5 Practical Ways To Manage Rising Home Loan Interest Rates In 2022

March 1, 2022

The United States Federal Reserve is indirectly behind home loan interest rates in Singapore. During the ’08 financial crisis, and Covid-19, they set interest rates to record lows, making home loans cheaper than ever in Singapore. But starting this March, the period of historically low interest rates may be coming to an end. Here’s what you can expect, and what to do about it:

Table Of Contents

- No delay in rate hikes is expected, despite the war in Ukraine

- How does all of this affect Singaporeans?

- What can be done about this?

- 1. Opt for a longer interest rate period

- 2. Prepare to use a semi-fixed strategy going forward

- 3. Look for repricing options in your home loan

- 4. Landlords should remember to claim tax deductions

- 5. Flat buyers can consider sticking with HDB for now

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

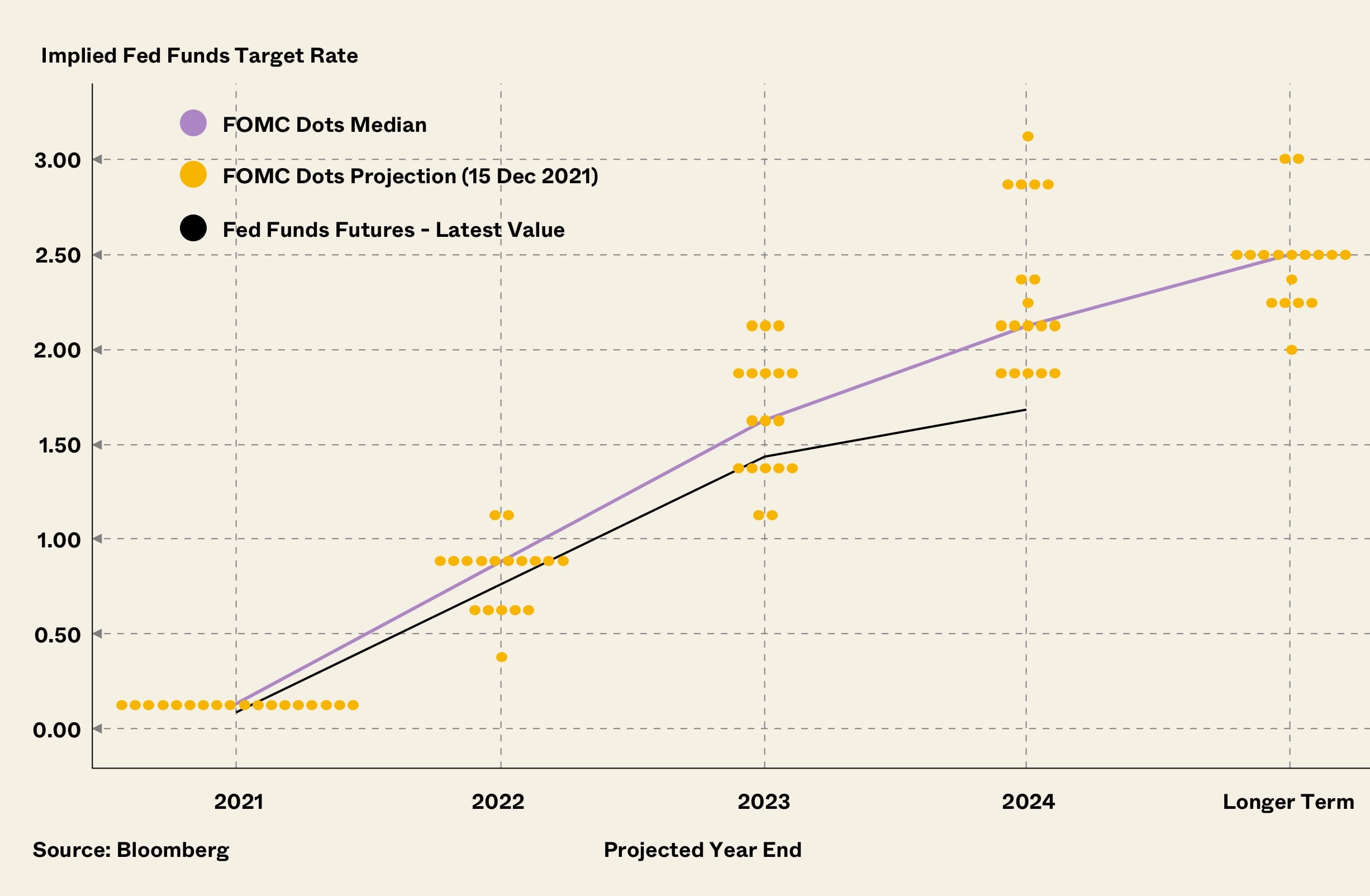

No delay in rate hikes is expected, despite the war in Ukraine

Let’s address the first topic on many minds: will the Russia-Ukraine war cause the Fed to put off planned interest rate hikes?

The answer to date has been a clear no. The US is seeing some of its worst inflation in 40 years; and some of its economists have theorised that rising commodity prices (which can potentially result from the war) could worsen inflation.

At this point, the question isn’t whether there will be rate hikes; it’s an issue of how steep the hike will be: either the usual increments of 0.25 per cent or possibly a “super-hike” of 0.5 per cent.

How does all of this affect Singaporeans?

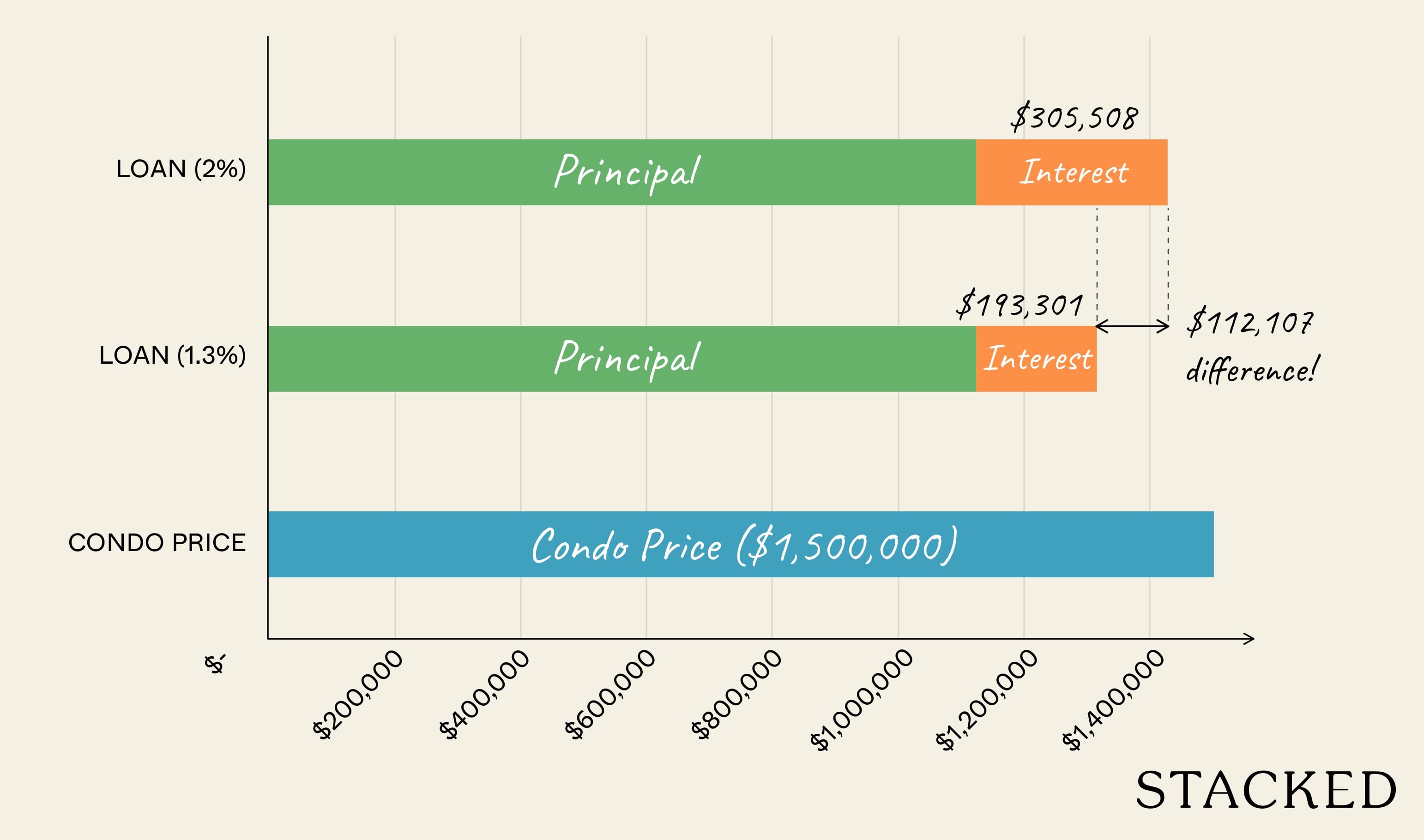

As an example, consider a loan quantum of $1.125 million (the maximum loan for a typical condo priced at $1.5 million).

At the current interest rate of around 1.3 per cent, over a 25-year loan tenure, monthly loan repayments are about $4,394. Assuming rates stay at this level throughout, the interest repayments would total about $193,301.

If we increase the interest rate to two per cent – close to the average before Covid, in the year 2018 – this raised monthly repayments to about $4,768, with total interest repayments at about $305,508, if the rate persists throughout.

So even if the sting isn’t particularly painful on a monthly basis, the higher rate will make a significant difference to your overall return, over a long period.

What can be done about this?

We have written a previous article about the most obvious solution, which is to speed up your home loan repayment. However, this isn’t a viable or prudent solution for every homeowner; and in such cases, you can instead consider the following:

- Opt for a longer home loan interest rates period

- Prepare to use a semi-fixed strategy going forward

- Look for repricing options in your home loan

- Landlords should remember to claim tax deductions

- Flat buyers can consider sticking with HDB for now

1. Opt for a longer interest rate period

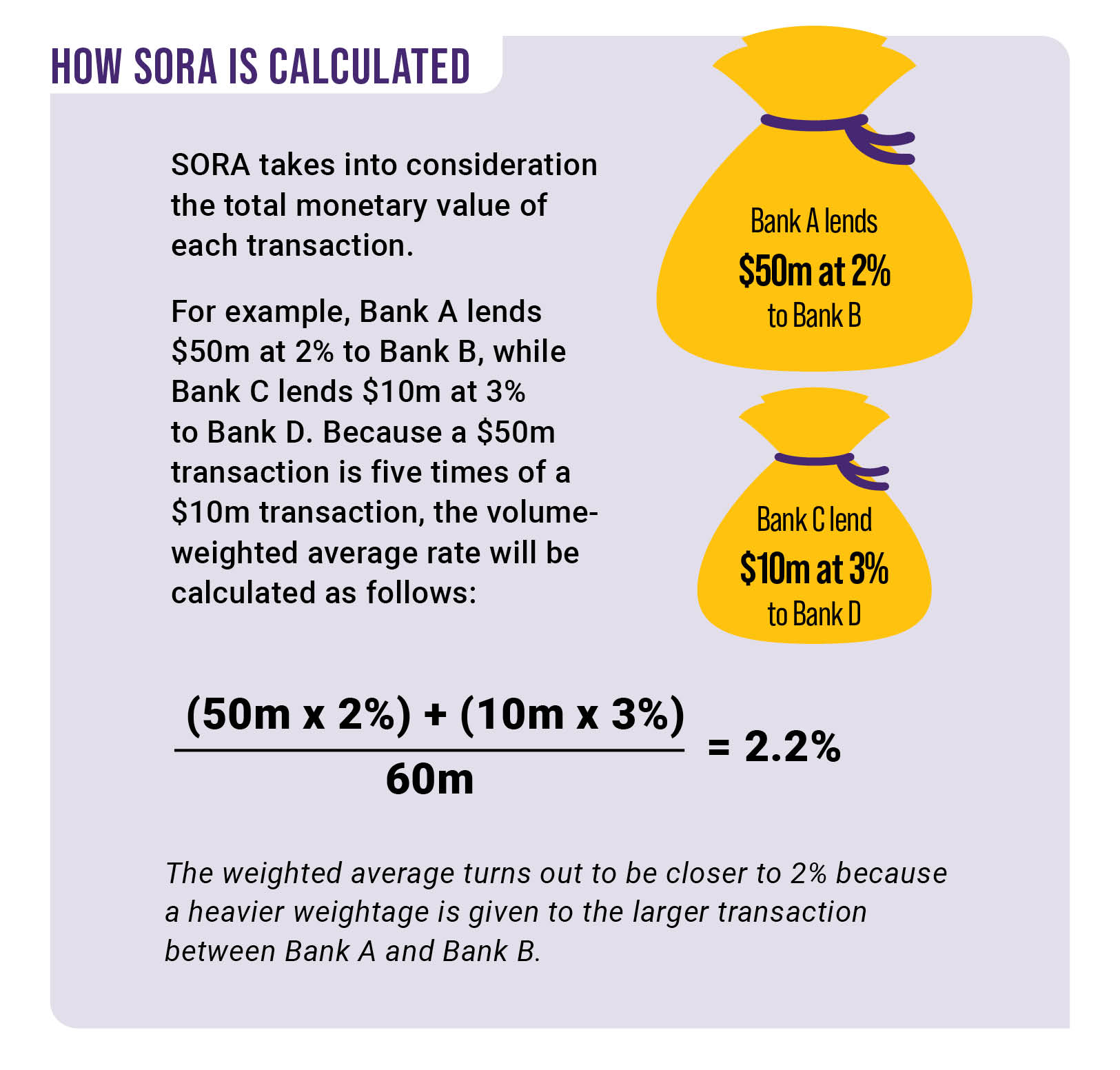

Most bank loans are currently based on SORA; but they can be based on one-month or three-month SORA rates (some may have even longer interest rate periods, like six or nine months, but these are rare).

The interest rate period reflects how often your home loan repayments are revised, to meet the prevailing SORA rate. So a one-month rate, for example, will have a loan repayment amount that changes every month; a three-month rate will be revised every quarter.

In theory (this is not guaranteed), a longer interest rate period can save you more, when rates are rising. On a three-month rate, for instance, you might still be paying February’s interest rate after the hike in March, as your loan gets revised in April.

However, we should add that mortgage brokers told us the theory doesn’t always pan out. For example, if the bank has a higher spread for a longer interest rate period, that might more than cancel out any savings.

It’s best to get an expert to compare options; but at the very least, a longer interest rate period makes your financial planning easier. That can be helpful if the wider economy turns volatile due to the Ukraine war.

2. Prepare to use a semi-fixed strategy going forward

There is, unfortunately, no perpetual fixed-rate home loan in Singapore. One possible solution to this is to refinance between fixed-rate loans when the time and cost are right.

For example, you might take a three-year fixed-rate loan for now, and aim to refinance into another three-year fixed-rate package in 2025. The rate may still rise, as there’s no guarantee the next fixed-rate loan is cheaper – but it does mean you’re able to lock in an acceptable rate for longer and reduce the overall volatility.

This approach does require a bit of number-crunching, however, as refinancing often involves costs (e.g., $2,500 to $3,000 in legal fees). You have to be careful that you don’t undo any savings, by refinancing too often.

This leads us to our next point, which is to…

3. Look for repricing options in your home loan

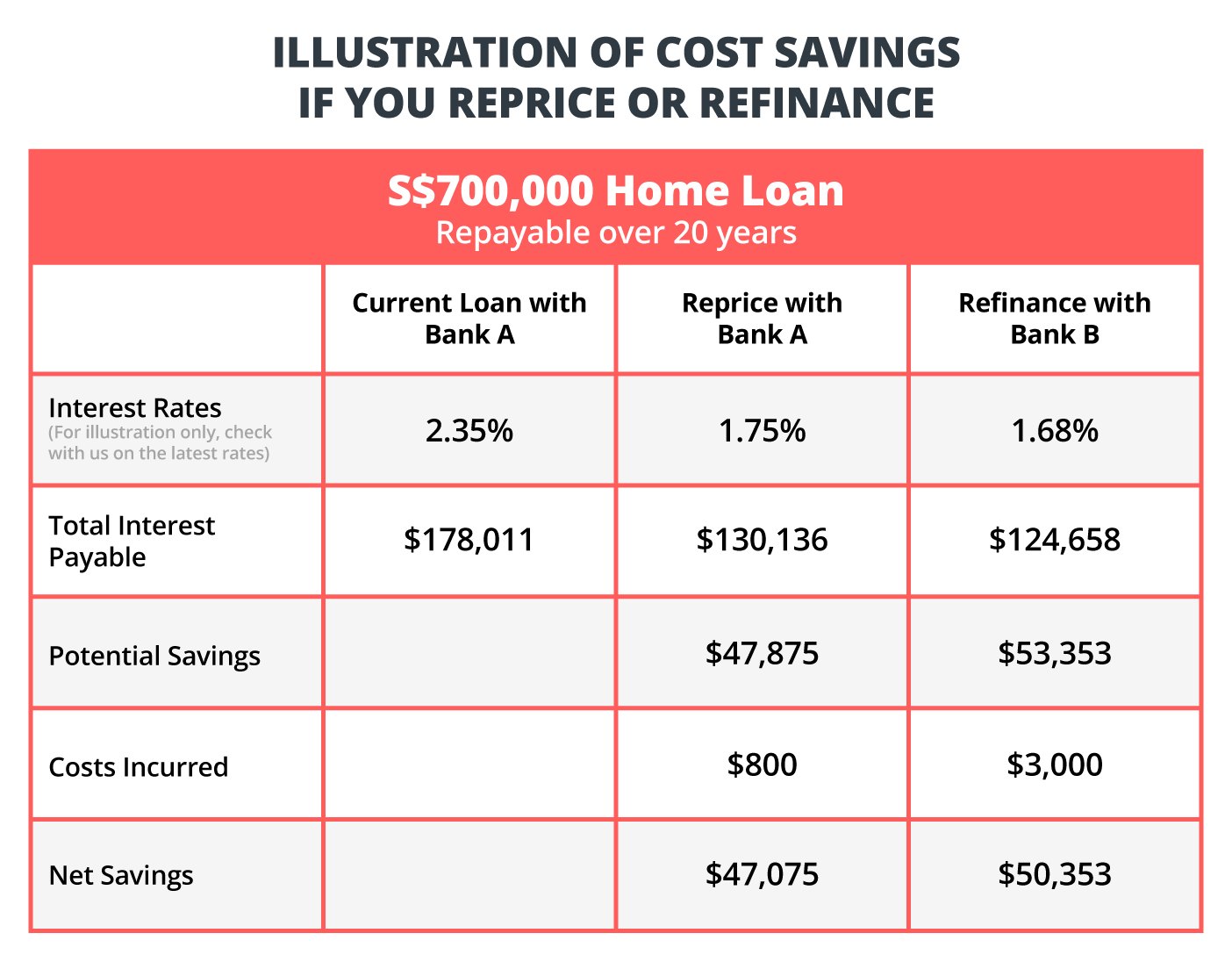

There are two main ways to switch out from your existing home loan package:

The first way is to refinance, which means switching to a loan package from a whole other bank. As we mentioned in point 2, refinancing almost always incurs costs; and you may find it’s not worth paying legal fees, just to save a two-digit figure every month.

The second way is to reprice. This is to switch your loan package to another one, within the same bank. This is considerably cheaper than refinancing, and the cost seldom exceeds $800.

If your home loan rate gets too high, it may be cheaper to reprice to a lower-rate loan from the same bank, than to refinance altogether.

Some banks also offer “free repricing” on home loan packages. This clause allows you to reprice the loan when the same bank launches a cheaper package, at no cost.

This will be under the terms and conditions, but don’t count on your bank being courteous enough to tell you about it. Check the terms and conditions, and know what you’re entitled to.

If you haven’t taken a home loan yet, you may want to look for such options in the terms and conditions; it can serve as a tiebreaker when choosing between two banks.

Property AdviceHow Do Rising Interest Rates Impact Property Prices And How To Prepare For It

by Ian Tan4. Landlords should remember to claim tax deductions

With property taxes and mortgage interest rates both rising, landlords may see slimmer yields ahead. This makes it more important than ever for landlords to claim their tax deductions.

Note that the interest portion of mortgage repayments can be claimed as tax deductions. For example, the monthly loan repayment on a quantum of $1 million, at 1.3 per cent for 25 years, is about $3,906 per month.

Of this $3,906, the interest portion is around $1,050 (the rest of the loan repayment goes toward paying down the principal). This $1,050 can be claimed as a deduction on your property taxes.

Remember it’s up to you, as the landlord, to pay attention to these details and make your claims; don’t assume the authorities are aware and will do it for you.

5. Flat buyers can consider sticking with HDB for now

HDB interest rates are 0.1 per cent above the prevailing CPF rates; and this hasn’t changed in around two decades. Unlike private bank loans, HDB loans tend to stay the same regardless of the wider economic conditions.

Buyers of HDB flats can use either HDB loans or bank loans, and they may feel safer deferring to HDB, with rates now rising. It’s also important to add that you can refinance an HDB loan into a bank loan later, if you decide it’s worth it; but you can go the other way around (a bank loan can’t be changed into an HDB loan).

That said, some mortgage brokers and home buyers will disagree with this assessment. This is on the basis that bank borrowers have seen lower interest rates for over a decade at this point: bank home loans have hovered at two per cent or lower since the financial crisis in 2008, while HDB loan rates have been at 2.6 per cent throughout.

While this is a fair point, an HDB loan can provide better peace of mind, with its lack of volatility. HDB is also more lenient, in case anything goes wrong and you have to pay late.

Overall, home loan interest rates aren’t rising so fast that borrowers will feel immediate pain; at least not yet. They are likely to keep rising in the coming years, however, and we’d remind readers that – prior to the crisis in 2008 – rates of around four per cent were common for home loans.

Speak to a mortgage broker about your specific situation, and whether it’s best for you to start angling for fixed-rate loans this early on. Drop us a note at Stacked and we can put you in touch with the right people. In the meantime, you can follow us for in-depth reviews of new and resale condos, and news on the Singapore property market as it progresses.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

1 Comments

hi Ryan,

the #4, landlord – seem only for the landlord renting out the whole apartment/flat/condo.

not owner-occupier situation?

is my understanding correct?