Is valuation an art or a science?

It’s an age-old question that has been asked many times, and while you’d get a mix of different responses depending on who you ask, I think most would agree that it is definitely a combination of the two.

So why is property valuation important to you – the homeowner?

Well, valuation is essentially, an estimation of how much the property is worth in the market.

This can be different from the actual buying or selling price, as negotiations usually cause the final price to fluctuate around the valuation – which is why the property valuation is usually the starting point of negotiations.

With good knowledge on how much the property is valued, as well as what goes into property valuations, buyers and sellers can rest assured that they are getting/paying a fair value.

To delve further into it, there are generally two types of valuation—estimates and indicative.

Estimates are usually done by owners themselves or through online tools that generate a rough estimation of the value.

Indicative valuation, however, takes into account many more indicators that can affect the property value in a subtle manner and is usually done by an independent valuer.

Now that we’ve got that out of the way, let me share with you some methods of valuation typically used by valuers!

Methods of Assessment

Valuations can be done in three ways, depending on the type of property assessed.

For residential properties, IRAS uses rentals of comparable properties, adjusted for size, condition, floor, among others.

Income-generating properties (such as shophouses) are usually assessed using the income method.

Lastly, the residual method is used to value a development site or to build a valuation plan to forecast a property project.

Let me go through each of them in detail:

1. Direct Comparison

The rental comparison is a quick and easy method and can be used for a multitude of properties, including residential or non-specialised commercial properties.

It involves the collection and adjustment of contracted rental evidence of similar or comparable properties and hence, ‘comparing’ to find the market value of a specific property.

The process involves:

- Search for the most recent rental transactions of similar or comparable properties

- Identify value-sensitive factors (I will cover this in a bit!)

- Selection of most appropriate rental evidence that requires minimal adjustments

- Adjust for the difference in value-sensitive factors

- Reconcile and attain final value

To obtain the most accurate valuation, the first step will be to choose the best and most comparable properties.

They are the ones that are the most similar to our subject property and hence require the least number of adjustments.

Then, we make the necessary adjustments by taking into account value-sensitive factors.

These value-sensitive factors are ones that can either positively or negatively affect the value of the subject property, through reflecting superior or inferior characteristics.

Many factors come into play here, but the most common include the size of the property, location, topography, ceiling heights, and floor levels, just to name a few.

Now, let me show you a simple example.

Mr Lim wants to sell a 2 bedroom unit at Kovan Regency and is looking for an indicative valuation for a potential sale in 2021.

After narrowing down the options, I’ve chosen 2 other units that are the best fit within the same development.

| Subject Property | Comparable Property A | Comparable Property B | |

| Date of Sale | – | 01-Jan-2021 | 05-April 2020 |

| Size (sqft) | 592 | 592 | 775 |

| Floor Level | Mid | Mid | High |

| View | Unblocked | Blocked | Unblocked |

| Condition | Good | Average | Good |

| Price (per sqft) | – | $1,230 | $1,380 |

Using market norms, the adjustments are:

- Change in market condition from 2020 to 2021: + $60 per sqft

- Premium for smaller sizes: $30 per sqft

- Premium for unblocked view: $50 per sqft

- Premium for higher floors: $80 per sqft

- Condition of property: $90 per sqft for jump between average to good

Hence, with all the information I need, here are the adjustments

| Subject Property | Property A | Adjust | Property B | Adjust | |

| Date of Sale | – | 01-Jan-2021 | – | 05-April 2020 | $60 |

| Size (sqft) | 592 | 592 | – | 775 | $30 |

| Floor Level | Mid | Mid | – | High | ($80) |

| View | Unblocked | Blocked | $50 | Unblocked | – |

| Condition | Good | Average | $90 | Good | – |

| Price (per sqft) | – | $1,230 | $1,380 | ||

| Adjusted Value | $1,370 | $1,390 |

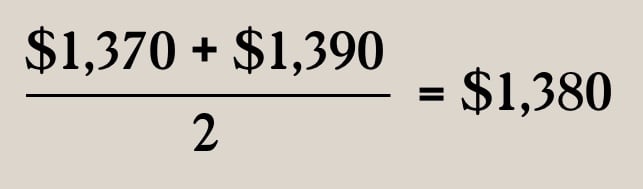

To reconcile, I will take the simple average, which is the most common method to reconcile the adjusted values.

So Mr Lim should sell his unit for around $1,380 per sqft which is $816,960 for a 592 sq ft unit.

This process can also be done using percentages, instead of a lump-sum adjustment, which is much more realistic.

Do note, however, that the factors used in this example are not exhaustive as valuers will take many more factors into consideration when producing a valuation report.

2. Profits Method

If you are an owner of an income-producing property, i.e., a real estate asset that collects rental income on a monthly basis, the profits method can be used to calculate the value of the property.

Note here that rental collection can also apply to residential properties, but this method is specifically used for commercial properties, such as shophouses or retail spaces.

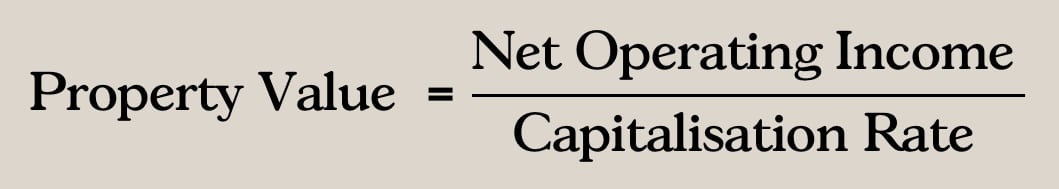

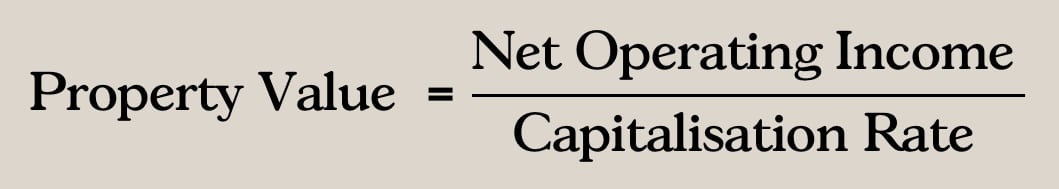

Essentially, it determines the property value by determining how much income can be generated by renting out the unit divided by a capitalisation rate.

What is Net Operating Income? (NOI)

Net Operating Income is simply the annual income generated by an income-producing property.

This is obtained through the formula:

Potential Gross Income – Vacancy and Debt Services – Operating Expenses = NOI

To breaking down the components,

Potential Gross Income – is the sum of all rents, assuming that the property is 100% occupied. It usually uses a market-based rental rate determined through comparable properties.

Vacancy and Debt Service – deduct the loss of income due to vacancy or potential defaults, as well as the debt service payable. Where the vacancy factor is not available, market vacancy rate can be used.

Operating Expenses – next, deduct all cash expenditures required to operate the property, including property taxes, property insurances and maintenance fees.

Overall, a positive NOI indicates that operating income exceeds operating expenses, and vice versa.

Determining the Capitalisation Rate

The capitalisation rate is the rate of return on the property, based on the income.

Usually, to find a suitable cap rate, you would need to use the average market rate of comparable properties.

The average market rate of comparable properties would then have to go through an adjustment process, much like the one mentioned in the Direct Comparison Method.

To give you an idea of the factors, it should include things like quality of tenants, amenities available and grade of property, etc.

As most factors are usually subjective, the final chosen capitalisation rate should fall within a 0.5% deviation from the market average. (i.e., for an average market capitalisation of 7%, the value is likely between 6.5% and 7.5%)

Now, let’s put this into an example.

Mr Tan owns a shophouse in Holland Village.

According to him, the shophouse can be let out at $80,000 per month, according to comparable properties.

Mr Tan has segregated the shophouse into 4 sub-units and has only found tenants for 3 sub-units.

On average, Mr Tan spends about $160,000 on maintenance, insurance, taxes and other miscellaneous expenditures for the shophouse yearly.

With this information, we can now find the NOI.

| Item | Value |

| Potential Gross Income | 80,000 * 12 |

| = 960,000 | |

| Vacancy Rate (0.25*960,000) | (240,000) |

| Expenses | (160,000) |

| NOI | 560,000 |

Based on market conditions, the current adjustments include:

- Quality of tenants: 0.4% increase when quality of tenants decreases each grade

- Condition: 0.7% increase when condition of property decreases by a grade

- Proximity of MRT: 0.3% increase when distance increases from ‘close’ to ‘far’

*Note here that a higher cap rate decreases the value of the property! It is an inverse relationship

| Subject Property | Property A | Adjust | Property B | Adjust | |

| Quality of Tenants | Good | Average | (0.4%) | Good | – |

| Condition | Fair | Fair | Good | 0.7% | |

| Proximity to MRT | Close | Close | – | Far | (0.3%) |

| Cap Rate | – | 7.5% | 6.5% | ||

| Adjusted Cap Rate | 7.1% | 6.9% |

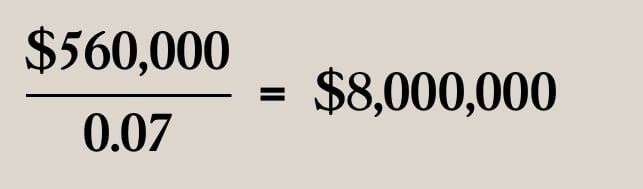

Taking a simple average, Mr Tan’s shophouse has an average cap rate of 7%

Applying the formula for the Income Method,

The value of Mr Tan’s shophouse is $8 million dollars.

3. Residual Method

The residual method is usually used by developers to determine how much they can afford to pay for the land.

While it may sound complicated, the method itself is actually relatively simple and intuitive.

Developers, to a certain extent, are bound by market prices of developments and how much competitors are selling their developments for.

With this fixed range of potential revenue from selling the property, you will need to work backwards to determine the value of land.

In this case, you will have to deduct all the costs that will be incurred for the construction, including materials, labour and professionals, as well as the required profit to induce the developer to take on the project.

It basically boils down to this;

Value of Land = Gross Development Value – (Construction Costs + Required Profit)

Let’s break down each component:

Gross Development Value: This the final expected capital value of the projected completed development upon sale. It is the fundamental building block of the calculation and is imperative for developers to get this as accurate as possible.

Construction Costs: Includes all costs related to construction, including material fees, professional fees, building insurances and labour costs.

Required Profit: Is the monetary reward given to developers, such that it induces the developer to take on the project. This is usually determined by an industry rate.

Let’s have a look at calculating how much to bid for the new plot of land in Bugis that recently was put up for tender.

You noticed that the average GDV of surrounding properties is $40,000,000 (*not accurate/realistic).

Using previous projects, you can estimate the costs of each component of construction.

Furthermore, the industry’s required profit for residential developers is averaged at 5% of GDV of the project.

| Item | Cost |

| Gross Development Value (GDV) | 40,000,000 |

| Construction Costs: | |

| Material cost | 20,000,000 |

| Labour cost | 5,000,000 |

| Professional fees | 500,000 |

| Total Construction Cost | (25,500,000) |

| Required Profit (0.05*GDV) | (2,000,000) |

| Value of Land | 12,500,000 |

So the maximum you should bid for the land should be $12,500,000.

Conclusion

By familiarising yourself with these components, you can see that anyone can conduct a basic property valuation.

But for those of you thinking that this knowledge will put valuers out of a job – think again.

In reality, valuation is highly subjective and two different valuers will usually not come to the same concluding valuation.

Most of the components of valuation can be differently perceived and can be assigned a different weightage in determining the final value.

Valuation is, after all, an approximation of how the market MIGHT value your property and, in most cases, different from what the final transaction price may be.

Nevertheless, it serves as a starting point for most transactions and ensures that you are not overpaying or underselling the property.

For more on the Singapore private property market, and updates as the situation unfolds, follow us on Stacked. We’ll also provide you with the most in-depth tours of new and resale properties alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?