The Housing Struggles Of Singles Below 35: Should We Be Easing Restrictions?

March 19, 2022

Homes for singles continue to be a hot topic, on sites from Reddit to coffee shop talk. Of late, we’ve seen discussions about lowering the age requirement, as mentioned by Member of Parliament Pritam Singh (check out a Reddit discussion here), as well as complaints about restriction by type (e.g., no more than 2-bedders in mature estates, or not in PLH flats). But what could happen if we ease restrictions, and is it a good idea?

Table Of Contents

- The current reality for singles who need HDB flats

- There’s also the politically charged issue of LGBTQ couples

- What could happen if we let singles buy younger, or removed other restrictions?

- 1. Demand will rise in the short term, but future home values may not

- 2. A new set of social and political rifts

- 3. Risk of wealthy scions capitalising on larger flats

- 4. Might reduce some demand for small private units

- 5. Single Singaporeans could waste less on rental

- Does it promote or discourage marriage?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The current reality for singles who need HDB flats

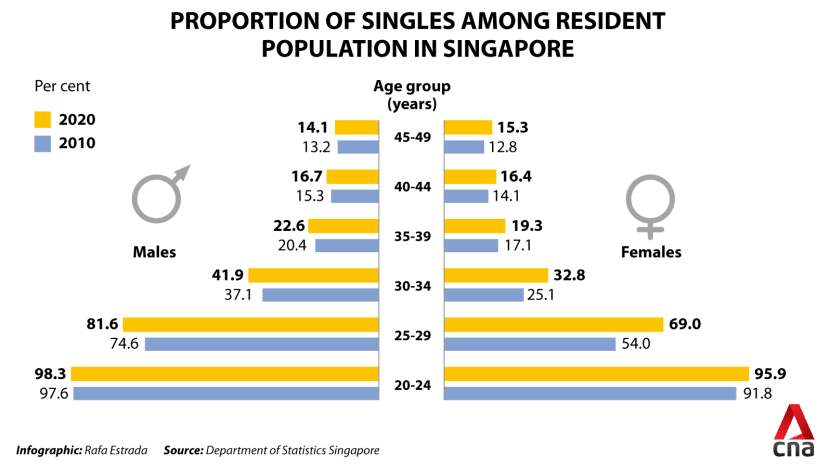

Population trends are changing, and the numbers show that the number of singles has increased across multiple age groups since 2010 – particularly among younger residents aged 25 to 34.

We have a detailed look at what flats singles can buy, in this article. But in quick summary, a BTO flat is out of the question unless it’s a 2-bedder, and in a non-mature location. Even if singles opt for a resale flat, they need to be at least 35-years old.

It doesn’t help that, in 2022, resale flat prices are at an all-time high, with about a third of transactions involving Cash Over Valuation (COV). Bear in mind that most singles are already taking on the entire mortgage by themselves, so they need substantially higher cash reserves; coupled with high resale flat costs, this can price many of them out of the market – even if they meet the age requirement.

Singles are also denied some of the choicer housing types, such as Executive Condominiums** (ECs), and Prime Location Housing (PLH) flats.

Some singles we spoke to felt this puts them at a financial disadvantage, a sentiment to which one realtor anonymously agreed:

“If you look at flat prices, the appreciation of smaller flats is not as good as a 4-room or 5-room*; and with a 2-room you don’t even have the chance to rent out a room right?

Also, ECs are good for investment, but if you’re single you’re left out**; and then also singles only get half the usual grants. So from a purely monetary perspective, single homebuyers have less going for them.”

*We had comparable findings in this article on older flats

**Singles can buy ECs jointly with another single (Joint Singles Scheme), but they cannot buy it alone under the Single Singapore Citizen Scheme (SSCS)

There’s also the politically charged issue of LGBTQ couples

As Singapore doesn’t recognise same-sex marriage, LGBTQ couples are in the position of buying as singles. Whatever your views on the issue, it is a fact that most have fewer options than hetero-couples, and are faced with a tougher time when they’re ready to move out.

A tricky issue here is that – even if the government doesn’t specifically change the rules just to help LGBTQ couples – it could end up being interpreted that way. This can result in significant pushback from more conservative elements. To some people, any action that supports single homeowners will be conflated with actions to support the LGBTQ community.

So, unfortunately, the politicisation of this issue (i.e., who gets to define the term “family”) has consequences on all single home buyers.

What could happen if we let singles buy younger, or removed other restrictions?

- Demand will rise in the short term, but future home values may not

- A new set of social and political rifts

- Risk of wealthy scions capitalising on larger flats

- Might reduce some demand for small private units

- Single Singaporeans could waste less on rental

1. Demand will rise in the short term, but future home values may not

If it’s easier for singles to buy flats, we have no doubt that demand will rise even higher than current levels. With the advent of Work From Home arrangements, more young Singaporeans than ever are seeking their own homes.

The short-term surge in demand will drive home prices even higher. For example, couples and families who lose out in a ballot, to a single, may end up forced into the pricier resale market.

Likewise, even if BTO flats remain out-of-bounds, removing the age restriction on resale flats can send a tide of singles into the market, again maintaining high prices (in fact, we suspect that even if singles could buy BTO flats at any age, they would still go for resale instead, as most are in urgent need of a home).

But consider the impact a few decades down the road, if the government ramps up construction to accommodate the higher demand.

Singapore is an ageing society, and most children will not – or we should say cannot – inherit their parents’ flats. Most Singaporeans will own their own homes, long before their parents even turn 65; we have a close to 90 per cent homeownership rate, and building more flats will simply maintain that.

As foreigners can’t buy flats, and Singaporeans can’t own multiple HDB properties, ramped-up construction could result in a deluge of available resale units when the inevitable inheritance of flats does happen. This is quite likely to drive prices down, and it would be a significant pain point to those who were relying on their flats as a retirement plan.

This means that, if we cater to singles and ramp up construction, we are hedging heavily on renewed population growth; and we had better end up with lots of young Singaporeans who need those flats, several decades from now.

Even then, not everyone will be happy with that outcome; the desirability of a population explosion is a hotly debated topic.

More from Stacked

We Are In Our 50s With $5m Assets & Earn $480k Per Year. Should We Keep Our Condo And Decouple Or Sell It To Purchase A Landed Home?

Hi Ryan, We have been avid readers of your Stacked Home articles, thank you for writing and sharing your knowledge with…

2. A new set of social and political rifts

The main issue is not construction costs or future home values, although those are certainly factors.

The real issue is that housing for singles invites over numerous other issues, beyond even LGBTQ rights.

It will, for instance, invariably spill over into arguments of who “deserves” more right to housing. Some will argue that single Singaporeans contribute as much to nation-building with their taxes, and deserve equal rights to housing. Others will argue that family units contribute in absolute financial terms. This also spills over into arguments of who “needs” the housing more; such as debates over how much space a single needs, as opposed to a family.

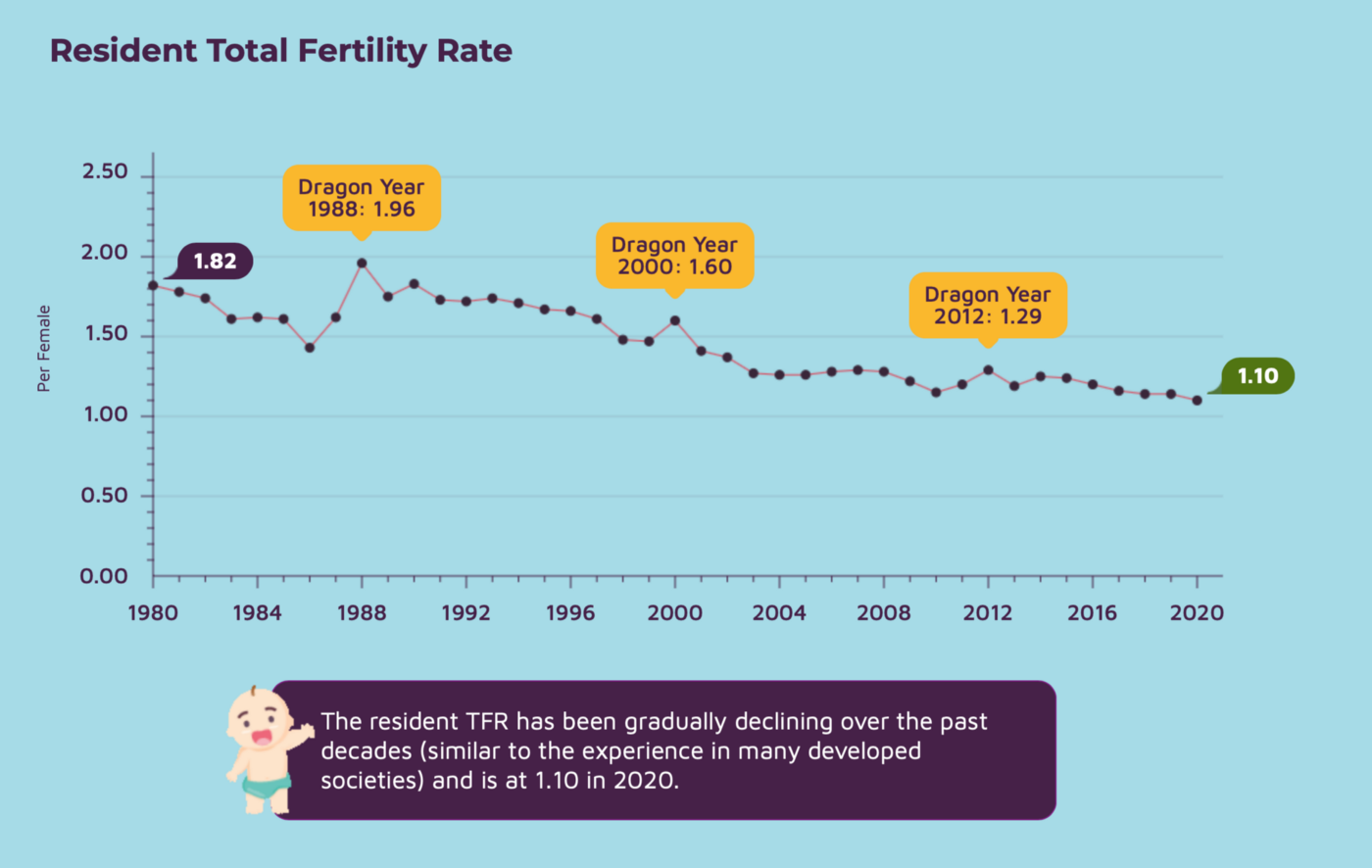

There is, of course, also the debate on if such relaxation of rules could have an effect on the already declining marriage and population growth rates. It’s only natural to think that a combination of a high level of home-ownership, and high property prices will make it difficult for younger Singaporeans to form their own households.

We daresay that none of those arguments will be resolved to everyone’s mutual satisfaction; there are some topics for which there’s no middle ground.

As such, the decision to grant housing to singles is not simply about the property market or retirement assets. It’s an agreement to take on certain ideological perspectives and values, for which Singapore must be ready on a cultural level.

It may be a simple fact that like LGBTQ issues, a predominantly conservative public needs to move into the area with baby steps – less we form a whole new set of divisive issues.

We think the government will gradually ease the restrictions on singles, rather than make a major policy change overnight. It’s an approach that’s likely to frustrate the singles today (sorry, we know you singles would like changes to happen before you get your senior citizen card).

3. Risk of wealthy scions capitalising on larger flats

This isn’t specific to the property market; we probably don’t need to tell you that the children of more well-to-do parents have an advantage in… well, almost everything in life.

However, allowing singles to freely buy flats can really bring this problem to the fore. Consider, for instance, the child of a family that already owns one or more large properties.

They can fund the purchase of a flat for their child when the child turns 28. After the five-year MOP, the child moves into one of the family’s other properties, and rents out the flat – thus securing rental income and an appreciating asset from the age of 33 onward.

On the flip side, some have argued that families who are so rich don’t bother buying HDB flats for their children anyway, which may be valid; but that doesn’t change the fact that the potential abuse is brought into the vital public housing system, rather than staying confined to the private sector.

Property Market CommentaryWe Asked: Is The New PLH Model Fair? Here’s The Collated Response From 175 People

by Ryan J. Ong4. Might reduce some demand for small private units

If singles can freely buy resale flats before 35, this could remove some of the demand for shoebox condo units, or two-bedders.

While most of these properties are bought as rental assets, there are singles who buy them simply because they don’t have other options. In most cases, it would be financially healthier for singles to not buy such units, and start with HDB.

Shoebox units can be tough to resell, and once a single buys a unit, they cannot also apply for a flat. This sometimes means they’re forced to sell, possibly at a loss, if they ever decide they want a family (they can’t raise one in a tiny shoebox unit).

(Ps. Singles who are affluent enough to buy a small private unit might bust the income ceiling on a BTO flat, but there’s no income ceiling for resale flats; this is likely the market they’ll rush into).

5. Single Singaporeans could waste less on rental

Singles who are forced to rent are at a financial disadvantage. They pay hundreds to thousands of dollars a month, on rental accommodation that leaves them with no actual asset. And this is further exacerbated by the current high rates in the rental market.

Some singles are forced into such arrangements due to abusive home environments, and having to pay rent isn’t really a choice (they may not be safe staying at home).

The opportunity to own their homes sooner is a boon to singles; provided they buy within their means.

On the issue of whether it promotes or discourages marriage, we have no idea

We’re not social scientists, so we won’t pretend to know if restrictions compel singles to settle down; nor do we know if homeownership would give them the confidence to get married.

It seems very much like these are unpredictable individual choices, based on a wider range of issues than whether they own their home (at least, we hope no one is getting married just so they can own a flat).

In essence, though, the issue of homeownership for singles is not confined to real estate considerations. Resale flat prices and BTO application numbers are a tiny sliver of the real debate.

At its heart, this is a debate about how Singapore wants to define the concept of family in the years to come.

For more on the topic as it rages, follow us on Stacked. We also provide updates on the latest trends, discussions, and strategies in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the current restrictions for singles buying HDB flats in Singapore?

How might easing restrictions on singles buying flats impact the property market?

What social or political issues are associated with allowing singles to buy homes more easily?

Could allowing singles to buy larger flats lead to abuse of the housing system?

How would easing restrictions affect singles' rental expenses?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments