How Will CPF Changes In 2025 Affect Your Housing Decisions In Singapore?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Several changes to the Central Provident Fund (CPF) have taken effect from 2025, prompting questions about their impact on housing purchases in Singapore. The effects vary between individuals, depending on their reliance on CPF for housing and the extent of its use. Here’s a summary of the recent changes and their potential implications for your buying decisions:

Changes to CPF in 2025

These changes mostly took effect from January 2025 and are currently in place:

1. Closure of the Special Account (SA) for members aged 55 and above

As of 19 January 2025, the SA for members aged 55 and above has been closed. Savings in the SA have been transferred to the Retirement Account (RA) up to the Full Retirement Sum (FRS), where they continue to earn long-term interest. Any remaining SA savings have been moved to the Ordinary Account (OA), earning the short-term interest rate, and can be withdrawn when needed.

Impact on housing purchases:

While home loans and stamp duties are typically serviced through the OA, previously, homebuyers aged 55 and above could transfer excess SA funds to their OA, provided they met the FRS in their RA. With the closure of the SA, this option is no longer available, potentially resulting in less money in the OA for mortgage payments or stamp duties for some buyers in this age group.

However, many property buyers aged 55 and above are often right-sizing rather than upgrading. If they are selling a larger property to purchase a smaller one, they may have sufficient proceeds to avoid the need for loans or CPF funds. Note that this change does not impact younger homebuyers.

2. Increased Enhanced Retirement Sum (ERS) amount

From 1 January 2025, the ERS has been raised to $426,000, which is four times the Basic Retirement Sum (BRS). For instance, if the BRS is $106,500:

- Basic Retirement Sum (BRS): $106,500

- Full Retirement Sum (FRS): $213,000 (2x BRS)

- Enhanced Retirement Sum (ERS): $426,000 (4x BRS)

Those who meet the ERS could receive CPF LIFE monthly payouts of around $3,100 to $3,300 for life from age 65. In comparison, those turning 65 in 2025 who had previously met the FRS at age 55 could receive CPF LIFE monthly payouts of $2,500 to $2,700.

Impact on housing purchases:

Older homeowners may consider right-sizing their homes, topping up to the maximum ERS, and living off higher CPF payouts for life. This approach could be more reliable than maintaining a larger property for rental income, which involves finding tenants, managing payments, and potential vacancies.

More from Stacked

7 Must-Know Things To Look Out In A Floor Plan Before You Buy A New Launch Condo

The floor plan is, ironically, both the most boring and important part of picking a unit. We know the show…

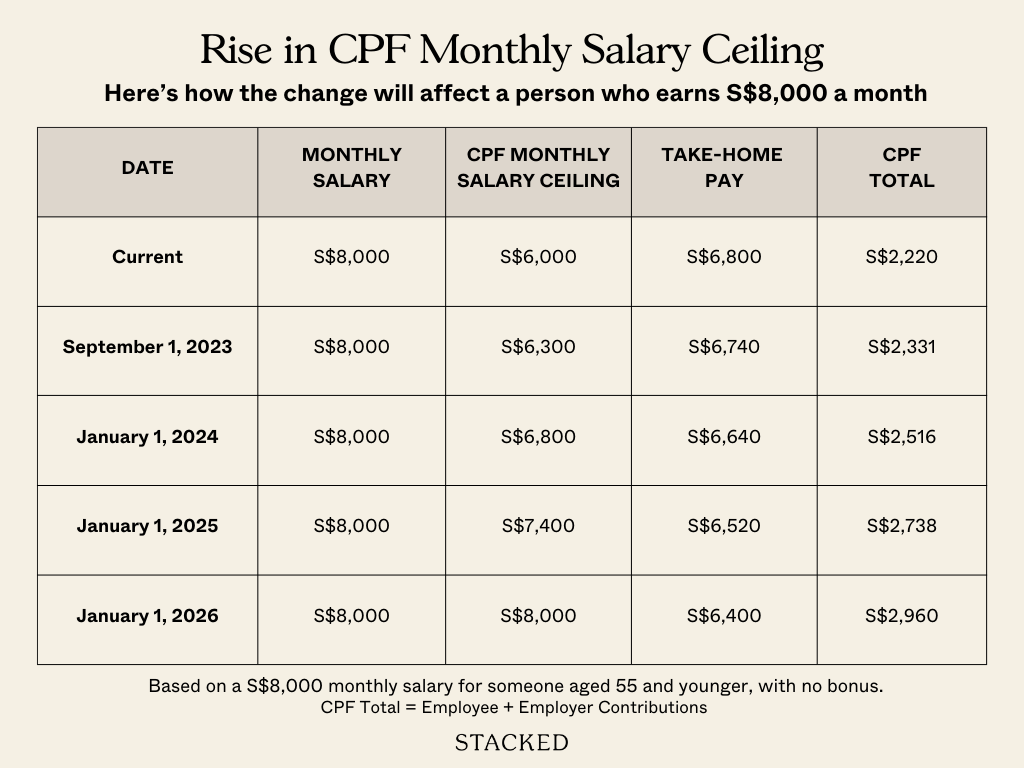

3. Higher monthly salary ceiling for CPF contributions

As part of an ongoing plan, the CPF monthly contribution cap increased from $6,800 to $7,400 per month as of January 2025, with a further increase to $8,000 per month planned for 2026.

Impact on housing purchases:

Higher-earning Singaporeans who reach the ceiling are now required to save more, resulting in increased OA balances available for housing expenses. However, this comes at the expense of reduced take-home pay.

4. Enhanced Matched Retirement Savings Scheme (MRSS)

The MRSS is designed to assist those who begin retirement savings later in life. Under this scheme, the government matches voluntary top-ups to the RA dollar-for-dollar. As of 2025, the matching grant cap has been raised from $600 to $2,000 per year, and the age cap has been removed.

Impact on housing purchases:

This enhancement can influence decisions on whether to retain a larger property for rental income or to right-size. For example, a senior could downsize from a five-room flat to a three-room flat and use the cash difference to make voluntary CPF top-ups for higher guaranteed payouts. Alternatively, substantial top-ups could enable seniors to maintain their current home without the need to right-size.

5. Higher CPF contribution rates for seniors and platform workers

For older workers (above 55), contribution rates have increased by 1.5% from 1 January 2025, with employers contributing an additional 0.5% and employees contributing an additional 1%. For platform workers, contributions are mandatory only if born after 1 January 1995; otherwise, it remains an opt-in programme.

Impact on housing purchases:

The main effect is higher OA savings, which can assist when buying a home, though this comes at the cost of lower take-home pay.

Overall, the CPF changes in 2025 lean towards higher forced savings, potentially making homes more affordable for platform workers and older workers with limited CPF savings. The closure of the SA is not likely to impact the average homebuyer significantly, primarily affecting older homeowners who had plans outside of right-sizing. It will be interesting to observe whether older flat owners decide to rely more on CPF than rental income, given the option for higher lifelong payouts.

For more on the situation as it unfolds, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden