9 Often Overlooked Costs That Can Eat Into Your Condo Profits

September 21, 2021

New homeowners often focus on the price of the property, but not the additional fees, stamp duties, and recurring charges. It’s a common mistake to think these “miscellaneous” costs don’t amount to much – in fact, they can sometimes be the deciding factor when it comes to real estate investment. Even for homeowners, it’s best to keep the following in mind, so you can budget appropriately.

Let me quickly illustrate what I mean.

Say you buy a $1 million condo, and sell it for $1.2 million after 5 years. While it would be common to say you’ve made $200k in profits, here’s what it could look like after you’ve accounted for other costs:

| Description | Amount |

| Buying | |

| BSD | $24,600 |

| Legal Fees | $2,750 |

| Reno | $45,000 |

| Buying Costs | $72,350 |

| Selling | |

| Commissions | $24,000 |

| Legal Fees | $2,750 |

| Selling Costs | $26,750 |

| Profit ($1.2M – <$1.0M) | $200,000 |

| Less: Interest over 5 years | $44,604 |

| Less: buying cost | $72,350 |

| Less: selling cost | $26,750 |

| Net Profit | $56,296 |

Note: All information here is relevant as of September 2021. We will update this article periodically, as stamp duties, policies, etc, change.

Now that you’ve some idea, let’s dive deeper into the 9 often overlooked costs with home ownership.

Note: This article has been updated as of 7 October 2021 to reflect some changes in the legal fees (point 3).

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Buyers Stamp Duty (BSD) and Additional Buyers Stamp Duty (ABSD) rates

The BSD applies to all properties, even HDB flats. The amount is as follows:

- 1% of the first $180,000

- 2% of the next $180,000

- 3% of the next $640,000

- 4% of any outstanding amount

So for a flat that costs $500,000, you would pay $9,600.

A commonly overlooked issue is that BSD is based on the higher of the price or valuation.

So if the valuation is $500,000, but the seller of the flat wants $525,000, your BSD would be $10,350, instead of $9,600. This means that, if there’s Cash Over Valuation (COV) in your transaction, you don’t just pay more to the seller – you also pay more for the stamp duty.

The ABSD applies to second or subsequent properties:

| Singapore Citizen | Permanent Resident | Foreigner | |

| First property | N/A | 5% | 20% |

| Second property | 12% | 15% | 20% |

| Third or subsequent property | 15% | 15% | 20% |

The ABSD can apply even if you are just upgrading (e.g., if you buy your condo before selling your flat). However, a married couple, with at least one Singapore citizen, can claim ABSD remission if they sell their previous property within six months.

This can be avoided if you sell your flat before you buy (as you are not buying a second property then), or if you are upgrading to an Executive Condominium (EC).

A commonly overlooked issue is that the higher ABSD rate always applies, if co-borrowers are of mixed nationalities.

This means that, if you are a Singaporean but your co-borrower is a Permanent Resident, the ABSD on your second property is 15 per cent, and not 12 per cent.

Stamp duties are payable within two weeks of completing the property transaction, and can be paid in cash or CPF.

2. Sellers Stamp Duty (SSD)

The SSD was implemented to prevent home-flipping, and disincentivise sub-sales (i.e., resale of properties before they are even completed).

The SSD is as follows:

- 12% if sold on the first year following purchase

- 8% on the second year

- 4% on the third year

Due to the SSD, few properties sold within the first three years will see good returns – in fact, they are quite likely to be sold at a loss, after subtracting the SSD costs.

A commonly overlooked issue is that SSD still applies in an en-bloc sale.

It doesn’t matter whether you voted in favour of the en-bloc. If you buy an old condo, and it goes en-bloc in the first year, you’re still required to pay the 12 per cent SSD.

This is a very real risk, when buying properties that have come close to an en-bloc in recent years.

3. Lawyer fees / Conveyancing fees

For HDB properties, the legal fees can range from a few hundred dollars to over a thousand, depending on the resale flat price as well as your choice of loan (whether it’s an HDB or bank loan). More information on fees can be found here.

For private properties, the fees often range between $2,500 to $3,000. This can sometimes be paid with CPF, depending on the law firm involved.

Because a lot of first-time homebuyers are unfamiliar with these fees, they may not realise they can opt to use a different law firm.

In general, “brand name” law firms will charge more, whereas smaller firms – some of which only specialise in conveyancing law – may charge less (while also being in their realm of expertise).

A commonly overlooked issue is that you can request to use a different law firm.

One common method is for mortgage bankers to recommend a law firm that’s on their panel – this will make refinancing less costly for you as switching banks and picking a firm that is not on the panel would incur extra costs.

4. Valuation fee

For resale properties, a bank may require a valuation. This may be needed from a buyer applying for financing, or even just the homeowner looking to refinance.

For new or very new properties, banks may be willing to just use the developer price as the value. But for older properties – especially those past the 20-year mark – you may need to engage a third-party valuation firm.

These firms often charge between $500 to $700, depending on the size of the property. Some banks may absorb this cost, so do bargain a bit; or get a mortgage broker to negotiate for you.

Note that different banks may accept different valuations. Some buyers end up accepting higher interest rates, because they opt for a bank that takes the higher valuation (and can thus lend them more).

5. Insurance premiums

For HDB flats, the mortgage is always insured under the Home Protection Scheme (HPS). This pays off the outstanding loan, if the co-borrower passes away.

For private property, there is no mortgage insurance unless you go and buy it yourself. This is highly advisable, unless your family has some other way to cover the mortgage if you pass on.

The exact cost of insurance premiums varies; like health insurance or car insurance, it is based on factors like your age, profession, health, etc. You should work out the monthly costs, and factor this into your overall home costs.

In terms of fire insurance, do note that many banks subsidise this cost for borrowers. However, there may be a clawback, requiring you to refund such costs if you refinance in a given time. Check the terms and conditions before you borrow.

6. Loan interest

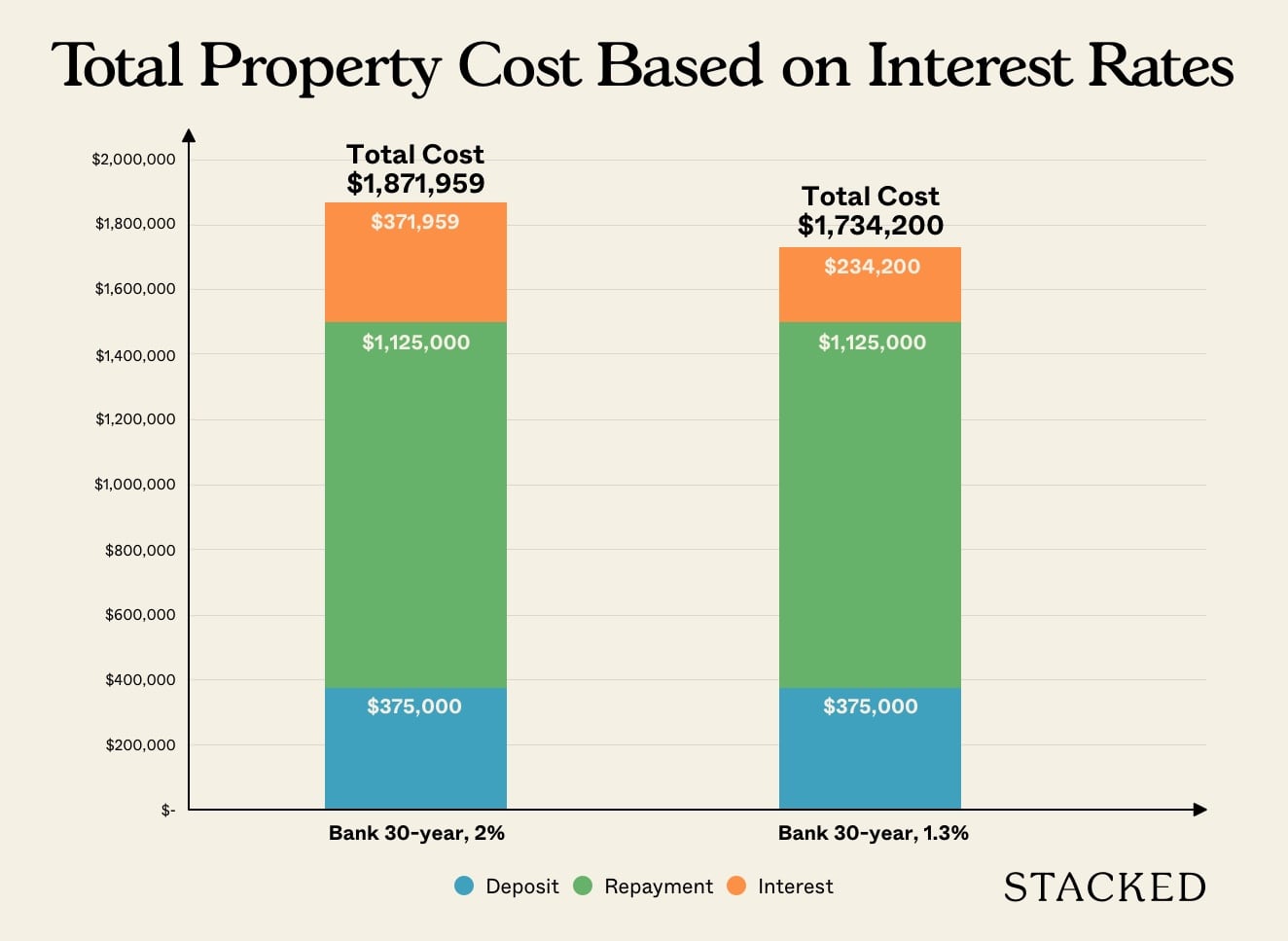

The loan interest rate is often dismissed, because it is easy to overlook in today’s low-interest rate environment. However, it can add significantly to the price of your home, over the long term.

As an example, consider a loan of $1 million, over 25 years, at the current rate of around 1.3 per cent per annum. This would come to around $171,823 by the end of the loan tenure.

It should be pointed out that interest rates can – and probably will – rise over time, as they are currently at record lows.

HDB loan rates, incidentally, are higher at 2.6 per cent. So a $500,000 loan for a flat, over 25 years, would come to around $180,504; ironically more than the condo in the above example.

Property Market CommentaryHow Does 2020’s Low Interest Rates Impact Your Property Purchase?

by Ryan J. Ong(But note that you can choose to buy HDB flats with either an HDB or bank loan, and can even refinance from HDB to bank loans; but not vice versa).

Because the interest rate affects your ultimate return, it’s important for property owners to refinance when rates drop, and keep the interest as low as possible. In general, loan packages raise rates on every fourth year or thereafter.

7. Renovation and furnishing costs

Renovation loans are capped at $30,000, or six months of your income, from all banks. The typical interest rate is four to five per cent. Over the maximum seven-year loan tenure (maximum seven years), you would probably pay about $4,620 in interest alone.

Bear in mind this is just for renovation, and doesn’t factor in furnishing.

Overall, most three or four-bedder units (around 970 to 1,100 sq. ft.) tend to cost up to $50,000 to $60,000 at least, inclusive of furnishings.

New units are often a bit cheaper to renovate, as there’s no prior work to hack away; some new homes are even sold “ready to move in”. However, you can save by accepting the existing renovations, instead of replacing them.

In any case, it’s best to tack on $50,000 to $60,000 to the home price, when making your plans.

8. Monthly maintenance

Monthly maintenance for condos is based on the unit’s assigned share value, which is based in turn off the unit’s size. Typically, new launch, mass-market condos have fees of about $70 to $80 per share value.

The smallest share value is five, for a unit of 50 sq.m or below. Beyond that, the share value increases by one, for every 50 sq.m. So a unit that is 101 sq.m., for instance, has a share value of seven.

So a unit with a share value of five, for example, would have maintenance fees of $350 per month. In most condos, maintenance fees are collected quarterly – so you’d expect to pay $1,050 per quarter. Over a 10-year period this would cost $42,000 so it’s certainly not a figure to be sniffed at! And that’s not even accounting for a possible rise in maintenance fees.

Note that late payment of maintenance fees incurs a high interest rate. This is around 15 per cent per annum in most condos, so it’s advisable to keep this paid on time.

| Unit Type | Size | No. of Units | Share Value | Est Maintenance |

| 2BR Compact | 646 – 678 sqft | 80 | 6 | $360 |

| 2BR Premium | 721 – 753 sqft | 119 | 6 | $360 |

| 2BR + Study | 797 sqft | 20 | 6 | $360 |

| 3-Bedroom Compact | 904 – 958 sqft | 94 | 6 | $360 |

| 3-Bedroom + Study | 1,012 sqft | 10 | 6 | $360 |

| 3-Bedroom Premium + Study | 1,109 sqft | 65 | 7 | $420 |

| 4-Bedroom | 1,302 sqft | 60 | 7 | $420 |

Look out for units that just barely slip into higher share values, such as 101 sq.m instead of 100 sq.m. This could translate to higher maintenance fees with few tangible space benefits.

9. Maintenance and repairs for your own home

The older your property, the more maintenance costs will rise. Some damages will be minor, such as replacing faucets or broken window ledges; but serious damages can involve overhauling the whole air-con system, to replacing the main toilet pipes.

Note that this is covered under home content insurance, not fire insurance. Premiums vary for each individual, but typically range into a few hundred dollars a month (older properties, or very large properties like landed homes, can cost much more).

Note that even with home content insurance, you may not be fully covered. For example, a policy may cover only the first $2,500 for major electrical work, and you need to pay the rest. Be sure to read the terms and conditions before signing.

There’s no way to give you a clear number here, as it will vary for each home; but you should get a contractor or Interior Designer to scout out any older units before buying. This will give you a sense of what you may need to replace, in the near future.

For more on finding the best new and resale properties alike, follow us on Stacked. We’ll give you a heads-up on what to expect, and can walk you through all the visible and invisible costs involved.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments