How Do We Deal With The “Unfairness” Of Prime Region HDB Flats?

December 1, 2020

Before you fork out $20,000 or $30,000 in Cash Over Valuation (COV), you should pay close attention to what National Development Minister Desmond Lee has been saying. Amid various discussions on Covid-19, mortgages, and help for the construction industry, the Minister said this regarding prime region flats:

“We may need a series of other measures to ensure that if resale is permitted for these flats, that they remain affordable for generations to come…

…People will, of course, pay what they believe the market can bear in order to get these very good flats and very good locations. So some of these measures would have to cover all these fronts”

We don’t know what these “measures” are, as they’re currently brewing; but it almost certainly seems like a way to cap the number of million-dollar HDB flats. As such, anyone considering an expensive, centrally located flat right now may want to pump the brakes.

But that aside, we also have a question we want to ask you, for which we are giving out a Google Home mini for the best response. More on this below:

What is the big deal with prime region HDB flats, and why now?

This discussion really goes back to around 2013, with the unveiling of the Greater Southern Waterfront (GSW). The GSW is a project that spans over 2,000 hectares, starting from Pasir Panjang to Marina East, and even reaching all the way to Mount Faber.

This is one of the biggest-ever undertakings in Singapore’s Built Environment, as it will transform 30 kilometres of our coastline, and involve an area six times the size of Marina Bay.

Remember how, in 2014, Keppel Golf Club members found out it would have to move or close? That’s due to the GSW, and the land it’s on will – in future – yield about 9,000 homes, in a mix of private and public housing.

We emphasise public, because that’s where the issue gets sticky.

What happens if people can get BTO flats in the best spots along the GSW?

To use an analogy, how would you react if today, HDB launched BTO flats just next to Marina Bay Sands? You can probably understand the degree of unfairness that would happen, for the small number of families that successfully ballot for such a location.

The winners of such flats would be purchasing subsidised properties, with grants, in a prime area; that’s a sure-fire recipe for huge gains after the Minimum Occupancy Period (MOP).

There’s also the fact that flats in such areas wouldn’t really feel like HDB estates. It’s likely that, even as BTO flats, the prices would be so high that only the uppermost echelons (close to busting the income ceiling) would qualify. Upon resale, it’s likely to contribute to the growing count of million-dollar flats.

How big is the price difference between prime region flats, and the overall resale market?

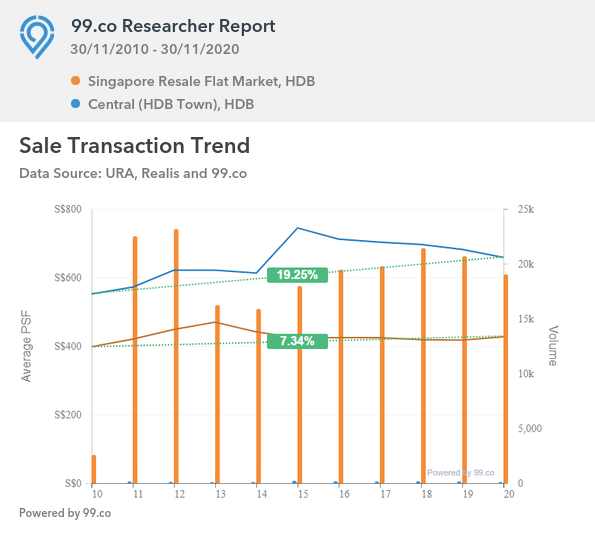

As of end-November 2010, the resale market saw average prices of $398 psf. By end-November of 2020, prices had risen to $427 psf. For flats in the Central Area, however, prices rose from an average of $552 psf in 2010, to about $658 psf today.

This is just for the Central Area; similar issues exist for places such as Bishan, Queenstown, and Tiong Bahru. This gives the impression of balloting as being more of a lottery than a home-ownership exercise.

The unequal distribution also creates HDB estates that look like anything but

When Tiong Bahru became gentrified, it caused a lot of friction with existing residents. More expensive homes are accompanied by a different demographic; such as the sort who are more likely to patronise upscale restaurants than a neighbourhood coffee shop, or a specialised deli instead of a provision store.

The Ministry of National Development seems conscious that this would disrupt the intermingling desired in an HDB estate.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How Singapore’s New Rental Rules May Benefit Landlords (And Tenants)

Sometimes, we need to remember who depends on who, when it comes to foreign workers.

However, we’d point out that there’s another problem too: if you’re a retiree living off your CPF payouts, your amenities are those coffee shops – not an artisanal café with $8 coffee.

As such, prime region HDB estates run the risk of being (1) not very much like HDB estates at all, and (2) having prices quickly run up, to the point where anyone who moved in during cheaper days feels priced out of their own neighbourhood (“sell and move out” is easier said than done for some homeowners, whatever the potential profit margin).

Property Market CommentaryHow Big Of A “Windfall” Is A Prime Region HDB Flat?

by Ryan J. OngWhat are the solutions being posited?

As Minister Desmond Lee has pointed out, the prime region flats will incorporate a mix of different housing, including two-room flexi-flats and studio apartments. This much we know for sure.

However, over the years some other solutions have been suggested. Some ideas we’ve come across are:

- Applying a version of the HDB buyback scheme, initially proposed by the Singapore Workers Party a few years ago, to prime region flats. This would mean that flats in prime regions can only be sold back to the government at a set price.

This limits the “lottery winner” effect: those who obtain such flats still get to live in a better and more convenient location, but they don’t really profit much financially.

- Increasing the MOP for flats in desirable areas. For example, a 10-year MOP instead of five-years, which delays the pace at which an owner could sell and upgrade. Some might argue it’s immaterial, as they still see a windfall at the end of the MOP.

- Limiting the right to rent / ownership with private property. This could mean preventing the owners of prime region flats from renting out the whole unit. It could also mean that owners of these units cannot purchase private property and still keep their prime region flats, even after the MOP.

- Shortening the available lease on prime region flats. They could, for example, have 60-year leases instead of 99-year leases, which would limit their upside for appreciation.

Which is the best solution?

This isn’t a rhetorical question! We’d love to know your opinions on what can be done, to make prime region flats a “fair deal”. So starting from now till 8 December, feel free to comment on Facebook/Instagram/email or message us with your ideas. We have a Google Home mini up for grabs to those who come up with what we feel is the most innovative solution.

In the meantime, we do expect the news to slightly dent the recent uptick in HDB flat prices; at least in hot spots like Bishan or Tanjong Pagar.

Some prospective buyers are likely to wait this out, and see what measures are coming before they buy. This might diminish some of the momentum given to the resale flat market, ever since Covid-19 ended up an unexpected boon to it.

In addition, we expect the typical knee-jerk reaction once the measures are announced, whenever that may be. Just like with private properties, interventions from loan curbs to tighter cooling measures typically cause buyers to go into “wait and see” mode.

Follow us on Stacked, and we can keep you updated as the situation unfolds. We also provide the most in-depth reviews on Singapore’s private homes, and the latest on property investing trends.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are prime region HDB flats considered unfair or problematic?

What is the Greater Southern Waterfront project and how does it affect HDB flats?

What measures are being considered to address the issue of expensive prime HDB flats?

How do prices of flats in prime areas compare to the overall resale market?

What are the potential impacts of high-priced prime HDB flats on residents and communities?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments