Should You Buy A Bigger HDB Or Smaller Condo For $1 Million In 2024?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

With more central area flats reaching the million-dollar mark (or at least around $800,000), there’s reason to reconsider small or far-flung condo units. Whilst you could potentially get a small resale condo for around a million, does that compare to the spaciousness of a 5-room or bigger flat and one that might be in a central area to boot? You may not have a tennis court or a swimming pool, but being right next to the MRT station, or close to the CBD, might well make up for it. Let’s weigh up the pros and cons:

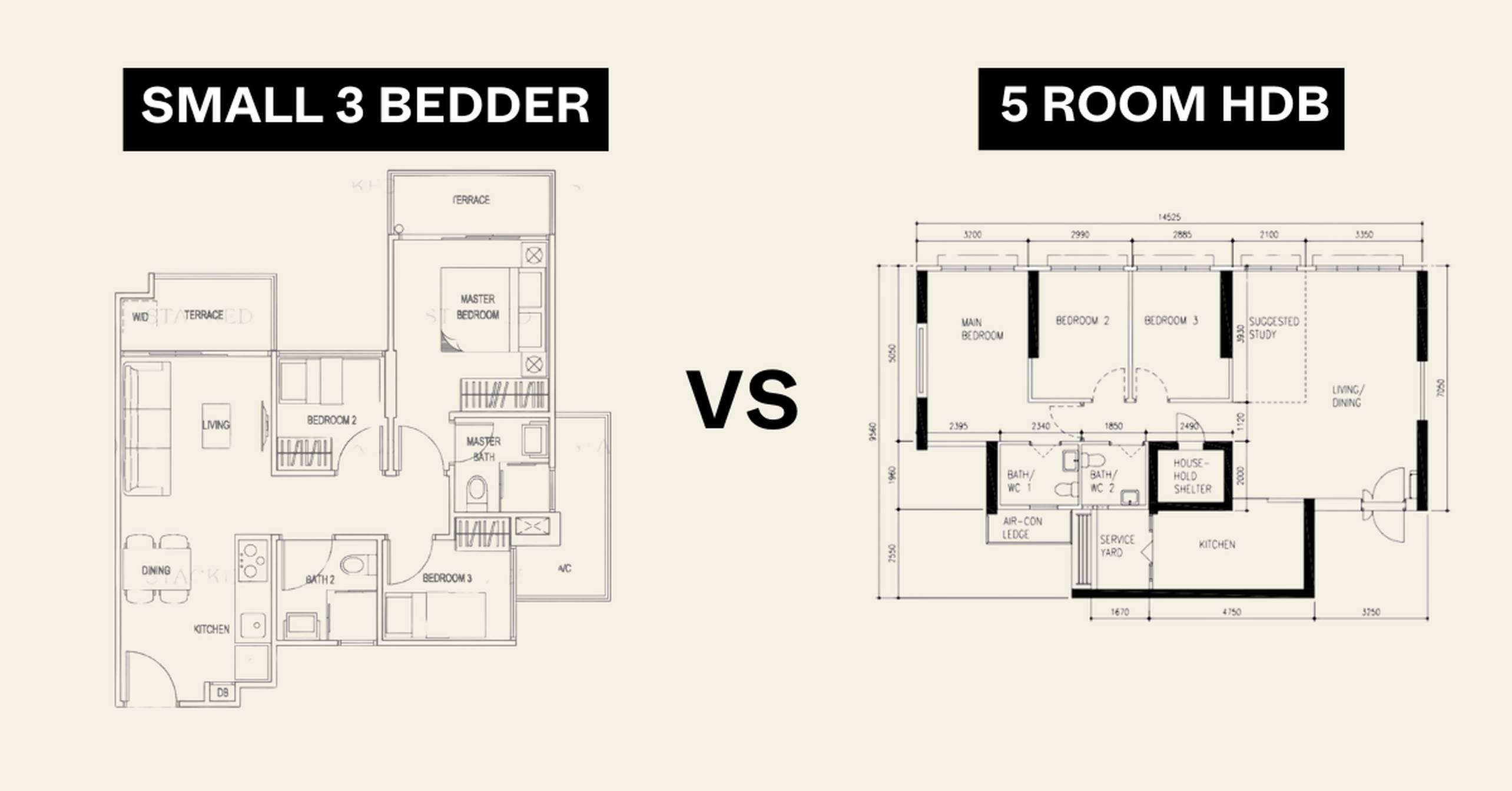

First up, this would probably be a typical 5-room flat that you may be considering in a central area:

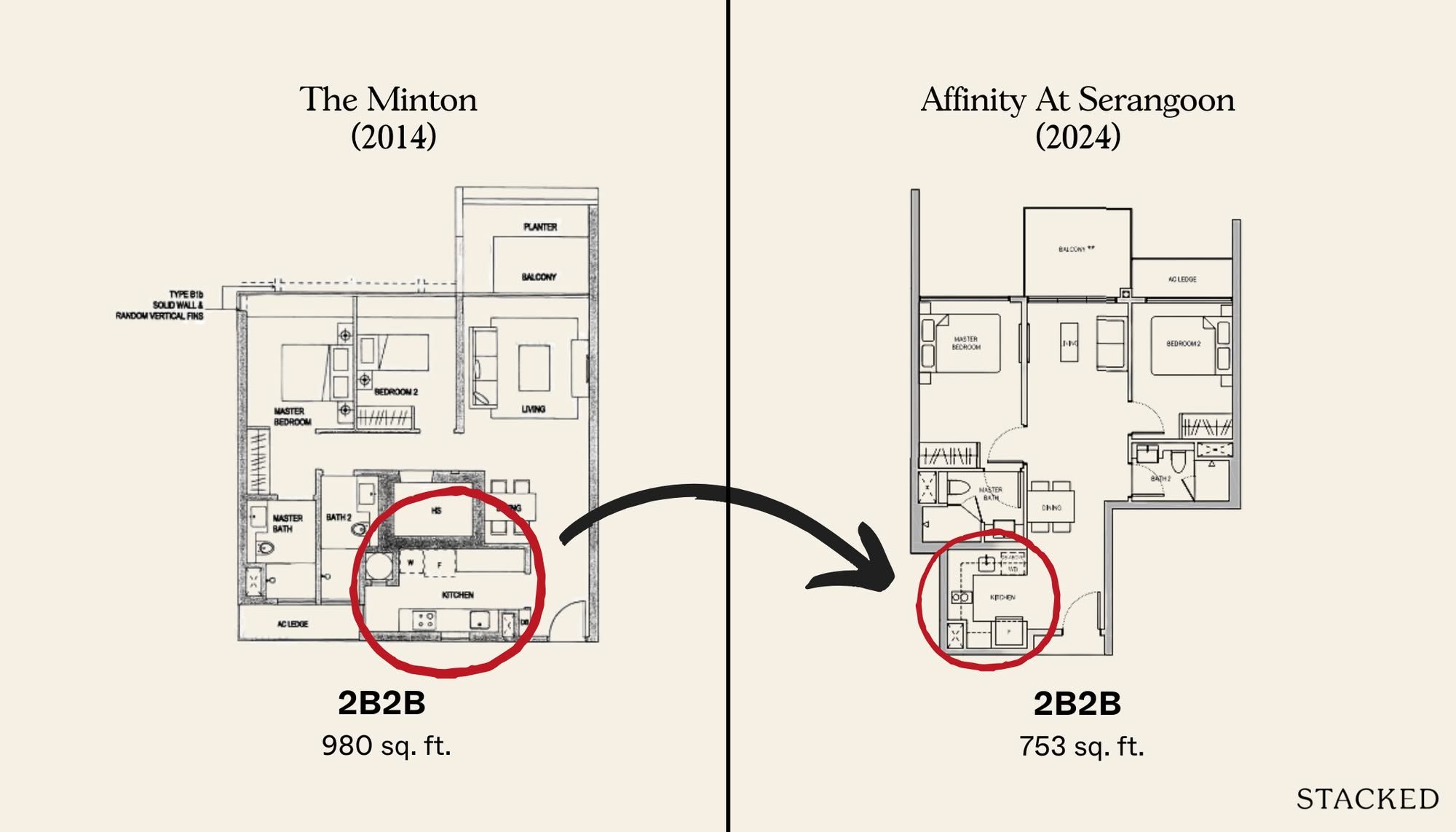

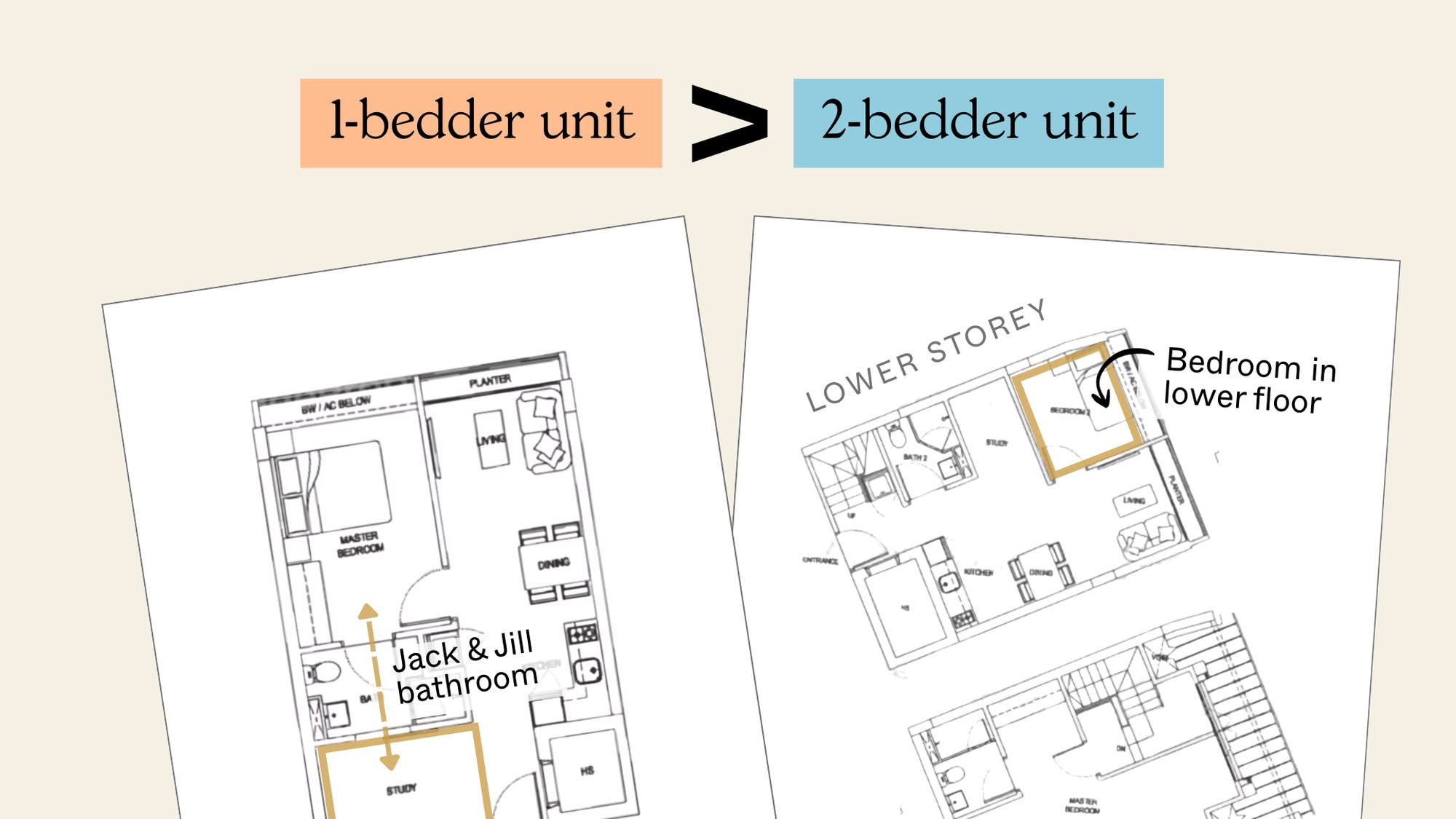

Contrast this to a million-dollar 3-bedder condo, where you find you’d have a much smaller footprint:

There’s no question that the compromises here will be big. Besides the smaller kitchen and lack of a yard, the common bedrooms are often much smaller too.

As such, from a liveability perspective, sometimes that trade-off becomes much harder to accept. Nevertheless if you feel that you are willing to make that sacrifice of space, here are the other points that you should consider.

The main pros and cons of picking a bigger resale flat versus a smaller condo

We’ll leave out the most obvious one, which is living space. If you have a big family, we’ll assume the answer is straightforward (please pick the bigger flat!) Otherwise, some of the other concerns would be:

- Availability of grants and subsidies

- Surrounding amenities

- Resale considerations

- Appreciation potential

- Use of common facilities and maintenance fees

- Possibility and risk of en-bloc

- Availability of freehold options

1. Availability of grants and subsidies

Between a $1 million 5-room flat and a $1 million condo, there’s still one more factor to keep in mind: grants and subsidies. There is, for instance, the $50,000 Family Grant (FG) for married couples buying a 5-room flat, and the Proximity Housing Grant (PHG) of $20,000 for living within four kilometres of your parents (also, the PHG goes up to $30,000 if you live with your parents in the same big flat).

There’s also the standard Enhanced Housing Grant (EHG) based on income, but since buyers of million-dollar flats are probably in higher income brackets, the amount they get may be negligible.

Due to the various grants and subsidies, the price disparity between a million-dollar flat and a million-dollar condo can be a bit wider than expected.

2. Surrounding amenities

This is a diminishing issue, as more MRT stations crop up every year, and Singapore becomes more decentralised. Nonetheless, HDB flats tend to be better supported in terms of transport infrastructure, as well as heartland amenities like coffee shops, markets, hawker centres, minimarts, etc.

When HDB builds a town – such as we’ve seen with the upcoming Bayshore – they also take the initiative of ensuring there are bus or train connections, as well as amenities like childcare centres, clinics, etc. HDB projects are typically conceived as part of an entire town, whereas developers tend to see condos as more standalone projects.

(The exception to this is Executive Condominiums or ECs, which are only HDB properties for their first 10 years. You’ll notice that many ECs tend to be quite far from MRT stations and neighbourhood hubs.)

And to be very blunt, some of the more affordably priced condos will typically be in areas that are further off. As such, you’ll find that condos outside of prime areas (i.e., those most likely to be priced in the low-million range) tend to be a bit cut-off: Bullion Park, Hedges Park, Parc Olympia, etc.

If you really do have to use a cab or PHV, consider that the cost of commuting every day, for the next few years, can indirectly heighten the cost difference between a condo and a flat. This is also true for food and grocery deliveries by the way: flat owners can often walk a few minutes to find a minimart or coffee shop, whereas condo dwellers may have to order in.

3. Resale considerations

If you buy a standard HDB flat, you must wait five years before you can resell it. For future Plus and Prime flats, this Minimum Occupancy Period (MOP) is extended to 10 years, though they are so new we haven’t seen any hit the resale market yet.

This restriction can be problematic if your children complete their schooling, and their next level of education is located far away. The same thing can happen if you change jobs, and find yourself unable to move closer to your office until your MOP is up.

For condos, you have a lot more flexibility and can move anytime you like. This is one reason why some singles – even if they’re eligible to buy a flat – prefer the flexibility of a small condo unit. Note that there is a penalty if you sell in the first three years, in the form of the Seller Stamp Duty (SSD). This is a 12 per cent tax on the selling price in the first year, eight per cent on the second year, and four per cent on the third year – but paying the SSD beats being legally unable to sell at all.

Condos can also be easier to sell, because of the lack of buyer restrictions. Anyone can buy a condo unit, be they a Singaporean, PR, foreigner, or even a company (if they’re willing to pay the ABSD, that is). HDB flats, however, have eligibility conditions like ethnic quota, age, and nationality. For future Plus and Prime flats, note that income ceilings will still apply even at resale.

(Standard resale flats have no income ceiling)

Note that the ethnic quota in particular can cause you to be lowballed when selling if the quota happens to be filled – something that can’t happen with condos.

A final consideration is financing: an HDB flat requires a Mortgage Servicing Ratio (MSR) of no more than 30 per cent (i.e., the buyer’s monthly loan repayment cannot exceed 30 per cent of the buyer’s monthly income). This restriction doesn’t exist for condos, where only the Total Debt Servicing Ratio (TDSR) is pertinent.

The TDSR is much more forgiving than the MSR, allowing monthly loan repayments to be capped at 55 per cent of the buyer’s monthly income (minus other outstanding loans).

4. Appreciation potential

While there are always exceptions, and results vary based on location, private properties generally appreciate better than resale flats.

Consider, for instance, the price movement of resale EM and jumbo flats, over a rough 10-year period (we use these flats because they’re more likely to reach the million-dollar mark):

Prices moved from $434 psf to $559 psf, only roughly about 2.56 per cent in terms of annualised returns.

Conversely, looking at resale condos, prices moved from $1,210 psf to $1,680 psf over 10 years, or about 3.36 per cent per annum.

Again, this is a very rough island-wide snapshot, and there will be exceptions for individual towns and properties; but in a very general sense, we’ve seen stronger appreciation from private versus HDB units. Perhaps this should be the case anyway, as HDB is meant for housing rather than investment; and that’s something to take into account when making your decision.

5. Use of common facilities and maintenance fees

Condos typically come with maintenance fees of about $300 to $400 a month. This covers various costs, chief of which are the upkeep of the pools, tennis courts, BBQ areas, etc. This is much higher than the conservancy fees charged by town councils – even the biggest flats seldom pay above $100 a month.

Besides factoring into overall costs, you should consider whether the facilities mean anything to you. If you never swim, use the gym, play tennis, etc., then is it worth paying so much? Likewise, is it truly important to you to have 24-hour security?

If all you want is a big spacious unit, then maybe the flat is a more sensible option. Alternatively, you might consider an apartment with no facilities, such as walk-up apartments and units above commercial shops/restaurants. These tend to also have low maintenance fees.

6. Possibility and risk of en-bloc

HDB flats don’t go en bloc to private developers. SERS (which affects only around four to five per cent of flats) and VERS (which we still haven’t seen) are the only ways they can go en bloc for now. For condos, private developers or the owners themselves can push for collective sales.

The possibility of an en-bloc is, depending on your situation, a blessing or a curse. On the one hand, en-bloc deals provide a lucrative exit point for condos, which you don’t get from HDB flats. For most condos, this happens at around 19 to 24 years of age.

On the other hand, an en-bloc can happen to your condo even if you don’t want it. A typical example would be buying an old resale condo, and then facing an en-bloc within the first three years. Not only are you still liable to pay SSD, you may find that – after you take into consideration your renovations and miscellaneous costs – you’re barely breaking even; with the added disadvantage of having to move again.

If you’re intending to never move again, and want a place to settle down for life, you might prefer minimising the odds of a collective sale; so choose a flat instead. On the other hand, if you’re worried about lease decay but are forced to buy an older unit, maybe the condo’s collective sale can give you a rewarding “out” sometime down the road.

7. Availability of freehold options

There’s no such thing as a freehold flat. So if you feel HDB flats are a 99-year timebomb, you might prefer private freehold options.

The tricky bit is that, because freehold condo units tend to cost much more (around 15 to 20 per cent more than a leasehold counterpart), you may not find many options at around the $1 million range. These could mainly be older freehold condos, or those with weaker locations.

Nonetheless, those who want a generational asset will often prefer a freehold condo. For legacy planning purposes, also keep in mind that no one can own two HDB flats – so chances are your children/grandchildren can inherit your condo, but not your flat.

A final note on owning two properties

It’s not many people who can afford to own multiple homes today, due to the higher ABSD. But on the off chance you’re ambitious to try, do keep this in mind:

If you start with a flat and wait out the MOP, you can then choose to retain the flat when you buy a private property later. You’ll have to pay the ABSD on the private property, but you can end up owning both.

You can’t do this the other way around: if you buy a private property, you can’t then buy a flat. In fact, you can’t even buy a resale flat for 15 months after disposing of the private property (unless you’re 55 or older, and downgrading to a 4-room or smaller flat).

So for those aspiring to own two properties, it might make sense to start with a bigger flat, rather than a small condo.

For more on the Singapore property market, as well as reviews of new and resale properties, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.