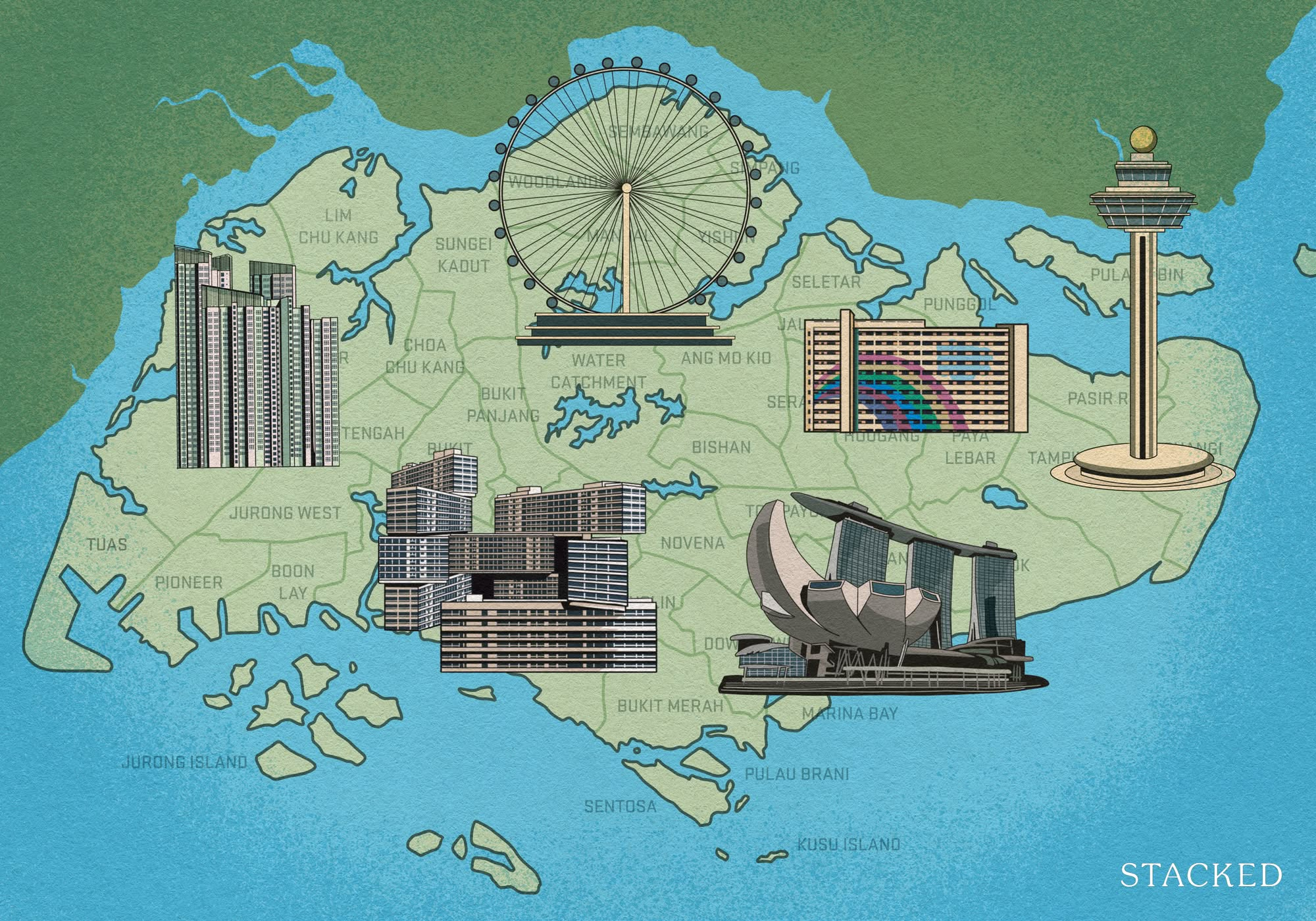

5 Biggest En Bloc deals in Singapore

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.

En bloc seems to be coming back in fashion in Singapore, with the latest news of three collective deals that were wrapped up within a week. The three sales, coupled with another earlier during the year brings the total to slight over $1.5 billion for 2017.

In the trend of talking about all things en bloc, here are the 5 biggest en bloc deals in Singapore to date.

1. Farrer Court $1,338,800,000

Back in the day the Farrer Court en bloc deal was seen as a staggering amount as it was the first development to surge past the billion-dollar mark. Ten years on and it is still unbeaten, although that remains to be seen this year. Currently D’leedon sits on the massive plot of land and with its towering façade, looks to be an iconic part of Farrer for years to come.

2. Leedon Heights $835,000,000

Just next door from Farrer Court, Leedon Heights managed to close the deal for $835 million only to be beaten by its neighbour just a couple months later. It was comfortably the largest collective sale in Singapore’s history at that point. As it is located in prime district 10 and holds the much-coveted freehold status, the tender for the estate was hotly contested. Most owners were able to walk away with profits of about $2.35 million each.

Property Market CommentaryWe analysed 87 en bloc condos. Here’s what we learnt.

by Druce Teo3. Shunfu Ville $638,000,000

Just last year, the en bloc deal came as a surprise because of the implementation of the Additional Buyer’s Stamp Duty on developers. This meant that developers were unwilling to risk larger investment deals of above $500 million. However last July, there seemed to be a major setback when some owners objected to the sale and subsequently filed an appeal to the High Court. This was ruled in favour of the sale, and results in each owner receiving an average of $1.782 million. From the 358 units, Qingjian Realty plans to create more than 1000 homes, featuring high-rise units of up to 25 storeys.

More from Stacked

We Have $1.2m In Cash/CPF And Own A Queenstown HDB: Should We Keep Our HDB Or Sell To Buy 2 Properties?

Hi Stacked homes,

4. The Grangeford $625,000,000

Despite its relatively small number of units (192), the Grangeford was sold to Overseas Union Enterprise (OUE) at an astonishing $1,810 per square foot which is by far the highest price paid for a leasehold development. This works out to over $3 million for each of its owners. Currently marketed as OUE Twin Peaks, when first launched prices were going for more than $3,000 PSF. Jackie Chan reportedly owns a couple of units here, as does local born singer JJ Lin!

5. Rio Casa $575,000,000

Rio Casa, a privatized HUDC estate is the latest entry to this list. The final price of $575 million is more than a hundred million higher than the price that the owners were reportedly asking for. It is estimated that each owner will receive around $2 million from the sale.

Property market bouncing back?

With 2 of the top 5 biggest en bloc deals coming from the past two years and a couple more being transacted in the first half of 2017, it is safe to say that developers are bullish about the next few years in the Singapore property market.

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

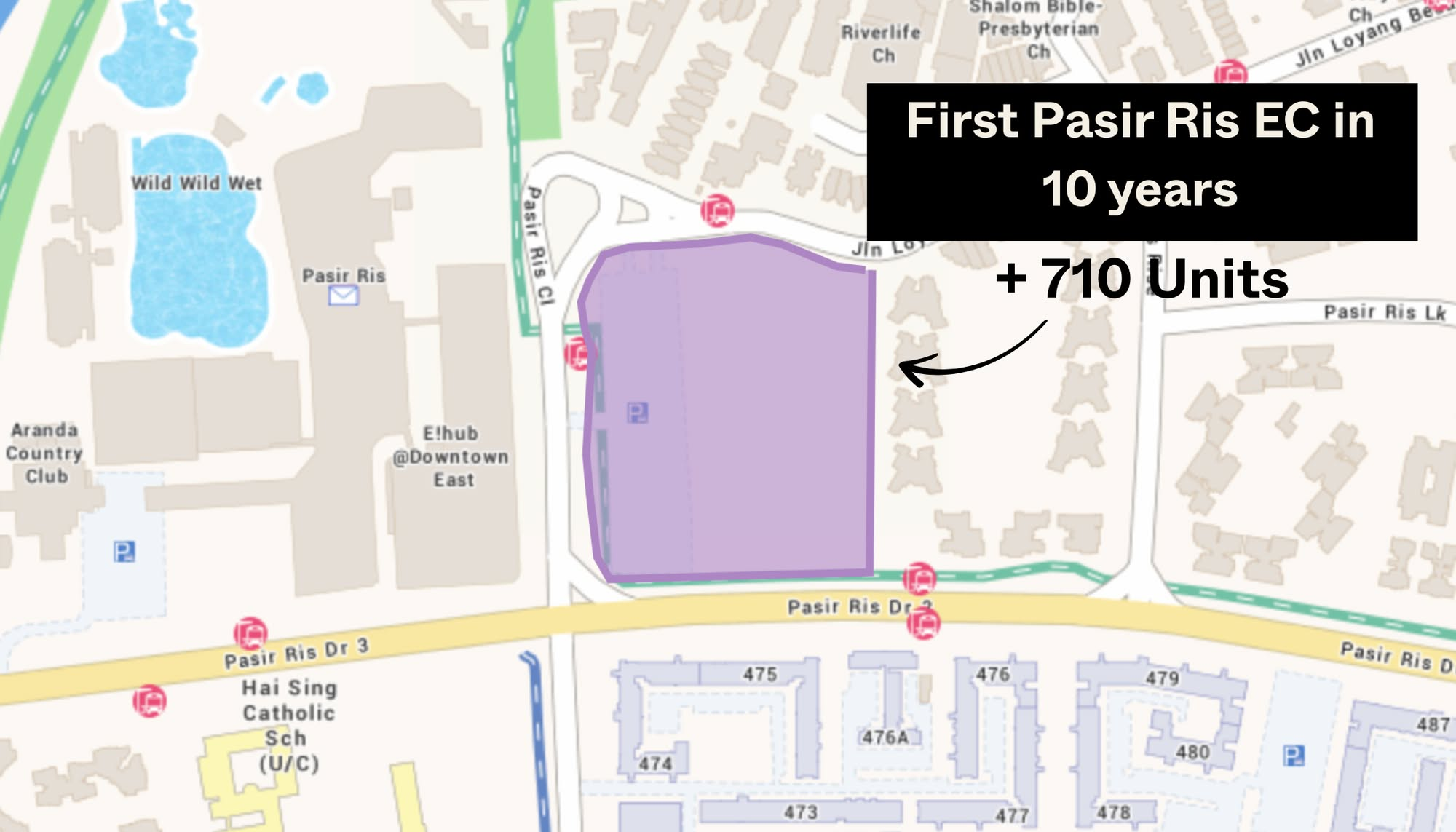

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

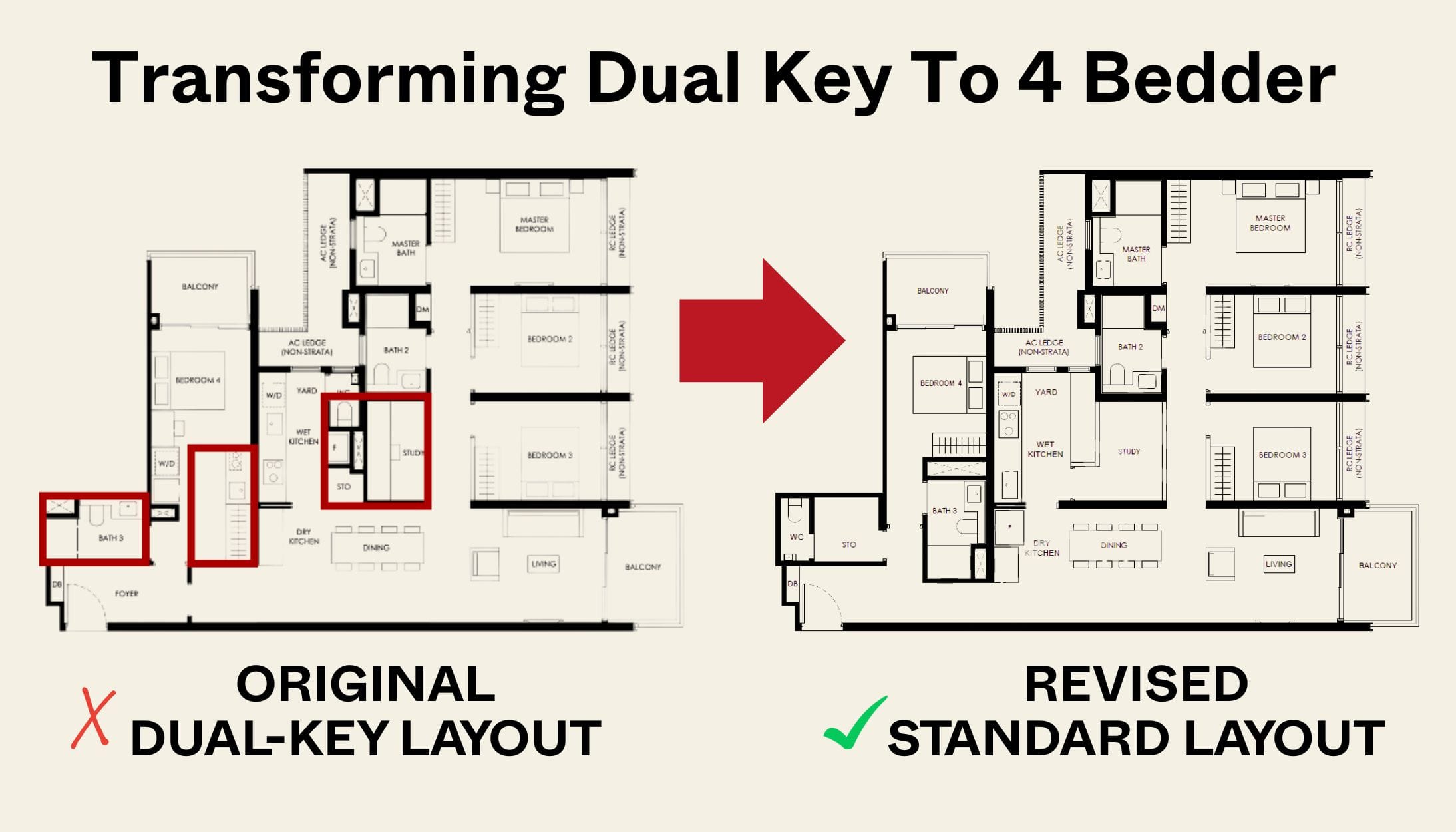

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

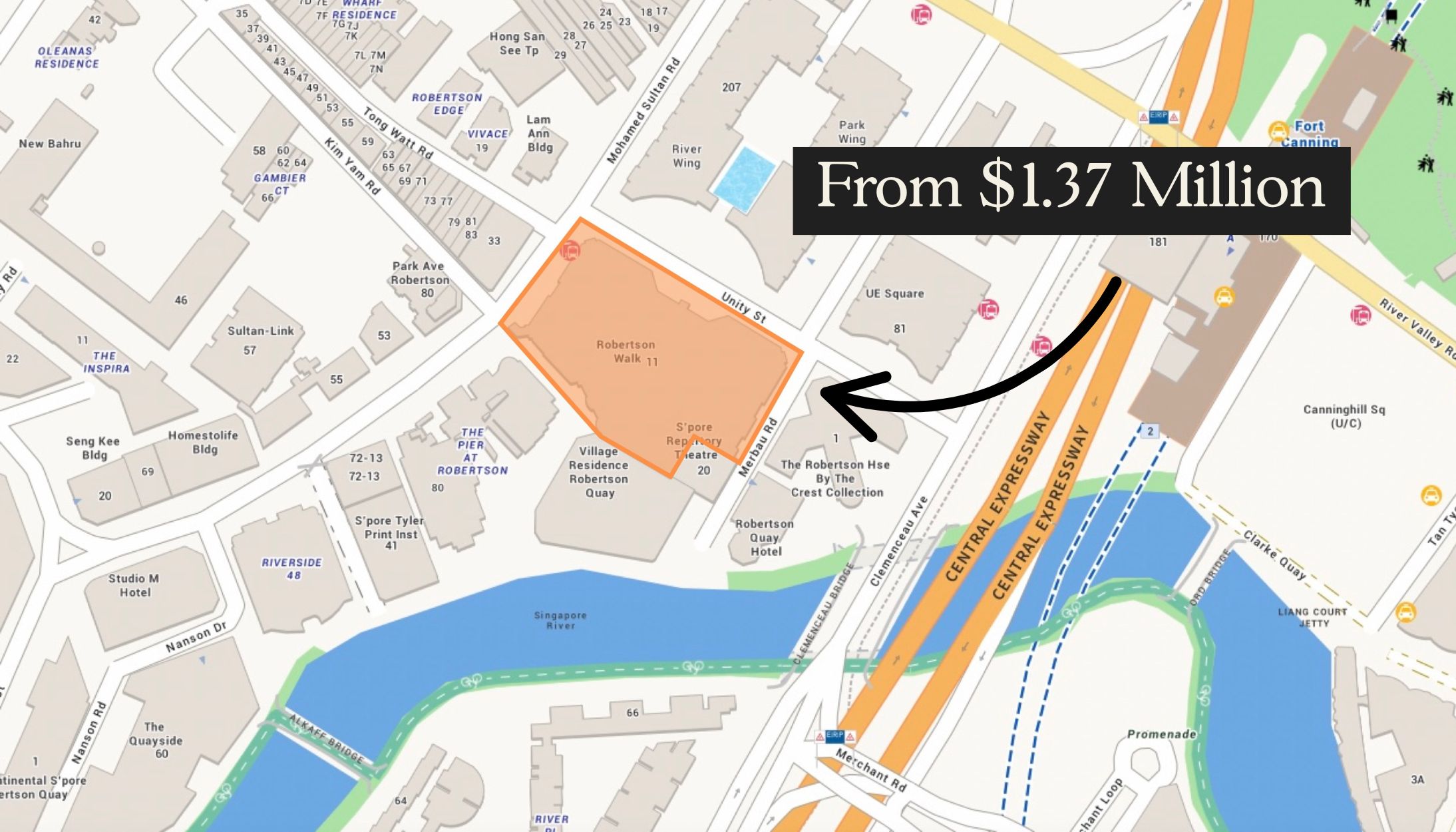

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

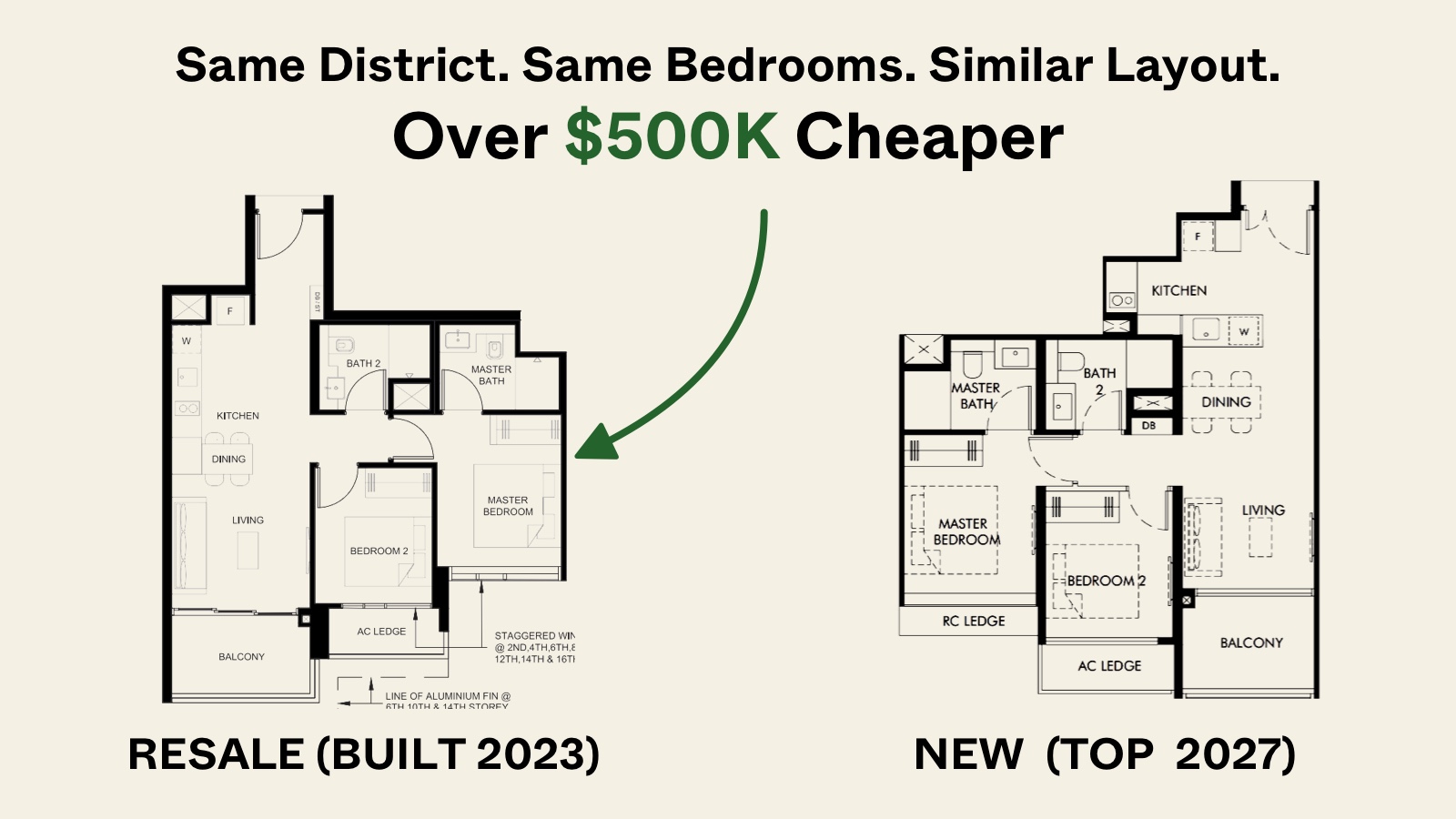

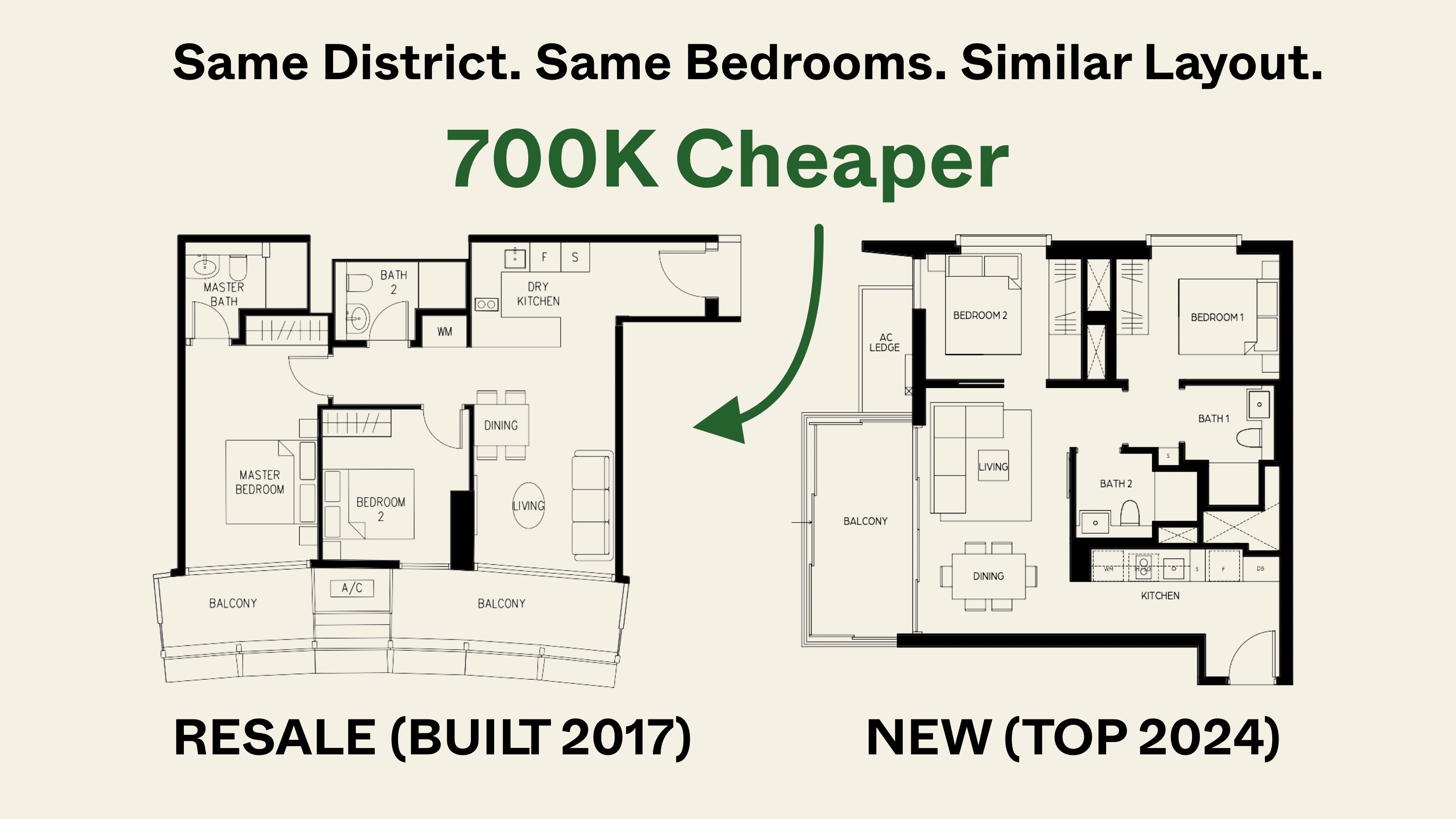

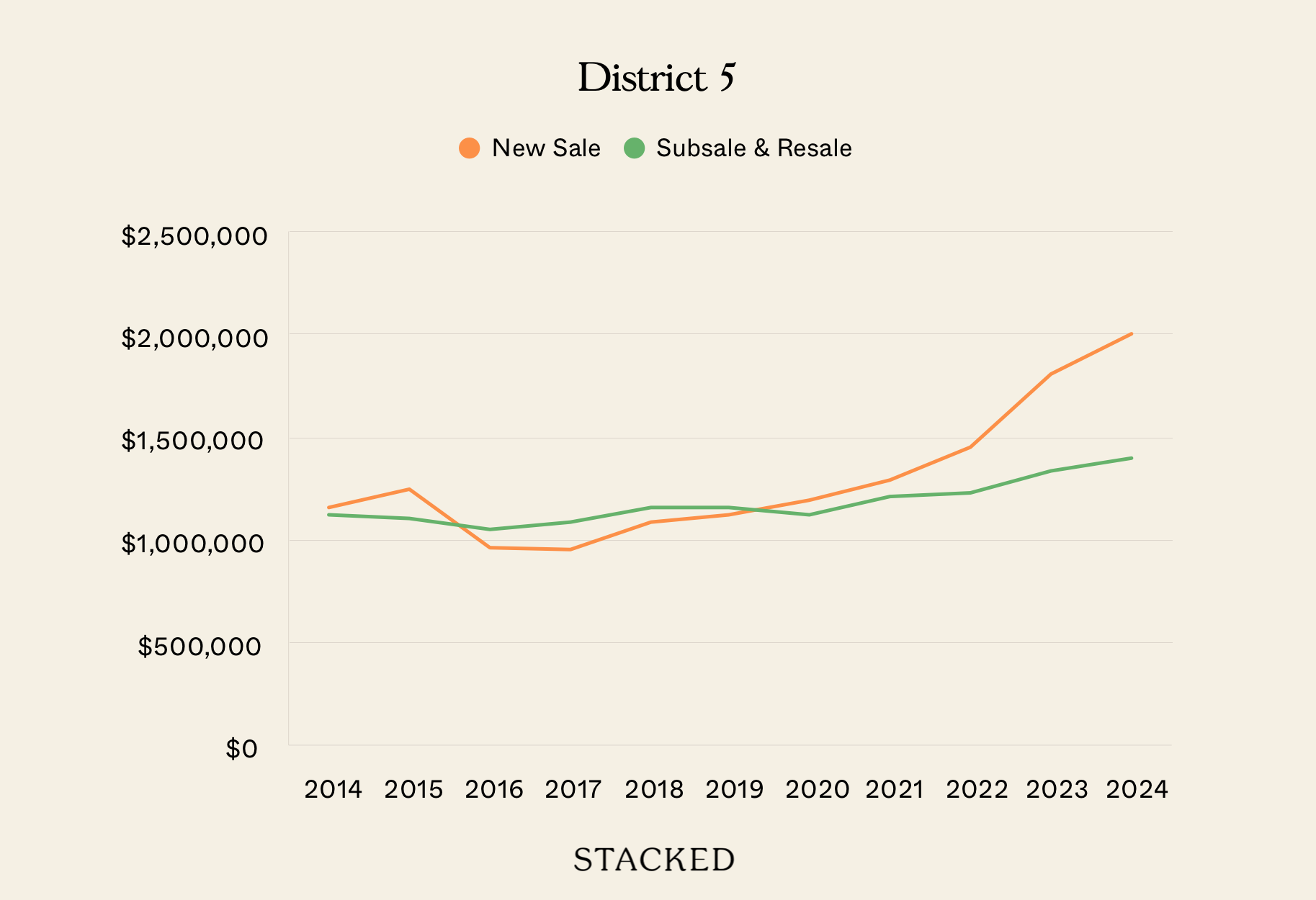

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

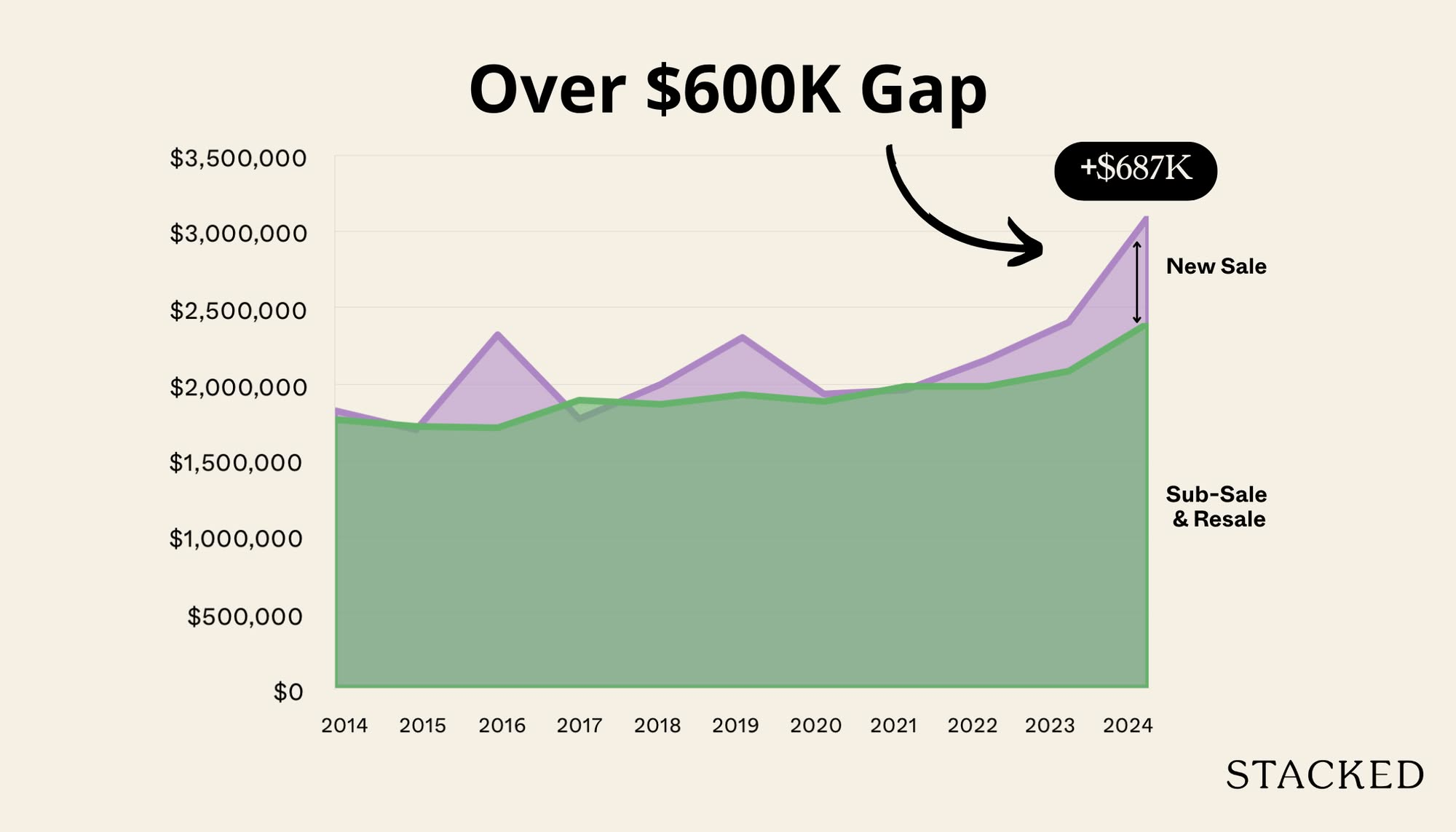

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest