Question 1

Hi Stacked,

My agent is proactively promoting 77 @ East Coast. Could I have some unbiased views on this property? Looking at the 1+1 or 2 bedders.

My agent cited a good location (was looking for East side!), high rentability and high(er) rental yield compared to Telok Kurau or Joo Chiat. And one of the few new launches in the area where it would be within my 1.2mil budget.

Had my reservations due to the lack of facilities and layout, as you mentioned actually

But my agent was pretty sure it would be easy to rent out.

Hi there,

Thanks for your question.

Firstly, it will be good to understand the reason why the agent is promoting this so actively – what were the selling points of this property that your agent highlighted to you? Sometimes the property is recommended due to constraints, such as locational needs or budget issues.

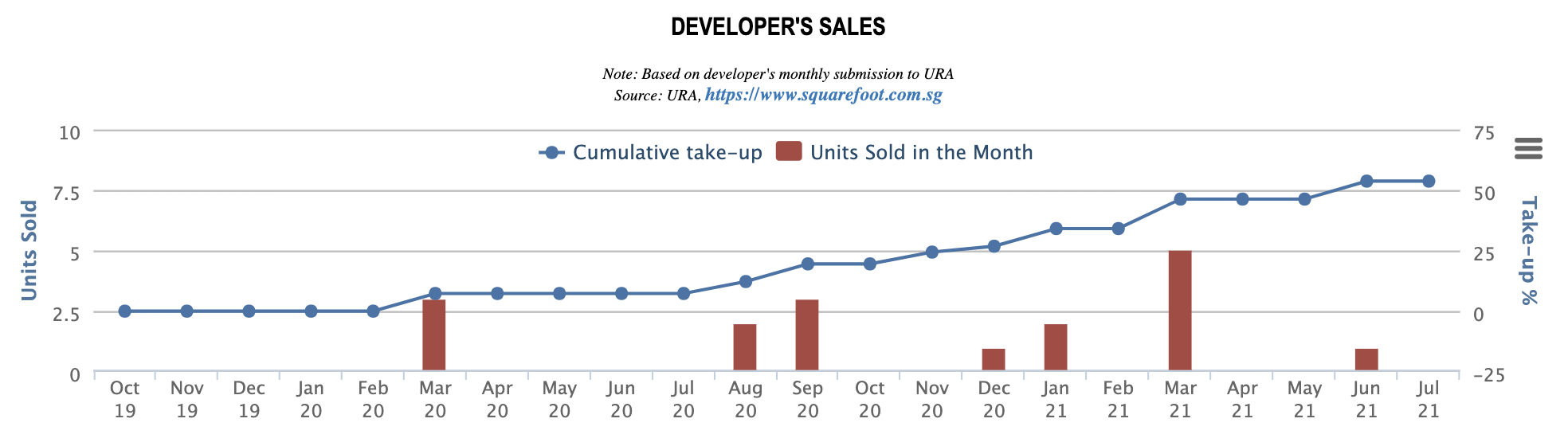

And, well to be fair, easy rentability does not equate to easy exit, especially for a boutique development. There has been a slow take-up so far even with only 41 units.

Let’s put ourselves in a tenant perspective, would you:

1) pay a high price for an apartment unit with no facilities

or

2) pay a slight premium for a condo nearby with full facilities (seaside as an example). When it comes to exiting, as there is a lack of transaction especially for small development, banks will find it hard to value the unit and chances are the valuations will come in close to whatever data that is last available, which may be data from years back. Hence that is what we are seeing for small developments in the Telok Kurau Lorongs. Prices haven’t moved much, even with those developments with a small pool and gym. With a development that has no facilities, honestly, would be hesitant here.

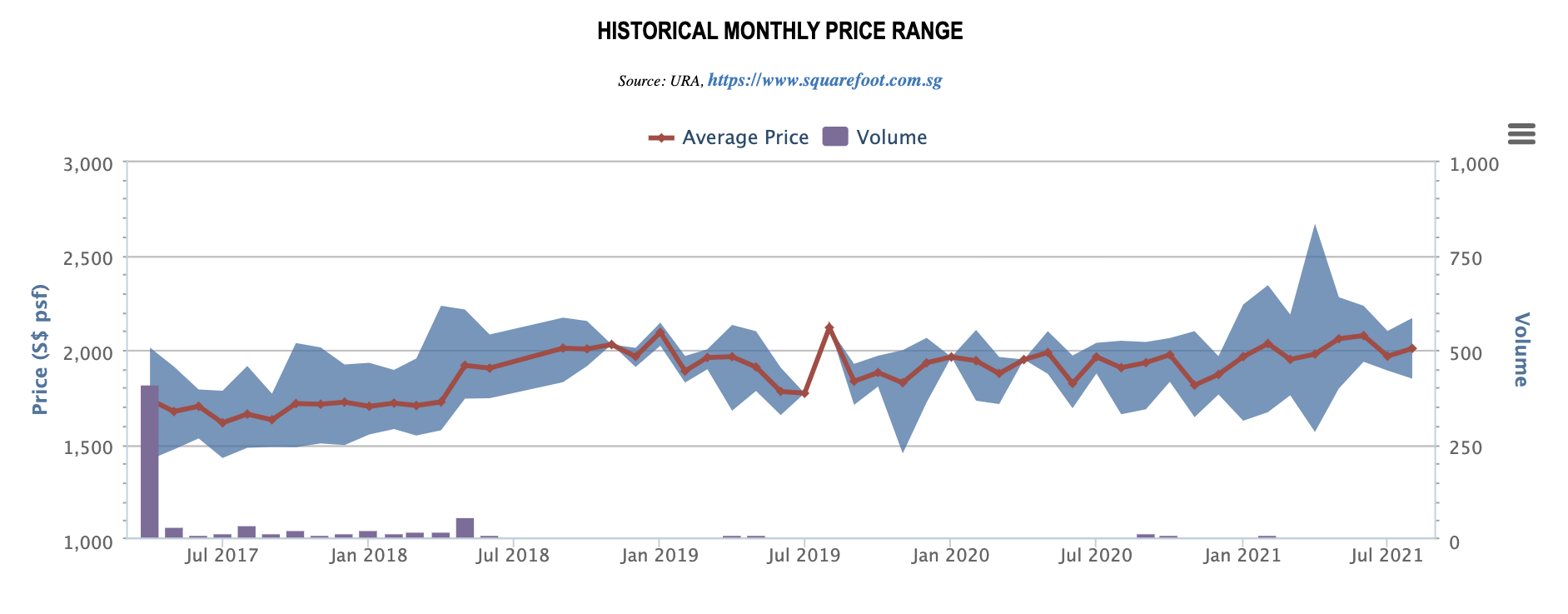

To be fair, your agent is doing their part to share in great rental yield and rentability but if you are looking for capital appreciation, freehold boutique developments may take years to see some upside as compared to a 99LH full-fledged condo. We can see from the healthy resale transactions from nearby Seaside Residences.

Prices have appreciated well within a short term as compared to small boutique development with lots of small unit mix like Suites @ East Coast & Vibes @ East Coast.

One of the reasons Tanah Merah resale may see an uptick in price is due to the upcoming mixed development GLS where we foresee it may be priced at a premium taking reference from the recent Pasir Ris 8 launch at $16xx psf on average. Thus this will bring some limelight to the resales nearby. Rentability-wise, being close to the MRT station, there’s always demand for it. So far, Grandeur Park Residences, the newest development in the area is seeing a great rental yield of 3.2 & 3.4% for the 2b1b and 2b2b unit sizes respectively. It is newly TOP and rental tested too. With regards to the sizes, 500 – 600sqft being the 2b1b unit type and 600 – 700sqft being the 2b2b unit type. Quantum-wise, within $1.2m. 🙂

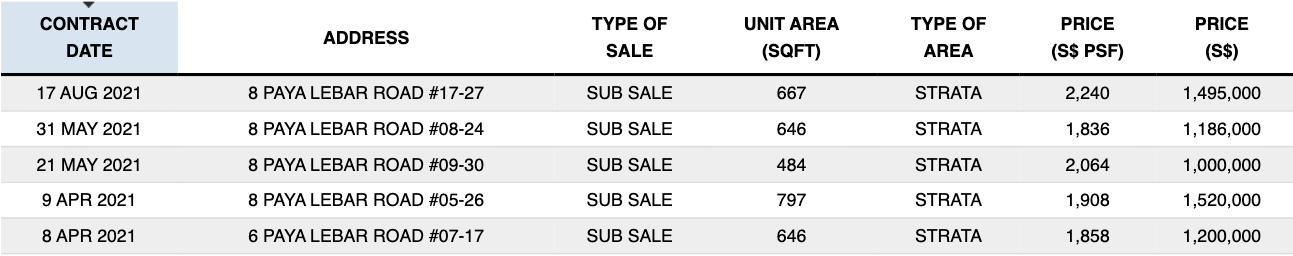

Another development that ticks lots of boxes on the amenities, transport node, and great rental yields would be Park Place residences at Paya Lebar. Being a mixed development with connectivity to malls, dual MRT line, grade A offices, we do foresee upside on this one. Two units of 2b1b (646 sqft) have transacted for $1.186m and $1.2m this year with a rental yield of 3.3%.

Question 2

Hi Stacked Homes!

May I have your opinion of The Antares @ Mattar, specifically on the 3BR Dual Key type? For own stay and investment. It is located near MRT and amenities, but why is the take-up rate not high? Thank you.

Hey there,

Thank you for your question, It’s interesting that you asked about The Antares, we’ve recently gotten inquiries on that.

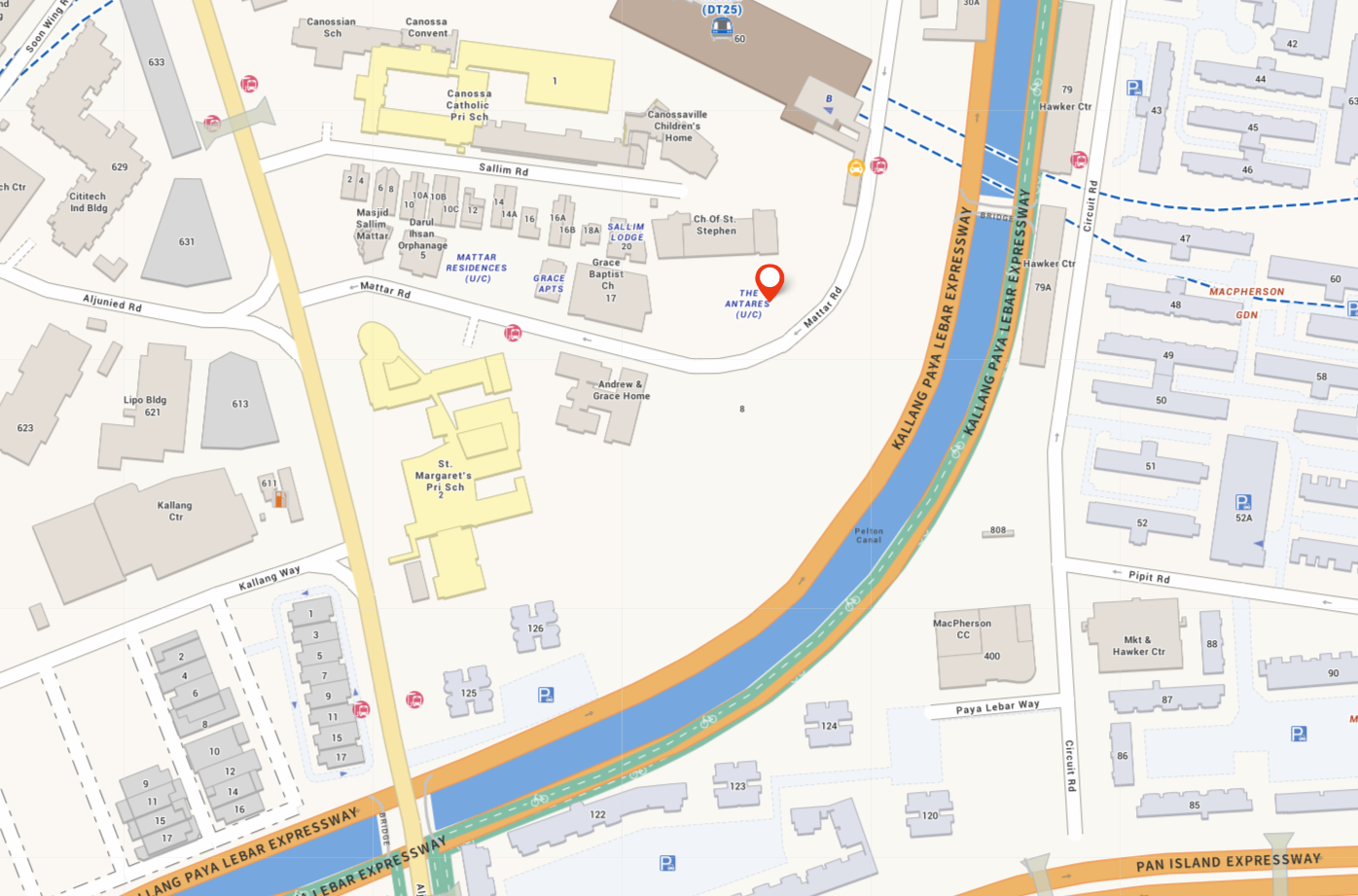

The Antares is a 99-year leasehold development located right next to Mattar MRT.

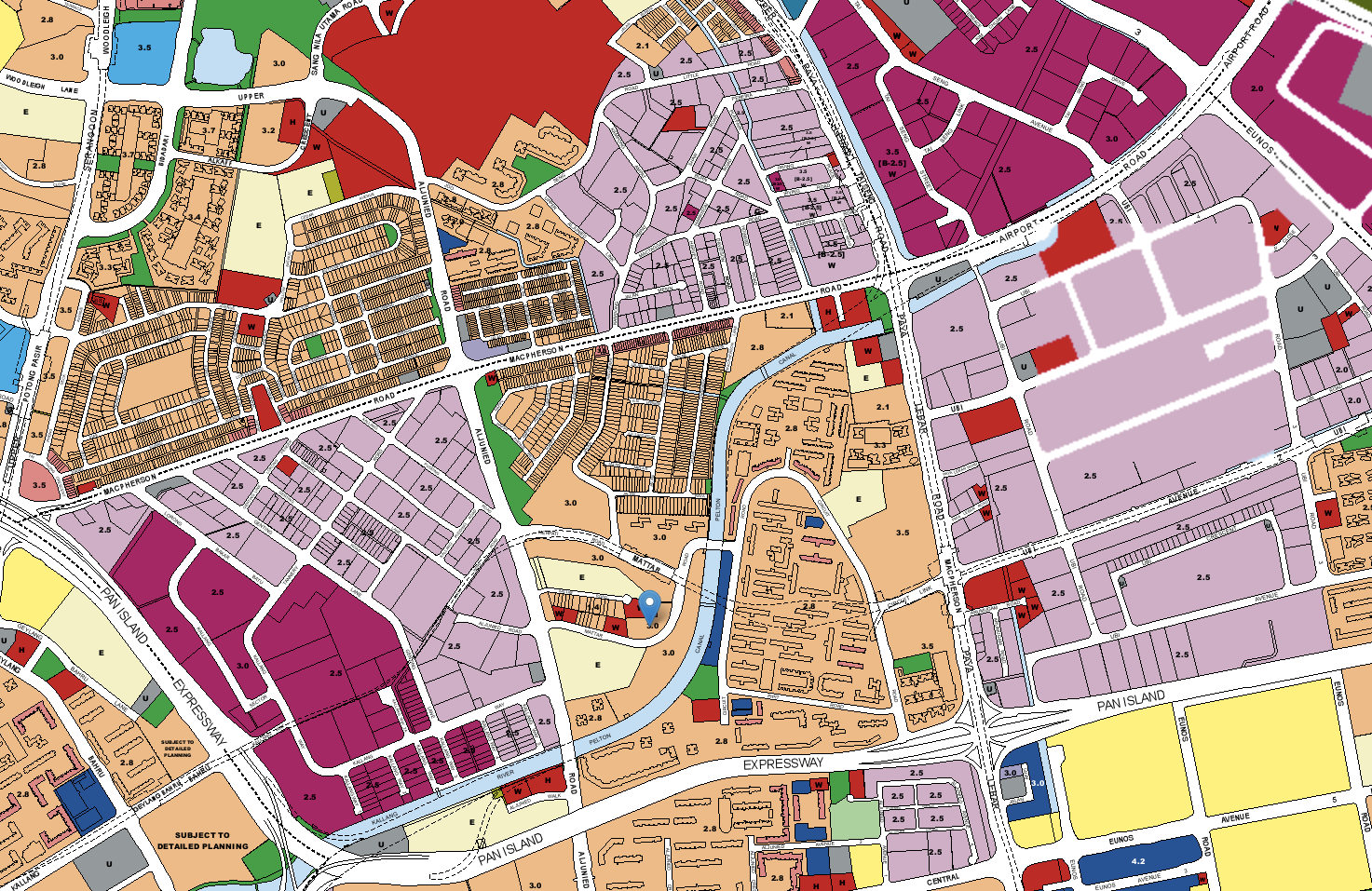

At first glance, the Master Plan reveals how undesirable the area actually is as it is surrounded by 3 large plots of mostly light industries.

That together with how the area immediately around The Antares is quite under-developed, is one good reason why despite the proximity to Mattar MRT, The Antares hasn’t been selling too well.

There is one upside to the under-development here – and that is the potential for capital growth.

There are quite a few sites here that are empty but zoned for residential. When new condos come up in the area, it could bring up the price of The Antares. These residential plots would also have to be supported by greater amenities, which may come up in the area.

We also note that the Park Connector (Central Urban Loop) runs along the Pelton Canal – similar to how the Park Connector runs through the Alexandra Canal to Queenstown.

So in some sense, we can draw a parallel to how Queenstown, while being one of the oldest estates in Singapore, was quite run-down, but underwent rejuvenation to become one of the most highly desirable places to live in.

However, a complete rejuvenation of the Mattar area may require the older HDB blocks across the Pelton Canal to undergo SERS too, similar to how the Dawson rejuvenation plan saw flats at Tanglin Halt undergo SERS.

Perhaps a rejuvenation of the Mattar area requires the same treatment – SERS of the old 50-year old HDB blocks in the area.

This brings us to the caveat here – this transformation of the Mattar area could mean a long-term play.

So overall, we do think that The Antares is a suitable buy if you are willing to wait for the long-term upside potential, but not so much if you’d like a family-friendly area to live in now.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Personally, do not like 77@eastcoast. I see 0 potential. When the agent was talking to me about it, i was thinking… why would i pay $400 mcst for a condo with 0 facilities? Also, all units has blocked view. Buy in is very high and I can foresee this condo having difficulties selling in the future. Also, the layouts for this condo is kinda strange though. Example, their duplex units (on the top floor) does not have actual windows on the above rooms.

But of course, to each its own. Some might like smaller developments.

on the bright side, it is close to Siglap MRT 🙂