A Buyer’s Case Study With Stacked: Fourth Avenue Residences

December 7, 2020

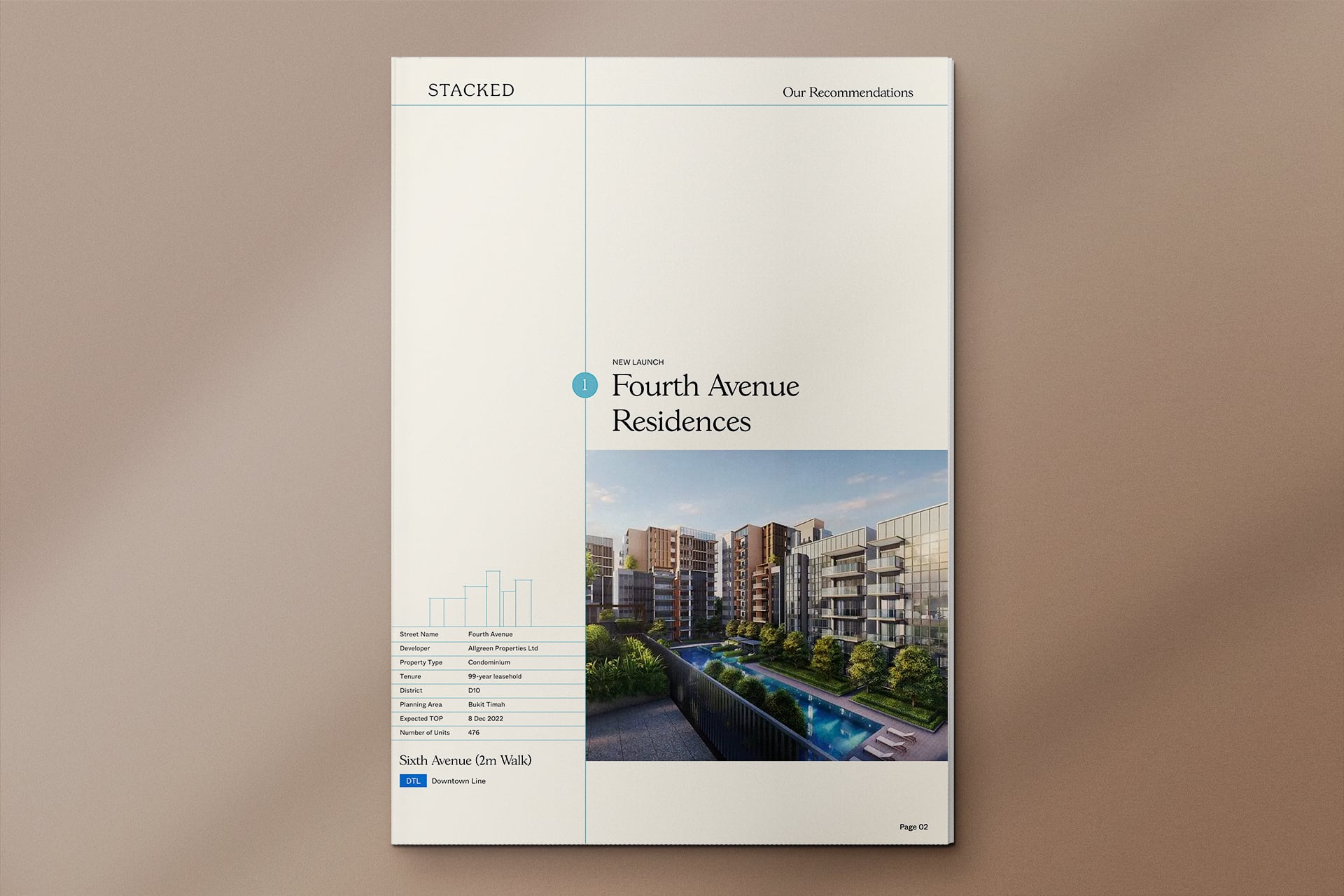

Project Case Study: Fourth Avenue Residences

Client Details

- Couple in their early 30s

- One was working as a consultant and the other in a tech firm

Buyer’s Brief

- Looking for their first home

- Used to the Bukit Timah/Holland area

- Medium term horizon of 10 years

Challenges They Faced

- Unsure of the exit strategy

- Caught in two minds between liveability and future appreciation

- Looking at resale but it was tough at that price point in the areas they were interested in

First Consultation

As you might well have guessed, this was another client journey that began in the earlier months of the pandemic.

Like many others that we’ve spoken to during this period, it was a confusing phase to be house shopping – let alone for someone looking to buy their first home.

The number one question on their minds usually was – would the prices drop further?

Couple that with resale prices that don’t really seem to be dropping and you’ve got yourself one bewildered home buyer.

If this reads like your thought process over the last few months, know that you are not alone – there are many others in the same boat as you are.

So like our previous case study on Kopar, unfortunately we could not meet up for the first consultation and had to do it over the phone.

For the benefit of those new to our case studies, the first consultation is always crucial. First, for us to better understand our client’s objectives and to dive deep into what they really want in a home. Oftentimes people have an idea of what they want in their head – close to good schools, capital appreciation, or even must have features like an open patio.

But after going through the entire process, what they end up purchasing can be very different – buying a home can actually be more emotional than you might think!

Second, we like to use the opportunity to better educate our clients on the Singapore real estate market. The trends, things to look out for, and general tips. We will also present what to look out for in any potential purchase – integration (shopping, MRT, transformation), comparables in the area, holding period, and sustainability for the property.

In this case, our clients had a lot of questions about freehold vs leasehold (very normal), and about new launch vs resale (again, very common).

They hadn’t done much prior research, but were keen on settling down in areas that they were used to, like the Bukit Timah, Holland, and to a lesser extent, the Alexandra regions.

After speaking to them, these were their initial set of criterias.

- Looking at resale as they wanted bigger living spaces (1,000 sq ft and above)

- Timeline was important, they wanted to move in by 2021, hence again, resale

- Freehold

- Only keen on Bukit Timah, Holland, and Alexandra

- Future capital appreciation

There were a few pertinent issues, of which we had to align during the call.

For one, their budget was at $1.6 million. Not a small one by any means, but in the prime areas you would be hard pressed to find something suitable. The older condos usually have bigger living spaces and hence a bigger overall quantum. And especially taking into consideration the freehold criteria, you really aren’t left with too many choices.

And as you might know by now, one of the problems when shopping for a resale unit is availability. More so for older developments in these areas as they tend to be more for own stay – which might mean you don’t always get the right unit you are looking for. In other words, the timing and availability is never within your control.

But again, the real issue here was that they were priced out of the areas that they were looking at.

Of course, we had to show them what we meant.

Take Gallop Gables for instance.

It’s quite an under the radar type development. It doesn’t occupy much frontage along Farrer Road like the rest but it’s deceiving as it stretches pretty far in.

Basically, it’s just 140 units on over 200,000 sq ft of freehold land. It’s spacious and walking distance to Farrer MRT station.

But, because it’s an old development – unit sizes are big.

By most accounts that would be a good thing, but for our clients here this just meant that the overall quantum is out of their reach.

Recent transactions have shown the 2 bedders transacting at over $2 million, which blows past their budget.

Likewise, other developments in that area like Spanish Village were priced at $1.8 million for a 1,100 sq ft unit. Again, while it fits the size requirements, even though the psf is low, the overall quantum is too high.

Although looking back now there was a transaction in Oct 2020 at $1.6 million at a reasonable price of $1,419 psf. Which does reinforce our point about looking at resale units – the timing is never within your control. While it may seem like a missed opportunity in this case, it is really just one of those things that can’t be predicted.

There have also been countless cases where you might be kept waiting, with no suitable unit coming on the market. When that happens you’d be stuck in no man’s land, should you rent? Or just give up the wait and buy someplace else.

More importantly, despite the current pandemic – these sellers had holding power. So contrary to popular opinion that they would be willing to let their units go at a discount, on the ground this wasn’t the case at all.

It may sound harsh, but doing this is important to let our clients have clarity of the actual situation, and how realistic their budget actually is for what they want ultimately.

It’s much better than going around on a wild goose chase for them to be disappointed at the end of the day.

Last but not least, we rationalised with them that since their targeted holding period was only about 10 years, it could actually be worth exploring the option of a leasehold new launch as well.

Because they were intending on using this property as a stepping stone to a bigger one in the future, it might not actually be worth it to pay the premium for a freehold one – so as long as the new launch TOP is within their timeframe.

So we gave them a little homework to do, they had to rank in order of priority between size, freehold and location.

After deciding which was more important, it would then be more conducive to see if the budget needed to be adjusted, or if one of the priorities could take a backseat.

They came back to us in about a week, and this was how they ranked it

1. Location

2. Size

3. Freehold

So now that everyone was on the same page, it was down to researching for the first proposal.

First Buyer Proposal

Now it goes without saying, the locations they were looking at has a ton of residential options.

But because of the budget constraints, it was a lot easier to sieve down to what was necessary.

Here were the first 4 options that we presented:

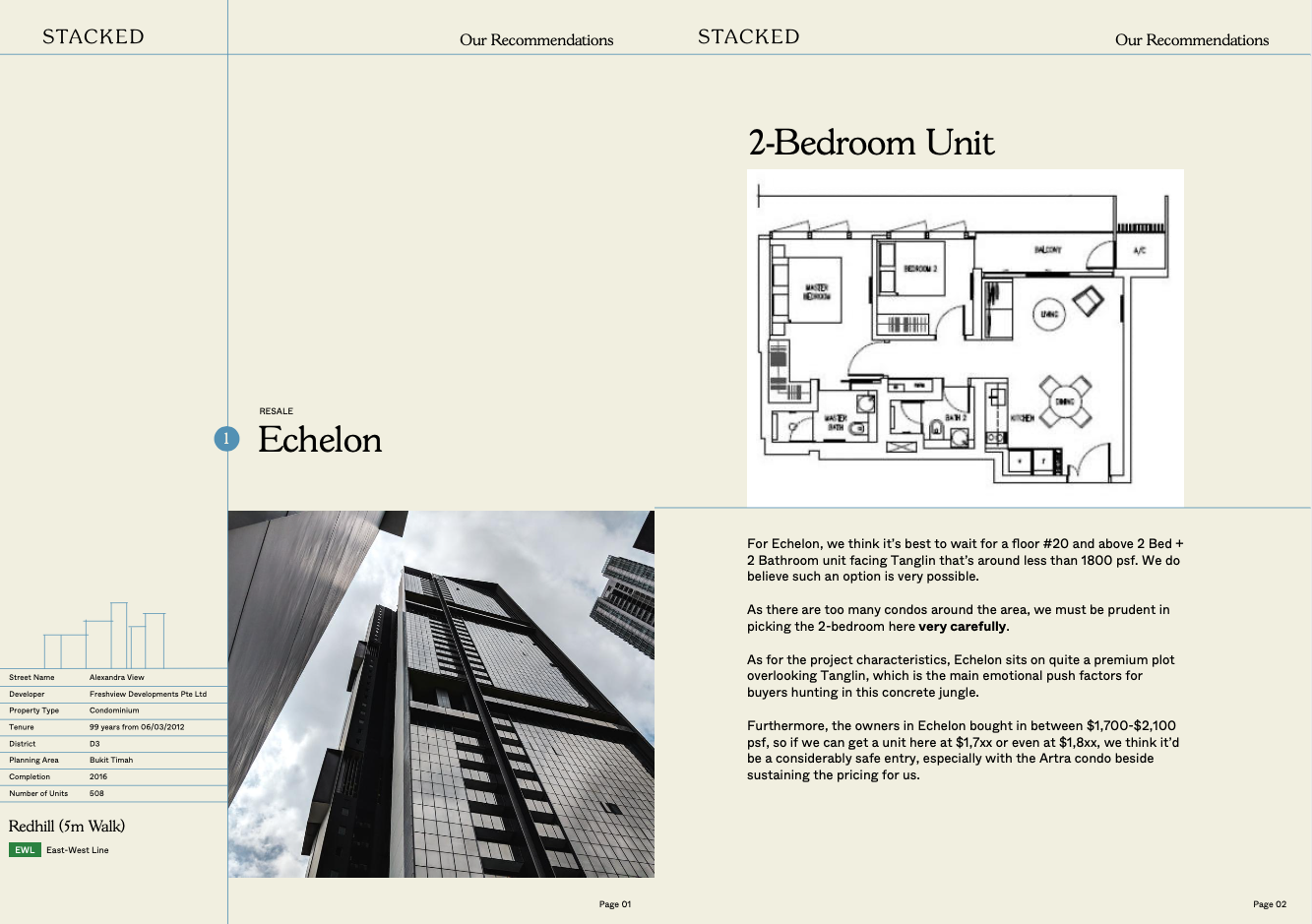

- Echelon

For those less familiar with the Alexandra area, the Echelon is one of the five newer developments in the immediate area. Arguably, it is the sleekest looking one (having been designed by SCDA). Although you do have Alex Residences next door with the rooftop infinity pool as the wow factor, and the newest kid on the block – the Artra, with direct MRT access and an NTUC located within the development.

For Echelon, we recommended to wait for a 2 bedroom unit from the 20th floor (for the views) and a pricing of under $1,800 psf. Given that there are quite a number of condos in that area, it is imperative to pick the right unit very carefully.

Most of the earlier owners of the Echelon would have purchased between $1,700 – $2,100 psf so $1,800 psf would be a considerably safe entry – especially with the newly built Artra to help sustain the pricing of the area.

Condo ReviewsEchelon Condo Review: Impressive hotel-like condo in Redhill

by Stanley Goh- The Merasaga

Our clients mentioned that the Holland Village area was one that they really liked. While there were many new launches in the area, they were all out of budget because of the freehold status and well, it is Holland after all.

So in this area, we looked at the resale market (Warner Court/Willyn Ville), but these older ones were all freehold and the current asking prices were overpriced plus out of the budget range.

Hence, we considered The Merasaga because it was leasehold so prices were almost within range.

Needless to say, the location is great, close enough to walk to Holland Village yet still enjoys relative peace and quiet.

That said, buying an old leasehold such as this would probably have to entail the exit strategy of waiting for an en bloc sale.

Alternatively, because of the revamp of Holland Village we would think that prices might be pushed up once the new launches are all built (best case), if not price would be maintained or there might be an en bloc opportunity – which renders your price quite well-protected.

Of course, the risk factor is if any speculators here for an en bloc fails, they might be pushed to sell below market value.

- Fourth Avenue Residences

With the asking prices at that point of time for a 2 bedroom 2 bathroom unit at $1.6 million budget, it was within their budget.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Analysing The Gap Between New Condos And Household Income (All 28 Districts): Which Are Still Affordable To Singaporeans?

There’s a list of “coffee shop complaints” that we hear all the time, from the rising cost of food, to…

You could almost consider it to have direct access to Sixth Avenue MRT station, and with food just opposite and a Cold Storage located next door, it does offer good prospects liveability wise.

Last but not least, you will enjoy good rentability not just from the characteristics above, but from the positioning of the RoyalGreen next door. Because that is a freehold project, owners there will be wanting to protect their rental yields with a higher asking rental price. This gives owners at Fourth Avenue Residences a buffer in pricing.

It’s quite simple really, if you are a tenant looking in the area, would you choose the development that is connected to the MRT (cheaper) or the freehold one opposite the road (which is more expensive)?

The biggest downside here is probably its scheduled TOP by the end of 2022.

- Margaret Ville

Admittedly, this was a stretch of budget but we felt this 4 bedroom unit at Margaret Ville was a good option that was worth considering. This was asking for $1.9x m where other 4 bedroom units in the area were priced at $2.2m and above.

We also like that there were only 300 plus units in the development, which is a great size. Not too big that facilities could get overcrowded, and not too small that monthly maintenance gets too overbearing. Plus, it is expected to TOP in 2021, which was perfect timing.

Second Consultation

So during the second consultation, we went through the proposal thoroughly so that they had a better feel of the pros and cons of each pick.

From here, we had a sense that they were really keen on The Merasaga, while Echelon was more of an interest to see how a new modern development would be like.

It was also during this call that they felt that they wanted to prioritise resale units first as the possibility of moving in earlier was a tempting prospect.

With that, it was a tense wait for the circuit breaker to end to commence the viewings!

Here’s a list of the projects that were viewed (other than the initial proposal). For fear of boring you completely, we’ll just quickly touch on what they liked and didn’t like about each of them.

- really liked the location, quiet yet close to HV

- dated exterior

- Asking price and guesstimate closing price of the available units at that time was much higher than last transaction and valuation

- Good location

- Poor facilities

- High asking price because freehold

- Close to MRT

- From here they dropped the Alexandra area, still preferred Holland

The Wharf

- Crowded on the weekends

- Surprisingly squeezy feel

- Didn’t feel homely

- Really like the resort ambience

- Location while good, was a bit underwhelming compared to Merasaga

- Liked the pool and facilities

- Wasn’t a fan of the unit layout

Newton Edge

- Small

- Not a fan of the location

Corals at Keppel Bay

- Really liked the location and feel of the development

- Stylish design

- Not great layout

- Concerned that the project still hadn’t sold out

- Liked the layout

- Good location

- Asking price and guesstimate closing price of the available units at that time was much higher than last transaction and valuation

- Unit condition required a lot of renovation

- Concerned about the amount of reno work needed

After viewing all the resale units, the straw that broke the camel’s back was because all the resale units were not in ready-to-move-in condition. This meant that substantial renovation costs would have to be incurred – which was exacerbated by Covid-19 (construction costs would be higher).

Not just that, you might even see the timelines having to be stretched even further because of construction delays.

Understandably, it was tough for them because while they did like some of the resale units, the asking prices and conditions were just too much to be considered. Taking into account the prices plus additional reno works meant that they were likely to have to account for a bigger overall budget.

And so because of those reasons, we proposed to them to take a look at the new launch side of things.

Back to New Launches

Unfortunately by that time, Margaret Ville was 100% sold out. So we turned our attention to Fourth Avenue Residences.

You might be wondering: there are so many new launches in the Bukit Timah area – so why Fourth Avenue Residences?

First things first, it has great connectivity to the Sixth Avenue MRT station (you could say it is direct) and there is a lack of unit supply in that landed-dominated area. Furthermore, as far as entry prices go, Fourth Avenue Residence is the lowest priced full-facility condo in the vicinity (we are talking about 2 bedroom units here specifically) because it is the only leasehold condo in the area – so it will also be an affordable quantum in the future resale market. This is a major trait that would contribute towards its value-retention factor for Fourth Avenue Residences despite its leasehold tenure.

Put it this way – this is simply an introduction of a mass market residential supply to an area lacking one. One comparison that you can draw would be to the Loft at Nassim – which has managed to hold its prices and demand (the only leasehold in a freehold dominated area).

For further comparisons, we have done a similar one with Kopar and its adjacent Amaryllis Ville.

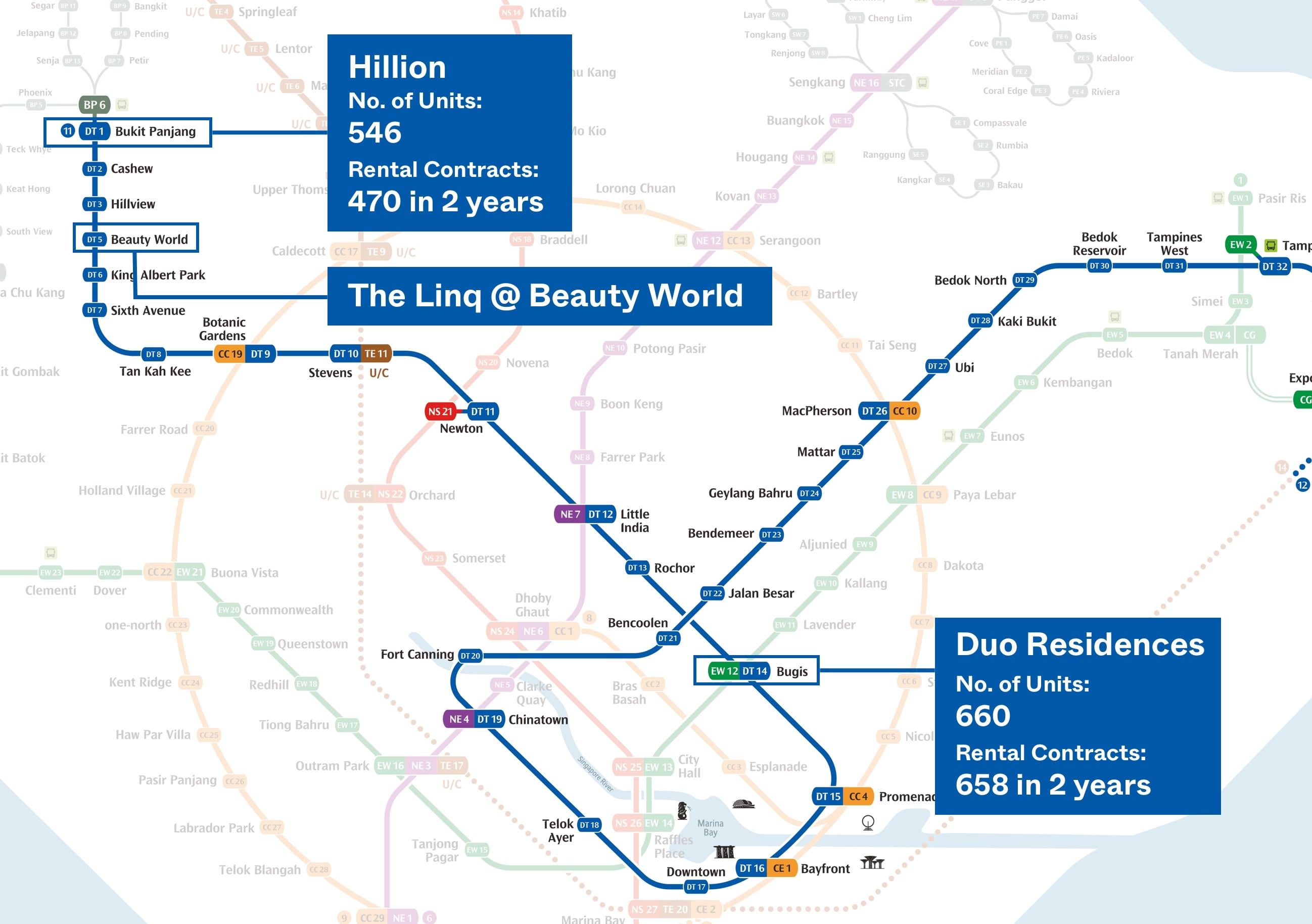

Next, we did additional research on its main attribute – its MRT connectivity and its bearings on rental demand.

If we were to look at the Downtown MRT line (with the upper limit of where our clients would go being Bugis), there are just a few projects that can boast to have direct MRT access.

To give you an idea, we have Hillion at Bukit Panjang, The Linq @ Beauty World, and Duo Residences at Bugis.

As a comparison:

Hillion 546 units, with a total of 470 rental contracts in 2 years

Duo Residences 660 units, with a total of 658 rental contracts in 2 years

Contrast this to further away projects from the MRT:

Eco Sanctuary 483 units, with a total of 171 rental contracts in 2 years

Foresque 496 units, with a total of 241 rental contracts in 2 years

Tessarina 443 units, with a total of 193 rental contracts in 2 years

This is just to illustrate that rentability and rental demand will play a role in the price protection of the development.

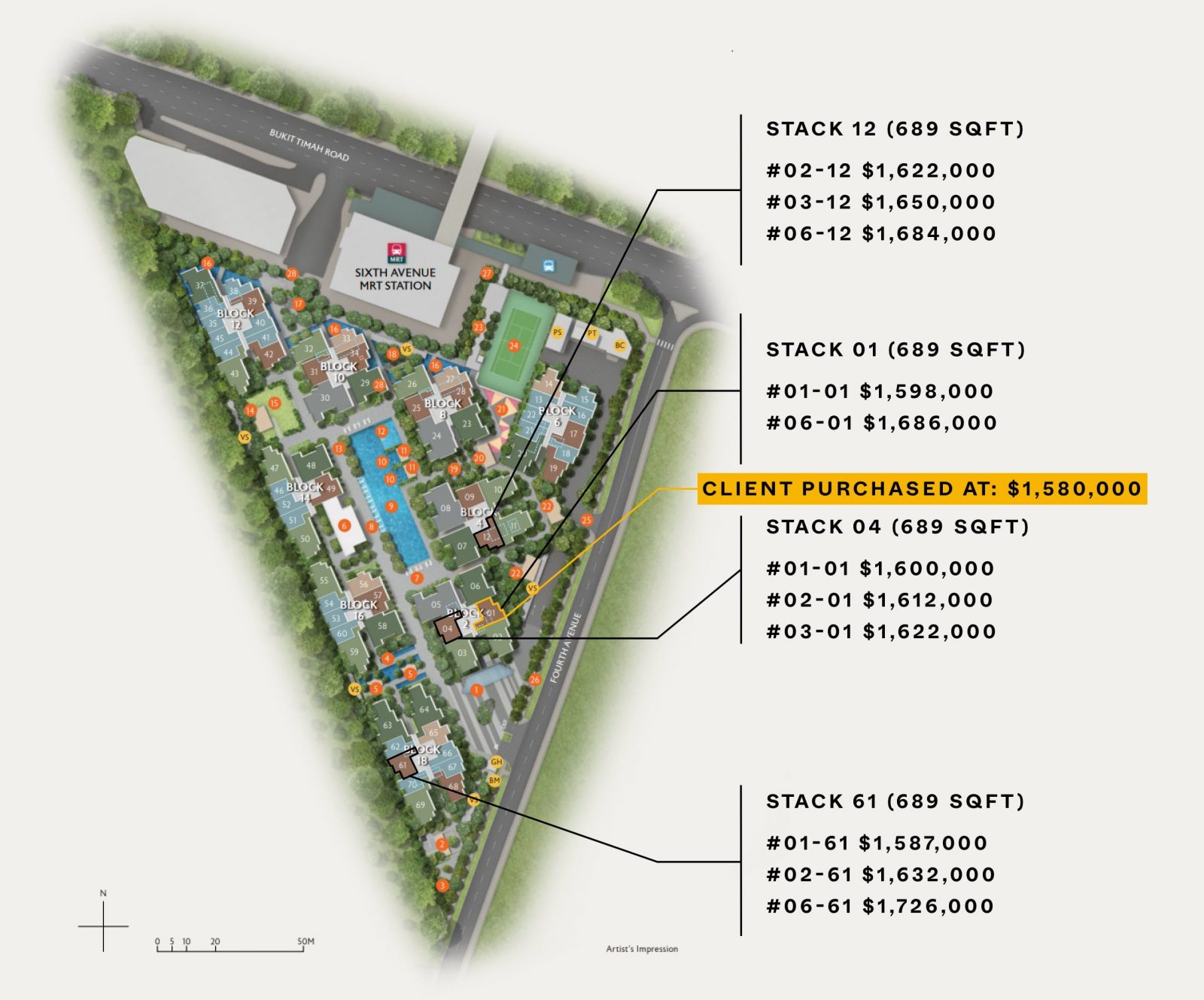

Beyond project comparisons, identifying the right unit within the development is just as important as well. To get that right, we will be relying on the varying stack premiums as a safety net.

This premium is at its highest gap during the new launch phase only. As the project enters the resale market, you still start to see this premium gap closing, and even disappear entirely at times.

To give you a better idea, these were some of the asking prices for a 2 bedroom unit at Fourth Avenue Residences.

So some of the Stacks we were looking at were Stacks 4 and 12 at $1.673m and $1.68m respectively.

But just as we were doing our research on it, we received word from our networks that there was a sub sale unit that was looking to sell at $1.63m, despite having bought at $1.68. This was a distressed sale, hence the lower price as the seller was urgent to let it go.

It was a fresh listing that was not even on any property portal yet.

We quickly did up a comparison with the other units to showcase why this sub sale unit would be one to go for.

Judging from the situation at hand, we advised for an offer at $1.58m.

At that price, we considered it to be an even safer entry, as you would be essentially almost getting it at one of the lowest prices for a 2 bedroom unit at Fourth Avenue Residences. As a matter of fact, only a small handful of units were going for cheaper – but bear in mind these were facing the wall (as it is facing the MRT). To give you a better idea, these were sold at $1.518m.

In comparison as well, current units were asking for above $1.6m, so the price was effectively well protected.

Final Purchase

To cut a very long story short, we were able to push through the deal for them at $1.58m.

Those with a good memory might remember that our clients initially wanted to move by 2021, but Fourth Avenue Residences was only slated to be ready by end 2022.

Well, because of the unpredictability of the availability of the resale units and the one-off of this sub-sale unit, they were willing to wait a little longer for it.

Ultimately, you could say this was a one-off that wasn’t going to come around again. But we do think that all things considered, it was a good entry price to a development that is well connected and would be an ideal stepping stone for them before moving to a bigger one in the future.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What was the main challenge faced by the buyers in the case study of Fourth Avenue Residences?

Why did the buyers consider a leasehold new launch as an option in their property search?

What were some of the initial criteria the buyers had for their property search?

How did the buyers' ranking of priorities influence their property options?

What were some reasons the buyers ultimately did not choose resale units during their property search?

Why was Fourth Avenue Residences considered a good option for the buyers?

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Investor Case Studies

Investor Case Studies Why We Chose A $1.23 Million 2-Bedroom Unit At Parc Vista Over An HDB: A Buyer’s Case Study

Investor Case Studies How We Made $270k From A $960k Condo Bought During COVID: A Buyer’s Case Study

Investor Case Studies Why We Bought A 3-Bedder Condo At Penrose: A Buyer’s Case Study

Editor's Pick Why I Bought A 2-Bedder Investment Property At Leedon Green In District 10: A Buyer’s Case Study

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

11 Comments

Good job in helping your client score on that deal! May I know what analysis did you do to offer $1.58m? seeing that it got accepted, do you think an even lower price would have also sealed the deal?

What do you think about a unit at Mayfair Gardens which has a lower quantum than Fourth Avenue but also close to amenities, MRT and schools?

Great case study! Always enjoy reading your articles 🙂

Just curious though – Mayfair Gardens and Mayfair Modern, both residing in the D21 Upper Bukit Timah area and 1 mrt station away from Sixth Avenue, seem to have similar or even better attributes (a few min walks to MRT which may even become a interchange with Cross island line in the future, 1km walk to two good pri schools which 4th Avenue doesn’t have, etc). And the price points for 2 bedders appears to be lower which may increase rental yield. Would you be able to share the thought process for excluding these developments?

I have always been somewhat keen on this project as I see potential for a prime district 10 project with the mrt right at the doorstep and the price of 2300psf or so for a 2 bedder is quite attractive. Good job in helping your client secure a rather good deal at 1.58mil.

You could have gotten a bigger 2 bedder at 19 shelford, freehold, for cheaper than 1.6M.