Why Knowing The Singapore Property Cycle Can Make You A Better Investor

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.

I do believe most people are aware that the value of property will grow over time.

It may not grow consistently, or uniformly, but it will trend upwards.

On the flip side, there is such a thing as being on the wrong side of the property cycle.

You’ve probably seen many examples of this on the news.

“Sentosa penthouse sold at a loss of $2m, buyer lost xx amount over 5 years.”

It doesn’t make for good reading, does it?

I had a friend who received a small inheritance all the way back in 2007.

Thankfully, he didn’t squirrel it away frivolously, but instead, chose to put it all in the property market.

Some would say that’s a smart move.

And in most normal circumstances – it would be, just that the not-so-smart move on his part was to not consult anyone for advice.

Because prices were rising up, he assumed that he would have no issues letting it go even if he had to.

Unfortunately, his timing could not be worse.

2007 was the peak of the property cycle back then, and it quickly crashed after thanks to the Global Financial Crisis.

He was hoping to sell it off 2 years later, but by 2009 the prices had dipped – it was too late.

As of today, it’s PSF value is… $2,002. An eye-opening 0.0 percent growth.

It’s been 13 years since that day, and prices have only just about reached that level again.

It has basically taken him 13 years to get to where he started from.

In this scenario, it wasn’t actually that bad because this was additional money that came his way.

While on paper, he hasn’t lost any money, it’s really all about that opportunity cost to him.

But can you imagine for those who had plunged in at that point and over-leveraged on a mortgage?

That’s what you call a truly caught with your pants down scenario.

This is exactly why having knowledge about the property cycle is so important.

Let’s get the boring stuff out of the way first.

From the famous words of Wikipedia,

A property cycle is a sequence of recurrent events reflected in demographic, economic and emotional factors that affect supply and demand for property subsequently influencing the property market

Wikipedia

If it sounds terribly tedious and uninteresting, that’s because it is.

Let me attempt to break it down for you.

So, how does a property cycle come about?

The first thing you’d need to know is the law of supply and demand.

In most markets, the forces of supply and demand work to keep prices in check.

Let’s try to apply it to a local context – the coronavirus mask situation.

If I only had 100 masks, and everyone in Singapore wanted one, I would be able to raise my prices sky-high to profit from the desperate (kiasu) ones.

Which is exactly what some “business-minded” individuals tried to do.

But when people start to see the amount of money they could make from this situation, they will naturally start to import masks from overseas to sell.

The additional supply coming into the market would mean that soon everyone has to lower their price to be competitive.

BUT, this does not apply to the property market because the supply of land is fixed.

So when the economy is doing well, this will lead to demand for newer, better homes.

Population will always be growing which will constantly prop up that demand.

Since land is limited, and there isn’t a way to buy more land or import land from overseas, prices will have to increase.

And because of this high demand, it is natural human behaviour to start speculating, or flipping houses if you will.

(Which was exactly why the SSD came about – to prevent speculation)

Once that happens, prices will increase beyond the affordability of most people.

Demand starts to fall, banks start to tighten their credit, interest rates go up.

This results in a crash of prices, low sentiment in the market – it’s really a buyers market from here on.

Gradually, the market will improve and the whole property cycle starts all over again.

If there’s anything you have to take away from the entire article it’s this:

Each property cycle will start from a higher bottom from the previous one, which means the long term trend is always upwards.

You could just take my word for it when I say that the property market is cyclical – but you won’t be convinced enough to take action based on it until you’ve fully grasped the logic for yourself.

So read on to fully understand how the phases of the property cycle play out.

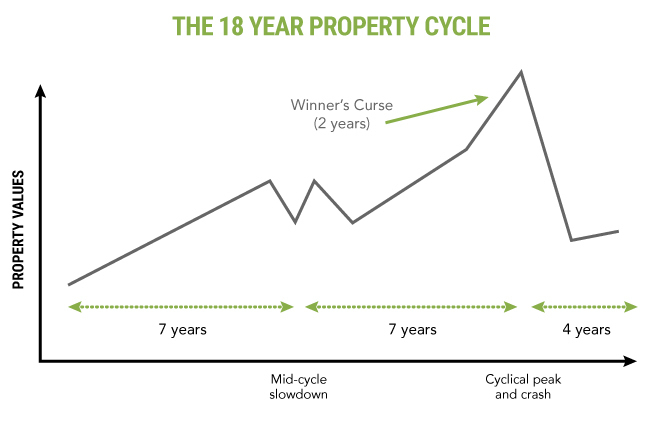

4 Phases of the 18-Year Property Cycle

The first person to discover that a property cycle happens in almost perfect 18-year cycles was actually Homer Hoyt, an American economist.

But it only got “mainstream” through economist Fred Harrison, who was also renowned for his predictions on housing prices.

There are basically 4 phases to every property cycle – recovery phase, mid-cycle dip, explosive phase, and recession phase.

Recovery Phase

The recovery phase is the one that will succeed the recession phase – this would usually go on for about 7 years. At this point, prices will have dropped enough to tempt smart investors back into the market. These savvy (or brave) investors are the ones that have identified the opportunity to get in at attractive prices as it is very much a buyer’s market. If you have the available cash you easily have the upper hand in any negotiation, with almost no competition to speak of.

Of course, even at this point, no one knows exactly when is rock bottom – which is basically impossible to predict. Even the best investors have absolutely no way of knowing, they just know that their potential upside outweighs the risk that they are taking.

More from Stacked

The Key To Get Your Resale Home Renovated Right, As Told By Interior Designers

Of all the reasons there are to buy a resale home over a new launch condo (and there are many),…

Even though this period is actually the best time to enter the market, you’ll find that the majority of buyers will be staying away.

Property Advice10 Cognitive Biases That Are Affecting Your Property Purchases!

by Reuben

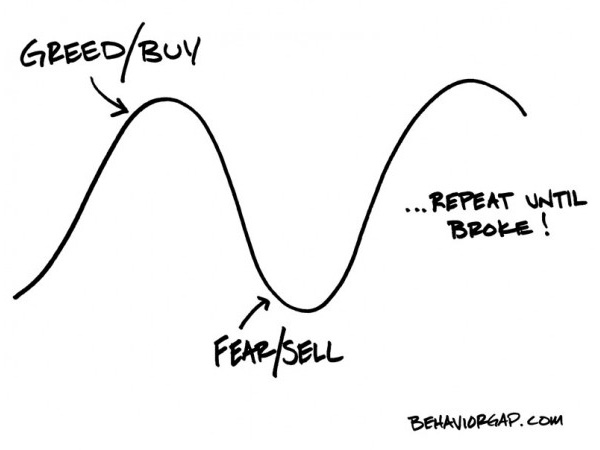

Everyone is still afraid the market might bottom out further and constant pessimism from the media plays a part in ensuring that the same thing happens every property cycle. Humans are very strangely wired creatures when no one is buying, everyone is afraid and no one dares to make a move. When transactions start picking up, everyone starts to hop on for fear that prices will rise too high beyond them. In short, this is a phenomenon that can also be described as a herd mentality.

Mid-cycle Dip

This is when transactions start picking up and more people begin to enter the market. More confidence is slowly being restored. A mid-cycle dip usually happens here as some early investors cash out. Some may predict another recession is about to happen, but this usually picks up into the explosive phase.

Explosive Phase

The explosive phase is an exuberant one, where banks are opening up and providing more competitive rates for home loans to gain market share. Confidence is at a high, and the younger market entering the market now may not have even experienced the last crash. Because sentiment is high, developers also start bidding for more projects. This leads to buying frenzies, balloting, and massive crowds at new launches. You’ll see newspapers and media churning out headlines after headlines of price jumps and profits.

Again, because of the herd mentality, prices are further pushed up as everyone is afraid of missing the boat. Potential investors who cannot really afford overextend themselves. The higher prices go, the more everyone thinks prices will go, and thus the mania continues.

The final two years of the explosive phase is dubbed as the “winner’s curse”. Like the example set out at the beginning of the article – you have picked the most unfortunate time of the property cycle to make your move. Similarly to the lowest point of the market, no one can predict when the absolute peak of the market would be. Those who have bought during this period would be suffering losses in the next few phases if they have no holding power.

Recession Phase

Naturally, the recession phase is the most unwelcome of all the phases in the property cycle. Just as easily as prices rose up, prices can just as easily fall. The sentiment in the market will be clearly felt, and those who have over-leveraged will face the consequences as bank auctions and fire sales start to become more frequent.

This is also the point where holding power becomes really apparent. Those who are inexperienced investors might look to sell off their properties as they are afraid of more losses.

So where are we at in the Property Cycle?

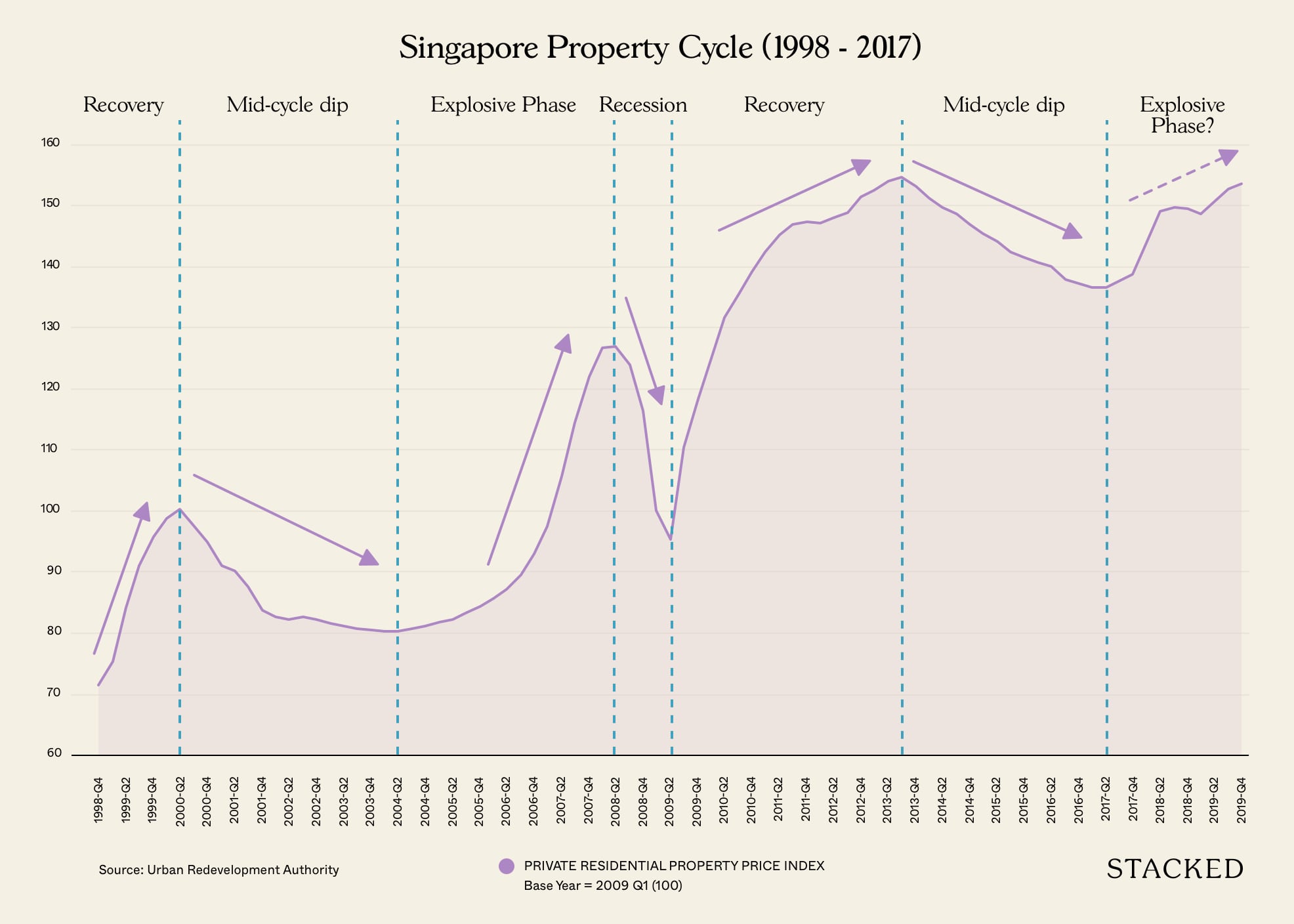

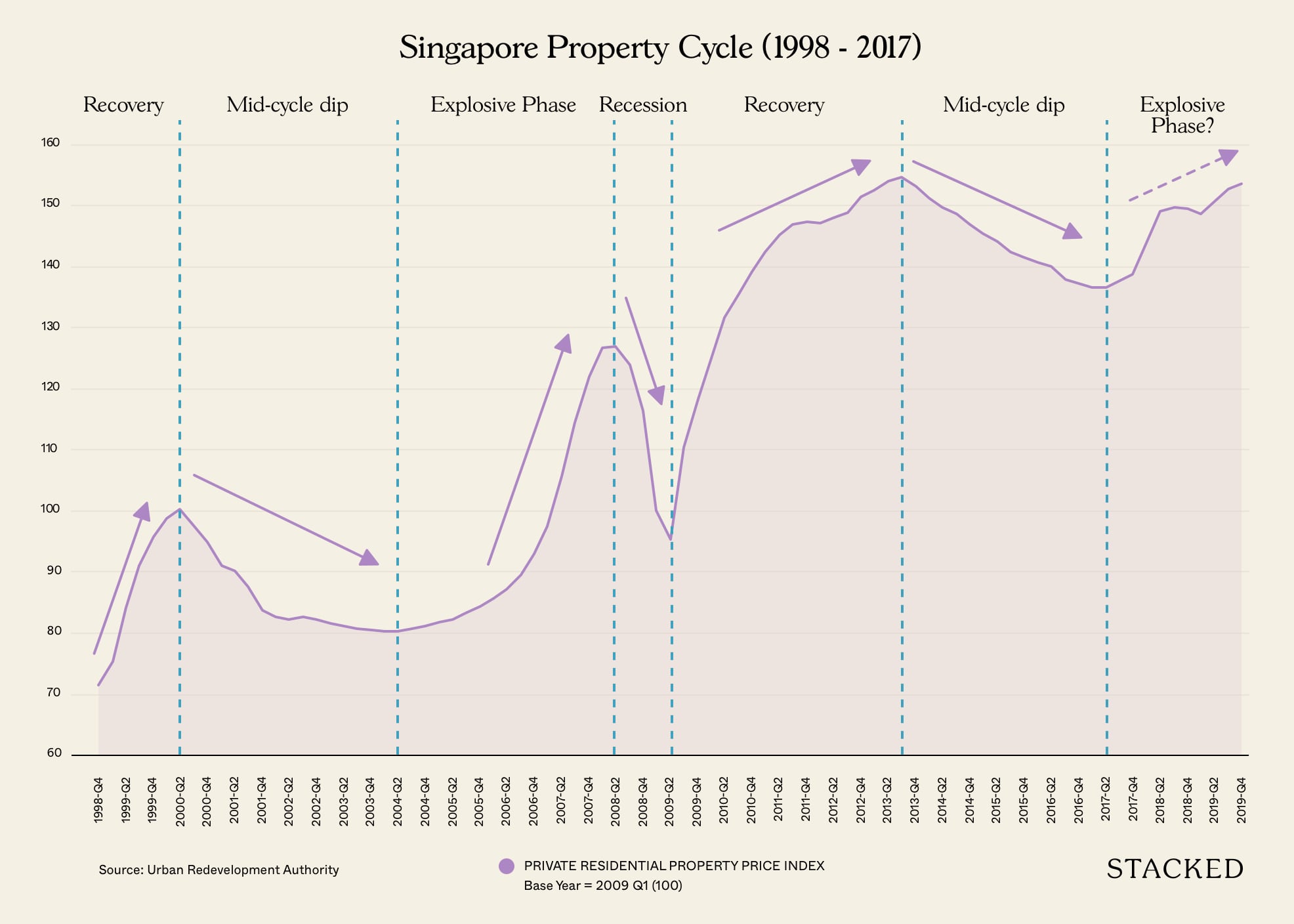

If we were to apply the property cycle in the context of Singapore, you can quite clearly see a pattern emerge.

Looking from the beginning of 1998 was the start of the recovery from the Asian Financial Crisis. This was followed by a long mid-cycle dip before a short explosive phase culminating till its peak in 2007/2008. The recession phase was up next, with the recovery only kicking in from 2009 onwards.

You might have noticed that from 1998 till 2009 doesn’t follow the 18-year property cycle, but the more important thing to note here is that there is a cyclical pattern. Unlike most other property markets, Singapore’s one is unique because of Government intervention – eg. cooling measures.

If you continue to chart out the pattern, we could be looking at the start of an explosive phase from here on.

So what can we learn from the property cycle?

Plenty.

- Don’t over-leverage

It’s been shown time and time again throughout history of amateur investors getting burnt because of over-leveraging. To a certain extent, the cooling measures of LTV and TDSR have prevented that, but it is still a worthwhile reminder to not bite off more than you can chew.

What you have to remember is every property cycle moves up at a higher point than the last, so as long as you have holding power you will not be affected by the fluctuations. This means that you can pick and choose the best time to sell.

- Don’t panic during the downturn

Now that you have some idea how a property cycle works, you know that the market will never bottom out completely. So you don’t have to be fearful even when prices are falling. As long as you haven’t over-leveraged to begin with, you should be confident that prices will go back to an even higher point during the next property cycle. Don’t ever let yourself be in a position where you are forced into a sale because you were not prepared.

- Don’t get greedy

During the explosive phase, it will seem extremely tempting to jump in and buy for fear of missing out. You might think that you are a savvy investor if you’ve made money from your first real estate deal, but FOMO is a real thing.

Conclusion

At the end of the day, most people buy because of hype, sell because of fear, and end up losing money. Having knowledge of the property market allows you to act rationally, and not panic just because the market fluctuates.

However, it also important to remember that the property cycle is just one part of the equation when it comes to investing in a property. Singapore does have something that is very different from all other countries – the Government has a big role to play in many aspects, the supply of land, the population growth of foreigners, and the all-important cooling measures.

Again if you have to take away just one thing from this article, remember this:

The property market is cyclical and the long term direction is up!

Sean

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

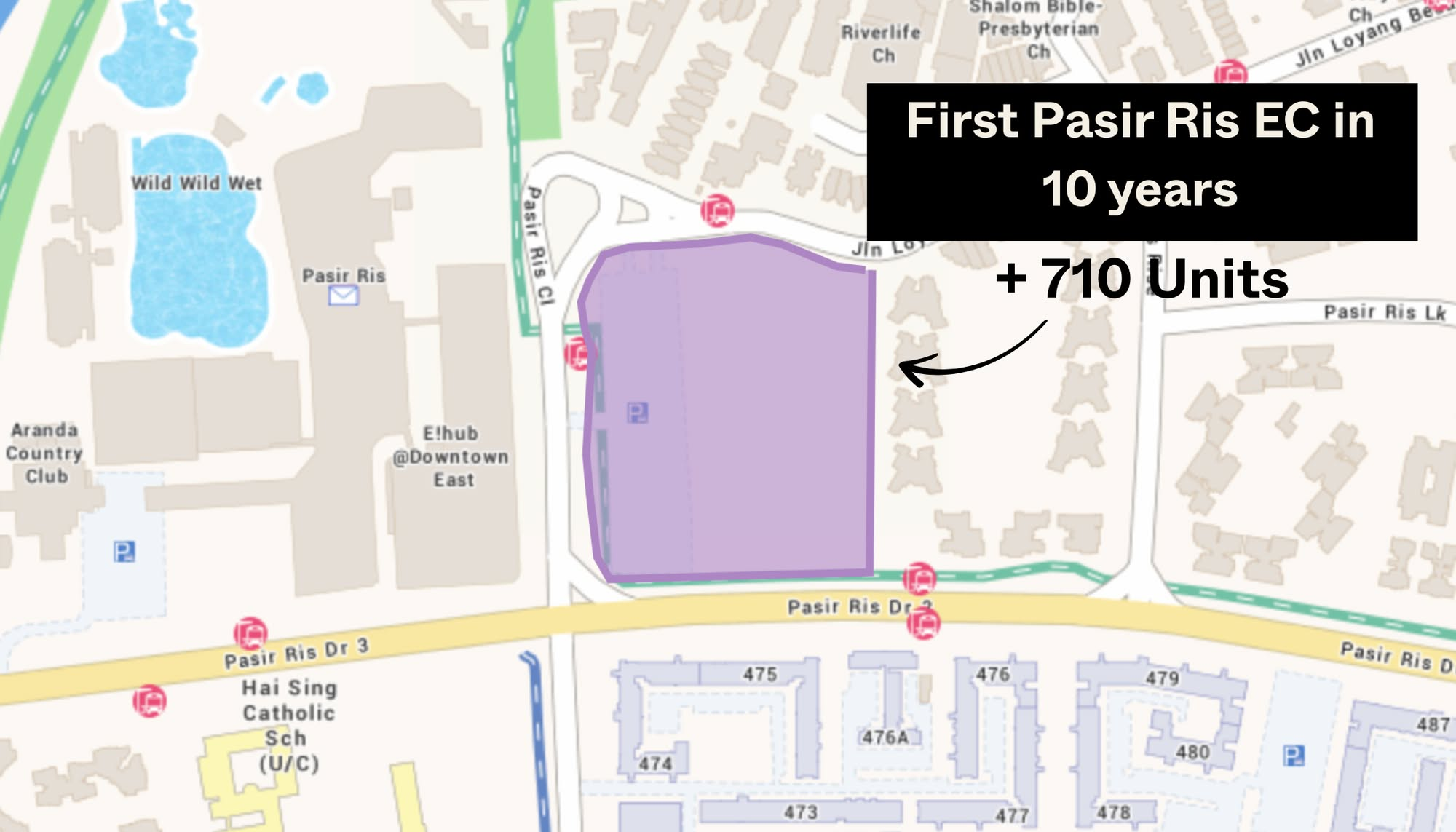

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

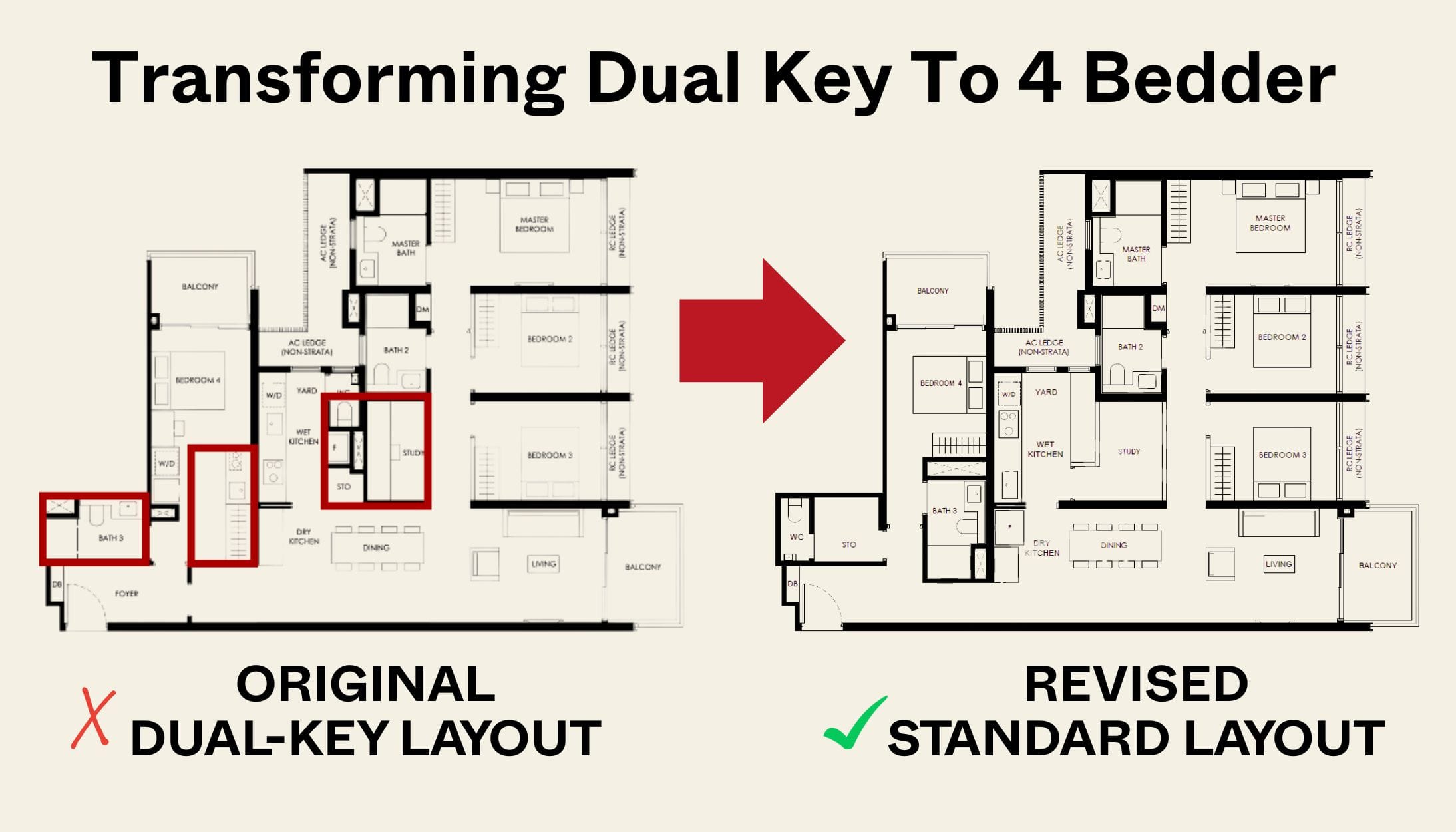

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

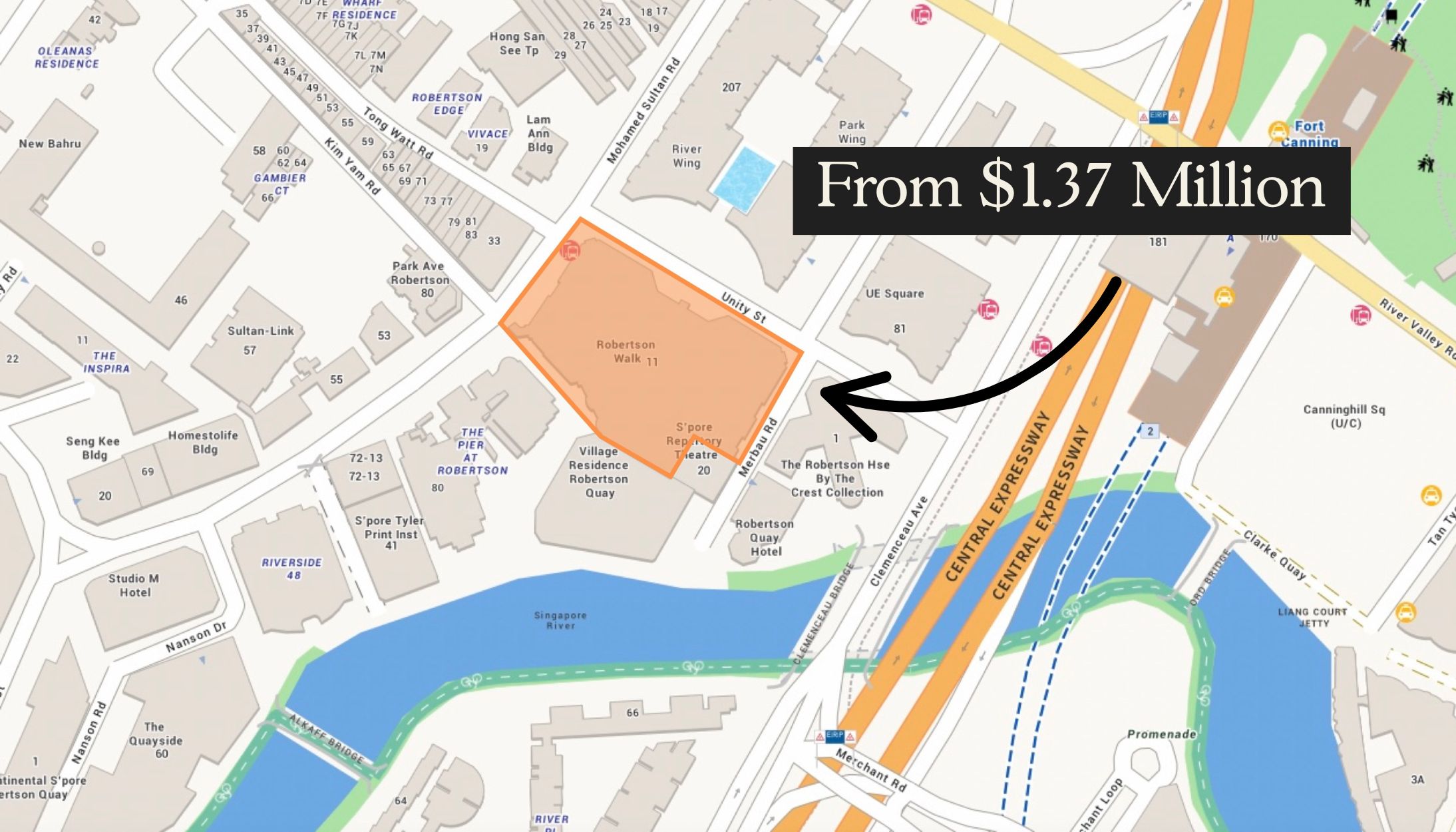

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

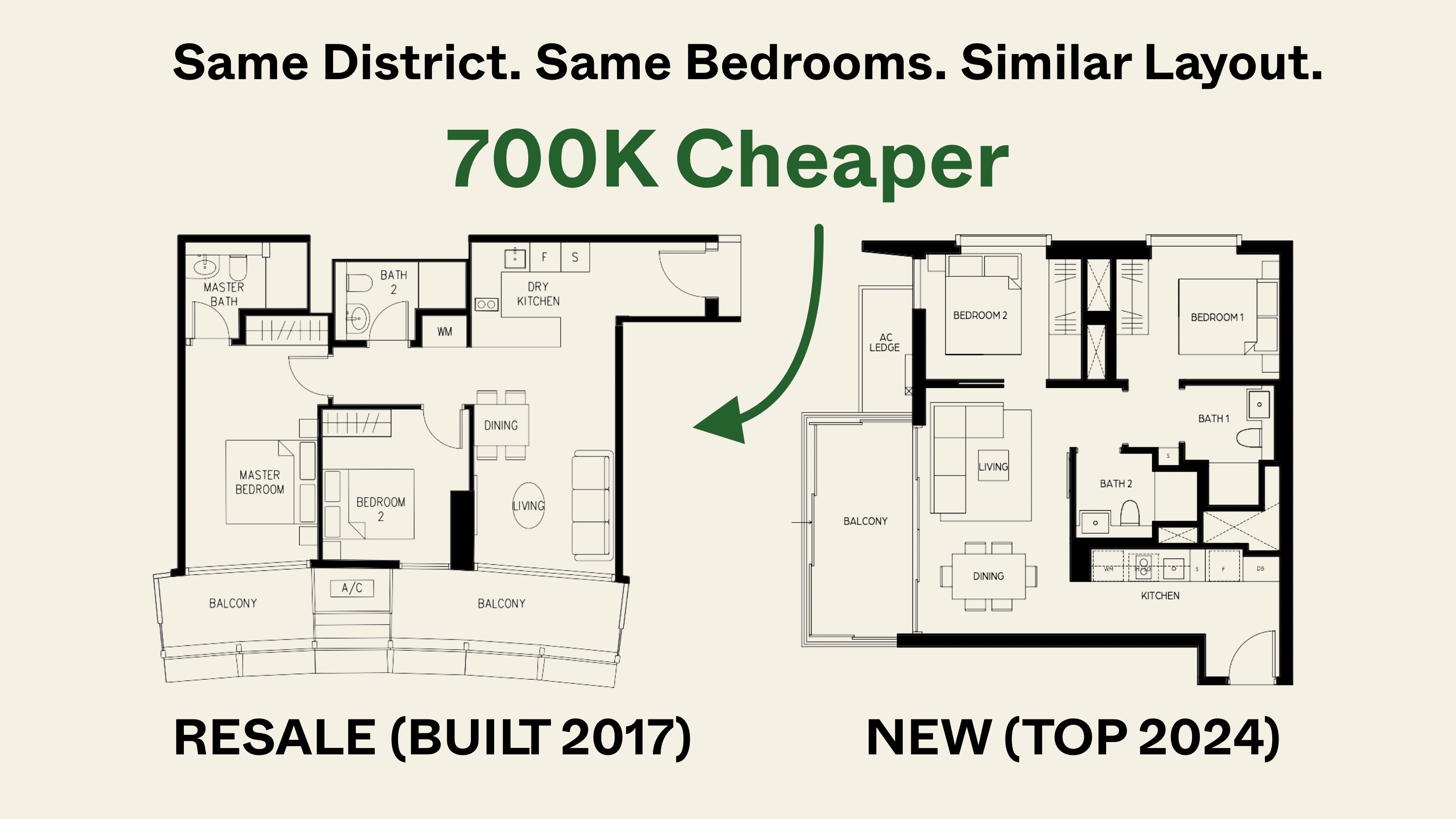

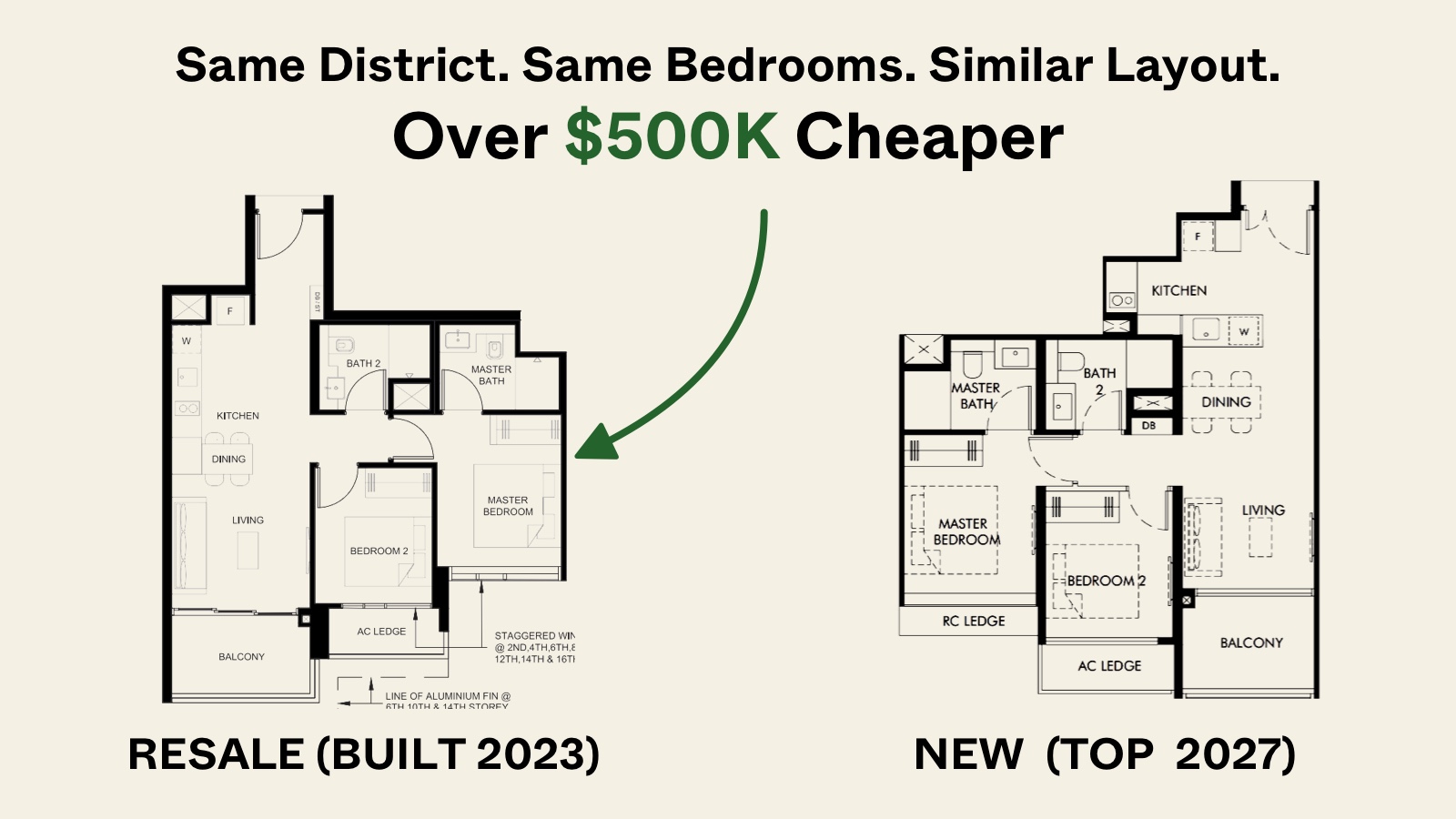

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

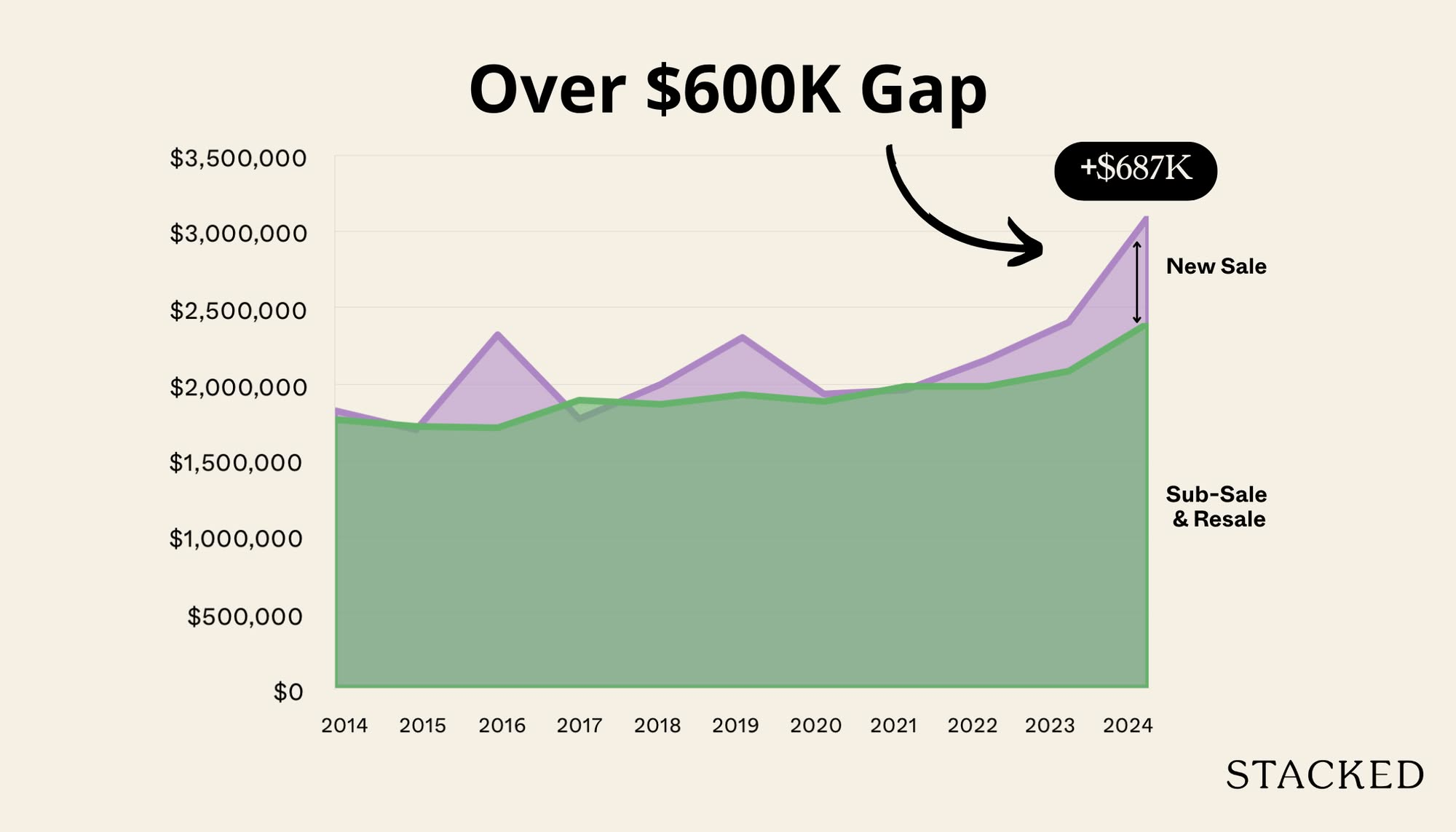

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

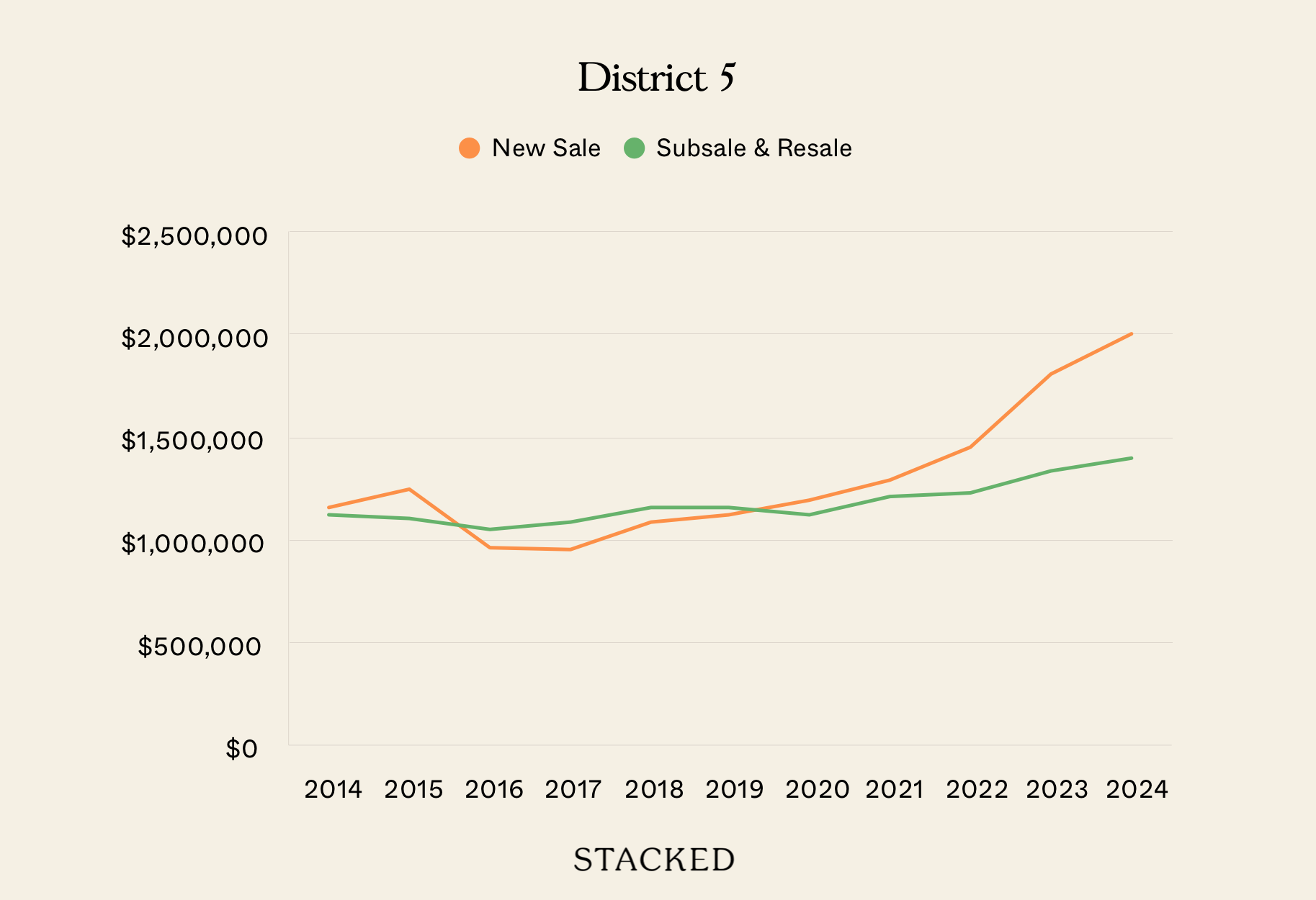

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Hi Sean, This is a refreshing perspective. It would be interesting to see the connection you can draw from property cycles with the stock market, especially REITS and property counters. As you would have known, most REITS are not spared in the recent sell down and so are the developers as well. Which market should we focus on first ? The stock market or the property market as an indicator ? Your enlightenment is much appreciated. Thanks

Hi Desmond! Please note that my opinions here do not construe financial advice in any way and are just my opinions.

Generally it’s observed that the stock market (STI in our case) moves before the property market, and it’s actually quite correlated too. It moves first due to liquidity, and also reporting is immediate for the stock market vs property market. So judging by this, I’d say the stock market is just one factor in predicting where the property market could head, but as it’s never 100%. What’s important is going in knowing you are prepared for any unforeseen circumstances.

Market sentiment is also a good indication. In 2016/17 at the market bottom, people were afraid to make home purchases because they didn’t know if it could go any lower. It’s when people are not afraid – that’s when we’re in the “explosive phase” and the last 1-2 years in that phase results in the “winner’s curse”. Today we’re far from this euphoria due to the cooling measures, so this could be a good indication that prices are still relatively safe to enter. At some point in the future, we’ll hit another explosive phase – as to when is anyone’s guess!

Our analysis here takes into account just residential property prices, so the property counters like REITs and developers behave quite differently as they’re more subjected many different factors compared to the residential property market. As such it’s actually not a suitable instrument to draw parallels with the residential market.

Great content! Super high-quality! Keep it up! 🙂

Great content! Just sharing my own opinion, when the recession phase comes, would Singapore’s property ignores it and goes from explosive straight into recovery (i.e. skipping recession phase) due to Government’s earlier multiple cooling measures that suppressed the property prices. What are your thoughts?

Cycles are very hard to predict. within each cycle, there’re also ‘mini-cycles’, and it’s hard to say where we are today. given the strong cooling measures by the government, really doubt that we’re in the explosive phase now.

Hi Sean. If I may share for your consideration and the other readers, the artificial demand is created through the credit market. While there is fixed supply and demand is limited by the spending power, the volatility that results in cycle are largely due to the credit market. Borrowing power allows the cycle to move up when people make use of their borrowing power and moves down when power are unable to sustain their credit worthiness.

If there is no borrowing involved, we would see the drastic cycle as we have witnessed across the year.

Hi Leon, this is wonderful. Thank you for sharing your insights with us and our readers 🙂 It’s true that credit fuels prices. It’s the same for any asset class, not just property. We’ve seen the stellar rise of property prices between 07-13 where low interest rates were one of the key drivers of price increase. But it is just 1 factor nonetheless. Easy credit and lack of regulations can cause a bubble – usually this happens when prices go very far from their intrinsic valuation. But we’ve seen what happened to property prices after a crash given the fundamentals that Singapore remains highly competitive and stable in government – prices continue to grow, unlike the lost decades that Japan faced when it came to their stock market crash. Even with the current regulations in place such as the ABSD, TDSR and the adjusted LTV, the property market remains resilient. Population growth is a key driver of property growth, and so long as the Singapore government can manage to increase its population while improving the spending power of its consumer base, we will continue to see prices rise. Between 2007 – 13, the population rose from 4.5m to 5.4m, an almost 25% increase which led to property prices rising (and thankfully median incomes). The next question is just when will the government start this again.

Thanks alot Sean, I find it very helpful to understand the property cycle as a 1st time investor. Especially with the amount of news in the media regarding the record bigging land prices and recent Pasir Ris 8 launch prices – it helps me to understand that we are in the midst of the explosive stage. I look forward to the right phase to enter the market (this might take a few more years, based on this cycle prediction). Hence, it would mean cultivating alot of patience and keeping FOMO in check. Would there be an impact from other factors like available land for bidding; foreign investors with deep pockets choosing SG over other markets; etc?

Hi, great article! Very detailed and accurate. May i ask which phase are we at now?