Are Resale Flats “Across The Road” From Prime Location HDBs A Better Buy?

October 1, 2024

One of the effects of Plus and Prime model housing is the impact on pricing “across the road”. Because these housing models are not applied retroactively, existing resale flats may share the high value Plus or Prime locations, but lack the same restrictions: they don’t have 10-year Minimum Occupancy Periods, for example, or an income ceiling for future buyers. As such, resale flats close to Plus and Prime flats may actually see a boost in prices; and those who fail to secure a Prime flat may look to these as alternatives:

Recent Prime Location Housing (PLH) prices:

| Prime Location Public Housing Model | |||

| Kallang/Whampoa | Verandah @ Kallang | ||

| 3-room | From $368,000 | ||

| 4-room | From $535,000 | ||

| Queenstown | Tanglin Halt Cascadia | 3-room | From $364,000 |

| 4-room | From $537,000 | ||

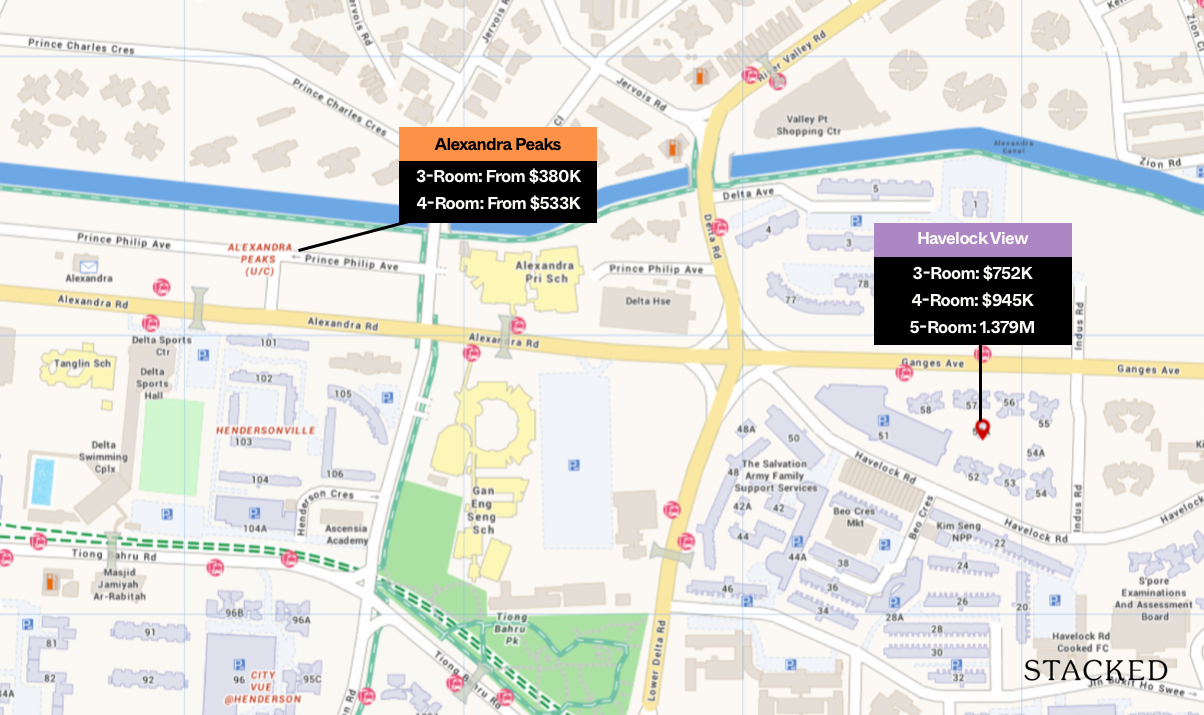

| Bukit Merah | Alexandra Peaks | 3-room | From $380,000 |

| 4-room | From $533,000 | ||

| Queenstown | Ulu Pandan Vista | 3-room | From $430,000 |

| 4-room | From $598,000 | ||

| Queenstown | Tanglin Halt Courtyard | 4-room | From $565,000 |

| Queenstown | Holland Vista | 4-room | From $582,000 |

Besides the prices shown above, please note that Subsidy Recovery (SR) isn’t reflected in the initial price. The SR is a clawback applied to the sale price, for the first batch of resellers*. This amount varies based on the project, but has been seen at six per cent for the first few batches of PLH units.

*SR is waived for 2-room flats sold on short leases. The SR will apply to the higher of the sale price or the valuation.

Here’s how they compare to prices in nearby resale developments

| Median Prices | ||||

| Development | Comparison | 3 ROOM | 4 ROOM | 5 ROOM |

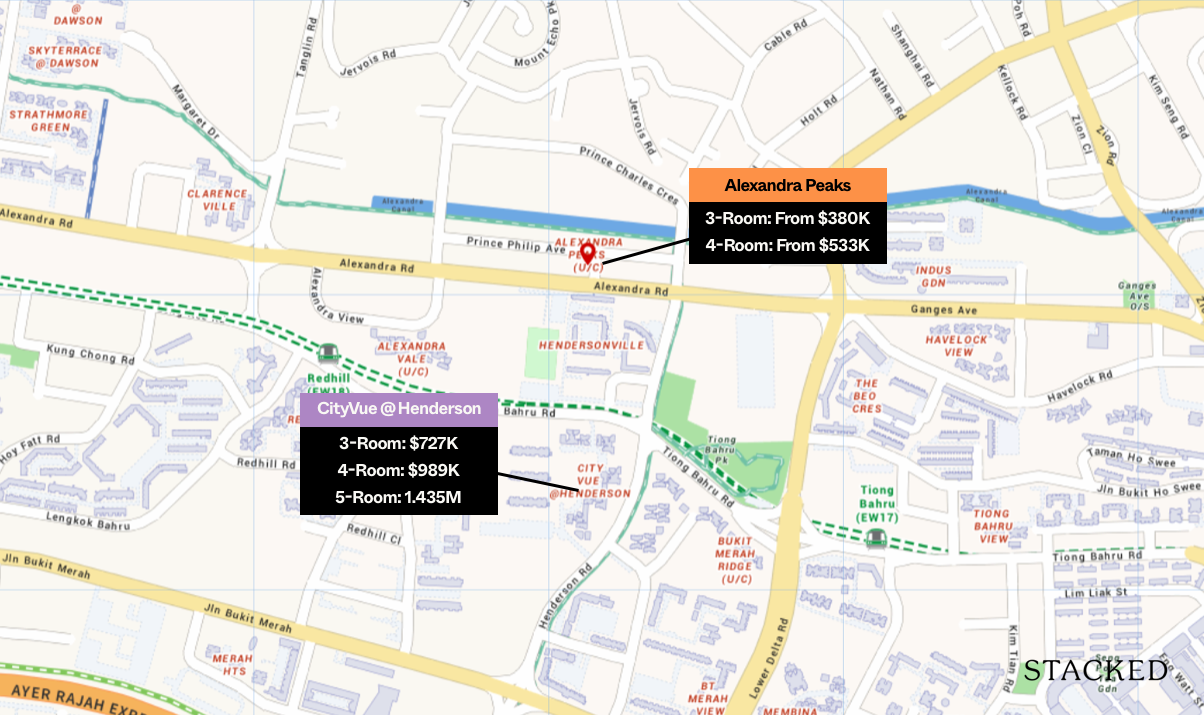

| CityVue @ Henderson | Alexandra Peaks | $726,500 | $989,000 | $1,435,000 |

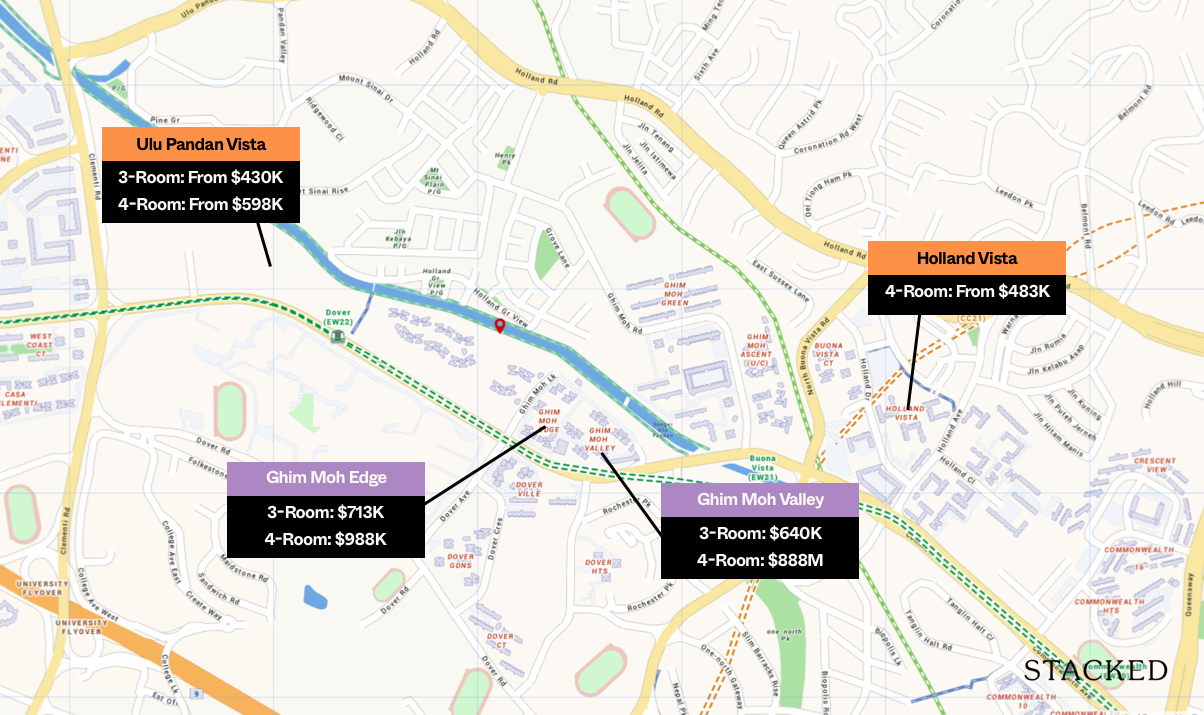

| Ghim Moh Edge | UIu Pandan Vista/Holland Vista | $712,500 | $988,000 | |

| Ghim Moh Valley | UIu Pandan Vista/Holland Vista | $640,000 | $888,000 | |

| Havelock View | Alexandra Peaks | $751,500 | $945,000 | $1,378,888 |

| Kallang Trivista | Verandah @ Kallang | $770,000 | $1,065,000 | $1,145,000 |

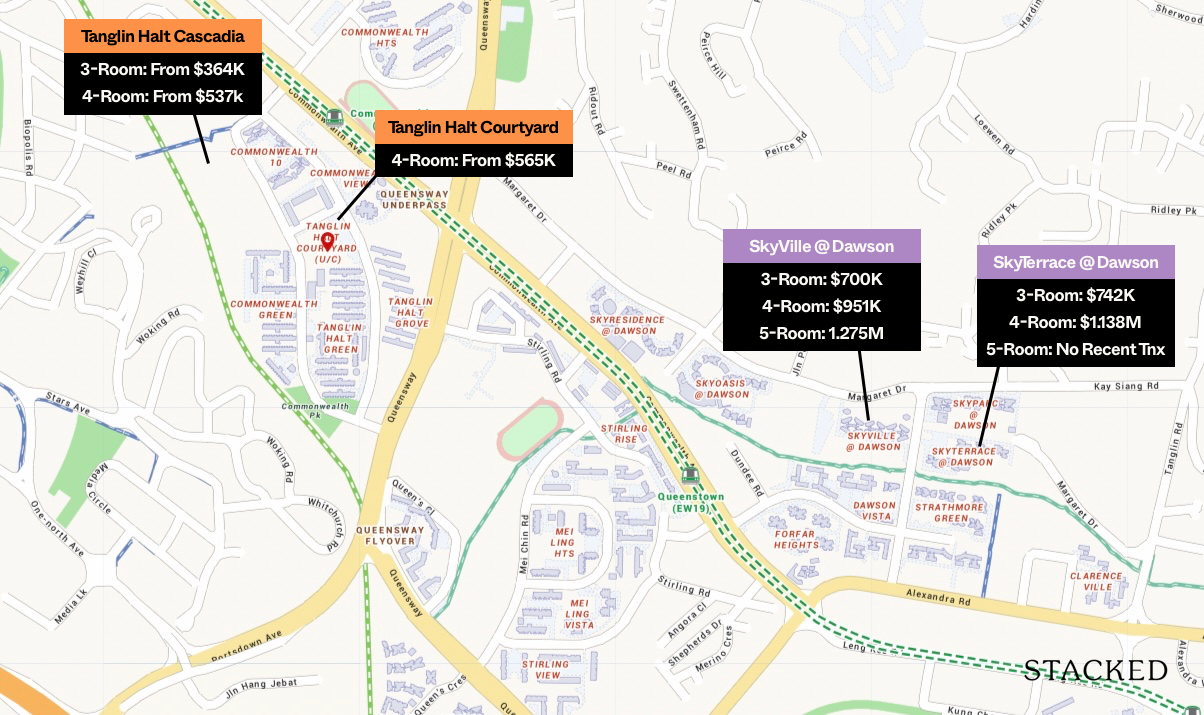

| SkyTerrace@Dawson | Tanglin Halt Courtyard/Tanglin Halt Cascadia | $742,000 | $1,138,000 | |

| SkyVille@Dawson | Tanglin Halt Courtyard/Tanglin Halt Cascadia | $700,000 | $951,944 | $1,275,000 |

CityVue @ Henderson vs Alexandra Peaks

Ghim Moh Edge/Ghim Moh Valley vs UIu Pandan Vista/Holland Vista

Havelock View vs Alexandra Peaks

Kallang Trivista vs Verandah @ Kallang

SkyTerrace@Dawson/SkyVille@Dawson vs Tanglin Halt Courtyard/Tanglin Halt Cascadia

From the above, we can see the price differences are particularly pronounced; largely due to the high prices for the centralised locations. For Verandah @ Kallang, for example, the nearby Kallang Trivista (resale) has 3-room flats that cost $402,000 more than its Prime counterpart, while the 4-room flats cost $535,000 more.

For SkyTerrace@Dawson (resale), the 3-room flats cost $378,000 more than their Prime counterparts, whilst the 4-room flats cost a massive difference of $601,000.

In light of the price gap, it seems even an SR of 6 per cent may be quite trivial, given how much more the resale flat costs. We will, however, need to wait for almost a decade to see how much prices can rise for Prime flats – at that point, we’ll have a better picture of how much the SR could really amount to.

Some other important considerations for the above:

More from Stacked

Is The Cost Of Land Too Expensive In Singapore Right Now?

We’ve entered the Government Land Sales (GLS) winter. For the third time, with the Media Circle land plot, there have…

1. No point of comparison for 5-room units

For families who need a 5-room flat, any comparison may be moot. To date, we haven’t seen a PLH flat that has a 5-room unit. This means bigger families may have no choice but to go for resale if they want a centrally located flat; regardless of their possible luck at the ballot.

The same goes for any flat larger than a 4-room, as we haven’t seen executive Prime flats either. This is likely due to the substantial quantum, which HDB may not want to put up for reasons of prudence.

2. While Prime units are much cheaper, the income ceiling significantly caps future resale value

There’s a Mortgage Servicing Ratio (MSR) that caps monthly loan repayments to 30 per cent of borrowers’ monthly income. In addition, loans are now capped at 75 per cent of the price or value (whichever is lower).

When we apply that to a SkyTerrace @ Dawson 4-room flat ($1.138 million), we have a maximum loan of $853,500. Applying a floor rate of four per cent per annum for 25 years, this comes to a monthly loan repayment of $4,505 per month.

This means the borrowers would need a rough income of about $15,000 or higher. That’s possible for SkyTerrace, a regular resale flat because there’s no income ceiling. However, a Prime project like Tanglin Halt Cascadia maintains an income ceiling of $14,000 for 4-room flats, even at the time of resale.

While only time will tell, it’s possible that – even over the next 10 years when Prime units join the resale market – their prices will still be significantly lower than regular resale counterparts.

(Barring a situation where the surrounding resale flats are so old, lease decay kicks in to even things a bit)

3. The 10-year MOP disincentives the upgrader demographic

This also helps to keep Prime prices lower than regular resale flats, all things being even. Upgraders tend to want to make the move as soon as possible, as every year increases the potential price gap between their flat and a condo. As such, doubling the MOP duration causes a self-selection process, where aspiring upgraders don’t challenge genuine home buyers for prime locations. However, this also means a smaller pool of buyers for future sellers of Prime flats.

Based on the current price gap, it may not be an easy solution to just find a resale alternative, if the ballot fails

Barring huge savings or other forms of help (e.g., assistance of parents), the Prime projects remain the most probable way for low to mid-income Singaporeans to live in the most desirable HDB areas; and we can see things are set up to keep it that way as long as possible.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are resale flats near Prime Location Housing more expensive than other resale flats?

What are the differences between Prime Location Housing and resale flats in terms of restrictions?

Can resale flats in prime areas be a cheaper alternative to new Prime Location Housing?

Are there any types of flats not available in Prime Location Housing projects?

How does the income ceiling affect the resale value of Prime Location Housing flats?

What impact does the 10-year Minimum Occupancy Period have on Prime flats?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

0 Comments