Struggling To Find A Resale Condo In 2025? Here’s Why Supply Is Drying Up

February 15, 2025

If you’re in the market for a resale condo, you may find that your options feel limited in 2025. Wherever you look, there seem to be few available listings, and in some projects, almost no transactions may have occurred in the past 12 months. We’re here to tell you—it’s not just you. Other buyers, and even property agents, have begun to feel the impact of fewer and fewer people choosing to sell their condos. Here’s a quick rundown of what’s going on:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The cost of a replacement property is the biggest issue in 2025

If you pay close attention to property agents’ flyers and advertising, you may have noticed a shift since last year: agents now spend much more time and money trying to attract sellers rather than buyers.

Indeed, an ongoing complaint is the lack of inventory: even if there are plenty of willing buyers for resale condos, it’s immaterial because there’s little inventory to sell to them.

From conversations on the ground, the growing scarcity of resale condo listings may be due to the following issues:

1. The cost of a replacement unit in 2025

This is the main reason why many owners have decided against selling: prices are so high right now that even if they sell, they may be unable to bridge the gap to a pricier new home.

Consider how much new launch prices have risen over just a five-year period:

The average new launch price has increased from $1,887 psf in January 2020 to $2,640 psf in January 2025—a rise of around 40 per cent.

Resale condo prices have risen from $1,348 psf to $1,695 psf over the same period, an increase of about 25 per cent.

This reflects the classic conundrum: if you can sell high, you’ll also have to buy high. The sharp increase means that, barring a few lucky owners, the appreciation in their property’s value may not be enough to bridge the gap to a new home.

This recalls a previous story we published, where one interviewee rejected an en bloc sale of his Tanah Merah condo for this very reason. Even with $2 million in sale proceeds, surrounding resale condos were already averaging $1.5 million, while a nearby new launch (Sceneca Residence) was priced above $2 million for a three-bedder.

2. Higher ABSD rates

This is particularly relevant for those who already own a second or subsequent property. There is strong resistance to selling because, if they later attempt to replace the property, the ABSD is now much higher.

For example, one of our readers rejected an offer for their two-bedder unit (a second residence) because of the higher ABSD rates. The couple had purchased the unit in 2012 for their daughter’s use. Now that she has moved out, they had intended to sell it. However, when they originally purchased the property, the ABSD rate was zero for their second home. At the time, Singaporean citizens only paid 3% ABSD on their third or subsequent property.

If the couple were to sell their two-bedder and then attempt to replace it today, they would face a 20 per cent ABSD. As a result, they decided to hold on to the unit and rent it out instead.

Another realtor told us that foreigners who own property in Singapore are likely to fight tooth and nail to keep it, even rejecting en bloc proposals. The reason? If they sell, any subsequent purchase would incur a 60 per cent ABSD rate (except for exempted foreigners, such as US citizens). There is also a psychological impact—ABSD rates have never decreased in history, creating fears that selling a second home now may mean never owning one again.

More from Stacked

Why Some Central 2 Bedroom Homeowners In Singapore Are Stuck

I’m talking about the number of homebuyers who are interested in living within the Core Central Region (CCR), where prices…

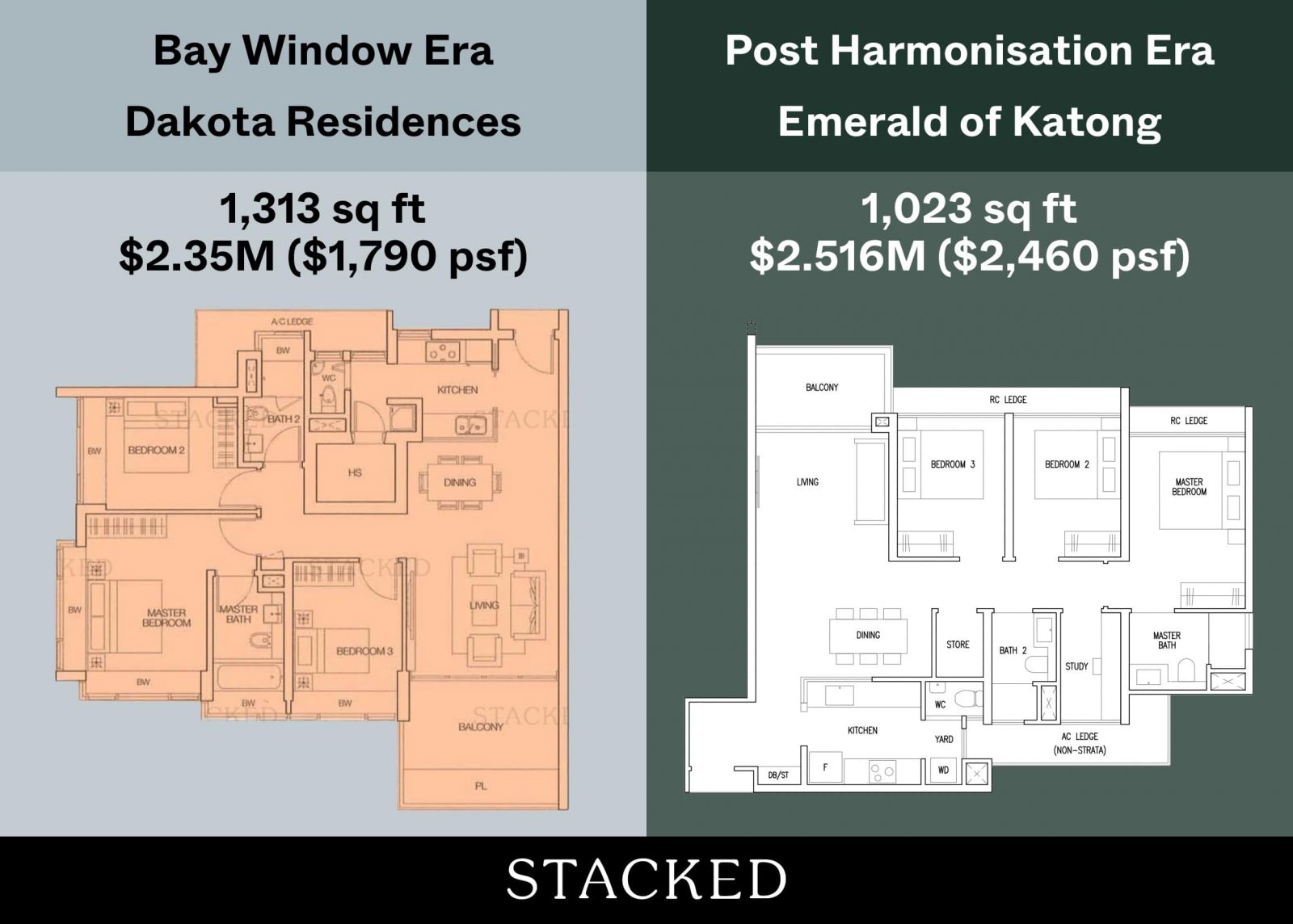

3. Newer replacements may be smaller

This is a bit ironic, as with GFA harmonisation, some newer condos may actually have more livable space than some older ones (where the total square footage includes things like air-con ledges, strata void space, and unusable long corridors).

However, in many cases, the sheer sizes of older condos are simply not available today—or if they are, the price quantum is so high that it is difficult to upgrade. Consider an older condo like Changi Court (1997): If an owner sells a 1,388 sq. ft. unit for $1.88 million (a real transaction from November 2024), what can the proceeds buy? At current new launch prices, a replacement would likely be 900 sq. ft. or smaller.

Some owners may feel that even if newer units are more efficient, they still represent too much of a compromise in size compared to their older homes. Indeed, one of the most common complaints among home seekers is that the biggest, most spacious resale condos have the least availability.

4. Waiting periods when right-sizing to flats

One of our readers recently opined that the 15-month waiting period – imposed on private property sellers who want to buy a resale flat – delayed their right-sizing decision.

Currently, anyone who sells a private property must wait 15 months after the sale before they can purchase a resale HDB flat.

(Build-to-Order (BTO) flats require a 30-month wait, making them an impractical alternative.)

While those intending to downsize will probably still do so eventually, the waiting period can create “stickiness,” causing some to reconsider due to inconvenience, and to hold off selling until they are fully prepared to handle the wait. In our reader’s case, they postponed their decision by close to a year, as they needed to work out the logistics of where to stay during those 15 months.

Note: This waiting period does not apply to those aged 55 or older who are downsizing to a 4-room or smaller flat.

5. Tighter financing and interest rate worries

Over the years, cooling measures have introduced several loan restrictions:

- Loan tenure limits were reduced in 2012.

- Total Debt Servicing Ratio (TDSR) was introduced in 2013 and has since been lowered from 60% to 55%.

- The maximum Loan-to-Value (LTV) ratio was reduced from 80% to 75% in 2018.

On top of this, many upgraders today are older, meaning shorter loan tenures, higher monthly repayments, and stricter eligibility criteria. Additionally, with higher home prices, loan quantums are also larger, making financing more difficult.

Interest rates are another concern, given the uncertain global economic situation. Depending on how the US Federal Reserve sets rates, borrowing costs could spike unexpectedly. For potential upgraders, the idea of another 10 to 20 years of potentially high interest rates makes holding onto their current home a safer choice.

A side effect: The weak en bloc market

If current owners aren’t willing to sell, the same applies to developers looking for en bloc sites. Many homeowners facing an en bloc sale would still have to deal with high replacement property costs, financing hurdles, and ABSD on any additional property.

As a result, beyond just being an issue for resale buyers, this also affects those hoping for collective sales. The market conditions suggest that en bloc sales are likely to remain weak for the foreseeable future.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are there so few resale condos available in 2025?

How do higher property prices affect resale condo availability?

What impact do higher ABSD rates have on condo owners' decisions to sell?

Why are newer replacement condos often smaller in 2025?

How does the 15-month waiting period affect owners wanting to sell and buy a resale flat?

What are the financing challenges faced by condo owners in 2025?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments