5 Less-Known Issues To Consider Before Buying A Mega-Development Condo In Singapore

October 23, 2024

Love or hate them, mega-developments are an undeniable part of Singapore’s property market landscape. With population growth and the redevelopment of large, older plots, these expansive projects will only become more common. On paper, they offer plenty of benefits – ranging from lower costs and maintenance fees to an abundance of facilities.

However, beneath the shiny exterior, small but significant issues can quickly pile up and become a major headache. From crowd management to access to amenities, there are hidden complexities you’ll want to keep in mind. So, what are some of the less-known issues to look out for when buying into a mega-development? Here’s a rundown of the key considerations.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The general advantages to expect from a mega-development

Mega-developments are generally defined as projects with 1,000+ units, although the term is loosely applied (e.g., some people consider 900+ units to be a mega-development). These developments tend to come with large land parcels, the best known being the ones redeveloped from former HUDC estates, like Normanton Park.

Due to the large land parcels and high unit counts, the advantages common to many mega-developments are:

- An expectation of more facilities – More pools, more tennis courts, bigger or multiple gyms, etc. (this is also a necessity, as more residents could mean more overcrowding)

- Lower maintenance fees than smaller projects – With more units to share the maintenance costs, the monthly maintenance fees are often lower. The exact amounts, however, still vary based on the nature of the facilities; sometimes the sheer extent of the facilities will compensate for the unit count, making it almost as expensive as a smaller condo.

- More affordable units compared to more exclusive projects – Treasure at Tampines is the best example of this to date. Due to the massive 2,200+ unit count, this condo was one of the most competitively priced condos during its launch.

- Price stability through higher transaction volumes – As the number of units bought and sold tends to be much higher, prices in mega-developments are less volatile compared to small condos, which may only see one or two transactions a year. This can be a bit of a double-edged sword though, as during a slower property market you will have increased competition.

With that in mind, what should you look for when considering a mega-development?

Some of the main factors to look at are:

1. Foot traffic around your block

Mega-developments generally have more dispersed facilities, due to the chaos and noise that would emerge from centralising them. But there’s no avoiding the fact that some areas – coincidentally units with the best pool views – are prone to attracting most of the condo’s crowd.

In a smaller project, you might be able to overlook this, or even find it advantageous to be near the facilities. In a mega-development with thousands of residents though, this can generate a combination of noise and jams (including queues to use the lift, see below). If you have pets, like a dog that likes to bark at the door when people walk past, this could end up being quite hectic.

So unless you’re happy to bear with it, it might be better to look for the more secluded blocks, which are further away from the cluster of facilities (but are ideally near a side gate as well). It might be more of a walk, but at least you won’t have to hear everyone and their relatives come to the pool on weekends.

2. Lift and car park issues

While these are common worries in most projects, they can get worse in mega-developments. For lift access, you’ll want to pay attention to how many units are in each block, and whether there are sufficient elevators: if it’s 30 storeys with 120 units, for example, then just having three lifts is going to be an issue.

Bear in mind that at any point in the year, some people will be moving, renovating, etc. which can cause them to monopolise the use of the lift for quite a while. There’s also the inevitable breakdown from time-to-time, and the morning and evening rush to get to the car park or get home.

Also, be wary of living near above-ground facilities. If your floor is the same one the sky garden or above-ground pool is on (or you live on a floor near it), be prepared for the lift to almost always be occupied.

For the car parks, do check how convenient it is to get to your unit from your car. Because of the large land plots, it can end up being quite a walk; and older mega-developments may not have fully sheltered walks to your vehicle (conversely, newer projects are more likely to only have one reserved lot per unit, or limited visitor parking for your friends).

3. Any overbooking of facilities

While regular condos can have overbooking issues as well, it can be much worse for mega-developments. Competition for facilities isn’t just inconvenient, it tends to encourage bad behaviour – like certain groups of residents who band together to continually book a facility.

For resale mega-developments, we’d ask around and see what the queue is like for BBQ pits, tennis courts, etc. Sometimes though, there are a few obvious warning signs – Stirling Residences has 1,259 units and just one tennis court, for example.

You generally want to see multiple function rooms, at least two tennis courts, different workout areas besides a single gym, etc. This may depend on each individual development, as they may have their own rules to follow for the booking of facilities. But for the newer projects that rely on an app to book the facilities, there are typically several measures to prevent residents from hogging the facilities. This may range from only being able to book one month in advance, or the ability to book a peak hour slot only once a week.

4. Side gates and different ingress/egress points

Mega-developments with only one main entry/exit tend to have congestion issues. This is especially true during the morning and evening school rush, when school buses, shuttle services, etc. crowd the roundabout or entry point.

In a regular-sized condo, this is just annoying. In a mega-development with thousands of residents, this can mean getting to school or work late. As with the lifts, remember there are many more households moving, renovating, getting deliveries, etc. So the vans and trucks of movers, contractors, couriers and food-delivery people will all be choking up the main entryway as well. For this reason, it’s ideal if there’s at least a side exit that is operational.

Likewise, the large land plots will impact walking. We’d try to pick a block where the side gate isn’t too far away; and for older resale projects, do check that the gates are actually in use. We’ve seen older projects where the side gate’s keycard readers or security devices are broken, so they just keep the gate locked all the time.

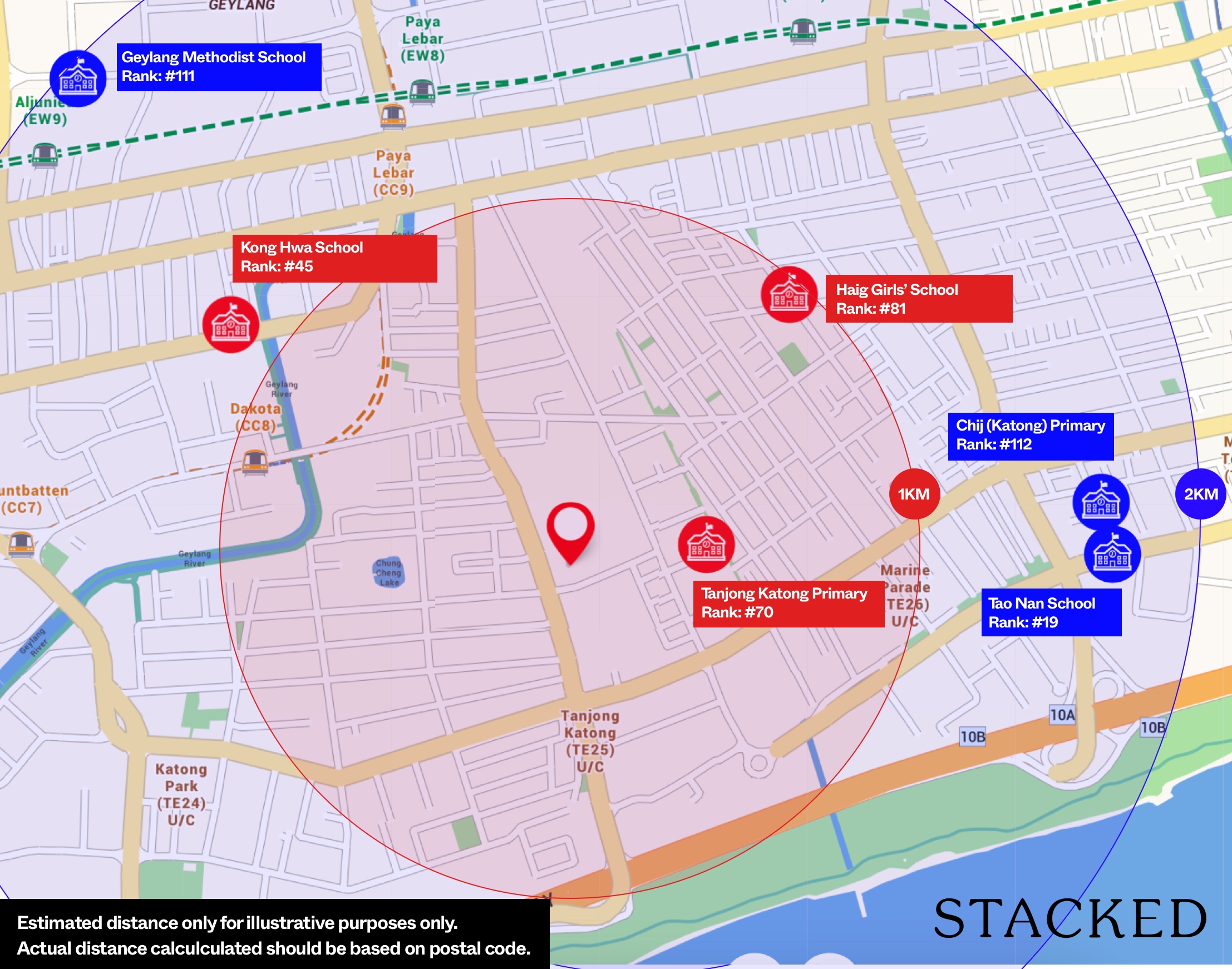

5. Exact postal codes for Home School Distance, for large plots

This is also related to the large land sizes of mega-developments. The One Map system, which is used to determine Home School Distance, uses ranges based on postal codes. This means one part of the condo can be within a kilometre of a given school, whereas another part of it is not.

So when you’re told the condo is within one kilometre, do check: it may be a general statement about the project, rather than your specific block.

More residents can mean tougher collective action

With annual meetings, for example, dissenting voices and conflicts can be worse, due to the sheer number of people involved. This is likely to be the case with big decisions like en-bloc sales, so it’s something you must be prepared for (it’s much tougher to reach a collective sale agreement with so many people). This is the price of being part of a bigger collective; so if you feel this might aggravate you, it may be better to opt for a mid-sized project.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments