Do Not Agree To An En-Bloc Sale Until You Read These 5 Factors

January 14, 2022

Despite the blow of cooling measures in December, it doesn’t change the fact that developers are facing depleted land banks today. So we can still expect more interest in collective sales, just don’t be expecting many mega-developments like the last cycle. The last of the condos from the en-bloc fever of 2017 has been redeveloped and sold, and many owners are expecting the knock of the pro-sale committee any day. In case this happens to you, here are some of the things to look for, before you agree to an en-bloc sale:

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Work out the cost of a replacement home, with current prices and financing restrictions

An en-bloc sale during a property peak is a tricky prospect: while you can sell high, you’ll also have to buy high.

As such, en-bloc sales in such markets are most beneficial if the property in question is a second home (i.e., you don’t need a replacement unit). Otherwise, you need to check if the sale proceeds can sufficiently cover the cost of a new home.

This is not as straightforward as ensuring (sale proceeds + savings) are higher than the cost of the replacement home.

For example, say you purchased your condo 10 years ago, and it’s going up for an en-bloc sale now.

As you’re 10 years older, the maximum loan tenure on your replacement home will be reduced. If the loan tenure plus your age exceeds 65, for example, the maximum financing for your replacement home may only be 45 per cent.

You need to work out if you can cover such a large down payment, along with stamp duties, after discharging your remaining home loan and refunding your CPF.

Financing issues are also impacted by the rising costs of property, which could make your replacement home pricier than expected:

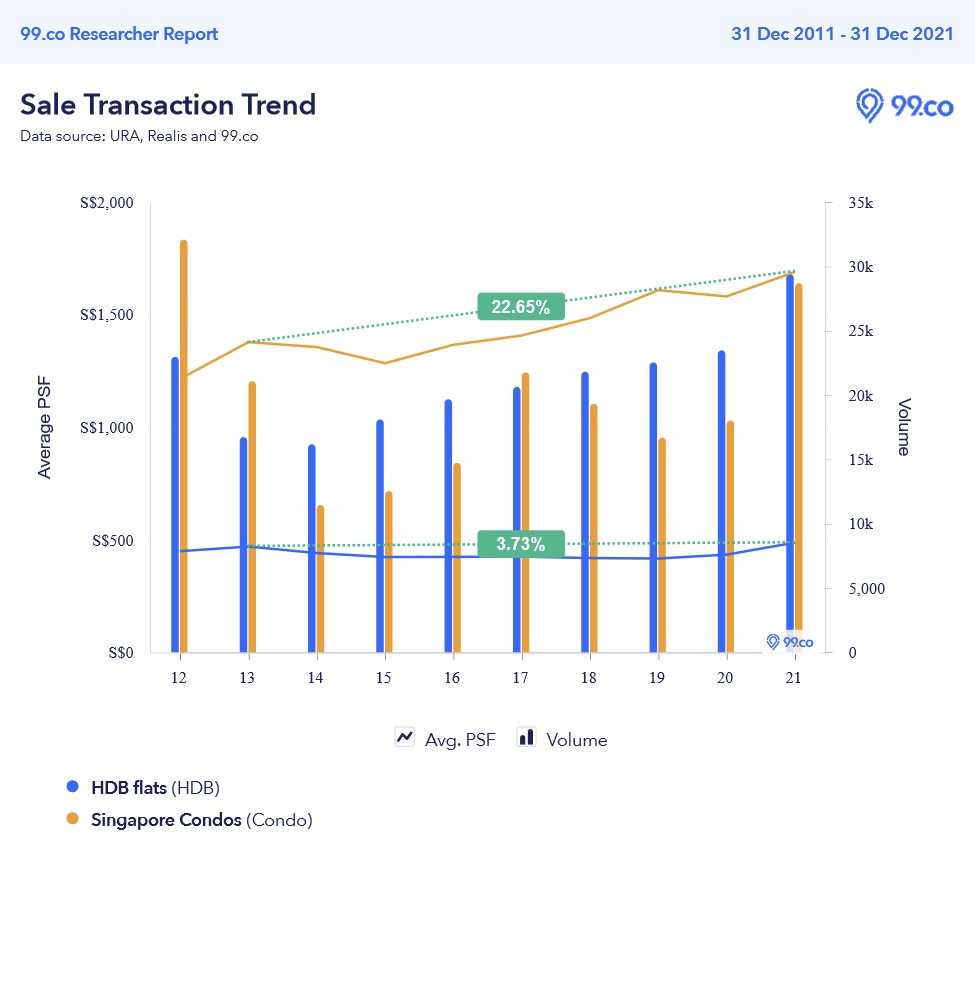

Islandwide, resale flat prices are at around an eight-year high, averaging $487 psf, while condo prices average $1,690 psf – around 22.6 per cent higher than even the last peak in 2013.

Note: you’ll have to check in the specific areas, as there can be large discrepancies. This is just to point out that your replacement unit – in most parts of Singapore – probably won’t come cheap.

Let’s assume the average prices apply for your replacement home:

Say you bought a 1,000 sq. ft. unit in 2011 for $900,000, and are getting sale proceeds of $1.3 million. Under normal circumstances, a somewhat respectable return of about 3.75 per cent per annum.

But the numbers don’t change the fact that – if you want a similar-sized replacement unit – you’re looking at a potential quantum of around $1.69 million today. This may not be a very palatable deal, especially if you face a higher cash outlay at your age.

Don’t forget that ABSD is higher after December 2021

If you still intend to buy a second or third unit after the en-bloc, remember that new cooling measures took place in end-2021. For Singapore Citizens, ABSD on the second property is now 17 per cent, while ABSD on the third or subsequent unit has risen to 25 per cent.

The sale proceeds may not compensate for the higher stamp duties. If you’re seeing low vacancies and a high rental yield, you may not want to let that vanish in an en-bloc deal.

2. Using share value for apportionment is unfair to you, if you own a larger unit

Some developers will suggest the use of share value, as a Method of Apportionment (MOA). The higher your share value, the more of the proceeds you get.

You should note that share values were never meant to be used this way: they were designed as a fair way to distribute maintenance fees, not sale proceeds.

The share value of a unit starts at five, and increases by one for every 50 sqm:

- 50 sqm = share value of 5

- 51 to 100 sqm = share value of 6

- 101 to 150 sqm = share value of 7

And so on. You can probably see the issue here: a unit that is 150 sqm is three times the size of a 50 sqm unit, but the share value only goes up by two points. As such, small unit owners tend to benefit much more than owners of larger units.

The other problem with using share value is that it’s blind to certain considerations, such as the storey your unit is on. A higher floor unit with a better view, for instance, should be valued higher than a mid or lower floor unit with an obstructed view – but this is completely ignored if the MOA goes by share value alone.

Nonetheless, this is still an irritatingly common approach that’s proposed to owners. If you own a larger or just better unit in the project, it’s to your benefit to argue for a different MOA.

On the flip side, don’t nickel and dime if you are already getting a fair price that you wouldn’t normally get at market value today. Some owners hold up an en bloc process (when the estate is in serious need of rejuvenation), because they feel they should be entitled to more. Sometimes you may believe your unit to be better than others, but this can be a very subjective thing.

Property AdviceWill My Condo En Bloc? 7 Commonly Overlooked Reasons Why It May Fail

by Ryan J. Ong3. Pay attention to when you’ll get the sale proceeds

If you need a replacement home, this may mean having to secure a new unit before receiving the proceeds.

If the last time you purchased a home was before 2020, note that some key rules have changed since then; one important change is that developers can no longer automatically renew your OTP as soon as it lapses, to buy you more time.

So if you don’t have the funds needed to make the down payment or other costs on a new home yet, you may need to use a bridging loan. These have interest rates that are much higher than home loans, at around five to six per cent per annum. In addition, there may be administrative fees involved; so check the likely costs to you, before you sign off on the en-bloc.

(It’s not very practical to do this by calling banks one at a time. Just contact a mortgage broker and explain your situation – they can help you find the cheapest probable options. You can also contact us directly for help).

Even if you do get a bridging loan, note that the maximum loan tenure is typically just six months. If the developer takes even longer than that to disburse the sale proceeds, you may have to resign yourself to renting first. Factor in the costs of such accommodation, which are hopefully covered by the sale proceeds.

Keep in mind that, in a market with still-rising prices like 2022, waiting longer to secure a new home could mean paying more for it.

4. Check if you’re within the SSD period, and if you can be compensated further if you are

The Sellers Stamp Duty (SSD) is 12 per cent of the sale proceeds if you sell on the first year, eight per cent on the second, and four per cent on the third.

The SSD still applies in an en-bloc sale, regardless of whether you consent to the sale. It’s a stroke of bad luck if, within three years of buying the unit, a collective sale happens. The only saving grace is that if you’d suffer a financial loss (you would get less from the sale proceeds than the price you paid), you can appeal to the Strata Titles Board (STB) to block the sale.

(You can do this even after the 80 per cent consensus has been achieved).

No one on the pro-sale committee, the hired property agency, the developer, etc. may know whether you’re within the SSD period, or will inform you of it: it’s down to you, as the owner, to be aware – so don’t end up consenting to a financial loss by accident.

It’s in your interest to negotiate for higher compensation before the CSA is done up, given that you have to pay the SSD. In addition, recent work done to the property – such as renovations – may not have been taken into account by the valuation.

5. If you gamble by withholding your signature, be aware of the potential consequences

A common tactic, taught to those facing en-bloc sales, is to hold off on signing the Collective Sale Agreement (CSA) until the very last minute. This is even if you actually want the en-bloc sale to go through.

This is on to the possibility that, if others get desperate to push the sale through, they will “sweeten the pot” by offering a better deal to any remaining holdouts. We won’t get into the ethical questions here, but be aware of the potential consequences.

If a lot of people decide to do the same, it could result in the entire en-bloc sale being called off. It can also lead to shady dealings, which give rise to legal reasons to throw out the sale.

En-bloc sales are tricky at a time when replacement home costs are soaring, so it pays to be extra careful right now. Follow us on Stacked for updates and help, and for in-depth condo reviews if you end up needing a new home.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

2 Comments

The fairest apportionment method is to use land share that is used to build the unit. The value is then proportional to the size down to the square cm. After all it is land that is being sold. Whatever value the high floor had offered excess to the land share required to build the unit had already been enjoyed and consumed. The price paid will most likely reflect this. If there wasn’t time since purchase to maximise utilisation, then that is the risk of an investment be it only for accommodation and some will be for speculative purposes and hence subject to risks. Management fees should also be proportional to land share.

Enbloc committee team should be able to know whether an owner is still within the SSD period by looking at previous sales data for the said development.

And with that, developer will be able to work a sum to make sure that all recent new owners will not incur a financial loss thereby not giving them a chance to appeal to STB.

Is this understanding correct?