10 Interesting New Land Plots Coming Up In 2024 (Including An EC In Woodlands)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

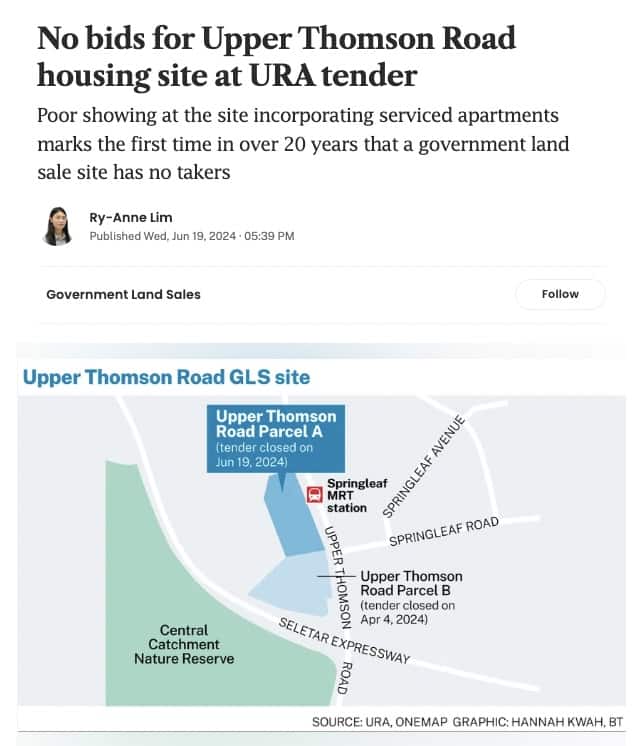

There was a time when the thought of GLS sites getting no bids was unthinkable; and if there weren’t sufficient sites, the en-bloc market would be roaring. But recent events show just how much things have changed, from the 2017 era when land-starved developers saw every parcel as solid gold. As of today, the government has had to slow the supply due to developer disinterest; and the demand hasn’t changed despite the availability of prime sites:

A dip in GLS sites for 2H 2024

The list of GLS sites has dipped from 5,450 potential new units in H1, to around 5,050 units in H2; and we may see further cuts in the year ahead. This is the first time since around 2021 that we’ve seen the supply of GLS sites dip (although it really isn’t by much at 7 per cent).

Even with the reduction though, we’re looking at a totally new supply of 11,110 new homes for 2024, which is the highest single-year amount since the last property peak in 2013. Do note that, back when the government surged land supply in 2013, it was also partly to cool real estate prices; so we may be seeing a similar play here.

The difference is that even with heightened supply back in 2013, developers were still buying. Prices did drop in subsequent years, but it was rare for sites to gather completely zero interest, as we saw with Upper Thomson Road (the first in 20 years); or for bids to be so low that the parcel remained unsold, as we saw with Marina Gardens Crescent.

These are the current sites on the confirmed list:

PROPOSED RESIDENTIAL, COMMERCIAL AND HOTEL SITES FOR 2H2024 GLS PROGRAMME

| S/N | Location | Site Area (ha) | Proposed GPR | Estimated No. of Residential Units (1) | Estimated No. of Hotel Rooms | Estimated Commercial Space (m2) | Estimated Launch Date | Sales Agent |

| Confirmed List | ||||||||

| Residential Sites | ||||||||

| 1 | Tampines Street 95 (EC) | 2.25 | 2.5 | 560 | 0 | 0 | Aug 2024 | HDB |

| 2 | Faber Walk | 2.58 | 1.4 | 400 | 0 | 0 | Sep 2024 | URA |

| 3 | Lentor Gardens | 2.06 | 2.1 | 500 | 0 | 0 | Oct 2024 | URA |

| 4 | River Valley Green (Parcel B) | 1.17 | 3.5 | 580 | 0 | 500 | Oct 2024 | URA |

| 5 | Bayshore Road | 1.05 | 4.2 | 515 | 0 | 0 | Nov 2024 | URA |

| 6 | Media Circle (Parcel A) | 0.81 | 3.7 | 345 | 0 | 400 | Nov 2024 | URA |

| 7 | Media Circle (Parcel B) | 0.97 | 4.3 | 485 | 0 | 400 | Nov 2024 | URA |

| 8 | Chuan Grove | 1.58 | 3.0 | 550 | 0 | 0 | Dec 2024 | URA |

| 9 | Holland Link | 1.72 | 1.4 | 240 | 0 | 0 | Dec 2024 | URA |

| Commercial & Residential Sites | ||||||||

| 10 | Chencharu Close | 2.94 | 3.2 | 875 | 0 | 13,000 | Sep 2024 | HDB |

| Total (Confirmed List) | 5,050 | 0 | 14,300 | |||||

The EC site at Tampines Street 95 will probably be a main point of interest, as ECs have long proven to be easy sales – this is especially true in 2024, when fully private, new launch prices are pushing $2,200+ psf, which may push a bigger chunk of HDB upgraders toward EC options.

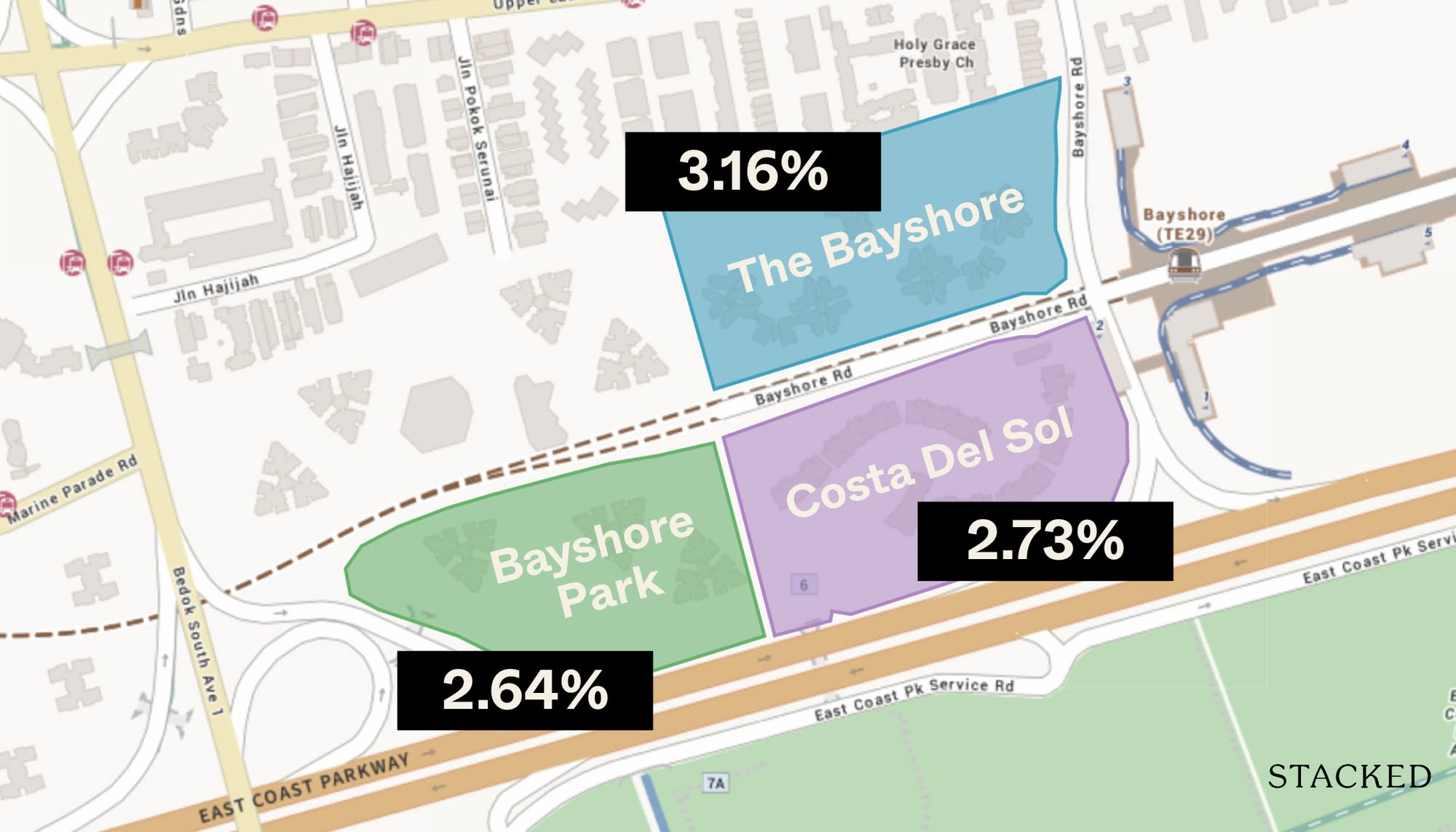

Bayshore, Chuan Grove, and Faber Walk may also retain interest. Bayshore because its MRT station is already up and will be home to the first Plus model flats. HDB seldom allows its pilot projects to go unsupported, and there’s a lot of developer confidence in what will be the new Bayshore enclave.

Faber Walk has good access to the One-North tech and media hub, and is part of aggressive efforts to transform this area into a live-work-play hub; and it also provides good access to the traditional hotspot of Tampines. Meanwhile, Chuan Grove may see further interest depending on the outcome of the soon-to-be-launched Chuan Park Residences, which now also has the Lorong Chuan MRT nearby.

More from Stacked

A First-Time Homebuyer’s Journey: List Of 27 ECs With Big Units + Review Of Citylife @ Tampines

Having viewed a number of ECs in the last few weeks, it seems that the developments with a fewer number…

The other following sites are on the reserve list. These sites are only activated when developers express sufficient interest, with a minimum tender.

| Reserve List | ||||||||

| Residential Sites | ||||||||

| 1 | Senja Close (EC) | 1.01 | 3.0 | 295 | 0 | 0 | Available | HDB |

| 2 | Marina Gardens Lane | 0.61 | 5.6 | 400 | 0 | 0 | Oct 2024 | URA |

| 3 | Woodlands Drive 17 (EC) | 2.58 | 1.7 | 435 | 0 | 0 | Oct 2024 | HDB |

| 4 | Holland Plain | 1.58 | 1.8 | 275 | 0 | 0 | Dec 2024 | URA |

| 5 | River Valley Green (Parcel C) | 1.15 | 3.5 | 470 | 0 | 0 | Dec 2024 | URA |

Given the current lacklustre responses, it’s quite possible that only the EC site (Woodlands Drive 17) might draw any attention right now.

Besides these, there are two other white sites, which are loosely speaking a kind of mixed-use area:

| 7 | Marina Gardens Crescent | 1.73 | 4.2 | 775 | 0 | 6,000 | Available | URA |

| 8 | Woodlands Avenue 2 | 2.75 | 4.2 | 440 | 0 | 78,000 | Available | URA |

Marina Gardens Crescent, as we mentioned above, failed to draw a sufficiently high bid. The two white sites are expected to be in low demand right now, due to factors such as their size, price point, and end-buyer demographics.

What does the developer’s response tell us about the direction of the market?

1. Cooling attitudes toward larger prime sites

Developers are sticking to land parcels for mid-sized condos, which are considered to be in the 500 to 600-unit range. This is because of the ABSD deadline, which requires developers to complete and sell their projects within five years; failure to do so results in losing a hefty percentage of the land price.

Given the growing resistance to new launch prices, rising interest rates, and weak economic outlook, there isn’t much confidence in selling large projects on time.

The other issue is the ABSD rates placed on foreigners and investors (i.e., those buying multiple properties). Whilst the average, single-home Singaporean isn’t impacted by this, the demographic that buys in prime areas like Orchard is a different batch: prime area luxury condos depend more on wealthy foreign buyers or investors. As such, demand for these areas is more adversely impacted by stamp duties.

This accounts for the poor showing of the Marina Gardens Crescent site.

2. A disinterest in the new and untested

The Upper Thomson site, which drew no interest, was hamstrung by the requirement for SA2 units – these are long-stay serviced apartments, which require leases of up to three months.

This spooked developers, who were uncertain how consumers would react; a key concern was the difficulty faced in renting out regular units in the same development. No private landlord wants to find themselves in competition with a serviced apartment company, and vice versa.

The location of the site was good though, where connectivity is concerned, and were we in different times (i.e., better economic outlook, and lower risk posed by ABSD rates), some developers may have given it a shot. But we can see that the high stamp duties and uncertain economy are causing a rejection of such novel attempts for now.

We can’t really blame them, as we do think now is the wrong timing as well. A weaker economy will also impact the demand for long-stay serviced apartments (e.g., during recessions, companies often reduce overhead by shrinking the number of expats they bring in).

3. A difficult time for en-bloc sales ahead as well

If GLS sites are not doing well, en-bloc sites may fare even worse. Keep in mind that between the two, developers tend to favour GLS sites (this is with regard to major developers, not smaller ones building boutique projects).

If they’re not even interested in bidding for government land, they’re even less likely to offer the high sale proceeds that individual homeowners will demand – and they will demand it, given the high cost of replacement properties today.

Those who were hoping for en-bloc sales may be better off trying to just sell their own units for now, as the market situation doesn’t seem likely to change anytime soon.

For more on the Singapore property market, follow us on Stacked. You can also check out our reviews of new and resale properties alike. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

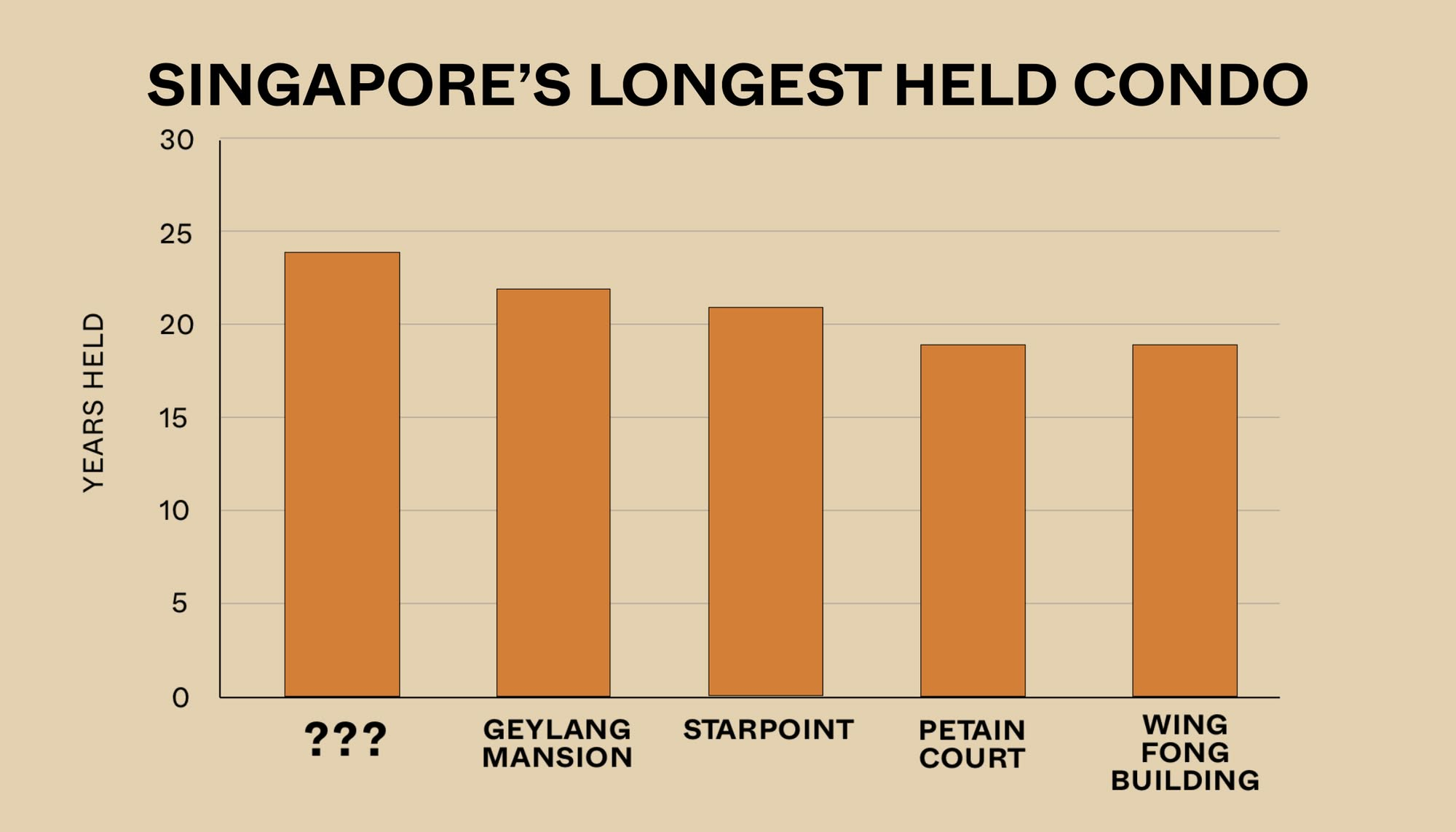

Property Market Commentary The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

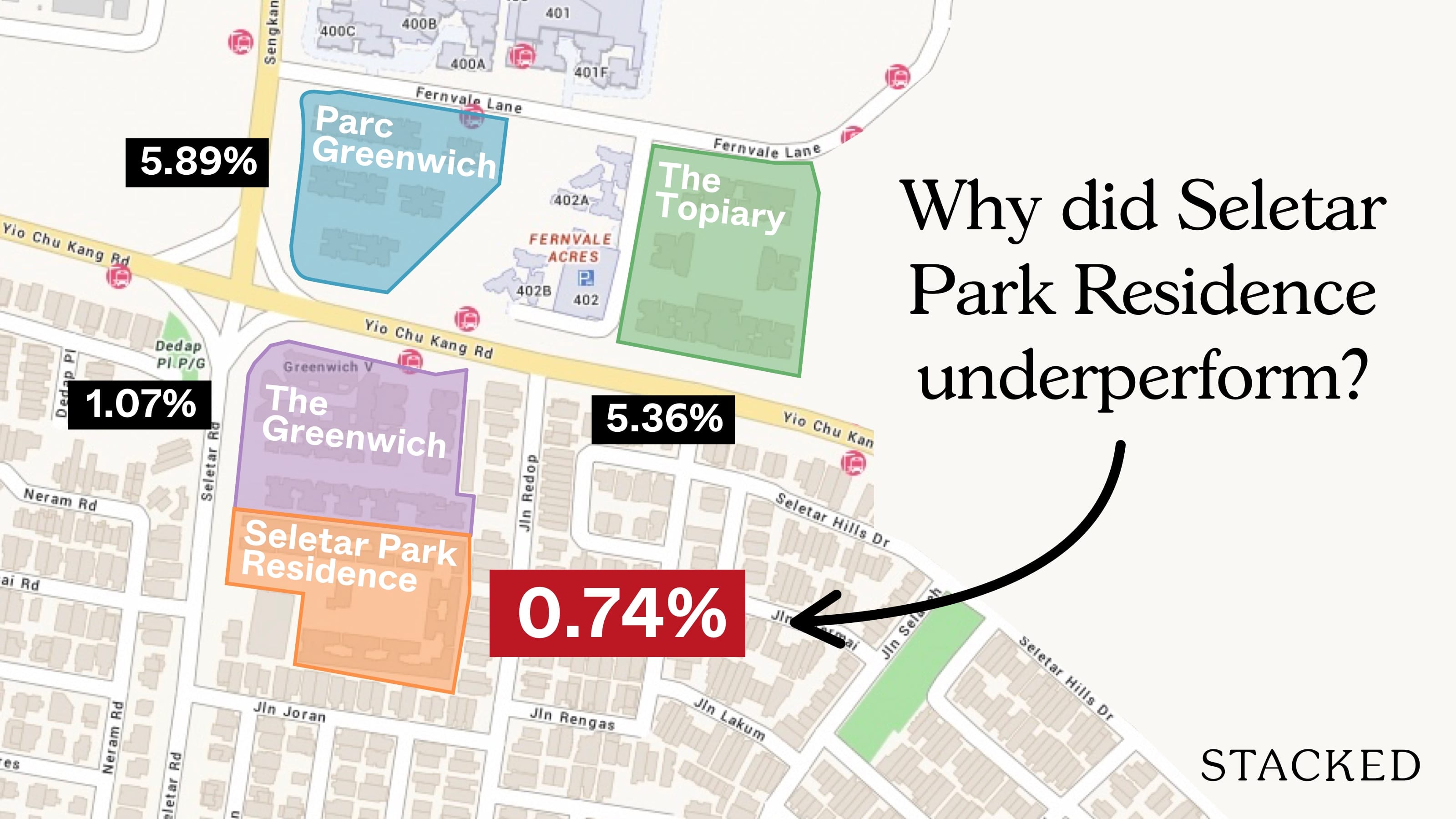

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

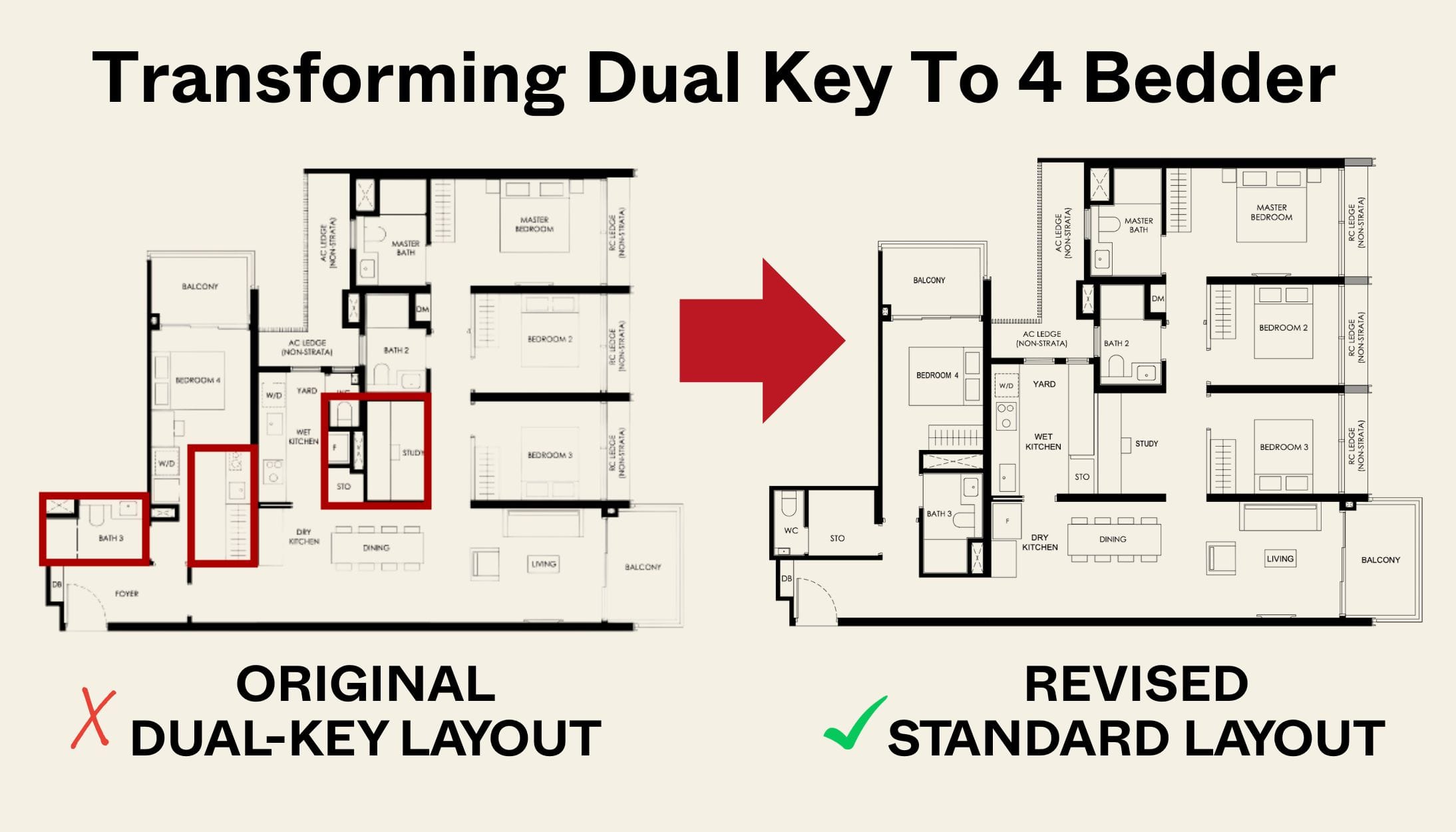

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000