I Bought My First Condo At 30 And Renovated It For Just $14k: Here’s How I Did It As A Single

June 17, 2023

The simple truth about home ownership in Singapore is that for most, it takes two parties. Barring shoebox units and the smallest flat, most Singaporeans would struggle with the cost if they had to bear it alone. This is, like it or not, a country where dual-income families are the norm for home ownership. However, there are some singles who manage to forge ahead anyway, with gumption and careful planning; and this week we talked to one such person:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

An early commitment to home ownership

Our reader, L, sought to own her home from a young age. She attributed this to growing up in a family of five, where she didn’t have the luxury of her own room. Later, this was amplified after an exchange programme:

“The desire to have a place to call my own intensified after a school exchange programme, where I experienced the joy of living alone (where I get to live away from parents). I liked the personal space and freedom it offered…After a few work trips and solo travels, I was further convinced that I wanted my own home.”

However, L also found, after completing school, that was part of the sandwich generation. She was in debt due to university fees, and her savings were impacted by the monthly repayments.

“I stumbled upon an article by Sgbudgetbabe titled ‘How I saved 20k in my first year after graduation,’ L says, “It opened my eyes to savings and the possibility of owning a property as a single individual, even without a high income or substantial bonuses.

I made a commitment to save at least half of my monthly income, leaving all bonuses untouched. I also adopted a balanced approach to my lifestyle, allowing myself occasional travel (using various hacks to find the best deals and affordable options) while being mindful of my spending on cafes, restaurants, and luxury goods.

With a few salary increments over the years since graduating, I managed to achieve my goal of owning a property at the age of 30.”

Finding a home is not without challenges for singles

Apart from disciplined savings, L found added hurdles facing single home buyers:

“As a single, I faced several challenges in securing a home, including the absence of a partner to share the down payment, the limited grants and HDB options for singles, limited resources for guidance, and the constant increase in property prices.”

L felt the risk of being priced out as housing costs spiked, and she knew she had a limited time to save up enough for a property. However, she faced challenges in the form of the minimum down payment (25 per cent for private properties), saying it “can be daunting for singles below the age of 35 who are not eligible for HDB flats.”

Rising interest rates, which occurred just after Covid, also added to monthly repayment costs. It didn’t help that rental rates were also on the rise, which “added a layer of financial strain” on those seeking to move out.

Finally, L had to pick from a more limited range of options, as a single homeowner. One reason was the “assumption that singles seeking their own houses are in for a lavish lifestyle, and have no intention of getting married. This misconception leads to the belief that they do not require housing support, priority or grants compared to their married counterparts.”

All of this made shortlisting properties a challenge.

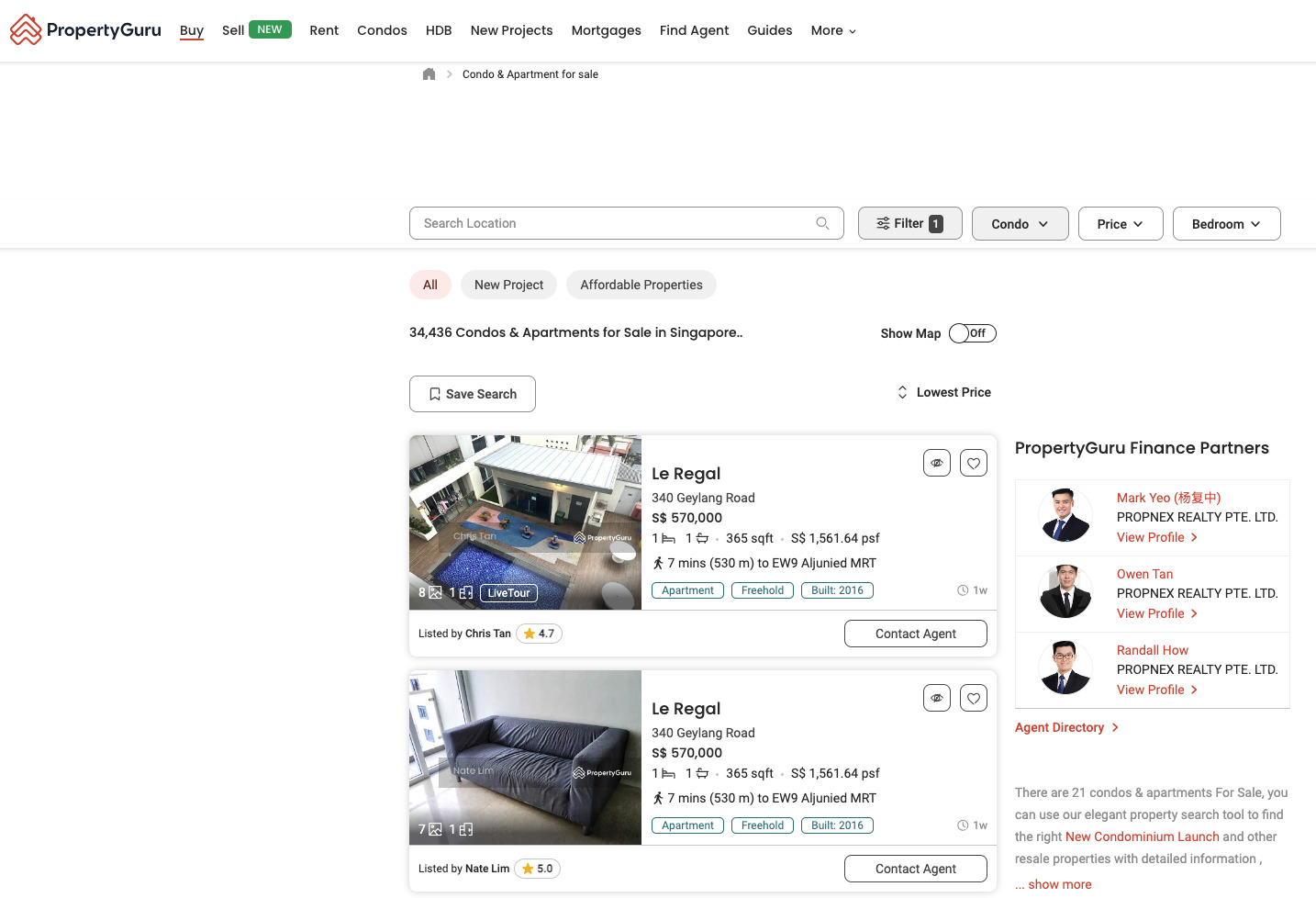

L says: “I used platforms like PropertyGuru and 99.co to filter the cheapest private properties, focusing on options near my current neighborhood.

My requirements included a separate bedroom and living area, as well as proximity to an MRT station.

Balancing my budget, potential resale value, and personal preferences was crucial. Initially, I had an ideal vision, but had to adjust my expectations to what I could afford. It involved constant evaluation and weighing of factors to find a suitable property.”

This meant L had to do a thorough analysis of property values and past transaction histories, while seeking advice from friends. This is normally done on sites such as the URA Transaction Data page, which is based on caveats lodged.

(Note: if you use property portals for researching transaction data, be careful that you’re looking at the actual transactions and not just asking prices. Some portals only show the asking price).

More from Stacked

How LTA’s new en bloc ruling will affect future potential en bloc developments

It was exactly ten years ago in 2007 that the last en bloc frenzy happened, with a total of $11.7…

Ironically, Covid helped a little, as it resulted in lower spending before her purchase:

“I closely monitored the available sales in these projects for about 12 months leading up to my projected offer date. Viewings commenced approximately six months before that date. During this period, I accelerated my savings and also benefited from reduced expenses due to Covid restrictions.

With the assistance of my property agent, I was fortunate to secure a deal on one of the projects as soon as I was ready to make an offer.”

Finding affordable renovations

L’s eventual choice was a 570 sq. ft. unit, a 1+1 layout that was purchased from the resale market. She says it’s located somewhere in the north of Singapore, and is just five to six years old.

The next challenge for L was finding an Interior Designer (ID), who was reputable and willing to work within her budget.

“I began by seeking recommendations from friends, but unfortunately, none of them had positive experiences with their IDs. I turned to online platforms, submitting requests for quotes and attending a Qanvast event to meet IDs in person. In total, I received around six quotes,” L says.

“During the review process, I focused on several factors. Besides a competitive quote, I wanted to know if the IDs would allow me to bring in my own contractors for certain tasks. I also inquired about any unexpected costs that I should be prepared for, and discussed strategies to reduce the overall cost.

I sought clarity on the project timeline, and explored alternative design ideas that could achieve a similar look at a lower cost.

While I did ask for portfolios, it didn’t heavily influence my decision-making as I already had a clear design concept in mind.”

Unfortunately, L couldn’t find a designer she liked. L was about to restart her search anew, when she got a call from a friend in the design industry. This time, L got a good recommendation for an ID, who was ultimately the one she hired.

Keeping the costs down

L says that her renovations were smooth and a positive experience, perhaps down to her stringent process of searching for a suitable designer. Part of the reason was her designer being transparent regarding timelines, and being “receptive to my ideas, and offering suggestions to enhance functionality.”

L says that: “While some added costs were expected, I took precautions by ensuring the initial quote I received was at least 15 per cent lower than my actual budget. This allowed me to avoid any major surprises.”

But like everyone else that has gone through a renovation journey, it’s never the case that things go smoothly. There would always be unanticipated hiccups that can occur:

“As I had a wall hacked, there were unforeseen expenses such as air conditioning rerouting and electrical rewiring, which can be costly.

Surprisingly, rather than experiencing delays, my ID actually handed over my flat earlier than anticipated. The entire renovation process took less than six weeks, which is impressive considering the scope of work involved, including hacking, flooring, electrical rewiring, air conditioning rerouting, carpentry for wardrobes and study, lighting and fixture replacements, and painting.”

A key step was not “obsessing over perfection in every aspect,” but in trying to collaborate with the ID – presenting and discussing ideas. L also suggests buying movable furniture from more affordable sites like Taobao, and bedding from Malaysia. She also hired her own handyman for certain tasks, where it would help reduce costs.

As a parting bit of advice for single home buyers, L has this to say about renovation loans:

“Personally, I do not believe in using renovation loans and would not consider recommending them.

If my budget does not allow me to achieve my ideal theme, I would rather make compromises and explore alternative options within my means. Taking on additional debt can be burdensome, especially when we are already dealing with mortgage payments as a single homeowner.”

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments