So, how much do you need to earn to afford that resale flat? Singapore’s HDB affordability has been put into question time and time again.

This article is meant to give you an overview of the minimum gross household income needed to purchase a resale flat. In producing the figures, we had to make several assumptions which cover most HDB resale flat buyers.

- Assumption 1: Only the down payment of 10% of the purchase price is made and a HDB loan is taken for the remaining 90%

- Assumption 2: The HDB loan charges an annual interest of 2.6%

- Assumption 3: The loan tenure is 25 years

- Assumption 4: No CPF Housing Grants are considered here

- Assumption 5: The HDB median resale flat prices in September 2017 is taken as the cost of purchasing a resale flat for that month

The steps taken to derive the gross household income are:

Step 1: Determine the median resale prices in September 2017.

Step 2: Calculate the monthly payments based on a 90% HDB loan at an 2.6% interest rate per annum and a 25-year loan tenure.

Note to step 2 – As taking a HDB loan requires that the monthly payments should not exceed the Mortgage Servicing Ratio of 30%, the result from step 2 is assumed to represent 30% of the gross household income.

Step 3: Multiply the result from step 2 by 3.33 (100% / 30%) to obtain the minimum household income needed to fulfill this MSR. This is the minimum household income you need to have to quality for the loan needed to purchase the flat.

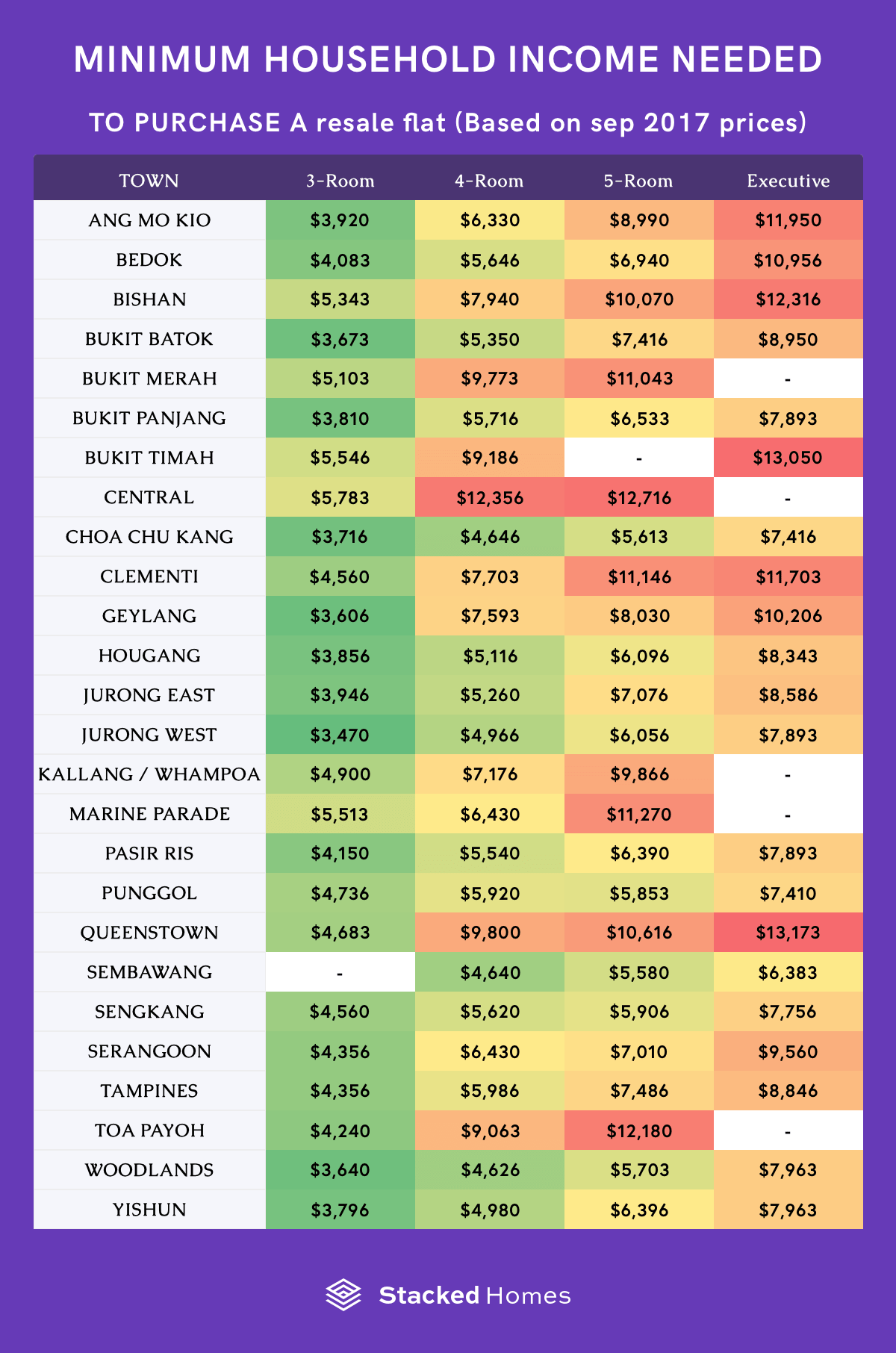

So diving straight into it, here are the gross household incomes needed for each estate and each flat type based on the median resale flat prices in September 2017:

These gross household income figures will only tell you how much HDB loan you qualify for, and does not account for the CPF Housing Grants you may receive, or the cash you have sitting in the bank. In other words, even if you had a million dollars in cash, applying for the HDB Loan does not take into account your hidden fortune. It only considers your household income.

Since these income figures were derived solely looking at the MSR, be mindful of other fees (see our first FAQ on estimated fees) you’ll need to pay such as the valuation fee, resale application fee, mortgage and fire insurance, so be sure to have cash lying around for these expenses too!

Sean

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?