I’m An LGBT Person Under 35 With An Income Between $7k to $10k: Should I Rent While Waiting For HDB Or Buy A Resale EC?

April 8, 2023

Dear Ryan,

I came across the article you had written for a couple contemplating to upgrade to a condo from their current 4BR flat. It was helpful to see the chart where you compared purchasing a property at a lower price with higher interest rate as opposed to purchasing a property at a higher price with lower interest rate.

I am a (not so) young Singaporean with some limitations and unique circumstances which I have been finding it hard to find good / much advice on the web. One of my friends suggested that I write in to StackedHomes and here I am!

Any advice would be much appreciated!

Would also highly appreciate it if this enquiry can be kept anonymous as much as possible

Situation:

– LGBT person

– Under 35

– Current residence is too small to accommodate another person

– Both of us are below 35 and I turn 35 only next year

Current CPF + Cash = $150,000

Income: Below $10K

Despite the limiting circumstances, we still very much hope to make a good housing purchase for the long term.

This is the first time I am looking into purchasing a house, I would greatly appreciate it if you would be able to point out some of the things that inexperienced / first time buyers tend to overlook, that we would need to consider when purchasing our first (and hopefully last) property.

We hope to be able to live in a 2-3 bedroom flat that is around 10 years old.

I am looking at areas convenient to get to town, e.g. few stops from Dhoby Ghaut/ Bugis, or in the East. We try to avoid Yishun (though there seems to be some affordable ECs in the area).

Option 1:

Buy resale EC now, would really love to get one in Tampines but they look way over a million, so maybe would consider the cheapest available ECs.

EC budget: $1,000,000 (downpayment = $250,000, short of $100,000 currently) – are there any other legal avenues for loans out of the 75% that we can borrow from the banks?

Other costs to consider: Monthly maintenance of $400

Is it generally true that ECs tend to peak at 8 years and will they appreciate even more after turning private after 10 years? Would this be sort of a good short-term investment decision where we stay in the EC for 2-3 years and then sell (at its 8th year/ 10th year) to purchase a resale HDB after? To ease the financial burden of maintenance costs and also perhaps move to a location of higher preference.

Investment is not the main motivation, but rather maximizing what we have within our current circumstance for a comfortable home.

Would the transactional costs of selling this place and the trouble of shifting house end up not saving us any money but instead becoming a whole load of trouble?

Option 2:

Rent first and wait one more year to purchase a resale 3 BR flat?

Rental budget/ month: $3000 x 12 months = Pay $36,000 till I turn 35 and am eligible to purchase a HDB

Dream home:

I am currently looking at a 3 BR flat in Bishan, and it currently costs about 1 million as well.

Based on CNA’s January report (HDB resale flat prices up 10.3% in 2022), it is more than likely that this 1 million property would also increase by around 10% or more when I turn 35, is this right?

(P.S. We have considered staying with parents/ spending less on rental by living in single room/ co-share spaces, but do not see them as viable solutions due to personal reasons. We are also not considering BTO due to the limitation on space and urgency of moving in together.)

Comparing the above 2 options, which one would make more sense in the near 3-5 years outlook?

Please let me know if this is the right avenue to be making this enquiry, and if there is a more appropriate one for reaching out to.

Thank you!

Cheers.

Hey there,

Thank you for writing in and apologies if this took a while to reply, we’ve really been quite flooded with questions!

Naturally, the situation that you find yourself in is something that is getting increasingly common, but not as much talked about (in terms of online articles, at least).

We empathise with your situation and recognise that it can be challenging to navigate family dynamics, and on top of that, as a first-time home buyer, the process of purchasing a property can be quite overwhelming and confusing.

There’s definitely a lot to mention when it comes to buying a home for the first time, and while we can’t showcase everything right now, we do have a section in which we’ve compiled everything you need to know that you can refer to right here.

So yes, while there are many factors to consider, one of the most important things to do is to first establish a budget for your home purchase which will help to narrow down your search to properties that are within your means.

In this article, we will run through the following:

- Your affordability

- Options available

- Things to take note of as a first-time home buyer

So let’s start by first determining your affordability!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

For a private property

| Description | Amount |

| Maximum loan based on the age of 34 with $7k fixed monthly income | $806,426 |

| CPF funds + Cash | $150,000 |

| Maximum affordability based on a 25% downpayment of $150,000 | $600,000 |

| BSD based on $600,000 | $12,600 |

| Estimated affordability | $587,400 |

For an HDB

| Description | Amount |

| Maximum loan based on the age of 35 with $7k fixed monthly income | $397,850 |

| CPF funds + Cash | $150,000 |

| Total loan + CPF + Cash | $547,850 |

| BSD based on $547,850 | $11,035 |

| Estimated affordability | $536,815 |

We understand you mentioned your dream home is a resale flat in Bishan costing around $1M. Frankly, this would be difficult to achieve with your existing finances. Ironically, private properties are more affordable in that the TDSR is 55% unlike with HDBs where the MSR is 30%. We’ll delve into that later on in more detail.

So what are your options?

1) Buy a freehold condo now

Doing a quick search on the property portals, the number of private properties that fall within your budget is very limited. The majority of them are 1 bedroom apartments in freehold boutique developments located in Geylang.

This is a common misconception that buyers have – that a freehold property is better than a leasehold property. While freehold definitely holds its value in the long-term compared to leasehold, the property’s appreciation really depends on many other factors, of which tenure is just one of them.

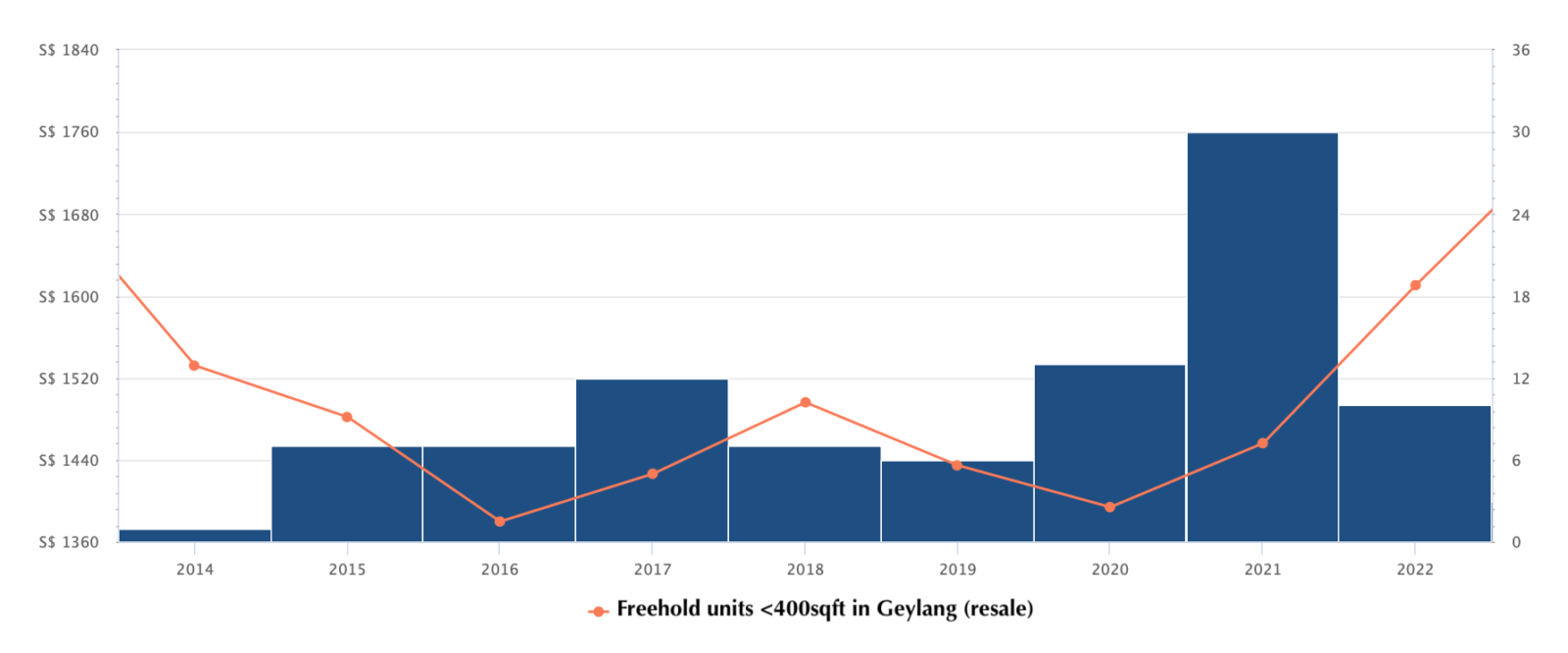

Let’s take a look at how these freehold 1 bedders in Geylang have been performing.

A quick search online shows that most 1 bedders in this area within your affordability are below 400 sq ft, so we’ll use $PSF data for such units:

| Year | Avg PSF of freehold units <400sqft in Geylang (resale) | YoY | Avg PSF of private non-landed (resale) | YoY |

| 2014 | $1,532 | $1,190 | ||

| 2015 | $1,482 | -3.26% | $1,190 | 0.00% |

| 2016 | $1,380 | -6.88% | $1,249 | 4.96% |

| 2017 | $1,426 | 3.33% | $1,292 | 3.44% |

| 2018 | $1,496 | 4.91% | $1,324 | 2.48% |

| 2019 | $1,435 | -4.08% | $1,344 | 1.51% |

| 2020 | $1,394 | -2.86% | $1,294 | -3.72% |

| 2021 | $1,456 | 4.45% | $1,345 | 3.94% |

| 2022 | $1,611 | 10.65% | $1,455 | 8.18% |

| Annualised | 0.63% | 2.55% |

We can see from the graph that prices of these units have been on the uptrend since the pandemic but if we were to look at the overall annualised growth rate over the last 8 years, it is only at 0.63% which is much lower compared to the overall growth rate of non-landed private properties.

There are several reasons why boutique condos in this area typically (again, it really depends on the individual property) don’t perform as well as larger, more conventional condo projects. This could be due to:

- Limited appeal: Boutique developments in such places tend to attract either rental investors (due to the high yield and freehold status) or those with limited budgets. This limited appeal can result in slower sales and difficulty finding buyers, leading to lower demand and prices. Investors also earn from rental income and would be more willing to let go of the property for lower than what a homeowner would be willing, especially since homeowners tend to need the money to move somewhere else.

- Lack of amenities: Larger condo projects often offer a wide range of amenities, such as swimming pools, gyms, tennis courts, and various communal areas, which can be attractive to buyers. Boutique condos may not have the space or budget to provide the same level of amenities, which can make them less desirable to some buyers.

- Resale value: The lower transaction volumes of boutique condos can make it challenging for their resale value to increase, as banks typically assess the value of a property based on recent transactions within the same development.

But let’s assume you were to purchase one of these 1 bedroom units in Geylang now at $580,000 and hold it for a period of 5 years.

Costs include interest expense, stamp fee, maintenance fees which we have set at $300/month and property tax. Here we are using an interest rate of 4.25% on a $430,000 loan (putting in the full $150K you have) with a 30-year tenure.

| Time period | Total costs | Total gains | Profit |

| Starting point | $12,000 | $0 | -$12,000 |

| Year 1 | $34,111 | $3,654 | -$30,457 |

| Year 2 | $55,908 | $7,331 | -$48,577 |

| Year 3 | $77,377 | $11,031 | -$66,345 |

| Year 4 | $98,503 | $14,755 | -$83,749 |

| Year 5 | $119,274 | $18,502 | -$100,772 |

Given its annualized growth rate of 0.63%, it would not be sufficient to offset the elevated interest rates, which could result in a potential loss of $100K over a short span of 5 years.

2) Renting for a year and buying an HDB after

Now let’s see on the other hand if you were to rent for a year and buy an HDB after.

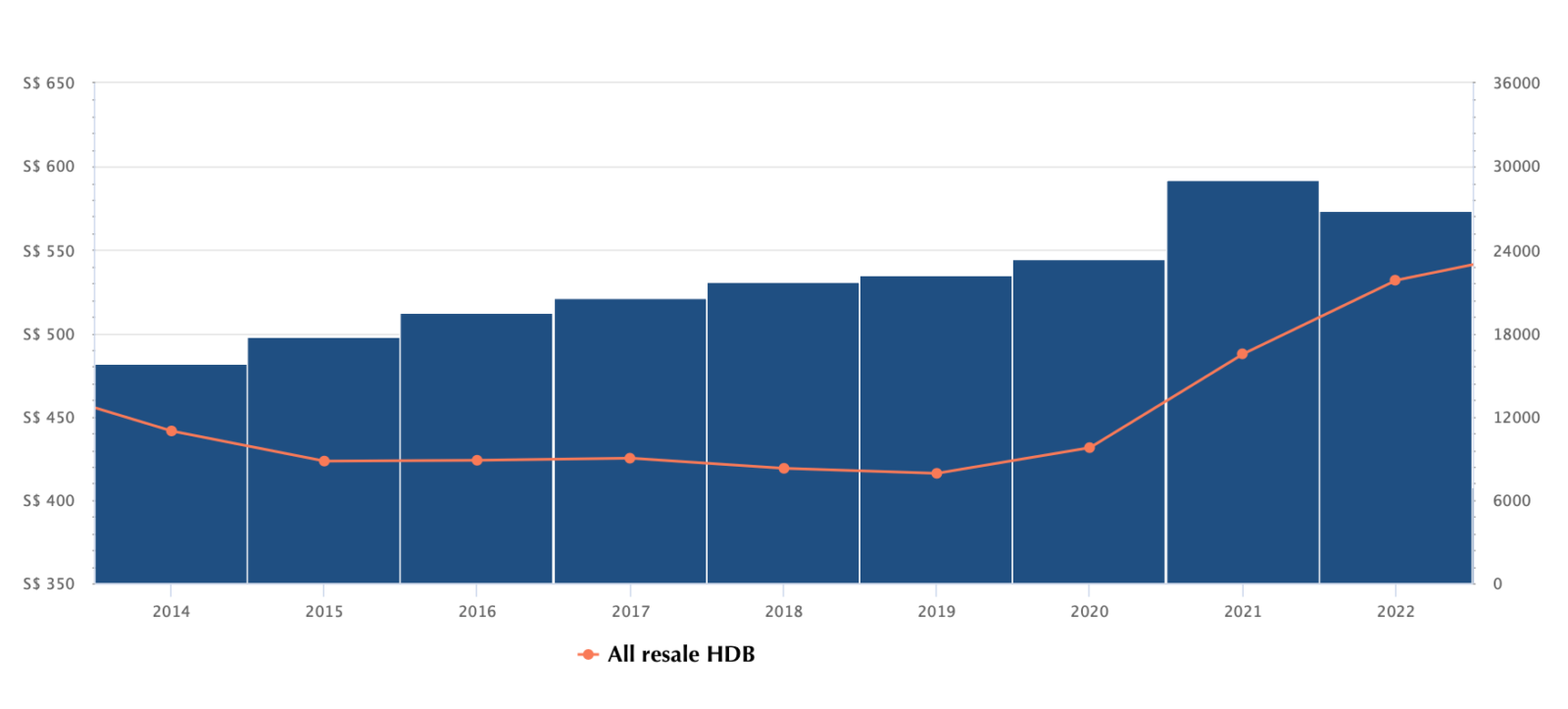

| Year | Avg PSF of all HDBs | YoY |

| 2014 | $441 | |

| 2015 | $423 | -4.08% |

| 2016 | $424 | 0.24% |

| 2017 | $425 | 0.24% |

| 2018 | $419 | -1.41% |

| 2019 | $416 | -0.72% |

| 2020 | $431 | 3.61% |

| 2021 | $488 | 13.23% |

| 2022 | $532 | 9.02% |

| Annualised | 2.37% |

We can see from the above graph and table that HDB prices have gone up significantly in the last two years bringing the annualised growth rate up to 2.37%. We are using this as a general guideline in our calculations but the actual growth rate of the unit may vary depending on factors such as its location, age, size, and condition.

Let’s assume you were to buy an HDB at $530,000. We will also assume you’re taking a bank loan as you do not qualify for an HDB loan due to your income.

Costs include interest expense, stamp fee, service and conservancy fees which we have set at $80/month and property tax. Here we are using an interest rate of 4.25% on a $380,000 loan with a 25-year tenure.

| Period | Total Cost | Total Gains | Profit |

| Starting Year | $10,500 | $0 | -$10,500 |

| Year 1 | $28,493 | $12,561 | -$15,932 |

| Year 2 | $46,091 | $25,420 | -$20,672 |

| Year 3 | $63,277 | $38,583 | -$24,694 |

| Year 4 | $80,032 | $52,059 | -$27,973 |

To ensure that the time period is consistent with buying a condo presently, we will look at Year 4 because you’d have to rent for one year before you’re eligible to buy an HDB. Taking the rent of $36,000 which you’ve quoted into account, the total losses after 5 years is -$63,973.

While buying an HDB could result in a loss in 5 years due to the rental and interest costs, it could still make more sense given the lack of growth for such small boutique developments that have limited appeal.

Having an income over $7K could also mean you won’t be eligible for the CPF Housing Grants. However, if somehow you do qualify (e.g. average income does fall below this amount over the next year), then the grants could amount to $25K (5-room flat purchased) or $40K (2 to 4-room flat purchased). You may also qualify for the Proximity Housing Grant of $10K if you stay within 4KM of your parents’ place. Note that there is no income ceiling for the Proximity Housing Grant.

3) Rent now while saving up to afford a resale EC

You mentioned that for a $1 million dollar EC, you’ll need $250K in downpayment. This is correct in that you’ll need 5% of it in cash, and 20% of it in cash/CPF. It may be possible to take a loan of $100K, but this type of loan generally costs more and is usually based on your personal income which makes it tough to get such a quantum given a $7-10K income. Moreover, the repayment period is pretty fast too, and certainly cannot be amortised over 30 years, unlike a property loan.

Another problem with taking a loan is the increase in your TDSR which will subsequently impact your mortgage loan (we will elaborate on this further in the article).

The subsequent chart illustrates the duration needed to accumulate the $100K through the different savings rates. This rate depends on mainly your rental cost and lifestyle choices. Let’s assume you earn an average of $7K – $10K which is $8.5K and part of this is used to pay for your rent.

Here’s how long it takes to save $100K with the different savings rates:

| Period | Savings (10% Savings) | Savings (20% Savings) | Savings (30% Savings) |

| End Of Year 1 | $24,204 | $32,364 | $40,524 |

| End Of Year 2 | $50,004 | $66,324 | $82,644 |

| End Of Year 3 | $77,316 | $101,796 | $126,276 |

| End Of Year 4 | $105,636 | $138,276 | $170,916 |

| Est. Months Taken To Save $100K | 46 Months | 36 Months | 29 Months |

As you can see, saving just 10% of your income would take you close to 4 years to save up $100K. This may or may not play out in your favour depending on the property market growth over the next couple of years as well as the interest rates.

Apart from the duration of having to save up $100K (and having to pay rent), the options that you can get in the resale EC market would generally be a newer 2-bedroom unit or an older 3-bedroom unit. Here are the most recent transactions for resale ECs:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date | Tenure |

| SOL ACRES | 992,000 | 710 | 1,396 | 24-Mar-23 | 99 yrs from 02/06/2014 |

| THE AMORE | 960,000 | 764 | 1,256 | 24-Mar-23 | 99 yrs from 30/10/2013 |

| NORTHOAKS | 1,000,000 | 1238 | 808 | 24-Mar-23 | 99 yrs from 16/12/1997 |

| THE VALES | 985,000 | 764 | 1,289 | 22-Mar-23 | 99 yrs from 19/05/2014 |

| THE VALES | 999,999 | 764 | 1,308 | 15-Mar-23 | 99 yrs from 19/05/2014 |

| THE BROWNSTONE | 970,000 | 753 | 1,287 | 10-Mar-23 | 99 yrs from 28/04/2014 |

| THE VALES | 985,000 | 764 | 1,289 | 9-Mar-23 | 99 yrs from 19/05/2014 |

| BLOSSOM RESIDENCES | 950,000 | 753 | 1,261 | 8-Mar-23 | 99 yrs from 02/03/2011 |

| THE CANOPY | 868,000 | 872 | 996 | 3-Mar-23 | 99 yrs from 14/06/2010 |

| THE CANOPY | 930,000 | 872 | 1,067 | 3-Mar-23 | 99 yrs from 14/06/2010 |

| WATERCOLOURS | 830,000 | 743 | 1,118 | 27-Feb-23 | 99 yrs from 10/01/2012 |

| PRIVE | 1,025,000 | 829 | 1,237 | 24-Feb-23 | 99 yrs from 14/09/2010 |

| ARC AT TAMPINES | 960,000 | 807 | 1,189 | 10-Feb-23 | 99 yrs from 22/02/2011 |

| THE TOPIARY | 1,020,000 | 904 | 1,128 | 7-Feb-23 | 99 yrs from 03/07/2012 |

| THE VALES | 953,888 | 753 | 1,266 | 3-Feb-23 | 99 yrs from 19/05/2014 |

| NORTHOAKS | 978,888 | 1249 | 784 | 31-Jan-23 | 99 yrs from 16/12/1997 |

| LILYDALE | 952,000 | 1195 | 797 | 27-Jan-23 | 99 yrs from 12/09/2000 |

| THE CANOPY | 990,000 | 1033 | 958 | 13-Jan-23 | 99 yrs from 14/06/2010 |

| SIGNATURE AT YISHUN | 880,000 | 764 | 1,151 | 12-Jan-23 | 99 yrs from 25/08/2014 |

| 1 CANBERRA | 1,050,000 | 936 | 1,121 | 11-Jan-23 | 99 yrs from 30/01/2012 |

| SUMMERDALE | 1,050,000 | 1216 | 863 | 5-Jan-23 | 99 yrs from 22/09/1997 |

| THE VISIONAIRE | 1,030,000 | 947 | 1,087 | 3-Jan-23 | 99 yrs from 09/01/2015 |

| THE CANOPY | 970,000 | 1033 | 939 | 3-Jan-23 | 99 yrs from 14/06/2010 |

So generally speaking, you can find a 3-bedroom for around $900K+ to $1M. If you’re willing to stay in a 2-bedroom, then you can get one at $800K+.

You did mention wanting to avoid ECs in far-flung places, however, most ECs are actually in the outskirts which is what makes them affordable.

Even then, this option would certainly be a stretch compared to buying an HDB. Assuming you are the sole breadwinner, banking on just your income could be risky since most of your liquidity would be tied up in the property. Moreover, you’ll need to pay the monthly maintenance fee given it’s a private condominium which would cost more than the conservancy charges for HDBs.

You also asked if ECs peaked at the 8-year mark and appreciate more after turning 10 years old. This is not something that can be generalised. In our study looking at profits for those who bought new ECs, it’s found that those who waited till the 10-year mark did make more than those who waited for the 5-year mark – but this is more likely due to the upward trajectory of the property market than specific traits of an EC.

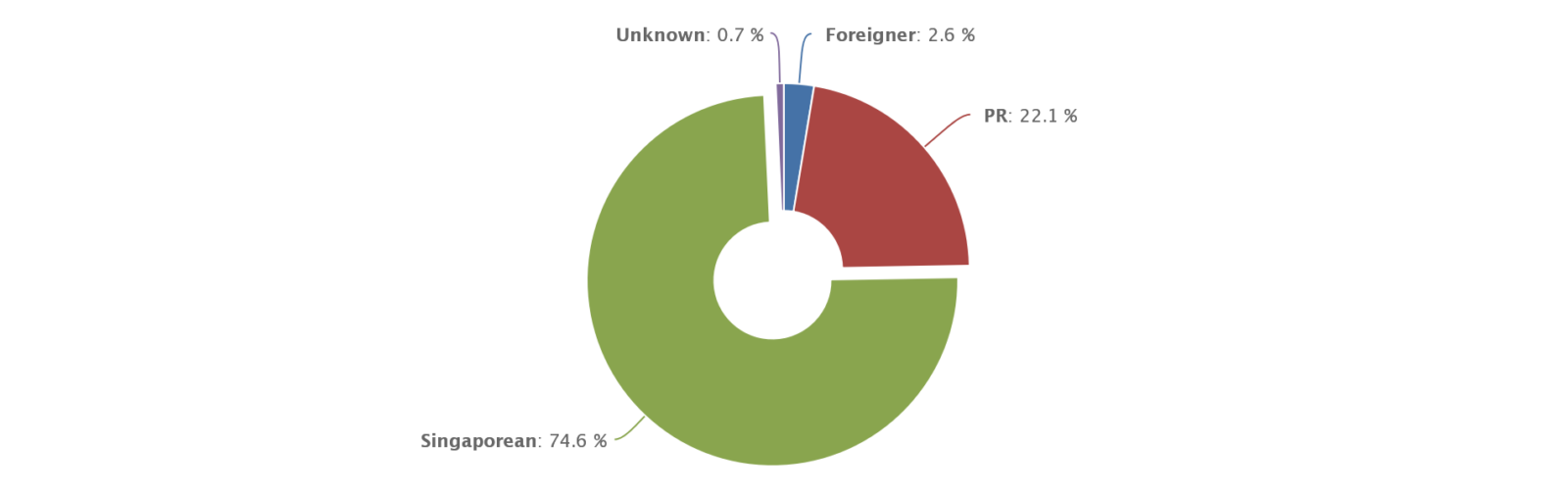

Even if the EC is fully privatised after 10 years, foreigners don’t make up a large enough proportion of buyers to skew prices upwards.

Here’s a look at the buyer’s profile for Northoaks EC (an EC well past its initial 10 years):

Less than 3% are owned by foreigners, with the majority being Singaporean Citizens and PRs who can purchase before the 10-year mark.

Now that we’ve shared more in detail about your 3 options, let’s briefly touch on the 2nd part of your question:

Things to take note of as a first-time home buyer

As a first-time home buyer, these are some noteworthy factors to consider especially if you’re weighing the options between an HDB and a private property. We have also recently written a guide on how to pick the right property as a first-time buyer.

MSR and TDSR

MSR stands for Mortgage Servicing Ratio, which is a measure of the percentage of a borrower’s gross monthly income that is needed to service their mortgage loan repayment, including principal and interest payments. The maximum MSR allowed for HDBs is 30% of a borrower’s gross monthly income.

On the other hand, TDSR stands for Total Debt Servicing Ratio, which is a measure of the percentage of a borrower’s gross monthly income that is needed to service all of their outstanding debts, including mortgage loans, car loans, credit card debts, and other personal loans. The maximum TDSR allowed for all debt obligations is 55% of a borrower’s gross monthly income. TDSR is used when calculating the eligible loan amount for private property which explains why the loan amount is usually higher than that of HDB loans.

For example, for a 35-year-old buyer that earns $10K a month with no other debt obligations, he can loan up to a maximum of $568,357 for an HDB and $1,152,037 for a private property.

However, if this same buyer has a monthly debt obligation of $2K which is 20% of his monthly income, his maximum loan for an HDB will remain unchanged at $568,357 but the maximum loan for a private property will be reduced to $733,114. This is because he can only utilise the remaining 35% of the TDSR for the mortgage loan.

HDB loan vs Bank loan

One issue with taking an HDB loan is your eligibility. As you currently earn between $7K to $10K, you’re likely not eligible to benefit from the stable and relatively low-interest rates as compared to a bank loan. That being said, if you somehow do qualify, it would be recommended to take the HDB loan in today’s interest rate environment. Here are some of the differences:

| HDB Loan | Bank Loan | |

| Interest rates | HDB loans have a fixed interest rate that is pegged at 0.1% above the prevailing CPF Ordinary Account interest rate. This is currently at 2.6% per annum. | Bank loans, on the other hand, have fixed or floating interest rates that can vary depending on market conditions. |

| Loan amount | The maximum loan amount is up to | The maximum loan amount is up to 75% of the purchase price or valuation of the property, whichever is lower. This is also dependent on the borrower’s creditworthiness. |

| Downpayment | The minimum downpayment is | The minimum downpayment is 25% of the purchase price or valuation of the flat, whichever is lower. Of this 25%, 5% has to be paid in cash, while the remaining 20% can be paid with CPF funds. |

| Repayment period | The maximum repayment period is 25 years. | The maximum repayment period can go up to 30 years or more. |

| Eligibility criteria | Your average gross monthly household income must not exceed: $7,000 for singles $14,000 for families $21,000 for extended families | No limitations on income |

| Prepayment penalty | No prepayment penalty, which means that borrowers can make early repayment without incurring any penalty fees. | Some bank loans may have prepayment penalties, which means that borrowers may be charged a fee for making early repayment. |

| Switching out | You can switch to a bank loan, but you cannot go back to an HDB loan once you do so. | You cannot switch to an HDB loan once you go with this option. You can refinance your home with another bank subject to the existing loan conditions. |

How will CPF usage affect your sale proceeds in the future?

When you use CPF to pay for your property, you are essentially borrowing from your future retirement savings to finance your home.

When you sell your property in the future, the CPF funds that you have used, plus accrued interest, will need to be returned to your CPF Ordinary Account (These funds can then be used to purchase your next property). This means that the amount of cash you will receive from the sale proceeds will be reduced.

For example, you purchase a property for $500,000 and use $200,000 from your CPF to finance the purchase. Over the years, the CPF used, plus accrued interest, may have increased to let’s say $250,000.

If you sell the property for $600,000, you will need to return the $250,000 to your CPF account, leaving you with $350,000 in cash proceeds. If you had not used CPF to finance your property purchase, you would have been able to withdraw the full sale proceeds of $600,000 as cash.

There are cases where owners face a negative sale not because their property did not appreciate but because the accrued interest on their CPF used has compounded so much over the years that they do not receive any cash proceeds from the sale of their property.

That being said, if you are able to utilise your cash to generate better returns than the accrued interest, then this could make sense. This may make sense during a high-interest rate environment like this as it’s easy to get a deposit above the existing CPF interest rates.

Other costs involved in owning a property

- Property tax: The tax amount is calculated based on the annual value of the property and is payable annually to the Inland Revenue Authority of Singapore (IRAS).

- Maintenance fees: Whether you own a private property or an HDB flat, you will need to pay monthly maintenance fees to the management corporation or town council for the upkeep of the common areas and facilities. However, HDBs have a cheaper maintenance fee, but if you do own a car, paying for season parking at an HDB could bring this value closer to a condo’s maintenance fee.

- Insurance: It is important to get insurance coverage for your property, such as home insurance, fire insurance, or mortgage insurance, to protect against unexpected events.

So what does this mean for you?

We’ve elaborated on the 3 options that were mentioned: buy a private property now, rent now then buy an HDB, or rent now and save up to buy an EC.

Considering your current situation, honestly, the options for private property are limited and not ideal. Those within your budget are shoebox units within less unfavourable locations and you will also be making a sacrifice in terms of lifestyle given such units are very small.

Your second option is to rent now and wait till you turn 35 to buy the HDB. While renting for a year incurs additional costs, buying an HDB may be a better choice as you will have more options to choose from. With a budget of $530K, you can get a 3 or 4-room flat under 10 years old but you’ll most likely have to look at the outskirt areas. That said, you may qualify for grants too which can help defray some of the costs. Given the lower loan quantum, your interest expense would also be more manageable. There’s also less stress given you are the only party to service the mortgage payment.

Your third option is to wait till you can save enough to buy a $1 million dollar resale EC. This would likely be a 2 or a 3-bedder. Factors to consider here would be whether having facilities is important, whether you’d be comfortable taking on a bigger loan (compared to an HDB) by yourself, and also the high-interest costs that come with it. You’ll also incur more expenses due to the maintenance fee. Doing so would also mean having to rent for a couple of years so you can save up $100K – by then, prices may even have moved up, so it could take longer (or shorter if it’s the other way).

As such, for your 3-5 year horizon, it would be best to purchase an HDB with a lower financing cost, and perhaps when your situation changes down the line, you could choose to upgrade to a private property/EC. You may also come to learn more about your taste and preferences in your new home to make a better property decision later on.

Many home buyers may assume that their first home will be their last, but often their housing needs and lifestyles change over time. While you technically can take out a personal loan for the down payment, doing so will affect your TDSR and may impact your mortgage loan. A personal loan attracts high-interest rates and has a much lower repayment period. It’s best to exercise prudence and avoid stretching your finances too thin. Perhaps when you have accumulated more funds down the road, you can then consider upgrading to a private property if you wish.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

5 Comments

Hi, LTV for HDBs has decreased from 85% to 80%. Thanks!

**HDB loan

Hi, is there a mistake on the saving duration calculation? Using $10k monthly salary, if saving of 10% how can we get to $24k at the end of year 1, and $50k at end of year 2 etc? Base on my napkin calculation with $10k monthly salary and saving of 10% will only yield around $12k savings at the end of year 1, even at 4% deposit rate quite impossible to boost it to $24k by the end of year 1. Please advise