Singapore’s Private Home Market Sees First Price Drop in Three Years: What’s Next?

July 3, 2023

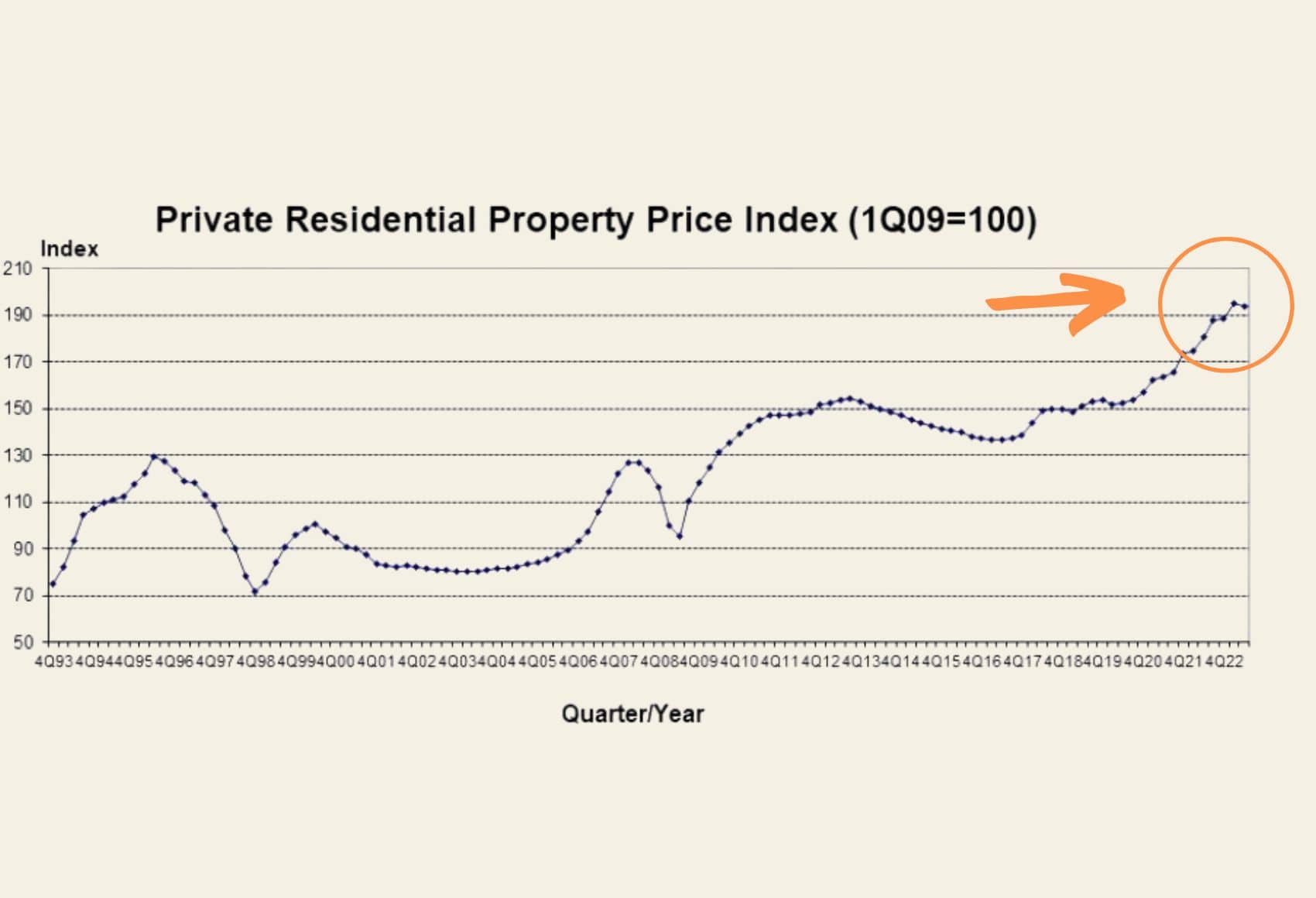

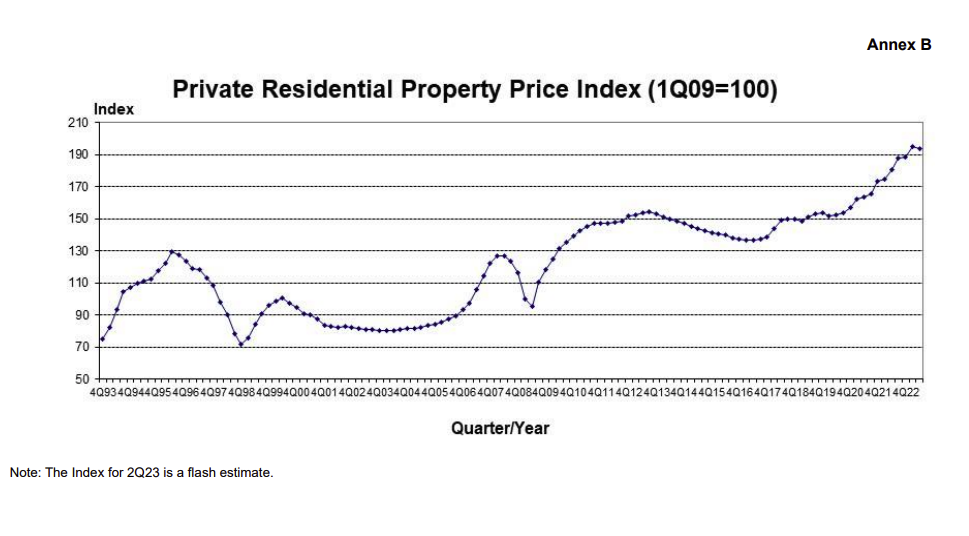

We don’t usually focus too much on the results of a single quarter, but this is an exception. Q2 of 2023 marks the first time we’ve seen a faint dip in property prices, since around Q1 of 2020. But does this show property prices are about to cool down at last, or are we just reading too much into it? Here’s a look at opinions on the ground right now:

A slight price dip of 0.4 per cent

According to URA flash estimates, private property prices dipped by 0.4 per cent for Q2 2023. While not a huge shift, it is the first time in the aftermath of Covid (the first time since Q1 2020 to be exact) that private home prices have declined. The decline was largely attributed to properties in the Rest of Central Region (RCR), as prices fell by 2.6 per cent in Q1 2023.

The price dip was across all market segments. Even landed properties, which are known for seeing gains even in weak markets, saw mostly flat prices (they were up only 0.1 per cent, compared to a 5.9 per cent increase in the previous quarter).

Transaction volumes have also dipped. While volumes were up from the previous quarter, due to new launches like The Continuum, they were still down by about 30 per cent from Q2 2022.

But why is this happening, and can prices dip even further?

The realtors and investors we spoke to were divided on this, but none of them were surprised. Most noted that prices had been rising unsustainably since the tail-end of Covid, with one investor alleging that “By the time the government raises the ABSD, it usually means prices were out of hand probably a year ago.”

Some of the issues they brought up were:

1. Expectations of higher supply

Back in March, National Development Minister Desmond Lee said that “We will turn the corner soon.”

This was in response to the shortage of housing, which was blamed for pushing up resale flat prices. (There was also further news today that 13,000 BTO flats will be launched in the second half of 2023, 31 per cent more than the first half). But it should be noted that private homes were in short supply as well; this was partly due to a cut in the supply of Government Land Sales (GLS) sites in 2020, in response to Covid-19.

Back in the Covid pandemic, the supply cut was meant to compensate for what experts predicted to be a weak economy and housing market, in the immediate aftermath. Ironically, the opposite proved true – housing demand soared, and the Covid-era cuts likely worsened the situation by limiting land sales.

It’s also worth noting that in the year before Covid, experts and analysts had claimed there was a supply glut that would supposedly take years to clear. This erroneous assumption may have also contributed to the low supply, as it drove developers to be more cautious with en-bloc sales and project sizes.

However, realtors said that immediate price dips are less about future land supplies, and more about how many units receive their Temporary Occupancy Permit (TOP) soon.

One realtor noted there has been a surge of these in 2023:

“This year we will see a lot of large projects reach completion. Normanton Park with 1,862 units, Treasure at Tampines, which is the biggest condo in Singapore with 2,203 units. So I think we have soaked up a lot of the existing demand, and going forward buyers are no longer short on options, so prices will probably moderate.”

We looked to corroborate this with URA records, and found the following in the URA’s report for Q4 2022:

“Based on the expected completion dates reported by developers, 19,291 units (including ECs) will be completed in 2023. Another 12,824 units (including ECs) are expected to be completed in 2024. In total, around 32,100 units (including ECs) are expected to be completed in 2023 and 2024, which is around two times the 15,900 units completed in 2021 and 2022.”

Another realtor noted that: “Even since April this year we started to see rental rates (in the private marker- Ed.) drop, so this is another sign that a lot more homes are becoming available. You will usually see home prices move down in tandem with rental rates, whenever there’s a significant increase in supply.”

Firms like Savills also earlier predicted a dip in the rental market.

The same realtor said that, given the expectation of more options and more competitive prices later, both home buyers and investors may decide to wait out 2023:

“They may see this as an inflection point, where prices start to go back down after a peak like they did in 2013. So there is a reversal in their mindset: previously they rushed to buy because they were afraid prices would keep going up. Now they don’t want to buy because they might end up buying at the peak.”

2. The ABSD and its impact, or lack thereof

Realtors and investors remain divided on the ABSD, and whether it has any bearing on the current price dip. One investor had an interesting take, saying that ABSD had an effect, but not as intended:

“Regardless of the actual increase, the market will still dip in the near term. It’s not about the maths. They (the property buyers – Ed.) are just speculating that prices may dip. Whether it’s up one per cent or three per cent, the reaction is predictable.”

More from Stacked

Neighbourhood Of The Week: Yishun (District 27)

Yishun is one of the most meme-worthy neighbourhoods in Singapore. It’s nicknames include “The Devil’s Ring” and to date, it’s…

This is a reference to the latest round of cooling measures, where Singapore Citizens buying a second property pay 20 per cent ABSD instead of the former 17 per cent.

Realtors, however, shared a consensus that higher ABSD affects only niche market segments. The greatest hike in ABSD rates, for example, was a rise to 60 per cent ABSD for foreign buyers. However, the number of foreigners buying Singapore property has usually been in single-digit percentages.

HDB upgraders (i.e., those who sell their flats to buy a condo) also typically don’t own more than one property, even after upgrading. As such, they don’t end up paying ABSD anyway.

One investor, however, disagreed. She pointed out that the impact of ABSD is real but hard to quantify because it’s “pre-emptive.” She said:

“These claims that ABSD are only affecting niche groups are not very well thought out. The impact is definitely there. We don’t know how much higher prices would be right now if it wasn’t for ABSD. We don’t know how many landlords or foreigners or companies have been discouraged from buying properties, and competing with home buyers, if not for the stamp duty making the numbers unattractive.

As much as I don’t like to pay ABSD, I think it’s a policy that works. I think it’s inaccurate to say it’s not helping to keep prices down. The trouble is we can’t quantify the extent of the effect, because it stops the bubble from forming in the first place.”

Property Market CommentaryHow To Lower Property Prices In Singapore: More Loan Curbs Or ABSD?

by Ryan J. Ong3. A combination of higher interest rates, plus high inflation

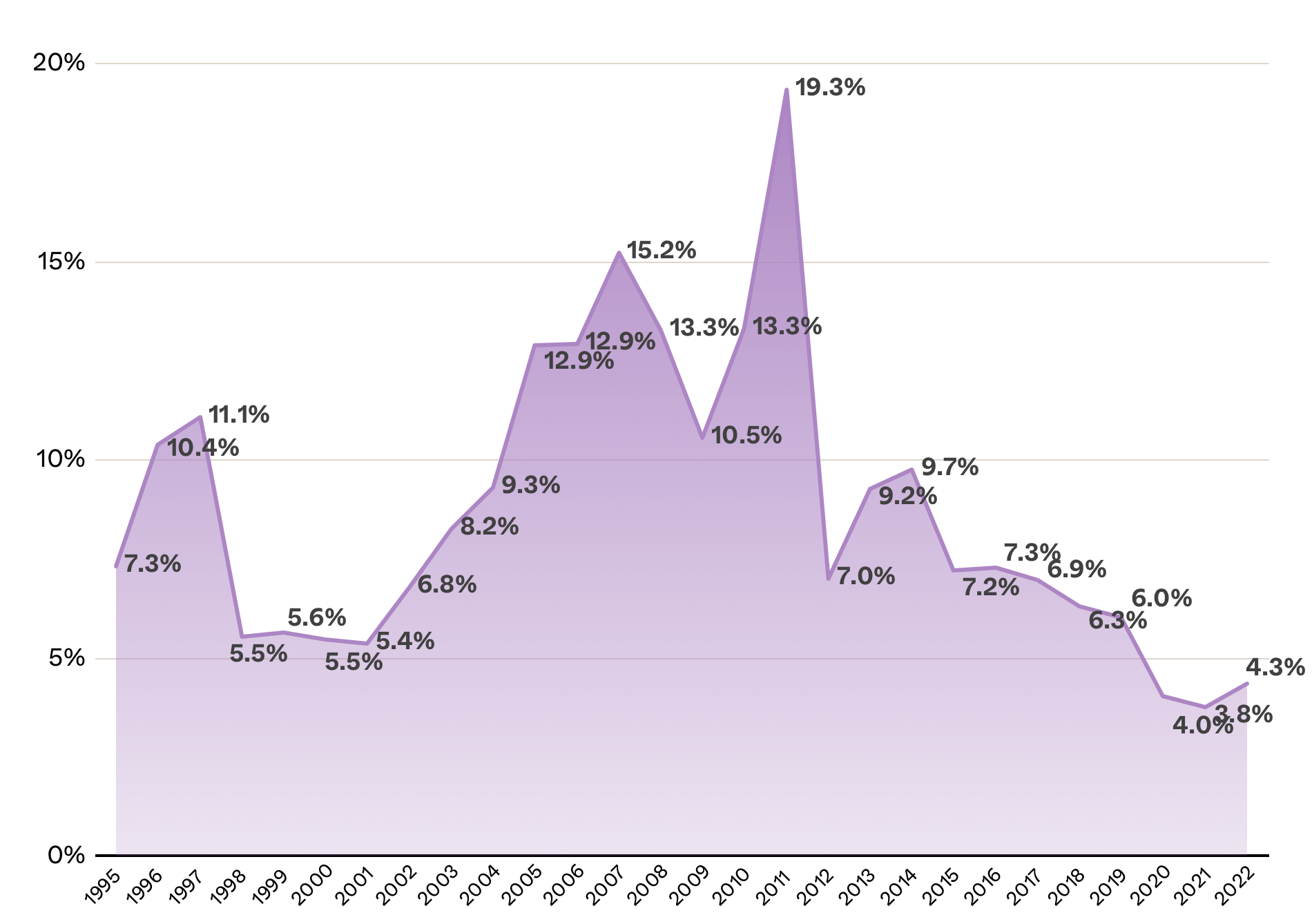

Interest rates between 2009 and 2017 averaged as little as 1.6 per cent, and between 2018 through to 2021 tended to be at around two per cent. But as of 2023, average home loan rates are climbing past 3.7 per cent.

There’s a psychological impact in private home loan rates finally rising past CPF interest rates. Previously, some buyers had a sense of “borrowing for free,” as the CPF interest rate of 2.5 per cent was far higher than their home loan rates. But with the era of low rates being over, buyers have become more conscious of the consequences.

One investor noted that a property’s main appeal, besides being a tangible asset, was the availability of cheap leverage. He noted that fewer investors are inclined to pay ABSD as well as higher interest rates, when other financial products now appear to promise higher returns at equally low risks.

One realtor opines that more buyers are backing out, over fears of affordability. She says that higher inflation, coupled with rising interest rates, were the reasons given by clients for backing out of upgrading:

“Previously I feel buyers were more confident; but now they are stressed out about other costs like their children’s education, their car loans, or healthcare expenses. I feel more of them have decided to save up more aggressively before upgrading.

There’s also a sense that if they upgrade now, renovation costs are also very high; some of my clients complain that they sell high but they also buy high…so their sale proceeds cannot even cover the renovation of their next home, whereas last time it could.”

Renovation costs have been on the rise because of Covid. In essence, prices spiked during the labour shortage in Covid, but the market adapted and the prices just never came back down.

These factors have seen more conservative bids from buyers and may be compelling developers to price their units more conservatively.

4. Increasing resistance from resale flat buyers

This may not seem directly relevant to the private market, but some realtors have remarked on the knock-on effect. HDB flat prices slowed in December 2022, with analysts predicting some moderation in prices this year.

Realtors pointed out that most HDB upgraders are highly dependent on the sale proceed of their flats, to cover the cost of upgrading to a condo. In particular, there must be sufficient funds left after discharging the existing loan and refunding their CPF, to cover the down payment of their condo.

At least five per cent of a private property’s price must be paid in cash, and the next 20 per cent with any combination of cash or CPF.

This means that, if resale flat prices cannot bridge the gap toward private homes, the private market could also see fewer transactions or a price dip. One realtor opined that lower sales proceeds from HDB flats, coupled with private home prices reaching a quantum of over $2 million, would be “the final nail in the coffin of rising prices”.

This is on the basis that the HDB upgraders constitute the largest demographic of buyers on the market right now. The same realtor noted HDB upgraders would continue to be the dominant force in years to come, as higher ABSD rates have further shrunk the numbers of foreigners and multiple-home buyers.

If so, it would mean that any price increases (or decreases) in the private market are at least partially tied to the fate of their HDB counterparts.

The general agreement, from the word on the ground, is that price increases will be slower compared to the post-Covid years of ’21 and ’22. However, it’s unlikely that significant price dips will occur, given that (1) Singaporean sellers are well capitalised with substantial holding power, and (2) there are lots of cooling measures that can be tweaked depending on the situation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did Singapore's private home prices drop in Q2 2023?

Is the recent decline in property prices a sign of a market downturn in Singapore?

How does the increase in property supply affect prices in Singapore?

What impact does the Additional Buyer’s Stamp Duty (ABSD) have on property prices?

How are rising interest rates and inflation influencing Singapore's property market?

What is the relationship between HDB flat prices and private home market trends?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments