4 Ways URA’s New Move To Curb Shoebox Units In Central Areas Could Affect The Singapore Property Market

October 19, 2022

The last time URA moved to curb shoebox units (one-bedder units, generally defined as 510 sq. ft. or smaller) was back in 2018. At the time, the impact was only for developments outside the central area. If you want a quick recap, the new guidelines meant that the number of permissible units will be derived by dividing the Gross Floor Area (GFA) by 85 sq. m. (it was 70 sq. m. previously). In short, this means that it will generally result in a lower number of units built per development, as well as bigger spaces.

For 9 other areas where shoebox units were particularly rampant (Marine Parade, Joo Chiat-Mountbatten, Telok Kurau-Jalan Eunos, Balestier, Stevens-Chancery, Pasir Panjang, Kovan-How Sun, Shelford and Loyang), the maximum number of units allowed will be by dividing the GFA by 100 sq. m. instead.

The upcoming policy change in 2023, however, impacts only the central region; and the intent is tied to URA’s vision for these hot spots. Here’s how it’s likely to impact property buyers:

New limitations on central region shoebox units

Starting from 18th January 2023, residential developments (including mixed-use projects) must have a minimum of 20 per cent of units with a size of at least 70 sq. m. (approx. 753 sq. ft.).

E.g., if a project has 500 units, then at least 100 of the units must be 753 sq. ft. or above.

As you can see from our earlier recap, this is quite different from the change in guidelines in 2018.

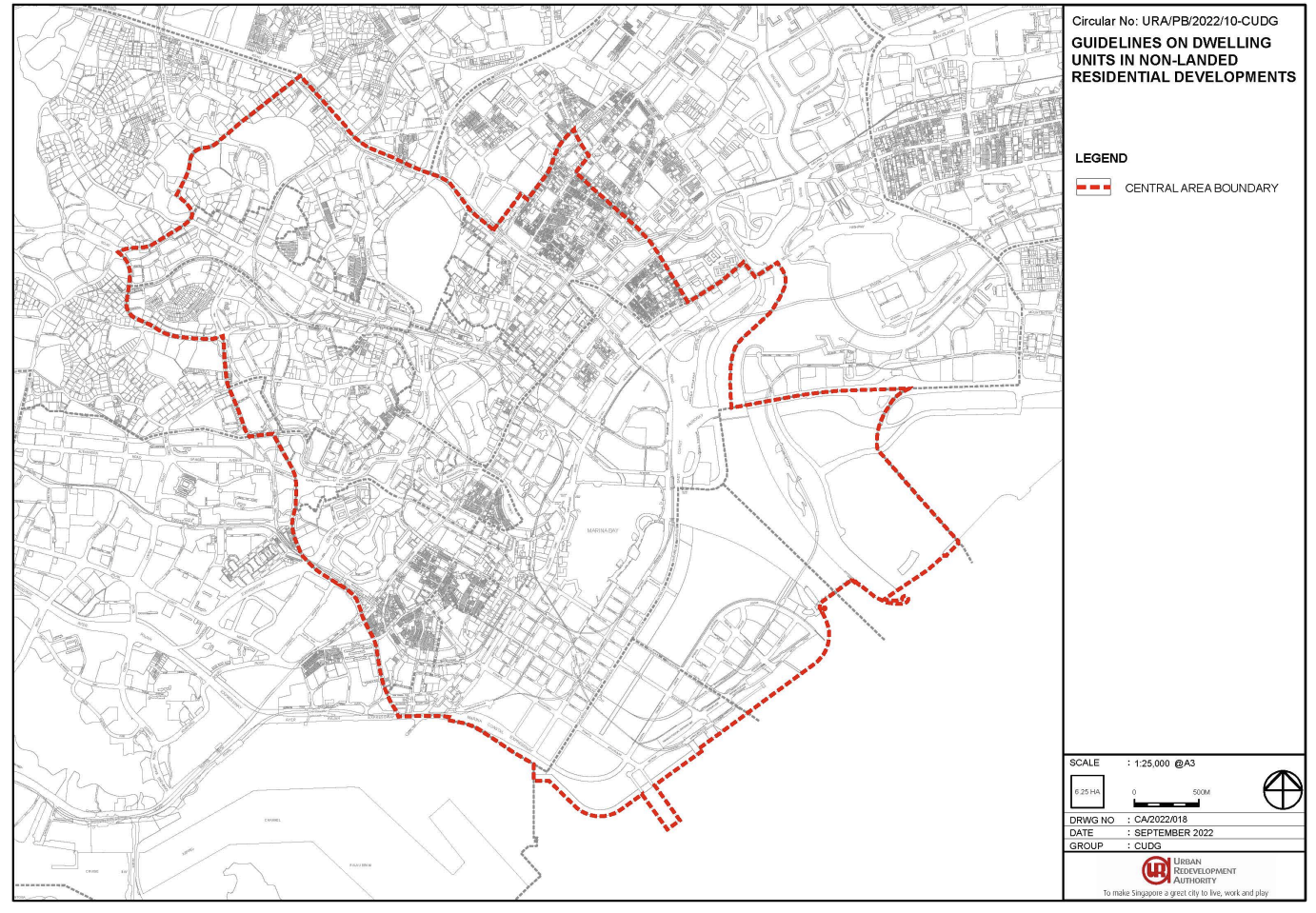

This will affect around 11 planning areas, all of which are central – this includes Orchard, Rochor, Newton, and the Downtown Core. This is the zone highlighted in the URA notice.

This move isn’t really targeted at any segment of the property market, nor is it related to current high prices. Rather, the motive is URA’s vision for a “live-play-work” environment in Singapore’s central region.

URA’s intent isn’t possible if central regions are packed with shoebox units, which can’t accommodate families. If the bulk of residents is transitional tenants, these zones will never develop the vibe of a balanced neighbourhood.

It’s a move that makes sense from a liveability perspective, as developers will now have to cater to a more diverse mix of unit sizes.

How could this impact the property market?

- A bigger challenge for developers

- Current en-bloc hopefuls may need to revise their price

- A possible price spike for new shoebox units

- Fewer options for singles and couples in the central region

Table Of Contents

1. A bigger challenge for developers

This is a tough time for developers to be told they get to build fewer shoebox units, especially in the central region where projects generally don’t move as quickly.

From a developer’s perspective, shoebox units deliver the most bang for their buck: the smaller the unit, the higher the price psf. If a developer were allowed to build nothing but shoebox units, they could maintain the same profit margins while buying up much smaller land plots (that’s why regulators like URA have to step in and prevent our homes from becoming hamster cages).

However, developers currently face high Land Betterment Charges, coupled with 35 per cent ABSD (five per cent non-remissible).

The five-year deadline of the ABSD is a factor here, as shoebox units are typically the low-hanging fruit of any show flat. As shoebox units have a lower quantum, they’re often the first units to be cleared out, whereas higher quantum units take longer to sell.

This is an especially rough and uncertain time for developers already; and limiting the number of their easiest sales will add to their challenges.

More from Stacked

Is Great World Quietly Becoming the Place to Live in Central Singapore?

When you think about Singapore’s Core Central Region (CCR), you probably imagine the designer shops along Orchard, the sleek skyline…

2. Current en-bloc hopefuls may need to revise their price

The whole point of an en-bloc is to intensify the use of the land. For example, a plot that previously only had 600 units could now hold 1,200 units, and shoebox units helped with that. With the new restrictions in place, some collective sales may yield fewer new homes than expected.

This has to be coupled with the other factors in point 1, such as shoebox units helping to maximise the price psf for developers.

This confluence of factors may see developers turn less generous toward central region collective sales, perhaps even for the smaller plots. We expect that current en-bloc hopefuls will revise their prices downward if they really want to push the sale through.

3. A possible price spike for new shoebox units

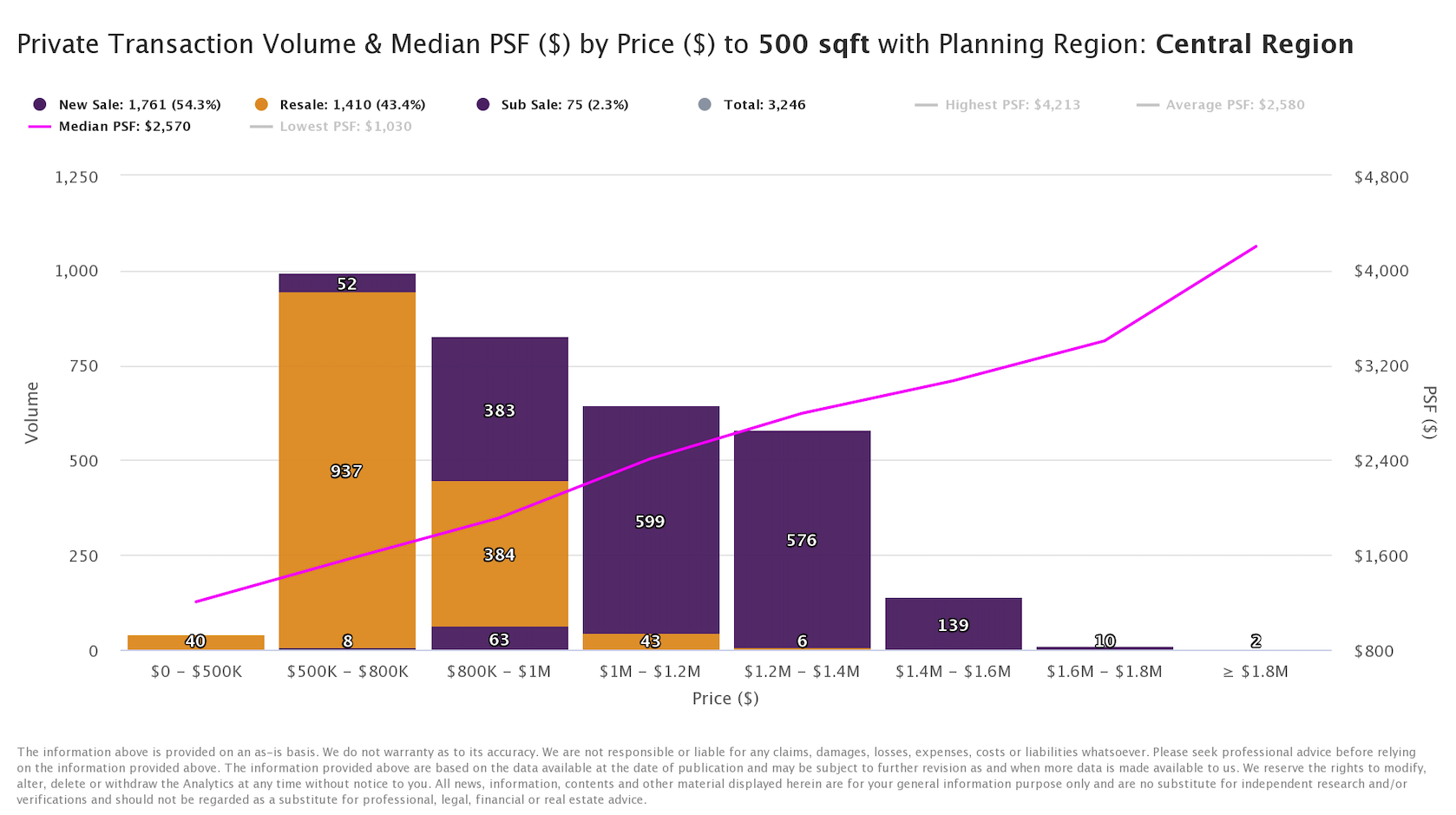

One realtor we spoke to said the move could spike prices for new shoebox units, once implemented.

She says that among new investors, with tighter budgets, shoebox units may be the only unit size with an affordable quantum (in the context of central region properties). At prices of around $2,900 psf, for example, new shoebox units in District 9 or 10 could still cost only around $1.45 million.

The low quantum, coupled with the high rental potential from well-heeled expats, draw many new investors to the central region instead of the fringes.

If we lower the number of shoebox units, however, these new investors are forced to compete for the smaller pool of units, and deal with rising prices.

But the realtor said this is unlikely to affect* other buyers, such as family buyers, who if anything will have more options available to them.

*We’re not sure there’s entirely no effect. We shouldn’t ignore the impact on developers in point 1, as it may affect pricing decisions for the wider project.

4. Fewer options for singles and couples in the central region

There is also demand from a growing population of singles, especially from those who are below 35 and want to move out and have their own space.

And so as you can imagine, this is all bad news for lifelong singles or couples, who dream of living along the Orchard belt or within the CBD. They’re usually priced out of the family-sized units in these districts.

They’ll have a smaller pool of units to compete for; and as we mentioned in point 3, this could lead to a momentary rise in new shoebox prices (in the central area).

In the long run, this move may help to support better liveability in the central region

The live-work-play neighbourhood that URA envisions is especially important, given ongoing decentralisation. With new commercial hubs like Jurong, Paya Lebar, Tampines, etc., the central regions can no longer rely on retail and offices to be their sole defining strength.

Realtors said that these days, it’s more common for buyers to look for a large heartland mall, such as Junction 8, Tampines 1, Parkway Parade, etc. than to worry about having access to Orchard or Raffles.

They also noted that, with Work From Home being a new norm, and the opening of new commercial hubs, it’s not possible for the central region to count on its Grade A offices as being the sole draw.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with reviews of both new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will the new URA rules affect small apartments in Singapore's central areas?

What is the reason behind URA's new restrictions on shoebox units in central Singapore?

How might these new policies impact property prices in the central region?

Will the new rules make it harder for singles and couples to find affordable homes in central Singapore?

Could the new restrictions influence the development plans of property developers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why The Feb 2026 BTO Launch Saw Muted Demand — Except In One Town

Singapore Property News One Of The Last Riverfront Condos In River Valley Is Launching — From $2,877 PSF

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Latest Posts

Editor's Pick We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Pro This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Editor's Pick Why Some Old HDB Flats Hold Value Longer Than Others

0 Comments