Loss Aversion: Why Do People Fail To Act During Downturns

May 15, 2020

You’ve probably heard these phrases countless times:

“Be Fearful when others are Greedy; and be Greedy when others are Fearful.”

OR

“Times of Crisis represent times of Opportunity.”

Afterall, one of the strongest fundamentals of savvy investing is to ‘buy low’ and ‘sell high’ right?

So when the going actually gets rough (as we’ve no doubt seen in recent times), where do the good folk who were previously chivalrising that beautiful notion disappear to?

For one, you’ll find an enterprising group, tirelessly scouring the markets – cash in hand for instant deployment into low-cost, high-potential deals.

Sadly, you’ll also find an unfortunate few hanging on for dear lives – clawing at every financial option within their grasp to make ends meet.

There is also a third group.

A group that the majority of us often fall into. A group that sits quietly and waits for the storm to pass so that they can carry on with their lives in a healthy economy.

Now I’ve found myself in these 3 groups as I (try to) navigate the meanders of life.

And I can tell you that finding yourself in that second scenario is no joke simply because you’re at the mercy of the wind – often with little ideas on how to climb out of the current predicaments you’re facing.

Neither am I saying that being in that group who is constantly redeploying cash into these ‘low-cost, high-value’ assets will necessarily guarantee success. Not at all.

In fact, make one wrong deal with a substantial amount of cash, and you can say goodbye to that dream of traveling the world in your twilight years.

Yet, having weathered these diabolical periods – first in the dot.com crash, and then in the financial crisis on 07/08, I’ll tell you right now that my biggest regret was always falling into that third group.

The group that listened, watched, waited… and simply carried on – despite having the potential to make some key investments during that period that would set us up for life.

I didn’t fall into it once. Or twice. Or thrice.

No. In fact, it happens to me even today.

Despite all the countless times that I’ve missed out on these incredible investment opportunities – only to see them wildly appreciate over the coming years, my investment mind still freezes in the face of downturns, simply because I’m too afraid to lose all that hard-earned dough to a silly mistake.

And I’m sure that this is a feeling something that most of you would resonate with.

That I’d rather keep my hard-earned cash, than risk squandering it all away for a chance at better prospects – minus that 9-5 grind.

It also brings me to my topic today.

“Loss Aversion: Why do we fail to act in downturns??”

Loss Aversion Bias – The ‘Fear of Uncertainty’ and the principle that drives it

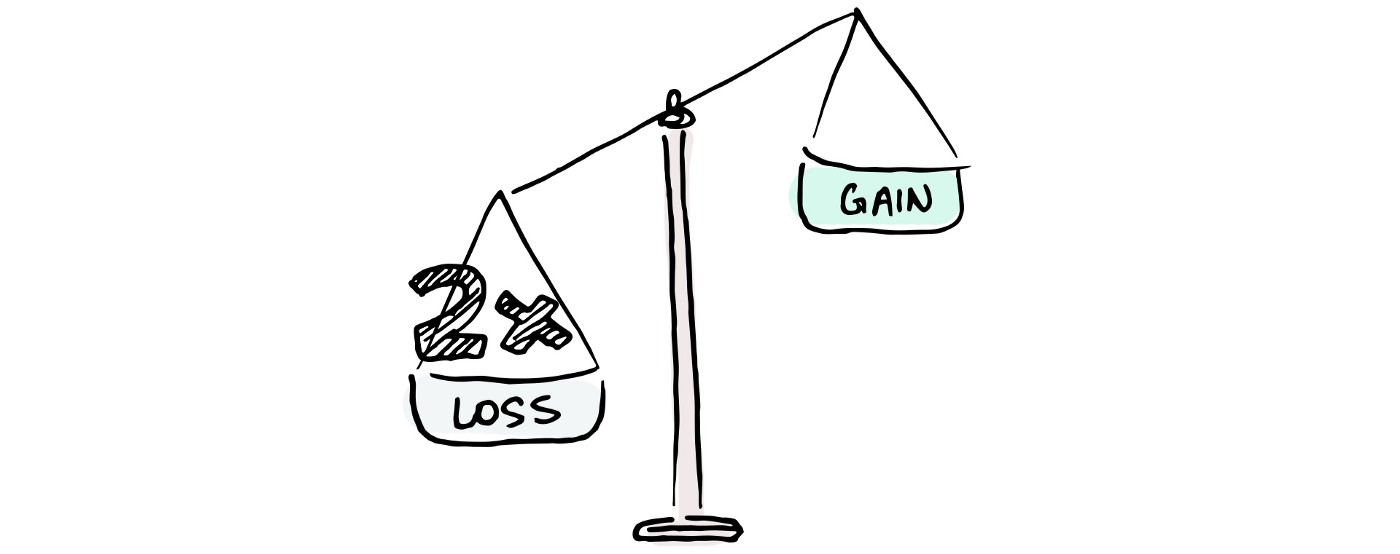

The Loss Aversion Bias can be described as the tendency to fear the psychological pain of loss, MORE than the pleasure of gain.

In fact, studies have shown that individuals react twice as strongly to loss – as compared to profit!

So what can this lead to?

Passivity. Reluctance to take action.

And yet another window of opportunity closing shut.

OR

Panic sales and unrealised (read: rightful) long-term appreciation gains.

Here’s an example that I came across not too long ago:

The Sunglade Case Study

Here, we compare 2 similar sized units at the Sunglade Condominium – one directly above the other.

(Some background: The Sunglade is a 99-year leasehold condo located in Serangoon (D19). It was launched on 23rd June 2001 with a total of 475 units)

| UNIT 1: #07-2X 861 sqft | New Launch Sale | 1st Resale | 2nd Resale |

| Transacted Price | $453,540 | $450,000 | $640,000 |

| Unit Price (psf) | $527 | $523 | $743 |

| Sale Date | 18th July 2001 | 16th July 2007 | 1st June 2008 |

| Capital Appreciation (For 2nd Buyer) | 42% |

The 1st resale transaction for this unit occured 4 months before Singapore was officially declared in recession (in the middle of the ‘07 to ‘09 Global Recession).

| UNIT 2: #06-2X 861 sqft | New Launch Sale | Resale |

| Transacted Price | $448,360 | $980,000 |

| Unit Price (psf) | $521 | $1,138 |

| Sale Date | 17th July 2001 | 27th Dec 2011 |

| Capital Appreciation | 219 % |

On the other hand, the resale transaction for this unit occured 2 years 4 months after PM Lee Hsien Loong announced the worst of the recession was over (National Day Rally, 16th Aug 2009).

Now I’m not saying that both units were identical interior-wise (for all you know, unit 2 might have a built-in fountain of wealth that we have no clue about) – but as was most likely the case, this scenario shows us how substantial a profit (219% appreciation) you could make if you do decide to avoid panic sales, or in the case of buyer #2 of that first unit – to take an investment plunge during a downturn (42% appreciation).

Property Trends$6M Profit!? – The Biggest Winners From The 08/09 Property Market Crash

by Reuben DhanarajOf course, real estate investors and regular home-buyers will naturally ponder the risk of investing, or even living in a property ‘currently worth’ less than its mortgage – with fears that the valuation of the property will not climb up as fast as they would hope (or worse, having to later sell it at a loss).

But here’s where it gets interesting.

While our concerns are definitely warranted, the study that was mentioned earlier (conducted by American social psychologist, Daniel T. Gilbert in 2006) concluded that “Loss Aversion is actually an Affective Forecasting Error”.

In this study, participants showed that, compared to winning, losses were seen to have greater impacts emotionally.

So what does that mean for us?

In four words – “We freaking hate losses”.

And often, this fear paralyses us from making our rightful gains.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How A Couple Turned A 20-Year-Old Rental Apartment Into A Stylish Home

When you first step into Laura's home (*not her real name for privacy reasons), you may be surprised to find…

What else stops us from… ‘making gains’?

Before we get to the solution, let’s have a look at another factor that contributes to this hesitancy of action.

You see, just like in the world of stocks, too many of us are focused on timing the property market (especially in downturns). Or in other words, waiting for the BOTTOM of the drop.

And that is something experienced traders/investors refrain from prioritising because gauging exact figures in a relatively unpredictable market is near impossible (not to mention destructive).

You will hardly ever be sure when a share has bottomed out – even less so when settling on the right price/time to sell.

And let’s face it. If you’re going to call yourself an investor, and hope to even make some form of returns in the future, you have to apply some risk (while doing this with well-backed methods/findings of course).

Let’s take this back to real estate.

Watching the prices too closely, and squinting at your screen to spot the perfect time to buy, WILL leave you waiting on the sidelines.

Price rises? You regret your decision to hold back. Price falls? You hesitate to make a commitment. Either way, zero actual attempts are made to make the purchase.

And you don’t get any returns (or losses for that matter).

Now, here comes the juiciest part.

The big money question gets a super saver answer.

“What if I’ve succumbed to loss aversion?”

What is my solution?

Methods for the wary

We’ve seen the figures, heard the phrases – and really, we all want to make the best of the situation.

But the whole reason most of us don’t take the plunge is because we are afraid of the risk and consequence.

So for those of us who are really afraid of taking the plunge, the ideal scenario is to reduce risk while preparing for consequences.

Reducing Risks (Dissecting the Margin of Safety – Singaporean Style)

Here’s a method that can be used to reduce the risks.

While Singapore’s property prices are relatively stable, we have seen some properties depreciate over the years (the Urban Resort comes to mind).

So how can we stomach these potential dips?

By always ensuring a relative margin of safety (MOS) – aka, doing good research.

And let’s face it, looking for Singaporean properties well below their valuation is almost a thing of the past. Houses are expensive, and almost all property owners have a good grasp of what their houses should be sold at.

Not to mention, the governmental measures already in place to mitigate sudden financial losses to property owners which, while most certainly would have led to fire sales in the past, is no longer the case today.

So what does my Singaporean-style MOS entail?

- Never take that initial sale price as the absolute figure you should be paying. Instead, look for other units in surrounding developments and spend some time with an expert looking at historical price points (in terms of development/region) before determining what you should/want to be forking out for this particular unit.

- Employing Ryan’s ‘Leveraging on Price Gaps’ method.

- Understanding the possible appreciation up/downtrends in the area

(ie. room for new surrounding developments, drop in leasehold property value etc.) and comparing it to the price that you are forking out for the unit – ie. is this a risk I want to buy into? - *Ability to make payments in the long-term.

Do we know where and when the fire sales will be? The truth is, we don’t.

But we should know what they are based on our individual Margins of Safety.

Instead of waiting and hoping for the right conditions (which is admittedly easier psychologically), actively work to create the right conditions. Better deals are found this way.

Summary (A few other tips & tricks)

I know the words can get a little chunky, so here’s a simplified/compiled summary of tips previously mentioned on tackling loss aversion, plus a few more:

- Think carefully about what your true long-term tolerance would be (ie. Will I be able to keep this job? Are there other financial responsibilities I have to undertake in the near future?).

- Analyse long-term market data – Don’t be disheartened by temporary speed bumps in the market’s consistent growth (always begin with an exit strategy in mind and avoid panic sales!).

- Take into account the Margin of Safety – how much are you willing to cough out at the start.

- *Be aware of your holding power* – Your ability to keep servicing your property loan and associated costs, especially in a market downturn.

- Increase your prowess of finding undervalued properties (read: not fire sales!).

- Get feedback – It’s good to seek the perspective of another whose beliefs/biases may be different, especially if he or she is a professional with experience in the industry.

Final Word (A look at our current situation)

Just like the ‘08 and ’09 Recession, and even the Dot.com crash before, things will not stay down in the dumps forever.

The negative impacts of this pandemic are undeniable, but it doesn’t mean that you shouldn’t continue or even begin investing in good assets.

At the end of the day, there will always be risk involved – learn to recognise the loss aversion bias that everyone has. Reluctancy to secure a property simply because of passivity just means the money won’t generate returns elsewhere.

As William Arthur Ward said, “Opportunities are like sunrises. If you wait too long, you will miss them.”

And perhaps more importantly, Ward also mentioned, “Before you invest, investigate”.

Cover photo source.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is loss aversion bias and how does it affect investment decisions during downturns?

Why do people often fail to act during economic downturns despite knowing it's a good time to buy?

How can investors reduce the risks associated with buying property during a downturn?

What does the Sunglade case study illustrate about investing during a recession?

What strategies are recommended for overcoming the fear of losses when investing?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

2 Comments

Excellent piece Reuben. I was looking to buy during the 2008 crisis being several years into my career and looking to start a family soon. I was lucky enough to be able to consider buying a condo then, but the crisis hit my workplace quite badly. While I managed to retain my job there, there was just too much uncertainty to make a purchase. While the crisis unfolded, it was hard to see the bottom – like it is now with Covid-19. Back then before Lehman Brothers collapsed, news after news just kept coming out like never before. My wife and I decided against buying then. Once the crisis ended however, property prices kept going up. We got caught in this wave (thankfully early in 2010) where prices still weren’t as high as they went in 2013. But in terms of investment opportunities, it’s hard to see prices apprecaite that much as it then – namely with the regulations in place. Now with the LTV of 75% and ABSD, it’s hard to imagine this happening again – housing affordability would be out of the question, and that’s political suicide. Would the government start to ease the regulations? I highly doubt so. Many Singaporeans who can hold onto a job would use the deregulation as an opportunity to purchase a condo with the idea that prices here can never go down long-term, and with cheap loans flooding the market now, it’d be crazy for the government to even hint of any cooling measure lift.