost amidst continued disruptions from the COVID-19 pandemic). The same goes for commodities and energy prices.

Figure 5: BCA’s Tender Price Index, 2015 to 2021 (Source: BCA)

Thus, construction cost is likely to continue increasing, whether the Ukraine-Russia war drags on or not. If it does, it is likely to accelerate the rate of increase, as Russia supplies 20% of the world’s high-grade nickel (used for motor vehicles) and is the world’s third-biggest oil producer. Both have seen their prices sky-rocketed since the war started. Mr. Putin could very well cut the supply of its commodities and oil to the world, bringing economies reliant on them to their knees if he is driven to the corner by the Western nations via their economic sanctions unless greener alternatives are available. While this would mean heftier price tags for aspiring homeowners, it also means developers will be more sensitive in setting their prices, which we will touch on shortly.

3. Plan your property purchases with prudence to hedge against volatility

If the Ukraine-Russia war drags on, inflation will escalate and the Fed will act to tame it through interest rate hikes. However, it is likely that they will do so gradually since an aggressive hike would mean that the US will spend most of its budget paying off its national debt, which is an unlikely scenario. With this, central banks will raise their home loan interest rates, translating to steeper mortgage repayments for homebuyers.

More from Stacked

We Lived In A 2,000 Sqft SLA-Managed “Penthouse”: The Surprising Reality Of Living In One

We’re aware that any mention of SLA today immediately starts arguments about Ridout Road; but there’s more to SLA rentals…

Against this uncertain outlook, most homebuyers will likely stay on the sideline until the storm passes, which means lower demand for houses. Alternatively, they would re-direct their funds to safe havens such as gold and bonds. Regardless of geopolitical events, here are some tips you can take note of when purchasing property:

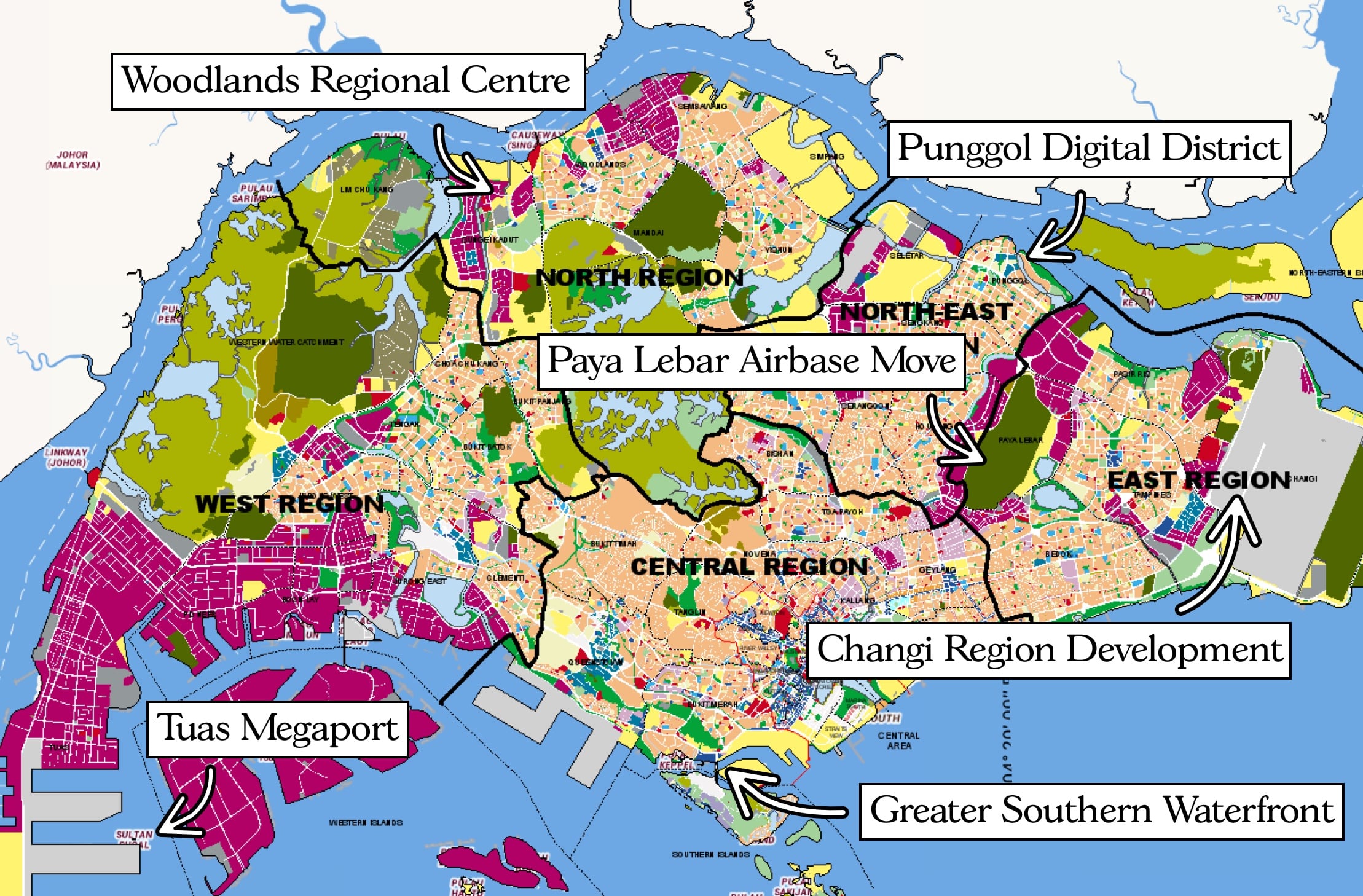

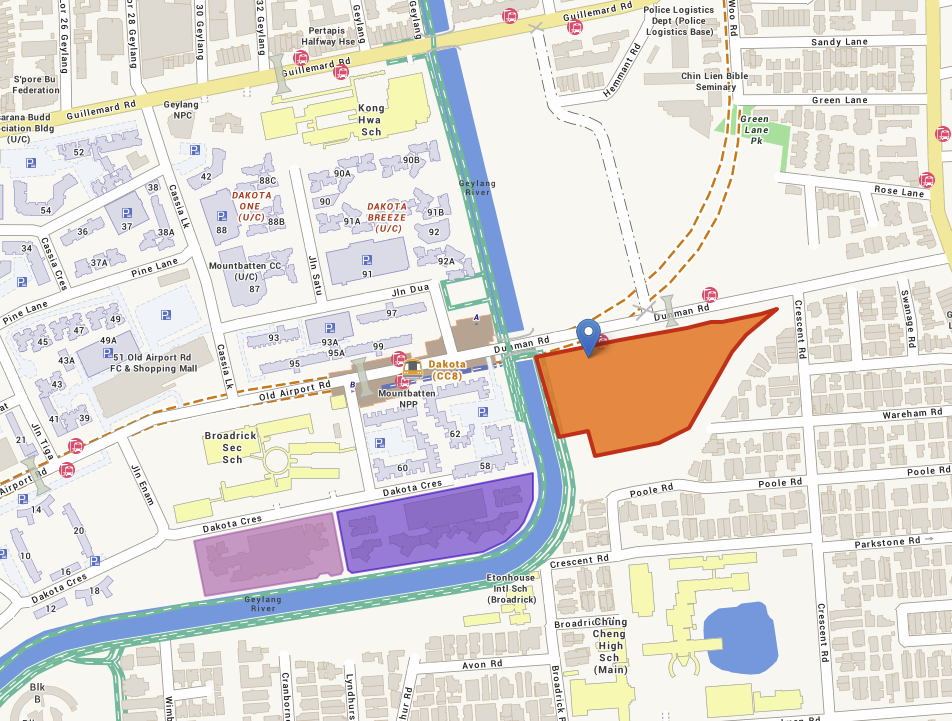

- Aligning your property purchase with urban transformations

We have previously shared how the Master Plan is a key tool for property planning. To ensure your property sees healthy capital appreciation, it would make sense to buy a property in areas where urban transformation is taking place since that is where the Government is investing significant resources in. To illustrate this point, consider Twin VEW which has recorded impressive profits for the first owners who sold their properties, as well as robust rental yields. While there are various factors to consider here (like the timing in a slower market), you can also attribute it to its proximity to Jurong East (which will be Singapore’s 2nd Central Business District), the upcoming Jurong Lake District and Jurong Innovation District.

Property Market Commentary6 Major Upcoming Changes You Need To Know In The URA Master Plan

by Ryan J. OngEven if the outlook remains choppy in the short to medium term, you are likely to weather through them with the potential appreciation for your properties located in these areas that are undergoing urban transformation.

- Avoiding the last plot of land in the area that you are buying into

This means if there are three plots of land under the Government Land Sales (GLS) Programme, buy into the first or second one when they are launched for sale if you can, as their future prices will be elevated by the subsequent or last plot of land, which tends to be pricier.

As an illustration, we can observe from the recent transactions at the Panorama, which is located at Ang Mo Kio Ave 2. It is a short walk away from the GLS at Ang Mo Kio Ave 1, which was won by UOL on 25 May 2021. Prices at the Panorama before the land sale were trending at around $1,400 to $1,500+psf. A few months after the sale, prices at the Panorama shot up to between $1,600 and $1,700+psf. Of course, like everything else, this isn’t the primary reason for the rise in prices, but it’s definitely a point to consider.

- Purchasing a property close to a popular primary school

This needs no further explanation, as our competitive society has driven young parents to do what they can to place their children in good primary schools so that they can get a good head start in life. This typically resulted in properties located near such schools to command a premium, including the two examples above, which are located within 1 km of Nan Hua Primary and CHIJ St. Nicholas Girls’ School respectively.

Bearing this in mind, an upcoming new launch to watch out for would be the GLS at Beauty World, which would be near Pei Hwa Presbyterian Primary School. With it anchoring the Beauty World transformation and more residential plots at Jalan Jurong Kechil (where Verdale is located) to be released, it is one development that has plenty of upsides if the price is reasonable.

Conclusion

All that said, at this point in time, it’s still hard to say how the conflict in Ukraine will evolve in the next few weeks or even months. If the conflict escalates into a world war then all bets are off.

On the property front, we are fortunate as Singapore has a very strong regulatory housing regime and good governance to ensure home prices do not spiral out of control. The recent cooling measures and those that came before it is good examples. Moreover, property transactions have always been transparent, which allows users like you and me to conduct our own analysis before making informed decisions. Hence, even when we are facing an external shock like a military conflict elsewhere, we can always go back to our fundamentals and re-calibrate our property plans.

While there are sceptics who are wary of property investment currently, I still remain optimistic about this asset class, especially since land will always remain scarce and as long as Singapore remains a safe and stable environment, overseas uncertainty may even see more foreign investment coming in. This means home prices can only eventually go up, whether the rate is faster or slower. If you noticed, property prices in Singapore are also less volatile compared with equities and its close cousin, REITs. Lastly, in times of heightened inflation, not investing (i.e. holding cash only) will definitely not make you any richer as inflation is akin to an invisible tax eroding your purchasing power.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How does war typically affect Singapore's property market according to history?

Will rising energy and commodity prices due to conflicts increase construction costs in Singapore?

Should I wait to buy property in Singapore during geopolitical tensions?

How can urban planning influence property investment decisions during uncertain times?

Does the current conflict impact the prices of new land plots in Singapore?

What precautions should I take when purchasing property amid global conflicts?

Ian Tan

Ian is a property enthusiast who finds himself constantly learning about this art and uses data to educate himself on property investment. When not analysing property data, Ian can be found shooting hoops, eating healthily and reflecting on himself, so that he can continue pursuing his aspirations for as long as his mind and body allow.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Latest Posts

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Pro The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

0 Comments