5 Key Consequences Of Rising Mortgage Rates In 2022

July 4, 2022

The median interest rate for home loans is set to double in as little as six months, and it would seem the era of cheap mortgages is coming to an end. Apart from a predictable rush for HDB instead of bank loans (for those who can get them), this has implications for both property investors, as well as genuine home buyers. Here’s how the rising rate may impact us in the years ahead:

Table Of Contents

- What’s happening to our cheap home loans?

- Although if you’re using HDB loans, none of this matters to you

- How will all this affect us going forward?

- 1. Bigger down payments to qualify for TDSR limits

- 2. Landlords may be compelled to raise rent

- 3. The possible return of semi-fixed as a strategy

- 4. A preference for longer interest rate periods

- 5. More innovative, but complex loan packages

- What about the impact on property prices?

- Borrowers using their CPF should review their home loan situation

Updated 05 July 22: Corrected TDSR figure

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s happening to our cheap home loans?

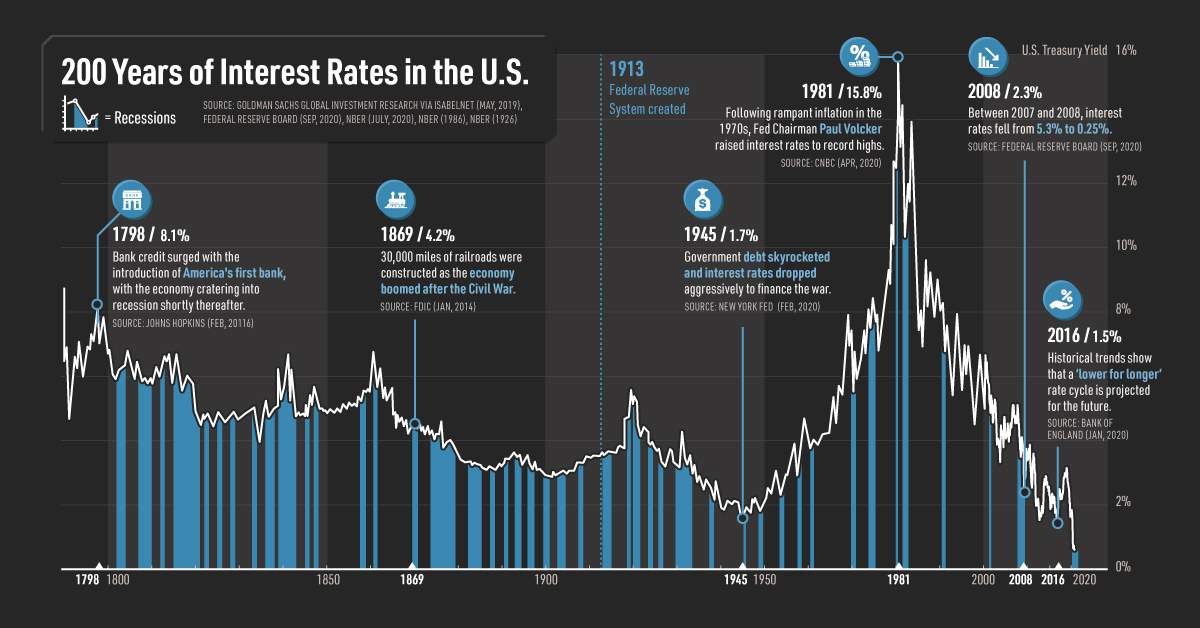

The United States Federal Reserve does lower interest rates, as a way to stimulate the economy when there’s a downturn; this lowers rates in Singapore as well, and Covid prompted this response.

However, we were seeing abnormally low rates since long before Covid.

If you go back to the 1990s or early ‘00s, interest rates for Singapore home loans (from banks, not HDB) were often around four per cent. This plummeted due to the Global Financial Crisis back in ‘08/09, following which the Fed set interest rates to zero.

At one point in 2011, the (now defunct) SOR-based mortgages even saw negative interest rates.

The Fed did attempt to normalise interest rates back in 2018 – but then Covid struck, and the interest rate was set to near-zero once again.

As such, the interest rate on mortgages has remained low for an excessively long period. Some borrowers haven’t seen rates above two per cent since the early 2000s; and what was once a momentary windfall has become normalised.

Nothing lasts forever though – prolonged periods of low-interest rates can spike inflation, such as the US is experiencing. As such, rates are going back up, and the old norm may be back to stay.

Although if you’re using HDB loans, none of this matters to you

The HDB Concessionary Loan is pegged to our CPF rate, not to market rates.

The HDB loan rate is always 0.1 per cent above the prevailing CPF rate. Currently, the CPF rate is 2.5 per cent, so your HDB loan is at 2.6 per cent.

That said, note that the HDB loan rate isn’t immune to change. If CPF were to raise the interest rate, your HDB loan rate would go up accordingly; but this hasn’t happened in over 20 years (to our knowledge, the last time CPF changed the interest rate was in 1999).

How will all this affect us going forward?

- Bigger down payments to qualify for TDSR limits

- Landlords may be compelled to raise rent

- The possible return of semi-fixed as a strategy

- A preference for longer interest rate periods

- More innovative, but complex loan packages

1. Bigger down payments to qualify for TDSR limits

The Total Debt Servicing Ratio (TDSR) limits your monthly loan repayments to 55 per cent of combined borrower income.

At the moment, TDSR calculations already use an interest higher than the actual market rate This is 3.5 per cent, regardless of what the current rate is.

For example, a $1 million loan for 25 years will have an estimated monthly repayment of around $5,000, at 3.5 per cent per annum. This would require a combined income of around $8,400 per month to qualify.

This practice has left borrowers well positioned to handle the coming rate hikes. However, as higher interest rates become the norm, we would expect the “stress test” of 3.5 per cent to eventually be raised.

For some borrowers, this might mean a bigger initial down payment, to lower monthly repayments to meet TDSR.

2. Landlords may be compelled to raise rent

Among landlords who haven’t paid off the loan, the usual expectation is for rent to cover maintenance fees, as well as the interest component of the mortgage.

At the time of writing, rental rates are already rising, as foreign workers make their return. Given this opportunity, we think it’s likely landlords will push up the rent, in expectation of coming rate hikes.

That said, rental rates are affected by many issues besides the landlord’s costs – so this assumes other factors, like the Russia – Ukraine war, don’t exert downward pressure on rental rates.

More from Stacked

“I Regret Buying A 2 Bedder Condo” 5 Young Couples Share Their Biggest Regrets

With high home prices and a constraint on land space in Singapore, it’s not surprising unit sizes have become a…

Rental MarketLandlord And Tenants Take Note: How Singapore’s Rental Market Has Changed In 2021

by Ryan J. Ong3. The possible return of semi-fixed as a strategy

This colloquially refers to a strategy where borrowers refinance from one fixed-rate package to another. For example, taking a five-year fixed package, then refinancing to a three-year fixed package at the end of it, and so on.

(There are no perpetual fixed-rate loans in Singapore, so this is the next best alternative to having predictable repayments).

This hasn’t been as popular in the last decade, when interest rates were low and fixed rate packages tended to be expensive. However, borrowers seeking security in an environment of rising rates could return to it.

4. A preference for longer interest rate periods

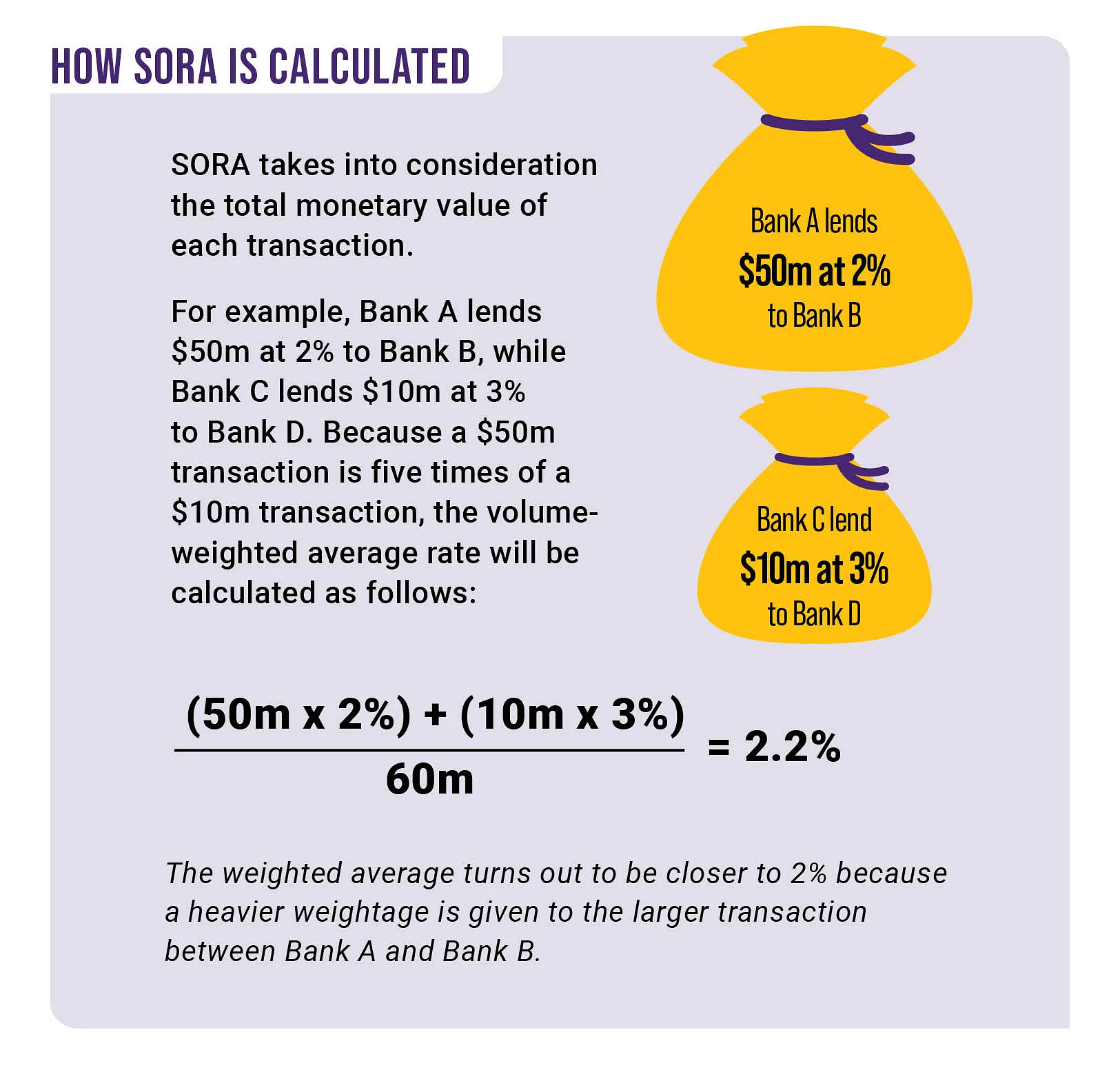

Most home loan rates are pegged to one-month (1M) SORA rates, or three-month (3M) SORA rates. This refers to how often monthly repayments are revised, to match the current interest rate.

In an environment of falling rates, 1M is preferred by borrowers – this is because you want repayments to drop as quickly as rates fall. In the current environment of rising rates, 3M will probably be preferred – even if the rate rises, you’ll still be paying the lower rate from three months prior.

Note that none of this is guaranteed, as interest rates fluctuate, and banks may charge a higher spread for 3M as opposed to 1M loan packages. However, borrowers who want less volatility will still tend toward the longer interest rate period.

5. More innovative, but complex loan packages

Whenever interest rates are climbing, banks start to innovate. One recent example of this is the hybrid fixed-and-floating packages, where half the loan is variable, and the other half is a fixed component.

In years past, we’ve also seen packages like interest-offset loans (where your deposit interest rate is used to offset your mortgage rate).

This is something of a double-edged sword. On the one hand, it’s good to have options that could save you money. On the other, the calculations involved are a massive headache for the average borrower; and some of these loans are so complex, that the terms and conditions are incomprehensible.

What about the impact on property prices?

This is where it gets tricky. Property prices move for a variety of reasons, of which mortgage rates play only one part; and you could argue it’s a small part, compared to factors like tight housing supply, or a flight to safety during downturns (which could well result from the ongoing situation in Ukraine).

As we’ve discussed before, most Singaporeans are well-positioned to afford their homes, even in light of rising interest rates. Bear in mind the current projected rate is 3.5 per cent for the TDSR, and Singaporeans are qualifying even at those rates.

As such, we doubt genuine home buyers are going to back off from their purchase, even with higher interest rates.

What this could affect, however, are new investors who were previously considering small property investments – such as buying and renting out shoebox units. The combination of higher ABSD, plus higher interest rates, could make these small rental units appear less lucrative.

Borrowers using their CPF should review their home loan situation

One risk of using CPF to service the home loan is that, sometimes, you become oblivious to the impact of rate hikes.

If you previously had a $1 million loan for 25 years, at 1.3 per cent, you would have paid around $3,900 per month. A rate hike of one percentage point would rise to about $4,400 per month, a substantial rise of about $500.

This also runs the risk of hitting the CPF withdrawal limit, and catching you off-guard. The last thing you want is to be winding down in your mid-50s, then suddenly finding out you need to service the remainder of your home loan in cash.

Now’s a good time to reassess your home loan and finances, and talk to a mortgage broker about the future. Follow us on Stacked so we can keep you updated on the situation; we’ll also provide you with in-depth reviews of new and resale properties, so you can make the most informed decisions.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will rising mortgage rates affect home buyers in Singapore?

Will landlords increase rent because of rising mortgage rates?

What loan strategies might become popular as mortgage rates increase?

How are home loan interest rate preferences changing in a rising rate environment?

Are banks offering new types of home loans as rates rise?

How might rising mortgage rates impact property prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments