I was a rookie real estate agent in 2008 – during the Great Financial Crash (GFC). I was only in my 2nd year in the business.

I saw fortunes being made and lost during that crisis.

So, you know the phrase about “a crisis is usually a time of great wealth transfer” ? I had front row seats to that experience.

I remembered when news of the subprime crisis hit our shores – it was October 2007 a couple of months after I first joined the real estate industry in April 2006.

And when the impact landed on our shores, it landed hard.

Volume came off tremendously as fear was the overarching sentiment and average home prices dropped by 36% from the peak of Dec 2007 to the bottom in Feb 2009.

It was those moments where Citigroup shares cost only $10 each and a 1 bedroom apartment at The Sail @ Marina Bay cost only $850K.

Landed properties in District 10 were going for under $1,000 per square foot (land), cheaper than what we can find in suburban areas today.

If you were a shrewd investor back then – it was deals galore.

And I recall vividly one of my deals that happened when sentiments were still at rock bottom.

This property in question was One Amber, a low floor 3 bedroom sub-sale unit that wasn’t ready yet as it attained TOP only a year plus later.

I was standing at the southwest garden of The Esta, overlooking the construction site that was One Amber and orientating the unit’s floor plan to ground, presenting it to a buyer and his agent.

The offer came in on the spot at $800 psf, which was roughly 10% off from the then market price and I sealed the deal at $1.016M that very day.

Unbeknownst to any of us, the market gained traction shortly within a span of 6 months and that same unit resold for a $355K profit or a 35% gain, all while it was still under construction.

There was no viewing, and it was one out of the many deals I transacted over a brochure, without a showflat virtual tour or impressive animations that are available today.

Pretty amazing since it was during the subprime crisis, if you ask me.

I was surprised and yet amazed at the immense wealth changing hands just like that.

In 2020 – there is another massive reset that is happening. If you are not careful – it can become overwhelming as there is too much information to absorb.

As we get used to the idea of wearing masks, practising social distancing and working from home – we need to let go of our existing habits and our current identities.

- Used to go to the coffeeshop for your morning perk-me-up before work? Now we make our own 3-in-1 coffee at home.

- Used to power dress for face-to-face appointments? Now we try to figure out how to look our best and professional during our Zoom meetings.

- Used to focus on work without interruption from our kids as they are in school? Now we need to answer reminders from their teachers to complete their home-based lessons.

One thing is for sure – we have to adapt to this new normal.

Are you still clinging on to the past and hoping to go back to the old ways of doing things?

It is time to let go – before it pulls you under.

Here are 3 adaptive strategies that helped me to thrive and do well during the last crisis.

1. Don’t assume that information creates informedness.

In our connected world, we have direct access to many sources of information at our fingertips.

Some people might conclude that since there is so much information and commentary available – we no longer need to think critically. We start to believe that we are updated with the latest and the best knowledge out there.

But in actual fact – we are only scratching the surface. We have seen the first few dominos falling but we are not sure yet of the actual outcome and eventual consequences.

What will be valuable is this – creating and sharing a regularly updated summary of facts and its implications.

From there we extrapolate by extending the timeline and try to think 3-4 steps ahead.

For example – there is this pervasive belief that property prices will drop thanks to the current pandemic. But if you really think about it – all the various cooling measures over the years have ensured overleveraging from happening.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

When Renting In Singapore Is The Smarter Move — And Buying Can Wait

There’s a certain taboo in Singapore toward renting, though a good deal of it is self-inflicted. I’ve never actually heard…

This means almost all existing property owners would have a strong holding power. In such a crisis – how much can the price index slide?

Remarkable performance comes from seeing things that other people can’t see.

2. Constantly reframe your understanding of what’s happening.

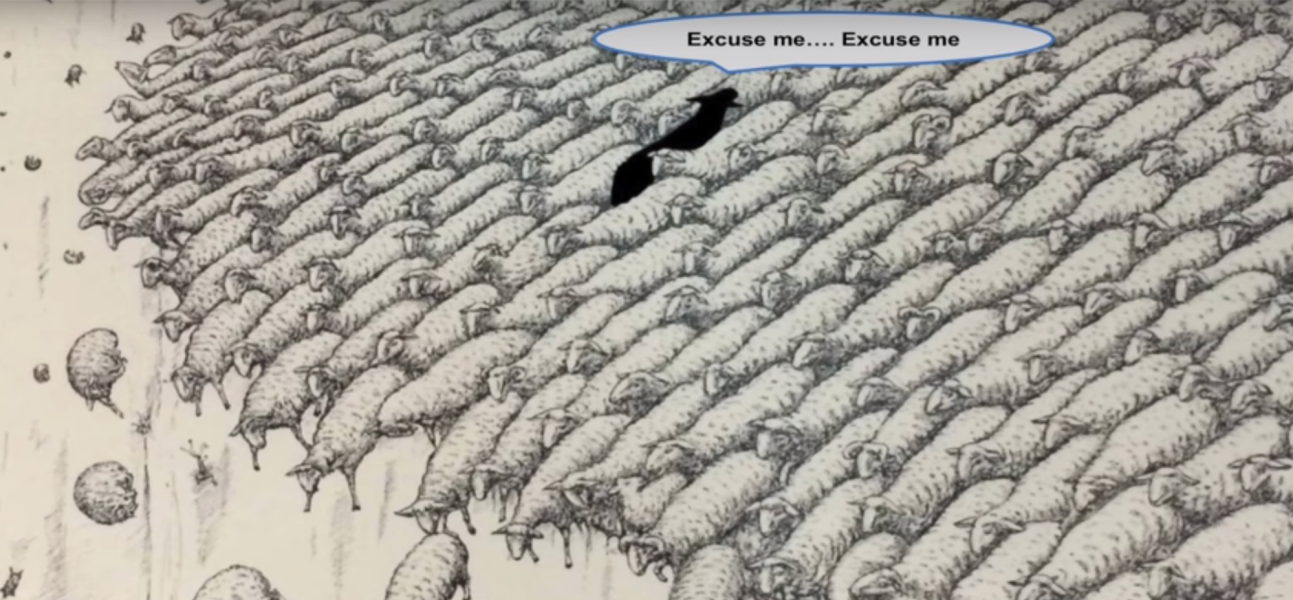

No matter how individual we think we are, we all have an inherent desire to conform. Psychologists call this the bandwagon effect – ideas, beliefs, trends, and concepts are spread between people.

The more people adopt them, the more people are influenced to do so. In this current crisis – there are some narratives being pushed forward.

We have to be careful and aware of the agendas being set. We have to be careful of the stories we tell ourselves – especially those that don’t serve us.

Some stories might be convenient for us at the time, but over the years – do we realize that it might be incomplete or ineffective?

The wrong story can rob us of the clarity that comes with truly seeing the big picture.

One story being told right now is to hunker down, retreat and not make any big decisions. While it is not wrong – it should NOT be the only story you tell yourself.

Is the story you are telling yourself worthy of who you are?

Seek out new ideas and concepts to reframe your understanding.

For example, most people would think it impossible to close property listings via virtual viewings. But I am seeing transaction after transaction happening from my team of agents – documents are signed virtually and virtual walkthroughs done by the sellers themselves.

Contactless closing is possible – a notion most experienced salespeople would have derided just weeks ago.

Just because things look like they have no immediate payoff, doesn’t mean that’s the case.

All it means is that there is less competition as most people decide to believe the first story they tell themselves.

3. Uncertainty creates opportunities

We are neurologically hard-wired to avoid the unexpected and prefer certainty. Situations that are ambiguous or uncertain can make us feel incompetent, embarrassed and ashamed.

But the truth is we live in a world of uncertainty, complexity and volatility.

People opt for “safe” investments after a market crash because the combination of fear and uncertainty is just too much for their mindset to handle. And this is when less competition exists as everyone else simply retreats.

This market decline will end but when it does – opportunities to grow your investments might no longer exist.

I saw it happen when I noticed that almost every property bought during the 2008 – 2009 period sold for huge gains just a few years later.

The market inflated so much that extensive cooling measures had to be applied in 2011 onwards. Opportunities became limited as terms such as ABSD and TDSR came into the picture.

2020 presents another opportunity in disguise provided if we have the eyes to observe the gaps emerging in the market.

Final Words

Successful investing is often contrarian and counterintuitive. If you go against the crowd, buck the current trends, and ignore your emotions, you will succeed. The strategies I suggest will help you excel in this VUCA (Volatile, Uncertain, Complex and Ambiguous) world.

If something feels good to you, it is likely to be bad for your portfolio. And if something seems terrifying – it is probably an opportunity in a very convincing disguise.

We love safety, but places for your money that seem safe are often dangerous for our future.

We generally abhor risks and are skeptical, but only by investing can you build a fortune.

What you can see is useful but the truth is your context is limited. Our frame of reference only allows us to see so much.

If you are looking for another perspective from my past 14 years of experience – I invite you to drop a message to Stacked to arrange for a no-obligation discussion.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Stuart

Stuart is a partner at Stacked and a co-founder of Navis Living Group where he leads and mentors more than 1800 agents in their training, growth and development as leaders and property wealth planners. Professionally, he is known for his interest and ability to connect with people and coaching both his agents and investors on obtaining better results in their lives and investments. Privately, he enjoys quiet time by himself, playing the guitar and acting all childish around his wife and 2 kids.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments