Live In Johor Bahru But Work In Singapore? How The RTS Link Is Reviving Interest In Cheap JB Properties

November 30, 2023

Do you remember the hype about the Iskandar region, or the Malaysia My Second Home (MM22H) programme?

Or perhaps you recall the High Speed Rail (HSR) project, which has been on-and-off for years now.

Well with the Johor Bahru – Singapore Rapid Transit System (RTS) set to be finished in 2027, interest in properties across the causeway is coming back. But as you’ve probably heard, the most common in-joke among investors is the saying “This time it’s different.”

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

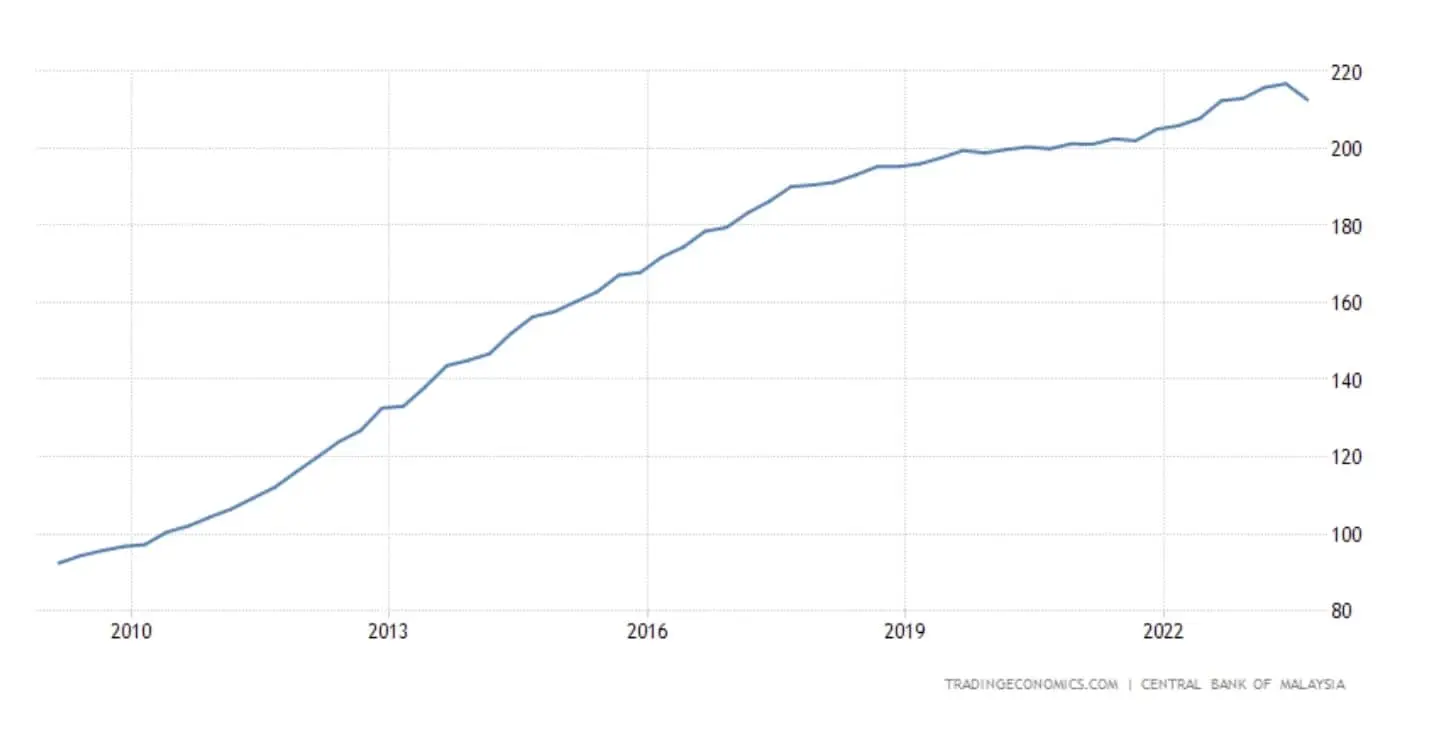

How has Malaysia’s residential property market performed?

Over the past decade, Malaysia’s property prices have been on a steady uptrend. It may come as a surprise to some Singaporeans given the negative impression shown in some online forums.

The growth in prices actually slowed from around 2017, but it promptly picked up from 2022. This was then met with a 5.7 per cent decline in Q1 of 2023.

More Singaporeans are buying properties in Johor Bahru

The Star notes that JB property sales rose by 17 per cent, between Q1 2022 and 2023. The reports indicate that buyers include Singaporeans, as well as Malaysians who are currently working in Singapore.

One of the reasons cited, on the Malaysian side, is the reactivation of the MM2H programme. This is an initiative by the Malaysian government to encourage foreign purchases of residential property. Back in 2019, Malaysia actually suspended the programme, and it was in limbo due to a “political turf war.”

Subsequently, the programme was reactivated in 2021. However, the programme’s eligibility requirements were so tight that the overall response was weak (and it didn’t help that the pandemic came soon after.)

We won’t go into the extensive requirements and the ups-and-downs; but suffice it to say that, as of 2023, a revised MM2H programme promises to make it easier for foreigners to buy Malaysian homes (you can check out the entire saga and past restrictions here.)

One of the key factors of the revised MM2H programme is that, when it comes to financing, banks can have a loan-to-value (LTV) ratio of 80 per cent (without the programme this would be 70 per cent.)

There are still changes to come, so we’ll wait for a more comprehensive view.

There is a double-whammy of lower MM2H restrictions, and Singapore’s ABSD rates being raised

The revisions to MM2H coincide with Singapore’s latest round of cooling measures, in April 2023. As of the latest revision, Singapore citizens now pay 20 per cent ABSD on the second property, and 30 per cent on the third or subsequent property.

This will likely dissuade investors from purchasing more local properties, with the exception of upgraders (who ultimately keep to one property and don’t pay ABSD, or can claim ABSD remission), and those who are wealthy enough to pursue “sell one, buy two” strategies.

It will likely be Singapore’s cooling measures, coupled with MM2H revisions, that compel buyers to look across the causeway.

Rising rental rates in Singapore may also have played a part

Besides easing the MM2H programme, rental rates were also cited as a factor. In the immediate aftermath of the pandemic, Singapore’s rental prices saw their biggest surge since 2007. This was making it increasingly untenable to rent and work in Singapore, and it was plausible that some might choose to rent across the causeway instead.

As of end-2023, however, we think this issue is less of a factor. As more condos (particularly large ones like Normanton Park and Treasure at Tampines) see completion, rates are likely to stabilise. As of now, analysts are predicting the rental market will lose its momentum, or even see a dip, as we go into 2024.

The completion of the RTS, as well as currency exchange rates, maybe a bigger factor

Investors are looking to the RTS, as well as potential LRT lines (on the JB side) that connect to it, to make property picks. When we spoke to some buyers, a few JB project names came up here:

- TriTower Residence – This is supposedly one of the closest projects to the RTS link, being within walking distance of the planned Bukit Chagar RTS station. The project is also only around five years old, and is an upscale serviced apartment.

- Skysuites @ Meldrum Hills – This project is nicely positioned between the RTS link and the city centre; it’s only around a five-minute drive to JB City Square.

- Setia Sky 88 – This is a luxury project in the central area of JB, and is also within range of the upcoming RTS. Being in the urbanised city centre, this is likely to be more of a rental asset.

- SKS Pavillion Residences – This project is within walking distance of both the RTS station, as well as the Customs, Immigration, & Quarantine (CIQ) complex in JB.

(We’re not experts on the property scene in JB, so we don’t have reviews or exhaustive lists; but if you’re an investor with some property picks, do let us know in the comments)

More from Stacked

One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

The 4Q2025 real estate statistics were published by the Urban Redevelopment Authority (URA) on Jan 23.

When we spoke to realtors and investors though, there was a certain wariness about the RTS. Many recall the HSR project, which seems to be taking an eternity to come to fruition. One investor, who has owned property in JB since 2012, said: “If it happens then good, but best to assume the worst. I look for a good catchment area for tenants, and for the right price point – I don’t really think about the RTS or HSR.”

Another buyer felt that, with or without the RTS, she had an incentive to buy in JB because “It’s not very hard to go from Singapore to JB correct? There are how many hundreds of Malaysians who commute daily? Very common. Even if there’s no RTS, there’s still a market. But of course, being near the RTS is a bit better.”

Besides this, most concurred that exchange rates are also making JB properties more attractive (just like how the low Japanese Yen has attracted lots of Singapore investment in Japanese properties). The Sing dollar has been at record highs against the Malaysian ringgit of late. Consider that the aforementioned TriTower has seen prices of around RM500,000 to RM$1.68 million. At the time of writing (November 2023) this is between $143,169 to $480,048.

A better fallback compared to buying in further away countries

One realtor said that buying in JB wasn’t just safer due to the lower prices. Rather, there is a fallback available, unlike buying in Australia, the UK, or farther away:

“Even if you buy in JB and there are vacancies, rental rates are low, whatever, you can contain your losses. You can choose to live in JB while renting out your Singapore property. Probably, you will more than cover the repayments on the Malaysian property. To me, this is the main advantage of buying in JB, rather than buying further away.”

Another couple, who own both commercial and residential properties in JB, noted that it’s “easier to check” on their properties, as it’s just a drive across the causeway. This was one of the main reasons they bought in JB, as opposed to other countries.

While we do see the allure of JB properties, we’d be wary of an oversupply situation

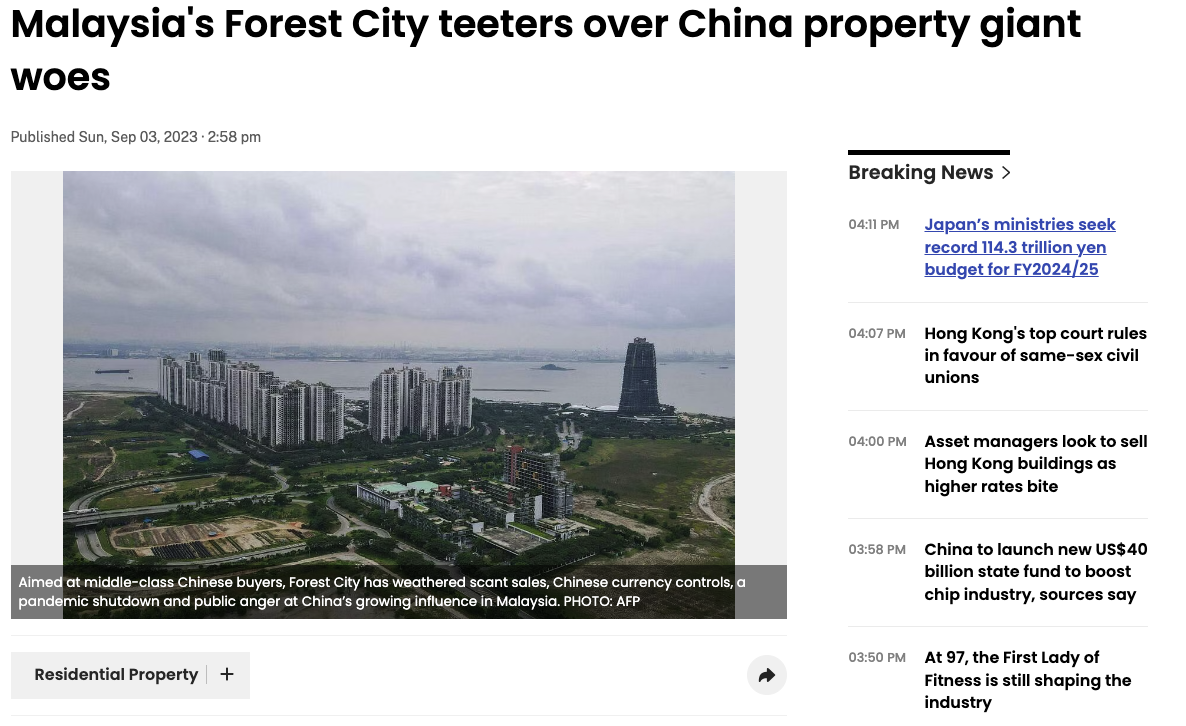

Homeowner StoriesHow We Sold Our Forest City Unit Before The Worst Happened: Here’s What It Was Like To Stay In A $100 Billion Ghost Town

by Ryan J. OngBack when Iskandar was the hot topic, one of the problems we witnessed was oversupply. Developers rushed to build in the area, and supply easily outstripped demand. There are still plenty of vacant homes waiting for tenants and residents in the area today, which makes it hard to see significant appreciation.

Assuming this doesn’t happen, however, it’s likely that some local property investors – tired of rising ABSD rates and new launch prices – may decide it’s time to venture abroad. And for many of them, JB represents a familiar and affordable alternative.

But let’s also not forget one of the biggest financial variables in foreign property investment: interest rate risks. As attractive as Malaysian properties may be, particularly in Johor Bahru, Singaporean investors need to be acutely aware of the potential fluctuations in interest rates. These can significantly impact the overall cost of an investment. Given the dynamic nature of global and local economies, interest rates are subject to change, influenced by factors such as the Malaysian Central Bank’s monetary policy and international market conditions.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more Singaporeans interested in buying property in Johor Bahru now?

How does the RTS link influence property prices in Johor Bahru?

What are some popular property projects near the Johor Bahru RTS station?

How do currency exchange rates affect Singaporeans buying JB properties?

What are the risks of investing in Johor Bahru property for Singaporeans?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments