I’m Stuck With An Old Condo I Bought Last Year That Isn’t Earning Much Rent: Should I Continue Renting It, Sell Or Just Move In?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Hi

I have been reading your articles and found the analysis very informative. Last year, I have been looking for a condo to invest or stay.

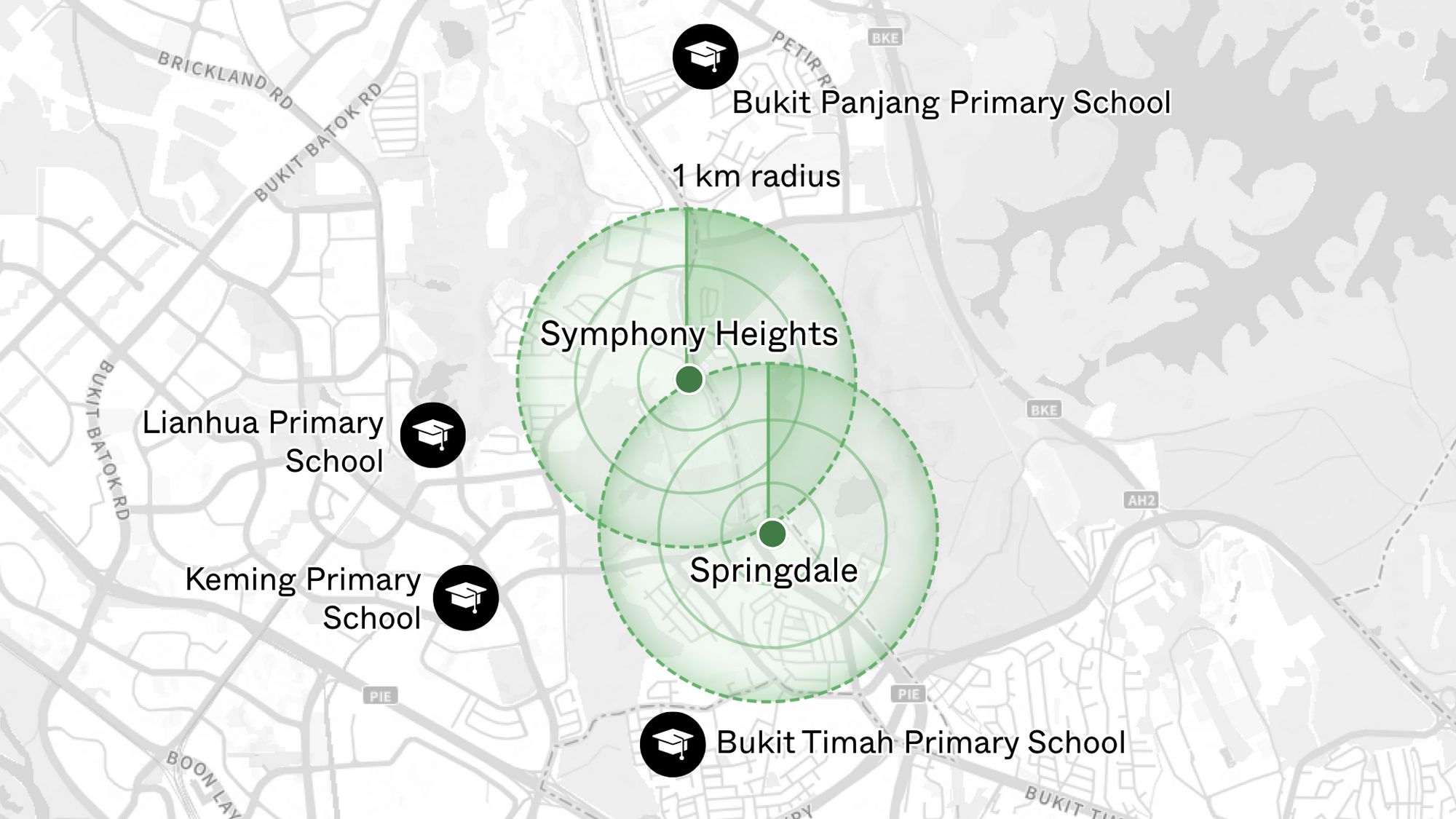

After a few rounds of unsuccessful ballots for new launches, in 2nd half of 2022, I bought a high floor 3-bedroom unit at Costa Del Sol (around $1.8m) as I always wanted to stay in the East and have a sea view. The new MRT station will be ready in 2025. It was purchased in my name as my spouse will be incurring ABSD. The condos in District 15 with sea view and above 1,000 sq ft are beyond my budget. My unit is currently tenanted until 3Q2023 at a very low rental as it was rented out by the previous owner before the rental rate started increasing.

My family is currently staying in a condo in the West as we are working around there and my child is studying there, graduating in 2025. Both my spouse and I drive to work.

Is it true that the price of condos will start coming down once it hit 30 years old (all else being equal)?

My options are:

1. Continue to rent out the unit until 2nd half of 2025 (no more sellers stamp duty) and sell it. That means we won’t get to enjoy the nice unit with sea view.

2. Continue to rent out until 2025 (i.e. after my child graduated to avoid travelling far for classes) and then move in. Question is how long can we stay there before the price drops?

3. Move in when the current tenancy ends in 3Q2023. We will need to incur about $80K to $100K for renovation. Sell after staying 5 years ie end 2028. Will it be too late to sell?

I would appreciate your advice on which is the best option or provide other alternatives. Do let me know if you need more information.

Thanks and have a wonderful long weekend ahead!

Cheers!

Hi there,

Thanks for writing in. We’re glad that our articles have been useful for you.

When it comes to balloting for new launches, especially those that are highly sought after, it can boil down to a matter of luck. We have heard of buyers in similar situations who eventually also turn to a resale property instead. Given that you and your spouse each have one unit, this definitely provides some flexibility in your planning.

That said, we understand the dilemma you are facing. On one hand, you’re happy to have finally purchased your dream home with a sea view but on the other, you’re concerned about its lease decaying while not getting the rental returns that are reflective of the current market conditions.

Here’s an overview of what we will be going through and hopefully by the end of it, you’ll have a clearer idea of how to move forward:

- Performance of Costa Del Sol

- Performance of developments greater than 30 years old in the vicinity with a sea view

- Your available options

Let’s start by looking at your question on whether prices of condominiums will start coming down once they hit 30 years old.

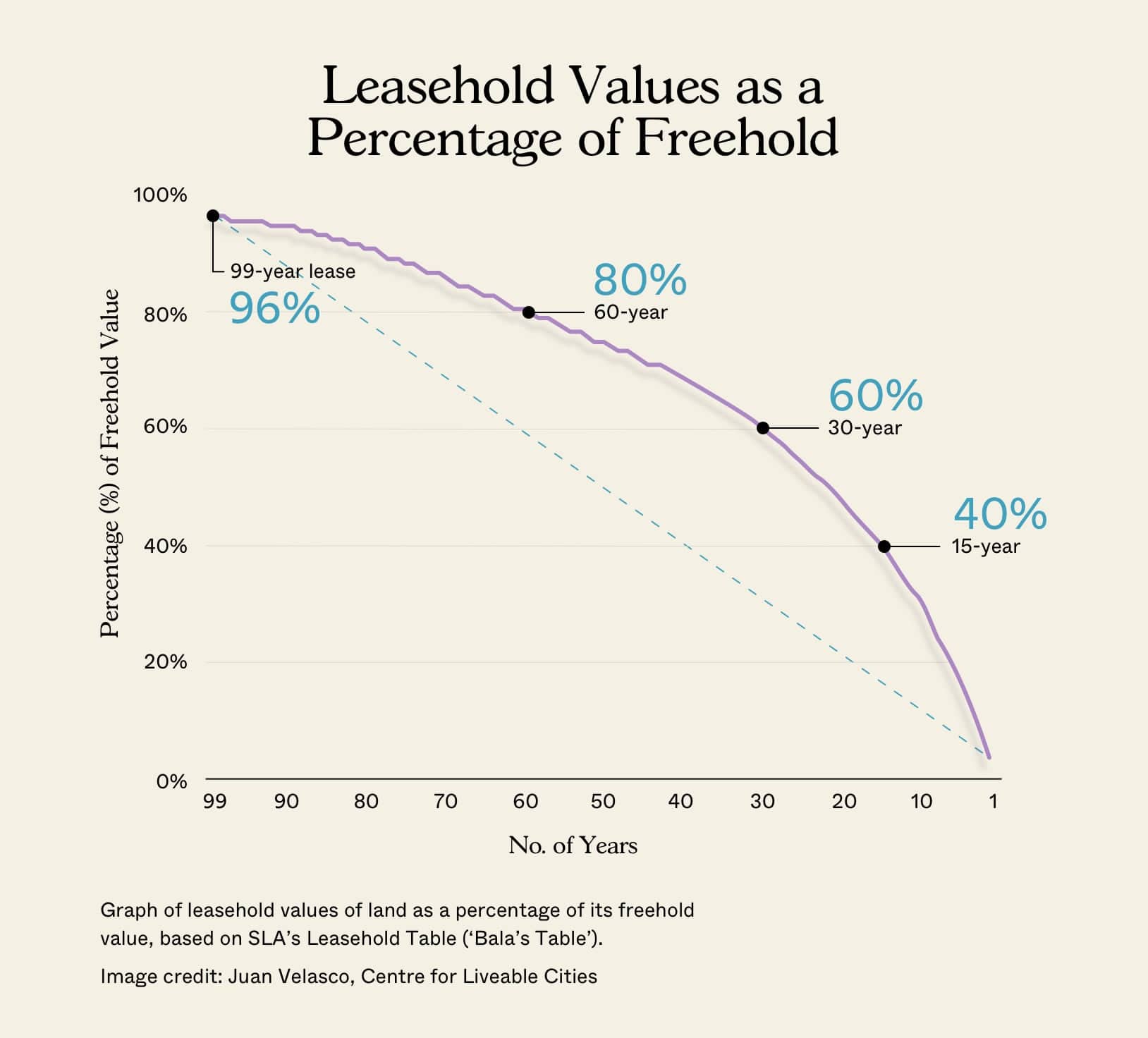

Based on Bala’s Curve, property prices may begin to decline as soon as the lease commences, all else being equal. Bala’s Curve illustrates the correlation between a property’s market value and the remaining duration of its lease. The curve indicates that a property’s value declines as its lease term decreases.

That being said, all things are never equal, and this is all just theory. If this was true, all leasehold properties should start losing money the moment the land was purchased – but we don’t see this happening at all.

While there is a general trend that the price of a leasehold property may start to decline/stagnate once it reaches 20+ years old, it is not an absolute certainty. You can see this from today’s market high – and we’ll be looking at Costa Del Sol shortly.

Ultimately, the value of a leasehold property is dependent on many factors. For instance, if the development is in a highly desirable location, with access to amenities and transportation, and is well-maintained, the demand and in turn price, for the property may remain high even as the lease gets shorter especially if supply in the area is low. An example of this is the Marine Terrace HDBs. These HDBs boast unblocked sea views and there are few HDBs like this that you can purchase in the area, providing price support even though it’s around 50 years old.

Therefore, the question isn’t so much whether you’ll lose money if it’s 30 years old – but does Costa Del Sol have the right characteristics to still hold value?

To get an idea of this, let’s take a look at how it has performed in the past.

Performance of Costa Del Sol

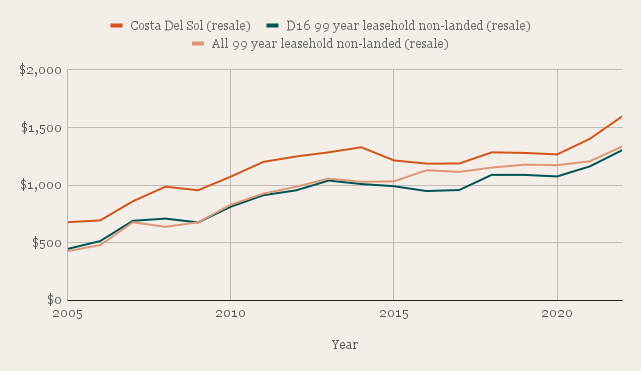

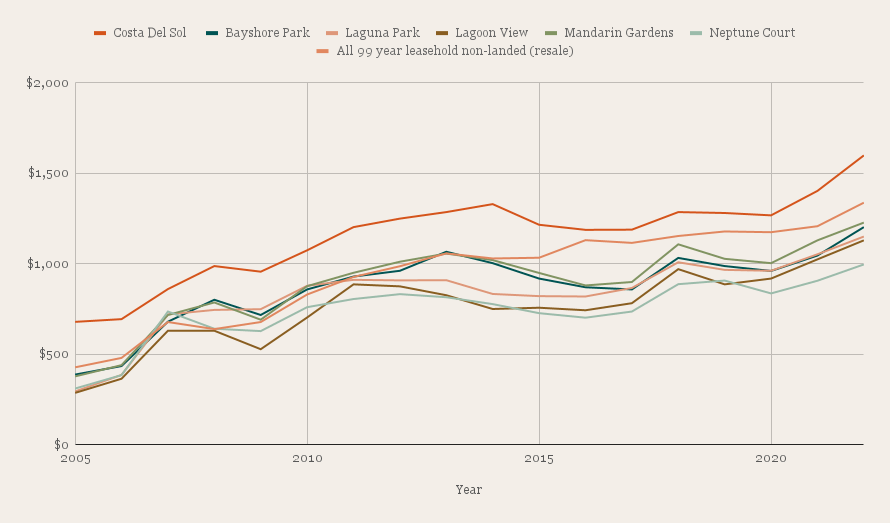

From the above graph, we can see that over the years, prices at Costa Del Sol have more or less been moving in line with other 99-year leasehold condominiums.

| Year | Costa Del Sol (resale) | YoY | D16 99-year leasehold non-land (resale) | YoY | All 99-year leasehold non-land (resale) | YoY |

| 2005 | $679 | $447 | $428 | |||

| 2006 | $694 | 2.21% | $515 | 15.21% | $480 | 12.15% |

| 2007 | $860 | 23.92% | $691 | 34.17% | $678 | 41.25% |

| 2008 | $987 | 14.77% | $710 | 2.75% | $639 | -5.75% |

| 2009 | $956 | -3.14% | $677 | -4.65% | $678 | 6.10% |

| 2010 | $1,074 | 12.34% | $813 | 20.09% | $830 | 22.42% |

| 2011 | $1,202 | 11.92% | $913 | 12.30% | $927 | 11.69% |

| 2012 | $1,249 | 3.91% | $955 | 4.60% | $986 | 6.36% |

| 2013 | $1,285 | 2.88% | $1,040 | 8.90% | $1,057 | 7.20% |

| 2014 | $1,329 | 3.42% | $1,010 | -2.88% | $1,029 | -2.65% |

| 2015 | $1,215 | -8.58% | $991 | -1.88% | $1,033 | 0.39% |

| 2016 | $1,187 | -2.30% | $949 | -4.24% | $1,130 | 9.39% |

| 2017 | $1,188 | 0.08% | $958 | 0.95% | $1,115 | -1.33% |

| 2018 | $1,285 | 8.16% | $1,090 | 13.78% | $1,153 | 3.41% |

| 2019 | $1,280 | -0.39% | $1,089 | -0.09% | $1,178 | 2.17% |

| 2020 | $1,267 | -1.02% | $1,076 | -1.19% | $1,174 | -0.34% |

| 2021 | $1,402 | 10.66% | $1,163 | 8.09% | $1,207 | 2.81% |

| 2022 | $1,598 | 13.98% | $1,305 | 12.21% | $1,337 | 10.77% |

| Annualised | – | 5.16% | – | 6.51% | – | 6.93% |

If we take a closer look at the data, you’ll notice that in the latest market upswing, Costa Del Sol actually outperformed 99-year leasehold condos in District 16, as well as other similar developments throughout Singapore.

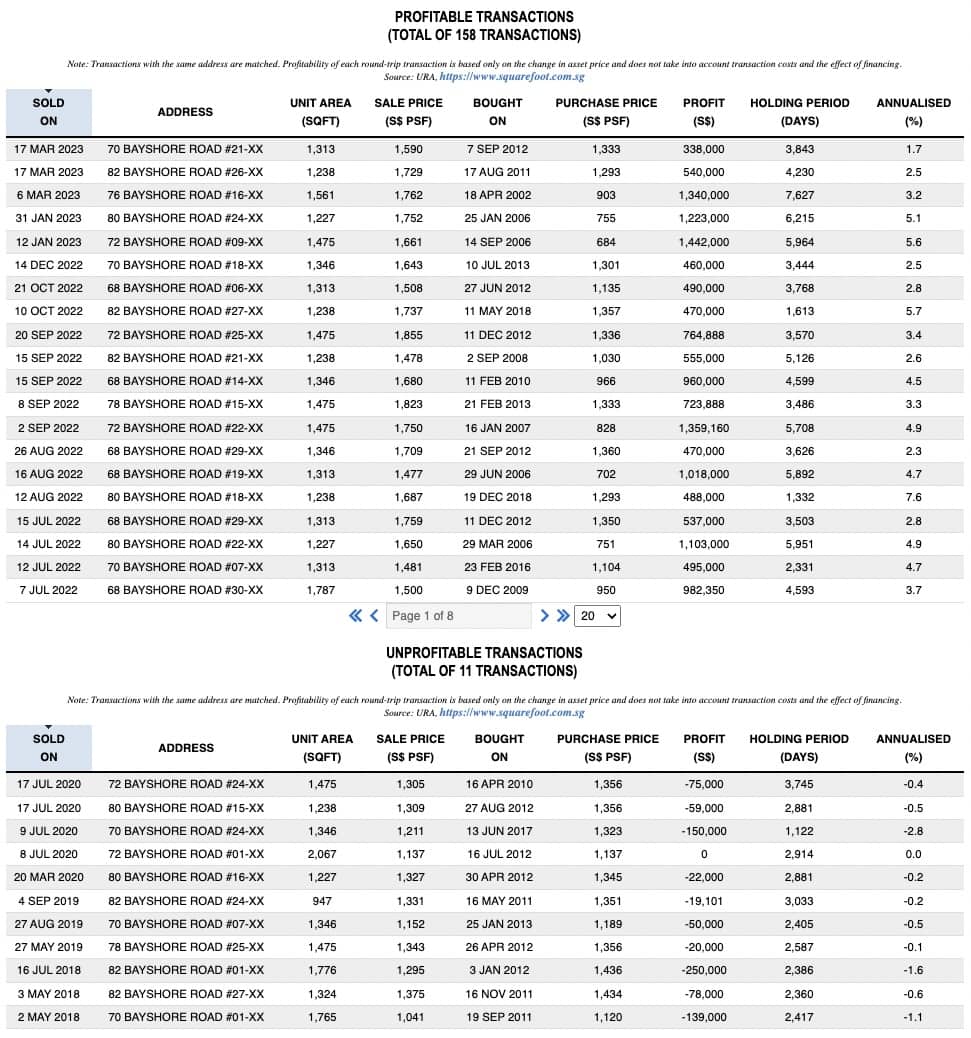

Here’s another way to look at it – the number of profitable and unprofitable transactions. In total, there were 158 profitable and 11 unprofitable transactions here:

In total, around 7% of transactions here are unprofitable which is quite healthy.

But then again, 26 years of age can be concerning still. So in order to make a more informed assessment, let’s look at how some 99-year leasehold projects located along the same stretch with sea views (which have exceeded the 30-year mark) have fared in terms of their performance.

Performance of older resale condos in the area

To be fair, we will look at the same time period from 2005 to 2022.

| Project | Lease start date | Completion year | Current age |

| Costa Del Sol | 1997 | 2004 | 26 |

| Bayshore Park | 1982 | 1986 | 41 |

| Laguna Park | 1977 | 1978 | 46 |

| Lagoon View | 1977 | 1977 | 46 |

| Mandarin Gardens | 1982 | 1986 | 41 |

| Neptune Court | 1975 | 1975 | 48 |

| Year | Costa Del Sol | YoY | Bayshore Park | YoY | Laguna Park | YoY | Lagoon View | YoY | Mandarin Gardens | YoY | Neptune Court | YoY | All 99 year leasehold non-land (resale) | YoY |

| 2005 | $679 | $388 | $295 | $287 | $378 | $311 | $428 | |||||||

| 2006 | $694 | 2.21% | $435 | 12.11% | $386 | 30.85% | $365 | 27.18% | $440 | 16.40% | $385 | 23.79% | $480 | 12.15% |

| 2007 | $860 | 23.92% | $680 | 56.32% | $720 | 86.53% | $630 | 72.60% | $717 | 62.95% | $736 | 91.17% | $678 | 41.25% |

| 2008 | $987 | 14.77% | $801 | 17.79% | $745 | 3.47% | $630 | 0.00% | $786 | 9.62% | $641 | -12.91% | $639 | -5.75% |

| 2009 | $956 | -3.14% | $717 | -10.49% | $749 | 0.54% | $528 | -16.19% | $691 | -12.09% | $628 | -2.03% | $678 | 6.10% |

| 2010 | $1,074 | 12.34% | $858 | 19.67% | $878 | 17.22% | $703 | 33.14% | $876 | 26.77% | $760 | 21.02% | $830 | 22.42% |

| 2011 | $1,202 | 11.92% | $929 | 8.28% | $911 | 3.76% | $886 | 26.03% | $950 | 8.45% | $805 | 5.92% | $927 | 11.69% |

| 2012 | $1,249 | 3.91% | $961 | 3.44% | $908 | -0.33% | $875 | -1.24% | $1,011 | 6.42% | $832 | 3.35% | $986 | 6.36% |

| 2013 | $1,285 | 2.88% | $1,066 | 10.93% | $909 | 0.11% | $826 | -5.60% | $1,056 | 4.45% | $815 | -2.04% | $1,057 | 7.20% |

| 2014 | $1,329 | 3.42% | $1,003 | -5.91% | $833 | -8.36% | $750 | -9.20% | $1,020 | -3.41% | $777 | -4.66% | $1,029 | -2.65% |

| 2015 | $1,215 | -8.58% | $918 | -8.47% | $821 | -1.44% | $757 | 0.93% | $949 | -6.96% | $727 | -6.44% | $1,033 | 0.39% |

| 2016 | $1,187 | -2.30% | $870 | -5.23% | $819 | -0.24% | $743 | -1.85% | $880 | -7.27% | $702 | -3.44% | $1,130 | 9.39% |

| 2017 | $1,188 | 0.08% | $858 | -1.38% | $866 | 5.74% | $782 | 5.25% | $899 | 2.16% | $736 | 4.84% | $1,115 | -1.33% |

| 2018 | $1,285 | 8.16% | $1,032 | 20.28% | $1,008 | 16.40% | $970 | 24.04% | $1,107 | 23.14% | $887 | 20.52% | $1,153 | 3.41% |

| 2019 | $1,280 | -0.39% | $987 | -4.36% | $966 | -4.17% | $886 | -8.66% | $1,027 | -7.23% | $907 | 2.25% | $1,178 | 2.17% |

| 2020 | $1,267 | -1.02% | $960 | -2.74% | $961 | -0.52% | $918 | 3.61% | $1,003 | -2.34% | $836 | -7.83% | $1,174 | -0.34% |

| 2021 | $1,402 | 10.66% | $1,045 | 8.85% | $1,052 | 9.47% | $1,024 | 11.55% | $1,129 | 12.56% | $906 | 8.37% | $1,207 | 2.81% |

| 2022 | $1,598 | 13.98% | $1,202 | 15.02% | $1,150 | 9.32% | $1,129 | 10.25% | $1,227 | 8.68% | $996 | 9.93% | $1,337 | 10.77% |

| Annualised | 5.16% | 6.88% | 8.33% | 8.39% | 7.17% | 7.09% | 6.93% |

From 2005 to 2022, there were a few notable cycles during this period:

- The upswing from 2005 to 2008, driven by strong economic growth and increased foreign investment.

- The downturn from 2008 to 2009, was due to the global financial crisis.

- The upswing from around 2010 to 2013, driven by an improving economy and record low-interest rates.

- The cooling measures implemented by the government from 2013 to 2017, which moderated demand and resulted in a slight downturn in the market.

- The relaxation of cooling measures in 2017, which led to a short-lived upswing in the market.

- The impact of the COVID-19 pandemic in 2020, which led to a brief downturn in the market followed by an upswing.

Looking at the data, we can see that at the peak of the first upmarket (2005 – 2008), the price jump was very significant even though these developments were inching close to or had already hit the 30-year mark. Despite the global financial crisis in 2008, which caused a dip in prices for some developments, they recovered well in the following year, with prices rising by 17% to 33%.

In the most recent upswing, all of these developments experienced a considerable appreciation in prices in spite of their ages.

We can also see from the data that the rate of year-on-year (YoY) decline during property market downturns is typically less severe than the YoY increase experienced during the market upswings.

Although it’s uncertain whether this pattern will persist in the foreseeable future, the data suggests that in the short to medium term, Costa Del Sol, being at least 15 years newer than these developments, is likely to follow the overall market trend.

Given the enhanced accessibility brought by the upcoming MRT station, it’s possible that the rate of depreciation for Costa Del Sol might not conform to traditional models. Especially since there are only that many large full-fledged condominiums with sea views that are situated in close proximity to an MRT station.

In other words – buyers only have this many full-fledged facilities to choose from that have sea views. And with new projects all being minimally priced from $2,000 psf onwards, buyers would start to see older resale condos like this in a more favourable light.

Let’s now consider your options.

Given your expressed desire to reside in a unit with a sea view in the east, we think it would be counterproductive to sell the property without ever experiencing its features firsthand.

While we cannot predict market upswings and downturns, current market conditions suggest that we may be experiencing a market high, as evidenced by elevated interest rates and cautious buyers. Consequently, selling the property in 2025 may not be the best course of action, and it may be necessary to hold onto the property until the next market cycle, which could potentially extend beyond 2030.

In making a decision, several factors must be considered. First and foremost, it’s crucial to think about your future plans after Costa Del Sol.

Do you still have a preference for a property with a sea view? If so, it’s worth evaluating whether you have the financial means to acquire another unit with comparable features in the current market. Without knowledge of your financial details, it’s challenging to provide specific advice. Since you plan on spending $80 – 100K to do up the place, one option to consider is making this property your permanent residence (at least until your child has moved out and you wish to downsize to a smaller unit), while utilising the property under your spouse’s name as an investment property.

In this case, you get to enjoy the amenities in 3Q this year that you’ve purchased Costa Del Sol for – something that must also be taken into account which you can use until you plan to downgrade later to a smaller sea view home.

Should you sell now and buy a younger leasehold property?

Just for reference, here are some newer 3-bedders on the market that come with a sea view and are under $2M (around the price of a 3-bedroom in Costa Del Sol):

| Project | District | Tenure | Completion year | Size (sqft) | Asking price |

| Ocean Front Suites | 17 | 999 years | 2016 | 1098 | $1,780,000 |

| Seahill | 5 | 99 years | 2017 | 1044 | $1,780,000 |

| Vue 8 Residence | 18 | 99 years | 2017 | 1044 | $1,550,000 |

Let’s assume you’re 1+ years into your purchase. This means you’d have to pay an SSD of 8%. Assuming you sell for $1.8M, this would come up to $144,000.

As an assumption, let’s say you were to move on to buy a private property that’s also $1.8M, you’d have to pay BSD of $59,600. In total, you would have incurred expenses of $203,600 and this doesn’t even include other costs like legal fees.

If the lease concern is big to you, what you could do is put your property up for sale, and see if you’re able to sell at a price that can at least recover these costs – but you’d be asking for around 11.3% more than what you paid just 1 year ago!

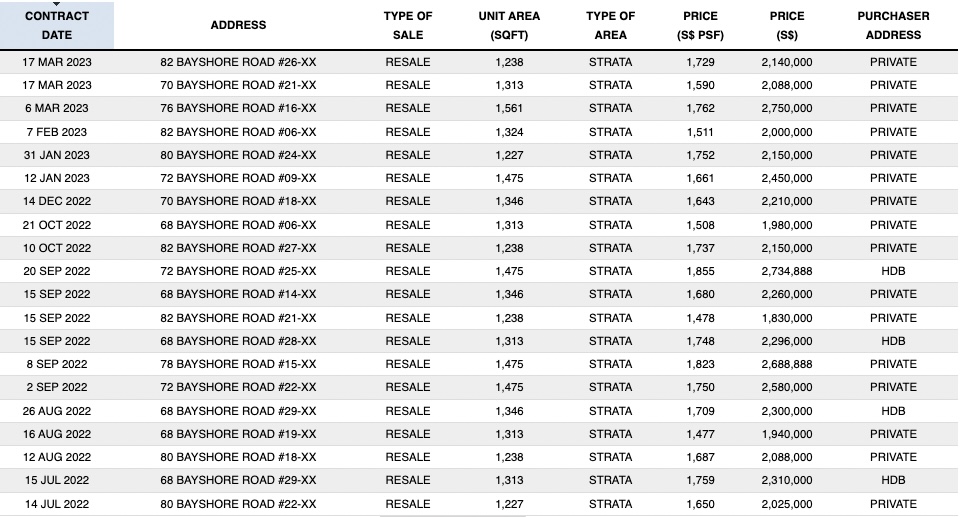

To be fair, $1.8m for a high-floor unit at Costa Del Sol with a sea view is actually a good price in today’s context. While we don’t have the specifics of your unit, 3-bedroom units with a sea view can go for $2m and above easily:

Let’s say if you do sell for $2m, you would’ve just covered your cost for stamp duties. In this case, we would rather bank on the certainty of not losing 8% over the next 2 years versus banking on the uncertainty of whether the market would drop by 8% or more in those 2 years.

If by then you’re still sitting on a profit, perhaps you can explore a younger leasehold property that also meets your own stay needs.

Assuming you can’t sell for higher than your buy price, selling now just to buy a younger property in hopes of better capital appreciation in the next 10 years is risky – can you really make back $203,600? And this is relative to Costa Del Sol’s performance.

These newer condos may have other shortcomings that hinder its capital appreciation in other ways. For example, if there’s an older resale development with a better layout/facilities and is huge so that it sees a large volume of transactions each year, then can we really assume that the newer condo would outperform the older one?

It’s not so clear-cut.

When you bought Costa Del Sol, what were the factors that pushed you to get the unit? Would these reasons continue to hold in the next 10 years? If so, then shouldn’t resale demand continue to hold in the area?

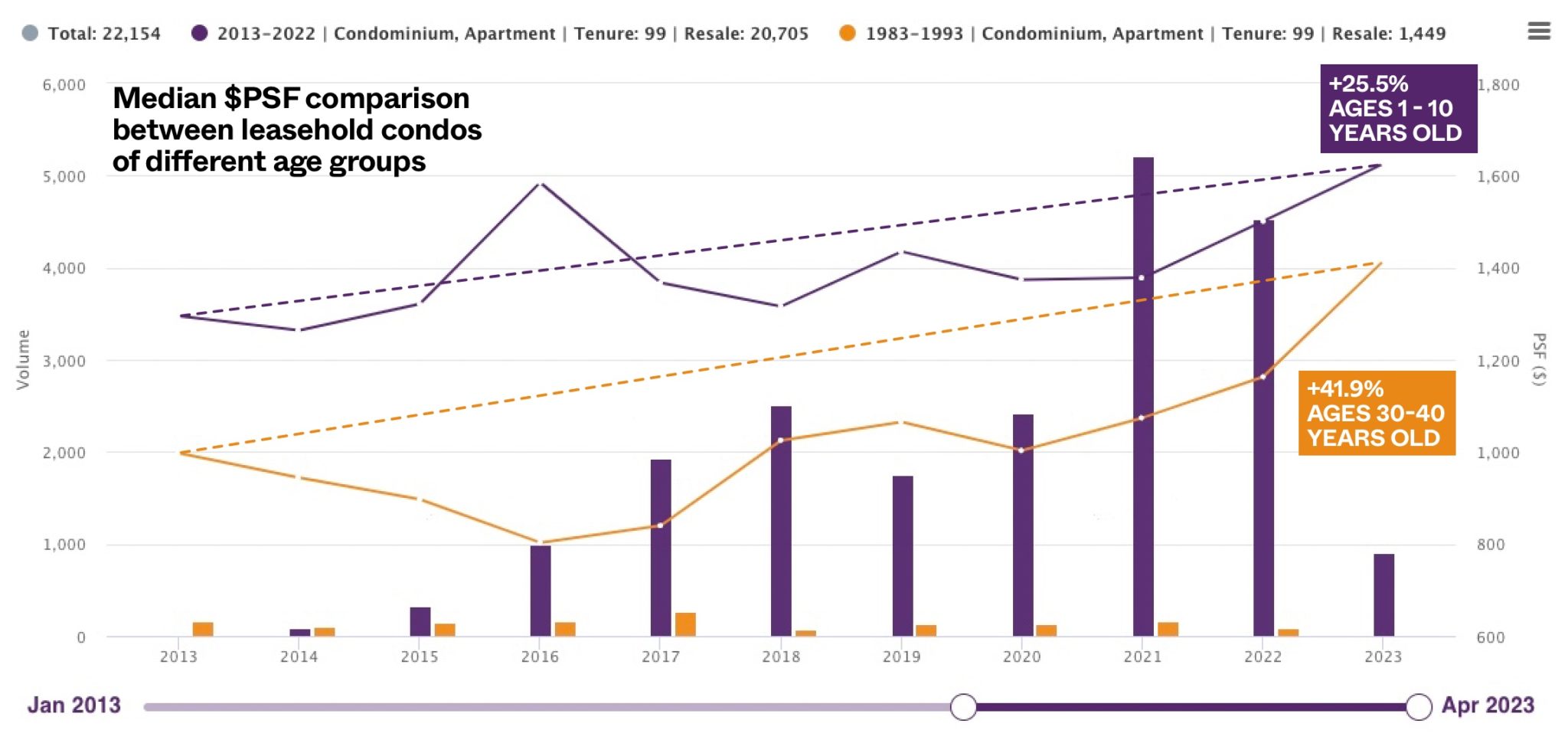

Just because they’re freehold or younger doesn’t mean they would necessarily make more money in the next 10 years. If we took into account all available transactions for condos of the 1-10 year category and 30-40 year category, here’s how their $PSFs moved:

During the property down market, older properties recorded a lower $PSF – on the contrary, newer ones managed to hold on to their pricing better. Yet in the wake of the pandemic, older leasehold properties caught up.

While it is a one-off event, most market cycles occur due to what we think of as “one-off events”. Few could have predicted the housing crisis of 2008, and even more so the recent pandemic. The next boom or bust in the property cycle is likely to be affected by yet another “one-off event” where people say this time it’s different.

As such, we think that to sell now and simply buy a younger property for the sake of being afraid that the property would lose money is pretty risky.

Why not just sell and wait?

Considering the 8% SSD, selling right now makes little sense.

Even if you sold it and waited, can you really recuperate the 8% loss from other investments? 8% is on your sale price, while the returns you’d make from the cash unlocked would probably be a lot less if you took a loan.

Why not just rent now and then sell when the SSD is over?

There’s nothing wrong with this option. Regardless of where the property moves, would you be happy to let go of it then? If this is an option, then perhaps it’s better to collect the rental first (after all you can raise it once it ends this year), then sell and purchase another property that meets both your investment and own stay criteria.

The real question is just whether you can find an alternative like Costa Del Sol that’s also younger which you can afford – and can hold its value for reasons other than age. Since we don’t have your financials, it’s hard for us to run your affordability numbers, so do bear in mind that in 3 years, the loan you could possibly take would be reduced as the tenure shortens.

Homeowner StoriesI Tried Renting Out My Own Home In Singapore: Here’s Why I Would Never Do It Again

by Ryan JTo conclude…

Predicting market movements is impossible, so we cannot give you a definite answer on when the best time to sell would be. Based on the data we have seen for older developments in the area, prices at Costa Del Sol should at least follow the overall market movement in the short to medium term. The upcoming MRT station may also help the project better withstand depreciation. Remember, the area has been lacking a convenient MRT connection for so long, that this would be a major upgrade – even if it may have been priced in already.

Since your desire to stay in a property with a sea view was one of the main reasons you purchased the unit, we suggest that you move in and enjoy it.

Of course, if you’re able to find another unit with similar features and better appreciation potential within your means, that would be a viable option as well. Seeing that if you were to move in, you’re planning to spend $80 – $100K on renovations, you may want to consider making this your permanent residence while using the property under your spouse’s name as an investment.

Whether you should rent out the unit until 2025 when your child graduates or move in now is a personal decision. Taking advantage of the current inflated rental market to earn the rental income could help with your mortgage repayments, and it would save your child the hassle of travelling a long distance to school. Ultimately, this decision is subjective and would depend on which option fits your lifestyle and/ or needs better.

In other words, don’t worry so much about losing money – your wife already owns a property, and assuming you haven’t bought a dud, you’re at least hedged in terms of real estate inflation.

While it’s no guarantee you won’t lose money, Costa Del Sol will continue to have reasons for being in demand – near an MRT, sea view, spacious home and good facilities.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

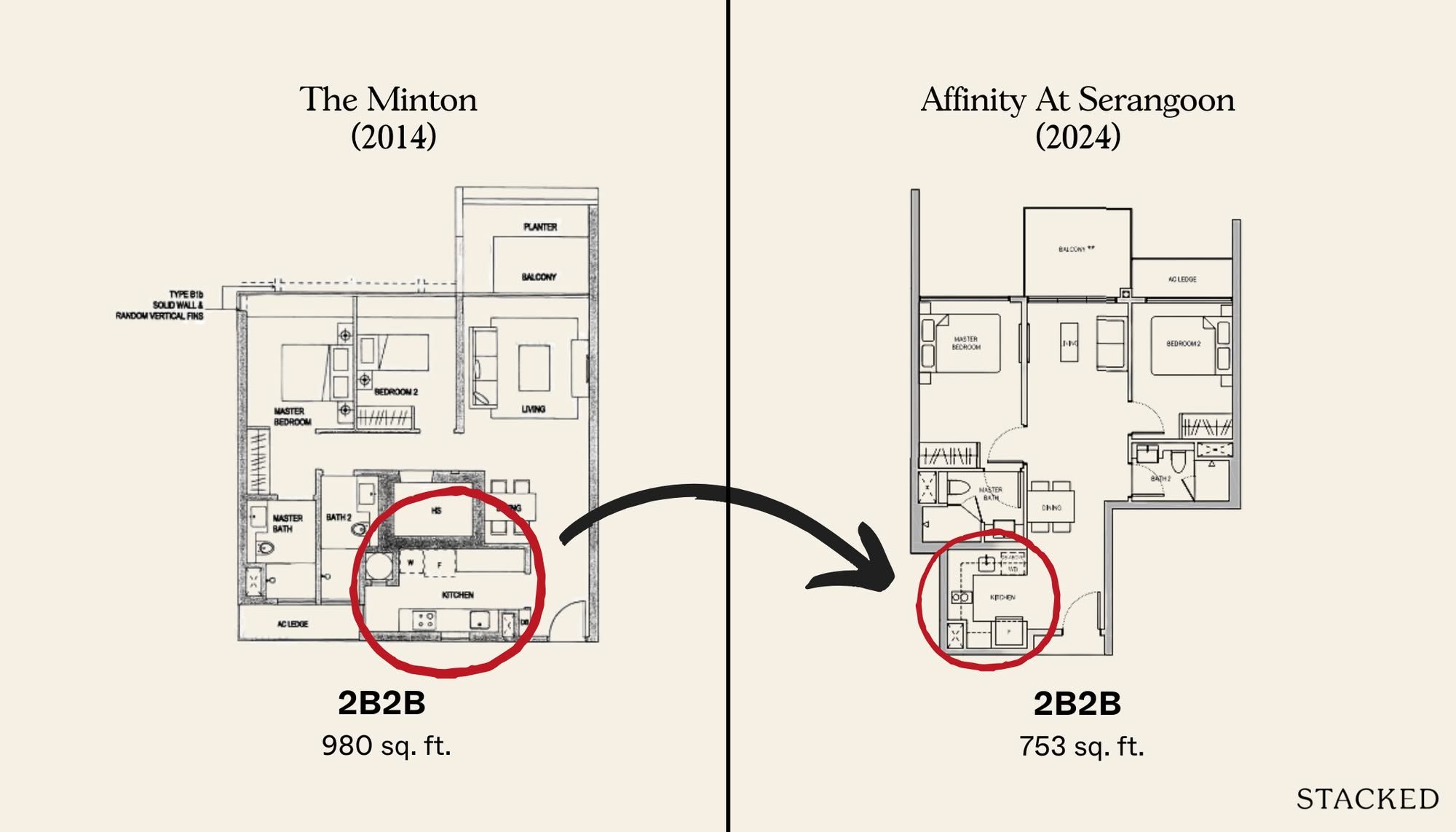

Property Advice The New Condos In Singapore With The Most Efficient Layouts In 2025 Revealed – And What To Look Out For

Property Advice The Hidden Costs of Hiring a “Cheaper” Agent In Singapore

Property Advice The Math Behind Why 30–35 Is The Sweet Spot To Upgrade From HDB To Condo

Property Advice The Ideal Size for Each Room of Your Condo to Actually Feel Liveable Revealed

Latest Posts

Singapore Property News How A Waterfront Development With 4,000 Homes Is Going To Reshape Singapore’s Property Market

On The Market 5 Rare HDB Flats Above 1,700 Sq Ft You Can Buy Right Now – From $850K

Pro District 15 Resale vs New Launch Condos – Analysing Price Gaps for Larger Family Units

Property Investment Insights Are Singapore’s Suburban Condos Still Affordable? The Surprising Truth

On The Market Rare 16,000 Sq ft Freehold Plot In D15 Hits The Market For $39M

Editor's Pick I Transformed My Two-Bedroom Unit Into A Dual-Key Layout – Here’s Why I Would Not Do It Again

Pro New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

Property Market Commentary Why More Families Are Choosing Two-Bedders Over Bigger Properties in 2025

Property Market Commentary What The URA Master Plan Reveals About Marina Bay’s Future (And How It Could Impact Property Values)

Editor's Pick We Toured An ‘Exclusive’ Freehold Landed Enclave In Singapore That Feels Close To Nature – And Even Has A Canal Running Through It

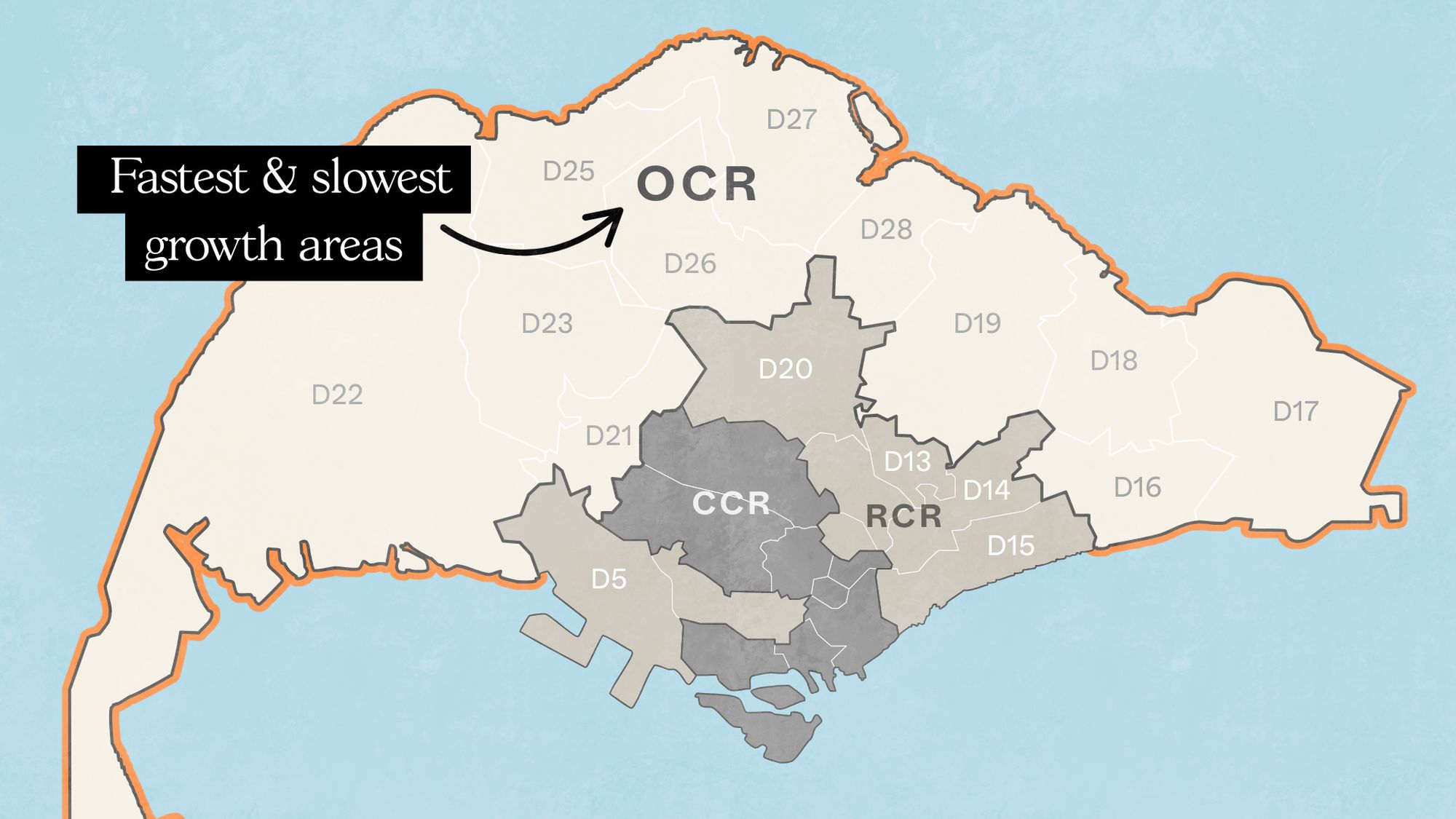

Singapore Property News Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

Editor's Pick I Left Singapore for New York and Ended Up Launching a $450M Manhattan Project. Here’s What I Learned About Buying Property Here

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Pro Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

Editor's Pick Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m