Shophouse Versus Bungalows: Which Are Better Investments?

October 23, 2020

If you’ve explored the more hipster-ised parts of Singapore, or happen to live near historic areas, you may have noticed flashier shophouses. From boutique hotels to serviced apartments to restaurants, shophouses are starting to make their presence felt like it’s 1920 again.

The revival of interest in shophouses actually started back in 2018. That year, shophouse sales hit a record high of $1.45 billion, and the momentum seems to be sustained. In fact, the Straits Times reported that a slew of shophouses are on the market this week, along with a $12.2 million transaction for 14 Mohamed Sultan Road.

As such, the issue of shophouse versus bungalow – from an investment perspective – comes up more often these days. With landed home sales surging, it’s a question we can expect to hear more often.

To get ahead of the curve, here’s a rundown on what to consider between the two:

- Conservancy requirements

- Rental and usage

- Property tax considerations

- Stamp duty considerations

- Surrounding amenities

Finally, we’ll try to determine the overall appreciation of bungalows versus shophouse in certain districts, based on available data.

A note on eligibility:

Foreign readers should note that they can’t usually buy bungalows – or any other landed property – on the mainland; they’re restricted to Sentosa Cove. They can, however, apply to the Singapore Land Authority (SLA) for permission to buy on the mainland.

This partly extends to shophouses. Foreigners can freely buy shophouses zoned for commercial use only. They cannot buy shophouses that also permit residential use. However, they can also appeal to SLA for permission.

1. Conservancy requirements

With regard to bungalows, there are two main types to consider:

The first are regular bungalows (also referred to as detached), which are landed properties on plots no smaller than 400 sqm, and a width of at least 10 metres. Most bungalows are two-storey structures. Owners can do with these properties as they please, subject to the usual structural limitations. These may also be referred to as class 1, 2, or 3 bungalows (this is in reference to size).

You can buy landed plots with terrace or semi-detached houses, and redevelop them into these types of bungalows (subject to approval).

The other type of bungalows are Good Class Bungalows (GCBs), of which some are in conservation areas – the areas of Chatsworth Park, Holland Park & Ridout Park, and Nassim Road & White House Park, and the Mountbatten Road Conservation Area (which mainly refers to a group of 15 bungalows).

You can’t tear down conserved GCBs, change the façade, or alter the interior in ways not approved by URA.

There is a bit of “give” in the system however – for example, while the main house cannot be torn down, vacant land to the rear or sides could be used for extensions (subject to URA approval).

Conservation bungalows outside the GCB areas – and in a zone where flats or condos are allowed – can be sub-divided into apartments or turned into a clubhouse.

For those interested in knowing the technical difference between a bungalow and a Good Class Bungalow, you can find out more here.

For shophouses, conservancy rules differ between historic districts, residential historic districts, and secondary settlements.

For shophouses in secondary settlements, you can either conserve the whole building, or include a rear extension (further details, such as height, will be determined by URA approval). Approval for changes is on a “streetscape basis”, which loosely means it depends on how well they fit into surroundings.

Secondary settlement areas include:

- Balestier

- Beach Roach

- Geylang

- Jalan Bear

- Jalan Jurong Kechil

- Joo Chiat

- Mount Sophia

- River Valley

- Tanjong Katong

- Upper Circular Road

- Tiong Bahru

For residential historic districts, rear extensions (that are lower than the main roof) are allowed. These areas are Blair Plain, Cairnhill, and Emerald Hill.

In historic districts, URA maintains the strictest level of conservancy. The entire building must be conserved. These are Boat Quay, Chinatown, Kampong Glam, and Little India.

In general, regular bungalows offer the most freedom to home owners or investors. Even shophouses in secondary settlements are subject to fairly tight conservancy rules – these include issues such as signage, the installation of elevators, or even flooring material.

Property Market CommentaryWhy Are Landed Home Sales Hitting New Highs Despite Covid-19?

by Ryan J. OngThis can be a hassle. For example, your property must conform to both the fire safety code, as well as conservancy guidelines. For example, if URA agrees to your use of timbre flooring, but SCDF won’t allow it, you still can’t go ahead.

There may be multiple agencies involved, and they may not communicate with each other. The onus will be on you to get approval from all the relevant bodies. So again, shophouses do tend to involve more red tape than regular bungalows.

Conservancy is also an advantage

While conservancy rules are restrictive, some investors will also see them as an advantage. The supposition is that our government won’t tear down conserved buildings to make way for new roads, MRT stations, etc.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How Have Older Leasehold Condos Performed Compared To Newer Ones? A Case Study Of The Tanamera

In this Stacked Pro breakdown:

This is otherwise a possibility with, say, a freehold condo (freehold land can still be taken back by the government if deemed necessary).

2. Rental and usage

Bungalows are straightforward in this regard: your two uses are either to live in them, or rent them out.

Shophouses with a commercial element, however, can also have an attached shop, office, eatery, or be converted to serviced units. This provides greater versatility, and a much wider range of possible tenants.

3. Property tax considerations

For shophouses that are mixed between commercial and residential, property tax is applied separately for each portion.

Residential tax rates depend on whether the property is owner-occupied, or rented out. It’s based on the Annual Value (AV), or estimated annual income, of the property. Commercial property tax, however, is a flat 10 per cent of the AV (of the commercial portion).

A professional valuer is needed to determine the exact value of the commercial and residential portions.

Investors should be careful to compare the shophouse’s eventual tax rate, to the one they would incur on a bungalow.

4. Stamp Duty Considerations

For bungalows, the usual stamp duties for residential properties all apply. These include the Additional Buyers Stamp Duty (ABSD), Sellers Stamp Duty (SSD), and Buyers Stamp Duty (BSD).

For shophouses that are mixed, the residential stamp duties only apply to the residential portion. For example, if ABSD is chargeable, it will only be charged on the residential portion, not on the entire shophouse. As mentioned in point 2, a professional valuer is needed to assess the exact portions.

Likewise, shophouses that have a commercial element will incur Goods & Services Tax (GST) of seven per cent. This is only on the commercial portion.

5. Surrounding amenities

Bungalows are often located in low density housing enclaves; and GCBs tend to be isolated spaces in and of themselves (the exclusivity is the selling point). While its generally assumed that owners of such homes have cars, do consider if it’s convenient for your lifestyle. It’s improbable that you will have convenience stores, supermarkets, etc. in the immediate vicinity.

Shophouses, however, tend to be in bustling areas. This is especially true of secondary settlement shophouses, which are sometimes directly across the road from malls, close to MRT stations, and so forth.

Neither of these are inherently “better”, it’s just a question of preference.

How have bungalows performed compared to shophouses?

The data here is derived from Square Foot Research. Please note that there are limits to the information provided; we do not, for instance, have data that discriminates between GCBs and regular bungalows, or between the conservancy status of the shophouses.

For details on a specific bungalow or shophouse, please contact us on Facebook; we’ll do our best to find the relevant information.

