Why Your Financial Future Depends On Your Exit Strategy

March 1, 2020

I’m sure most people would have heard of the saying:

If you fail to plan, you plan to fail.

As corny as it sounds, this saying does not ring more true than when it comes to investing in property.

I’m sure most of you reading this now would have done one or more of these things at some point:

- Spend hours reading reviews online and watching youtube videos to determine the best phone to upgrade to

- Read travel blogs, follow Instagram accounts for trip planning for a year-end holiday

- Prepare for months for the best bang for your buck wedding

Not to say that these things aren’t as impactful on your life, but the amount of time to plan and research is not nearly proportionate to the significance of the purchase.

To be fair, most people do think of the usual suspects.

Rentability.

Proximity to MRT.

Surrounding upcoming redevelopments to the area.

And while all these are important factors, their exit strategy is something that they almost usually never think about.

Let me explain what I mean.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

So what is an exit strategy?

You might have had a consultation with a (good) financial planner before.

One of the most common questions they will ask is – what are your life goals?

That’s not hard, you might be thinking.

Get married by 28, first kid by 32, second kid by 35.

And finally, you aim to retire by the ripe old age of 50.

#wellplanned #lifegoals

So from the targets you’ve set, your financial planner will then come up with the different insurance policies and plans to ensure that you are adequately covered to help you when you reach those points.

Let’s just walk through one scenario.

If everything goes smoothly and you do have your first kid at 32, this means you’ll be 52 by the time he/she goes to university.

And since you plan to retire at 50, you’ll need a good savings plan that matures by exactly that time.

Thus, the lump sum disbursement will allow you to have the funds to send your kid to university.

Worry free, isn’t it?

So why don’t we do the same with our plan for property investment?

Remember, the exit strategy that you end up choosing will have a big impact on where you want to end up financially.

Your exit strategy may change over time, but if you go into the market knowing how you are going to come out (whether it is in 5 years or in 10 to 20 years) it will more likely lead you towards your financial goals.

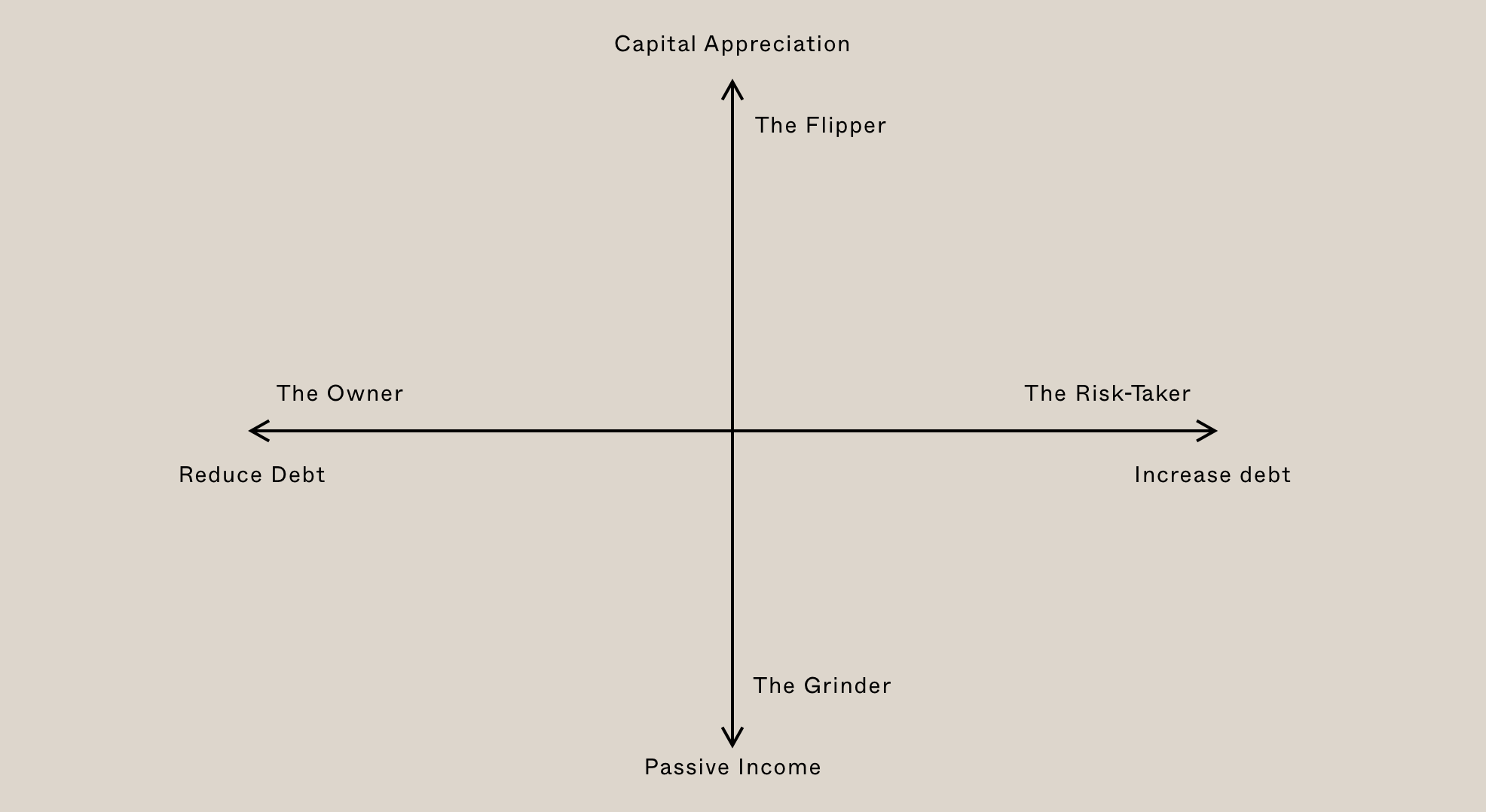

So what are the different exit strategies you need to know about?

The Grinder

Not everyone is into investing in property because of capital appreciation, some are in it just to generate a passive income towards financial freedom.

In this case, this is really a long term strategy to hold all the properties without focusing on paying down your debt.

Over a period of time, your properties will increase in value, and hopefully so will your rent.

But your debt amount stays the same.

As your rents go up and your debt stays the same, your passive income will begin to increase.

This is basically an interest-only loan, with the goal of generating a passive income that is higher than the expenses of your property.

More from Stacked

We Are In Our 20s With $17k CPF And Are Saving Up $60k For A HDB: Should We Get A 3-Room Flat?

Hello,

Property Market CommentaryHow A Home Equity Loan Will Save You From Having To Sell Your Property

by Ryan J. OngThe Owner

Most people take this route because they don’t want the stress of having too much debt.

With this option, your main focus is on repaying your mortgage.

So you’ll really only start earning income from your investment property after you’ve actually paid off your debts.

Whether it is income from your job or rental income from your property, everything does into paying down those mortgages with the ultimate goal of owning those properties outright.

The Risk-Taker

This is easily the riskiest strategy of all.

Basically the aim here is to own multiple properties over time.

Once they go up in value, use the value of the property to take a loan as your income.

Say you need $100,000 a year as living expenses. This amount is simply drawn down from a loan, therefore increasing your interest payments. Hopefully, rents are going up as well so that it covers the increased interest repayments.

Of course, you’d want your rental to be able to cover your interest payments which will leave you in a better position.

But do remember that there is a matter of sustainability here that you’d have to consider.

In downtimes of no tenancy, would you still be able to have adequate cover for your mortgage?

Note, this option is usually only available to people with quite big property portfolios.

The Flipper

For most people, the dream would be to purchase a property with a minimum downpayment, only for it to appreciate in a matter of months – before selling it off for a profit.

Which is more commonly known as “flipping”.

Unfortunately, while this currently isn’t possible in Singapore because of cooling measures like ABSD and SSD, you can still do this on a slower timeline or even overseas.

The risk involved here is quite clear – you don’t get the appreciation that you expected or the market turns and you are left with paying for a mortgage on a property that has dropped in value.

At the end of the day, time is money.

Having an exit strategy before you put in any money will help you determine how best to proceed when it comes to your investment.

If you have a fixed plan with quantifiable targets and numbers – it takes the emotion out of the equation.

You are then able to make a much better decision because you are not emotionally invested in the property.

I’ll leave you with this quote:

Look on every exit as being an entrance somewhere else.

Tom Stoppard, Rosencrantz, and Guildenstern Are Dead

I hope this has gone some way to help, if you’d like to understand more on property investment, knowing more about the property cycle will be a great next read!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is an exit strategy in property investment?

Why is having an exit plan important when investing in property?

What are some common types of property exit strategies?

How can an exit strategy influence my overall financial future?

Can my property exit strategy change over time?

Stanley Goh

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

2 Comments

interesting take on exit plans. thanks for sharing!