6 Key Things HDB Upgraders Should Know Before Buying A Condo In 2023

February 20, 2023

With recent policy tweaks and a much pricier property market, upgrading in 2023 might be a bit of a challenge. Here’s a look at how you might go about doing it smoothly. Whether you’re looking at a new launch or resale unit, these are the main issues to keep in mind:

Table Of Contents

- A few points on how 2023 might differ from previous years

- 1. Rental rates are at record highs

- 2. The Buyers Stamp Duty was recently adjusted

- 3. Interest rates on bank loans are much higher

- 4. If you need to sell your flat to upgrade, the prospective pool of buyers may be a bit smaller

- Key things to know when upgrading

- 1. Obtaining home loans

- 2. Restrictions on CPF usage

- 3. HDB upgrading levy

- 4. ABSD and whether it applies

- 5. Condo maintenance fees

- 6. Timeline for moving, including renovation

A few points on how 2023 might differ from previous years

Before we go into detail below, we should highlight some potential hazards of the current boom market. While most readers are already aware that prices are higher, here are a few other factors to watch for:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

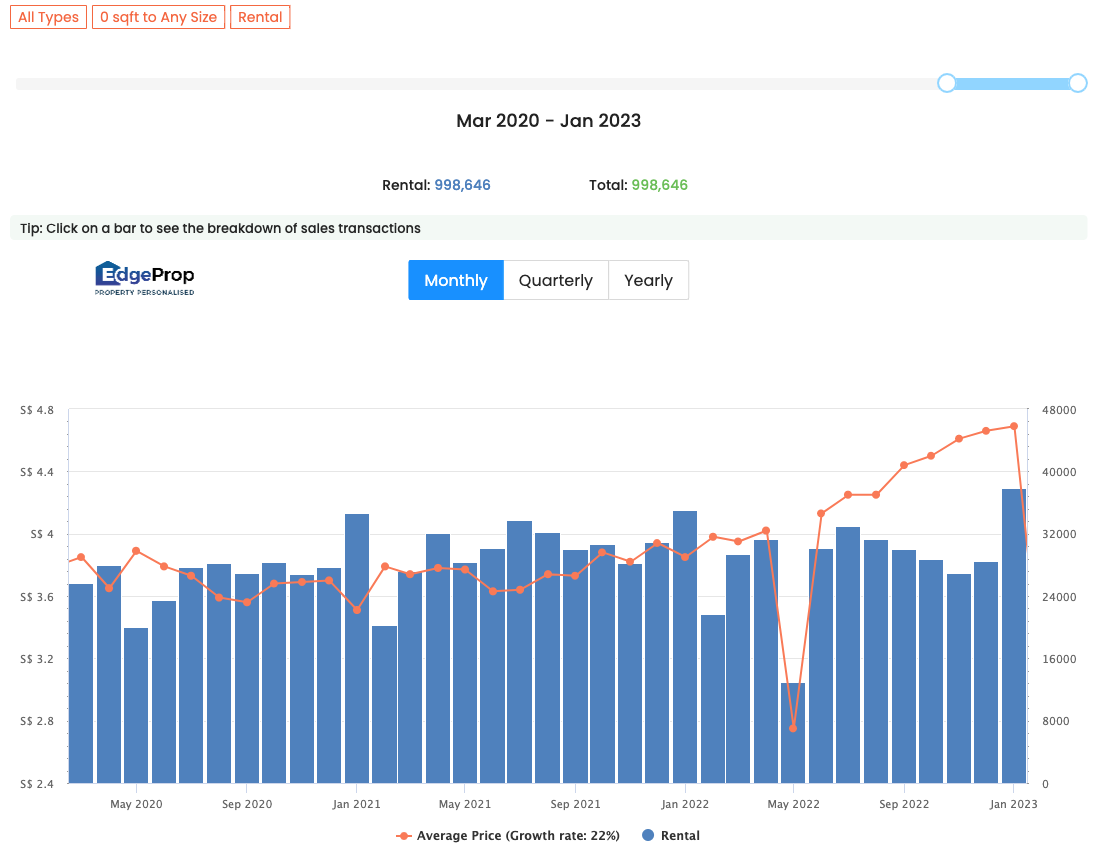

1. Rental rates are at record highs

From word on the ground, realtors have mentioned more cases of sellers requesting a later vacant date of possession. Some sellers may even be willing to negotiate further or pay you rent, in exchange for being allowed to stay on longer.

This appears to correlate with rental rates right now, which are among the highest we’ve seen over the last few years. Some buyers might be able to use this to their advantage (assuming you’re not in a huge rush to move in yourself).

On the other hand, those buying new launch condos may need to increase their planned budget, if rental accommodation is necessary.

We suggest you read this article on how to only move once when upgrading, as it could spare you hefty rental fees right now.

Property AdviceHow To Properly Plan Your Timeline When Upgrading To A Resale Condo (Move Once And Avoid ABSD)

by Ryan J. Ong2. The Buyers Stamp Duty was recently adjusted

The Buyers Stamp Duty (BSD) was recently tweaked to impose higher taxes on properties valued at $1.5 million or more. This has been the case since 14th February this year. While it’s not a huge sum, it is something else to factor into your calculations.

Here’s what the new rates would look like:

The increased Buyer’s Stamp Duty (BSD) will impact property values above $1.5 million. This portion of the property value (above $1.5 million and up to $3 million) will be taxed at five per cent, up from the current four per cent.

Any remaining value above $3 million will then be taxed at six per cent:

| Dates | Before 15/2/2023 | On or after 15/2/2023 | Difference | |||

| Purchase Price | $1,000,000 | 4% | $24,600 | 4% | $24,600 | $0 |

| $1,200,000 | 4% | $34,600 | 4% | $34,600 | $0 | |

| $1,500,000 | 4% | $44,600 | 5% | $44,600 | $0 | |

| $2,000,000 | 4% | $64,600 | 5% | $69,600 | $5,000 | |

| $2,500,000 | 4% | $84,600 | 5% | $94,600 | $10,000 | |

| $3,000,000 | 4% | $104,600 | 5% | $119,600 | $15,000 | |

| $3,100,000 | 4% | $108,600 | 6% | $125,600 | $17,000 | |

| $3,500,000 | 4% | $124,600 | 6% | $149,600 | $25,000 |

3. Interest rates on bank loans are much higher

Around two years ago, it was still possible for bank loan rates to be around two per cent per annum. As of 2023, you are more likely to find loan rates at around three per cent, with fixed-interest loans being at about 3.8 per cent.

Buyers of Executive Condominiums (ECs) should keep in mind that you must use a bank loan for ECs; there’s no HDB loan for such properties. This is regardless of whether the EC is new or already privatised.

Another factor caused by high-interest rates is that you might hit CPF Withdrawal Limits sooner (see below). This could mean having to pay your monthly home loan in cash at some point, rather than with your CPF.

4. If you need to sell your flat to upgrade, the prospective pool of buyers may be a bit smaller

With some exceptions*, anyone who sells a private property must now wait 15 months after the transaction before they can buy a resale flat. So far, realtors say this hasn’t seemed to cause a significant drop in resale flat prices or transactions; but it’s worth keeping in mind if you’ve yet to liquidate your flat.

*Singaporeans aged 55 and above, who are right-sizing to 4-room or smaller flats, are exempt from this.

Key things to know when upgrading

Besides the above, you’ll want to take note of the following details:

- Obtaining home loans

- Restrictions on CPF usage

- HDB upgrading levy

- ABSD and whether it applies

- Condo maintenance fees

- Timeline for moving, including renovation

1. Obtaining home loans

The maximum loan quantum for private property is 75 per cent of the price or valuation, whichever is lower. For properties that are purchased directly from the developer (i.e., new launch condos), the price and valuation are considered to be the same.

This means that, after the sale of your flat, you need to ensure you have sufficient cash or CPF reserves to cover at least 25 per cent of your new home’s cost.

The first five per cent must be paid in cash, while the next 20 per cent can be in any combination of cash or CPF.

The chief concern is the first five per cent. If your sale proceeds would leave you with no cash (see below), then you may need to save up before you can make the leap.

Banks are not allowed to loan you additional money to cover the down payment, under MAS regulations.

2. Restrictions on CPF usage

The biggest factor for most upgraders is their CPF refund. Upon the sale of your flat, you must pay back the CPF monies used (inclusive of the 2.5 per cent interest rate) into your CPF account.

Most Singaporeans would have used their CPF for the down payment on their flat, the legal fees, and possibly the monthly loan repayment for the flat. All of this amount must be refunded from the sale proceeds.

CPF has an online calculator for you to check your housing usage.

Due to the refund, there’s a possibility that you will have no cash left over after the sale – this is called a negative cash sale.

This doesn’t necessarily stop you from upgrading, as you can still use your CPF monies for your new property – but it does mean you need to pay the cash portion (the first five per cent) through other savings.

In addition to this, there are limits to how much of your CPF you can use. This is not a factor for BTO flats, but it does matter for properties such as condos. We cover details such as the Valuation Limit and Withdrawal Limit in this article; for example, you can only withdraw up to 120 per cent of your private property’s value from CPF, before you must start servicing its cost in cash.

A higher interest rate increases the possibility of hitting the withdrawal limit; so you must be prepared to service the home loan in cash when this happens. A realtor can help you estimate when this may happen.

Finally, if you are using your CPF for a second property (i.e., you have not yet sold your previous flat), you must be able to meet the Basic Retirement Sum first. Only monies in excess of this sum can be used for your housing.

3. HDB upgrading levy

Some flat sellers will need to pay an upgrading levy; this is to compensate for previous improvements done by HDB.

Those who are in this category include owners of flats which have undergone the Main Upgrading Programme (MUP) twice or more and Singapore Permanent Residents whose flats were upgraded under MUP.

The levy is 10 per cent of the price or valuation of the flat, whichever is higher.

The last MUP was a long time ago, way back around 2007, so this mostly affects owners of older flats.

4. ABSD and whether it applies

If you buy your new home before selling your flat, you will have to pay the Additional Buyers Stamp Duty (ABSD) first. This is currently 17 per cent for the second property for Singapore Citizens, or 25 per cent for Permanent Residents.

Provided you sell your flat within six months of buying your new property, you can claim ABSD remission – but you must be a married couple, and at least one of you must be a Singapore Citizen. It’s worth highlighting that the six months timeline starts from the day of ownership of the next property. Also, it must be a matrimonial home purchase which means both the names of the couple must be owners of the property.

Do also remember that this way can be highly stressful as it means that you have a six-month time period to sell. Managing such timelines may not be so simple, and you may have to expect to let go of your flat at a lower-than-expected price if your flat takes longer to sell (although the market now definitely makes this easier to do).

You can avoid the upfront ABSD if you (a) buy an Executive Condominium, or (b) sell your flat first, and buy your new property afterward (but this could mean having to rent in the interim). Some people have attempted to do this without renting, but requesting for an extension from buyers isn’t always so straightforward either.

An important note on using CPF to pay the ABSD

You can pay for the ABSD through CPF. However, if you are buying a completed or resale property, you must first pay the ABSD in cash – you can then claim reimbursement from your own CPF later (it takes around two to three weeks).

If you buy a new launch property, the ABSD can be directly deducted from your CPF.

Stamp duties must be paid within 14 days of completing the transaction.

5. Condo maintenance fees

Once you switch to a condo, be aware that maintenance fees are quite different from HDB conservancy charges.

The maintenance fee is based on the share value of your condo unit and is sometimes expressed in terms such as $85 per share value. This would mean a unit with a share value of five pays ($85 x 5) = $425 a month in maintenance fees.

Share values begin at five for any unit of 50 sqm. or below, and rise by one for every 50 sqm. afterwards (e.g., a 150 sqm. unit would have a share value of seven).

The maintenance fees can go up or down over the years, and your vote at management council meetings can affect the expense. Unlike HDB flats, there’s no town council, and you have a direct vote on issues that may impact maintenance. This also means that if you have a lousy management committee, this may have a negative impact on your stay there overall.

Almost every condo collects maintenance fees quarterly, not monthly. There is usually interest charged for late payment (15 per cent per annum in most condos).

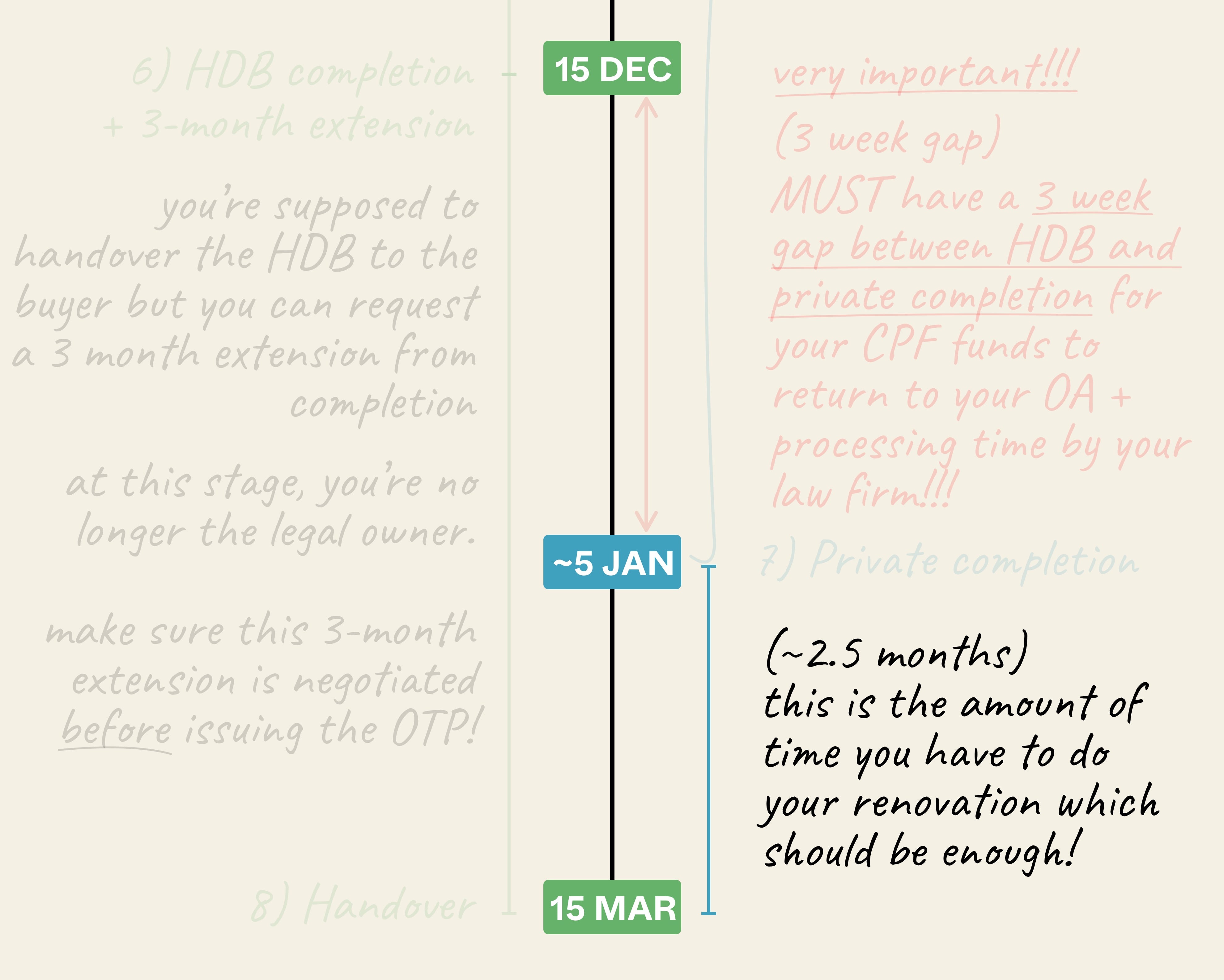

6. Timeline for moving, including renovation

Finally, you should talk with your realtor and contractor about how soon the unit is ready to move into. For new launch units, a common oversight is the renovations – remember that even after construction is complete, you may be faced with a wait of four to six months as your flooring, walls, custom lighting, etc. are done up. So it’s a bit longer than just your construction time.

This is, of course, dependent on how major your renovations would be. If you are intending to move in with just simple light fixtures and loose furniture, a new launch condo today would already come with the most basic essentials.

For resale condos, renovations may take longer as the previous works need to be hacked away. One possibility, for those who need to move in urgently, is to pick a unit where the renovations are still quite new (five years or less).

You can then move in right away, and slowly replace the renovations with your own over time.

Planning the date of vacant possession, with a resale unit, can involve a bit of negotiation. This is especially the case if you’re buying a tenanted unit, as the sellers need to settle terms with their tenants. In these situations, a realtor can help to negotiate on your behalf and try to find small compensation for any delays.

To get direct help for upgrading, you can also contact us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike, so you can ensure your next home is a great one.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments