Is PSF Still Relevant In The Singapore Property Market? Why Price Per Square Foot Could Be Misleading in 2024

November 24, 2024

Price Per Square Foot (PSF) is a time-honoured way of comparing prices in the property market; but along the way, it became far too intertwined with notions of value. It’s just an easy, intuitive way to think: if two properties are the same size, but one has a lower price psf, that must be “better value.” Easily done. But the property market in Singapore has changed a lot over the years, and today, this sort of assumption is often way off and causes price psf to become more misleading than helpful. Here’s why you might not want to read so much into it these days:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What makes the price PSF an increasingly poor indicator?

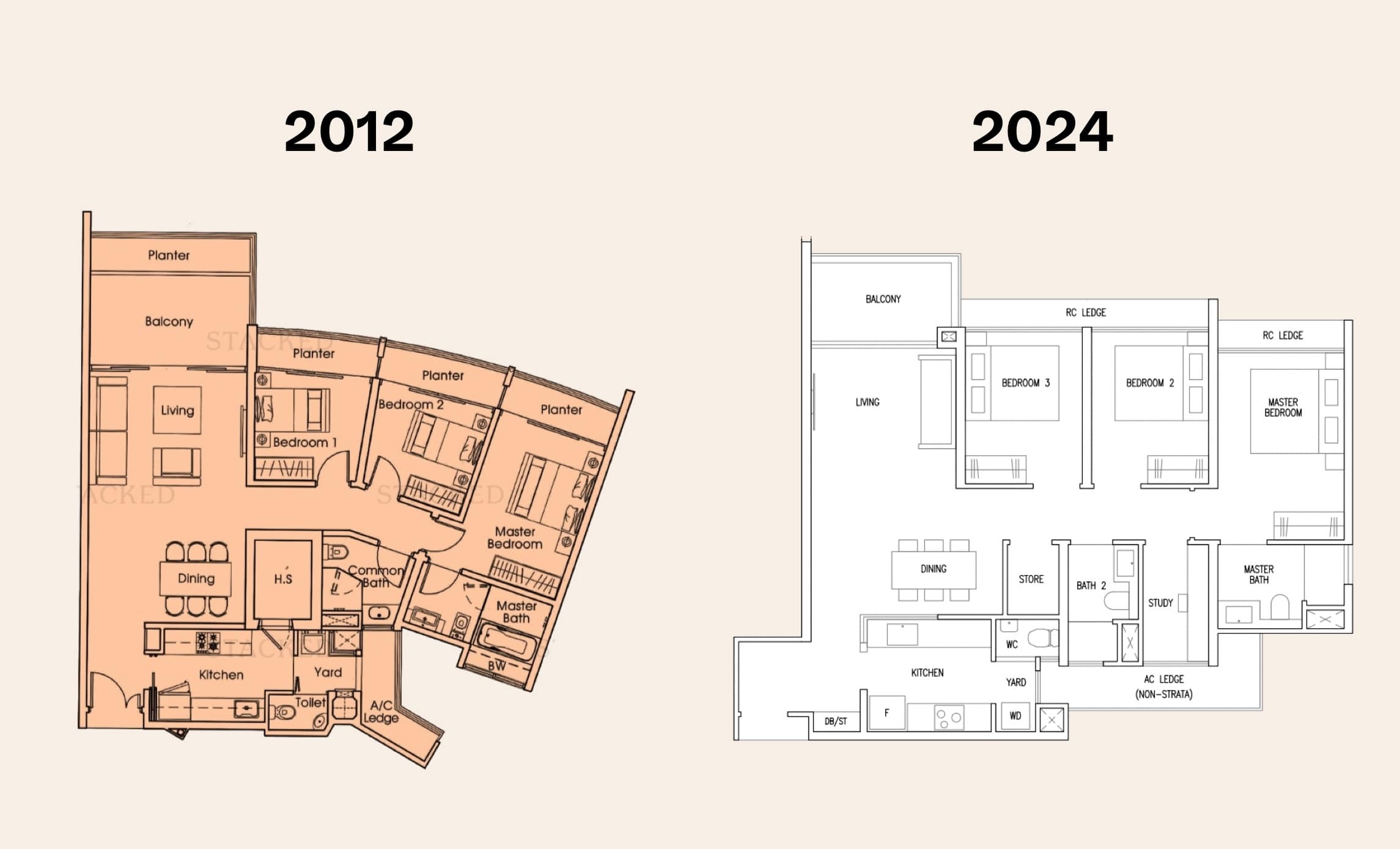

To understand why the price PSF isn’t very helpful today when it comes to comparing properties across time periods, you need to know more about how certain regulations have shaped the market.

One of which was the 2010s bay window/planter era, which you can read more about here. At that time, developers didn’t have to pay for air-con ledges/bay windows/planters, which they exploited liberally throughout the floor plan (but you, the homeowner had to pay for it).

This rule was eradicated later, and you can see the period after when floor plans started to get much more efficient.

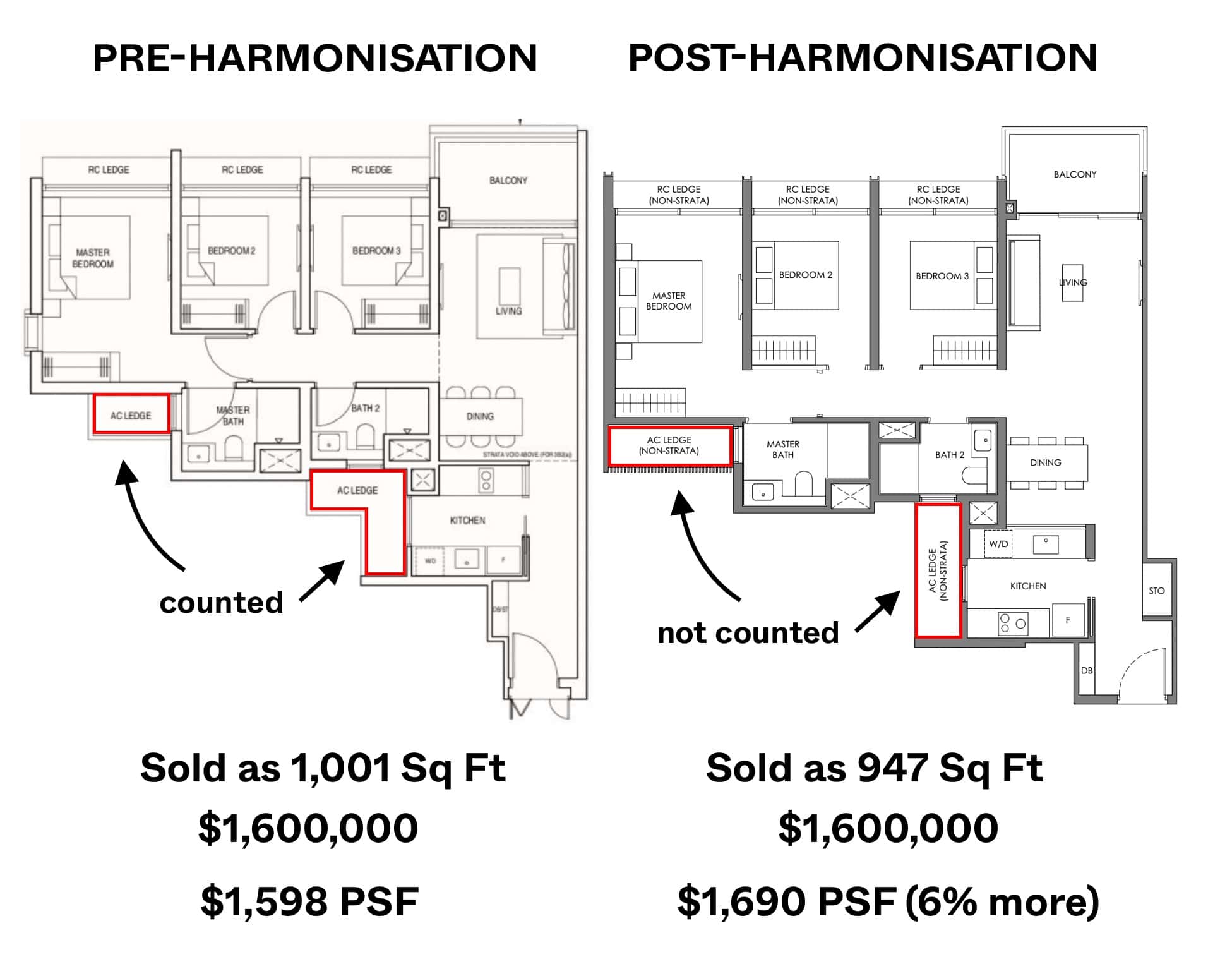

Recently, the GFA harmonisation rule was introduced, and that has led to the most efficient floor plan possible, as buyers now don’t pay for AC ledges or air space.

As such, even though the price per square foot may be higher, the eventual quantum may end up being the same.

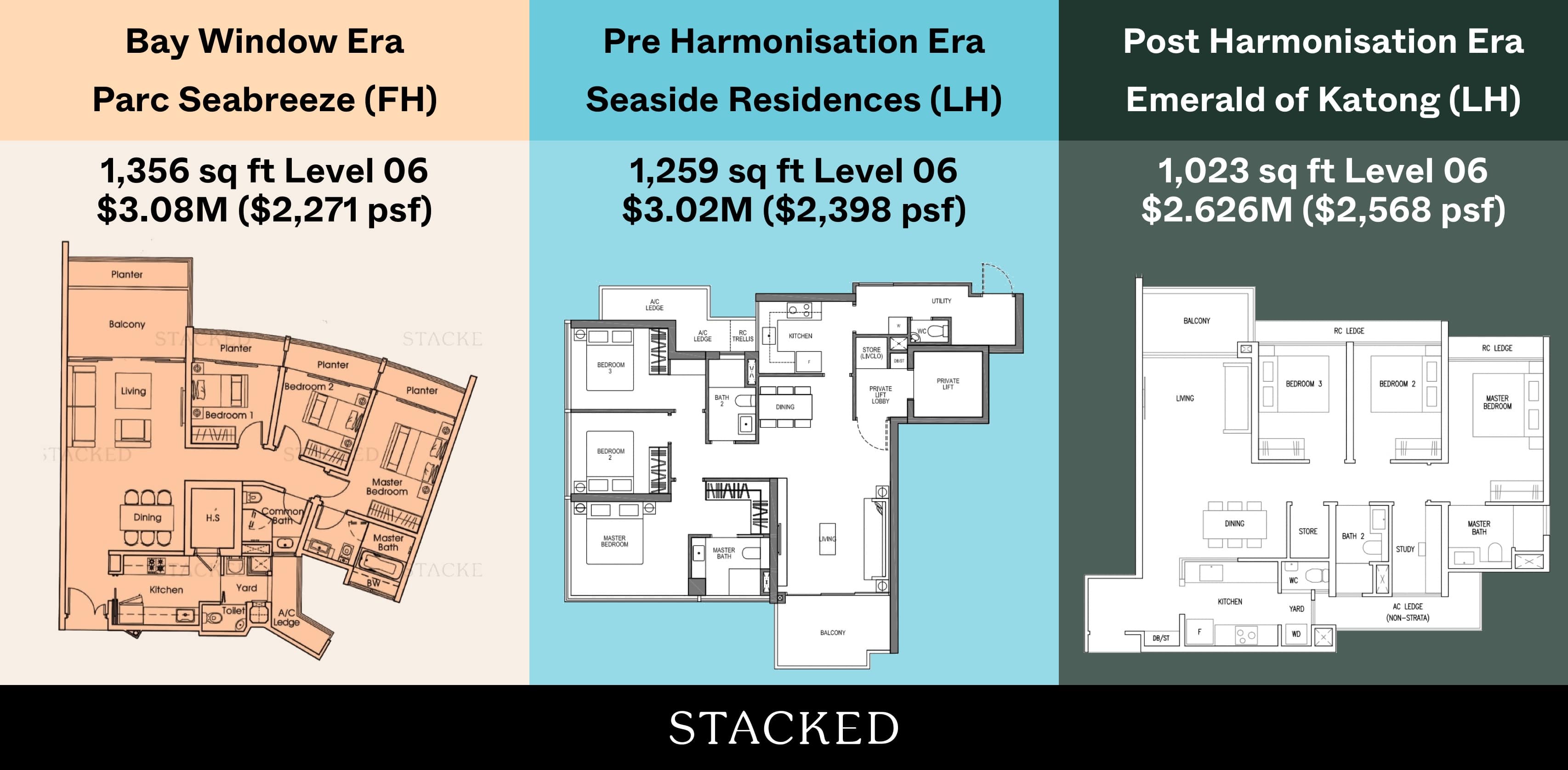

Here’s an example of how if you were to compare solely by psf across three similar 3-bedder properties in the East, you would end up with a very distorted picture:

When you couple this with potentially higher renovation costs, and a tendency to be less efficient, price psf becomes a poor point of comparison. The lower price psf may no longer reflect real value differences. So once you’re comparing against a condo that’s over a decade older, it’s best to focus less on price psf.

Price psf also ignores certain risks inherent to older properties, such as looming en-bloc sales, or aging facilities that are in tatters.

(All of this is true for HDB properties as well)

Besides this, here are a couple more reasons why you shouldn’t compare solely by psf today.

No qualitative depth

If a property has a higher price psf, there may be a good reason for it.

A newer condo is a good example: its higher price psf might look expensive compared to an older resale condo. But once you factor in the cost of renovation (older condos tend to need more work), you might find the newer condo would have been cheaper, or similarly priced but with better facilities.

A higher price psf may also be due to better unit facing, being closer to amenities like sky gardens or above-ground pools, or being a rare premium unit (e.g., top-floor units with rooftop access, or one of a handful of loft units).

People’s Park Complex, for example, has a remarkably low price psf for a Chinatown-area project. It averages $1,200 psf; but we doubt many would consider it “better value” than, say, One Pearl Bank, in its current condition.

More from Stacked

When Is It Worth Buying A 3Gen HDB Flat?

With the current trend toward larger homes, it’s inevitable that some Singaporeans will think of 3Gen flats. After all, these…

It’s especially worth noting that dual-key units, which consist of two subunits rolled into one, are almost always higher in terms of price psf. But these layouts can allow for better extended family living, or the ability to maintain privacy while taking on tenants. These are important features that simple price psf doesn’t take into account.

Efficient use of space is just as important – if not more important – than sheer square footage. This is something that price psf doesn’t take into account.

A very large unit will have a low price psf. However, these large units may also have expansive hallways, gigantic balcony/patio spaces that can be a third of the living room size (look out for these in ’80s-era terrace-style condos), or large antechambers at the main entrance. These are just added areas you need to keep clean and aren’t really liveable spaces.

Useless for comparing different property types

Price psf is best used in a very narrow capacity, such as when comparing two units of a similar layout, in the same project. That might give some indication of better value.

Once you start comparing different property types entirely, price psf is almost useless. Bungalows at Sentosa Cove, for instance, have a low price psf compared to many condos – even some mass-market ones. But that’s because they’re so big, the quantum can still be in the double-digit millions.

Conversely, some of the cheapest city fringe options – like M condo – would look expensive by price psf (its one-bedders could exceed $3,000 psf). But at launch, it was one of the few condos with Beach Road/Bugis area one-bedders for $1 million or under.

Meanwhile, penthouse and premium units tend to be both bigger and have a higher price psf.

So unless you’re comparing two very similar units and layouts – in which price psf could be a “tie-breaker” – you’ll find it’s not a very versatile tool.

The quantum is what has a real impact on you anyway

The quantum is what will determine your loan amount, your stamp duties, your rental yield, and – if it’s an investment – the overall measure of your return.

Looking at price psf is sometimes a distraction from this. When faced with a high-pressure sales pitch, your attention is sometimes drawn repeatedly to the price psf, to convince you to buy one property over another. Keep this in mind when making your choice, and keep the quantum at the forefront.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is price per square foot still a good way to compare properties in Singapore?

Why is comparing property prices based on PSF misleading in Singapore?

Can PSF be useful when comparing similar properties?

What should I focus on instead of PSF when buying property?

Does PSF reflect the quality or condition of a property?

Is PSF useful for comparing different types of properties like condos and bungalows?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

2 Comments

What is quantum? Sorry for ignorance.