Why Are Landed Home Sales Hitting New Highs Despite Covid-19?

October 20, 2020

If you’re like most people, you might guess the most expensive property segment – landed property – will fare worst in the downturn. After all, who would buy a bungalow or Semi-D in Singapore’s worst economic situation to date, right?

The answer, apparently, is “way more people than we’d imagine”.

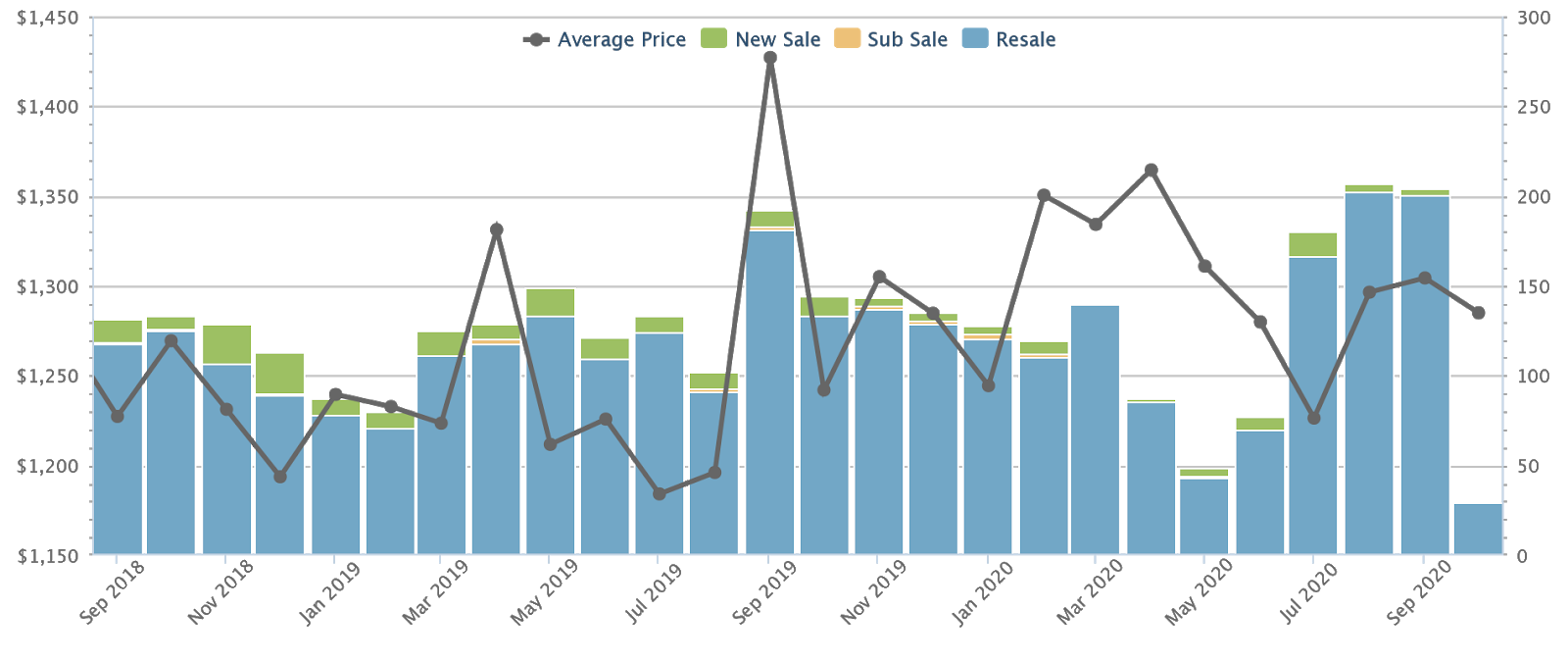

In fact, landed home sales are at an all time high as of Q3 2020. There were 544 landed home transactions this quarter, according to a report from OrangeTee & Tie. We checked on Square Foot Research to see if the data corresponds – while it’s not an exact match, the two are quite close:

Square Foot Research shows 591 landed home transactions for Q3 (counting both new and resale): that’s 180 units in July, 202 units in August, and 200 in September. This is a sharp rebound from Q2, where total transactions numbered 212. This is an increase of 179 per cent.

In terms of price, landed homes across Singapore averaged $1,280 psf at the end of June 2020. As of end-September 2020, they averaged $1,304 psf, up around 1.87 per cent.

This is down around 8.6 per cent from the last peak, in September 2019; but it’s a notable recovery from the Circuit Breaker period.

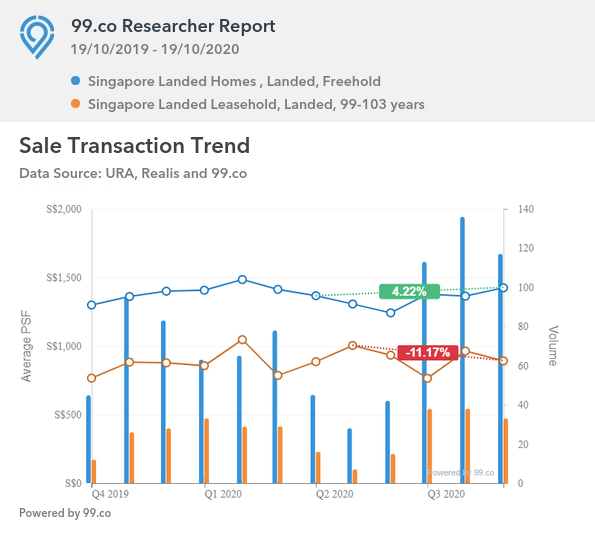

However, some analysts we spoke to pointed out a disparity between freehold and leasehold landed gains.

Naturally, we checked the price movement along those lines.

The difference is significant – freehold landed properties from $1,367 to $1,424 psf since Q2, up around 4.2 per cent. Conversely, leasehold landed property values have fallen in the same period – they are down around 11.1 per cent, from $1,004 to $892 psf.

As such, we can see leasehold landed has not benefited proportionally from the current demand surge, and is in fact doing worse. We’ll explain the possible reasons below.

Why are landed home transactions and prices rising?

- Past performance of landed properties during downturns

- Continued faith in scarcity value

- A response to a low interest rate environment

- Pent-up demand from the Circuit Breaker period

1. Past performance of landed properties during downturns

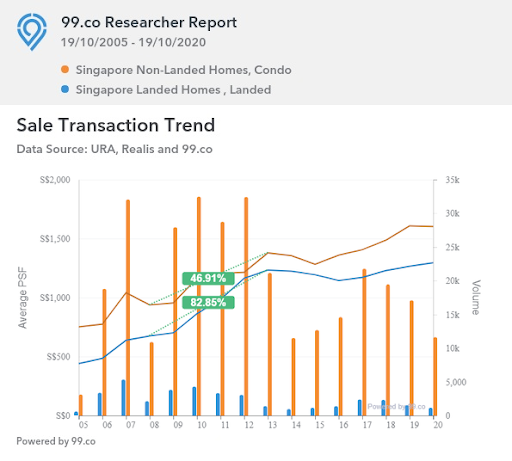

The most significant recent recession, before Covid-19, would be the Global Financial Crisis. For investors, the performance of landed homes during that time might still be fresh in the memory:

Between the troubled period 2008/9 to 2013, property prices began to peak as investors rushed into the safe haven of Singapore real estate.

Between 2008 to 2013, non-landed private homes managed a percentage gain of almost 47 per cent, from around $938 psf at the time of the crisis, to $1,378 psf by 2013.

In the same time however, landed properties appreciated by 82.8 per cent, soaring from $675 psf to $1,233 psf.

The property market as a whole proved that it could thrive during a downturn, and landed property was the best performer of the lot. As such, it’s not surprising that investors – or even some affluent home buyers – have chosen landed homes as a safe place to park their assets.

2. Continued faith in scarcity value

The main draw of landed properties is their scarcity. As you should know by now, demand and supply plays an important role in real estate prices. There are only 39 residential areas in the whole of Singapore designated as Good Class Bungalow Areas (GCBA), for instance – and as of Q1 2019, URA noted there were only 73,105 landed private homes in Singapore.

For readers who are unaware, the Singapore government does not give out any more freehold or 999-year leases. This is under Rule 10 of the State Lands Rules of the State Lands Act (Cap. 314, Section 3), which says:

“The title ordinarily to be issued shall be a lease for a term not exceeding 99 years, except that where the land is not capable of independent development…”

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

If you owned a two-bedder condo unit, would you move back into an older (35+ years) 4-room flat, while your…

This makes landed freehold property scarce, and in almost perpetual demand. In particular, the limited supply of freehold landed means it tends to climb faster than non-landed homes, whenever we see an upswing in property values.

So there is solid reasoning behind the landed property surge in Q3: buyers are hunting for protected freehold homes to park their cash in, and they aren’t just buying any landed homes on a spree (or else leasehold prices wouldn’t show such a great disparity).

3. A response to a low interest rate environment

Interest rates are being kept at near-zero by the United States Federal Reserve. This is likely to last till 2022, to stimulate US markets in a downturn – again, a similar situation to what we saw in the last Global Financial Crisis.

The interest rate cut has two effects that helps the landed housing segment:

First, the lower interest rates mean they get to buy for cheap; rates at present are around 1.3 per cent per annum; half of what you’d pay for an HDB loan (if you don’t have such a low rate, message us on Facebook and we may be able to remedy it).

If the bank will lend enough to buy a freehold landed home, at a low interest rate of 1.3 per cent per annum, it’s unsurprising that many will bite. As we’ve seen above, the appreciation of the landed property alone effectively pays for the interest, and these buyers are “borrowing for free”.

Second, low interest rates also mean lower bond yields, with US Treasury Yields slipping below one per cent for the first time. Given the unattractive returns of such products, plus the volatility of the stock market during Covid-19, some buyers will be more inclined toward property.

4. Pent-up demand from the Circuit Breaker period

This one doesn’t take much explanation: the huge percentage increase in volume is because we’re coming from a low base. Q2 2020 made it almost impossible for agents to sell landed homes, as there were no viewings allowed.

It’s also possible that buyers at the time were still in a wait-and-see mode; they could have been waiting for the possibility of discounts, such as if the market would be hit by desperate sellers who needed to liquidate.

By this point, it’s become apparent that sellers haven’t flinched. Not only has MAS provided support through deferred mortgages, Singaporeans owners have significant holding power thanks to enforced prudence (e.g. loan curbs such as the Total Debt Servicing Ratio).

Please don’t take this as a suggestion to run out and buy the first landed home you can afford

Not all landed properties – even freehold ones – are guaranteed winners. Landed homes lock up a larger portion of your capital, and can be very expensive to maintain if you pick the wrong one.

Also, given that Covid-19 will lower the number of expatriate workers on our shores, landed properties are tough to rent; it’s a rare Singaporean who rents a bungalow or terrace house.

Follow us on Stacked or drop us a message if you have any questions about buying a landed property.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are landed home sales increasing during the Covid-19 pandemic?

How have landed property prices changed during the Covid-19 period?

What is the difference between freehold and leasehold landed properties in Singapore?

Did past economic downturns influence the popularity of landed homes?

What role does scarcity play in the demand for landed properties?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

2 Comments

Are we extrapolating/concluding too much from just one data point? We know that Q2 landed sales would be depressed due to COVID so naturally Q3 would be significantly better. In fact, if you average out Q2 and Q3 (212+514=726/2=363), that works out to lower sales than the preceding 4 quarters (Q2’19 to Q1’20).