Is It The Right Time To Sell Our $1.5m 5-Room BTO For An EC/Condo?

October 18, 2024

Hi stacked homes,

Always enjoy your thorough analysis on different properties and scenarios.

Would like your advice on what’s my next step in property journey since my current 5 room hdb in Central location is already mop.

Agent approached us to sell now at 1.5M.

My scenario:

- Early 30s couple with 2 kids 2yo and 1yo

- Combined cpf 300k and cash savings 200k

- Planning to send kids to a good primary school in 5 years time

- What’s the plausible next step?

- Sell the flat now or in 5 years time when kids start their primary school?

- EC/Condo or another BTO for next home?

- What decision will make good financial sense for our future retirement and kids education?

Thank you so much.

Hope to hear from you soon.

Warmest regards,

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

There are two key factors to consider: your criteria for a good primary school and your long-term financial goals. Since you’re in your early 30s, retirement is likely some time away, and this next property may not be your final home. Even if you stay until your child completes primary school, that’s around 11 years away, which means you would still be in your early 40s.

If you’re planning for retirement, it’s a good idea to reallocate your housing asset to something else that could produce better returns – but more on that later. As to what a “good school” is, we’ll leave that definition completely up to you as this can be completely subjective. This would ultimately influence the location of your next housing which we also won’t go into since that’s a personal preference. However, we’ll explore the pros and cons of the options you’re considering and their financial implications.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Potential pathways

Buy another BTO

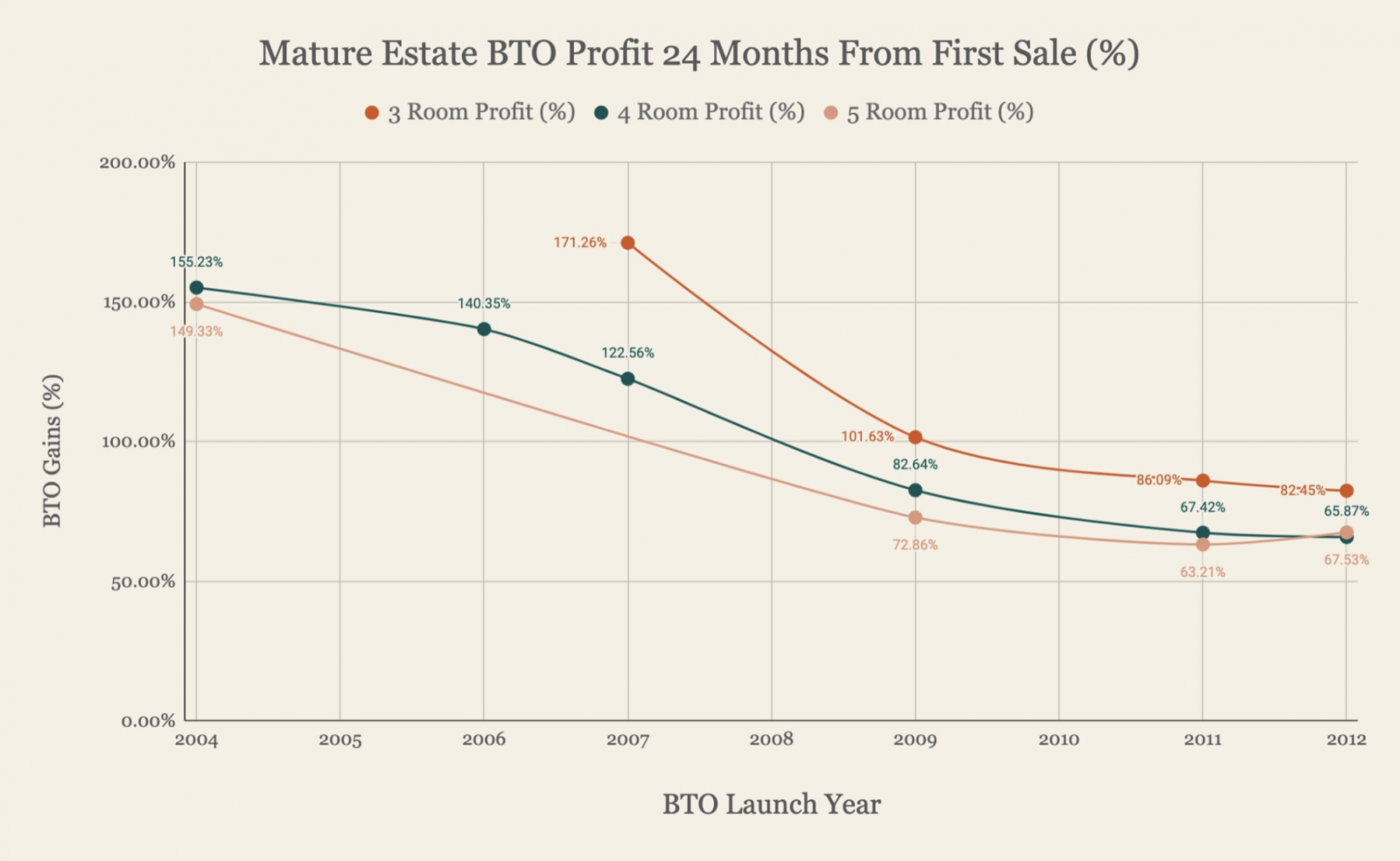

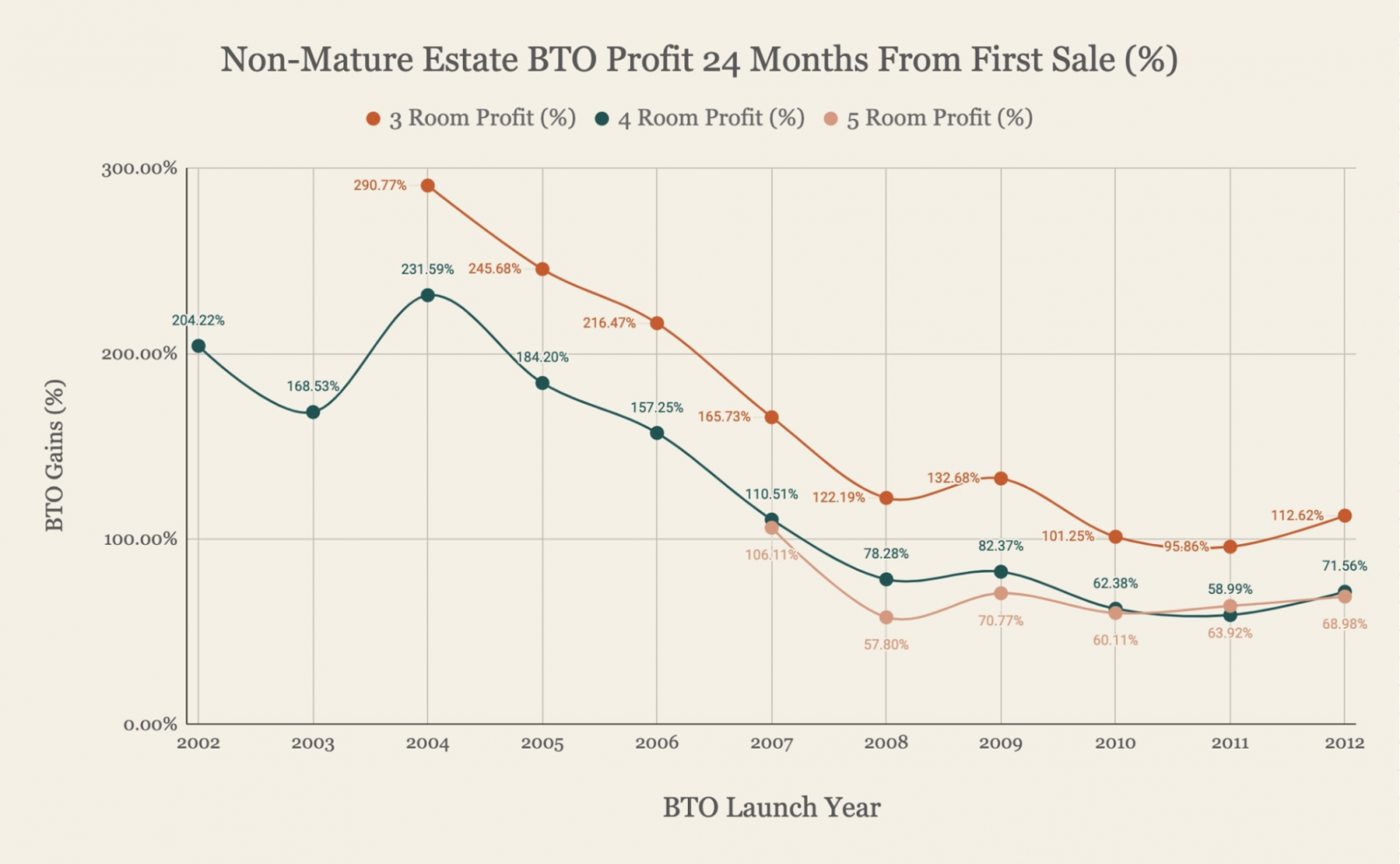

These graphs are taken from a previous article on whether BTOs are still profitable. With rising land and construction costs, BTO prices have increased, leading to lower profit margins. Despite this, BTOs do still yield significant returns, with all flat types achieving gains of over 50%.

| Pros | Cons |

| New flat with a fresh lease | Will take a long time before you are able to cash out due to construction time and MOP |

| Most affordable option | No control over locations launched – may or may not be your preferred estates |

| A lower percentage of flats allocated for second-timers | |

| Resale levy payable |

As we do not have all your financial details, we will be making the following assumptions for our calculation:

- Purchased the BTO at $700,000 and took a 90% loan at 2.6% interest with a 25-year tenure

- You have stayed in the flat for 5 years

- Outstanding loan is $534,439 with a 20-year tenure remaining

For the sake of calculations, we’ll consider a 10-year timeframe. We’ll assume you successfully secure a BTO unit on your first attempt, with a wait time of 4 years. During this period, you’ll remain in your current flat for 4 years and live in the BTO for the following 6 years. Let’s also assume the purchase price of the new BTO is $700,000, and you take out the maximum loan of 75%.

Costs incurred holding your current property for 4 years

| Interest expense (Assuming 20-year tenure at 2.6% interest) | $51,285 |

| Property tax | $7,920 |

| Town council service & conservancy fees (Assuming $90/month) | $4,320 |

| Total costs | $63,525 |

Buying the BTO

| Purchase price | $700,000 |

| BSD | $15,600 |

| Resale levy | $45,000 |

| 75% loan | $525,000 |

| Funds required | $235,600 |

Costs incurred holding the BTO for 6 years

| BSD | $15,600 |

| Resale levy | $45,000 |

| Interest expense (Assuming 25-year tenure at 2.6% interest) | $74,647 |

| Property tax | $2,080 |

| Town council service & conservancy fees (Assuming $90/month) | $6,480 |

| Renovation costs* | $50,000 |

| Total costs | $193,807 |

*Will vary depending on the extent of renovation done

Total costs if you were to take this pathway: $63,525 + $193,807 = $257,332

Buy an Executive Condominium (EC)

This is assuming you are referring to the purchase of a new EC.

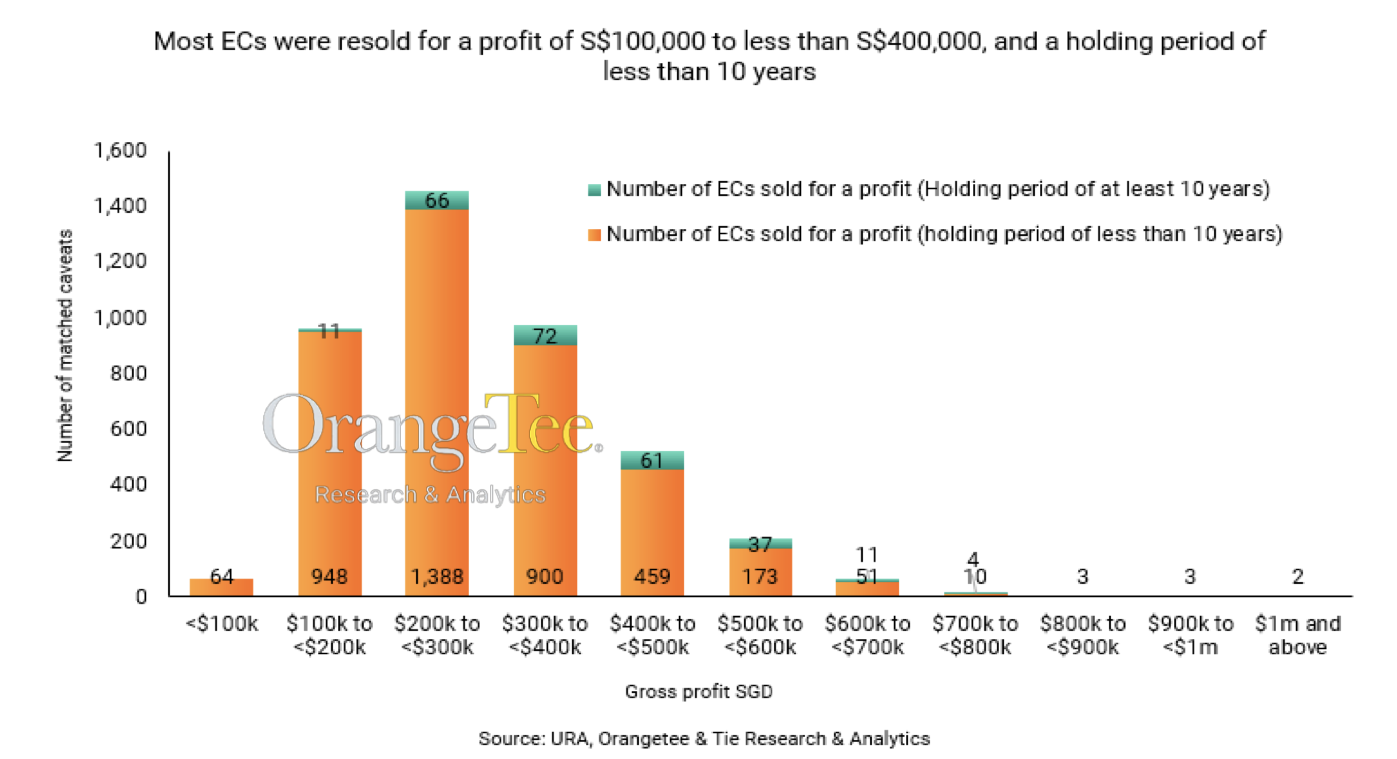

In October 2022, OrangeTee published a report analysing the profit and loss of EC units by matching new sale caveats between 2007 and 21 August 2022, with resale caveats (where available) for the same units. They identified 4,266 matched caveats from a database of 26,882 new EC transactions (the remaining units were either not resold or did not have caveats lodged). Of these, 99.9% generated an average gross profit of $295,904 each, with 4,001 units being sold within 10 years of purchase.

We have also previously done an article discussing the profitability of ECs.

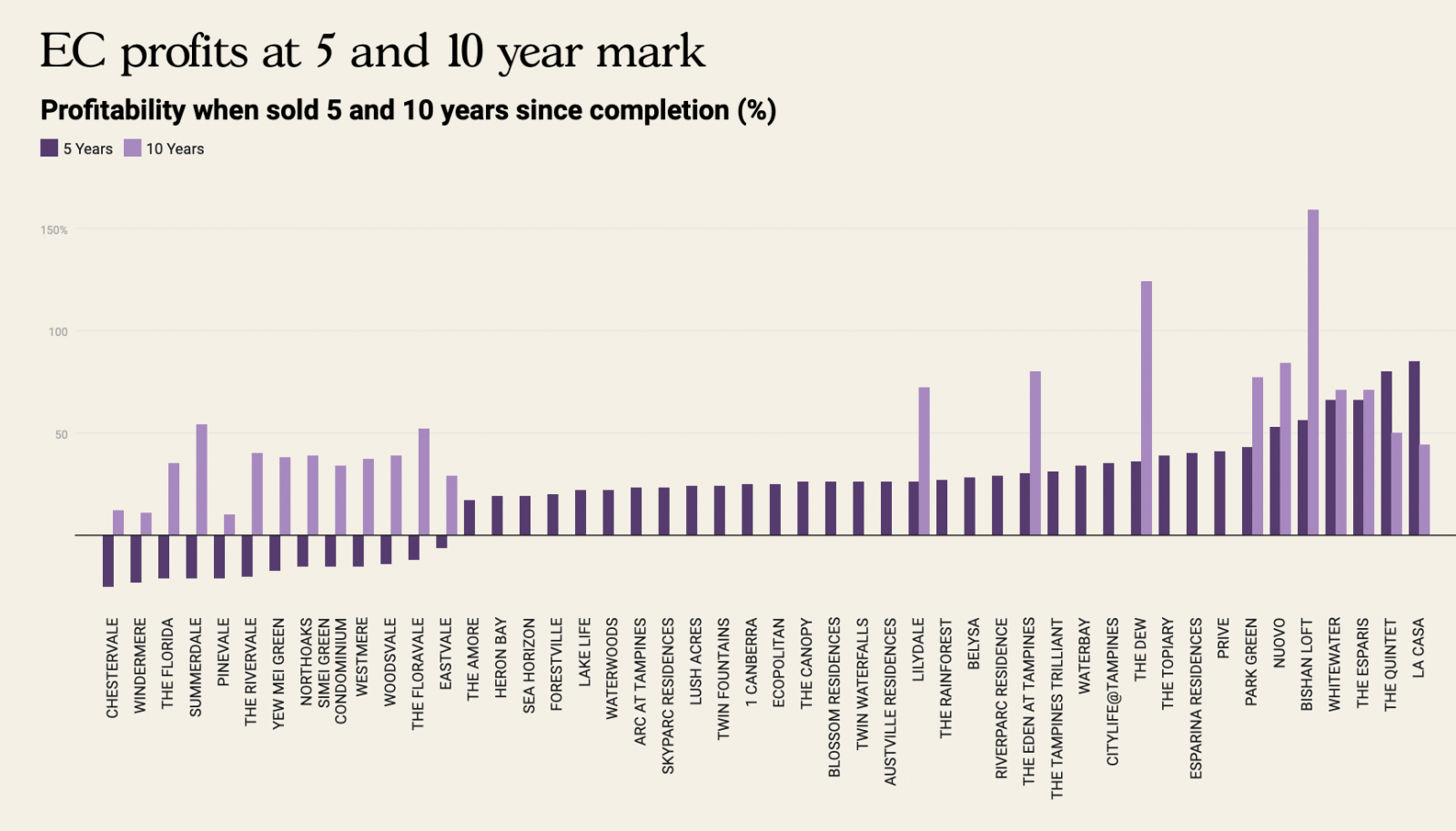

From the graph, it’s clear that all ECs sold at the 10-year mark were profitable. However, for those sold when they hit the 5-year MOP, only 23 out of 36 ECs were profitable. Early developments built in 1999/2000 registered losses, ranging from -6% to -25%. However, these losses were largely due to the timing of their launch, as global events like the 1997 Asian Financial Crisis and the tech bubble burst in 2001 significantly impacted the first batch of ECs, leading to reduced demand and lower prices during that period.

Considering the potential for strong profitability and a lower price point, ECs naturally attract high demand. However, the income ceiling and Mortgage Servicing Ratio (MSR) limit the ability of some buyers to purchase new ECs. With a reduced loan amount compared to private condominiums, buyers are required to make a larger upfront payment.

For example, a couple under 40 with a combined monthly income of $16,000, at a 4.8% interest rate, can secure a maximum loan of $837,701 for a new EC, compared to $1,535,785 for a private property, which is a significant difference.

Taking the latest EC launch, Lumina Grand, as an example, the most affordable 3-bedroom unit at the moment costs $1,357,000. With a maximum loan of $837,701, the couple would need to pay $519,299 upfront, which is almost 40% of the purchase price. This amount does not include the BSD or any resale levy that may apply.

Let’s assume you were to purchase an EC at $1.5M. Given that you are eligible to purchase a BTO, we will assume that your combined monthly income is $14,000 and that you can take up a 30-year loan.

| Purchase price | $1,500,000 |

| BSD | $44,600 |

| Resale levy | $45,000 |

| Maximum loan | $800,510 |

| Funds required | $789,090 |

Since you have sufficient funds to cover the down payment, BSD, and resale levy, you can continue living in your current flat and sell it within 6 months of your EC obtaining its Temporary Occupation Permit (TOP). However, this means you’ll need to manage two mortgages until the flat is sold unless you opt for the Deferred Payment Scheme (DPS) (do note though that units under DPS are typically priced higher). For calculation purposes, we’ll assume you choose the Progressive Payment Scheme, staying in your current flat for 4 years and in the EC for 6 years.

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 5.00% | $75,000 (paid in CPF/cash) | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 10.00% | $150,000(paid in CPF/cash | $0 | $0 | $0 | 6-9 months | $0 |

| Completion of brick wall | 5.00% | $75,000(paid in CPF/cash | $0 | $0 | $0 | 3-6 months | $0 |

| Completion of ceiling/roofing | 5.00% | $24,490 (paid in CPF/cash $50,510 (bank loan) | $168 | $73 | $241 | 3-6 months | $438 |

| Completion of electrical wiring/plumbing | 5.00% | $75,000 (bank loan) | $418 | $181 | $599 | 3-6 months | $1,086 |

| Completion of roads/car parks/drainage | 5.00% | $75,000 (bank loan) | $668 | $289 | $957 | 3-6 months | $1,734 |

| Issuance of TOP | 25.00% | $375,000 (bank loan) | $1,918 | $829 | $2,747 | Usually one year until CSC | $9,948 |

| Certificate of Statutory Completion (CSC) | 15.00% | $225,000 (bank loan) | $2,668 | $1,153 | $3,821 | Until property is sold (66 months) | $76,098 |

| Total interest paid in 10 years | $89,304 |

*We are assuming the longest duration for each stage

Costs incurred holding the EC for 6 years

| BSD | $44,600 |

| Resale levy | $45,000 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $89,304 |

| Property tax | $7,920 |

| Maintenance fee (Assuming $300/month) | $21,600 |

| Renovation costs | $50,000 |

| Total costs | $258,424 |

Total costs if you were to take this pathway: $63,525 + $258,424 = $321,949

Buy a resale condo/EC

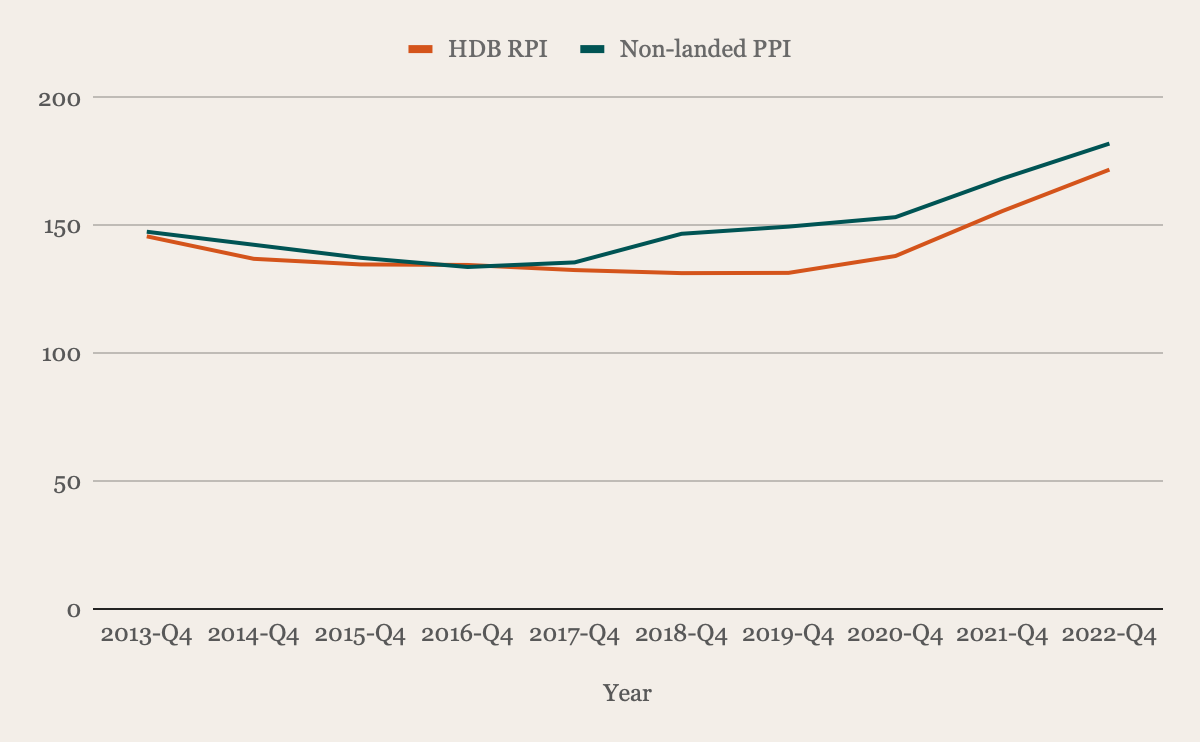

| Year | HDB Resale Price Index (RPI) | Non-landed Property Price Index (PPI) |

| 2013-Q4 | 145.8 | 147.6 |

| 2014-Q4 | 137 | 142.5 |

| 2015-Q4 | 134.8 | 137.4 |

| 2016-Q4 | 134.6 | 133.8 |

| 2017-Q4 | 132.6 | 135.6 |

| 2018-Q4 | 131.4 | 146.8 |

| 2019-Q4 | 131.5 | 149.6 |

| 2020-Q4 | 138.1 | 153.3 |

| 2021-Q4 | 155.7 | 168.4 |

| 2022-Q4 | 171.9 | 182.1 |

| 2023-Q4 | 180.4 | 194.2 |

| Average | 2.30% | 2.90% |

Solely examining the growth rate of private properties doesn’t provide us with a full picture. However, when we compare it to the growth rate of HDBs, we observe that not only is the average growth rate for private properties higher, but they also recovered more quickly after the cooling measures implemented in 2013. While private property prices began to rise again in 2017, HDB prices only started to increase when the pandemic struck.

Private properties face fewer regulations and attract a wider range of buyers compared to HDBs, making their prices more susceptible to shifts in economic sentiment. This dynamic can be a double-edged sword, as it presents the opportunity for significant gains but also carries the risk of losses.

Since we don’t have information on your affordability or preferred location, we will estimate the purchase price based on your maximum loan amount. As before, we’ll assume your combined monthly income is $14,000, and you can secure a 30-year loan. Based on this, your maximum loan (75% of the purchase price) would be $1,467,602, resulting in a maximum property price of $1,956,803.

For this calculation, it is under the assumption that you sell the HDB and stay in the condo for 10 years.

| Purchase price | $1,956,803 |

| BSD | $67,440 |

| Maximum loan | $1,467,602 |

| Funds required | $556,641 |

Considering the CPF and savings you currently have and your potential sales proceeds from the HDB, it is unlikely that you will have to take up the full loan but for calculation’s sake, let’s assume that you do.

Costs incurred holding the condo for 10 years

| BSD | $67,440 |

| Interest expense (Assuming 30-year tenure at 4% interest) | $529,420 |

| Property tax | $34,990 |

| Maintenance fee (Assuming $300/month) | $36,000 |

| Renovation costs | $50,000 |

| Total costs | $717,850 |

What should you do?

Since this is a property you intend to live in, you do need to consider beyond just the investment perspective.

If you want to enrol your child in a reputable primary school in five years, there are a couple of things that have to be done beforehand. To qualify for priority admission under the Home-School Distance (HSD) category, you’ll need to use your address at the time of registration and reside there for at least 30 months after the Primary 1 registration exercise. While you can register using the address of a newly launched property, its vacant possession date must fall within two years of your child’s Primary 1 enrollment.

Nevertheless since you own a unit in the central region, it’s reasonable to expect stable prices in the short to medium term, alleviating any urgency to sell immediately. Even if newer flats come up, they’ll likely be Plus or Prime flats which would make your existing flat more desirable due to lower restrictions. Whether you should move now or a few years later will depend on the next property that you purchase considering their varying timelines.

As such, if you are able to purchase a second BTO, it will be the most prudent choice given the numbers. Even considering the resale levy, this option incurs the lowest overall costs.

However the key point here is as a second-time buyer, your chances of successfully balloting for a unit will decrease, and available locations may not be near a good primary school. Furthermore, the new BTO classifications mean that if you purchase under the Prime or Plus categories, you’ll face a 10-year MOP and will be required to return a portion of the resale price to HDB upon selling.

Choosing a new EC has similar uncertainties regarding location and lower allocation chances for second-timers. Given the reduced loan amount, you will need to contribute a higher amount of CPF or cash, which may limit your available funds.

As for new launches, this is largely the same issue where you will be limited to certain locations. If no launches meet your preference for proximity to good schools, you can always consider purchasing a private condo later in a location you like. A good purchase would take into account factors like the entry price, layout, development size, yearly transaction volume, available facilities, and proximity to amenities.

Ultimately, if your push factor to making this move is for your kid’s future school, then the timing shouldn’t really be a crucial factor here. If your finances are sound and you can make the move now you should keep a lookout for a suitable place – trying to time the move later could cause unnecessary stress.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments