I Own A 4-Room 1985 HDB: Should I Sell To Buy A PLH BTO In Kallang Instead?

October 25, 2024

Hi,

I wish to seek advice on whether to get a second BTO or stay at my current one.

I’m in my mid 30s and currently own a 4-room flat from 1985, with less than $150k remaining on the mortgage. As a single parent earning $5k a month, I recently received a low three-digit ballot number for a 4-room PLH BTO in Kallang/Whampoa, and I can afford the 10% down payment as early fees. I plan to sell the current place just before collecting the key to the new place, while asking for extension during the transitioning period.

Given my goal to retire in 15 years and eventually migrate overseas, would it be wise to go ahead with this BTO purchase, or should I stay in my current flat? What would be the least disruptive way to do the selling of the old flat?

Thank you.

Hi there,

Thanks for writing in with your inquiry.

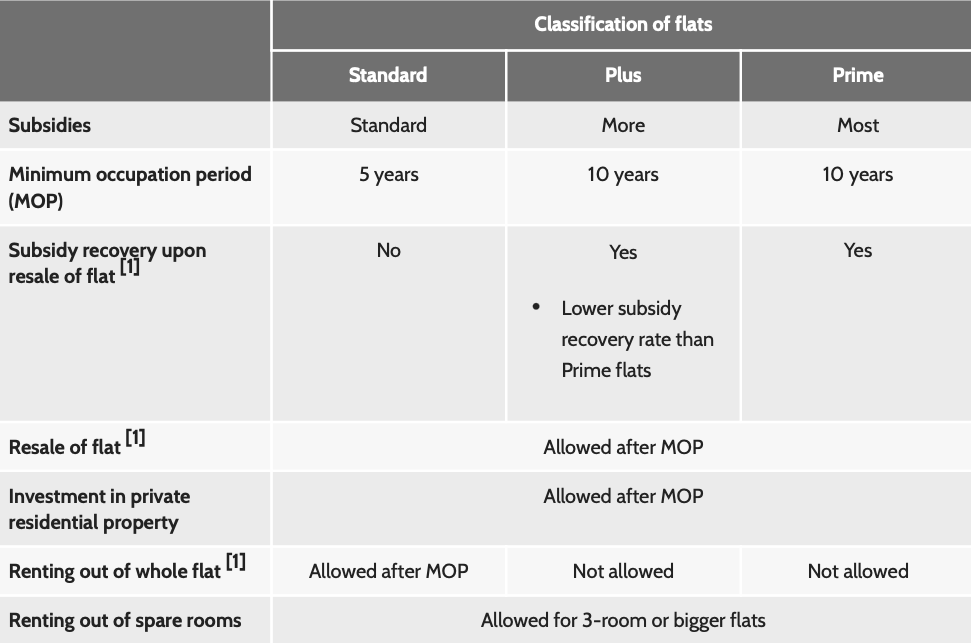

While it might seem like a no-brainer decision to get a new BTO, the introduction of the new Prime, Plus, and Standard BTO categories makes the decision more complicated as additional regulations have been implemented to curb the “lottery effect” for centrally located units.

Let’s review your affordability before exploring the two pathways in more detail.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Looking at the BTO launch in June this year, the prices for 4-room flats in Kallang/Whampoa ranged between $568,000 and $779,000, with a median price of $673,500. For calculation purposes, let’s assume this would be the purchase price if you successfully secure a BTO unit.

Since you mentioned that this would be your second BTO purchase, we’re assuming you utilised the CPF Housing Grants for your current flat. As a result, a resale levy would be payable when purchasing the second BTO.

| Purchase price | $673,500 |

| BSD | $14,805 |

| Resale levy (Assuming you took the CPF grant for singles when buying your current flat) | $20,000 |

| Maximum loan based on the age of 35 with a monthly income of $5K at a 3% interest | $316,315 |

| Funds required | $391,990 |

As we do not have the financial details of your current flat, we cannot fully assess whether this is a viable option for you. As such, we will assume you have the necessary funds.

Now, let’s take a look at how older HDB flats have been faring.

Performance of older HDBs

We will focus on 4-room flats since that is the property type you currently own.

| Year | <1980 | 1980-1990 | 1991-2000 | 2001-2010 | 2011-2020 |

| 2013 | $492,629 | $446,701 | $462,800 | $549,676 | $714,594 |

| 2014 | $463,636 | $420,311 | $431,774 | $492,106 | $597,604 |

| 2015 | $446,856 | $406,395 | $407,349 | $463,986 | $630,236 |

| 2016 | $447,546 | $407,316 | $407,200 | $463,801 | $521,001 |

| 2017 | $437,304 | $405,437 | $405,751 | $457,305 | $516,668 |

| 2018 | $419,806 | $394,997 | $395,091 | $465,008 | $502,585 |

| 2019 | $394,352 | $387,466 | $399,178 | $476,328 | $485,959 |

| 2020 | $399,549 | $394,999 | $412,048 | $479,025 | $505,186 |

| 2021 | $436,013 | $444,896 | $470,236 | $528,091 | $559,683 |

| 2022 | $473,951 | $485,000 | $506,025 | $560,226 | $619,839 |

| 2023 | $496,252 | $516,058 | $537,604 | $597,883 | $655,080 |

| Average growth rate | 0.21% | 1.61% | 1.69% | 1.01% | -0.39% |

The data indicates that 4-room flats built between 1980 and 1990 have experienced the second-highest growth rate over the past decade, following closely behind those constructed between 1991 and 2000. However, a closer look reveals that much of this growth occurred during the pandemic.

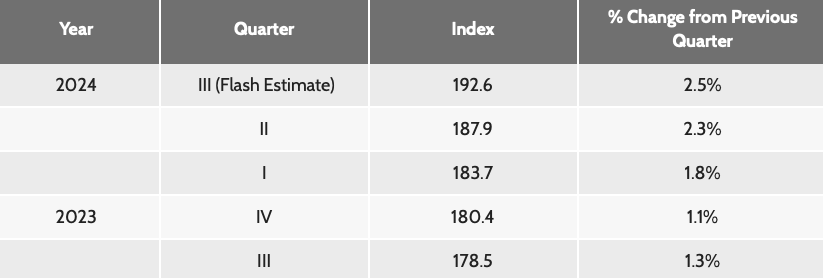

As the market stabilises, it’s uncertain whether this growth trajectory will continue. That said, HDB resale prices remain on an upward trend and have accelerated in recent quarters.

According to HDB, the rise in resale prices and transaction volume is being fueled by strong demand and a tighter supply, as fewer flats are reaching their minimum occupation period (MOP) in 2024 compared to 2023.

Next, let’s examine the performance of BTO flats.

Performance of BTO flats

Since you’re looking to purchase a unit in Kallang/Whampoa, we will analyse the price trends of BTO flats in mature estates. Based on the October 2024 BTO exercise, Kallang/Whampoa would be classified as either Plus or Prime.

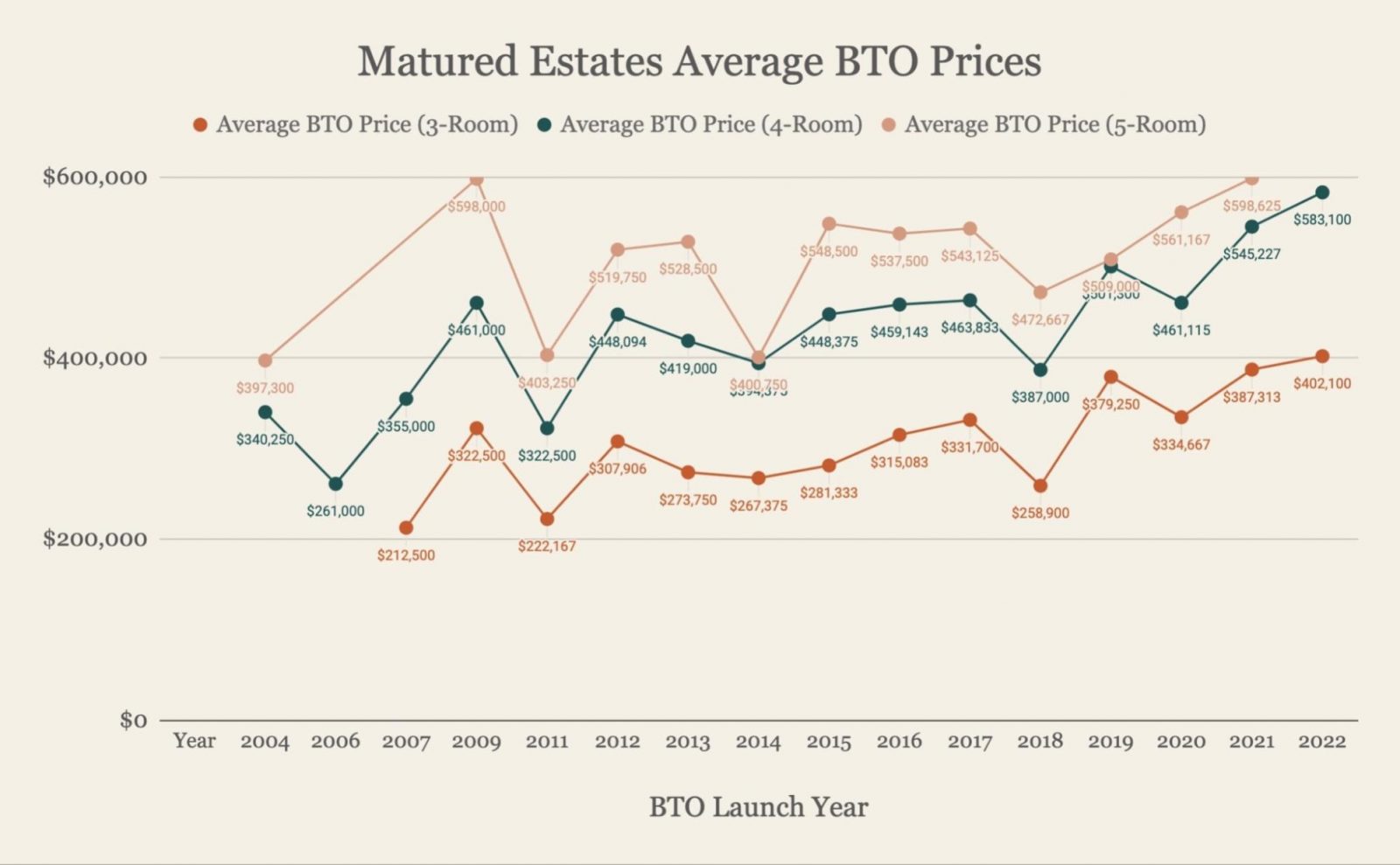

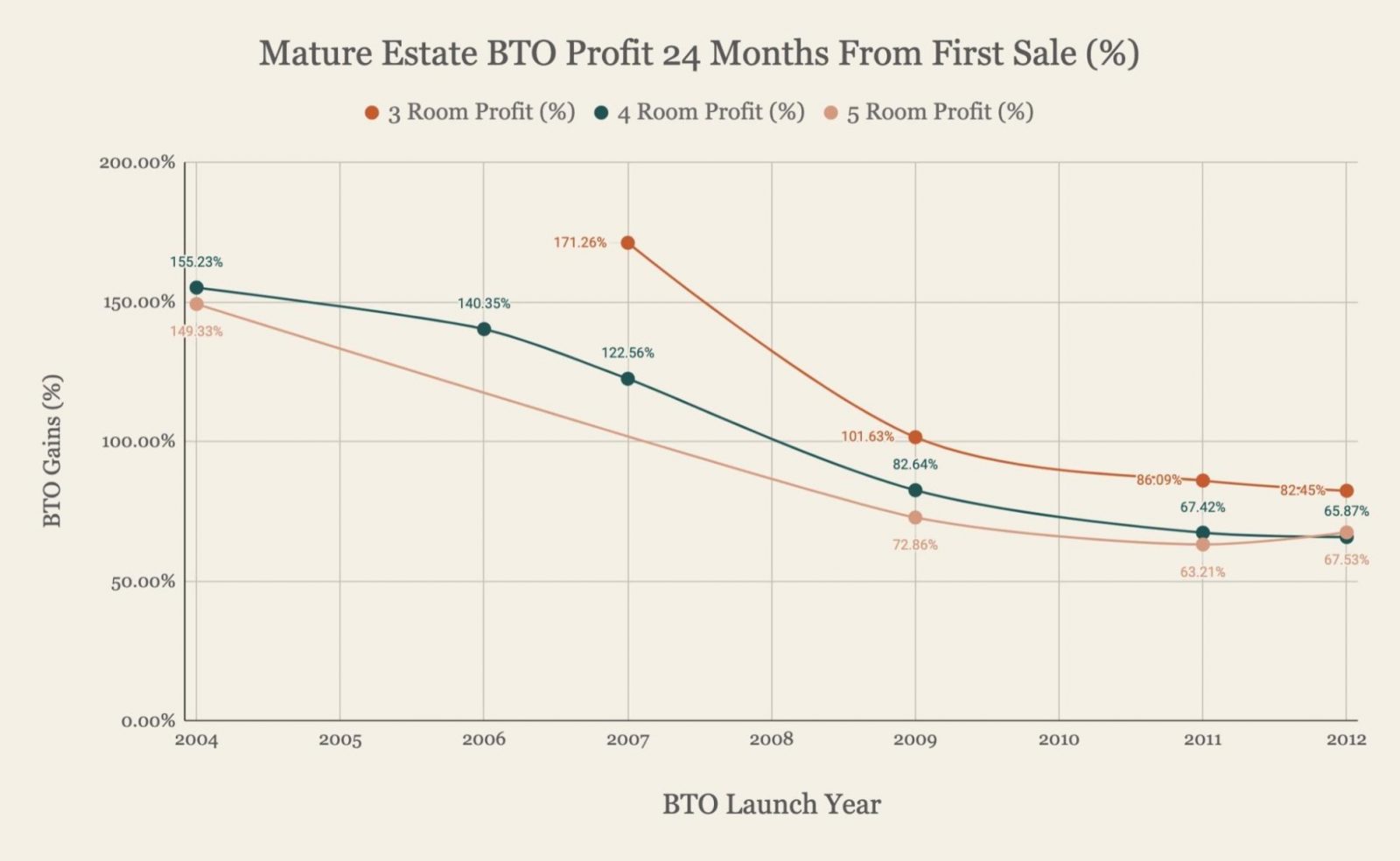

Needless to say, BTOs have always been profitable:

With rising land and construction costs, BTO prices have steadily increased over the years. While this has reduced potential profit margins, BTO flats still show strong returns. The data indicates that BTO flats are still yielding over 60% in gains.

So despite higher prices, they remain more affordable than young resale flats in the same location, further solidifying their appeal. The fact that profits are almost guaranteed and the relative affordability compared to resale flats creates a significant demand-supply imbalance, with demand typically outstripping supply so there is an element of luck involved in securing a unit.

Let’s now dive into the pros and cons of the two pathways you’re considering and the potential costs you might incur for each.

Potential pathways

Buy a second BTO

*Upon selling a Plus or Prime flat bought from HDB, you will be required to return a percentage of the resale price^ of the flat to HDB. The subsidy recovery percentage is commensurate with the extent of the additional subsidy provided. The amount will be made known when Plus or Prime projects are launched for sale.

^Where HDB assesses that a flat valuation is required, the subsidy recovery will be a percentage of the valuation or the resale price of the flat (whichever is higher).

You probably already know this, but PLH flats come with specific stipulations, including an MOP double that of a standard flat. Furthermore, when you do sell, the recovery of subsidies could diminish your profits, although it’s difficult to quantify the exact impact at this stage. You’ll also be subject to a resale levy when you sell your current property, which will reduce the overall profits you can expect from that transaction.

What’s less known is the effect of the income ceiling on resale Plus/Prime flats, which may be a bigger factor in the future when you need to sell. Plus flats cannot be sold to those earning an income of less than $14,000, while for Prime flats, an additional cap of $7,000 for Singles is imposed.

The estimated construction time for a BTO flat is approximately 3 to 4 years, meaning that while this pathway won’t directly affect your retirement timeline, it may limit your flexibility should you decide to expedite your retirement plans or relocate overseas.

While prices of older resale flats remain elevated for now, it’s uncertain how long this trend will continue. Given the age of your current flat, moving to a newer unit in a prime, central location like Kallang/Whampoa could provide you with better value retention potential in the long term.

Let’s now take a look at the potential costs incurred. Since you are looking to retire in 15 years, we will be looking at a 15-year timeframe.

As we do not have the financial details for your current flat, for calculation purposes, we will be making the following assumptions:

- The value of your current flat is $516,058 (the median price for 4-room flats built between 1980-1990 in 2023)

- The existing loan is an HDB loan with a remaining loan tenure of 20 years

- BTO construction will take 4 years

Cost of holding your existing flat for 4 years

| Interest expense (Assuming 2.6% interest) | $14,394 |

| Property tax | $1,196 |

| Town council service & conservancy fees (Assuming $70/month) | $3,360 |

| Total costs | $18,950 |

Cost of holding the BTO for 11 years

| BSD | $14,805 |

| Resale levy | $20,000 |

| Interest expense (Assuming a 25-year tenure at 2.6% interest) | $75,006 |

| Property tax | $5,368 |

| Town council service & conservancy fees (Assuming $70/month) | $9,240 |

| Renovation costs* | $30,000 |

| Total costs | $154,419 |

*Will depend on the extent of renovation works done

Total cost if you were to take this pathway: $18,950 + $154,419 = $173,369

Presuming that you take the maximum loan of $316,315, based on a 25-year tenure at 2.6% interest, the monthly mortgage repayment will be $1,435. And based on the age of 35 with a monthly income of $5K, the amount going into your OA each month is around $1,050. This means you will have to top up $385 monthly for the repayment.

Just for comparison purposes, let’s also consider the potential gains for this pathway. We will assume that the property appreciates by 50% which amounts to $336,750.

Potential gains if you were to take this pathway: $336,750 – $173,369 = $163,381

The resale price of 4-room HDBs under 10 years old in Kallang/Whampoa currently ranges from around $900,000 – $1,100,000. Assuming a sale price of $1M and an 8% subsidy recovery rate, the potential gains will go down to $83,381.

Remain status quo

Given that your flat was constructed in 1985, it will be 54 years old in 15 years, which is considered relatively old. This may limit the pool of potential buyers, especially since loan amounts and CPF Housing Grants for younger buyers are prorated if the remaining lease does not cover them up to the age of 95.

The data indicates that flats constructed before 1980 experienced a significant decline in value leading up to the pandemic and have seen the slowest growth rates even during the subsequent market recovery.

Without knowing the specific location of your current flat, it’s challenging to provide a precise assessment of its projected performance. The sustainability of HDB prices, particularly for older flats, remains uncertain, especially if your property is situated in an area with an oversupply of flats.

That said, there are benefits to staying put. Your current mortgage is likely lower and since your unit has already met its MOP, you have greater flexibility to move if your plans change.

Now let’s look at the costs incurred.

Cost of holding your existing flat for 15 years

| Interest expense (Assuming an outstanding loan of $150,000 with a 20-year tenure at 2.6% interest) | $39,481 |

| Property tax | $4,485 |

| Town council service & conservancy fees (Assuming $70/month) | $12,600 |

| Total costs | $56,566 |

We will use the average growth rate of HDBs built between 1980 and 1990 over the last 10 years of 1.61% to do a simple projection, which will amount to a profit of $139,703. However, it’s important to consider that there has been a spike in prices in the last couple of years so the eventual growth rate might be lower.

Potential gains if you were to take this pathway: $139,703 – $56,566 = $83,137

What should you do?

After weighing the pros and cons of both options, it’s evident which pathway may be more advantageous for you.

Opting to move to a BTO, despite the higher costs, presents a greater likelihood of better appreciation than remaining in your current property. While the MOP for the BTO may be longer, it still aligns with your 15-year retirement timeline. Although the potential gains may not be considerably higher due to the subsidy recovery, a newer flat in a prime location is likely to retain its value better, particularly if you intend to sell shortly after fulfilling the MOP.

Now, let’s outline the timeline for the sale of your current property and the purchase of the BTO. Assuming you will need the proceeds from your existing flat to finance the BTO purchase, we will detail the necessary steps to facilitate a smooth transition.

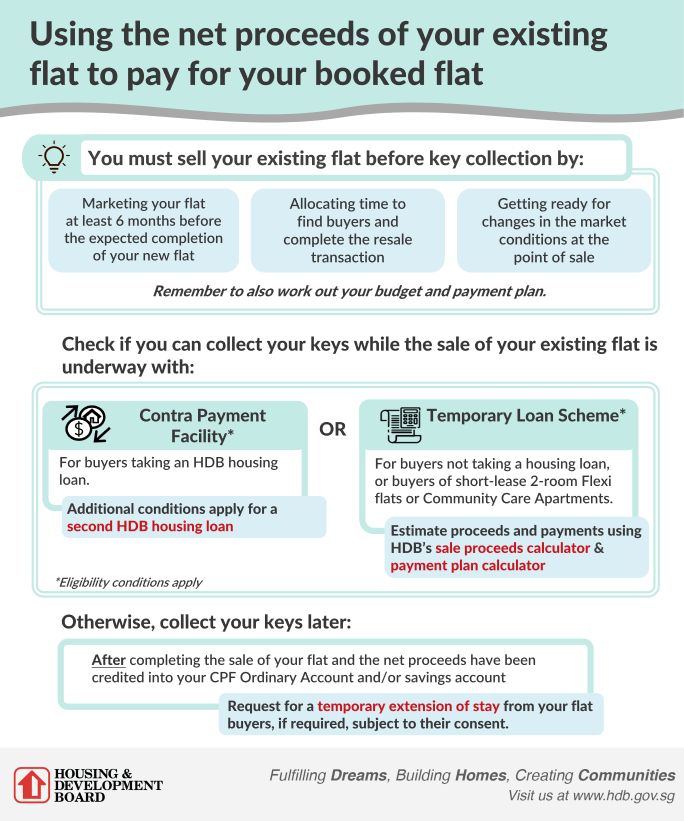

The diagram above illustrates two pathways for navigating the sale and purchase process. The first option is to utilise the contra-payment facility, which facilitates a smooth financial transition between selling your existing HDB flat and purchasing a new one. This allows you to use the proceeds from your sale directly to finance your next purchase. Alternatively, you could complete the sale of your current flat and request a temporary extension of stay from the new buyers.

If you choose the first option, you will be able to collect the keys to your BTO after the approval of your resale application for your existing flat. This arrangement allows you time to renovate your new BTO while waiting for the completion of the sale of your current property. However, this option requires careful coordination to ensure a seamless transaction. It’s also important to note that only one party—either the buyer or the seller—can utilise the contra-payment facility; both parties cannot take advantage of it simultaneously.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments