Are We Finally In A Buyer’s Property Market? Why The Recent Price Dip May Not Tell The Full Story

October 22, 2024

Speak to some agents and sellers, and you may be told the tide has turned: the housing supply crunch is over, and it’s buyers who now have more negotiating power. There’s also a dip in private home prices between July and September this year (2024), of about 1.1 per cent; this is the first dip since Q2 of 2023.

But at the same time, buyers we’ve spoken to have said they certainly don’t feel it. Recent examples like Norwood Grand at Woodlands selling 84 per cent of its units at $2,067 psf, or Meyer Blue selling half at $3,206 psf show otherwise. So are we really in a buyer’s market? The answer as always is a little nuanced, and it may depend on which side of the market you are on (although it’s probably still a little too early to make that supposition):

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A snapshot of property prices

If we only look at unit prices, there’s little to imply that it is a buyer’s market. Even with the housing supply crunch being resolved, prices have so far continued a relentless march upward:

New launch condo prices islandwide rose from $2,177 psf in September 2023, to $2,390 psf in September 2024, an increase of about 9.78 per cent. This is in close tandem with resale condo prices:

Resale non-landed homes averaged $1,529 psf in September 2023, and rose 9.58 per cent to $1,675 psf in the same time this year.

If we were to take a quick snapshot of HDB resale prices, across all unit sizes and towns, the general trend is still upward:

Resale flat prices averaged $571 psf in September 2023 and rose by 8.2 per cent to $618 psf at the same time in 2024. What’s worrying to homebuyers, however, is the quantum: more than half of the resale flat transactions in Q3 were above $600,000, and word on the ground is that the number of million-dollar flats may exceed 1,000 transactions this year (for some detail on how resale flat prices have moved, check out this article.)

So for the most part, those hoping to see lower prices will be disappointed – the realtors weren’t wrong when they said it would be more expensive down the road. However, there are signs of impending changes: we can see the market has lost momentum, since the aftermath of Covid. It’s taking a while to sink in, but HDB ramped up production in 2022 and 2023: it will take four to five years for completion (and another five years after that to go on the secondary market). It’s a long time, but it does mean the pace of rising prices can’t be sustained.

Private home transaction volumes may tell a different story

Looking at the above, you may notice that – even as prices rose – transaction volumes appear to be falling off. For the last three months (July to August of this year), both condo and flat transactions have tapered off.

Indeed, one sign is the low volume of private home sales. Developers moved just around 2,700 units between January and August this year, making it very unlikely that the total transaction volume for 2024 will match last year’s (6,421 transactions). These are some of the lowest transaction numbers we’ve seen since the Global Financial Crisis in ‘08.

But that’s just one side of the coin. These numbers are just a consequence of fewer new launches this year, and they have generally been on a smaller scale, too.

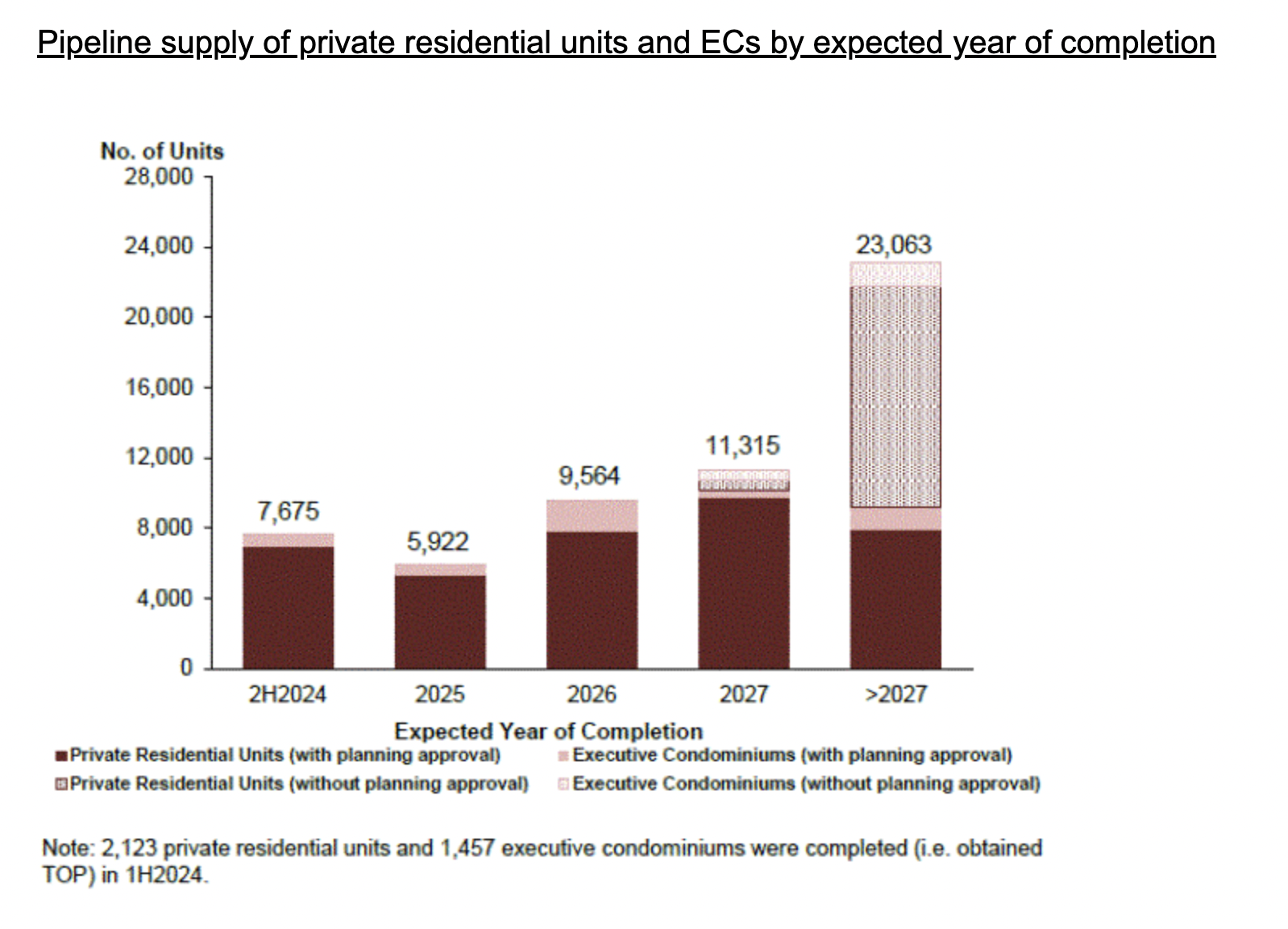

And looking at the numbers of the expected completed pipeline next year in 2025 (which would be the lowest in the next few years), buyers may have even fewer options next year:

But from what we’ve heard on the ground, whether it is a buyer’s market depends on which section of the market you are in. For those hunting in the OCR and even the RCR areas, it doesn’t seem as if the demand is abating. New launches like Pinetree Hill which may have seen a slower take-up rate at the beginning, are now more than 70 per cent sold. Despite the “supply glut” in the East, The Continuum is nearly 50 per cent sold, while Grand Dunman (71 per cent), and Tembusu Grand (81 per cent) are majority sold out. This may be a different story for those looking in the CCR, as the demand here is more heavily affected by the ABSD cooling measures for foreigners.

As for the HDB market, this is the inverse of what we’re seeing on the private residential side. Resale flat transactions are actually up by a substantial 20 per cent year-on-year, as of Q3 2024. However, some realtors have pointed out that the surge in resale flat transactions may be reflective of high private property prices: upgraders who now find themselves priced out of the condo market, for instance, may instead turn to more “premium” flats like DBSS units, or pricey central area flats. Even at around $1 million, these are still much cheaper than many fringe-region condos right now.

More from Stacked

Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Or would you call that an overreaction? This past week, I met a pair of older Singaporeans who are considering…

In any case, whilst the private property market may look like it’s turning in the buyers’ favour in the central regions, this effect may not be felt in the resale flat market or outer regions private residential market yet.

Is the behaviour of developers a sign?

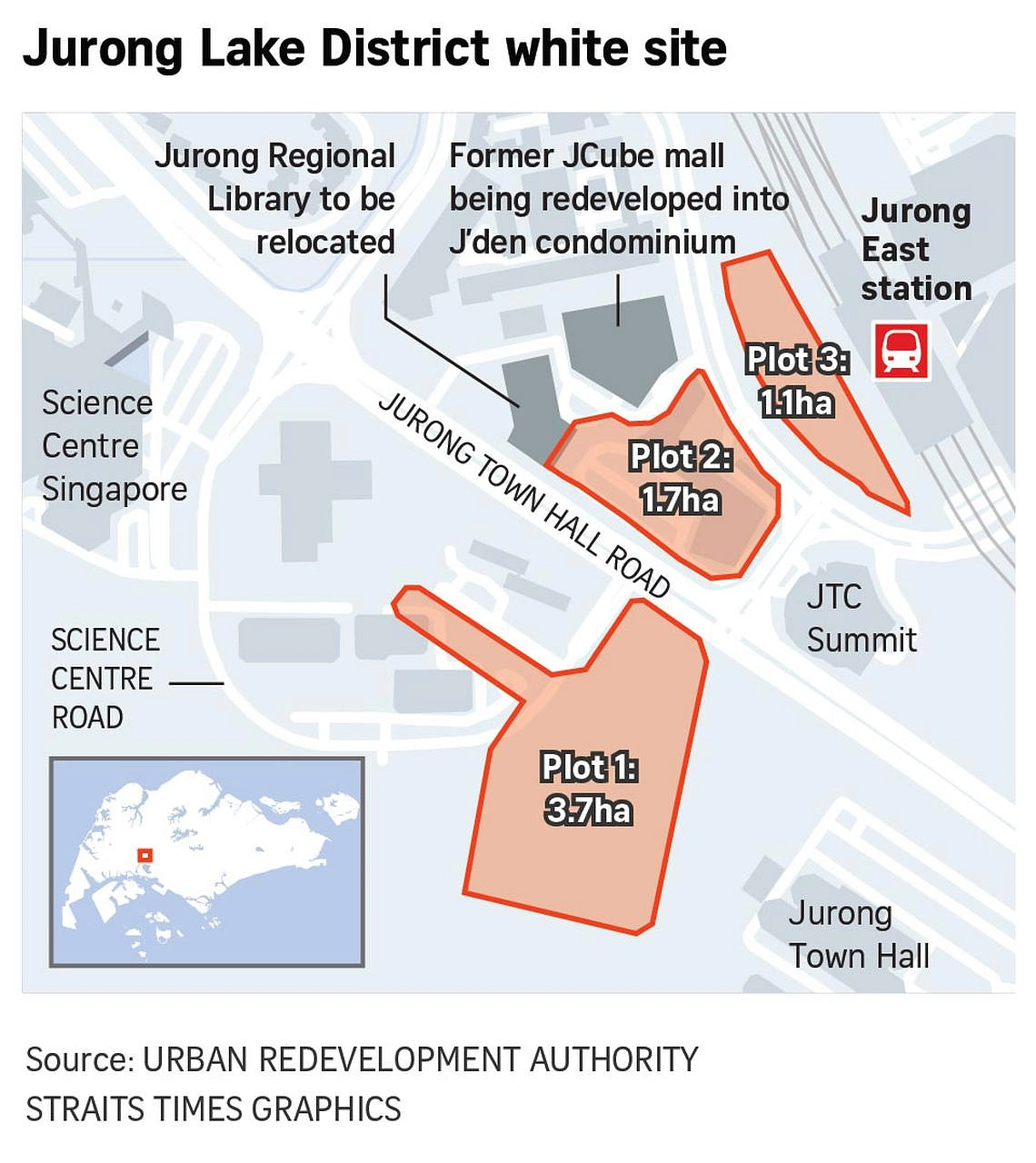

Recently, the Jurong Lake Megasite wasn’t sold because the only bid (of two total bids) was too low. This was for a mixed-use site that would have yielded around 1,700 residential units, 146,000 sqm of office space, and additional spaces for retail, dining, entertainment, etc.

As Singapore’s “second CBD,” this land site should have been an easy sale – but the consortium of developers, which included heavyweights CDL and Frasers Property – didn’t seem to have much confidence even so. Just a short while earlier, we also noticed that the government rejected Frasers’ bid for a Media Circle site, again because the bid was too low.

We also saw the same thing happen with the Marina Crescent Site in February, where again the sole bid was rejected for being too low. This was for a site in the prime Marina South area, which again, should have been an easy sell.

If we go back just five years, it would have been unthinkable that we’d see so many failed bids; especially at a time when developers should be struggling with depleted land banks. Consider that in 2022 and 2023, we were expecting a return of the en-bloc craze, which never manifested.

There are several factors why some developers are hesitant right now. These range from ever-slimmer margins to concerns over recent cooling measures.

Unfortunately, that still may not translate to lower costs for buyers – at least not in the immediate sense. Developers are too squeezed to offer substantial discounts, so buyers are still likely contending with $2,100+ psf prices for some time to come; even if the land was bought at a cheaper rate.

There are two other factors that could change the market but will likely have an effect in the coming year

The first is the increasing supply in 2023/24, as more condos and flats are completed. Landlords are already seeing the effect of this, as more tenants end their leases and move into their finished homes. The rental market is softening, and coupled with the recent cooling measures, investors may turn their attention to other assets. This will reduce competition with genuine homebuyers, which is something that many upgraders or first-timers will probably appreciate.

The second is the uncertainty of the US economy, and its resulting impact on home loan interest rates (you can read more on this relationship here). Mortgage rates were previously on the rise because the US was focused on combating inflation – this put some downward pressure on home prices in Singapore, as bank loan rates rose. In recent weeks, however, the US instituted a jumbo rate cut, with rumblings of more to come if their economy needs the stimulus.

Back in 2008/9, when the US cut interest rates to cope with the financial crisis, it caused a massive spike in property prices in Singapore. When mortgage rates are cheap (especially when they fall below CPF rates), some investors see that as a way to “borrow for free,” which could drive up home prices again. It’s unknown if today’s cooling measures will prevent a repeat occurrence, if interest rates bottom out again.

In the meantime, while buyers on the private end are having a better time than in 2020/21, prices are still trending up. And the bad news is that with developers having little room for discounts – and resale flats having such a high quantum – buyers may not feel much relief.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it a good time to buy property in Singapore now?

Are home prices in Singapore expected to drop soon?

How is the resale flat market in Singapore performing right now?

What are developers doing in the current property market?

Will rising supply and interest rate changes affect property prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

1 Comments

lol