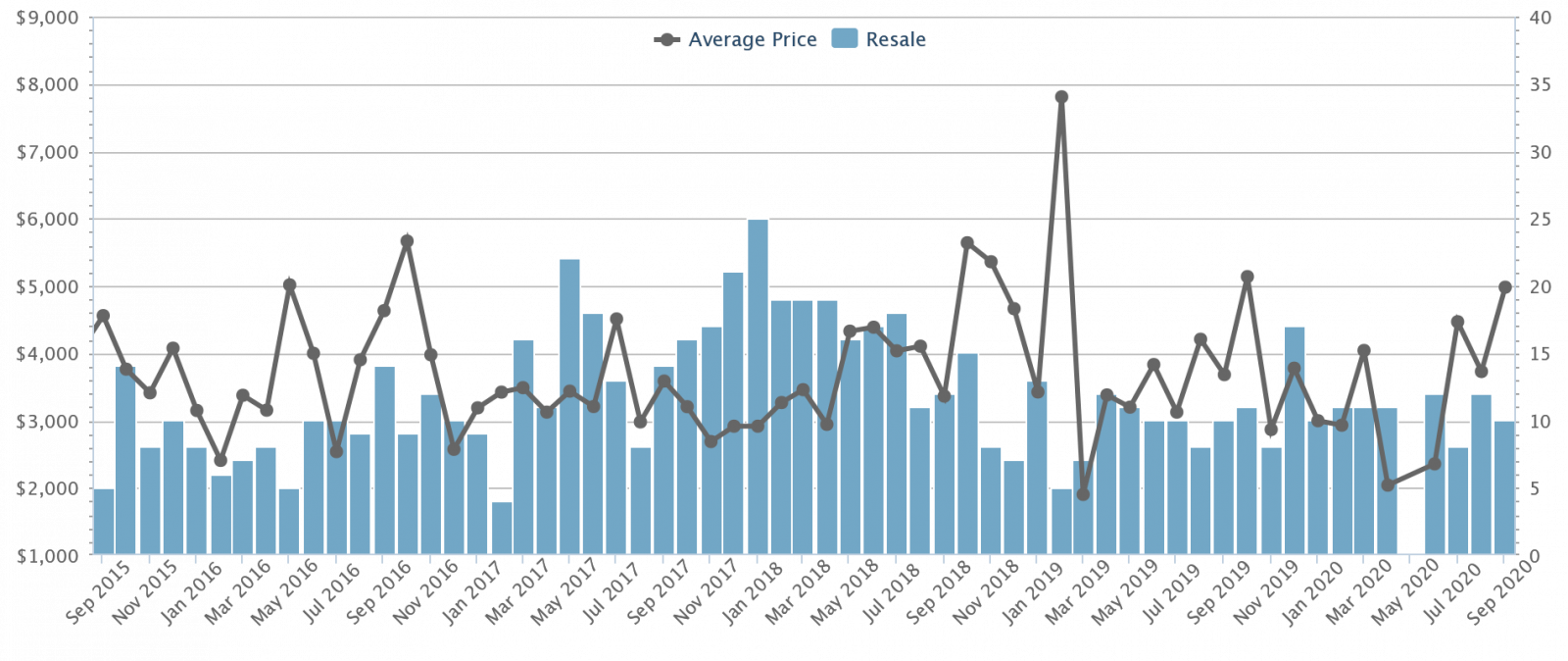

Shophouses in all districts averaged $4,558 psf in September 2015, with prices appreciating to $4,980 psf by September 2020. This is a percentage increase of around 9.2 per cent, or an annualised return of 1.79 per cent.

Data is taken from August 2015 to August 2020 (latest available information).

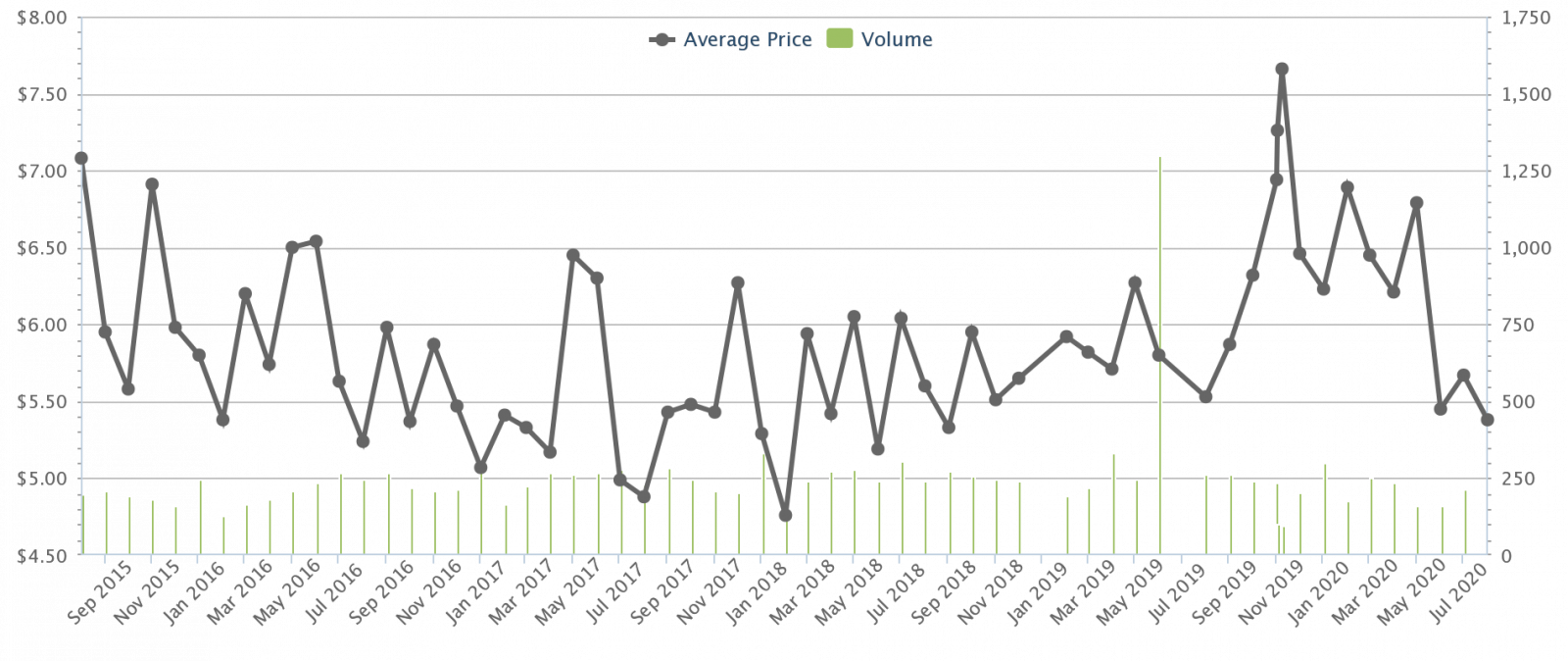

In terms of rental, shophouses across all districts averaged $7.08 psf in 2015. This decreased to $5.38 psf, a fall of around 5.4 per cent, by 2020.

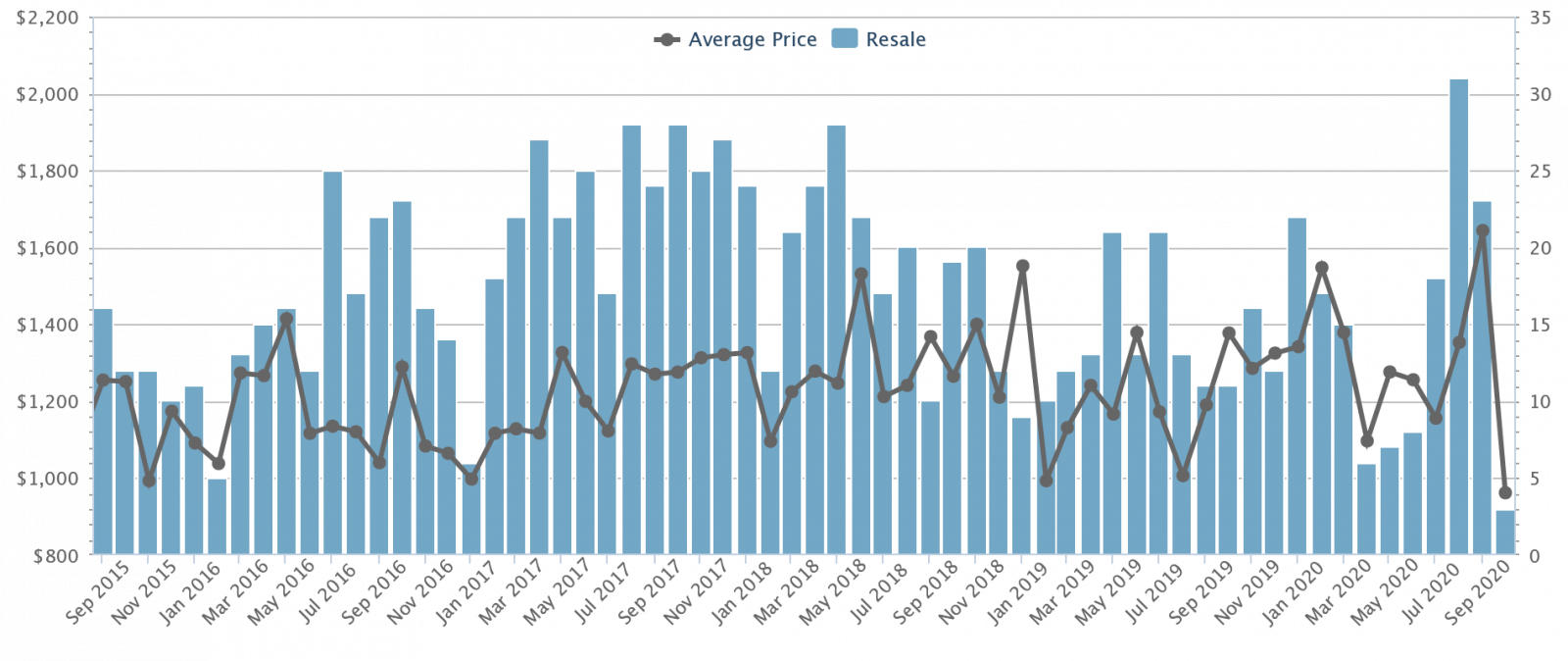

Detached homes (bungalows) across all districts averaged $1,255 psf in September 2015, and appreciated to $1,644 psf in September 2020. This is a percentage gain of 31 per cent, or an annualised return of 5.5 per cent.

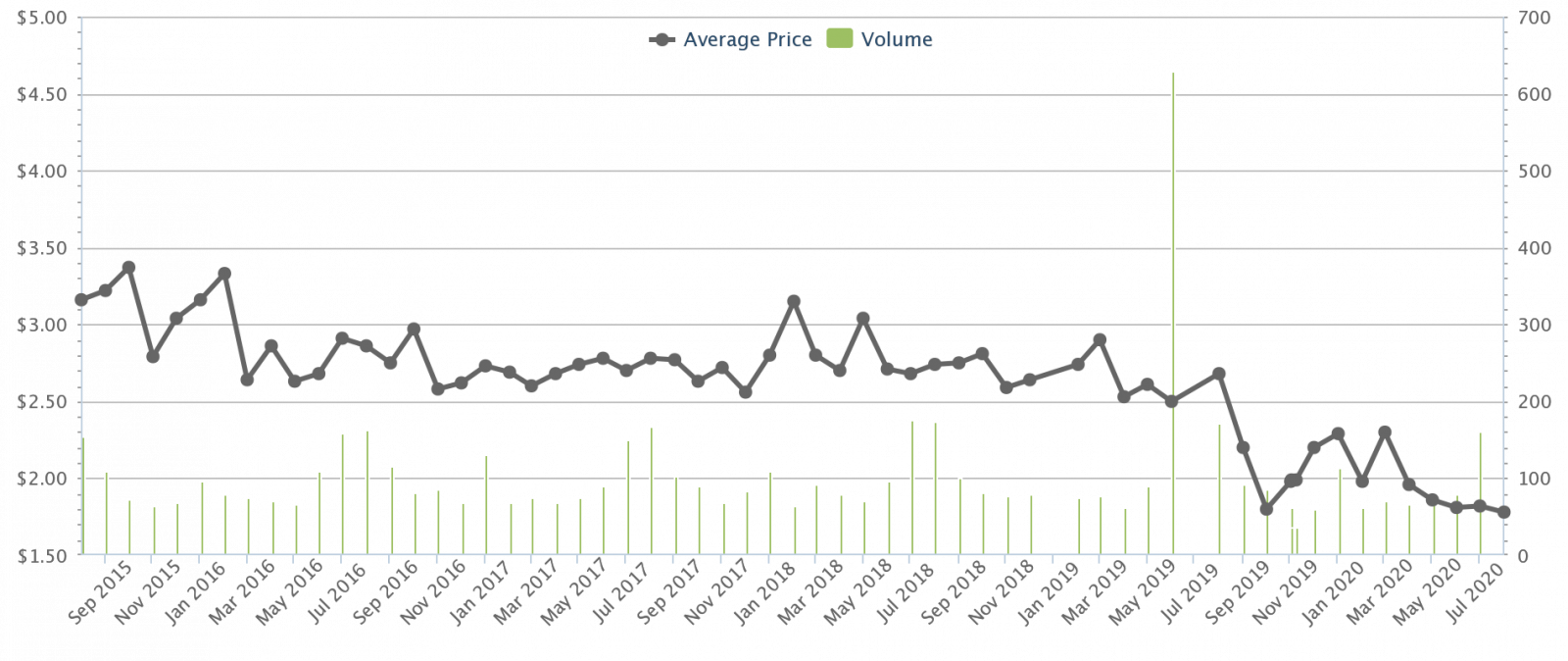

Rental rates averaged $3.16 psf in 2015, but have since plummeted to $1.78 psf. This is a decline of around 43.6 per cent.

As a quick approximation, we can see that bungalows have appreciated much faster. However, shophouses have shown more resilience in terms of rental income. This can be attributed to shophouses having a wider range of tenants, with some of them having a commercial element.

It seems likely that shophouse investors may prefer the “full commercial” units at this point; besides the lack of ABSD, many of the units in the ongoing shophouse revival are of this segment (see the Straits Times link above).

Buyers of bungalows are more likely eyeing resale gains, with rental income being an afterthought. This is especially in light of the ongoing Covid-19 situation, which will further reduce the number of prospective foreign tenants for their property.

We’ll update you with details as the shophouse revival, and general surge in landed home sales, continues. Follow us on Stacked to get the news, as well as in-depth reviews of Singapore’s private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main differences between investing in shophouses and bungalows in Singapore?

Are foreigners allowed to buy shophouses and bungalows in Singapore?

How do conservancy rules affect the ownership and renovation of shophouses and bungalows?

What should I consider about rental income when choosing between a shophouse and a bungalow?

How have shophouses and bungalows performed in terms of property value appreciation in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments