Most Sellers Don’t Know This: 7 Less Obvious Factors That Can Affect Your Selling Price

December 16, 2022

The fundamentals that affect your property price – such as location, lease decay, state of maintenance, etc. – are relatively easy to spot. Most realtors and valuation companies have broadly similar checklists. However, we often get questions on why, even if a property checks all the right boxes, it can sometimes fetch lower offers. This is where the puzzling part of the property market comes in, and we often discover “invisible” factors like the ones below:

Table Of Contents

- 1. A combination of low transaction volumes, plus price anchoring

- 2. The re-launch effect

- 3. Developers changing pricing midway, through, or toward the end

- 4. Negative perceptions due to timing

- 5. The unit mix may impact the future pricing

- 6. Units close to yours are selling under special circumstances

- 7. The property just doesn’t stand out as much as you might think

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. A combination of low transaction volumes, plus price anchoring

Low transaction volumes occur when there hasn’t been any unit bought or sold in the project – or perhaps even near the project – for a period of 12 months or longer.

This situation is common in old walk-up apartments, where the last unit sold may have been four or five years ago; but it sometimes occurs even for HDB flats such as in the Marine Parade area, where transactions are infrequent.

When there’s no discernible price history, the first person to transact in the project can end up “anchoring” the price. That is, for lack of any other reference point, someone’s willingness to buy at that price is used as the guide for the next transaction. The risk to sellers is that, if the first transaction is unusually low, their own property price could be dragged down.

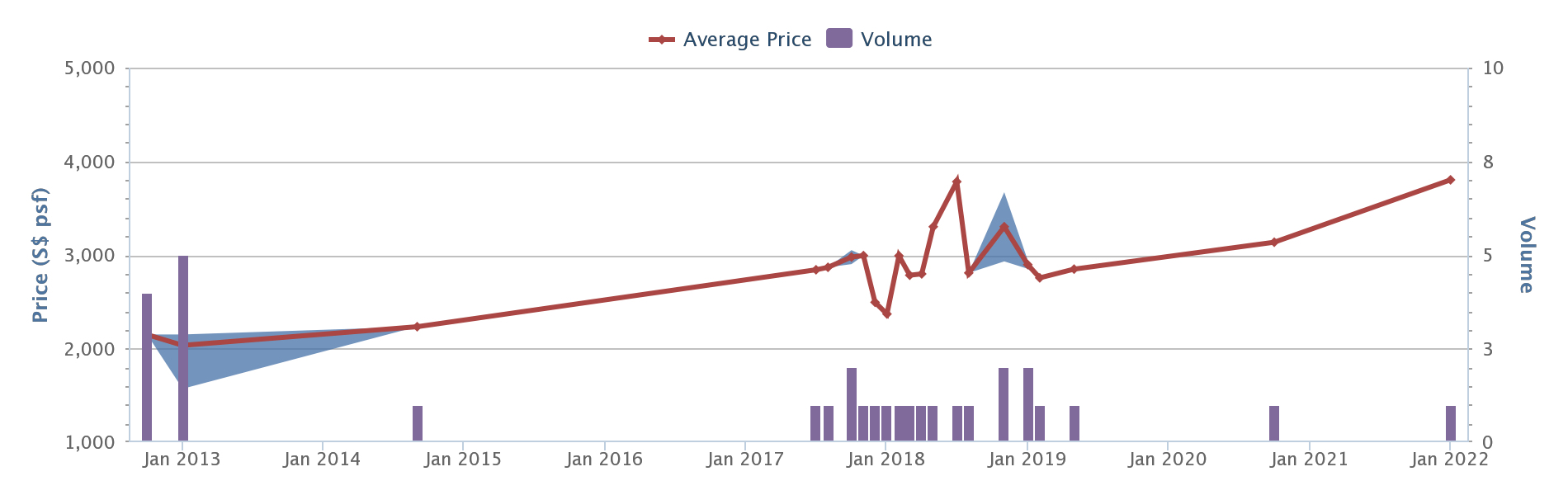

Take, for example, a boutique condo like Lloyd Sixtyfive:

All the transactions shown are one or two units, with the last one being in January this year at $3,802 psf. If you asked for a “median price” for a unit here, anyone would be hard-pressed to give you a clear answer. Chances are, the answer will be based on the January transaction; even if it was over 11 months ago, and before the latest cooling measures.

In our earlier article, we pointed out that this is similar to Executive Condominiums (ECs) that have just crossed their five-year MOP: as there are few to no sales before then (special permission is needed to sell before the MOP), the first few sales end up being the anchor price.

2. The re-launch effect

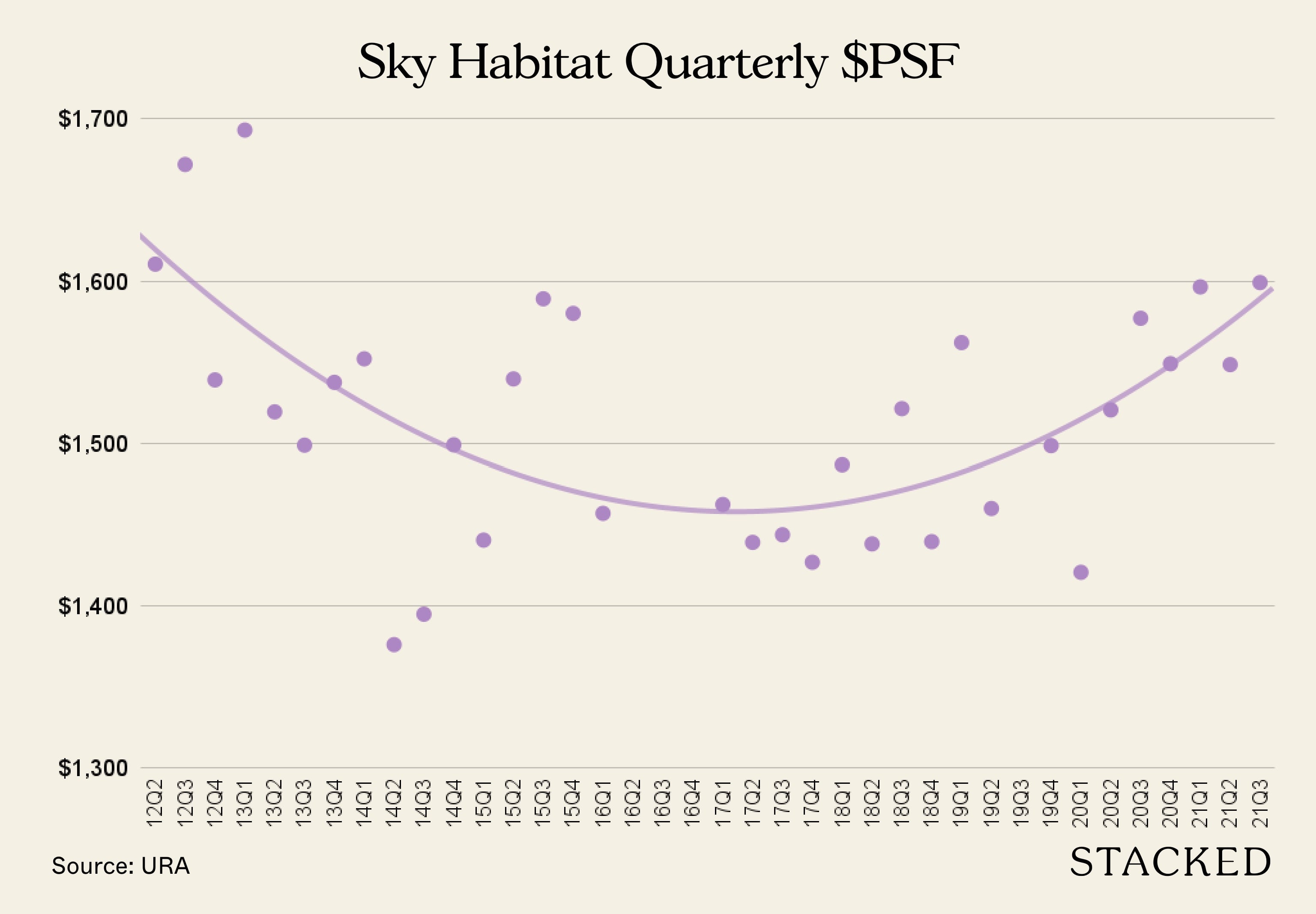

There are cases where a developer’s launch doesn’t go as planned, and the developer then executes a re-launch. One example of this is Sky Habitat, which dropped prices during the re-launch.

During the re-launch, the developer dropped prices by 10 to 15 per cent on average, resulting in a second batch of buyers buying at $1,276 to $1,590 psf, compared to $1,435 to $1,893 psf.

At present, Square Foot Research shows resale prices of between $1,116 to $1,932 psf. A decent return for the second batch of buyers, but disappointing for the first batch. The initial buyers had no way to see this coming: they couldn’t have known that, at some later date, subsequent buyers would purchase similar units for less, and accept the current pricing that we’re seeing today.

This is related to the next phenomena below:

3. Developers changing pricing midway, through, or toward the end

Sometimes a developer doesn’t have a second launch but rather lowers prices toward the end of the launch. This can be for several reasons, from beating ABSD deadlines to moving the last few stubborn units (often units with a high quantum, or in the least desirable stacks).

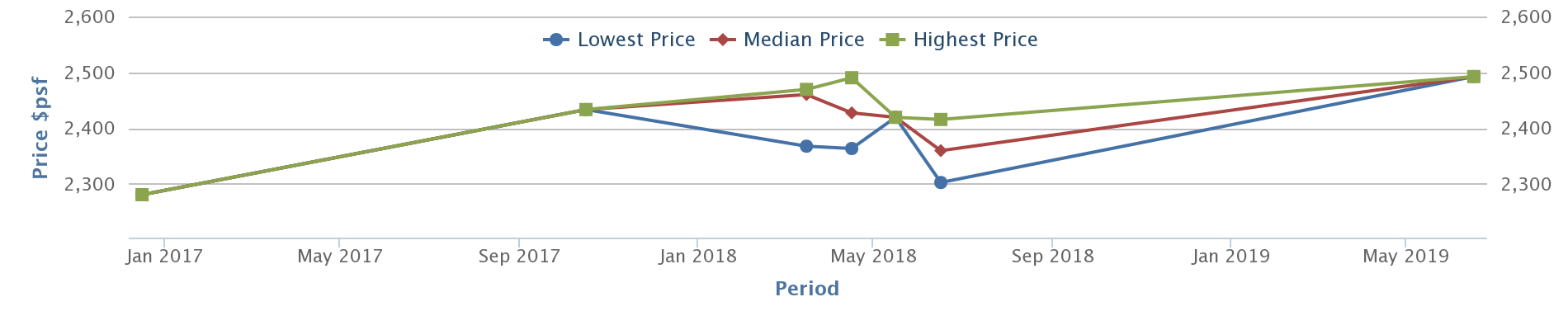

The most recent dramatic example in recent years would have been 38 Jervois. Prices came down by 13 to 24 per cent, for the 16 remaining units; the developer either had to sell these or absorb the cost of the ABSD.

This resulted in some unusual price movements by the developer:

As with point 2, this can result in those who got discount prices agreeing to sell at lower rates (they would realise a profit anyway), at the cost of those who bought at peak developer pricing.

If you see sellers in your project accepting offers that, to you would result in slim to no gains, it may be time to check if your developer changed the pricing at various phases.

4. Negative perceptions due to timing

#1 Loft at Geylang suffers from this issue. This condo has 21 unprofitable transactions to 3 profitable ones – with the 3 profitable transactions only popping up due to the price increases from the last 2 years.

This creates the perception that something must be “wrong” with the condo; although you could also argue that it’s more to do with timing than the project. #1 Loft launched in 2013, at the peak of the property market. Subsequently, policy changes like cooling measures kicked in and dragged down home prices. This, more than anything about the condo itself, resulted in many unprofitable changes.

Due to the perception created by the transaction history, sellers here may have a tougher time raising prices.

Of course, there’s also a lot to say about other factors such as its location and layouts, etc (just like most other unprofitable condos)

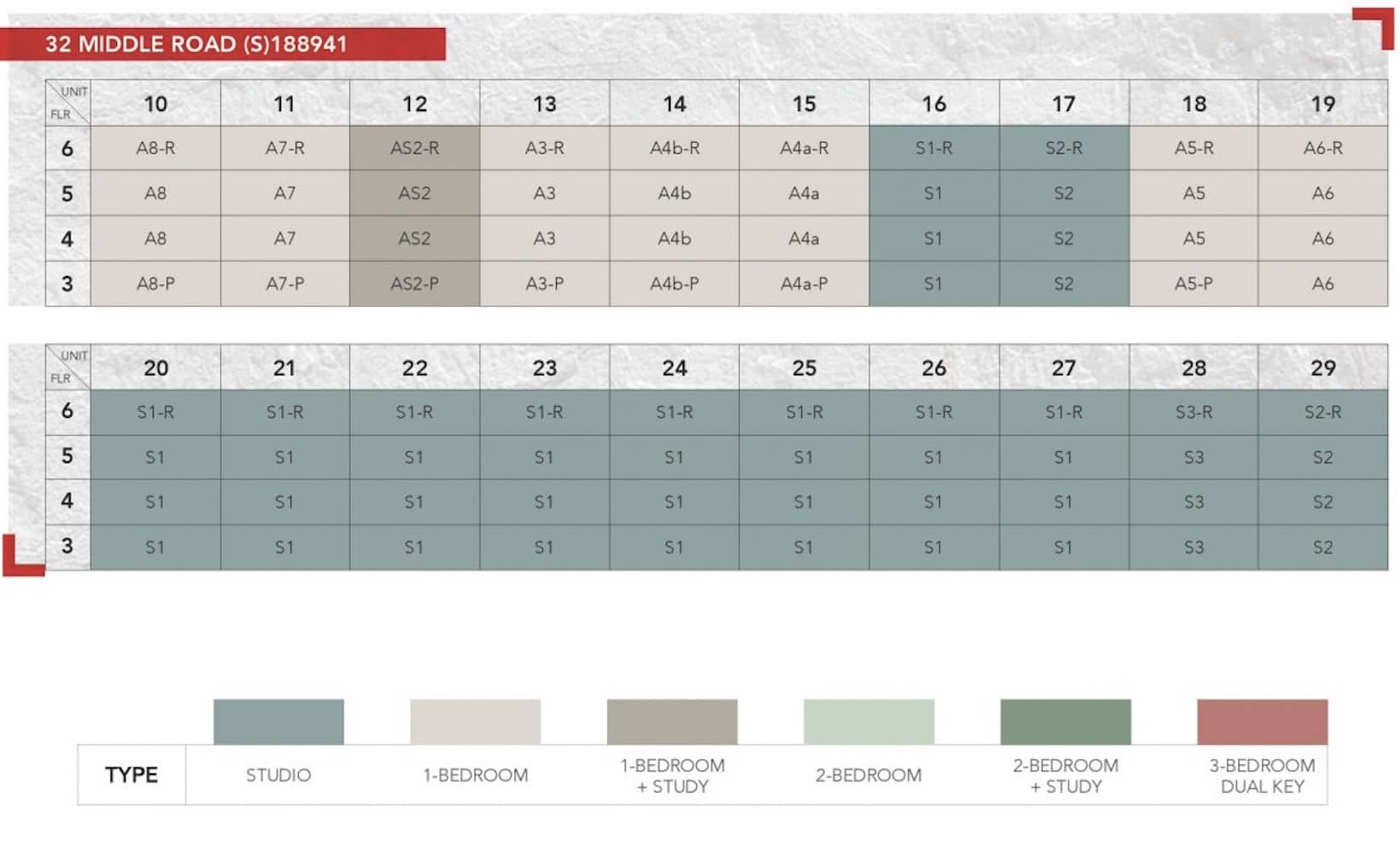

5. The unit mix may impact the future pricing

Falling prices and transaction volume may reflect the unit mix, rather than other issues with the condo. A key difference is that, unlike the shoebox craze of the past, size is now the market trend.

This has been the case since around 2019 when HDB upgraders re-emerged as the dominant group of buyers. This demographic consists of family units, that have no use for shoebox apartments of 500 sq. ft. or below.

For projects that consist of a high number of single-bedders (Urban Vista in point 4 also has this trait), transaction volumes may seem to dip or go lower. This is especially in contrast to 2013 or earlier, the years when the shoebox craze was in effect, and small units could have sold for higher.

So if you see prices dipping and you can’t explain why, try checking the unit mix. You may find that the project has an inordinate number of single-bedders, or 1+1 bedder type layouts. This was one of the reasons we found,

Property Investment InsightsAnalysing Unprofitable Condos: 6 Reasons Why Urban Vista Has Performed Poorly

by Sean Goh6. Units close to yours are selling under special circumstances

Sometimes, due to sheer bad luck, a unit on the same floor or block sells for a pittance. There could be any number of reasons behind this, from the sellers’ bankruptcy to someone’s divorce. This could lead to an urgent sale, at an unusually low price.

If you also happen to list your property at the same time, however, the last transaction may cause future buyers to lowball you. In these cases, you may have to wait a bit longer and show sufficient confidence not to budge on price.

As a final note for flat-sellers, we suggest checking if the “special circumstance” is simply the ethnic quota for your block. Sometimes, sellers overlook the fact that the quota has shrunk the prospective buyer pool – and this can put downward pressure on prices.

7. The property just doesn’t stand out as much as you might think

To be fair, this is a really hard one to quantify or justify. But we’ve seen properties that on paper, have all the makings of what people would be a good property. Freehold, close to MRT, near good schools, etc.

Sometimes, this can just be a case of how the property actually feels when buyers visit. This could be just down to the ambiance of the surroundings, the upkeep and maintenance of the property, or just that it has much more impressive neighbours that overshadow it. In short, these are all factors that aren’t quantifiable, and it’s hard to capture in words.

This could also sometimes happen in conjunction with how the property was priced in the beginning by the developer. There are cases where the beautiful renders that you saw in the show flat just didn’t translate well in the actual product – sometimes the reality is just disappointing.

For more information on the Singapore property market and what makes it tick, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike, so you can make a better-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments