My Journey As A Singaporean Buying A Property In France: Here’s A Step By Step Guide

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.

With me openly sharing my overseas property journey or any sort of real estate advice, I am the most uncomfortable about sacrificing my privacy to deliver more transparency to our readers.

I love my privacy, that is beyond a doubt. But I also want to share useful information so that keen Singaporeans can make sense of my journey, avoid my mistakes, and also get a reality check that it’s not rainbows and roses on the other side of the grass patch.

Many overseas property columns like to oversimplify the amount of steps required to be successful in your property purchase. Usually, they claim the path is something like this:

- Check your affordability

- Look at homes

- Make an offer

- Get a bank loan

- Pay and sign the final paperwork

- Congrats, you’re an overseas homeowner

And quite often, these articles claim that you can do so from the comfort of your home, without needing to fly thousands of miles and establish yourself in the desired location before buying the said property.

Is it possible? Yes.

Is it something I recommend? Not really.

—

Now let’s talk about intention, because I always find being philosophical about purchases instead of just focusing on the economics helps define whether my journey or advice is applicable to the mass public.

I have been looking at French property for 6 years. This was way before I moved to Europe and the reason why I’ve been looking at Europe is because I have a European boyfriend.

It’s a mix of personal and financial reasons where I have a backup of a European citizen being my future husband and residency sponsor. (We’re not married yet, okay, I came here by myself with a job offer on a legitimate work visa. Not flexing, just wanted to clear speculations about which ‘privileges’ I have and which I earned.)

Many Singaporeans I know who have bought a place here in Europe generally have European spouses. I would not have bought my French property or even considered buying one if we weren’t going to tie the knot at some point soon.

It generally doesn’t make sense to buy property overseas unless you’re very familiar with the location, fluent in the language to handle legal paperwork, and confident you’ll be staying there long-term. In most cases, overseas property doesn’t offer the same appreciation and rental yield as properties in Singapore.

Anyway rambling aside, here is my journey so far, with all the transparency that I can offer.

—

The first step to buying property overseas: Figuring out where you want to buy

The world is a vast place, and before I set my heart on France, I cast a very wide net to start researching. Malaysia and Indonesia were serious considerations, Japan and Taiwan as well, the entirety of Europe is made up of many countries with different economic dynamics so it was pretty hard to shortlist, and the Americas also have much to offer.

It was very hard to point at the globe and just be like, “I like this place, I will only buy here”. France alone has 36,000 communes, and having a European boyfriend (who isn’t even French) means you have other European countries to consider.

It was very overwhelming, to say the least. And after years of discussions and nudging, and seeing where life took us, we ended up deciding on France, in a very specific region that is known but not as famous as Paris.

Second step: Analysing the property market of your desired country

For a small group of people, it might make more sense to analyse multiple property markets before really deciding on your location, especially if you’re coming in with an investor point of view, but I have a life and don’t have the time to obsess over the property of so many countries, so I just settled on the one.

There are a ton of property blogs in many countries so you’re not really losing out if you don’t keep a close eye on it, you can usually get a summary of the analysis and whether you should trust the summary then depends on you doing your fact-checking homework.

So don’t feel FOMO if you’re not on top of the market, you’re not a superhuman with 20 eyeballs.

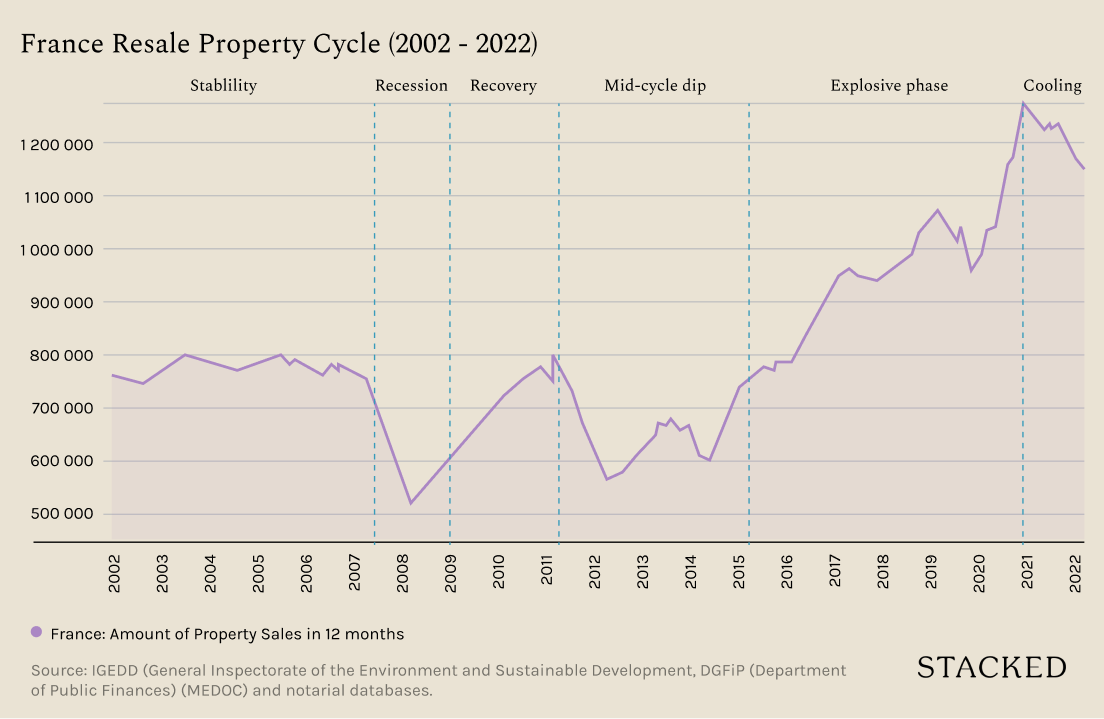

What I managed to discover in terms of the French property dynamics is the fact that they are rather predictable. Especially with the strict regulations and almost complete transparency when it comes to tracking prices on the public notaries, buyers in France can make informed decisions before committing to their purchases.

I was begging my boyfriend to buy something in 2018, just at the start of my analysis and right before the property bubble boom, but he won the argument by reminding me we were two broke kids and I was a broke Singaporean earning a weaker currency.

The property prices exploded after, but he was ultimately right. At that point in time, I was just looking at the long-term data but not understanding the laws when it comes to capital tax gains nor which locations in France were the most stable and desirable. The gains we would have made would be menial anyway as our affordability was pathetic and capital gains tax is quite heavy on short-term owners.

Did we miss out on good deals? Yes, but opportunities come in cycles. As long as you have the cash or the ability to borrow, you can become a player in the game in the future. It pays to be patient.

So I worked towards that.

Step number three: Establishing myself financially and keeping good habits

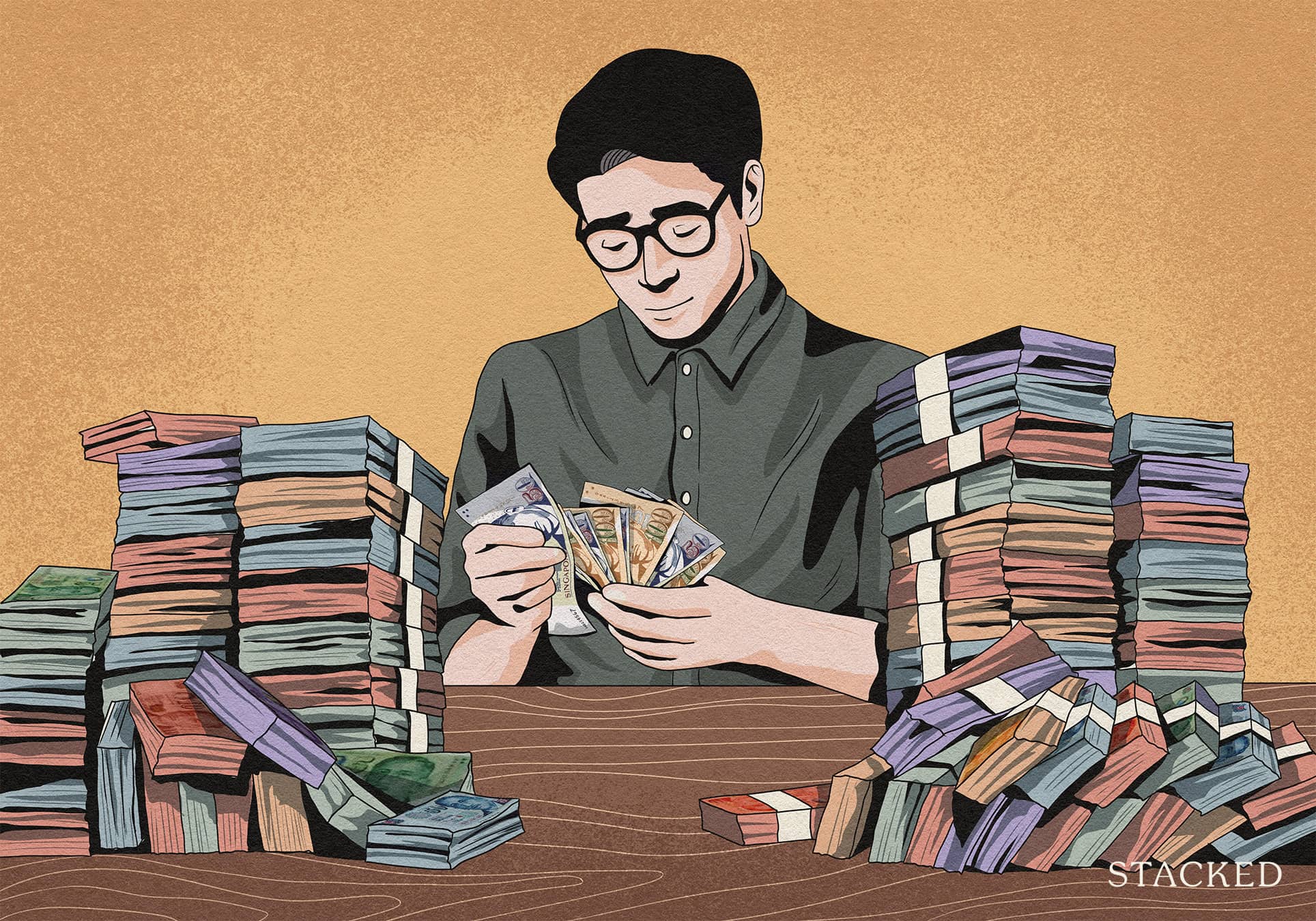

You can’t be poor if you want to own property anywhere in the world, so the only thing I could obsess over was saving money and having a career.

Now I was paying rent early on as I’d moved out of my parents’ due to circumstances, but that liability drove me like no other. I worked really hard to establish myself in my industry, while keeping my cost of living as low as humanly possible.

Not everyone can live in a $550 room rental with no air conditioning with a dementia patient as your landlady. I also ate $2.60 cai png daily. A lot of my peers wouldn’t be able to accept that sort of living conditions. It would be a lie to say it wasn’t difficult, but it was well worth it.

When I hit a little salary milestone, I allowed myself to upgrade to a $1,000 room that had air conditioning and occasionally treated myself to Boon Tong Kee chicken rice.

I managed to hit S$100k in cash savings at 26 as a result, so you know what, it’s definitely possible if you work hard and make a few sacrifices (I didn’t go to uni, nor travelled much).

Step number four: Establishing myself overseas

I had all this money now, and since I wasn’t going to stay in Singapore, it didn’t make much sense to dump it into investments knowing I need to tap into it in the next few years.

So what did I do? I spent it.

I’m oversimplifying my story, but migrating overseas is not easy.

When I did get a job offer to relocate, quite a large sum went into visa applications and relocation, which was only partially sponsored since I wasn’t moving via internal transfer.

Temporary housing costs quite a bit in the first few months. Deposits and new furnishings for the long-term rental apartment also took a chunk. I know a lot of Singaporeans dream of moving overseas, and this isn’t super relevant to real estate, but you know what, it costs a lot of money to be an immigrant.

I lost that S$100k milestone almost as soon as I attained it. But it was alright for me, I saved that money with a purpose and I used it for that purpose.

I didn’t start looking at property as soon as I moved though. Many overseas Singaporeans can attest that moving and settling down is stressful and it takes a while to shake off the bad mojo you accumulated in the process.

I was focused on work, and I was right to do so because to qualify for a bank loan in Europe, you need at least 2 years of tax statements as proof of income. Property is really a secondary concern at this point; I was more worried about job stability and the re-establishment of my emergency funds.

It felt like a lot of steps backwards, but it also enabled more steps forward.

Step number five: Pre-approval of financing

So after I finally hit the 2-year mark, I excitedly went to a mortgage broker to check my maximum affordability. Keep in mind that maximum affordability is just as it sounds, it’s the MAXIMUM you can afford. It doesn’t mean you should just borrow the maximum just because you can.

It took a few weeks for me to understand and re-optimise how much I would be able to comfortably afford for my situation. Adjusting my affordability based on some personal circumstances led to borrowing only a fraction of the projected affordability.

Many of you might question now why I wouldn’t want to wait till later to buy something, but as I said in my introduction article, I want to invest in something small anyway to learn about the market. My first property won’t be my last and hence I wouldn’t be putting all my eggs in one basket.

The interest rates in France are also rapidly rising, hence I felt quite hard-pressed to lock something down now instead of waiting a few years down the line.

Step number six: Looking at apartments

Arguably the most fun part, but also the most tiring and frustrating. Searching for suitable apartments online was quite a pain because, in France, you don’t just send the real estate agent an email or text and expect a quick reply, you need to call them (and speak French).

Because if you don’t call, you’re going to lose the property to someone who did. Good properties aren’t on the market for long. When you do call, scheduling visits is based on the agent’s availability, which will never be the same day or the next day, you’ll likely have to wait a week, sometimes a month if you stumble across holiday periods.

Addresses of the actual location are also only revealed after you give them a call and confirm a viewing appointment, and once you have the address, even if you know the location isn’t what you desired, you have to show up, if not risk appearing rude and blacklisting yourself from the real estate company.

You don’t want that to happen because all agencies will have exclusive properties from time to time. Buying property as a foreigner is difficult enough, you’ll need all the allies you can get.

Before you go for your apartment viewing, it’s important to note that you’re not going there to view apartments for fun. You’ll need to prepare a checklist of questions to ask the real estate agent. Things like why the owner is selling, technicalities about the property, and questions to dig out potential blind spots of owning the said property (like having to change new windows, or adding a new water heater tank).

Anyway, during your rendezvous, you need to make sure to be punctual, well-dressed, and polite. The usual stuff. If you really like the property and the real estate agent is confident about your financial profile, they will send you documents about the property before you make your offer.

Step number seven: Reviewing the property’s documents

In France, it’s important to understand that apartments you buy usually have a co-ownership agreement set up. What this means is that the land that your apartment is on is owned by a collective of people, and you’ll have a part of it.

If you buy a house, you don’t need to deal with this, but it’s important to note you then have to deal with the upkeep of the entire property yourself.

If you’re buying an apartment, once a year, all the co-owners meet up to discuss the management of property funds and agree on what sort of maintenance work we want to take on for the year.

Typically for larger and taller buildings, you can have a co-ownership membership of 40 to 100 people, sometimes even up to 200. It is ill-advised to get property with such a large co-ownership because when you need to do work that affects everyone (e.g. repainting the exterior of the building or upgrading an elevator), getting permission and consensus is a pain in the butt.

It’s important to take note of how many shares you’ll take over in the co-ownership, as it will determine your voting stake at meetings. Reviewing meeting notes to see how decisions are carried out and if it’s usually amicable is also equally important. You can usually get a sense of what sort of personalities own the place, and if there are any serious problems in the community you need to take note of.

More from Stacked

What Makes A Small Boutique Condo Profitable?

Boutique condos are something of a niche buy. Often with 100 units or less (in some cases even fewer than…

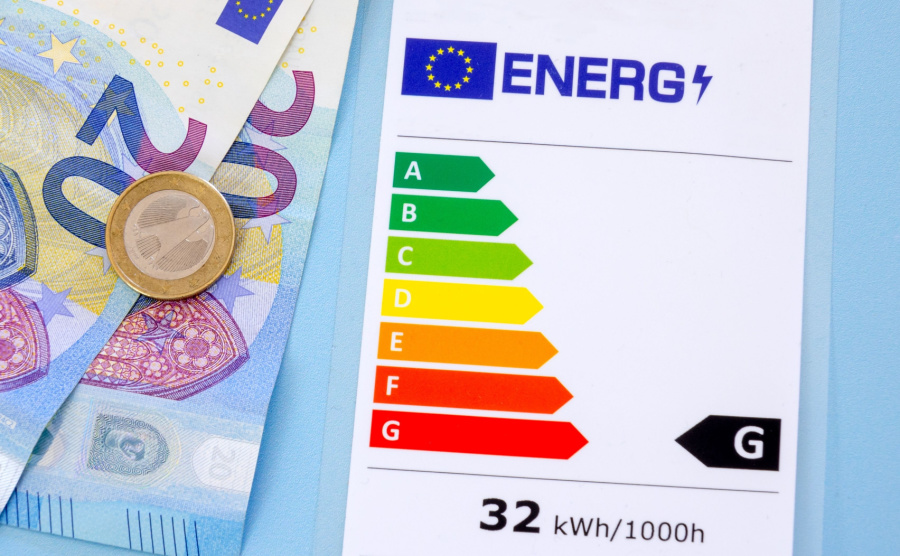

Another important document to note is the energy rating of the apartment. In France, all homeowners have an obligation to make sure that their property is energy efficient and produces as little carbon emissions as possible.

This helps save on rising energy costs and also makes the property good to live in. The energy ratings go from A to G, where A is the best rating, and G being the worst before the extinction of the H rating.

This is done to prevent the occurrence of slumlords where you allow homeowners to charge rent for property in bad conditions. In 2021, France announced that it would ban properties rated F and G from being rented out in the near future. Since most landlords are ageing retirees, there is a massive race to sell these low-energy rating properties right now.

But buyer beware, just because these properties are cheaper now, it doesn’t mean it’s a good idea to buy them. The energy renovations might be more than you can chew, so if you’re purchasing for investment purposes, you’ll have to do more due diligence.

I generally don’t recommend it for non-resident, beginner investors. Really, I cannot emphasise how bad an idea it is (For perspective, it’s already a bit questionable buying these properties for your own stay).

Your energy rating theoretically gets lower every few years, so you will have to constantly update and actively maintain your home to make sure it stays energy efficient.

Anyway, by reading the energy report, you’ll get a sense of what sort of energy renovation is needed down the line.

Depending on the property there will be more documents to review, but these are the two major ones (They are, of course, in the native language of the host country).

Step eight: Get professional and friendly advice

This is by far my biggest tip when it comes to buying property overseas: Never trust yourself and always get a second opinion.

Let’s face it, you’re not the expert on construction, you’re not the expert in energy efficiency renovation, you’re not an architect, and you’re not a mortgage expert. Before you make an offer, pay the money to get advice from 3rd party professionals who don’t benefit directly from the sale.

For my case, I consulted different insulation experts to give me a quote for replacing the insulation of the roof and walls for one of the apartments I was interested in. It turned out to be around 40K Euros, so if I were to buy that place, I need to be prepared to fork out that money down the line.

I also hired a freelance architect/interior designer for some help with space planning (though I did end up firing them, but that’s a story for another day).

I am also really lucky to have access to French locals as my friends, as well as other Singaporeans purchasing their homes in France, so their opinions and experience, though varied, helped prevent mistakes and blindspots in the process.

Work with people and get their opinion, because if it is a bad idea, they’ll make you see it.

Step nine: Making an intelligent offer

In France, all listing prices of property are the maximum you can pay for the said property. There is no such thing as bidding over the asking offer nor increasing the price after listing the property, as that is illegal. But it also means that homeowners usually ask for a slightly higher price to protect themselves from low-balling.

I really like that, as it keeps greed at bay. Anyway, negotiations are definitely allowed in France, but if you ask for too big of a discount, the homeowner will likely just blacklist you and you close your door to counter offers and lose your chance at owning the property completely. So don’t play play.

It is important to note that negotiations will usually go through the property agent, so every time you make an offer, it’ll be a few days before you get a reply. But generally, if you don’t make an unreasonable offer, it should be accepted the first time.

Typically you will be able to ask for a 5% to 7% discount if the property has reasonable flaws that you’ll have to deal with in the future. It’s not much, but it’s something.

Negotiations aren’t just about price, they could also be requests for service or items from the owner. An example could be any furniture that you see in the property that you would like to keep, or asking for a professional cleaning before the property is handed over.

I personally added all the furniture and chimney cleaning in my offer (Yes, I’ll have a fireplace, how cool). My requests were super reasonable because I barely budged on the asking price and all furniture was included in the first place, thus it was accepted the first time without much fuss.

Step ten: Begging the bank for a loan

After the price is settled, it’s a good time to ask your bank to give you a loan. I waver on which step comes first, honestly, the final offer or the bank’s agreement. But the bank won’t give you an actual loan agreement until you have settled on a price, so I would say negotiating the price comes first.

Anyway, this is where the process gets a little bit long and stressful. The bank needs a lot of documents from you to ensure that you’re good to loan financially, and processing these documents takes time. Whether you’ll be given a loan offer is something you’ll only know after they’ve finished processing your documents.

You’ll have to talk to multiple banks like I did. I made the mistake of being lazy and settling on the one bank that was too overconfident about processing my case, and they ended up rejecting me leaving me scrambling for a loan solution.

To be fair, I made the big mistake of switching jobs during the finalisation of my purchase offer. So that kicked me out from getting a mortgage in Europe. It sucked for me because I ended up having to take a loan back home and I now have to deal with multi-currency payments until my loan is repaid. Highly do not recommend anyone doing this though, the risk of being at the mercy of exchange rates and additional fees is not worth it.

Step eleven: Signing of many papers and the start of the property transfer process.

On average, it takes about 2-3 months for you to get all of the paperwork finalised with the banks and the notary, and I won’t get into too much detail because it’s always the standard set of papers and appointments you’ll have to go down to the town hall to sign.

Basically, the culture shock Singaporeans need to be prepared for buying a home in Europe is that it takes a long time to get the sale closed (even if you can pay full cash).

It is important to note though, that you have two chances to back out of your purchase if something in your brain suddenly clicks and you think it’s a bad idea.

The first chance is when you have signed an official purchase offer, known as compromis de vente in French, and made your deposit. You will be given 10 days to “cool off” and should you choose to back out within those 10 days, you will get your deposit back, no questions asked.

The second chance is when a conditional withdrawal happens. You can get the notary to add a suspensive clause into the compromis stating that you will not go through the sale if you did not acquire the bank loan. This is highly important because it keeps you from legal repercussions if you don’t acquire the funds to finalise the purchase.

So your two chances to either back out by choice during the cooling period, or by default when conditions are not met for the sale to proceed. It is important to note that the suspensive clause only applies to French loans, so being unable to secure a loan outside of France doesn’t count.

You can technically still back out of the sale, but you will piss many people off, especially the seller, and it also becomes a criminal offence. They can get you fined, and on top of that, you’ll have a forfeit you’ll need to pay. It differs from contract to contract, but the typical forfeit is 10% of the property price (basically the deposit), and a fine can be up to 5,000 euros I believe.

The worst penalty of all is a criminal record on your profile, so if you’re looking into permanent residency, you’re screwed.

Anyway, the seller is not allowed to back out of the sale once the compromis de vente is in progress, but complications can happen that would delay the sale (such as divorce, so basically a dispute in money allocation when the sale is complete). But before the compromis is signed, the seller isn’t obligated to sell to you even if they verbally accepted your offer.

If another buyer comes along and makes a better offer, or the seller just likes them more, they can sell the property to others instead of you. However, after the compromis is signed, even if the seller dies, the sale will still be completed. How extreme, I love it.

Thankfully not much drama happened to me; the current owner was a retired old lady who really wanted to sell, and I was someone who really wanted to buy. She was nice enough to even let me buy without a deposit, which came as a big surprise when I first read the legal draft of the compromis.

After months of waiting, the paperwork should be in place, and all that is left is to buy home insurance and transfer the money to the notary to finalise the purchase for you to get your keys.

Step twelve: Finalising the details

In the months leading up to your final purchase offer, also known as acte de vente, you will make use of the time to finalise the loan offer you got from the bank (ideally you settle the loan as soon as you can after you sign the compromis). This is when you negotiate loan terms and even interest rates with your bank so you get the most ideal outcome.

Unfortunately for me, I was denied by most of the European banks due to my freshly incubated probation period, and after comparing the interest rates, it was better for me to take a loan from Singapore. So if you’ve taken a loan before, you know how it goes, pretty standard stuff.

Once you have the money, you follow the transfer instructions of the notary and as soon as they validate the deposited funds, and you’ve gone ahead and bought home insurance, you can make an appointment to head down to the office again to sign the acte, visit your property for final checks, and become a proud new owner of your French property.

At the time of writing, I haven’t gotten to this step yet. Again, you need a lot of patience in Europe, and thankfully it’s something I have been mentally prepared for.

—

As you can see, owning a property overseas is a lot of planning and work, with many baby steps accumulating to a big result. This process does not even account for the after-admin of property maintenance, taxes, and renovation.

The property you buy has to either make a lot of sense or is something worth the new chronic pain you’ll now have as a responsible property owner. Don’t own a property overseas just because you feel FOMO or you want to make yourself feel pretty, own it only if it makes sense for you to do so.

I’m not trying to sell some overseas property crash course nor am I encouraging blind buying by sharing my stories. I just want people to understand the process a little bit better from my experience, and just kick start some collective intelligence for Singaporean friends who are with me in Europe considering making a purchase here.

Maybe overseas property is for you, and maybe it’s not. Just make sure your decision is a well-informed one where you can get multiple facets of support.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Read next from Editor's Pick

Overseas Property Investing I’m A Singaporean Property Agent In New York — And Most Buyers Start In The Wrong Neighbourhood

Overseas Property Investing What A $6.99 Cup of Matcha Tells Us About Liveability in Singapore

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Singapore Property News This HDB Just Crossed $1.3M For The First Time — In An Unexpected Area

Latest Posts

Property Market Commentary This HDB Town Sold the Most Flats in 2025 — Despite Not Being the Cheapest

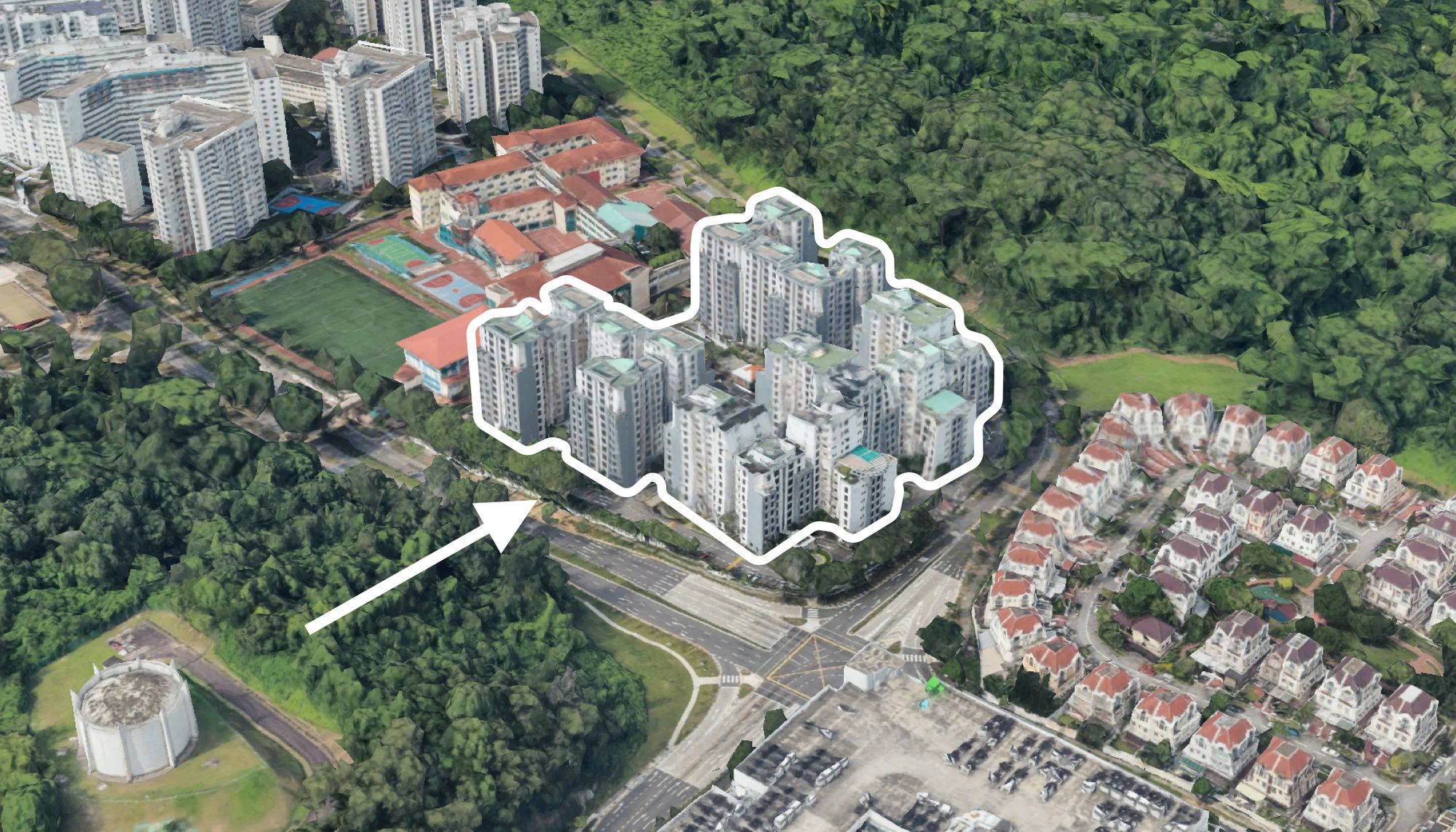

Singapore Property News This Former School Site May Shape A New Kind Of Lifestyle Node In Serangoon Gardens

Singapore Property News I Learned This Too Late After Buying My First Home

Property Market Commentary How To Decide Between A High Or Low Floor Condo Unit — And Why Most Buyers Get It Wrong

Singapore Property News This 4-Room HDB Just Crossed $1.3M — Outside the Usual Prime Hotspots

On The Market Here Are 5 Rare Newly-Renovated HDB Flats Near MRT Stations You Can Still Buy In 2026

Pro Why This 24-Year-Old Condo Outperformed Its Newer Neighbours In Singapore

Singapore Property News More BTO Flats Are Coming In 2026 And Why This Could Change The HDB Market

Pro How A 625-Unit Heartland Condo Launched In 2006 Became One Of 2025’s Top Performers

Property Investment Insights Does Buying A One-Bedroom Condo Still Make Sense As An Investment In 2026

Property Market Commentary Why This Once-Ulu Town In Singapore Is Going To Change (In A Big Way)

Singapore Property News “I Never Thought I’d Be Sued by a Tenant.” What Long-Time Landlords in Singapore Miss

Singapore Property News Breaking News: District 23 Condo Sells Out In Under Two Years At $2,120 Psf Average

On The Market Here Are The Cheapest 3-Bedroom Condos in Central Singapore You Can Still Buy From $1.15M

Property Market Commentary Why The Singapore Property Market Will Be Different In 2026 — And It’s Not Just About Prices

Hi there!

Are you able to share which bank in Singapore did you go for your property in france?

Thanks!