40 New Condos With Profitable Sub Sales: A Look Into Their Performance And What You Need To Know

June 14, 2023

Every now and then, we publish updates on condo sub sales, and the profits that sometimes result. In recent years we’ve seen some windfalls, on the back of a (possibly overheated) property market. Here’s an update on the sub sale market so far in 2023, and all you need to know:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What is a sub sale unit?

A sub sale unit is classified as the sale of a property before the development receives CSC (Certificate of Statutory Completion). This can happen because construction can typically take three to four years; so an owner could sell their unit in this period.

Note the CSC date is different from the TOP date, so a sub sale can still happen even after the key collection. There will take a certain level of nuance here to decide if you want to sell before or after the condo is completed (assuming your SSD is up). If the condo turns out worse than expected (just doesn’t look as nice as the renders or lots of complaints about defects), it may have been better to sell beforehand. Yet on the other hand, a much better feel and execution once it is completed could also mean better prices overall as buyers are able to see and touch it for themselves.

Gains from sub sales in 2023

Here’s a look at the average gains broken down by projects for those who had a sub sale transaction 2023:

| Project | Gain ($) | Gain (%) | No. Of Tnx |

| 3 CUSCADEN | $220,000 | 13.9% | 1 |

| AFFINITY AT SERANGOON | $165,329 | 16.0% | 27 |

| AMBER PARK | $177,693 | 10.3% | 4 |

| ARTRA | $387,867 | 20.6% | 3 |

| AVENUE SOUTH RESIDENCE | $175,500 | 11.8% | 3 |

| BOULEVARD 88 | $3,872,000 | 38.2% | 1 |

| DAINTREE RESIDENCE | $258,153 | 22.3% | 8 |

| DAIRY FARM RESIDENCES | $162,188 | 16.6% | 1 |

| FOURTH AVENUE RESIDENCES | $153,200 | 7.5% | 5 |

| GEM RESIDENCES | $279,116 | 26.1% | 17 |

| J@63 | $562,820 | 29.1% | 1 |

| JADESCAPE | $348,623 | 25.0% | 27 |

| KENT RIDGE HILL RESIDENCES | $212,667 | 17.5% | 3 |

| KI RESIDENCES AT BROOKVALE | $363,267 | 19.3% | 3 |

| KOPAR AT NEWTON | $165,000 | 10.3% | 1 |

| LAUREL TREE | $102,333 | 17.0% | 3 |

| MAYFAIR GARDENS | $165,714 | 11.4% | 7 |

| MAYFAIR MODERN | $309,267 | 15.8% | 3 |

| MIDTOWN BAY | $56,000 | 2.9% | 1 |

| MIDTOWN MODERN | $177,410 | 11.1% | 2 |

| NYON | $235,000 | 15.4% | 2 |

| OLLOI | $434,000 | 17.5% | 1 |

| PARC CLEMATIS | $249,261 | 20.3% | 13 |

| PARC ESTA | $323,922 | 24.6% | 52 |

| PARC KOMO | $130,000 | 14.9% | 1 |

| PARK COLONIAL | $180,500 | 14.7% | 4 |

| RESIDENCE TWENTY-TWO | $525,000 | 28.0% | 1 |

| RIVERFRONT RESIDENCES | $194,312 | 19.9% | 55 |

| SENGKANG GRAND RESIDENCES | $104,400 | 8.5% | 2 |

| SKY EVERTON | $153,000 | 6.3% | 2 |

| STIRLING RESIDENCES | $314,682 | 24.4% | 7 |

| THE FLORENCE RESIDENCES | $248,132 | 20.4% | 21 |

| THE JOVELL | $144,700 | 23.6% | 2 |

| THE LINQ @ BEAUTY WORLD | $173,000 | 17.2% | 1 |

| THE TRE VER | $241,516 | 20.6% | 40 |

| THE VERANDAH RESIDENCES | $71,296 | 6.5% | 3 |

| THE WOODLEIGH RESIDENCES | $221,000 | 16.8% | 2 |

| TREASURE AT TAMPINES | $202,943 | 20.1% | 39 |

| VIEW AT KISMIS | $196,500 | 17.2% | 2 |

| WHISTLER GRAND | $384,690 | 31.4% | 12 |

Some things to note about sub sale transactions:

1. Sub sales may not happen by design or intention

Some buyers are under the impression that sub sales come about as an actual strategy or method of property investment. But most of the time, successful sub sales were not by design – they are transactions that happen sporadically, such as when an owner gets approached by someone who really likes the unit, someone’s financial situation changes so they sell before completion, etc.

This is also more likely in the 2023 market: at this current time, our stock of unsold housing is at a 15-year low. This has resulted in a slew of buyers, who are in absolute urgent need of a new home – and that contributes to both the profits and numbers of sub sales in the data.

But even under these optimistic market conditions, we’d caution you against assuming a prospective pool of buyers, ready to swoop in on the fourth year.

2. The high sub sale profits we’re seeing are due to a booming property market

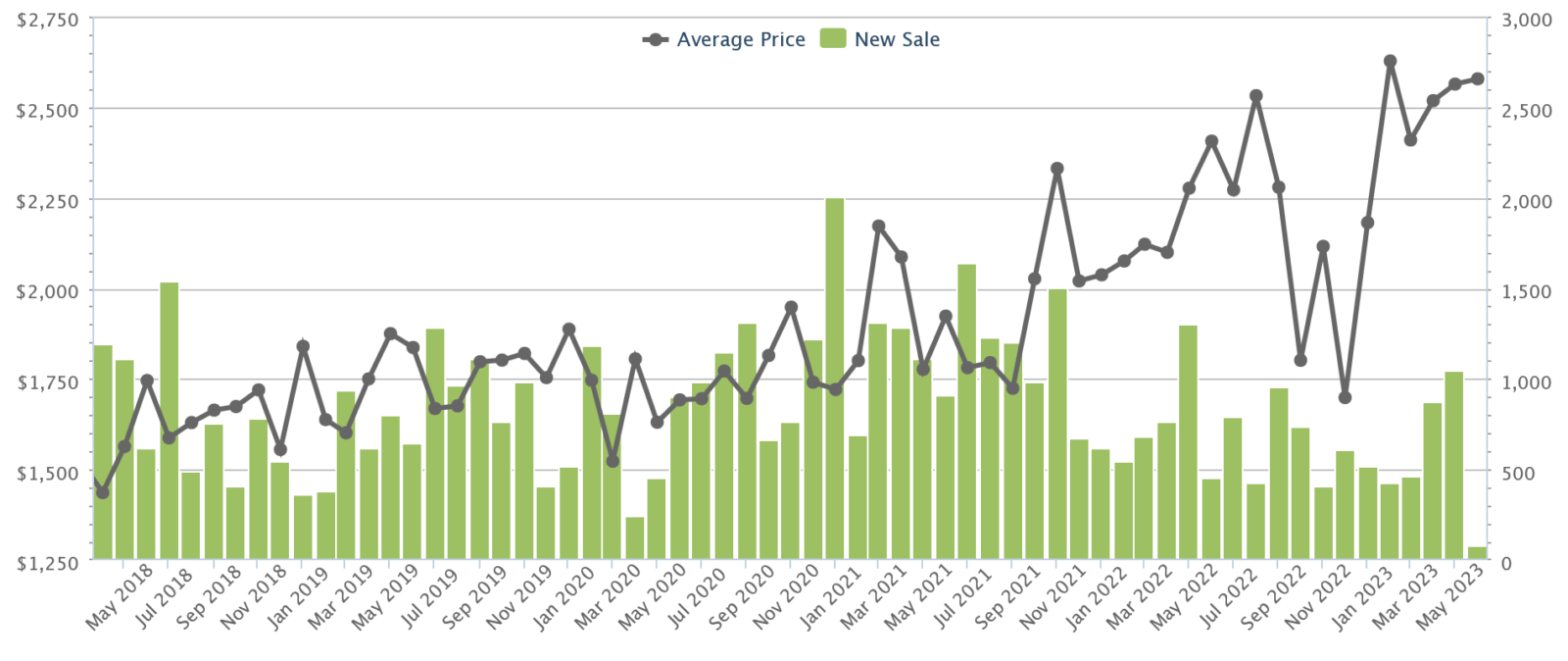

The past few years have been exceptional. Property prices rose 10.6 per cent across the board between 2020 and 2021, and a further 8.4 per cent by end-2022. New launch prices, for instance, rose at an exceptional pace in 2021 and 2022:

More from Stacked

This New 706-Unit Integrated Condo near River Valley Starts From $1.298M – And the Price Raises a Big Question for Buyers

Long associated with high-end projects, River Valley has become one of the busiest launch zones in 2025. A wave of…

We don’t know if similar sub sale profits would exist in a less exuberant market (at least, we haven’t gathered data on this yet). There’s no guarantee that a downturn won’t happen, sometime within the four years of your condo’s construction.

Also, bear in mind that our article shows some sellers making a loss, even in the current boom market.

3. Getting the early-bird discount doesn’t ensure your sub sale will be profitable

Even if you buy at the earliest, VVIP phase (or whatever the developers call it), this is no guarantee of profit. Some buyers may assume that, if they buy at 15 per cent discount, then selling in year four – when developer prices have assumedly risen – means a 15 per cent quick profit.

In reality, there are cases where developers decreased prices in later sales phases. Sky Habitat and Skywoods, for instance, saw prices drop after the initial launch. This might translate to slimmer profits for sub sales.

As an aside, don’t forget yours may not be the only sub sale listing for your project or even your specific block. If someone else is attempting a sub sale out of desperation (e.g., a drastic change in income and they can no longer afford the unit), there’s a chance they’ll lower their asking price significantly below yours.

4. There are loads of inconveniences and smaller costs that come with a sub sale

Unless you already have another home, there’s the issue of getting your new unit if you just sub sale-d the one you were waiting for. Here’s where things can get sticky.

You may find that the same market which granted you a profitable sub sale has also driven up the costs of other projects. Any profit you made from the sale may simply be swallowed by the higher price of your next home.

There’s also the practical consideration of having to wait for a new home all over again (if you elect to buy a new launch as a replacement). You need to consider the cost of temporary accommodation, for example, if you have nowhere else to stay (and rental rates in Singapore are also at a peak as of 2023).

A common complaint about people who have done sub sales involves the various bills and fees, which can total up and eat into profits. Many bank loans, for instance, have lock-in periods that last for up to three years – so you may find yourself paying a hefty prepayment penalty. You also incur conveyancing fees for the paperwork, and there must be developer approval, which can take time to coordinate. You may also be paying an agent’s service fees, unless you’re handling the sub sale on your own (which is a tough feat).

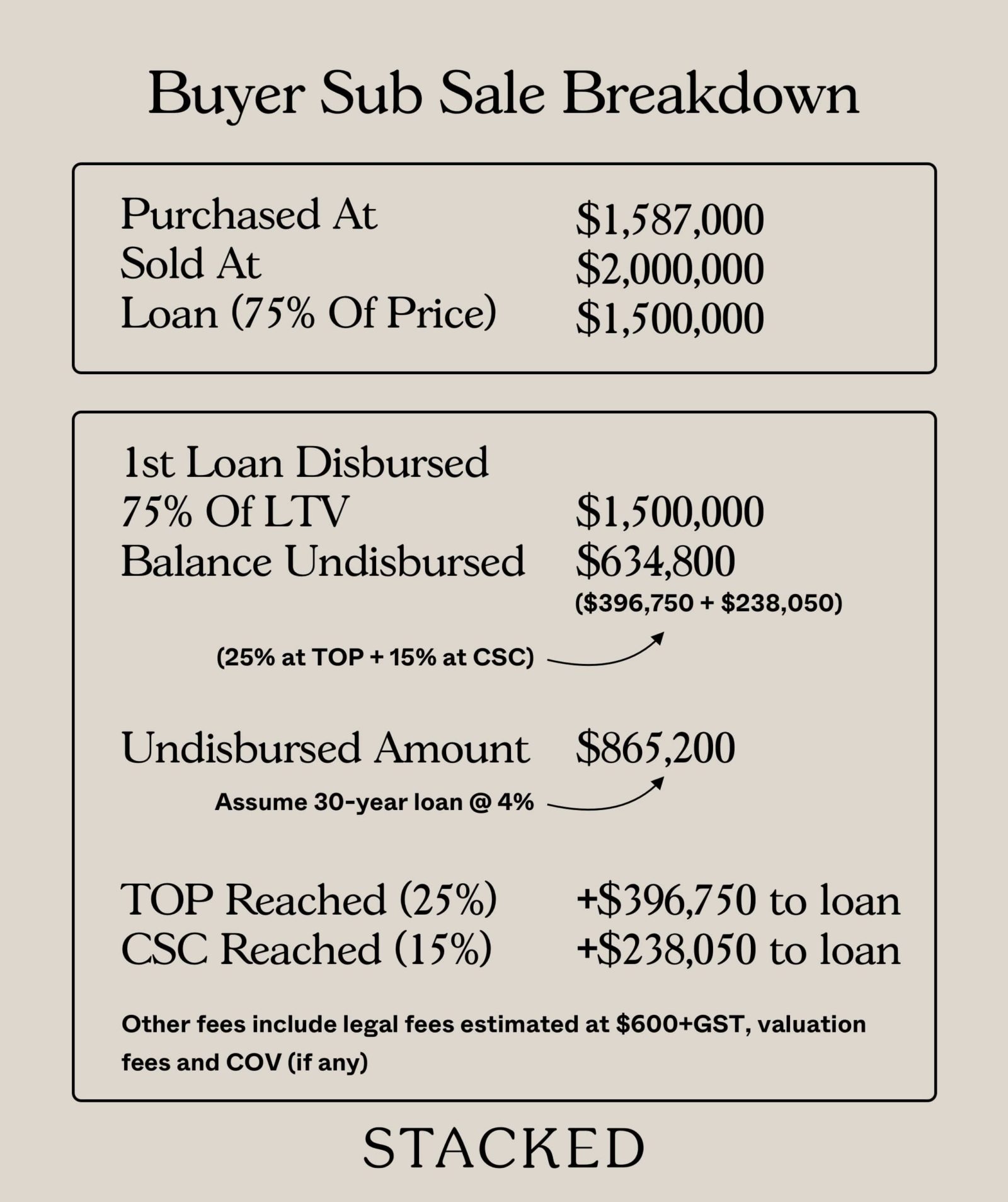

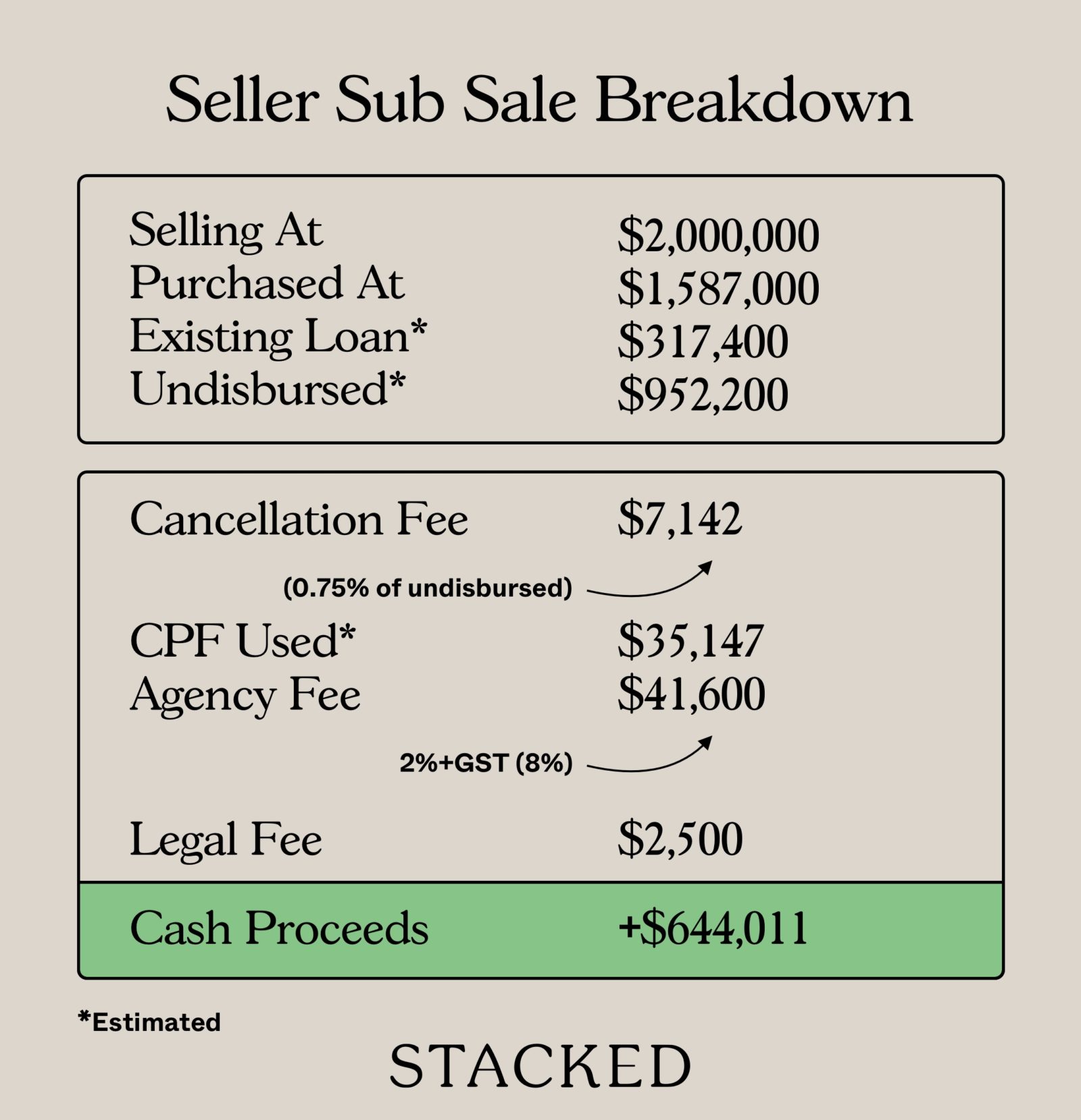

Here’s how the calculations might look like from a buyer and from a seller:

Buyer sub sale calculations

Seller sub sale calculations

5. Listing and selling a sub sale unit is tough

Attempting a sub sale is a much tougher process than you might think. There’s a chance that the developer is still heavily marketing its unsold units, so you may have further price competition there, depending on how desperate they are to clear their remaining units.

There’s also the issue on the marketing front. If there are still unsold units, your one listing is going to get lost among all the other advertising. This may be especially so in mega-developments, where there can be hundreds of listings at one go. Your agent may need to spend heavily on refreshing these listings, to appear constantly to attract new buyers.

Another complication could be due to incentives. If there are remaining units sold and developers are offering a high commission to clear (and you are offering your agent below market commission rates), some agents may be more inclined to swing buyers towards buying from the developer instead.

There’s also a tendency to assume that, if you’re an owner looking for a sub sale, you must somehow be in desperate need to back out of your purchase. Don’t be surprised at how aggressively some sellers will try to lowball you, even in a tight housing supply situation.

For more on the inner workings of the Singapore private property market, follow us on Stacked. We also provide in-depth reviews of new launches, just in case you’re considering buying a sub sale unit.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What exactly is a sub sale condo unit?

Are profits from sub sales common in 2023?

Does buying early at a discount guarantee a profitable sub sale?

What are some challenges of selling a sub sale unit?

Are there additional costs or inconveniences with sub sales?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments