“I Regret Waiting For The Cooling Measures To End” 4 Homebuyers Share Their Property Investment Mistakes

October 23, 2023

The tricky part about Singapore’s residential market is its dynamism: cooling measures can appear overnight, and the supply of housing is subject to five-year feast-and-famine cycles. These can make a lot of otherwise sensible housing decisions at that time look… well, dumb in hindsight. We’ve collected some stories of home buyers and investors, who can’t believe some of their previous decisions. Perhaps there are lessons to be found in the following:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Deciding to wait for “temporary” cooling measures to end

GT had just missed the deadline to purchase a second condo unit, back in 2011. He says that:

“Around 2011, we were considering if it was worth it to buy a ‘mickey mouse’ unit, because my daughter was renting a flat there with her partner. So we thought they can live there until they buy their own place, and later we can rent it out. But we ding-donged on the decision, and at the end of the year the government imposed the three per cent ABSD.

At the time we believed the ABSD to be a temporary measure. So I asked my agent if I should wait until the ABSD was removed, and she said that was also a viable option. So I listened to her and waited.

Then in 2013, the ABSD increased to 10 per cent. And in June of the same year, they also passed the TDSR framework. I could sense where the wind was blowing, so I just gave up and bought. In the end, I got a unit that I didn’t like as much, and I paid seven per cent ABSD for no reason.”

GT also says that, in the process of waiting, property prices had risen from around $1,100 to over $1,300 psf, on top of the added ABSD.

In all fairness to GT though, even some industry analysts, and many of us (this was before Stacked was set up) also thought the measures were “temporary.” One realtor told us that, at the time, there were even suggestions of using a Deferred Payment Scheme (DPS) because of the chance that cooling measures would be over after the two-year deferment.

GT’s experience mirrors that of many who tried to outwait the government’s cooling measures, hoping they’d be rolled back. To put this into perspective, today, Singapore citizens are contending with an even steeper ABSD of 20 per cent for their second property purchase. If anything, this makes GT’s ordeal from nearly a decade ago seem almost tame by comparison.

Property Picks10 New Launch Dual Key Units Still Available In 2023 (To “Avoid” ABSD)

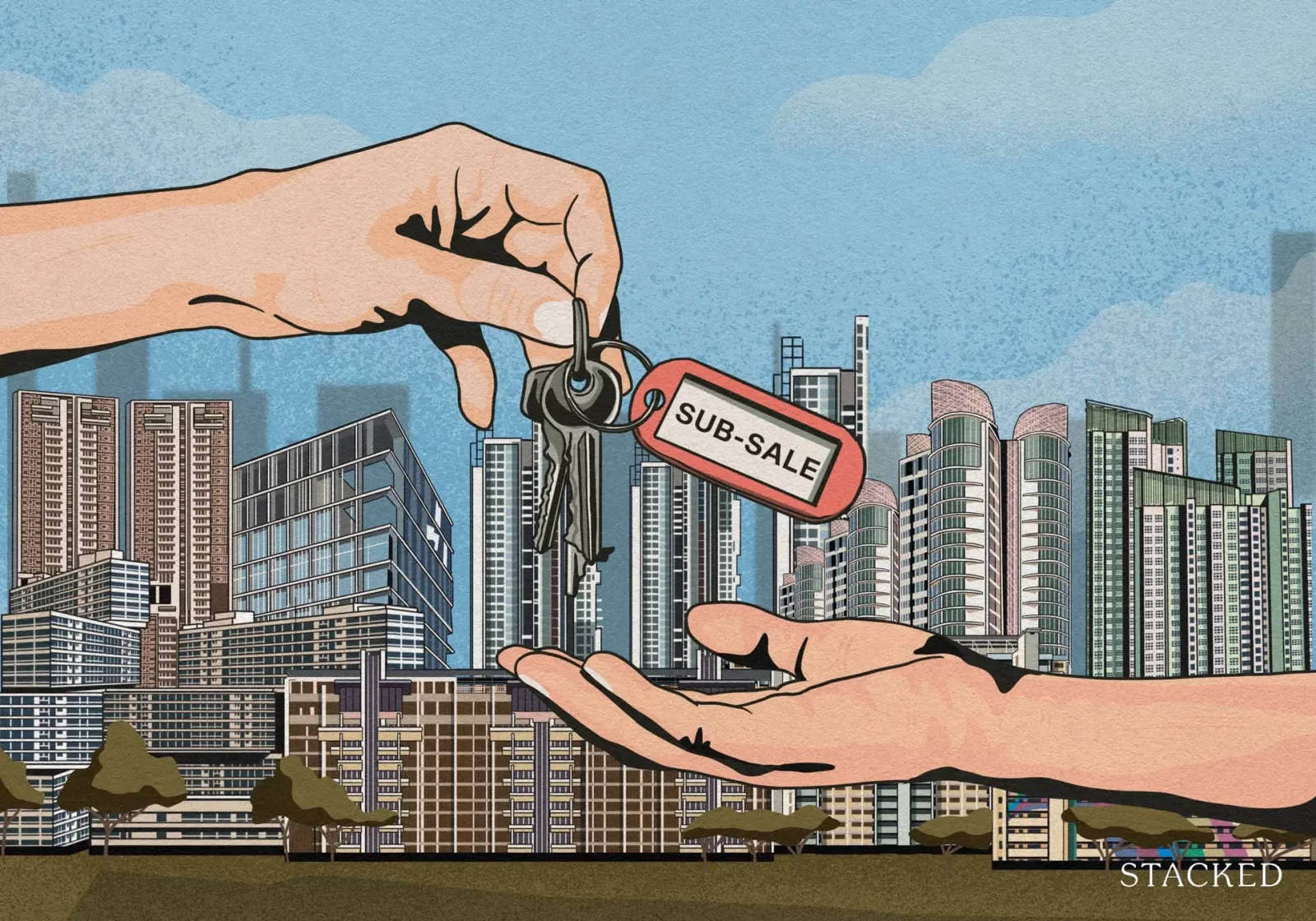

by Ryan J. Ong2. A sub sale transaction that led to 4.5 years of renting

A reader who calls himself Dom once told us about a sub sale transaction, in which he sold his unit one year from completion:

“The condo was about five minutes’ walk from my office, and only one train stop from my in-laws’ place. It was perfect for us. But the buyer was motivated, and we would have seen a good return, even after the seller’s duty.

I think we also got ‘psychoed’ by the buyer’s agent, who gave us ideas like taking the money and straightaway buying a bigger unit.

But it was a mistake, because after we sold we couldn’t find anything appropriate. In the end we rented at a few places over two years, then almost bought a unit – but backed out again. Then we rented two other places over the next 2.5 years, until eventually we bought our current unit.

The stupid part is that it’s less than one km from the unit we initially bought anyway. I can literally see our old condo from my balcony. So we just flushed away money for rental for nothing.”

Dom says that, in hindsight, he may not have been mentally ready to buy the unit. He says he had been “wavering due to some cognitive dissonance after buying,” which made him much more receptive to the sub sale offer.

More from Stacked

Why Some Old HDB Flats Hold Value Longer Than Others

The HDB situation in Singapore is unprecedented, and we mean that quite literally. Singapore’s public housing system - which is…

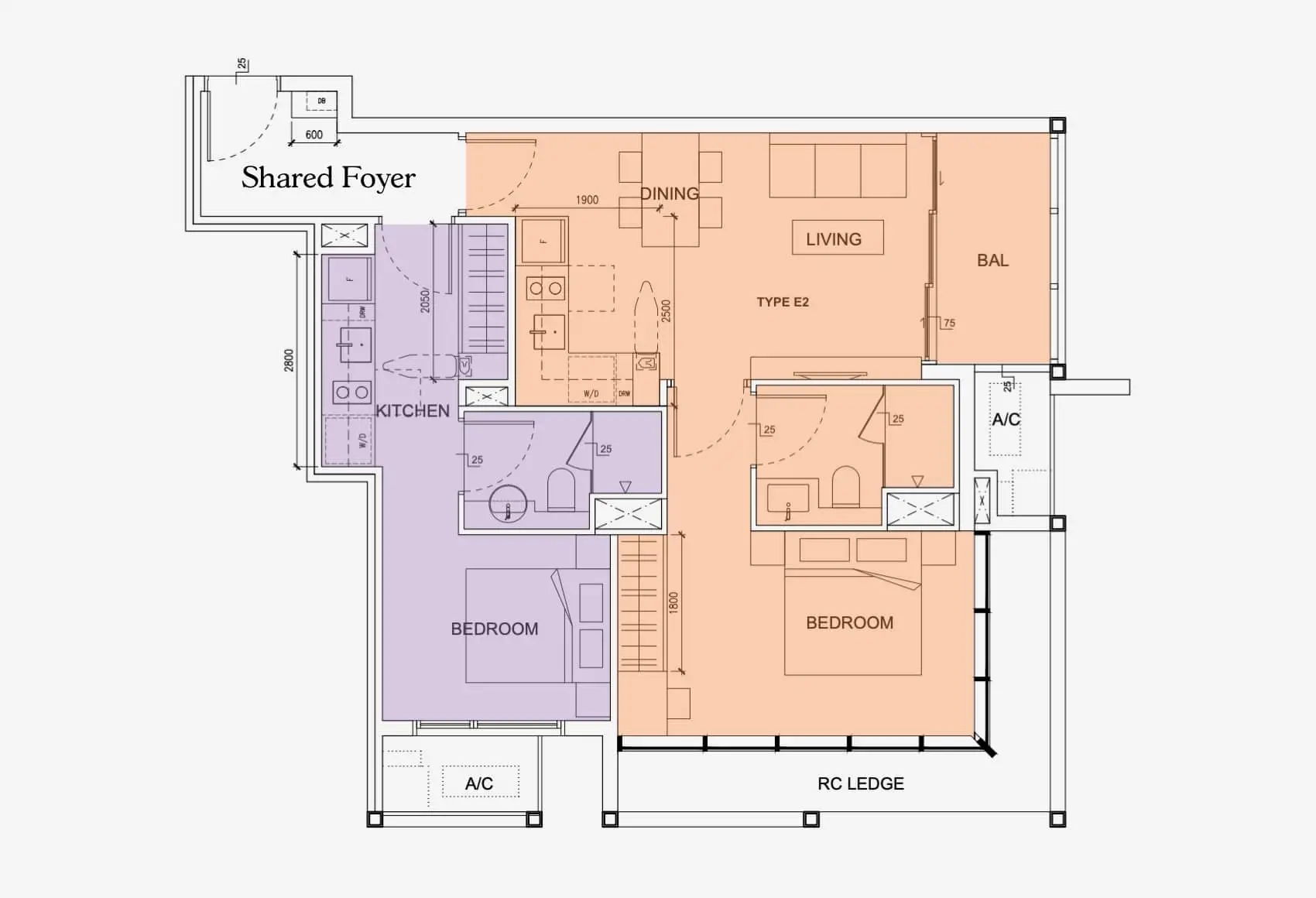

3. Buying two units, both of which are too small

SJ says he was enthusiastic about property investment from a young age, and even enjoyed visiting show flats in his 20’s. As such, he was too eager to quickly build a property portfolio.

“My income was relatively high for my age,” SJ says, “Although I did end up roping in my dad and later my uncle. Before I was 30 I had bought one unit with my dad as a co-borrower, and a second unit with my uncle as a co-borrower. Both were one-bedders, which I intended to rent out while I was still staying with my dad.”

The reason for buying the one-bedders was simply affordability, as SJ didn’t yet have the capital for a larger three or four-bedder. Unfortunately, SJ didn’t foresee that he would be settling down, around four to six years after buying each unit.

“Both were one-bedders, so they were not really big enough for a family. So I had to talk to my dad and uncle about liquidating them. They were not very happy, as in 2017 the market was not so good. I do feel quite dumb for not looking further ahead; but I feel the most guilt at roping in my family, and causing a lot of inconvenience.”

Fortunately for SJ, he says both units were still profitable, although he would have gained significantly from a longer holding period.

4. Buying a home just to be near Raffles Institution, then sending the children abroad instead

PC and his wife were big believers in education, and had bought a semi-detached house close to the venerated Raffles Institution (RI). This was despite the warning of the property agent, who said the sellers’ asking price was substantially above average for the given location.

“But we understood it’s rare for these types of houses to be available, and we liked the existing house so it would need very little renovation” PC says, “So we decided to bite the bullet and meet the seller’s price, even though the east side is actually our preference.”

PC says that, even after moving to their new house, the family still spent most of their time driving to the Marine Parade area. They never really got used to the surroundings of their new home. But to make it worse, a decision was eventually made to go to a different school.

“One of our relatives had moved to Australia, and offered to take in our two children if they wanted to study there. Both wanted to go overseas. My oldest son went first, his brother followed the next year. Then I felt dumb and I asked myself, what’s the point of paying so much, when we don’t even really like the place?”

PC still hasn’t moved over the past few years, as he loathes having to pack and unpack everything; but he has vowed that the next move will only happen at a “reasonable” price, and only to a place he truly likes.

Do you have any stories of property decisions you regret? Do reach out to us and let us know. You can follow us on Stacked for more homeowner experiences, as well as in-depth reviews of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments