5 Key Future HDB Plans You Need To Know From NDR 2024: BTO Priority For Singles And 120km Coastline

August 19, 2024

The first National Day Rally by Prime Minister Lawrence Wong covered some upcoming changes to the HDB market. While they are significant, we feel most of the changes (barring a parental proximity change for singles) are going to take a while more to sink in. It’s high time we heard about these though, giving the rising discomfort over million-dollar flats, and the fear of some Singaporeans being priced out of the HDB resale market:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What to expect in the HDB market:

1. Bigger housing grants for first-timers and lower-income Singaporeans

While we don’t have the exact numbers yet (MND will cover this later in the year), the Enhanced Housing Grant (EHG) will be raised for first-time buyers and lower-income Singaporeans. At present, the EHG is up to $80,000 for families and up to $40,000 for singles.

This does seem appropriate given the higher inflation we’ve seen, post-Covid. However, we don’t think it’s an episodic thing (i.e., it’s not just about recent prices, even if it was mentioned in relation to the high resale flat prices). The effort to absorb the impact of HDB prices appears continual: it was only in 2019, for instance, when housing grants were last raised and merged into the EHG.

We’ll have more to say on it once the actual numbers are out.

2. Priority access for singles from mid-2025

30 per cent of flats in any BTO launch is reserved for first-timers families, under the Married Child Priority Scheme. This grants priority to these families if they’re living within four kilometres of their parents.

Starting from the middle of next year, singles will have the same level of priority if they pick a flat within four kilometres of their parent’s home.

This will have quite an immediate impact, as the number of singles hunting for a flat has been high since the end of COVID-19. There’s also a big long-term impact from this: by living closer, children are within easier distance to help their ageing parents. This is perhaps beyond just a housing policy, as it will go some way to ease the issue of an ageing population in Singapore. And in the event they get married and start a family later, it’s easier for grandparents to help with the children.

In any case, this is a slight concession in the right direction for singles, as they’ve had nothing to cheer about each time housing policies have been tweaked.

3. Waiting times for BTO flats will decrease

During the speech, it was pointed out that 100,000 new flats would be completed by 2025, and that the projects delayed by Covid have since been completed. But it was also said that the waiting times for BTO flats can decrease by about a year.

Whilst there won’t be an immediate impact from this, the long term implications of shaving off a year can be significant. At present, for example, those intent on upgrading to the private market tend to prefer resale: this is because they can reliably sell and move within five years (note that the Minimum Occupancy Period counts down from the time of key collection, not successful application).

With a four to five year wait, there’s a risk that a BTO buyer won’t be able to sell and move until a decade is up (i.e. four to five years construction, and then a five-year wait for the MOP). Getting the time down to three years makes it more viable to pick a BTO flat, even if your intent is to upgrade later.

Also, the quicker BTO flats are built, the less incentive there is to tolerate the price premium for a resale flat. Reducing the wait time to three years may be sufficient for some homebuyers to decide they’re okay to rent and wait for a BTO, rather than pay high Cash Over Valuation (COV) rates right now.

More from Stacked

4 Common But Surprisingly Complicated Seller Situations: How Would You Deal With It?

Most people think selling a home is an easy task.

As a long-term issue, it does raise the question as to whether we’ll see oversupply, as the next generation passes on

Singaporeans are getting older, and no one can own two HDB properties. When the previous generations move on, we’ll have quite a number of older vacant flats, which many can’t inherit and hold (i.e., they’ll go on the resale market). Coupled with the hectic pace of building over the past few years, we might see the supply crunch turn into an oversupply many more years down the road.

It’s not necessarily a bad thing though: having a lot of cheaper resale flats will be a boon to our children/grandchildren. But it does mean some of us may need to start rethinking the role of our flats, in our overall retirement fund. The pace of HDB appreciation we’ve seen – both recently and in the earlier decades – may come to an end by the time we’re older.

4. More community care apartments

The first community care apartments (flats that come with additional care services, like a 24-hour emergency response) will be completed later this year. The government intends to have more of these over time, which is essential for our ageing society.

This is another move with long-term implications for the market. It’s plausible that more Singaporeans, upon reaching an advanced age, may want to surrender their existing flats and move into something with a community care option (or think about the lease buy back scheme). This could free up some of the older, larger resale flats; and the added supply will help moderate prices.

This could, however, again compound the issue that – at some point when the next generation passes on – we could be looking at more vacant 4-room, 5-room, or larger flats.

Because most of these changes are not short-term and dramatic, they may not get a lot of attention for now. But they are part of an ongoing series of constant tweaks, which have subtly kept flat – or at least BTO flats – affordable over the years. Some of this year’s changes, however, are the sort that may subtly impact the HDB market only years from now.

5. More housing along a 120 km southern coastline

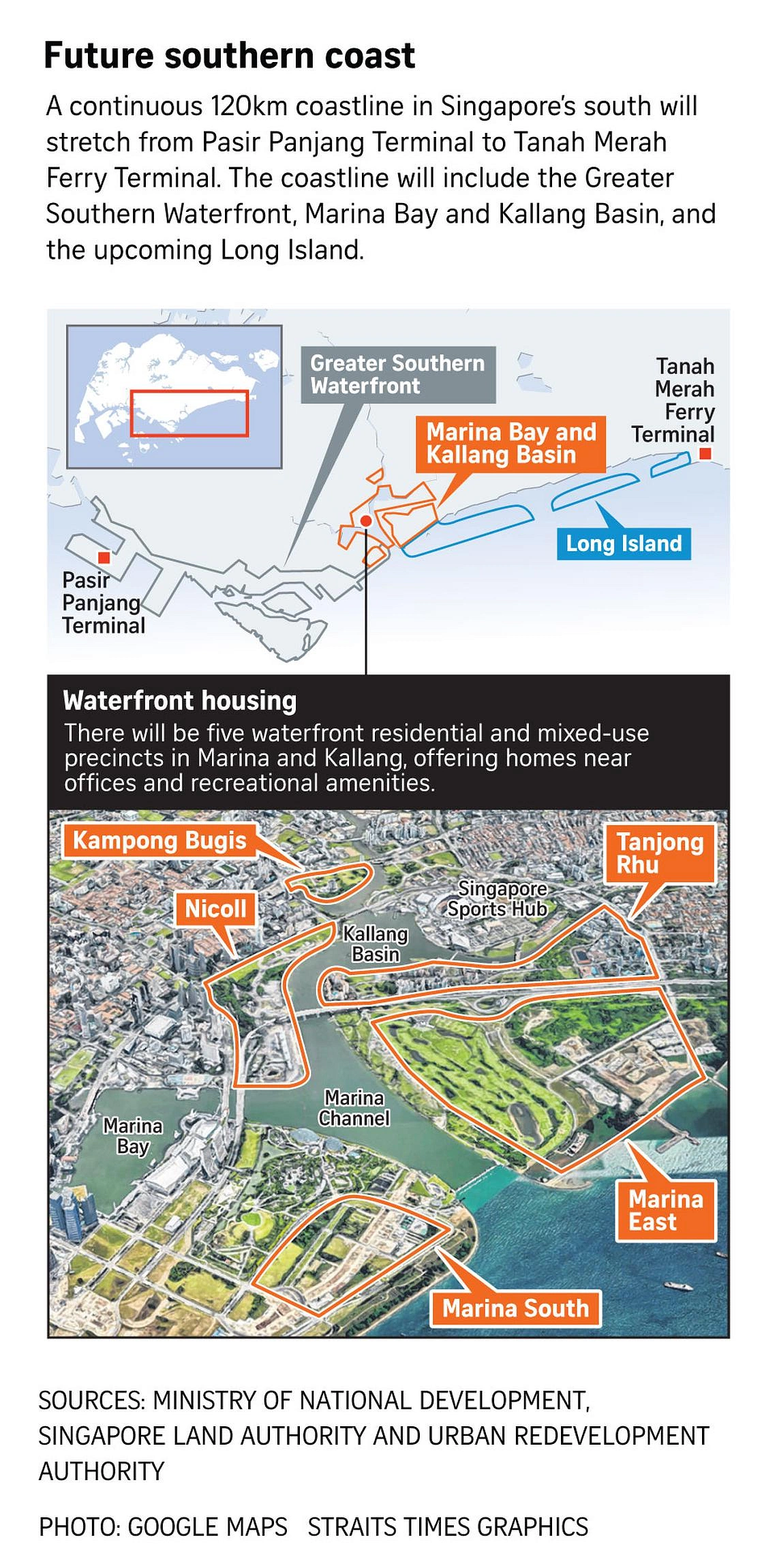

Lastly, there’s a long-term plan to build a continuous waterfront, with new homes along the stretch. Five residential and mixed-use sites were highlighted – Nicoll, Marina East, Marina South, Kampong Bugis, and Tanjong Rhu.

The Greater Southern Waterfront has been in development for some time, and we’ve already heard about the Long Island project (see here for some details). But the speech mentioned the remaking of the entire southern coast, such that we’ll have an uninterrupted 120-kilometre waterfront. This will stretch all the way from the Greater Southern Front, along Marina Bay, the Kallang Basin and up to Long Island.

Along this stretch, we’ll see a few new precincts that will add new homes, though we don’t know the mix of private and public numbers yet. The most immediate upcoming ones are Kampong Bugis, a 17.4-hectare plot, and an 88-hectare Tanjong Rhu plot. The Bugis plot will see around 4,000 new homes, while Tanjong Rhu’s Riverfront I and II were the first BTO projects in the area in around 60 years (they were launched in June this year).

Overall though, this is a transformation that will take many years to happen.

For updates once the numbers are in from MND, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the upcoming changes to housing grants for first-time and lower-income buyers in Singapore?

How will priority access for singles to BTO flats change from mid-2025?

Will the waiting time for BTO flats decrease in the future?

What is the plan for community care apartments in Singapore?

What is the long-term development plan for Singapore’s southern coastline?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

1 Comments

No mention of larger HDB flats for families with more than 2 children.. current flat sizes are way too small for large families. Hence you see the bigger, older, resale flats going at premiums.