I’ve Been Renting Since I Was 20 In Singapore, Here’s Why I Don’t Regret It

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.

Those who knew me growing up wouldn’t be surprised that I moved out of my parents at the not-even-legal age of 20. There’s no major family drama or anything like that, but it is known that I prefer my independence and like being left alone (for the most part).

In an already high cost-of-living situation, many young Singaporeans would see rent as an additional unnecessary expense. “It’s a waste of money.”, echoes the thoughts of many, as they stay sheltered in their childhood homes.

Now, there is nothing wrong with living with your parents until you’re ready to leave the nest. I am rather envious of the majority who get to do that.

But in a way, I am also quite thankful that I decided to move out and stuck to my decision. Ultimately, it did wonders for my finances, even though it did seem counterintuitive since it looked like I was spending more money at first.

Renting taught me the reality of personal finance

The reality of whether something is a waste of money or not is down to perspective and adaptive cost optimisation. The truth is that we all have a limited budget to spend every month, this doesn’t change whether you have rent or not. You simply only have X amount to spend.

I had S$550 to pay monthly due to rent, but since I see it as an essential spend, it is just something I had to factor into my monthly budget. It’s all perspective and re-framing your expenses.

Now I understand that S$550 is an impossible rental to find in the current rental market in Singapore, and for transparency’s sake, this was back in 2018, pre-pandemic. So it was a very different economy.

I was spending around S$1,000 every month on food and transport when living with my parents, including the allowance I had to hand over to them (rent essentially). This S$1,000 is all-inclusive.

Because my parents lived so far from my workplace, I had to eat most of my meals outside and spend 2 hours travelling daily. And no, I could not use their kitchen to prepare bento meals for myself.

So when I moved out and stopped giving them their parent landlord allowance, I actually ended up saving some money because I was able to cover rent, food and transport under S$850 every month.

Renting also made me hyper-aware of where my money was going and kickstarted the refinement of my financial habits. I was cost-optimising my meals and because I rented a place near the centre of Singapore, I saved a lot of money on transport as well.

Essentially, my food and transport costs went down to S$300 monthly. Add rent on top of that and we have a S$850 expense.

Renting saved me a lot of time

I cut down my daily travel from 2 hours both ways to only 30 minutes a day. You know what they say, time is the most priceless currency. I can totally understand why many Malaysians choose to pay a premium to rent a place in Singapore instead of making the daily causeway commute if they can afford it.

With nearly 10 hours of my life saved every week, I had more time for self-development and side projects. I started a side hustle, and even fulfilled my childhood dream of picking up the violin with the time I saved and the extra cash I earned. I also found the time to start home workouts in my rental room.

The extra time I got from renting really pushed me to become a much better version of myself.

I grew a backbone after renting

Because I had to pay rent, I was a lot more proactive when it came to getting recognition at work. Not to blow my own horn, but I’ve always been a rather hard worker, however having more bills to pay means I am a lot less susceptible to toxic work environments and bad salaries.

I didn’t have a safety cushion and I can only rely on myself in order to survive. So when companies I work for throw me any sort of shade or show signs of trouble, I don’t tolerate it. I used to be quite easy to bully at work, but after renting? No longer.

More from Stacked

5 Biggest En Bloc deals in Singapore

En bloc seems to be coming back in fashion in Singapore, with the latest news of three collective deals that were…

I was also a lot more aggressive when it came to salary negotiation. Obviously, it’s not justified for Human Resources to just give you more salary just because you have rent to pay, but my unique situation on top of good performance made it easier to pull their heartstrings.

All the time I saved myself and put into self-development bore its fruit during salary negotiation. And the desperation of survival gave me the backbone and confidence I needed to drive these difficult conversations. There was no more paiseh, there was only paikuan.

Renting taught me about property and feng shui

Might be hokum for some, but I am a big believer that one should be comfortable in the space you live in. Viewing rooms of multiple HDBs and condos taught me that it’s not about how luxurious the place is, it’s whether you feel at home in it.

And this is where feng shui comes in, because it’s the only viable explanation I have for how some people started thriving after living in specific spaces. I looked into my ‘lucky’ directions and was basically doing room viewings with a mobile compass and digital ba-gua in hand.

I’m not sure if these are biases, but the properties that were in my ‘lucky’ direction and checked the feng shui list always made better first impressions than properties that weren’t. So this just became my north star when looking for new places to rent.

After viewing rooms all over Singapore and checking out multiple neighbourhoods, I can quite confidently say which neighbourhood and what kind of rooms I love to be in. So renting really helped reaffirm my love of my favourite neighbourhood in Singapore, and it’s easy to know where I want to buy a flat if that time ever comes.

Renting in Singapore prepared me for my life overseas, and renewed my respect for immigrants back home

While probably only applicable to myself and a few overseas Singaporeans, renting a place in Singapore has taught me the basic skills required before I ventured out to a world where life wasn’t going to be as easy.

One of the biggest culture shocks for most Singaporeans living overseas for the first time is the fact that you need to pay rent. That alone usually turns us away from overseas opportunities because it’s honestly a lot of money on top of higher taxes.

But since I was paying rent in Singapore, it wasn’t too much of a shock for me.

I’ve always known that being an immigrant is not a walk in the park; being away from home and family, having to deal with legal paperwork and admin in a new country, setting up finances and emergency funds so you don’t miss out on rent payment; I was glad I learned those life skills back home before I flew to Europe.

It’s not that I’m too stupid to learn these on the fly, but I am willing to bet Singaporeans who have never even rented in Singapore wouldn’t do so hot finding a place to rent by themselves outside of our home country. Truthfully it’s a lot to deal with, and very overwhelming for first-timers.

Kudos to all my immigrant friends back home, you guys are champs. For the Singaporeans renting outside Singapore, haha good luck and I feel you.

—

I currently live in Europe, and I’m still in a rental apartment. I’m in the process of buying an apartment, but I will continue renting after owning it.

Now, I’m not trying to start a rental movement with this article. But I do hope my story encourages some of you who are seriously thinking of it to take the leap and try. While uncommon, there are actually quite a few Singaporean youths who moved out for their own reasons and started thriving after they did so. We don’t regret doing it one bit, even if some of us moved back home after.

If I were to turn back the clock, I would repeat the exact same thing. Sometimes, you just gotta do what you gotta do.

If renting makes sense for you, you should definitely just try it.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Melody

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Read next from Editor's Pick

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Property Market Commentary The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

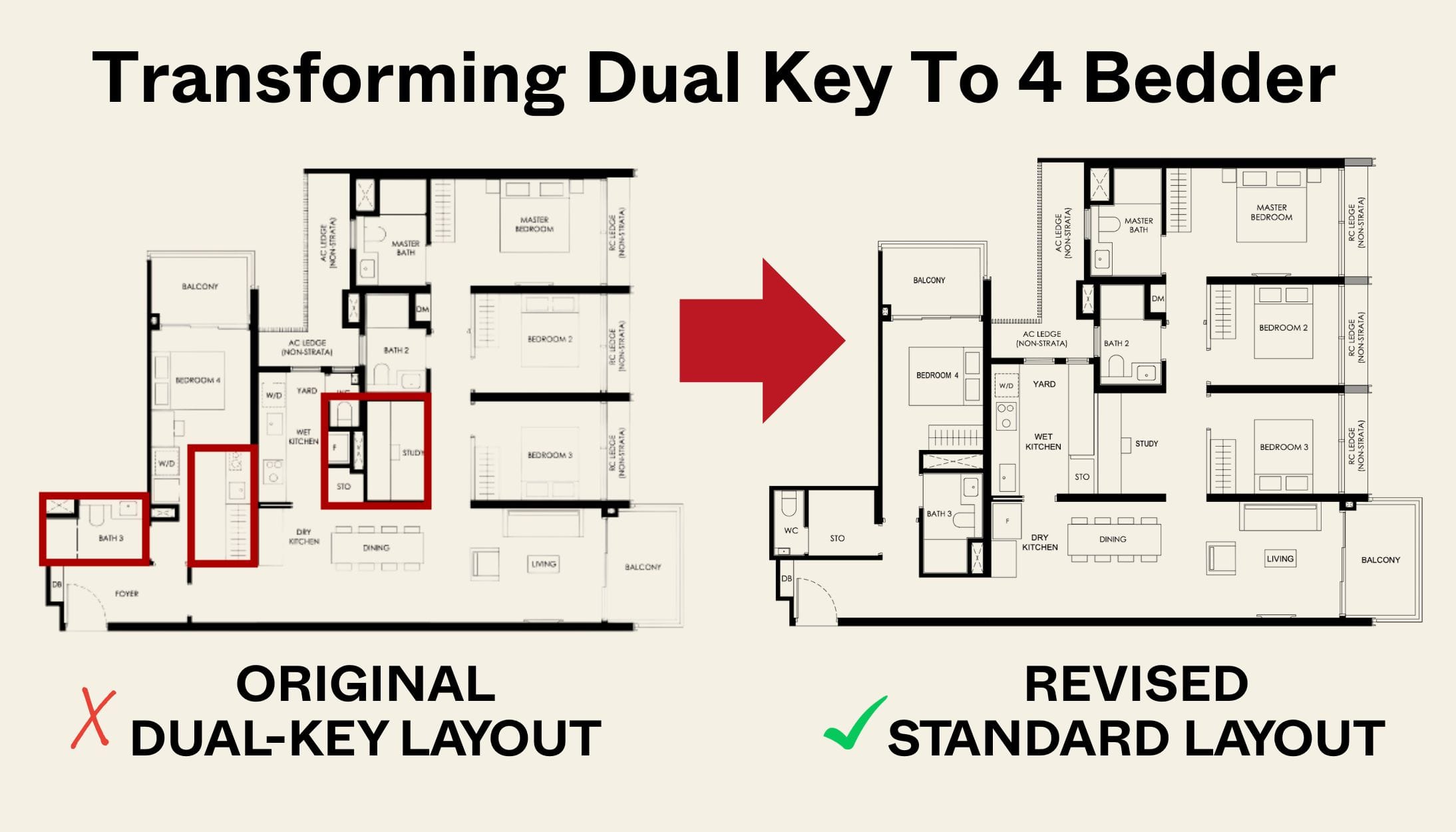

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000