Can Dual-Key Condos In Singapore Be Profitable?

December 20, 2024

The industry-accepted belief is that dual-key units are niche layouts, intended for either rental benefits or extended family living; and they’re much less desirable for resale gain. But how true is this? We did a bit of digging to find out:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The theory on why dual-key units aren’t good for resale gains

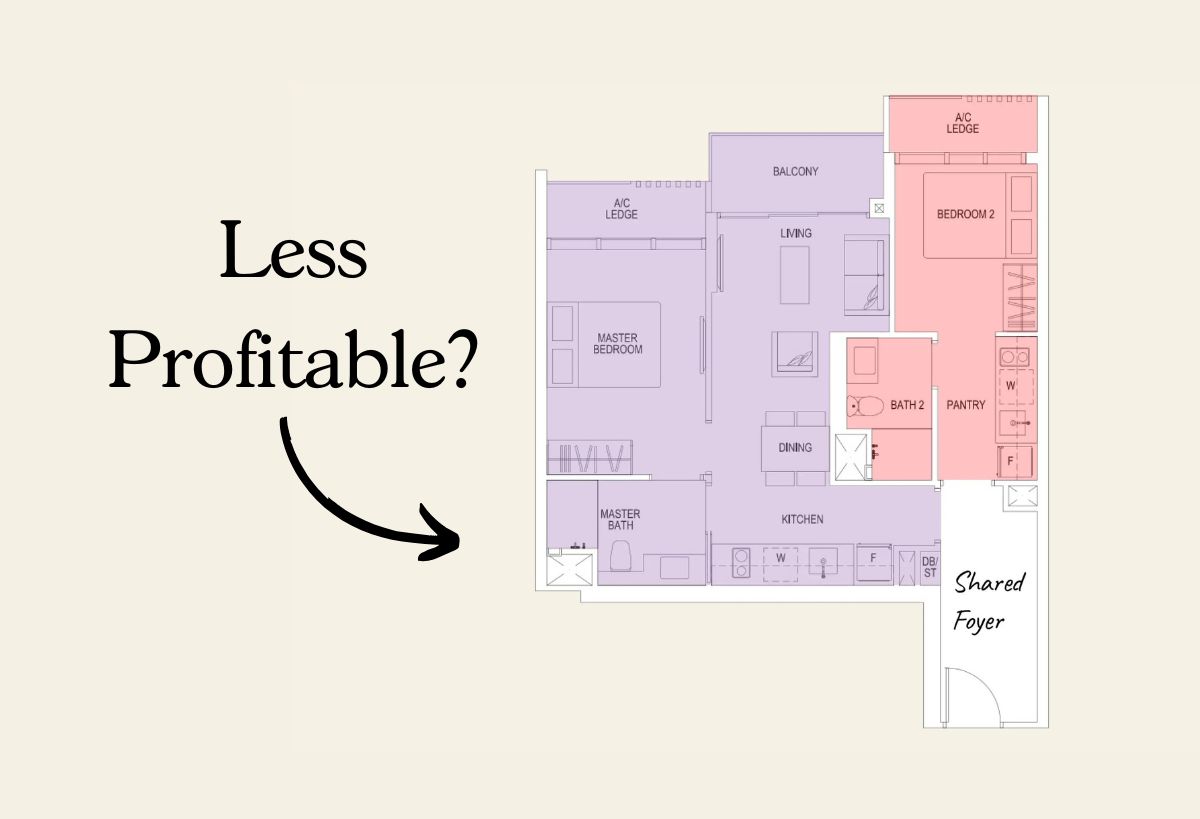

Dual-key units are assumed to draw fewer buyers because the niche layout reduces living space, and not everyone would have a need for such a flexible layout. Besides the use of partitioning to create a sub-unit, a dual-key unit also has to include a pantry and an extra bathroom. Buyers who have no use for the sub-unit would probably prefer a bigger bedroom or living room, over such redundant utility rooms.

Dual-key units also tend to cost more on a per square foot basis, and not many buyers are happy to pay more when they have no need for a split unit.

As such, we took a look at some resale dual-key units in more recent launches, to see how their prices play out:

How well have dual-key units performed in recent new launches?

| Dual Key | Not Dual Key | ||||

| Projects | Avg % Returns | Vol | Avg % Returns | Vol | Difference |

| 120 GRANGE | 1.8% | 1 | -5.0% | 4 | 6.8% |

| ARENA RESIDENCES | 9.0% | 4 | 13.6% | 13 | -4.5% |

| BOTANIQUE AT BARTLEY | 21.7% | 4 | 26.3% | 293 | -4.6% |

| CITY GATE | 8.5% | 4 | 10.4% | 61 | -1.9% |

| COCO PALMS | 18.8% | 6 | 27.1% | 280 | -8.4% |

| GEM RESIDENCES | 27.4% | 1 | 20.2% | 156 | 7.2% |

| HIGH PARK RESIDENCES | 35.3% | 10 | 31.9% | 512 | 3.4% |

| HIGHLINE RESIDENCES | 21.6% | 1 | 18.4% | 84 | 3.2% |

| KALLANG RIVERSIDE | 7.6% | 3 | 11.9% | 19 | -4.3% |

| OLLOI | 17.5% | 1 | 24.0% | 1 | -6.5% |

| PARK COLONIAL | 8.9% | 2 | 20.1% | 139 | -11.2% |

| PARK PLACE RESIDENCES AT PLQ | 7.4% | 2 | 15.0% | 69 | -7.6% |

| PRINCIPAL GARDEN | 30.1% | 21 | 19.0% | 167 | 11.1% |

| RV ALTITUDE | 7.2% | 2 | 5.4% | 2 | 1.8% |

| SOPHIA HILLS | 2.4% | 14 | 4.6% | 63 | -2.2% |

| THE TAPESTRY | 34.4% | 6 | 16.6% | 162 | 17.7% |

| TRE RESIDENCES | 15.6% | 5 | 12.6% | 79 | 2.9% |

| TRILIVE | 7.2% | 38 | 5.5% | 8 | 1.7% |

| WHISTLER GRAND | 33.5% | 13 | 26.6% | 123 | 6.9% |

Some observations from the above

We can see it’s a bit hard to draw clear conclusions, due to the disparity in transaction volumes. Regular units outnumber dual-key units in most projects, and most resale transactions are for regular units.

Nonetheless, there is a case to be made that dual-key units fetching worse returns don’t always hold.

More from Stacked

A $45,000 HDB Renovation Breakdown: A Couple Shares Their Reno Costs And Furnishings

For first-time homeowners looking to renovate their home, it's often like navigating a maze. From choosing the right ID, to…

Consider The Tapestry and Principal Garden. The Tapestry’s dual-key units significantly outperformed regular units (34.4 per cent return, versus 16.6 per cent return for regular units). Principal Garden also saw its dual-key units beat its regular units, by a difference of 11.1 percentage points.

Gem Residences provides a less useful example, due to it having just one dual-key transaction; but this one transaction beat out regular units by a difference of 7.2 percentage points.

Conversely, Park Colonial, Coco Palms, and Park Place Residences all show significantly weaker returns for dual-key units.

Overall, it’s almost a 50-50 split, if you overlook the transaction volume issue. It may be that, although dual-key units appeal to a more niche group of buyers, there’s still sufficient buying power and interest among that niche group.

From the opinions of some realtors, the issue isn’t so much profitability, but saleability

When we asked some realtors about the above, they weren’t surprised that dual-keys beat regular units in some cases. However, they did point out that the downside was how long it could take to sell a dual-key unit or the number of offers a seller could expect.

Even if a dual-key unit does sell for a higher return, it may only be after a longer period than a regular counterpart; and this can still pose problems for sellers (i.e., by the time you find a profitable seller, your intended replacement home may be off the market).

One realtor did, however, point out a reason why dual-key units might be doing better of late: that’s the progressive increase in Additional Buyers Stamp Duty (ABSD):

The ABSD rate for Singapore citizens buying a second property is now at 20 per cent, and we’ve never seen ABSD rates go down in their entire history. By purchasing a dual-key unit, you indirectly avoid ABSD: you can rent one portion to a tenant, live with an in-law, etc. with full privacy, and without having to buy a second property.

This might incentivise some buyers to consider dual-key living, instead of actually buying two properties.

To conclude, dual-key units may take longer to sell, but it’s not a guarantee that they always do worse for resale gains

You would probably still prefer a regular condo unit if the goal is resale gains. But we’d be less quick to assume a dual-key unit is always going to do worse at resale: there’s clearly a market for them out there, and a willingness to pay for this less common layout.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are dual-key condos in Singapore good for resale profit?

Why do some people think dual-key condos are less profitable for resale?

Have dual-key units in Singapore shown good returns in recent property launches?

What are the challenges of selling dual-key condos in Singapore?

Can buying a dual-key condo help avoid additional property taxes in Singapore?

Should I prefer a regular condo or a dual-key unit for resale gains?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments