23 HDB Resale Flats That Broke The $1.5 Million Barrier In 2024

-

Ryan J

Ryan J

- December 28, 2024

- 5 min read

- Leave comment

5 min read

5 min read

There was a time when a million dollars would have been record-breaking for an HDB flat. But we’ve reached the point where million-dollar flats no longer have the same shock value. In some projects, like Pinnacle @ Duxton, a million dollars is even an expected price. Now instead, the focus is shifting to $1.5 million as the definition of a truly expensive flat; and here’s where they’ve begun to emerge:

A quick note on the importance of $1.5 million

This is a psychologically important number, now that we’ve seen more flats hit the $1 million mark. The typical price for a resale private condo is about $1,680 psf (as of December 2024). This means a 900 sq. ft., three-bedder resale condo unit is about $1.51 million.

This is also a comparable price point to a new launch Executive Condominium (EC).

So flats being able to hit this amount have, in effect, managed to eliminate the price gap between public and private housing; at least in the resale and EC segment. And going forward, this is likely to be a point of alarm; one that may prompt policy changes.

Fortunately, the number of flats able to reach $1.5 million are very few in number. But that echoes what many of us said just over a decade ago (July 2012), when the very first million-dollar flat was sold. It didn’t take long for the numbers to climb.

Resale flats that have reached the $1.5 million mark

| Period | Town | Flat Type | Address | Storey | Size (Sqm) | Flat Model | Lease Start Year | Remaining Lease | Resale Price |

| 2024-06 | BUKIT MERAH | 5 ROOM | 9B BOON TIONG RD | 34 TO 36 | 112 | Improved | 2016 | 90 years 08 months | $1,588,000 |

| 2024-06 | BUKIT MERAH | 5 ROOM | 96A HENDERSON RD | 46 TO 48 | 113 | Improved | 2019 | 94 years | $1,588,000 |

| 2024-09 | BUKIT MERAH | 5 ROOM | 126A KIM TIAN RD | 40 TO 42 | 113 | Improved | 2013 | 87 years 06 months | $1,580,000 |

| 2024-01 | TOA PAYOH | 5 ROOM | 139A LOR 1A TOA PAYOH | 40 TO 42 | 117 | DBSS | 2012 | 87 years 04 months | $1,568,888 |

| 2024-07 | BISHAN | 5 ROOM | 275A BISHAN ST 24 | 37 TO 39 | 120 | DBSS | 2011 | 86 years 03 months | $1,568,000 |

| 2024-07 | KALLANG/WHAMPOA | 3 ROOM | 53 JLN MA’MOR | 01 TO 03 | 366.7 | Terrace | 1972 | 47 years | $1,568,000 |

| 2024-11 | QUEENSTOWN | 5 ROOM | 28A DOVER CRES | 37 TO 39 | 124 | Improved | 2012 | 86 years 05 months | $1,550,000 |

| 2024-11 | CENTRAL AREA | 5 ROOM | 1D CANTONMENT RD | 43 TO 45 | 105 | Type S2 | 2011 | 85 years 03 months | $1,542,880 |

| 2024-01 | TOA PAYOH | 5 ROOM | 138C LOR 1A TOA PAYOH | 31 TO 33 | 117 | DBSS | 2012 | 87 years 03 months | $1,540,000 |

| 2024-06 | TOA PAYOH | 5 ROOM | 139A LOR 1A TOA PAYOH | 31 TO 33 | 117 | DBSS | 2012 | 86 years 11 months | $1,540,000 |

| 2024-10 | CENTRAL AREA | 5 ROOM | 1F CANTONMENT RD | 43 TO 45 | 107 | Type S2 | 2011 | 85 years 04 months | $1,540,000 |

| 2024-12 | BISHAN | 5 ROOM | 275A BISHAN ST 24 | 31 TO 33 | 120 | DBSS | 2011 | 85 years 10 months | $1,539,000 |

| 2024-06 | BISHAN | 5 ROOM | 275A BISHAN ST 24 | 28 TO 30 | 120 | DBSS | 2011 | 86 years 03 months | $1,538,000 |

| 2024-05 | CENTRAL AREA | 5 ROOM | 1C CANTONMENT RD | 37 TO 39 | 106 | Type S2 | 2011 | 85 years 09 months | $1,515,000 |

| 2024-09 | CENTRAL AREA | 5 ROOM | 1D CANTONMENT RD | 37 TO 39 | 107 | Type S2 | 2011 | 85 years 05 months | $1,515,000 |

| 2024-06 | TOA PAYOH | 5 ROOM | 138C LOR 1A TOA PAYOH | 34 TO 36 | 114 | DBSS | 2012 | 86 years 11 months | $1,503,888 |

| 2023-06 | BUKIT MERAH | 4 ROOM | 50 MOH GUAN TER | 04 TO 06 | 176 | Adjoined flat | 1973 | 48 years 08 months | $1,500,000 |

| 2024-05 | BISHAN | 5 ROOM | 275A BISHAN ST 24 | 22 TO 24 | 120 | DBSS | 2011 | 86 years 04 months | $1,500,000 |

| 2024-05 | BISHAN | EXECUTIVE | 286 BISHAN ST 24 | 22 TO 24 | 172 | Maisonette | 1992 | 67 years 04 months | $1,500,000 |

| 2024-06 | BUKIT MERAH | 5 ROOM | 95C HENDERSON RD | 40 TO 42 | 113 | Improved | 2019 | 94 years | $1,500,000 |

| 2024-10 | TOA PAYOH | 5 ROOM | 138B LOR 1A TOA PAYOH | 31 TO 33 | 114 | DBSS | 2012 | 86 years 08 months | $1,500,000 |

| 2024-11 | CENTRAL AREA | 5 ROOM | 1G CANTONMENT RD | 40 TO 42 | 106 | Type S2 | 2011 | 85 years 03 months | $1,500,000 |

Finally, we want to add the highest resale flat on record today. That’s a shocking $1.73 million for a flat at SkyOasis @ Dawson, which we covered here. To date, we haven’t yet seen anything that beats this – not even from the famed Pinnacle @ Duxton.

Common trends among $1.5 million+ resale flats

1. Still in quite specific clusters

If we were to look at “just” a million dollars, the locations of these flats are quite diverse. In fact, as of 2024, resale flats reaching $1 million can be found in every HDB town except Choa Chu Kang, Jurong West, Sembawang, and Tengah.

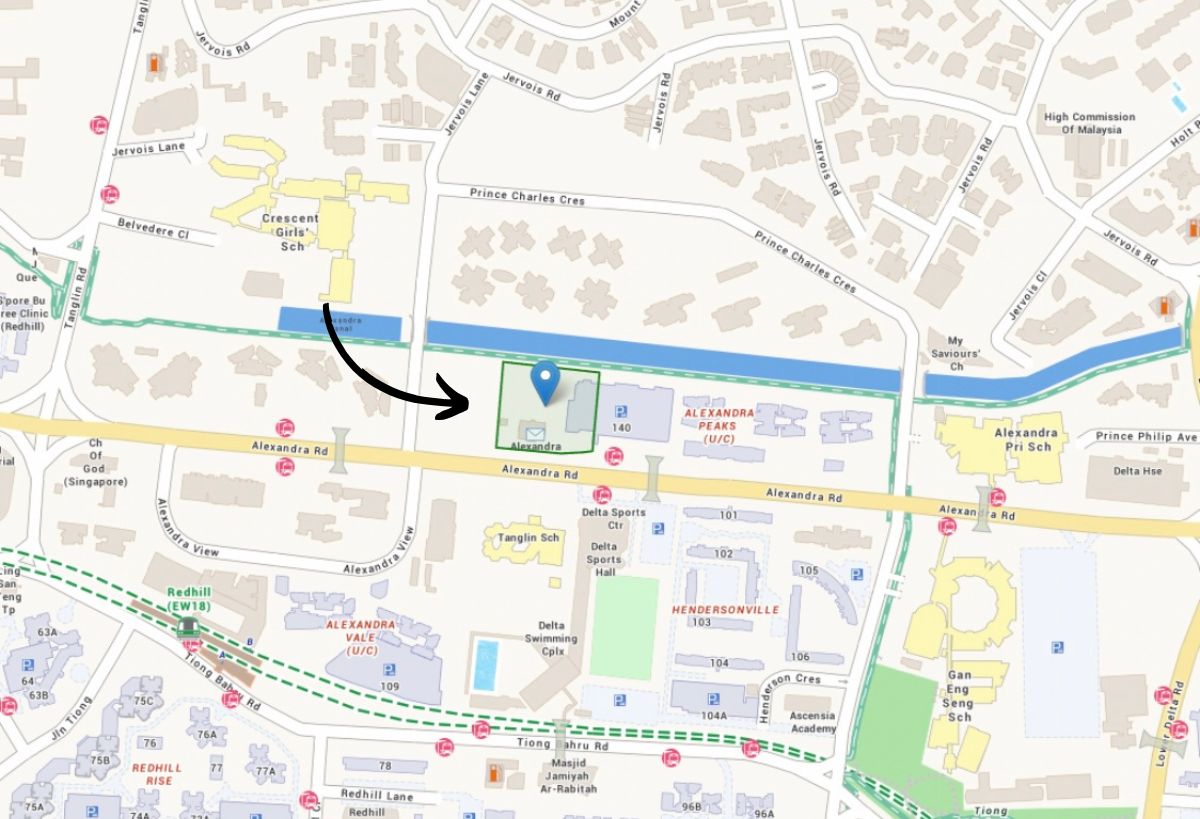

For a price point of $1.5 million, however, we can see they’re still quite concentrated. Most are in the Central Area (Cantonment Road), Bukit Merah, Bishan, and Toa Payoh. These four names are not particularly surprising, since they were also among the first to churn out large numbers of million-dollar flats; but by being the first to also produce $1.5 million+ flats, we can see they continue to be a cut above other towns.

Going forward, we can see strong demand for Prime BTO flats in these areas, even with restrictions like the 10-year MOP. At virtually condo-like prices, we may reach the point where a Prime flat is the only way to afford a home in Bishan, Toa Payoh, or the other two towns.

2. Almost always the largest flats

Note that the 3-room flat on the list is not really a 3-room flat: it’s a landed terrace house. These landed HDB properties date back to the time of SIT, which was HDB’s predecessor. The smallest unit on the list is a 4-room flat in Bukit Merah.

Other than that, everything is a 5-room or executive flat. Size does contribute to quantum, and their ability to reach $1.5 million; but it’s worth noting the persistent demand for the largest units. The market has likely noticed this by now, and we see it on the ground as well:

It’s not uncommon to encounter buyers striving for larger flats than they actually need, such as couples who want 5-room flats even if their children have already left. There’s a perception that bigger flats are easier to sell, and bring higher returns. This, in turn, perpetuates the rising prices and demand for big flats.

3. Non-standard and DBSS flats

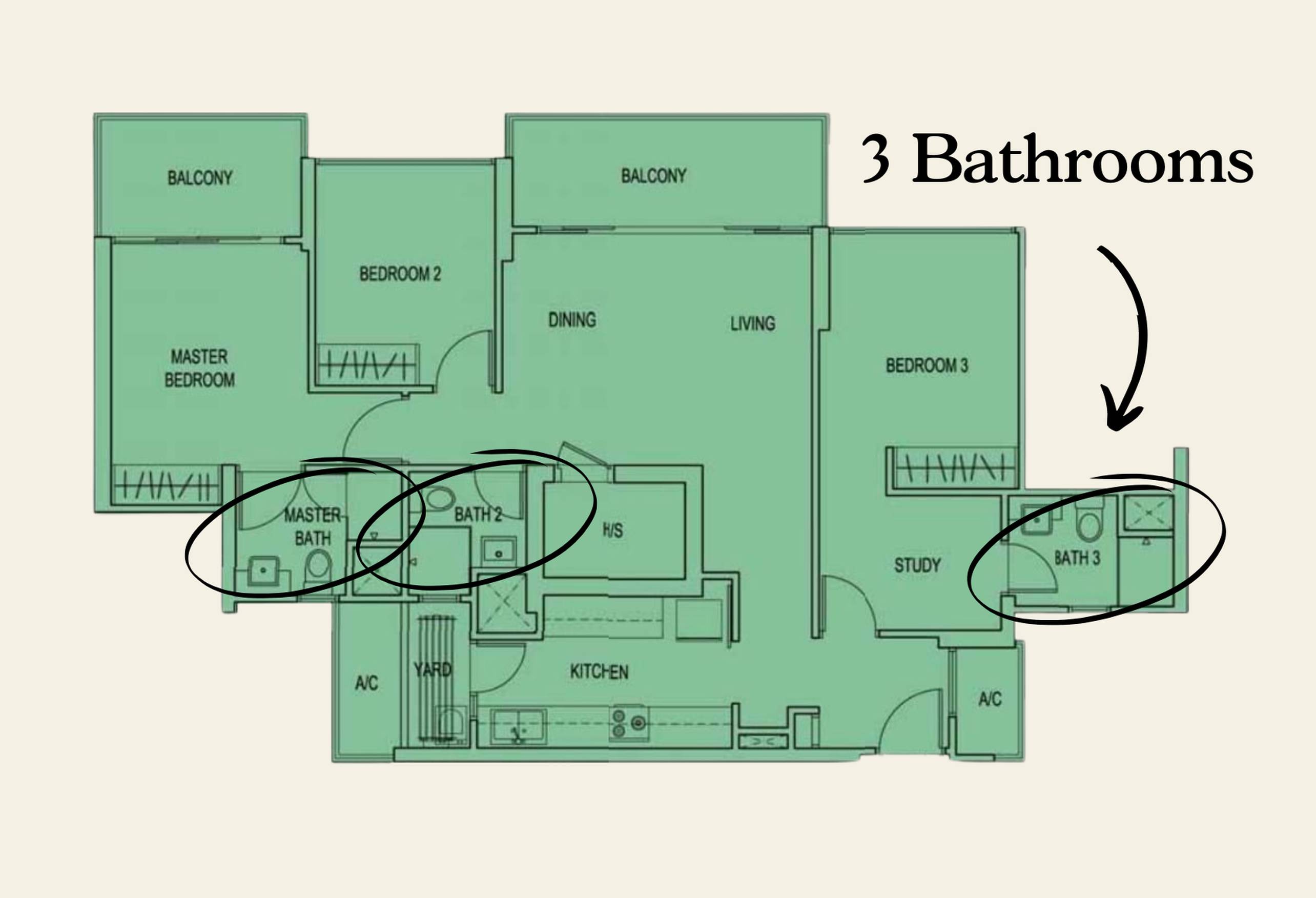

Several of the $1.5 million flats are DBSS flats. This is quite ironic, since the Design, Build, and Sell Scheme (DBSS) produced some of the worst quality and pricing complaints, and the scheme was suspended. The demand may be due to the better location of some DBSS flats, rather than the design itself; but some buyers do treasure things like having an extra bathroom or a high-ceiling living room.

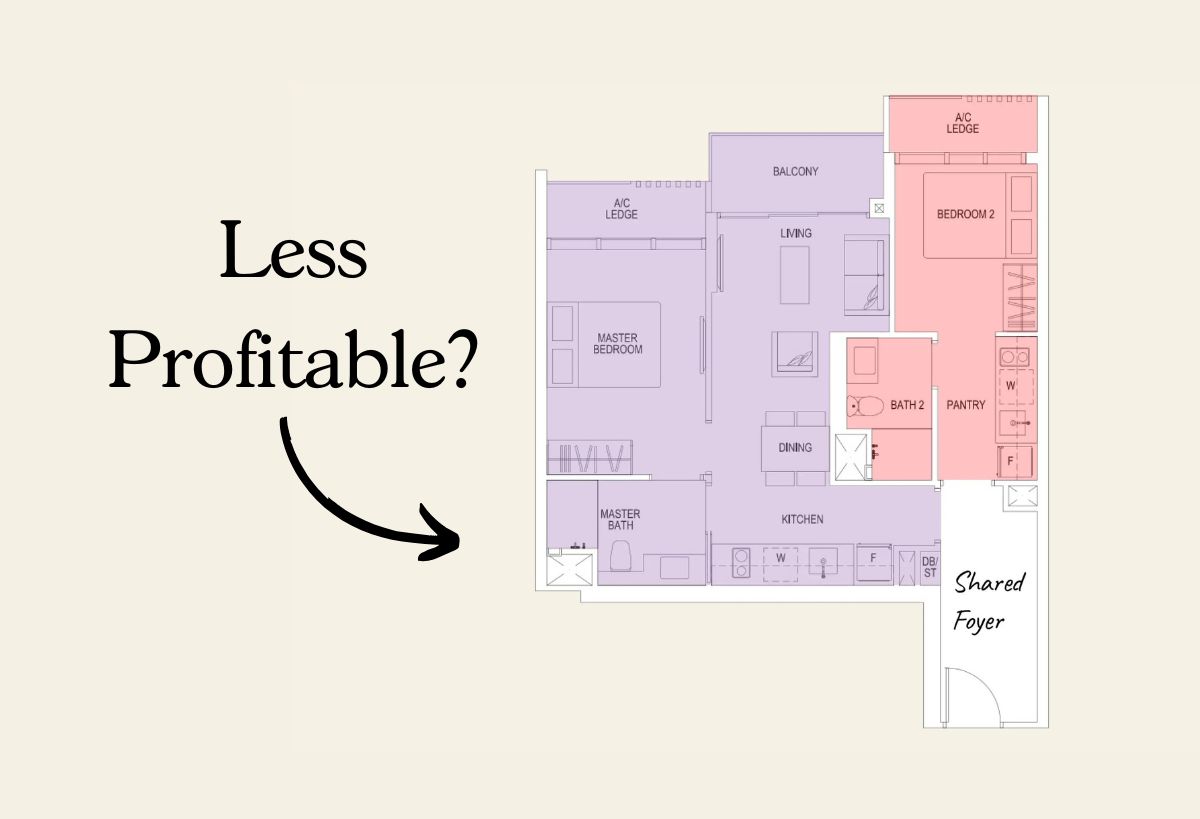

If quality is a major factor though, there is little sense in opting for a DBSS unit instead of an EC unit, if they’re both going to be at around $1.5 million+. Perhaps it’s just the desire to avoid paying for unused facilities.

Also, note the presence of a maisonette (double-storey flat) and an adjoined flat (two flats merged into one) on the list.

4. Usually quite new

One of the observations for million-dollar flats is that many tend to be quite old, and we do have some examples of that even on this $1.5 million list (the 4-room flat at Bukit Merah, the maisonette, and the terrace house).

But if you look at the remaining lease, you’ll notice many of these $1.5 million units are quite new, with 85 to 90 years remaining. This particular combination, of low lease decay plus a central/convenient location, contributes to the high price point.

With flats that are “merely” a million dollars, such as you might find in Tiong Bahru, the convenience may be offset by lease decay and the accompanying, limited resale prospects.

5. Almost never on the lower floors

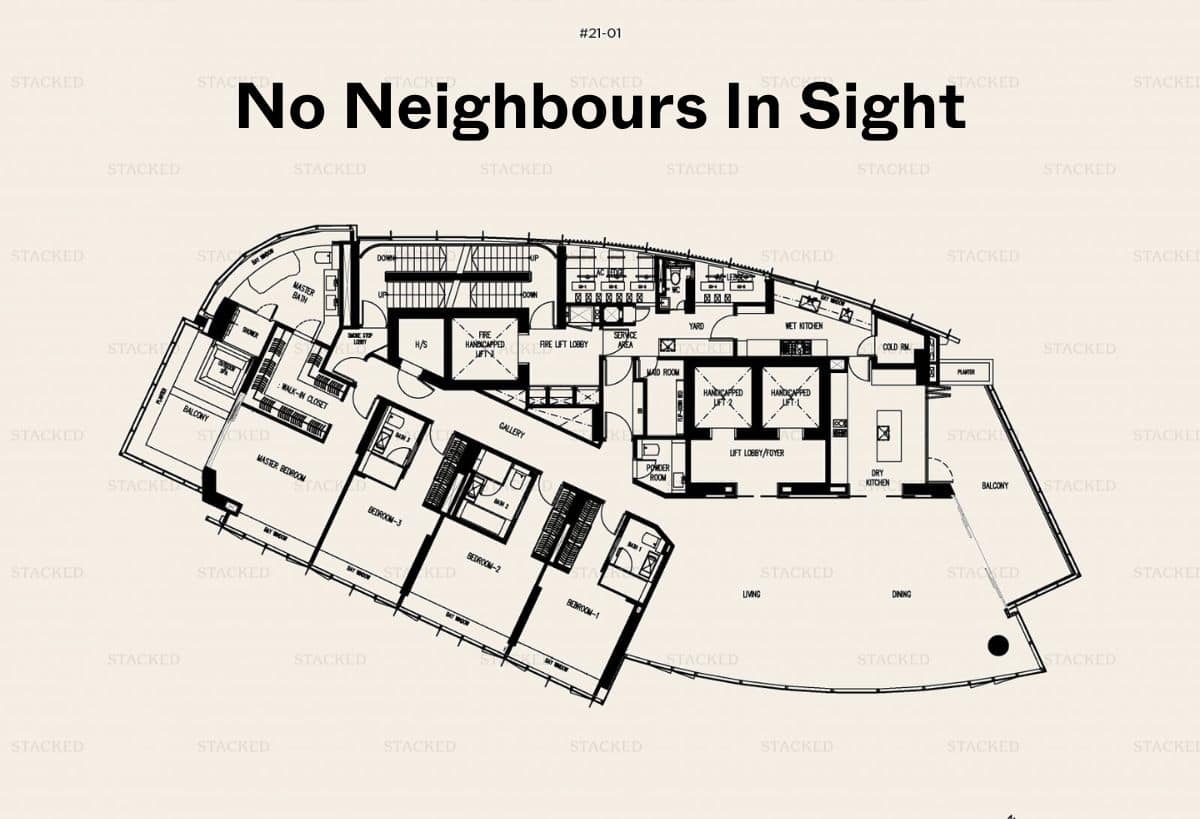

Apart from the terrace house or the adjoined flat at Moh Guan Terrace (the block at Moh Guan Terrace is a low rise), everything else is off the ground floor. The view and privacy are clearly important; and we note that for the $1.73 million SkyOasis @ Dawson unit (see the above link), the view was one of the contributing factors.

For those looking at resale gains, the extra cost of a higher floor may be well worth it; and some may consider it another “windfall” effect to secure a higher floor unit.

It will be interesting to see if resale flat prices can maintain their momentum going into 2025/26, given how much HDB ramped up production in the aftermath of COVID-19. We also believe the introduction of Plus and Prime models will result in a shake-up, and one that could impact prices in these highly desirable HDB towns; but it’s still too early to see where that’s headed.

For more on public and private housing alike, and an in-depth look at specific residential projects, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.