Is A PLH Model Flat Worth Buying? We Break Down The Pros And Cons

November 10, 2021

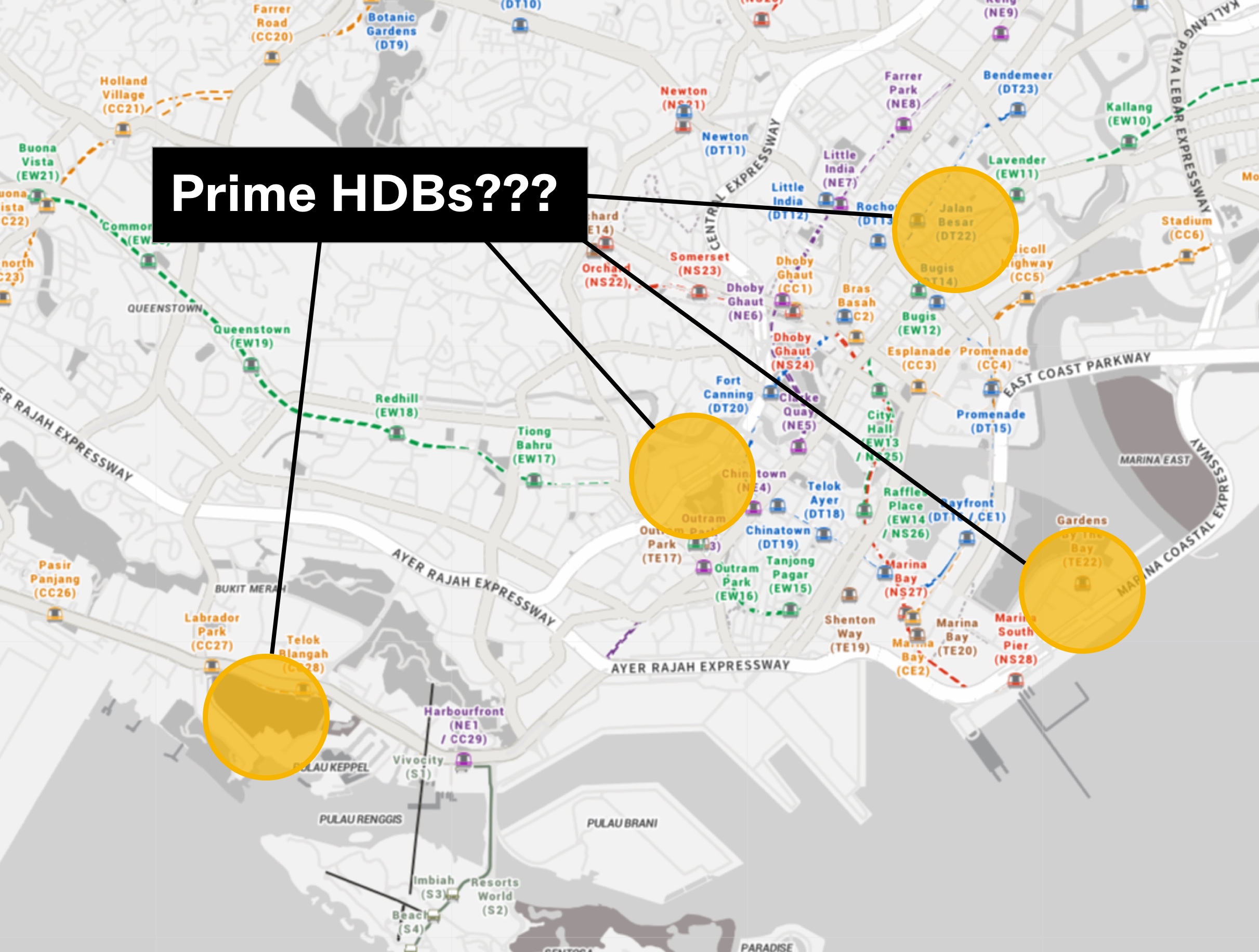

With the new PLH model housing unveiled, the question on everyone’s mind seems to be: is it worth it? While living in an area like Rochor seems nice, the slew of restrictions involved are jaw-dropping. In fact, we’d say these are some of the harshest control measures we’ve seen, to prevent profiteering off flats. If you’re looking for a home in the city, is it then viable to even consider these prime units?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The perspective for investors and upgraders

- Disproportionate risk to the first batch of buyers

- A long MOP could leave you priced out of the market

- Fewer options with lack of rental

- SR raises the risk of a negative cash sale

1. Disproportionate risk to the first batch of buyers

Due to the sheer number of unknowns, the first group of PLH buyers are taking a huge risk.

They don’t know, for example, whether PLH flats will appreciate like the high-demand flats in Bishan or Queenstown. Given the tight restrictions involved, there’s no guarantee they’ll see high Cash Over Valuation (COV); even if their flats are in the Central Area.

It’s entirely possible that, after a long period like 14 or 15 years (the construction time plus the 10-year MOP), the initial buyers will find their returns are worse than new or resale flats the next neighbourhood over.

It may turn out that future Singaporeans have no desire to take on a 10-year MOP; also, ongoing decentralisation could mean the Central Area won’t be as big an advantage, a decade or so down the road.

On top of that, keep in mind that the prospective buyer pool is smaller. For example, PLH flats cannot be bought by all-Permanent Resident (PR) families or singles – however affluent these buyers may be.

Even downsizers can’t easily buy your PLH flat. They’re required to wait 30 months after selling a private property, before they can buy a PLH unit; this applies even if it’s a resale flat. This means the buyers who are flush with cash, from having recently sold their condo or landed home, are probably not going to be the ones viewing your flat.

Also, unlike normal resale flats, an income ceiling still applies. This is currently $14,000. An income cap places a constraint on potential gains, although it’s impossible to gauge the exact impact this early.

In effect, investors need to treat PLH flats as if it’s a whole new property segment, for which we cannot gauge future demand. Their location may be proven, but PLH flats are a new and untested element in the property market. No one can say for sure what would be the resale demand with these new conditions.

2. A long MOP could leave you priced out of the market

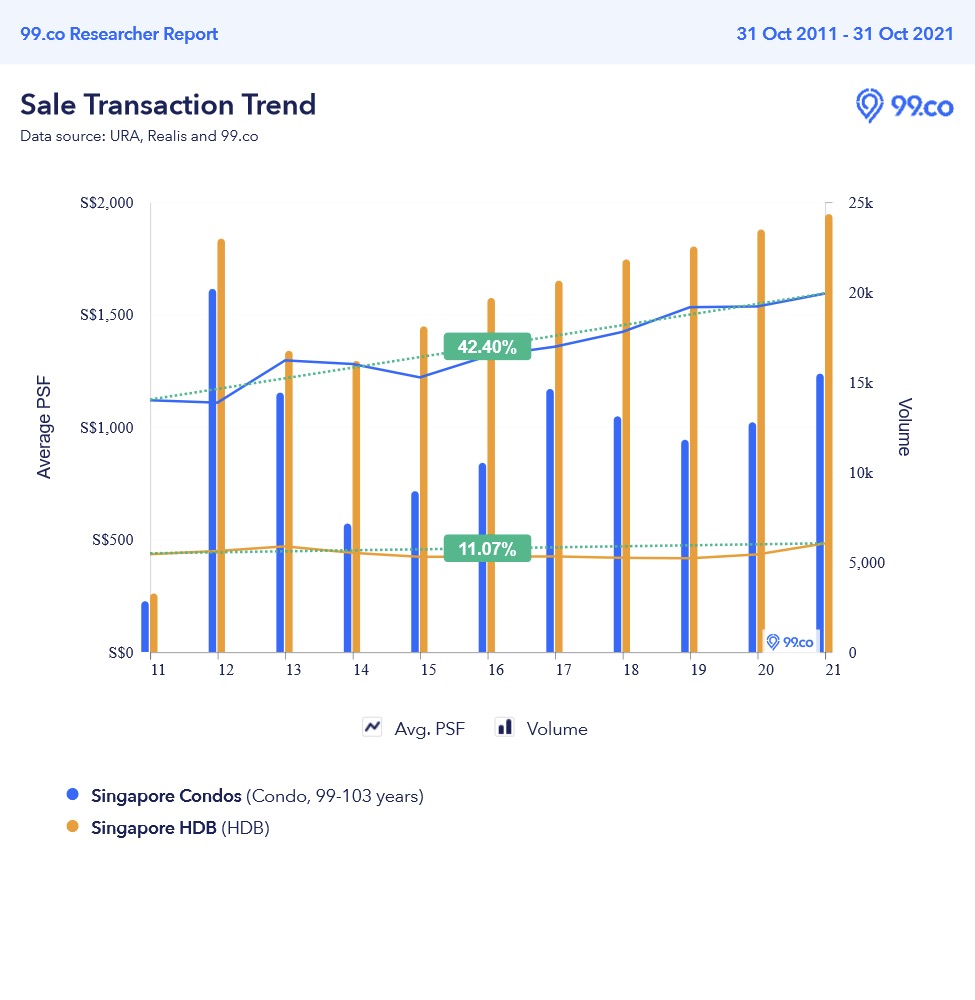

Loosely speaking, many (but not all) condos will appreciate faster than flats.

(We used 99-year leasehold condos and excluded ECs, as freehold doesn’t really make for a fair comparison basis to flats).

To be clear, the above is a quick snapshot, which may not hold true in more specific comparisons; but you can see where investors might worry. With private housing prices rising faster, there’s a risk that resale flat prices won’t suffice to bridge the gap toward a private condo.

As is, this is sufficient to drive some upgraders to swear by resale flats instead; this is to ensure they can upgrade in five years, as opposed to nine to 10 years with a BTO flat.

Investors who believe this are not inclined to wait out a decade-long MOP; not unless they’re certain PLH model flats are so superior, their appreciation far exceeds that of regular flats (but see point 1, about how this is a complete unknown).

3. Fewer options with lack of rental

With regular flats, you can choose to rent out the entire unit after the five-year MOP. This provides a range of financial opportunities to some Singaporeans.

For example, we know of some couples who move back in with in-laws (who may own their own property), while renting out their whole flat. This sometimes provides the savings for a child’s university education, or can be a failsafe in the event of retrenchment / reduced income.

With PLH model flats, only room rental is allowed. Even after you stay past the 10-year MOP, it will never be an option for you to rent out the entire unit.

This isn’t a dealbreaker, as not many Singaporeans rent out their whole flat anyway. But it’s still worth serious consideration, for investors choosing between PLH flats and regular flats.

Property Market Commentary4 Possible Locations Of Future Prime BTO Flats Under The PLH Model

by Ryan J. Ong4. SR raises the risk of a negative cash sale

As higher subsidies are given out for PLH model flats, these must be paid back in the form of Subsidy Recovery (SR), for the first batch of buyers.

(This adds to the risk faced by the first-time buyers, as mentioned in point 1).

The SR is a percentage of sale proceeds, at the time of sale; not a percentage of the original price. We’ve also heard a recent misconception that SR is applied on the profit of the sale, or upon profitable sales; neither is true. It applies to the price you sell the PLH flat for, even if you happen to sell at a loss.

This will be on top of discharging the existing flat loan and refunding the CPF monies used. And given the higher prices of PLH flats, both the loan and the CPF usage are already likely to be higher.

If we add the SR on top of it, there’s a chance that – even if a profit is realised – the seller will be left with no cash in hand; everything left behind is refunded straight back into their CPF.

This is a problem for upgraders, as the first five per cent of any private property must be paid in cash.

Do note, however, that the exact percentage is not known yet. The details on this will be released in the upcoming Nov 2021 BTO launch.

The perspective for home buyers

- A lot of changes can happen in 10-years

- Some Central Areas are not great for families

1. A lot of changes can happen in 10-years

It’s true that the MOP matters less to home buyers than investors. However, home buyers can’t totally dismiss a long MOP as a non-factor.

For example, consider that Primary School is six years, and Secondary School is four to five years. Even if your flat is close to a school right now, that may not be true for the next phase of schooling. With a five-year MOP you could move reasonably soon – with a 10-year MOP, you might find yourself locked in place.

A decade is also a long time, in which unexpected things might happen. While HDB has almost always provided leeway for deaths and divorce, homeowners need to consider other possibilities, such as diminished income.

If you’re forced into a lower-paying job, for example, you may not want to be saddled with the PLH flat for the entire 10-year MOP; that would prevent you from downsizing sooner, to maintain your finances or lifestyle.

While you can always make appeals to HDB, keep in mind they’re not always approved.

You also have to consider the possibility of your workplace moving, or amenities changing in a way you don’t like. You’re forced to commit to the same area, for a much longer period.

2. Some Central Areas are not great for families

Central Area amenities tend to be pricier, so we hope steps are taken to manage this. Families may not want every eatery and retail mall nearby to be upscale; especially since PLH flats are meant to be inclusive.

(E.g., it would terrible for those in 2-room rental flats, to find out most of the amenities nearby are priced beyond their means).

Assuming that’s addressed, however, we note that the Central Area often has fewer schools in the priority enrollment range. There’s also the simple fact that the Central Area is heavily built up, without the open space you’d find in areas like Punggol or Sengkang.

While some families like convenience, others will find the urban density unpleasant; and they can’t “escape” for at least 10 years once they’ve made their choice. That’s most of someone’s entire childhood.

With these in mind, is it worth buying a PLH model flat?

For investors, PLH flats are a tough call. Right now it’s a gamble to be a first mover and count on these flats to fund an upgrade. Most aspiring upgraders are better off looking at resale flats in non-prime areas, that have proven track records and five-year MOPs. Perhaps you can say that the new measures have done exactly that – to deter investors and those looking to profit off their flat as opposed to those seriously looking at a home to stay.

For home buyers, it’s appropriate once you’ve thought through the situation over the coming decade. Just keep in mind you have less flexibility to move, once you commit to a prime flat.

Lastly, the unintended consequence of this is HDB flats that fall just outside of these prime areas may just rise in value from here on. After all, if they close by enough to these areas without the same restrictions, it’s easy to see the appeal.

For more on the situation as it unfolds, follow us on Stacked. You can also check out in-depth reviews of new and existing resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

2 Comments

Makes so much sense. The people i know that have balloted for PLH just purely looking to profit but i already had all this these points mentioned in my mind. I ruled out that staying closer to neighborhood heartlands just makes more sense and financially responsible.