“I Lost RM 1 Million Investing in KL Real Estate”: 5 Key Lessons From A Singapore Investor Of 36 Years

-

Cheryl

- July 14, 2022

- 9 min read

- 14 14 Comments

9 min read

9 min read

We’ve all heard stories of someone who has invested in Malaysian property and got burnt. From horror stories of the estate not having enough funds to pay for a working lift, or to developers running out of money to leave the development half-built, it does seem like investing in Malaysia isn’t for the faint-hearted.

Enter Ken (*not his real name for privacy), a real estate investor who has at one point, lost more than a million Malaysian Ringgit in KL properties alone.

He has had vast experiences as a real estate investor, with a good 26 years 36 years up his sleeve. Already well into his late 50s, he constantly jokes by calling himself semi-retired.

His punchline? A true real estate investor will never retire.

He was only in his mid-20s when he first bought his first property in Malaysia. At that time he didn’t have much equity to purchase anything over the budget of S$20K (this was back in the 70s 1980s).

*Editors note: Apologies for the confusion, we have clarified and it should be 1980s and 36 years.

Despite being engaged to his now-wife at that point in time, they opted to live with his parents in order to buy an investment property rather than their personal home to stay in. And this was one of the toughest compromises he had to make in his investment journey.

“I’m just glad my wife was so supportive of me. This was out of the norm at that period of time, and I felt really terrible for not being able to provide her a house then. We stayed at my parents’ house for a good 4 years after we got married. We definitely overstayed our welcome”.

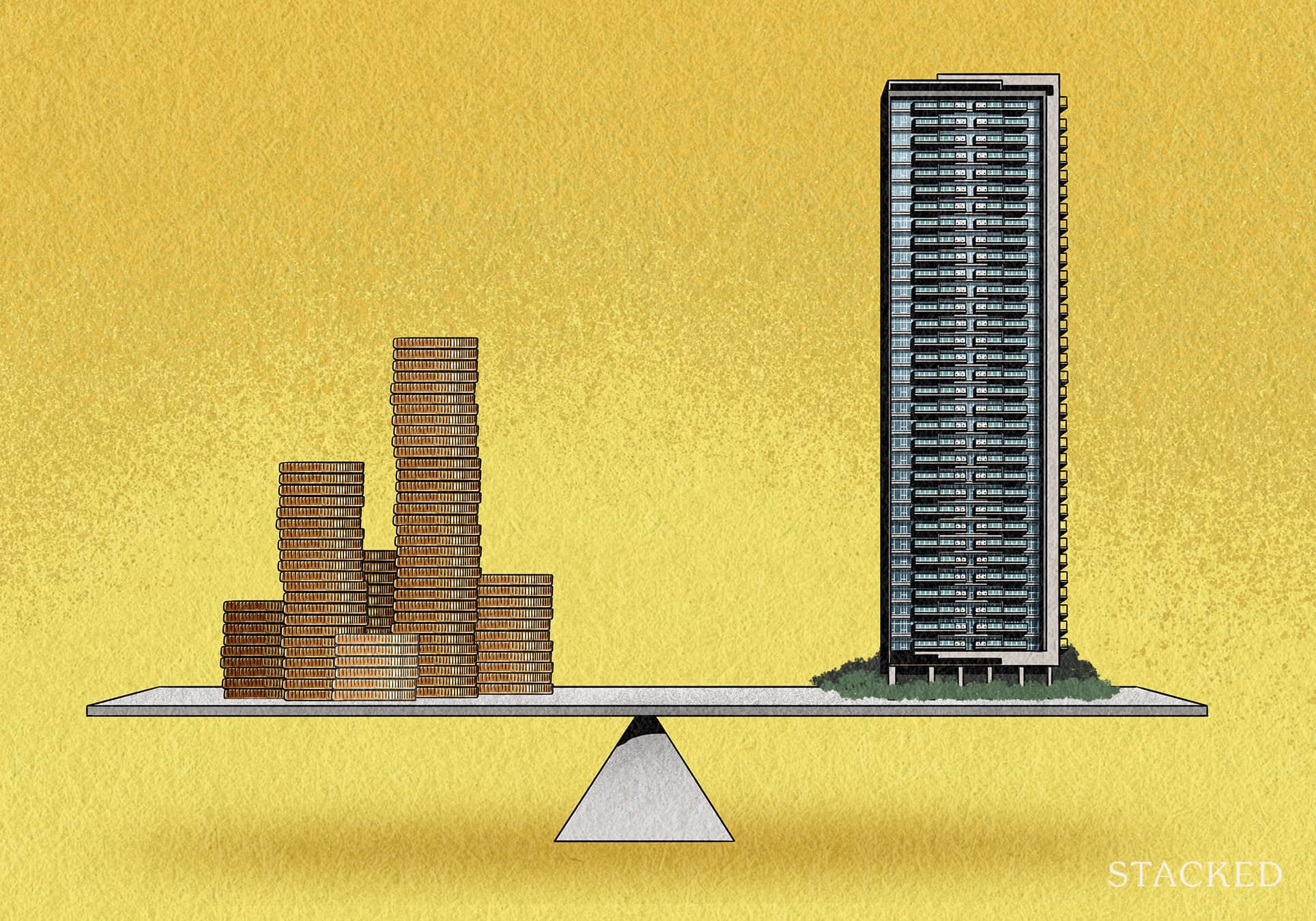

Of course, he admits that it was much easier to be a real estate investor than as compared to now. He laments that the additional taxes, costs, and sky-high prices will be tough for many to sustain this as a business (Yes, he believes that investing in real estate is as much of a business as any other commerce).

Now, he spends his days managing his vast portfolio of global real estate investments, finding new opportunities, and trying to streamline his business.

“I first got into the business of real estate investing because of this quote I read by the billionaire Andrew Carnegie. He says that “90% of all millionaires become so through real estate investing” and it got me thinking – maybe it could be the golden route for me. I really got to thank myself for coming across this quote, because life would probably turn out very different for me.”

“People think my achievements are an overnight success, but they don’t see the stress and turmoil I had to endure for many years. I felt like giving up many times and I’m not ashamed to say I almost declared bankruptcy a few times due to my carelessness or bad timing. There was even a period of time when I lost more than RM1,000,000 just in KL properties alone. We all learn from our mistakes.”

Celebrating his 26th anniversary as a real estate investor, Ken has very graciously agreed to share his key lessons and major pitfalls for real estate investors to look out for.

Let’s start with the first one:

Pitfall 1: Chasing The Highest Yield and Short-Term Gains

Ken shares one main regret he had when he started his career – focusing too much on high yields for the short term when analysing a deal.

This was a common amateur mistake he sees many make. Because they’re so excited about the green numbers, they fail to consider the long-term implications – would this yield continue to perform as it did?

“People need to realise that although a strong yield is a very important number to factor into your consideration, choosing the highest one out of all other deals might be a bad choice. Just think about it, why is this deal even offering such a high yield? Probably because you’re lucky or it has already many issues, to begin with. You need to understand what is the nature of this property”, Ken shared.

“I always say that real estate is not like stocks, where it is liquid and you can just sell your shares in the open market after a year. Real estate is only truly profitable if you can hold it out for a good 7 to 30 years, something like growing your own money tree. So chasing short-term gains is a very poor judgment of a good class asset. You need to consider many other factors too.”

Ken then further explained that he doesn’t mean for people to stray away completely from these high-yield properties, but for them to be confident enough to say that these unique deals can grant you a positive result when exiting in the future.

He stresses that high-yield properties are only suitable for those that have time to manage their own assets and most importantly – to understand the country’s local laws. In his experience, for people to make these types of high-yield assets work in the long run, they would typically need to have a huge budget to account for any miscellaneous costs that might pop up in the future.

To be sure, a landlord will need to be liquid enough to be able to continuously finance their existing assets.

Pitfall 2: Bad Financing Strategy

“This is one of the most destructive pitfalls for all real estate investors, whether you’re a novice or a seasoned one. It caused many of my friends, even those with more than 10 years of experience, to go out of business. I always say do your financing first and the money will come”, advised Ken.

After all, financing and leveraging are what make real estate as indulging as it is.

Ken shared that these 4 variables are crucial when thinking of your financial strategy:

- Interest Rates (IR)

- Mortgage Payment

- Leveraging

- Choosing the best financial institution for your situation.

“What makes a horrible financing strategy is actually a combination of high IR, floating IR, insane monthly payments, and opting for a personal recourse. And these are very real combinations especially if you look at real estate classes like commercial and industrial. Financing planning is crucial because it tells you if you’re taking on too many risks just for that one deal.”

Ken whips out his iPad and wrote down a scenario for me. “Imagine that you’re Bob’s friend and both of you are trying to strategise his finances for a deal. Bob doesn’t have much equity and has to take up a huge mortgage just for a 2 bedroom deal in Florida. The bank currently offers him a 13% because of his subpar credit score. Considering that he might have to make a balloon payment in the next 5 years, should Bob take up this option?”

I shook my head.

Why? Simply because this financing option is too much of a risk for a regular joe that has the intention to grow his holdings. This deal will likely generate a negative cash flow for a long time due to the huge mortgage payments and who’s to say that Bob can afford that balloon payment 5 years later?

Ken smiled and said that those were his exact concerns too. “I also think that private lendings are very underrated, so is refinancing your own home for more liquid cash. I like how I can negotiate for anything when I approach a private lender.”

“This only works if you can negotiate as well as me”, he added cheekily.

Pitfall 3: Not Having Enough Buffer Cash and Proper Budgeting

“Costs are a scary thing, especially to a landlord. I remember when I was on my 5th property when this particular unit I bought had to do a complete makeover because of water damage and mites in all the wooden flooring and wooden cabinets. It was completely my fault for missing these issues when I was doing my due diligence”, recounted Ken.

Ken shared that he initially budgeted $15K to revamp the unit. He thought a change in the washer, dryer, paint and some other basic appliances would suffice. On top of that $15K, he also budgeted another $5K for any other hidden expenses. This still wasn’t enough, as the bill amounted to a shocking $60K when he had to add the flooring, cabinet, and piping makeover.

“The initial expectation I had was to rent the unit out within 2 weeks of receiving the keys. That 2 weeks turned into almost 2 months of no revenue. Not to mention, I didn’t have that amount of cash on me since most of my assets were stuck in real estate. I had to refinance a part of my other property just to pay for this $60K. I was lucky that I even had something to refinance. I wouldn’t have known what to do otherwise”, shared Ken.

From then on, one important lesson ingrained in him was that cash is king. He adds that he still owns that particular property and it is bringing him healthy revenues every month.

Ken explained, “I’m glad I could tide past that issue, but many would have had to hold on to that empty unit while paying for the mortgage if they couldn’t fork out that $60K. Always get a professional to come with you to inspect your house and budget accordingly to their advice. That’ll rarely go wrong”.

InvestmentAvoiding A 20% Loss: 5 Important Lessons I’ve Learned Trying To Sell My Property In London

by TJPitfall 4: Not Planning Your Next Step Forward & Seeing the Bigger Picture

Throughout our conversation, Ken was keen to reiterate that real estate is only suitable for those who want to build their wealth slowly with a bigger picture in mind.

“When I bought my first property, I already had a clear idea of how I wanted my portfolio to look like in another 10 years time. I want it to look diverse, healthy and focus only on residential and commercial properties. My main reason was mainly to reduce risks. I had a growing family to take care of, you know”, recounted Ken.

Ken then focused on choosing properties that he knew would definitely generate a sustainable income, even if it’s not the highest yield. He never picks the next property in the same location as the previous and always does his due diligence to make sure he is always in the green.

As the story of the tortoise and the hare shows, slow and steady wins the race.

Pitfall 5: Not Building Rapport with Other Investors, Contractors & Agents

“My team of real estate investors, contractors, and agents are on visiting basis during Chinese New Year with me. We send each other Christmas gifts and we meet for tea regularly. That’s how close I’ve built my relationship with these key pillars of my business over the past years. I’ll know who to contact if I face a problem or if I’m looking out for an opportunity. And I have people from all over the world to guide me”, said Ken.

Upon listening to this, I am reminded of this African proverb that shares, if you want to go fast, go alone. If you want to go far, go together.

“I found out that once my community started to share our strategies, advice, and issues with one another did it revive my love for investing in real estate and truly spurred me much further into growing my wealth using real estate. How could you possibly solve all issues alone? We all need help and can give help to others at one point in our lives.”

He finds it much more enjoyable to be in a community rather than being a lone wolf.

“I won’t say that doing things alone is a pitfall but you’ll be limiting yourself to further potential. I like how I can always trust the standards of work by my contractors and the reliability of my agent. I have my community to depend on when sharing news and strategies,” shares Ken.

A key part of the process in real estate is to understand that leveraging on people and your community can be a great saver of time. You don’t have to know everything to succeed, but you need to know people who do.

Final Thoughts

“Many friends around me asked for my opinion on whether they should invest in real estate too, and my question back to them is – why are you even investing in the first place?”

To Ken, real estate is not something to get rich quick, and it’s more important to have the right mindset.

Ken’s advice shows that you don’t have to be perfect to succeed in this business. You just need to be agile and learn from them and keep moving forward.

Thank you Ken for your time and words.

would have wanted to know specifics about the KL real estate loss as the title suggests! But still a good read!

Hey! Thanks for your feedback – we’ll check in on this 🙂

Losses would be from sharp depreciation in the Ringgit, which is not discussed.

Agreed about he high risks investment in Malaysia. Till now I am still not confident to invest in Malaysia.

Thanks for sharing! Have you invested anywhere else?

If the guy was in his mid-20s in the 1970s, then how can he be in his late 50s now?

If the guy was in his mid-20s 26 years ago, how can he be in his late 50s now?

This article was actually written 20 plus years ago….

Hi Tom, we made a typo in the year and have since rectified it. Thanks!

Were the major risks that cause huge losses the ones under construction, hence the risk of not completing the property? Were there major losses in completed properties that were greater than the losses incurred for the uncompleted ones?

Complete bullshit article by “Cheryl”. How is it possible for someone who started in the 1970s to have 26 years of investing experience? What is this, the year 2000?

Hi Centaurus, thanks for pointing the typos out. We’ve made the relevant corrections. We’d like to assure you that this article is legitimate, and we do have a writer called Cheryl.

All of our articles are authentic, but sometimes we do want to be more deliberately vague on some personal information as some investors can be understandably concerned about privacy. They do not receive any benefit from providing their insights as well, and so we do our best to provide as much information to you, our readers. We hope this clarifies. Thank you.

I was drawn to the captioned headline of losing 1m in KL Property but couldn’t find any elaboration on this mistake by the author. Investing in property is somewhat a timing game and also you’ve to be ready for it whatever comes after the purchase. I’ve made so may mistakes investing in at least 4 properties in Msia but still it does not deter me from looking for more

Is it really necessary to take a dig at Malaysian developers especially since the article is a clickbait and didn’t even discuss about KL real estate.