Are HDB Flats Really As Unaffordable As Everyone Claims? We Look At 468,600 Transactions To Find Out.

May 23, 2022

With the fresh new record of a $1.4 million HDB flat being sold at Henderson, it has yet again sparked conversations about whether HDB prices are getting increasingly unaffordable.

Which brings to mind a statement from the Ministry of National Development (MND) in November 2021 that “HDB new and resale flats continue to remain affordable, as incomes have generally kept pace with new and resale flat prices over the past few years.”

You might have also seen this separate Reddit post, which was highlighted in one of our previous articles, where we discussed if our household income has outpaced growth in property prices, particularly those of private properties.

But unlike private properties, HDB flats are priced to be affordable by the masses to promote homeownership in Singapore. So, MND’s statement was aligned with this intent.

Let’s look at the data for ourselves to see how it plays out.

Table Of Contents

- Notes on this Study

- Key findings

- 1) Flats today are less affordable prior to the pandemic, but more affordable than a decade ago

- 2) Newer resale flats are a lot more affordable today than they were back in the early 2010s

- 3) Centrally-located flats are at an all-time high, but not as unaffordable as before too.

- 4) Newer 5-room flats in centrally-located areas are almost reaching the most unaffordable levels since 2010

- 5) Families and singles can expect to pay more for flats in mature locations, but it isn’t as unaffordable as before.

- Conclusion

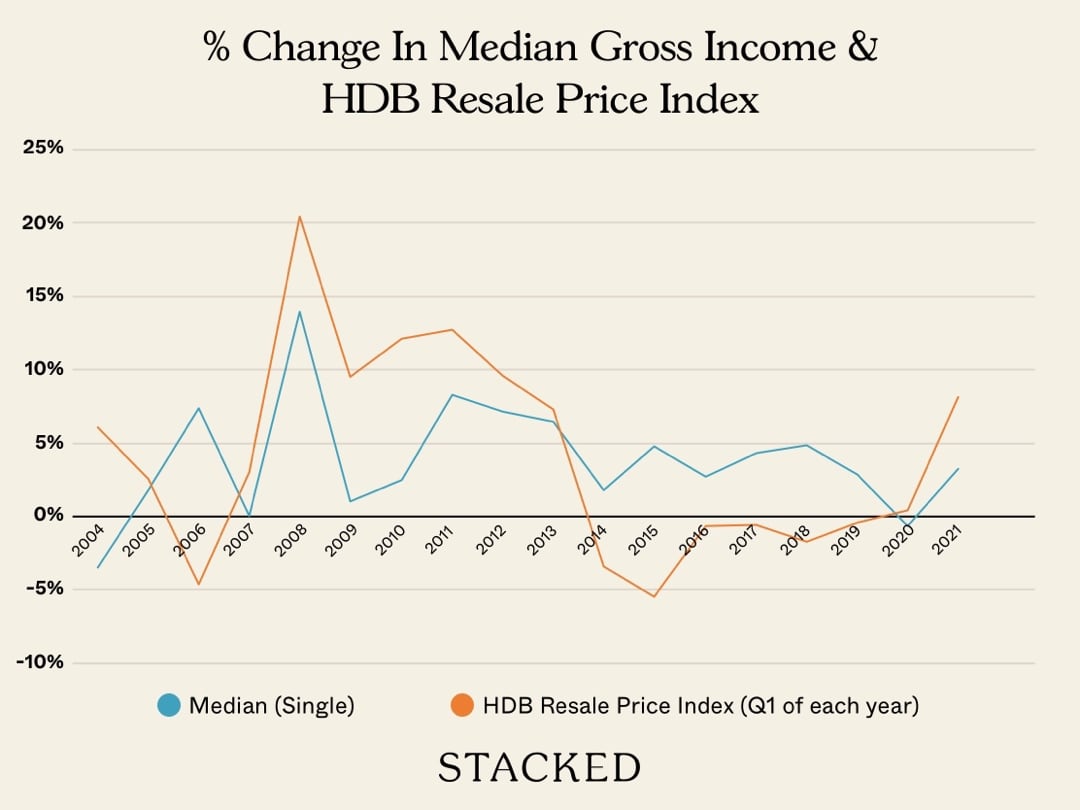

Here’s a look at the change in the HDB price index alongside the change in median gross income from work:

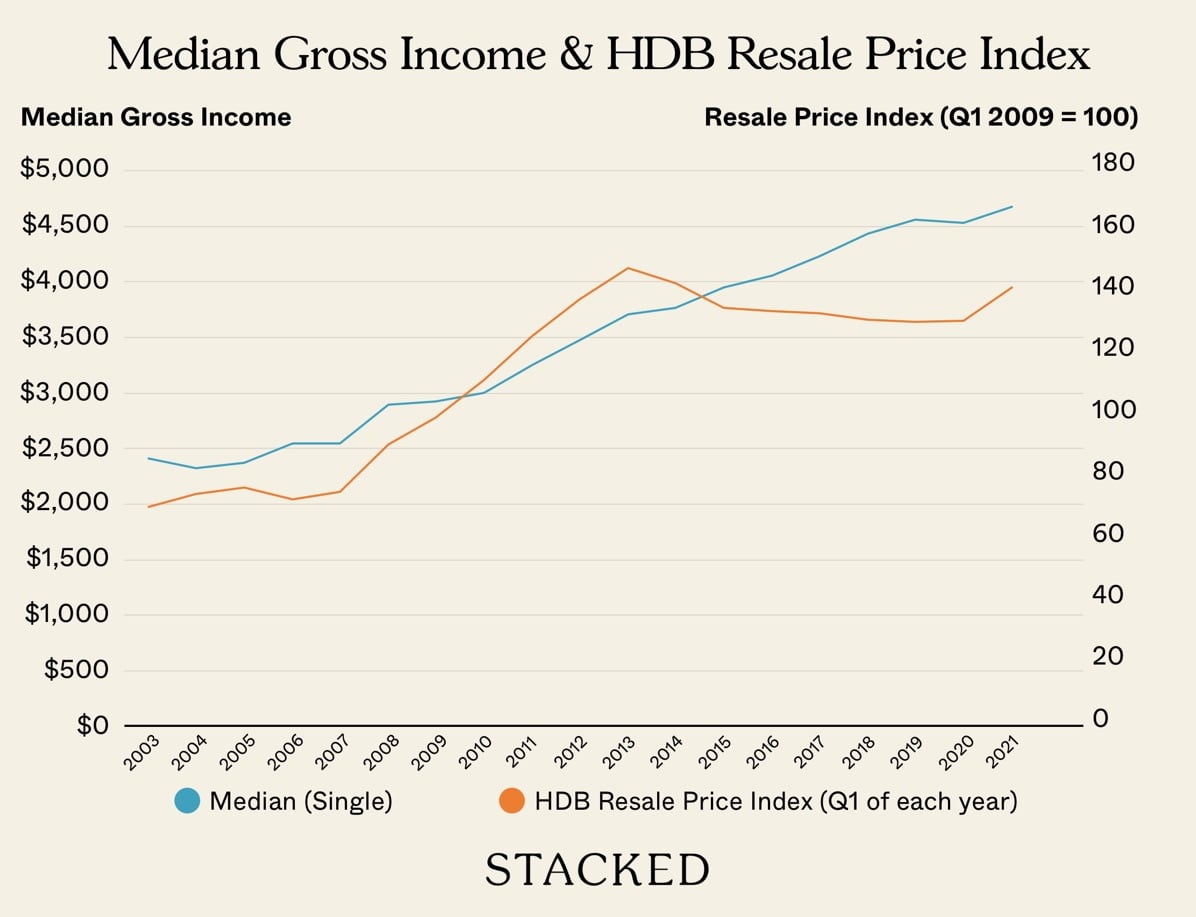

Overall, there were some years where income outpaced HDB prices and vice-versa. In the past 3 years, however, resale flat prices have outpaced income. Here’s what the two look like overall when you put them side by side:

From this chart, it may seem like the trends are showing that incomes have truly kept in line with HDB prices. But with the HDB resale price index shooting up while median income tapers off in the past few years, let’s see if HDB flat prices have really outpaced the growth of incomes in Singapore.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Notes on this Study

Before we present our findings, here are the following points that we wish to highlight –

- The dataset that we examined contains around 468,600 resale transactions from HDB spanning from 2003 to present-day (around 20 years of data).

- The HDB developments in our dataset were grouped based on their centrality, maturity, and age to cater to homebuyers who wish to live in central or mature locations, or in newer flats, depending on the type of buyer’s affordability we’re interested in.

- The Gross Median Income Including CPF is taken from the Ministry of Manpower. Only data up until 2021 is considered as there is no official data for income in 2022.

- We have also used 30% of the median gross monthly income from work for computing the repayment period, which is the same as the current mortgage servicing ratio. Regardless, this should not be seen as an absolute measure of affordability, but rather how affordability has changed. As such, whether 30% or 100% of income is used is moot – what matters is the trend of affordability over time. The 30% repayment also does not factor in interest cost.

- Our study focused mainly on a hypothetical married couple with no other household member earning income looking to purchase their HDB. As such, we took double the median income (husband + wife), while a single income is used for our analysis on the purchase of mature 3-room flat HDBs.

- We decided not to use household income which is more commonly used in other studies as that is derived from all employed household members e.g. Working parents + working children. Since most HDBs are purchased by the parents only to form a family nucleus, we decided to use the median income of two working adults. For singles, we stuck to the median income of one working adult.

- Only the affordability in terms of HDB flat prices is measured here, not overall affordability which should take into account inflation. This could erode our purchasing power as a whole which can affect HDB affordability, however, that is not within the scope of this study.

Key findings

The key findings of our study are summarised as follows:

- Flats were generally less expensive and more affordable between 2014 and 2019. The supply crunch arising from construction delays that were precipitated by the pandemic, led to a rebound in prices and correspondingly, a longer repayment period. However, it’s still more affordable than about a decade ago as a whole.

- Across all estates, newer flats (10 years or less from their lease start date) are a lot more affordable today than they were back in the early 2010s.

- Centrally-located flats have consistently gotten more expensive over the years, but they are still not as unaffordable as they were 10 years ago.

- New 5-room centrally-located flats are the most unaffordable today.

- Families looking for large flats (e.g. 5 rooms) in mature locations (e.g., Ang Mo Kio, Bedok, Bishan, Bukit Merah, Clementi, Geylang, Tampines, Toa Payoh) that are relatively new, can expect to pay more as such flats are in greater demand. A similar trend was observed for singles looking for 3-room flats in mature locations.

1) Flats today are less affordable prior to the pandemic, but more affordable than a decade ago

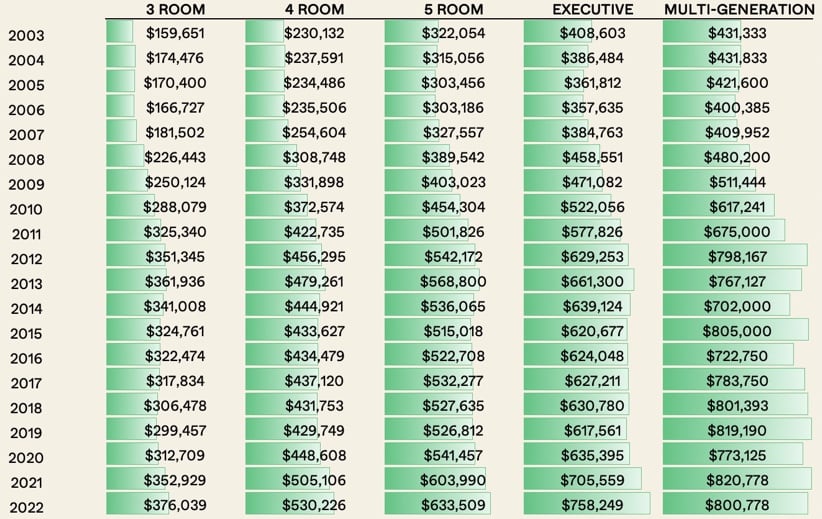

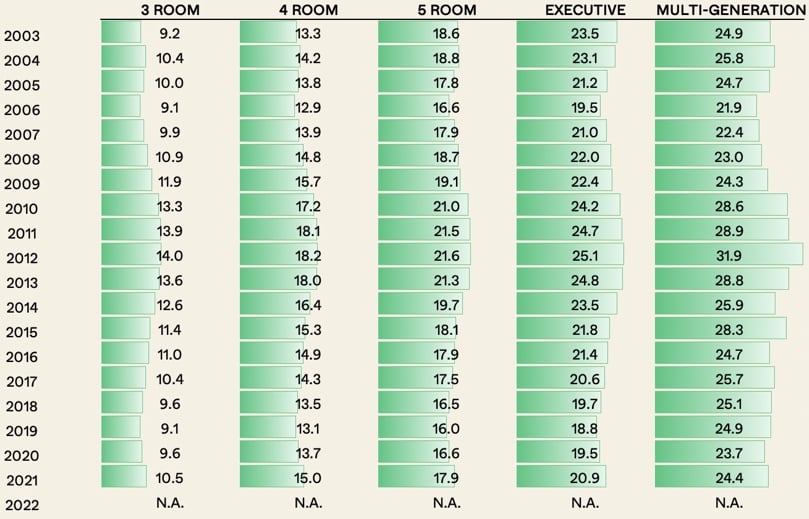

If you look at the affordability chart (Figure 1B), you’ll find that the ratio of price to repayment today is not as high as they were between 2010 – 2014. This implies that while HDB prices have indeed risen to all-time highs, the rise in income has supported this growth.

This may come as a surprise given the numerous million-dollar HDBs being featured across the media, but if we consider the data before us, then we can generally say that the situation today is not as bad as before.

After all, overall prices have indeed risen across the board. HDB flat prices are at an all-time high today as shown in Figure 1A.

But is it fair to say that incomes have kept pace with HDB prices?

Looking at the price to income ratio, you’ll find that the numbers have steadily increased across all flat types (except for Multi-Gen flats). Thus if we look at a couple earning the median income over the past 3 years, it’s fair to say that their affordability has steadily declined in recent years. But if we look at the last 10 years instead, then it is fair to say that incomes have kept pace and that we are perhaps in a better position today than we were 10 years ago.

Considering the high prices today, it remains to be seen whether this is sustainable following the pandemic, construction delays that ensue, and a spike in inflation and interest rates.

As of now, prices have been rising with a corresponding higher repayment period. While HDB has pledged to ramp up flat supply by 35% in 2022 and 2023, and up to 100,000 flats by 2025, construction delays may continue to persist due to the lingering effect of the pandemic and ongoing geopolitical tensions that exacerbate the supply chain situation. Thus, demand, prices, and repayment period may continue trending north which may result in unaffordability levels as high (or higher) as in 2013/14.

The data above used average prices across all flat types in every location, age, and town in the respective years. Since we cannot look at affordability in a vacuum, we have to consider how affordable flats with certain positive attributes are like today, and this brings us to our next point.

2) Newer resale flats are a lot more affordable today than they were back in the early 2010s

When we look at the overall prices of newer flats today, you’ll find that 3 and 5-room flats are not at a market high. Figure 2A shows that 3-room flats today are not as expensive as they were in 2012/13, while the same can be said for 5-room flats in 2016-18. That said, 4-room flats are indeed at an all-time high just this year compared to their previous high in 2013.

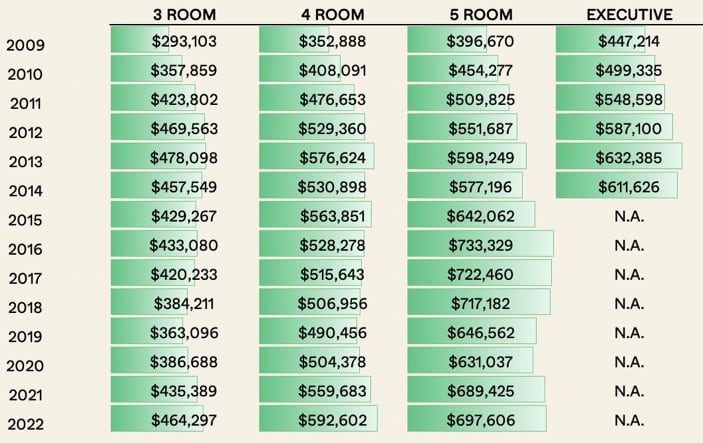

Figure 2A: Average Price Trend ($) by Year of Sale, Novelty, and Flat Type (Flats built from the early 2000s) (Source: HDB)

While this is true, it may come as a shock to you that in terms of affordability, newer resale flats are a lot more affordable than they were 10 years ago. Take a look at Figure 2B.

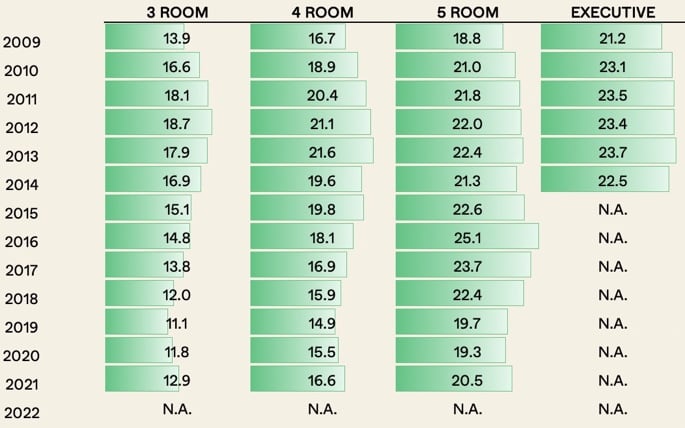

Figure 2B: Average Repayment Period (Yrs) by Year of Sale, Novelty, and Flat Type (Flats built from the early 2000s) (Source: HDB/Ministry of Manpower)

As you can see, the price to repayment ratio was at 18.7 in 2012 for 3-room flats, 21.6 in 2013 for 4-room flats, and 25.1 for 5-room flats. In 2021, these numbers were 12.9, 16.6, and 20.5 – a lot more affordable than they were years ago.

This increase in affordability rhymes with our earlier findings when we took the overall HDB market into consideration, but the difference in affordability is even greater. So what can explain this?

More from Stacked

Tour A 1,227 Sqft Condo Transformation: How A Homeowner Used 3D Renders To Create A Seamless Indoor/Outdoor Home

If you are a design-inclined or a hands-on person, designing your own home would naturally be something that you’d want…

One possible explanation is that flats launched in the early 2000s/2010s and resold in the mid-to-late 2010s were in suburbs (e.g. Hougang, Punggol, Sengkang, Yishun, Woodlands), where prices were much cheaper as compared to those in other locations, despite the former’s novelty (a point which we will revisit towards the end of this article). This allows homebuyers to service their flats’ mortgages in a relatively shorter amount of time.

As such, it can be argued that the large supply of BTOs in such estates in the past has increased affordability for those seeking a newer flat.

But what if we considered only centrally-located flats?

3) Centrally-located flats are at an all-time high, but not as unaffordable as before too.

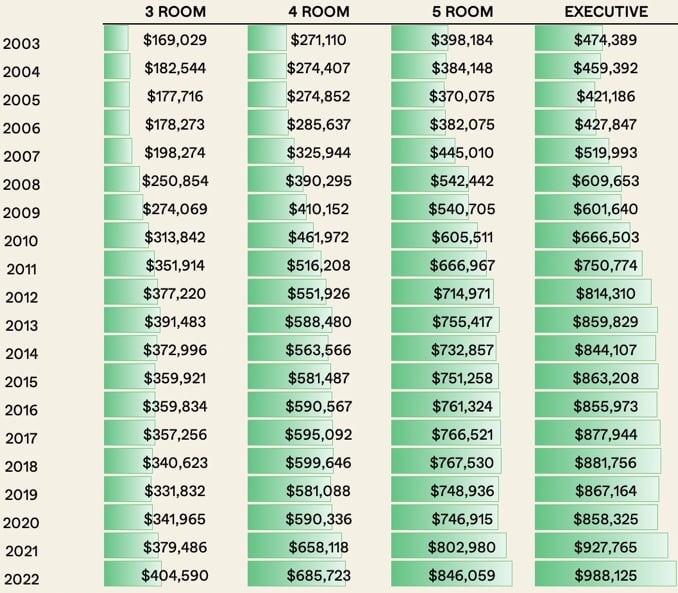

I know this sounds contradictory, but centrally-located flats have displayed the same pattern as the overall market: While prices are at an all-time high, they are still not as unaffordable as before if we consider the increase in median income.

Figure 3A below shows the changes in prices of centrally-located flats, which are defined as those in Ang Mo Kio, Bishan, Bukit Merah, Bukit Timah, Central Area, Clementi, Kallang/Whampoa, Marine Parade, and Queenstown. While some on the list may be arguably non-central such as Clementi and Queenstown, we did factor in an element of desirability here since Clementi is a very sought-after estate.

Figure 3A: Average Price Trend ($) Year of Sale, Centrality, and Flat Type (Source: HDB)

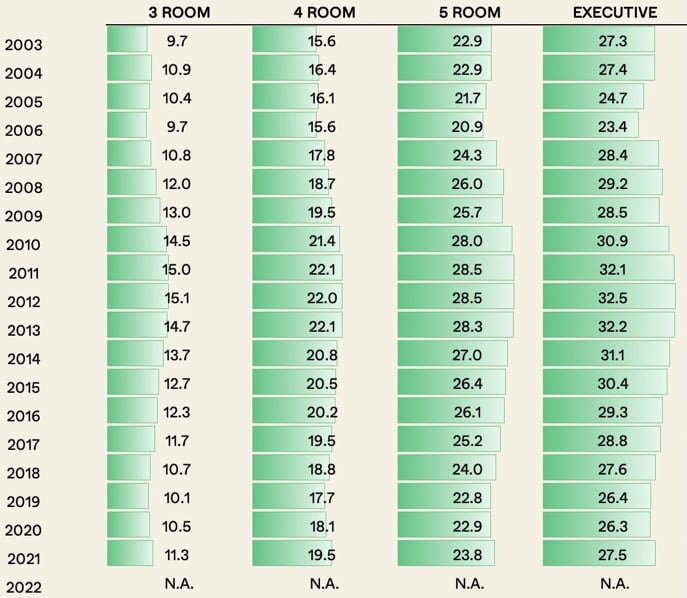

Figure 3B: Average Repayment Period (Yrs) by Year of Sale, Centrality, and Flat Type (Source: HDB/Ministry of Manpower)

Figure 3B shows the change in affordability of centrally-located flats over the years. As you can see, these types of flats are relatively more affordable today than they were in the early 2010s. For example, 5-room flats had a ratio of 28+ between 2010 to 2013, while in 2021, it stood at 23.8 or about 25% more affordable.

Centrally-located flats may be more affordable today than before, but this could be due to the many old HDBs transacting found in the data. And so, what if we only considered newer and central flats?

4) Newer 5-room flats in centrally-located areas are almost reaching the most unaffordable levels since 2010

Are you looking for a newer and centrally-located flat? Well, then things do look a lot worse for you, I’m afraid. Prices are high, and when we consider affordability, it’s much worse than if we compared it with the overall market.

Let’s take a look at Figure 4A which examines the prices of flats across centrally-located towns with a lease start year that’s less than 10 years from the transaction year. Do note that Executive flats are excluded as they cannot be considered to be in a new development since the last Executive flat was built a while ago.

Figure 4A: Average Price Trend ($) Year of Sale, Centrality, and Flat Type (Source: HDB)

As you can see, the average price of new 5-room flats is already above the million-dollar mark in both 2021 and 2022 (so far). 4-room flat prices are already at $835K on average for these centrally-located flats, and it’s clear that these types of flats are always in demand due to convenience and proximity to amenities.

A look at the recent BTO applications, with application rates as high as 187.4 times and 149 times oversubscribed for 4-room flats at Dakota Crest (@Geylang) and King George’s Heights (@Kallang/Whampoa) respectively, speaks volumes of their popularity. With no other newer alternatives, homebuyers can only turn to the resale market, which fuels demand for such flats and the premium that they can command.

Now here’s a look at the affordability of newer centrally-located flats:

Figure 4B: Average Repayment Period by Year of Sale, Centrality, Novelty, and Flat Type (Source: HDB/Ministry of Manpower)

The price to repayment gap has narrowed when compared to the overall market. While 3 and 4-room flats are still not as unaffordable as they were in 2013, 5-room flats are coming pretty close to the 2010 and 2015 numbers. These are likely your 5-room flats found at The Pinnacle@Duxton, as well as other newly-MOPed flats such as City Vue @ Henderson, SkyVille@Dawson/SkyTerrace@Dawson (some of which feature unique attributes such as loft units).

HDB ReviewsSkyTerrace@Dawson Review: Greenery Living In A Central Location

by Reuben Dhanaraj5) Families and singles can expect to pay more for flats in mature locations, but it isn’t as unaffordable as before.

For our final analysis, we looked at how much it might cost as well as the affordability level of homebuyers from two different household structures:

- Families looking for larger flats (i.e. 5 room and larger) in mature locations

- Singles looking for 3 Room flats in mature locations)

Do note that we did not consider the novelty factor here, i.e. flats that are 10 years old or less from the year of the transaction.

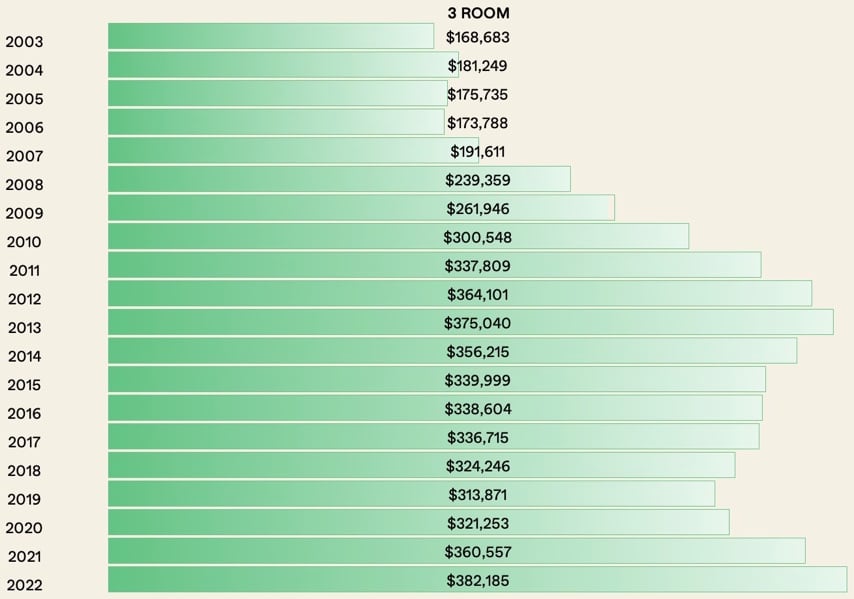

Unsurprisingly, prices for both 3 and 5-room flats in mature locations have risen since the pandemic and are at an all-time high today.

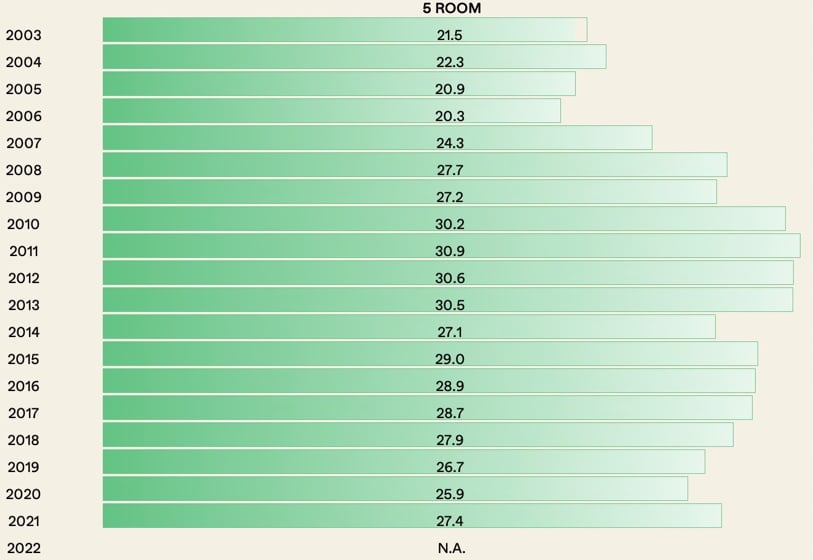

Yet, if we look at the affordability levels, you’ll see that 5-room flats in mature locations are not as unaffordable as they were in 2011.

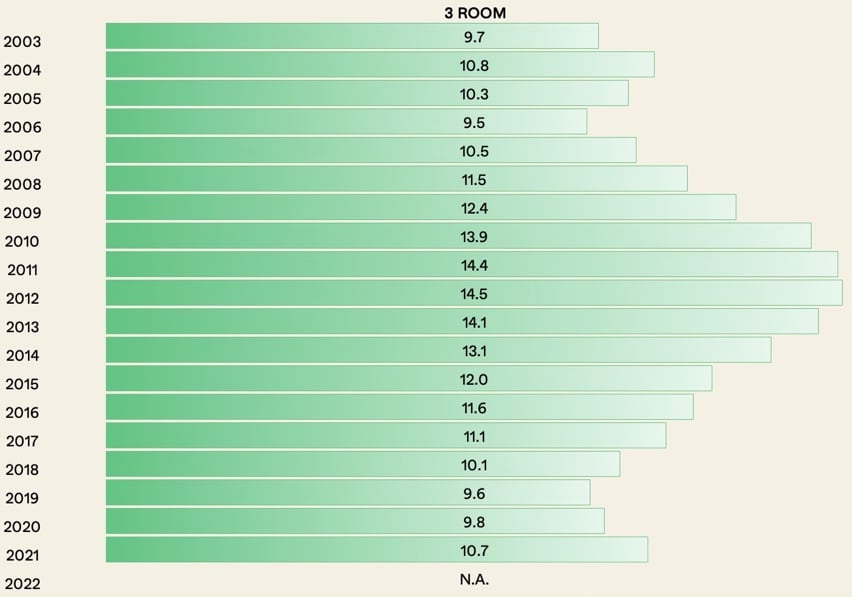

The difference is starker for 3-room flats, where the number of years it took to repay the loan is 14.5 in 2012 compared to the 10.7 years in 2021.

As such, while prices of centrally-located flats suitable for families as well as singles have risen, the level of income has also risen so that the situation is not as bad as before.

Figure 5A: Average Price Trend ($) for 5 Room Flats by Maturity and Year of Sale (Source: HDB)

Figure 5B: Average Repayment Period (Yrs) 5 Room Flats by Maturity and Year of Sale (Source: HDB/Ministry of Manpower)

Figure 5C: Average Price Trend ($) for 3 Room Flats by Maturity and Year of Sale (Source: HDB)

Figure 5D: Average Repayment Period (Yrs) for 3 Room Flats by Maturity and Year of Sale (Source: HDB/Ministry of Manpower)

Conclusion

You’re probably thinking – how can it be that with multiple million-dollar HDB headlines appearing in the news the prices of HDB are not as unaffordable as before?

Well, for one, you do have to remember that the number of million-dollar HDB flats is still just a very tiny number of the total number of sales. So you really shouldn’t be taking that as a yardstick to judge affordability as a whole.

Next, as we go back to the opening statement from the MND, there is some truth that incomes have also risen in line with HDB prices – that is, if you compare it with data from the early 2010s. Buyers then had it slightly worse than buyers today if we consider affordability levels.

Still, we need to consider the increasing lower levels of affordability over the past 3 years and also recognise that the yardstick referenced affordability levels in the run-up of the property market prices up to 2013.

And as we’ve uncovered from looking at newer 5-room resale flats, the affordability levels for certain types of purchases are indeed close to the lowest levels a decade ago. So while affordability in terms of price may not be as bad as a decade ago in a general sense, perhaps the quality of life we can get from what we can afford today has gotten worse.

It must also be noted that while median incomes have risen, not everyone has benefitted from this equally. Some segments of the market may have been left out, and their voice of discontent is equally valid and should be heard/addressed.

Finally, we would like to raise that comparing affordability strictly with the prices of HDBs is not an accurate measure of true affordability. While a home is a big-ticket item, it’s not the only thing that we buy. Our daily necessities, transportation, and monies spent on leisure activities make up a significant portion of our spending too. With rising inflation, our overall purchasing power has gone down. So even if incomes have risen and are not as bad as 10 years ago from an HDB affordability standpoint, our net position after taking inflation into account could put us in a less favourable position today.

So for those who are considering purchasing a resale flat, particularly for those that are newer in central locations/mature towns, it may be opportune to re-consider your search criteria by expanding your horizon to non-mature towns, which may offer a better “bang for your buck” as we have shared more extensively in a separate article. Moreover, you could say that flats in these towns could have more runway for appreciation as they become more mature with the increasing transformation of the area.

For more on property analysis, follow us on Stacked – and if you have any questions related to resale HDBs, feel free to drop us an email at stories@stackedhomes.com.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are HDB flats becoming more unaffordable in Singapore?

How does the affordability of newer resale flats compare to a decade ago?

Are flats in central locations more expensive or less affordable now?

What is the trend for the prices of new 5-room flats in central areas?

How does location affect the cost of flats for families and singles?

Ian Tan

Ian is a property enthusiast who finds himself constantly learning about this art and uses data to educate himself on property investment. When not analysing property data, Ian can be found shooting hoops, eating healthily and reflecting on himself, so that he can continue pursuing his aspirations for as long as his mind and body allow.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments