6 Tips To Maximise Your Profits When Selling Your HDB Flat

February 20, 2021

Despite a few hundred agents and websites explaining how your HDB flat is a great “stepping stone”, upgrading is never as easy as it sounds. You need to make enough from selling your flat that you can cover the CPF refund, as well as the 25 per cent down payment on your condo.

And let’s be honest: like most sellers, you’re hoping to cover part of the renovations on your new home with the sale proceeds, right?

All that means aiming high, and trying to get the most out of your flat. You may as well, since you’ve spent at least five years – probably more – on paying for it. While there are no guarantees, here are some ways to improve the odds:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Let’s start by understanding the unique situation in 2021

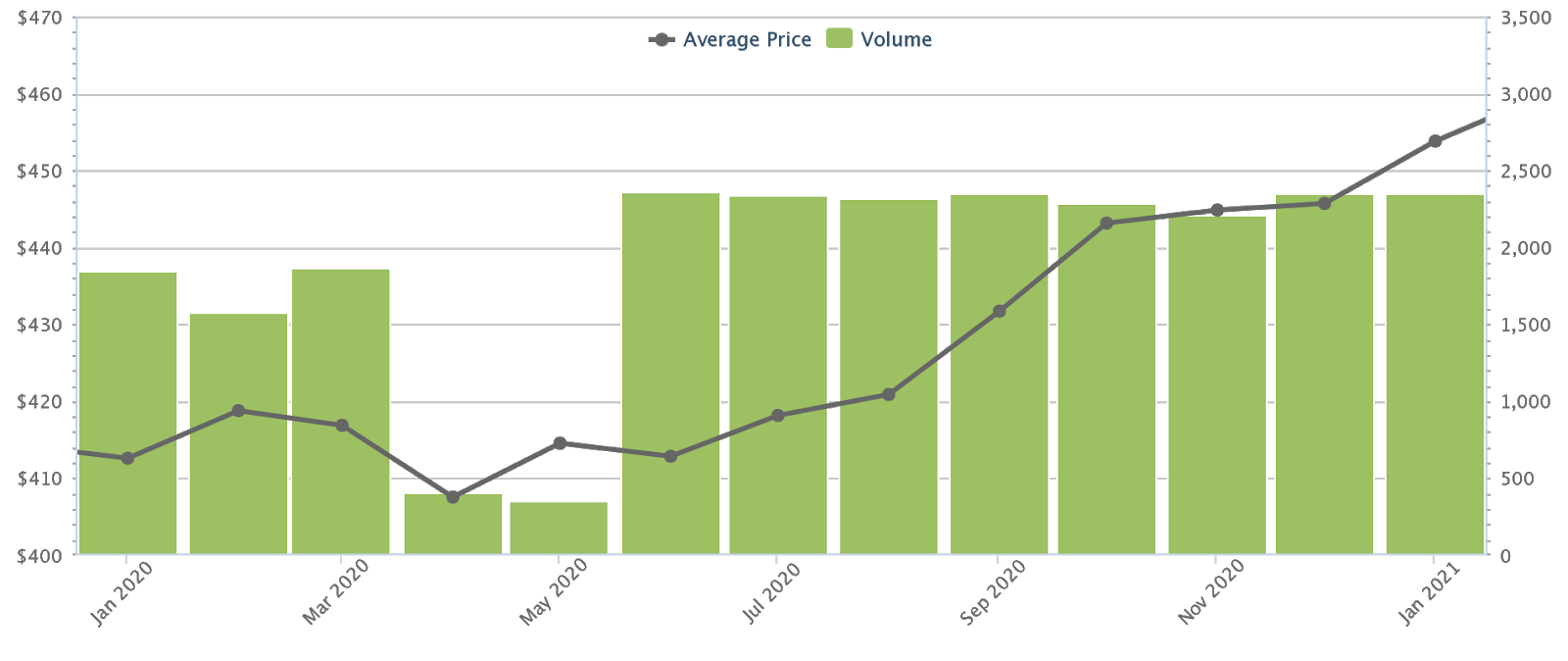

Sometime in the year 2020, HDB resale flat prices did this:

After roughly seven years of consecutive decline, resale flat prices hit a sudden inflection point. In January 2020, the average resale flat cost about $413 psf. By January 2021, it was up to $454 psf. In addition, transaction volumes have consistently surpassed 2,000 for most of the second half of 2020, which suggests demand is stronger than expected.

At the same time, there’s a record number of resale flats entering the market. This is a bit of an odd situation, as usually an increased supply should bring prices down. So 2021 is an unusual time in which to be selling a flat: on the one hand, you’re almost certain to see better gains than at any point in the past seven years.

On the other hand, there’s more potential competition as well. HDB upgraders like yourself are now a leading buyer demographic, so there’s a veritable horde of people also trying to sell their flat at the same time as you.

So while it’s not hard to find a buyer, it can be hard to get a better price, when several other flats within spitting distance are also up for sale. Here are some general methods you can use to improve the odds:

- Check the median price for your flat type and location

- Look up asking prices and competitors on portals

- Determine if you need to extend the time frame

- Weigh the pros and cons of DIY selling

- Alternatively, negotiate with an agent

- Be selective with maintenance

1. Check the median price for your flat type and location

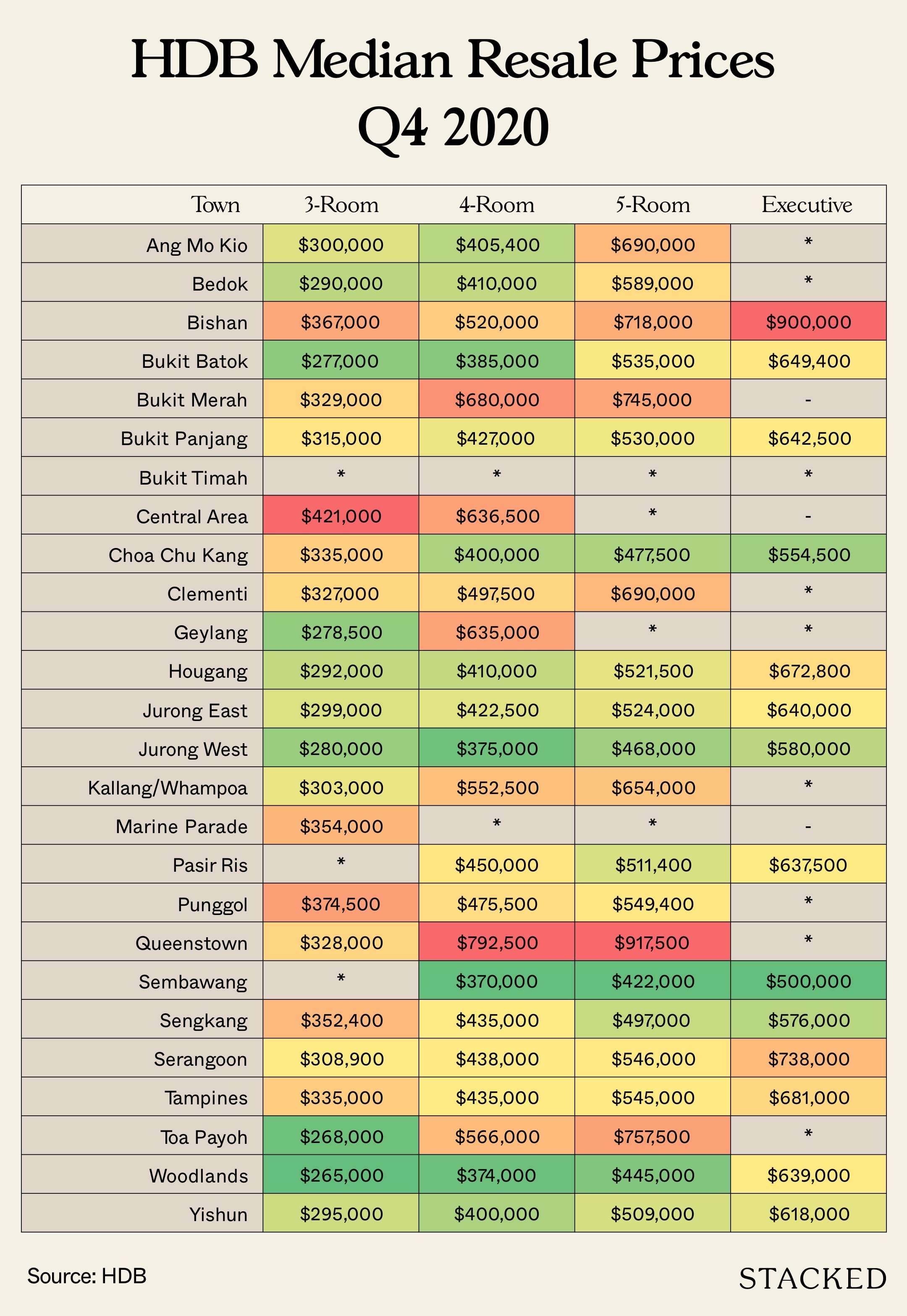

You need to know the median price of your flat, before you can set your asking price. This is quite easy to check, as HDB will post the previous quarter’s prices as soon as they’re available.

For your convenience, the median resale flat prices for Q4 2020 are as follows:

For those of you who last bought or sold a resale flat before 2014, note that Cash Over Valuation (COV) is no longer published by HDB. This doesn’t mean that COV no longer exists; it still happens, it’s just not transparent anymore.

Those of you who own rare resale flats – such as Maisonettes or jumbo flats – may not see a median price reflected. This is because, if the volume of transactions for the flat type is too low, it won’t appear in the data. For these instances, drop us a note about your specific address, and we can provide more details.

2. Look up asking prices and competition on portals

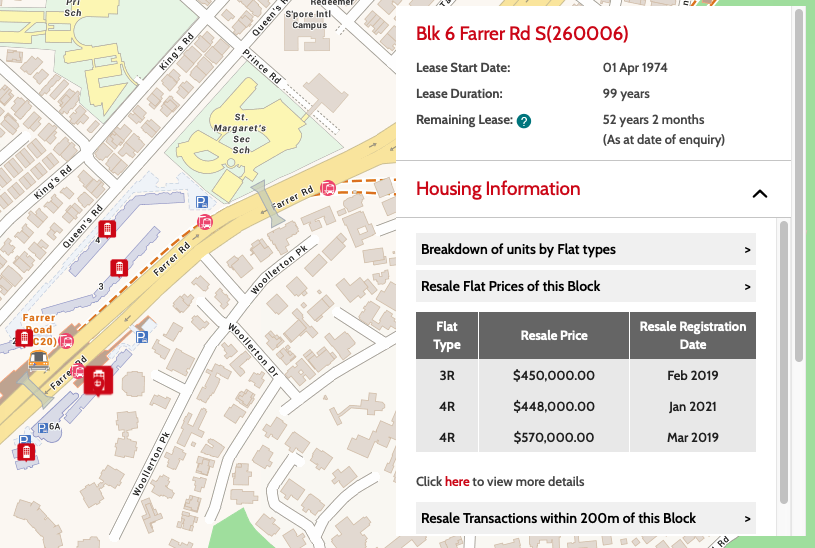

The next step is to find out what your immediate neighbours are asking for. The simplest way to get a sense of this is to visit property portals, or to check listings in your area. Do note that what you see on property portals aren’t always indicative of the current prices – they are often higher than what is being transacted. You’ll want to look up asking prices within a radius of one-kilometre.

As the location gets more specific, deviation from the median price gets higher. For example, the median price given for a 4-room flat in Bedok is $410,000; however, consultation with agents reveals a more typical price of $516,000 for 4-room flats, if they’re within one-kilometre of the MRT station.

This is why you need to know more than just the median price for your town. If you’re close to a major mall, MRT station, or lifestyle zone, you may be able to push the asking price. Even having a less obstructed view could net you some COV.

You’ll also want to take a look at how many people are listing their flats. If you see multiple listings within your same block (e.g., you find out there’s a dozen other people listing in the same block, on floors close to you), you may want to consider waiting a bit. Sometimes, it’s better to wait for the current sellers to fight it out, and then step in later when buyers have fewer similar options.

3. Determine if you need to extend the time frame

There are certain times when it’s just tougher to maximise gains. One example, as mentioned above, is when everyone around you is selling.

Another common example is when the ethnic quota for your block has been reached. You can be rest assured that most buyers will find out; and since they know your prospective pool of buyers is diminished, they’ll often attempt to lowball you.

Certain times of the year also make it harder to maximise gains. These can be cyclical, like the Hungry Ghost festival, and Chinese New Year, or one-off events like the Circuit Breaker in 2020.

Finally, you might just want to wait longer to receive more offers. In general, the longer you can afford to wait, the better your odds of maximising your gains.

4. Weigh the pros and cons of DIY selling

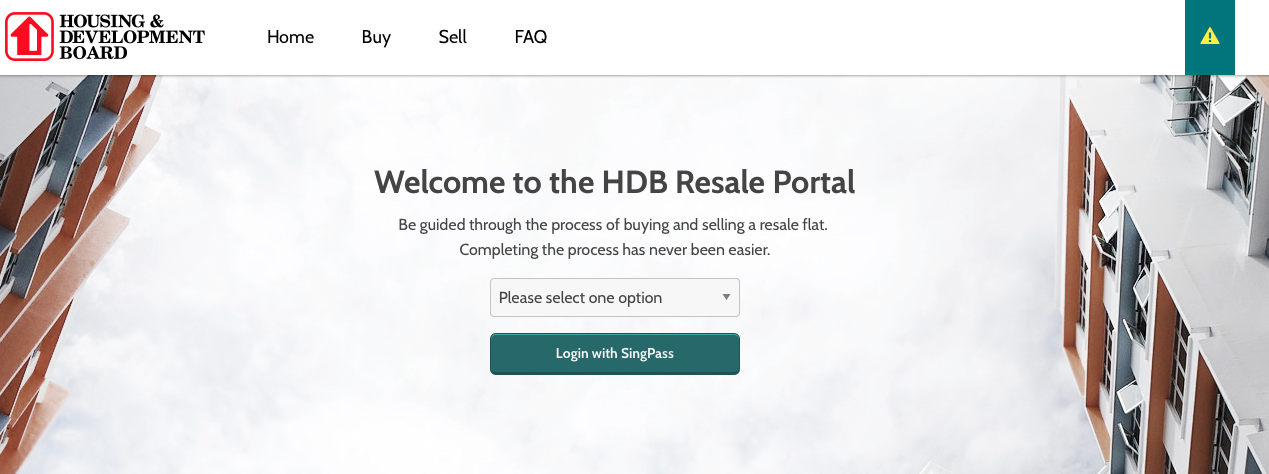

You can sell your own HDB flat without going through an agent, via the HDB resale portal.

This will allow you to skip paying service fees / commissions, which typically – but not always – amount to two per cent of your property price. So you would save about $9,000 on the sale of a typical $450,000 flat. The downside, of course, is that you may not get as good a price as a property agent might.

Some might point out that this is a biased viewpoint, but remember, our origins were from a buy-sell direct portal that had ambitions to cut out the property agent. If you’ve never been in that situation it might be hard to grasp, but the truth is most people find it hard to leave their emotions out of a negotiation when it comes to their own home.

That said, in practice, sellers who have a typical flat might do better to sell it themselves. Assuming there’s nothing exceptional about the flat, an agent may not have much leverage to get a better price anyway (mind you, this analysis requires you to be an unsentimental sort, who can see your old home as “typical”).

Property AdviceFirst-time home seller: Don’t sell your home without reading these 5 pricing strategies

by Druce TeoYou could say the same for those with a flat in a desirable location and is well renovated. Using a mixture of the Facebook Marketplace, Carousell, and even YouTube videos – as the saying goes “the place practically sells itself”.

For flats that are outside the norm – such as maisonettes, jumbo flats, DBSS flats, or anything at Pinnacle @ Duxton – it’s a good idea to at least consult an agent. The same goes for flats that are in unusually strong locations, such as Central Area flats in Tanjong Pagar or Chinatown; there could be much more value to be wrested out of these units.

5. Alternatively, negotiate with an agent

While commissions are not fixed, it’s highly improbable that an agent will settle for less than two per cent. What you can negotiate, however, is a higher commission rate if the agent fetches a higher price. For example, a commission of three per cent if you can sell the flat for $450,000 instead of $420,000.

(This is a difference of $5,100 that you pay the agent, but you’re making $24,900 more so you still come out way ahead).

Assuming you’re in no immediate rush to sell, you might consider this as a way to stretch your sale proceeds.

A quick note on super-special marketing deals

Some agents today offer full-blown marketing packages, at much higher commissions such as five per cent. This may include extras like making videos of your home for YouTube, ongoing social media posts, etc.

These are more commonly done for private homes, but they may be offered for flats as well. Before you agree to these deals, ask about the full extent of the costs, and about what happens if you want to change your property agent later.

I would say this: if done well, there is definitely an advantage to doing so (clearing out the gunk and doing proper staging) – especially if your flat has good competition and yours is in a less than desirable condition.

But, like point 4 above – if you flat is in a good location and is well furnished, I am still quite skeptical about how much more value a video would bring for you. Frankly, if priced well, good exposure on PropertyGuru would probably do the job.

6. Be selective with maintenance

Don’t renovate your flat to get a better price; it rarely if ever pays for itself. Most buyers of resale flats will simply rip up the renovations as soon as they move in anyway; we’ve seen this done even to kitchens and toilets that were renovated in the same year. Most families will want to customise their own homes.

Stick to selective maintenance. In most cases, this means you should restrict the works to:

- Repainting (this is almost a given when attempting to sell)

- Replacement of sagging or damaged doors

- Visible issues like leaks and cracks

- Electrical and plumbing fixes

- Air-conditioner maintenance or replacement

If you have old and damaged shelving or cabinetry, you might consider hacking it away without replacing it (this depends on how it makes the property look of course, but do consider it for the savings).

The less you spend on maintenance, the better your gains. However, don’t be stingy and do no maintenance either. A $500 paint job could potentially net you twice or three times as much in gains, if you make a good emotional impact on the buyer. That is, a flat that’s not dark or visibly old.

For more direct help with your flat, contact us for a detailed consultation. In the meantime, you can follow Stacked to keep up to date on trends and strategies in Singapore real estate.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments